Market Overview

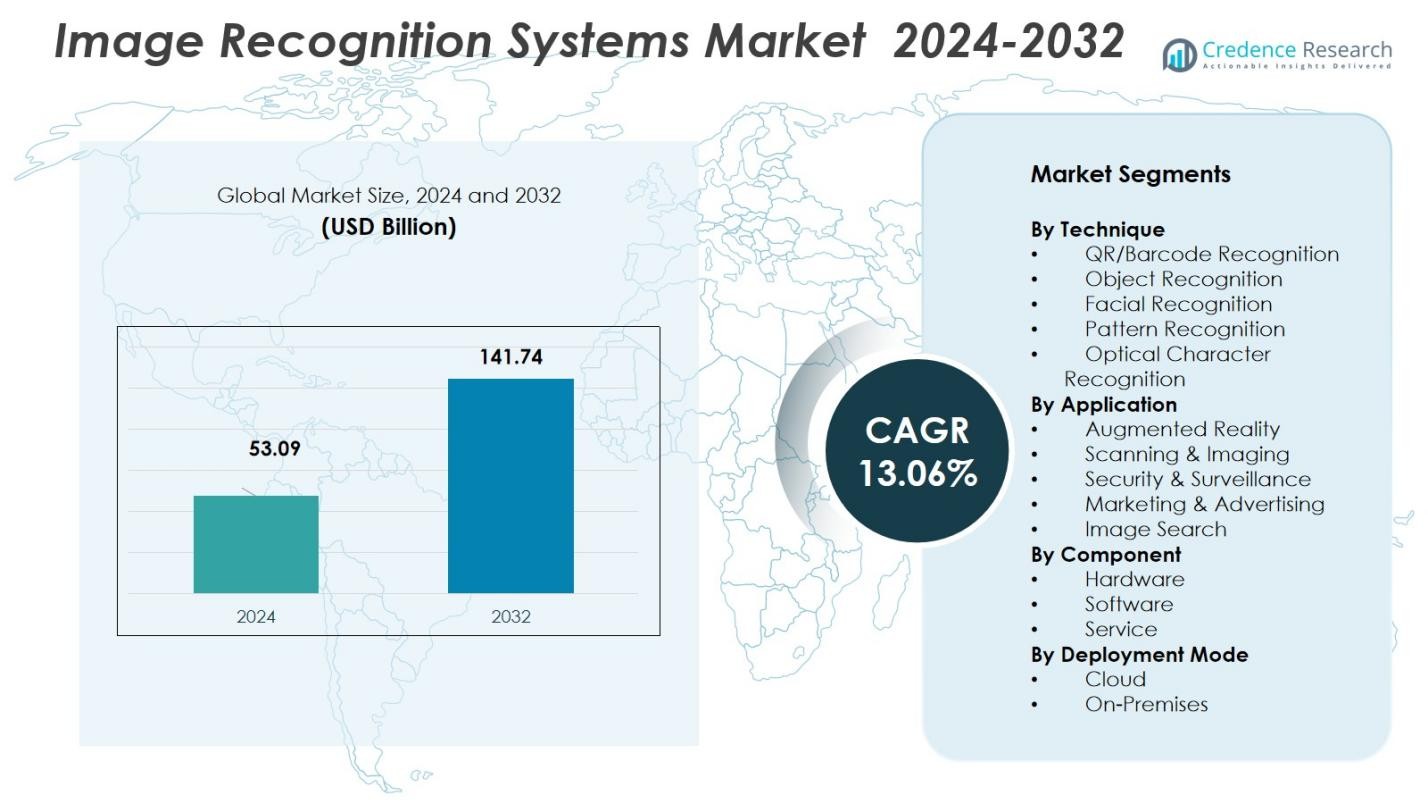

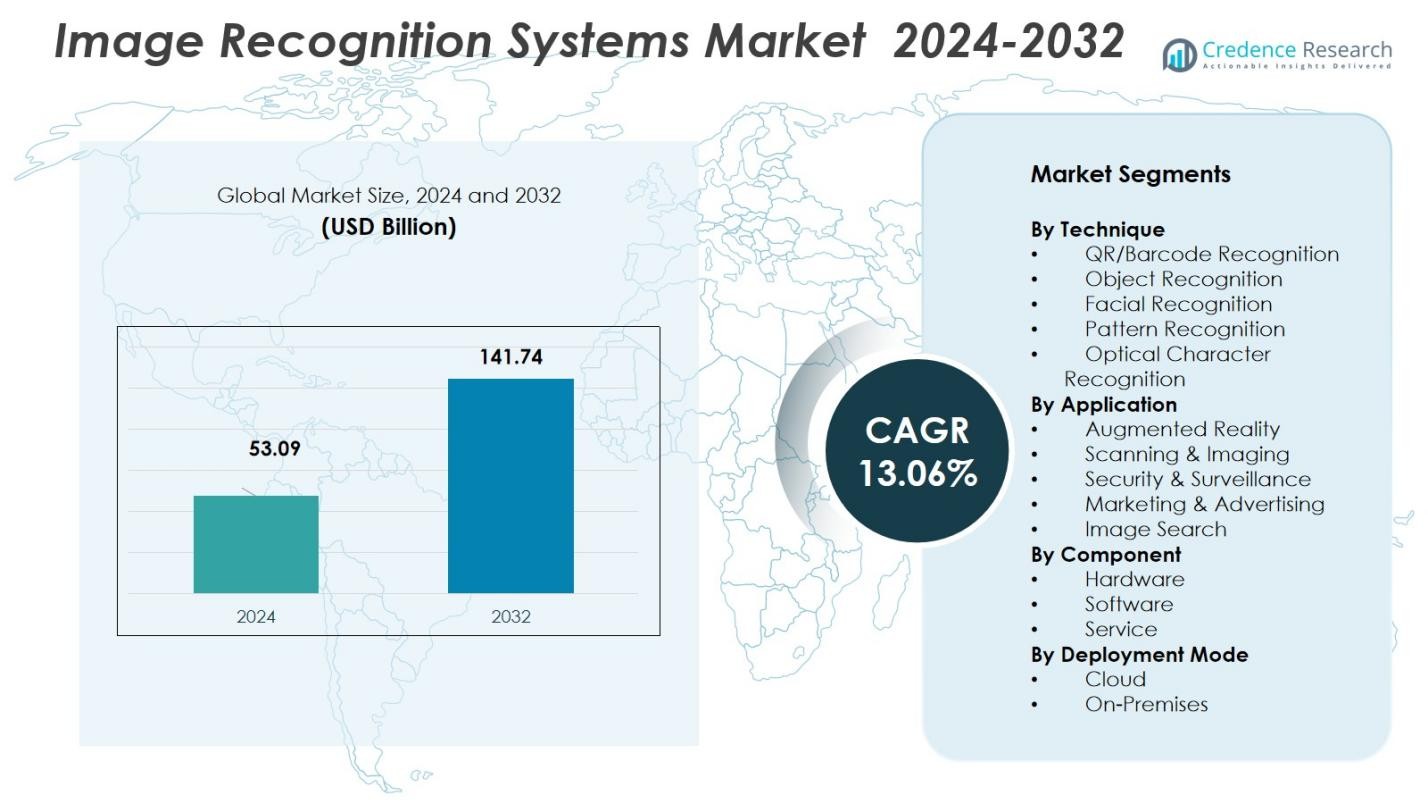

The Image Recognition Systems Market size was valued at USD 53.09 Billion in 2024 and is anticipated to reach USD 141.74 Billion by 2032, at a CAGR of 13.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Barley Market Size 2024 |

USD 53.09 Billion |

| Germany Barley Market, CAGR |

13.06% |

| Germany Barley Market Size 2032 |

USD 141.74 Billion |

Image Recognition Systems Market is shaped by major technology leaders such as Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., Intel Corporation, NVIDIA Corporation, Qualcomm Technologies, Inc., Cognex Corporation among others. North America stands as the leading region, accounting for 35.0% of the global market in 2024, driven by strong AI‑innovation infrastructure, widespread cloud adoption, and high demand across enterprise, healthcare, retail, and security verticals. Asia Pacific emerges as a rapidly growing region, supported by rising digitization, increasing smartphone and IoT penetration, and expanding demand for image recognition across security, e‑commerce, and smart city applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Image Recognition Systems Market was valued at USD 53.09 Billion in 2024 and is projected to reach USD 141.74 Billion by 2032, growing at a CAGR of 13.06% during the forecast period.

