Market Overview

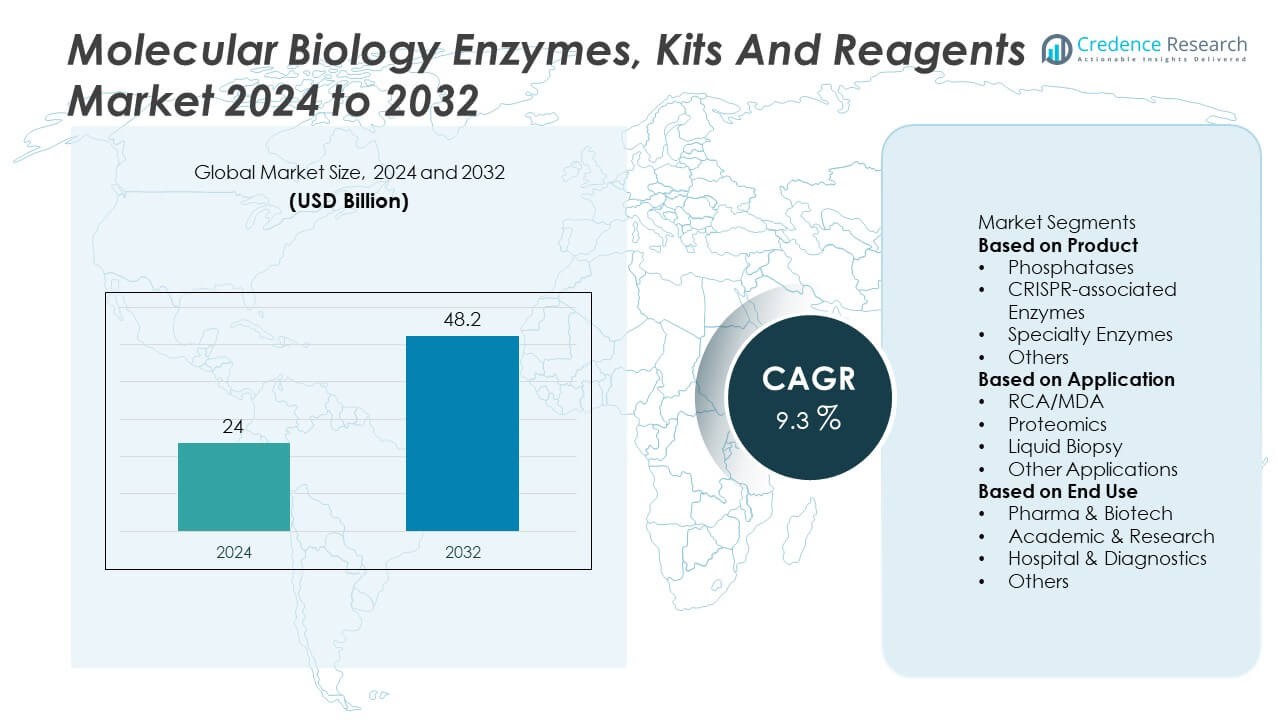

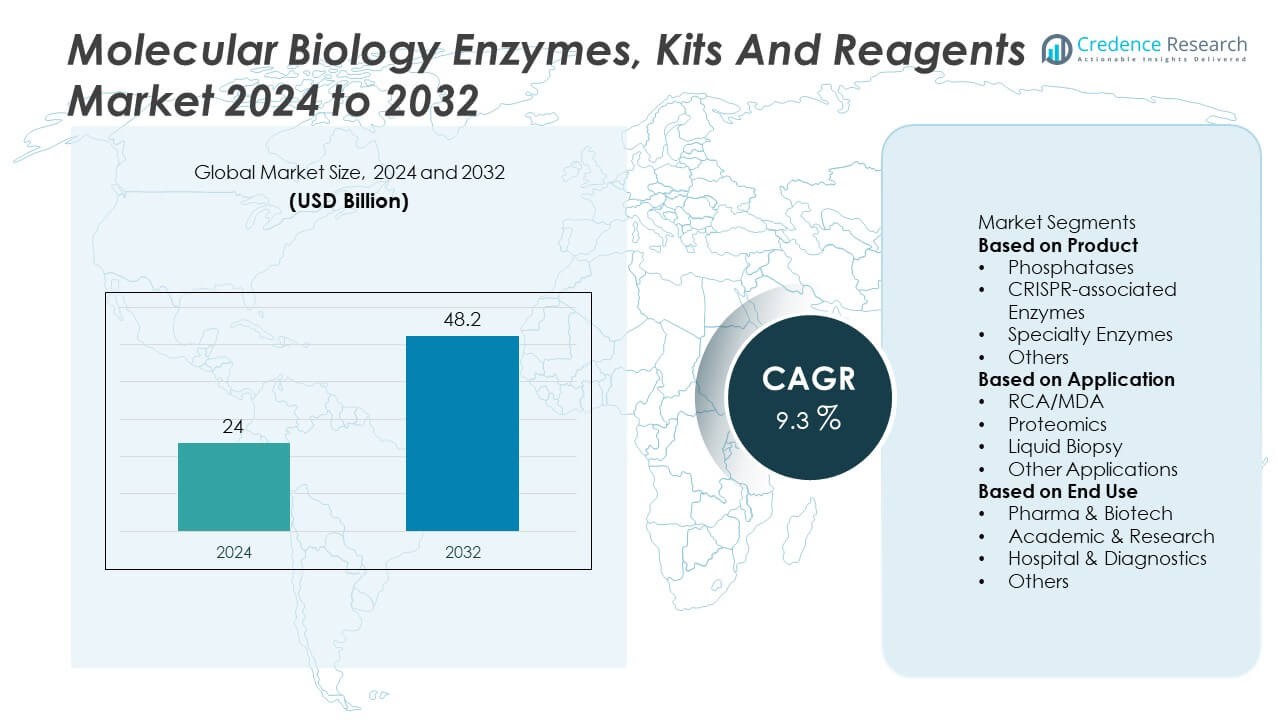

The Molecular Biology Enzymes, Kits, and Reagents Market was valued at USD 24 billion in 2024 and is projected to reach USD 48.2 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Molecular Biology Enzymes, Kits, and Reagents Market Size 2024 |

USD 24 Billion |

| Molecular Biology Enzymes, Kits, and Reagents Market, CAGR |

9.3% |

| Molecular Biology Enzymes, Kits, and Reagents Market Size 2032 |

USD 48.2 Billion |

The molecular biology enzymes, kits, and reagents market is led by major players including Takara Bio, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Promega Corporation, QIAGEN, Illumina, Inc., New England Biolabs, Merck KGaA, F. Hoffmann-La Roche Ltd., and Thermo Fisher Scientific, Inc. These companies dominate through advanced product portfolios, strong R&D investments, and strategic collaborations across biotechnology and diagnostics sectors. North America holds the leading regional position with a 39.2% share in 2024, supported by extensive research infrastructure and high adoption of genomic technologies. Europe follows with a 30.1% share, driven by government-funded life science programs, while Asia-Pacific captures 22.8%, emerging rapidly through expanding biopharma research and healthcare modernization.

Market Insights

- The molecular biology enzymes, kits, and reagents market was valued at USD 24 billion in 2024 and is projected to reach USD 48.2 billion by 2032, growing at a CAGR of 9.3%.

- Rising demand for genomic and proteomic research, driven by advances in personalized medicine and diagnostics, continues to boost market growth across developed and emerging economies.

- Increasing adoption of automation, AI-based workflows, and CRISPR technologies is shaping market trends, enhancing laboratory efficiency and accuracy.

- Key players such as Thermo Fisher Scientific, QIAGEN, Merck KGaA, and Illumina are investing in R&D, partnerships, and product innovation to strengthen market presence and technology leadership.