- Key drivers include advancements in AI and machine learning, the growing need for enhanced security systems, and the increasing use of smartphones and IoT devices, which fuel demand for image recognition technologies.

- A significant trend is the integration of image recognition systems with augmented reality (AR) and virtual reality (VR), particularly in retail and healthcare applications, creating new opportunities.

- The market faces restraints such as data privacy concerns and high implementation costs, which can slow adoption, especially in emerging economies.

- North America leads the market with a 35.0% share in 2024, followed by Europe with 24.0%, while Asia Pacific, the fastest-growing region, holds a 22.5% share, driven by rapid urbanization and increased demand in security and e-commerce.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Technique:

The Image Recognition Systems market is divided into several key techniques, including QR/Barcode Recognition, Object Recognition, Facial Recognition, Pattern Recognition, and Optical Character Recognition (OCR). Among these, Facial Recognition holds the dominant position, with a market share of 32.7% in 2024. This segment’s growth is fueled by increasing adoption across security, surveillance, and consumer applications, driven by the need for enhanced identity verification and security measures. As facial recognition technologies become more advanced and accurate, their integration into smartphones, retail, and law enforcement systems is expanding rapidly, boosting market growth.

- For instance, Apple’s Face ID technology uses advanced facial recognition to securely unlock iPhones and authenticate payments, employed by millions globally.

By Application:

The Security & Surveillance application segment leads the Image Recognition Systems market, capturing 35.2% of the market share in 2024. This dominance is attributed to the rising demand for enhanced security in both public and private spaces, as well as the growing use of AI-based systems for real-time threat detection and response. Security firms, government agencies, and organizations are increasingly relying on image recognition technologies to ensure public safety and improve monitoring systems, with applications spanning from facial recognition in security cameras to intrusion detection systems in high-security environments.

By Component:

The Software component segment holds the largest share of the Image Recognition Systems market, with a market share of 48.3% in 2024. The software-driven approach to image recognition is essential for processing and analyzing visual data, and its market dominance is attributed to the increasing reliance on AI-powered platforms for real-time image analysis, deep learning algorithms, and neural networks. The demand for advanced image recognition software solutions is particularly strong in industries such as healthcare, retail, and automotive, where data-driven insights from visual inputs are becoming integral to operational efficiency and decision-making.

- For instance, Google’s TensorFlow enables real-time image analysis with neural network models deployed across various applications, including healthcare imaging diagnostics.

Key Growth Drivers

Advancements in AI and Machine Learning

The rapid advancements in Artificial Intelligence (AI) and machine learning technologies are one of the primary drivers of the Image Recognition Systems market. AI-powered systems, such as deep learning algorithms, enable faster and more accurate image analysis, making them increasingly indispensable in a wide range of industries. The continuous evolution of these technologies, along with the growing availability of large datasets, is fostering innovation and enhancing the efficiency of image recognition solutions. This trend is particularly significant in sectors like healthcare, security, and retail, where real-time, automated image analysis is in high demand.

- For instance, NVIDIA’s Clara platform leverages AI to accelerate and improve diagnostic imaging workflows in healthcare.

Rising Demand for Enhanced Security Solutions

The growing emphasis on safety and security across both public and private sectors is driving the adoption of image recognition systems, particularly in surveillance and monitoring applications. The ability of image recognition technologies to automate the identification of individuals and objects in real time is crucial for enhancing security. In the wake of increasing global security concerns and the rise in criminal activities, organizations are increasingly investing in surveillance systems equipped with image recognition capabilities. This trend is especially prominent in airports, government buildings, and urban areas, where advanced security systems are becoming a priority.

- For instance, the London police deploy Live Facial Recognition technology during public events like demonstrations and concerts to identify suspects in real time.

Increasing Use of Smartphones and IoT Devices

The widespread use of smartphones and the growing network of Internet of Things (IoT) devices are significantly contributing to the growth of the Image Recognition Systems market. With smartphones becoming more integrated with AI-powered image recognition apps, from facial recognition to barcode scanning, the demand for these systems continues to expand. Additionally, the proliferation of IoT devices, such as smart cameras, automotive systems, and wearables, is driving the need for efficient image processing solutions. As these devices generate more visual data, the need for robust image recognition technologies to analyze and interpret this data grows, further boosting market expansion.

Key Trends & Opportunities

Integration with Augmented Reality (AR)

The integration of image recognition systems with augmented reality (AR) is a key trend in the market, unlocking significant growth opportunities. AR applications in industries such as retail, healthcare, and entertainment are increasingly relying on image recognition technologies to overlay digital information onto the real-world environment. By enhancing user experiences with real-time data and interactive visuals, AR has the potential to transform sectors such as e-commerce, where customers can virtually try products, and healthcare, where medical imaging can be enhanced with additional layers of information. This trend presents a vast opportunity for companies to innovate and expand their presence in the market.

- For instance, IKEA’s AR app uses image recognition to help customers visualize furniture in their homes before purchase, improving confidence in buying decisions.

Expansion in Healthcare Applications

Healthcare is emerging as one of the most promising sectors for the adoption of image recognition systems, driven by the need for automated and accurate diagnostic tools. Image recognition technologies are being integrated into medical imaging platforms to assist in the detection and analysis of diseases such as cancer, neurological disorders, and heart conditions. With advancements in AI, these systems can detect anomalies in medical images more quickly and accurately than traditional methods. The growing demand for telemedicine and remote diagnostics further amplifies the need for image recognition solutions in healthcare, providing a significant growth opportunity for market players.

- For instance, Zebra Medical Vision developed an AI-powered platform that rapidly detects cardiovascular diseases in CT scans, improving diagnostic speed and precision.

Key Challenges

Data Privacy and Security Concerns

One of the primary challenges facing the Image Recognition Systems market is the growing concern over data privacy and security. As image recognition technologies become more embedded in surveillance, healthcare, and other sensitive applications, the risk of misuse of personal data rises. Facial recognition systems, in particular, have faced scrutiny due to potential privacy violations, especially when used for surveillance in public spaces. Governments and organizations must navigate complex regulatory frameworks to ensure data protection and address consumer concerns. Ensuring the ethical and secure use of image recognition technologies remains a significant hurdle for the market.

High Implementation Costs

Despite the vast potential of image recognition systems, high implementation costs remain a major challenge. The development and integration of sophisticated AI algorithms, hardware infrastructure, and software solutions require substantial financial investment. Smaller businesses or organizations with limited budgets may find it difficult to afford these advanced systems, limiting the widespread adoption of image recognition technologies. Additionally, the complexity of implementing these solutions and the need for specialized expertise further increase the cost. This financial barrier may slow the growth of the market, especially in emerging economies with budget constraints.

Regional Analysis

North America

North America leads the global Image Recognition Systems market, holding a market share of 35.0% in 2024. This dominance stems from a mature ecosystem of AI innovators, extensive R&D infrastructure, and early adoption of advanced image-recognition solutions across sectors such as security, retail, automotive, and healthcare. High penetration of cloud-based services and a robust regulatory environment support large-scale deployment. The United States, in particular, drives growth due to demand for smart surveillance, autonomous vehicles, and enterprise-level visual analytics, consolidating North America’s position as the largest regional market.

Europe

Europe commands a significant share of the market, with a market share of 24.0% in 2024. This growth is supported by strong demand for image recognition in automotive, industrial automation, and public infrastructure. Regulations on data privacy and security have also encouraged the deployment of compliant, high-performance recognition systems. Growth is driven by adoption in surveillance, smart city initiatives, and regulated industries. As automakers accelerate implementation of driver-assistance and safety systems, Europe’s position remains robust in the global market.

Asia Pacific

Asia Pacific is the fastest-growing region, with a market share of 22.5% in 2024. The region’s growth is driven by increasing smartphone penetration, the expansion of e-commerce, smart city initiatives, and rising adoption of surveillance and security solutions. Countries such as China and India are leading the growth due to large populations, rapid urbanization, and government investments in AI and IoT infrastructure. This region is expected to register the highest CAGR during the forecast period.