- North America leads with a 39.2% share, followed by Europe at 30.1% and Asia-Pacific at 22.8%, while the specialty enzymes segment dominates product categories with 46.8% share, supported by its critical role in PCR, sequencing, and proteomic applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The specialty enzymes segment dominates the molecular biology enzymes, kits, and reagents market, accounting for 46.8% share in 2024. Its leadership stems from the increasing use of polymerases, ligases, and restriction enzymes in genomic research and molecular diagnostics. Growing applications in PCR amplification, sequencing, and cloning drive demand. Continuous development of high-fidelity and heat-stable enzymes enhances research efficiency and accuracy. Expanding use in next-generation sequencing and genetic modification studies further strengthens this segment’s position over phosphatases, CRISPR-associated enzymes, and other enzyme categories.

- For instance, Thermo Fisher Scientific, Inc.’s Platinum SuperFi II DNA Polymerase offers a fidelity greater than 300× that of Taq DNA Polymerase when assessed by NGS-based error-rate analysis.

By Application

The proteomics segment leads the market with 41.2% share in 2024. Its dominance is attributed to the growing demand for protein identification, biomarker discovery, and drug target analysis. The rising integration of mass spectrometry and advanced analytical workflows boosts the use of reagents and kits designed for protein analysis. Expanding pharmaceutical R&D and personalized medicine initiatives further support this segment. Liquid biopsy and RCA/MDA applications are also gaining traction as precision medicine and non-invasive testing technologies advance.

- For instance, Illumina, Inc.’s Protein Prep assay can quantify around 9,500 unique human protein targets from a single plasma or serum sample using NGS-based workflows.

By End Use

Pharma & biotech companies hold the largest market share of 52.4% in 2024. Their dominance is driven by rising investments in drug discovery, genetic research, and biopharmaceutical production. The demand for efficient and reliable enzyme-based kits and reagents is increasing to support large-scale testing and process development. Additionally, expanding collaborations between biotech firms and academic institutions are accelerating innovation. Hospital and diagnostic laboratories are also growing rapidly due to the rising adoption of molecular assays for disease detection and monitoring.

Key Growth Drivers

Rising Demand for Genomic and Proteomic Research

The expanding focus on genomics and proteomics is driving strong demand for molecular biology enzymes, kits, and reagents. Increased investment in genetic sequencing, biomarker discovery, and protein profiling supports product adoption. Research institutions and pharmaceutical companies are utilizing advanced molecular tools for precision medicine, drug development, and diagnostics. This surge in R&D activities accelerates the need for high-quality, efficient enzymes and reagents that enable accurate and reproducible molecular analysis.

- For instance, New England Biolabs reported their engineered ligase profile enabled assembly of more than 20 DNA fragments in a single reaction with over 90 % success rate for a 24-fragment construct.

Technological Advancements in Molecular Biology Tools

Continuous innovation in enzyme engineering, next-generation sequencing (NGS), and PCR technologies enhances performance and reliability in molecular biology workflows. Modern enzyme formulations with higher specificity and stability are improving experimental accuracy. Integration of automation and digital systems streamlines laboratory operations, reducing manual errors and boosting throughput. These advancements make molecular tools more accessible and cost-effective, fostering their use across academic, clinical, and industrial research environments.

- For instance, Agilent Technologies’s D5000 ScreenTape assay achieved detection sensitivity down to 5 pg/µL DNA, with sizing precision of about 3.8% CV for a 1,000 bp fragment.

Expanding Applications in Clinical Diagnostics and Biopharma

Growing utilization of molecular biology enzymes in diagnostics and biopharmaceutical manufacturing is a major growth driver. Enzyme-based kits play a vital role in liquid biopsy, infectious disease testing, and genetic screening. Biopharma companies rely on high-quality reagents for recombinant protein production and therapeutic development. Increasing focus on personalized medicine and rapid diagnostic assays further propels demand, strengthening the clinical and industrial importance of these molecular products.

Key Trends & Opportunities

Growing Adoption of CRISPR and Gene Editing Technologies

CRISPR-associated enzymes are gaining prominence as researchers increasingly apply gene editing for therapeutic and agricultural innovation. The rising use of CRISPR-Cas systems enhances demand for specialized molecular reagents. Companies are investing in developing high-precision enzymes and ready-to-use kits that simplify complex genome editing workflows. This trend presents strong opportunities for market players to expand portfolios and tap into emerging synthetic biology applications.

- For instance, Merck KGaA announced that it now holds 22 CRISPR-related patents across nine geographies, underpinning its genome-editing reagent portfolio.

Increasing Integration of Automation and AI in Molecular Workflows

Automation and artificial intelligence are reshaping molecular biology laboratories. Automated liquid handling systems, AI-assisted data analysis, and cloud-based platforms are improving accuracy and operational efficiency. These technologies optimize reagent usage and speed up result interpretation, enabling high-throughput experimentation. The trend supports wider adoption of molecular biology tools in diagnostics, drug discovery, and academic research by reducing complexity and enhancing reproducibility.

- For instance, Thermo Fisher Scientific, Inc. introduced a real-time PCR automation solution capable of processing up to 6 000 samples in a single day, enabling significantly scaled throughput for molecular workflows.

Key Challenges

High Cost of Advanced Molecular Reagents and Kits

The significant cost of specialized enzymes and reagent kits limits accessibility in small and mid-sized laboratories. Premium-grade molecular biology products require expensive manufacturing and quality control processes, increasing overall pricing. This creates affordability challenges, particularly in emerging economies. Limited funding for academic and public research institutions further constrains large-scale adoption of advanced molecular tools, slowing market penetration.

Storage and Stability Constraints of Molecular Products

Molecular biology enzymes and reagents often require stringent storage conditions, including controlled temperatures and handling protocols. Improper storage can degrade enzyme activity and compromise test accuracy. These stability issues raise logistical challenges for distribution and long-term inventory management. The need for cold-chain storage and specialized packaging increases operational costs, especially in regions with limited laboratory infrastructure.

Regional Analysis

North America

North America dominates the molecular biology enzymes, kits, and reagents market with a 39.2% share in 2024. The region’s leadership is driven by robust biotechnology and pharmaceutical industries, high R&D expenditure, and early adoption of advanced molecular tools. The United States leads the market with significant investments in genomic research, proteomics, and personalized medicine initiatives. Growing funding from organizations such as the NIH and rapid integration of automation in laboratories further strengthen market growth. Canada also contributes through expanding academic research and strong collaborations with global biotech firms.

Europe

Europe holds a 30.1% share in the molecular biology enzymes, kits, and reagents market in 2024. The region benefits from strong public funding for life science research and a well-established academic infrastructure. Countries like Germany, the U.K., and France are key contributors, emphasizing proteomics, genomic sequencing, and molecular diagnostics. The growing adoption of CRISPR technologies and biomarker research supports the expansion of reagent demand. Additionally, the presence of leading companies such as Qiagen and Merck enhances Europe’s innovation ecosystem, driving continuous technological development and broader research applications.

Asia-Pacific

Asia-Pacific accounts for 22.8% of the molecular biology enzymes, kits, and reagents market in 2024. Rapid growth in the biotechnology sector across China, Japan, and India fuels strong demand for molecular tools. Government-led genomic initiatives and increasing investments in precision medicine are accelerating adoption. The region is also witnessing a surge in biopharmaceutical production and academic research output. Affordable manufacturing capabilities and strategic collaborations between local and global firms are boosting supply chain efficiency. Rising healthcare expenditure and disease awareness further position Asia-Pacific as a key growth hub for molecular diagnostics.

Latin America

Latin America captures 4.7% of the molecular biology enzymes, kits, and reagents market in 2024. The region is experiencing steady growth supported by improving research infrastructure and greater focus on disease diagnostics. Brazil and Mexico lead the market, driven by academic research expansion and adoption of molecular tools in healthcare. Increasing partnerships with global biotech firms are enabling access to high-quality reagents and enzyme technologies. However, limited funding for large-scale research and high product costs pose challenges to rapid adoption across the region.

Middle East & Africa

The Middle East & Africa region holds a 3.2% share in the molecular biology enzymes, kits, and reagents market in 2024. Growth is supported by rising investments in laboratory infrastructure, healthcare modernization, and infectious disease research. Countries such as Saudi Arabia, the UAE, and South Africa are increasingly adopting molecular testing technologies in diagnostics and academic research. The establishment of new research centers and collaborations with international biotech companies are strengthening market presence. However, limited technical expertise and infrastructure gaps continue to restrain wider adoption of advanced molecular biology products.

Market Segmentations:

By Product

- Phosphatases

- CRISPR-associated Enzymes

- Specialty Enzymes

- Others

By Application

- RCA/MDA

- Proteomics

- Liquid Biopsy

- Other Applications

By End Use

- Pharma & Biotech

- Academic & Research

- Hospital & Diagnostics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the molecular biology enzymes, kits, and reagents market is defined by the strong presence of leading players such as Takara Bio, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Promega Corporation, QIAGEN, Illumina, Inc., New England Biolabs, Merck KGaA, F. Hoffmann-La Roche Ltd., and Thermo Fisher Scientific, Inc. These companies focus on product innovation, technological enhancement, and strategic collaborations to strengthen their market positions. Continuous advancements in enzyme formulations, next-generation sequencing, and molecular diagnostics are driving competition. Players are expanding their product portfolios with high-performance reagents, CRISPR-based kits, and automation-compatible solutions. Partnerships with research institutes and biopharmaceutical companies are enabling innovation in precision medicine and genetic research. Mergers and acquisitions remain key strategies to broaden geographical presence and improve supply chain efficiency. The overall market is evolving toward high-quality, reliable, and cost-effective molecular solutions that enhance research productivity and diagnostic accuracy worldwide.

Key Player Analysis

- Takara Bio, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Promega Corporation

- QIAGEN

- Illumina, Inc.

- New England Biolabs

- Merck KGaA

- Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

Recent Developments

- In October 2025, Illumina released its 5-base solution enabling simultaneous detection of genomic variants and DNA methylation in a single workflow.

- In April 2025, QIAGEN N.V. launched the QIAprep & Plasmodium Kit enabling detection of all five malaria-causing parasites in a streamlined workflow via qPCR.

- In November 2024, Takara Bio announced a high-throughput, cost-effective qPCR system (with associated kits and reagents) for clinical research.

- In October 2024, Takara Bio, Inc. expanded its Gothenburg site to offer customised molecular biology products including PCR and qPCR enzymes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for molecular biology reagents will grow with rising genomic and proteomic research activities.

- Adoption of automation and AI-based platforms will enhance laboratory productivity and precision.

- CRISPR and gene editing technologies will open new opportunities in therapeutic and agricultural research.

- Next-generation sequencing and PCR advancements will continue to drive innovation in diagnostics.

- Biopharmaceutical companies will expand enzyme and reagent usage in drug discovery and vaccine development.

- Point-of-care molecular testing will gain traction in clinical and decentralized settings.

- Emerging economies will experience rapid adoption through healthcare modernization and research funding.

- Partnerships between academia and industry will accelerate development of advanced molecular tools.

- Sustainable and high-stability reagents will see rising demand for eco-efficient operations.

- Expansion of digital and cloud-based laboratory solutions will improve workflow integration and data management.