Latin America

Latin America holds a market share of 6.0% in 2024. This region’s growth is driven by the increasing adoption of image recognition technologies in sectors such as retail, security, and manufacturing. Economic development, rising urbanization, and demand for digital infrastructure and surveillance solutions in major cities are key contributors to market expansion. As the region modernizes its retail, transportation, and public-safety infrastructure, the market for image recognition systems is expected to continue growing.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region accounts for 5.0% of the global Image Recognition Systems market in 2024. Growth in this region is mainly driven by investments in smart infrastructure, surveillance, and government-sector digitization. The adoption of image recognition technologies in sectors such as security, oil & gas, and urban surveillance is increasing. As regulatory support improves and infrastructure investments rise, the region’s market share is expected to grow steadily in the coming years.

Market Segmentations:

By Technique

- QR/Barcode Recognition

- Object Recognition

- Facial Recognition

- Pattern Recognition

- Optical Character Recognition

By Application

- Augmented Reality

- Scanning & Imaging

- Security & Surveillance

- Marketing & Advertising

- Image Search

By Component

- Hardware

- Software

- Service

By Deployment Mode

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Image Recognition Systems market is highly competitive, with key players such as Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services, Intel Corporation, NVIDIA Corporation, and Qualcomm Technologies driving innovations and strategic developments. These companies are heavily investing in AI and machine learning technologies to enhance the accuracy and efficiency of image recognition systems. Major players are focusing on expanding their product portfolios through new product launches, partnerships, and acquisitions. For instance, AI-powered image recognition software, cloud-based services, and hardware advancements are key focal areas for these companies. Additionally, strategic partnerships with organizations in sectors like automotive, healthcare, and retail are fostering growth opportunities. Companies are also increasingly incorporating edge computing and deep learning capabilities into their offerings to improve real-time data processing. As demand rises for applications in security, retail, and healthcare, competition is intensifying, with players striving to differentiate themselves through superior performance, scalability, and integration capabilities.

Key Player Analysis

Recent Developments

- In December 2023, Panasonic introduced an advanced image recognition AI built on a new classification framework that improves accuracy in challenging environments, enhancing its next-generation computer vision capabilities.

- In October 2025 NVIDIA Corporation announced new strategic AI‑infrastructure partnerships with firms such as Palantir Technologies and T‑Mobile US, Inc. to advance large‑scale deployment of computer vision and real‑time video analytics systems, signaling intensified investment in image recognition deployment.

- In January 2025, Vision Group Retail acquired Hivery to bolster its AI retail assortment simulations, integrating advanced predictive ROI solutions for improved retail execution.

- In July 2025, RealSense (spun out from Intel Corporation) announced its separation as an independent company, backed by a USD 50 million Series‑A funding round to scale AI vision, robotics, biometric, and depth‑camera solutions for security and robotics applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technique, Application, Component, Deployment Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Image Recognition Systems market is expected to witness continued growth as AI and machine learning technologies evolve, enhancing the accuracy and efficiency of image processing.

- Increased adoption of image recognition technologies in sectors like healthcare, retail, automotive, and security will drive demand for advanced solutions.

- The integration of image recognition with augmented reality (AR) and virtual reality (VR) is set to create new opportunities, particularly in retail and entertainment.

- Facial recognition and biometric authentication will gain widespread adoption, especially in security and identity verification applications.

- Growing concerns around data privacy and security will drive advancements in ethical and privacy-compliant image recognition technologies.

- Cloud-based image recognition solutions will continue to expand due to their scalability, cost-effectiveness, and ease of integration.

- Real-time image recognition capabilities will become essential in industries like manufacturing, logistics, and surveillance, enhancing operational efficiency.

- The increasing use of IoT devices will lead to higher volumes of image data, fostering demand for robust image recognition solutions capable of handling large datasets.

- Small and medium-sized enterprises will increasingly adopt image recognition systems as technology costs decline and cloud-based solutions become more accessible.

- Collaboration between key players and startups in AI, software development, and hardware manufacturing will result in innovative products that further propel market growth.

Market Segmentation Analysis:

Market Segmentation Analysis: