Market Overview

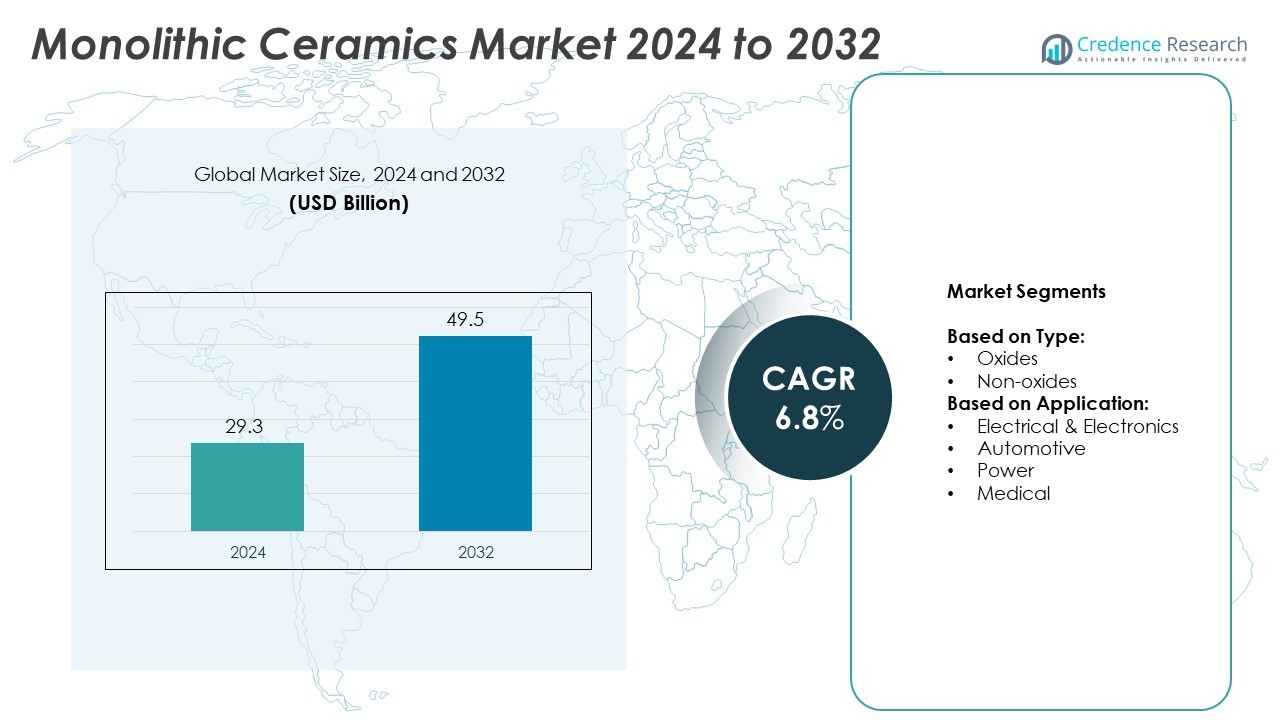

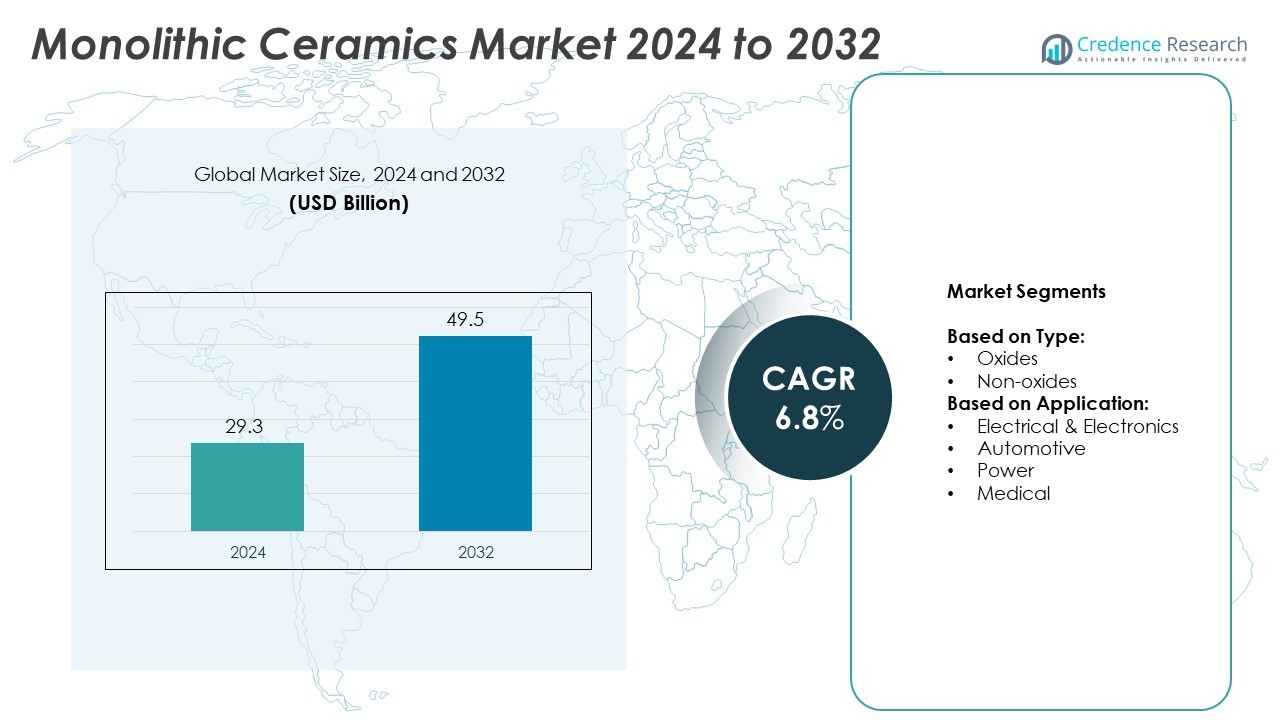

Monolithic Ceramics Market size was valued at USD 29.3 billion in 2024 and is anticipated to reach USD 49.5 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Monolithic Ceramics Market Size 2024 |

USD 29.3 Billion |

| Monolithic Ceramics Market, CAGR |

6.8% |

| Monolithic Ceramics Market Size 2032 |

USD 49.5 Billion |

The Monolithic Ceramics market is driven by growing demand across aerospace, electronics, automotive, and healthcare industries. High thermal resistance, durability, and lightweight properties make these ceramics suitable for critical applications. Rising adoption in semiconductors, electric vehicles, and renewable energy systems accelerates market growth. Advancements in manufacturing technologies, including 3D printing and precision machining, enhance product performance and design flexibility. Increasing investments in R&D and the shift toward sustainable solutions further strengthen demand, positioning monolithic ceramics as essential for modern industrial innovations.

The Monolithic Ceramics market spans key regions such as North America, Europe, Asia‑Pacific, Latin America, and Middle East & Africa, each offering unique growth drivers. Asia‑Pacific leads with rapid industrialization and strong electronics and EV demand. North America and Europe benefit from innovation in aerospace, defense, and clean technology. Leading industry players include Kyocera Corporation, CeramTec GmbH, CoorsTek, Inc., and 3M Company, focusing on R&D, advanced materials, and customized ceramic solutions to meet evolving global needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Monolithic Ceramics market was valued at USD 29.3 billion in 2024 and is projected to reach USD 49.5 billion by 2032, growing at a CAGR of 6.8% from 2025 to 2032.

- Rising demand across aerospace, electronics, automotive, and healthcare sectors drives market growth due to high durability, thermal resistance, and lightweight properties.

- Technological advancements in 3D printing, precision machining, and material innovation enhance product performance and enable wider industrial applications.

- The market is highly competitive, with key players such as Kyocera Corporation, CeramTec GmbH, CoorsTek, 3M Company, and NGK Spark Plug focusing on R&D, innovation, and strategic partnerships.

- High production costs, complex manufacturing processes, and raw material price fluctuations act as major restraints, limiting adoption in cost-sensitive industries.

- Asia-Pacific leads the market, driven by rapid industrialization, electronics manufacturing, and EV growth, while North America and Europe focus on aerospace, defense, and clean energy applications.

- Growing investments in renewable energy, semiconductors, and electric vehicles present significant opportunities, supported by sustainable production methods and government-backed infrastructure initiatives.

Market Drivers

Growing Demand in Aerospace and Defense Applications

The Monolithic Ceramics market experiences significant growth driven by rising demand in aerospace and defense sectors. These materials offer high strength, lightweight properties, and superior thermal stability, making them ideal for critical applications. Defense agencies invest in advanced armor systems, jet engines, and missile components, increasing adoption rates. Manufacturers focus on developing materials that withstand extreme environments and high temperatures. It benefits from rising defense budgets and growing space exploration programs globally. The market gains momentum through technological upgrades in aircraft and defense equipment.

- For instance, Kyocera supplies over 200 high-performance fine ceramic materials engineered for aerospace applications. These technical ceramics are designed to meet demanding industry needs, offering high reliability, heat resistance, and excellent wear and corrosion resistance.

Rising Adoption in Medical and Healthcare Industries

The Monolithic Ceramics market benefits from its increasing use in medical devices and dental applications. Biocompatibility, high durability, and resistance to corrosion make these ceramics suitable for implants, surgical tools, and prosthetics. Healthcare facilities invest in advanced medical equipment requiring precision-engineered components. It drives innovation in orthopedic implants and dental crowns, expanding product applications. Growing demand for minimally invasive procedures supports the rising consumption of high-performance ceramic materials. Manufacturers develop customized solutions to meet diverse healthcare requirements.

- For instance, CoorsTek Medical delivers more than 1,000,000 biocompatible ceramic components annually to OEM medical device manufacturers. As part of the larger CoorsTek company, it draws on a portfolio of over 300 advanced material formulations used across multiple industries, including medical implants and devices.

Expanding Role in Electronics and Semiconductor Manufacturing

The Monolithic Ceramics market sees strong adoption in electronics and semiconductor industries due to their superior insulating properties. High-performance ceramics support applications in microchips, circuit boards, and advanced electronic devices. Rising demand for smartphones, EV batteries, and high-speed computing drives production volumes. It enables thermal management and miniaturization in semiconductor components. Manufacturers focus on integrating ceramics into cutting-edge technologies, enhancing performance and durability. Growing 5G adoption and connected devices further accelerate industry requirements.

Increasing Use in Industrial and Energy Applications

The Monolithic Ceramics market gains traction in industrial machinery, power generation, and energy storage solutions. These materials provide high wear resistance and withstand extreme operational conditions. Their use in gas turbines, heat exchangers, and power plants drives steady consumption. It supports innovations in renewable energy technologies, including hydrogen production and solid oxide fuel cells. Manufacturers expand production capacity to meet rising energy efficiency demands globally. Strong industrial growth in emerging economies further strengthens market development.

Market Trends

Growing Focus on Lightweight and High-Performance Materials

The Monolithic Ceramics market witnesses rising demand for lightweight and durable materials across industries. Manufacturers develop advanced formulations to enhance strength, thermal stability, and corrosion resistance. Automotive, aerospace, and electronics sectors adopt these ceramics for performance-driven applications. It benefits from the shift toward materials that reduce energy consumption and improve efficiency. Investments in research help companies design ceramics with higher reliability under extreme conditions. Growing awareness of sustainability further drives interest in eco-friendly production methods.

- For instance, CoorsTek produces a range of aluminum oxide (alumina) ceramics, with higher-purity grades exhibiting a flexural strength of 400 MPa or more. These materials are used for various demanding aerospace applications, such as sensors, antenna components, and specific electrical parts. However, the most extreme conditions in turbine engines often require even more advanced CoorsTek technical ceramics, such as silicon nitride and silicon carbide.

Advancements in Manufacturing Technologies and Product Innovation

The Monolithic Ceramics market experiences growth fueled by progress in manufacturing techniques like 3D printing and precision machining. Automation improves product consistency, reduces material waste, and increases scalability. Companies introduce ceramics with improved toughness and thermal shock resistance for specialized applications. It supports customization in industries such as semiconductors, defense, and healthcare. Advanced production methods enable greater design flexibility and shorter development cycles. The trend fosters innovation and strengthens competitive positioning in high-value markets.

- For instance, Toshiba Materials, spun off from Toshiba in October 2003, supplies silicon nitride ceramic balls for EV motors and other demanding applications. The company holds approximately 50% of the global market share for silicon nitride balls. Toshiba Materials is recognized for its reliability and the highest mechanical performance of any silicon nitride balls.

Rising Demand from Semiconductor and Electronics Industries

The Monolithic Ceramics market benefits from strong adoption in semiconductor fabrication and electronics manufacturing. High thermal resistance, insulating properties, and structural stability make ceramics essential for electronic components. It supports advanced chip designs used in smartphones, EVs, and high-performance computing systems. Growing 5G infrastructure and IoT integration increase the need for miniaturized and efficient solutions. Companies focus on creating next-generation ceramics that meet stringent technological requirements. Expansion of global electronics production boosts overall market growth.

Increasing Integration in Renewable Energy and Clean Technologies

The Monolithic Ceramics market sees expanding applications in renewable energy and clean technology solutions. Solid oxide fuel cells, hydrogen production systems, and energy storage devices rely on advanced ceramic components. It helps improve energy efficiency and system performance in sustainable technologies. Companies invest in developing ceramics that endure extreme environments while maintaining high durability. Growing government support for green initiatives accelerates the adoption of high-performance materials. The trend strengthens market prospects across energy and environmental sectors.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes

The Monolithic Ceramics market faces challenges due to high production costs and complex manufacturing requirements. Advanced raw materials, precision processing, and specialized equipment increase overall expenses for manufacturers. It becomes difficult for smaller companies to compete with established players offering cost-efficient solutions. Achieving consistent quality while meeting performance standards adds further operational pressure. Limited availability of skilled professionals and advanced infrastructure slows large-scale production capabilities. These cost-related challenges restrict adoption in price-sensitive industries and emerging markets.

Supply Chain Constraints and Raw Material Availability Issues

The Monolithic Ceramics market experiences disruptions caused by raw material shortages and supply chain inefficiencies. Key materials such as alumina, silicon carbide, and zirconia face price fluctuations due to global demand shifts. It leads to longer lead times, impacting timely delivery for critical applications in aerospace, electronics, and healthcare. Trade restrictions and geopolitical tensions further affect smooth material sourcing for manufacturers. Companies struggle to secure stable supply agreements while maintaining profitability. These constraints increase dependency on technological advancements and strategic partnerships to stabilize production.

Market Opportunities

Expanding Applications in Healthcare and Medical Device Industries

The Monolithic Ceramics market presents significant opportunities in healthcare due to growing demand for advanced medical devices and implants. High biocompatibility, corrosion resistance, and durability make these materials suitable for dental restorations, orthopedic implants, and surgical instruments. It supports innovation in minimally invasive procedures and precision-engineered medical components. Rising investments in healthcare infrastructure and increasing preference for high-performance materials drive product development. Manufacturers focus on creating customized ceramic solutions to meet evolving patient needs. Growing awareness of long-lasting and reliable medical technologies further strengthens adoption.

Rising Demand from Renewable Energy and Electric Vehicle Sectors

The Monolithic Ceramics market benefits from increasing opportunities in renewable energy and electric vehicle production. These ceramics play a key role in solid oxide fuel cells, battery components, and thermal management systems. It enables higher efficiency and performance in energy storage and clean power solutions. Governments support sustainable initiatives, boosting demand for advanced ceramic technologies. Manufacturers invest in R&D to create products suitable for extreme operating conditions and emerging energy applications. The shift toward electrification and low-carbon solutions enhances future growth prospects across global markets.

Market Segmentation Analysis:

By Type:

The Monolithic Ceramics market is segmented into oxides and non-oxides, with both categories showing significant demand across industries. Oxide ceramics, including alumina and zirconia, dominate the market due to their superior insulating properties, chemical resistance, and cost efficiency. These materials are widely used in electronics, medical devices, and structural applications where durability is critical. It offers stable performance in high-temperature environments, supporting innovation in power generation and semiconductor manufacturing. Non-oxide ceramics, such as silicon carbide and boron carbide, are gaining traction for their exceptional hardness, wear resistance, and thermal conductivity. Industries like automotive, aerospace, and defense adopt non-oxides for specialized applications, including engine components and protective systems.

- For instance, Morgan Technical Ceramics has extensive machining and finishing capabilities, including advanced Computer Numerical Control (CNC) and diamond grinding. This supports the manufacturing of highly precise and robust ceramic components for demanding applications in industries such as power generation.

By Application:

The Monolithic Ceramics market serves diverse applications across electrical and electronics, automotive, power, and medical sectors. Electrical and electronics hold a significant share, driven by demand for insulating components, substrates, and circuit boards in advanced devices. It supports miniaturization, thermal management, and high-performance computing requirements. In automotive, ceramics are used for sensors, engine parts, and braking systems to enhance performance and fuel efficiency. Power generation relies on these materials for turbines, heat exchangers, and energy storage technologies, ensuring reliability under extreme conditions. Medical applications demonstrate strong growth, with ceramics being used in dental implants, orthopedic devices, and surgical tools due to their biocompatibility and durability. Rising technological advancements and investments in healthcare, renewable energy, and electronics continue to broaden the scope of applications and strengthen market growth.

- For instance, Niterra Co., Ltd., formerly NGK Spark Plug Co., Ltd., maintains a leading position in the global spark plug market and manufactures millions of spark plugs annually under its NGK brand, ensuring efficient ignition and reduced emissions in internal combustion engines.

Segments:

Based on Type:

Based on Application:

- Electrical & Electronics

- Automotive

- Power

- Medical

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 18.4% of the global Monolithic Ceramics market in 2024, driven by strong demand in aerospace, electronics, and defense sectors. The region leads innovation in semiconductor substrates, thermal shields, and high-performance electronic components. Manufacturers in North America invest in advanced processing technologies and vertical integration to maintain competitiveness. Rising electric vehicle production and renewable energy adoption boost market consumption. North America also focuses on improving ceramic durability and energy efficiency through extensive research programs. Companies in the region capitalize on premium-grade materials like alumina and silicon carbide to meet performance requirements.

Europe

Europe accounts for 14.7% of the Monolithic Ceramics market in 2024, supported by advancements in clean energy and sustainable manufacturing. The region has a strong presence in medical ceramics, high-precision automotive parts, and aerospace components. Producers in Europe adopt additive manufacturing and low-emission production techniques to enhance material performance. Collaborative projects between European research institutions and industry players strengthen innovation pipelines. Growing demand for hydrogen technologies and efficient power systems further expands applications. Europe continues to focus on technological upgrades and product diversification to retain competitiveness.

Asia-Pacific

Asia-Pacific dominates the Monolithic Ceramics market with a 43.6% share in 2024, supported by rapid industrialization and strong electronics manufacturing capacity. The region benefits from large-scale semiconductor production, EV battery manufacturing, and advanced electronics demand. Manufacturers in Asia-Pacific invest heavily in scaling production capacity and improving material efficiency. Strategic government support across China, Japan, South Korea, and India boosts research and infrastructure development. Asia-Pacific also leads in miniaturization and integration of high-performance ceramic components. Rising investments in renewable energy and 5G deployment further enhance the region’s market expansion.

Latin America

Latin America holds 3.7% of the Monolithic Ceramics market in 2024, with steady growth in automotive, energy, and manufacturing sectors. The region benefits from rising industrialization and the development of localized ceramic component production. Manufacturers in Latin America explore regional sourcing to reduce costs and improve supply reliability. Brazil, Argentina, and Chile drive demand for ceramics in power, transportation, and construction applications. The region leverages growing infrastructure investments to accelerate industrial modernization. Long-term opportunities depend on collaborative R&D and an increased focus on high-value applications.

Middle East & Africa

The Middle East & Africa represent 4.9% of the Monolithic Ceramics market in 2024, led by investments in energy, defense, and infrastructure projects. The region witnesses rising demand for corrosion-resistant and high-temperature ceramic applications across oil, gas, and power sectors. Manufacturers in the Middle East & Africa partner with local firms to strengthen supply chains and meet project-specific requirements. National development programs in the GCC region accelerate the adoption of ceramic technologies in industrial systems. Growth opportunities emerge from renewable energy initiatives and water-treatment technologies. The region continues to focus on diversifying applications to support industrial transformation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Monolithic Ceramics market is shaped by leading players such as Kyocera Corporation, CeramTec GmbH, Morgan Advanced Materials plc, Saint-Gobain Ceramics & Plastics, Inc., CoorsTek, Inc., NGK Spark Plug Co., Ltd., 3M Company, Murata Manufacturing Co., Ltd., Ceradyne, Inc., and Rauschert Steinbach GmbH. These companies focus on innovation, capacity expansion, and technological advancement to strengthen their global presence. They invest heavily in R&D to develop high-performance ceramics with improved thermal stability, mechanical strength, and resistance to extreme environments. Strategic partnerships with electronics, automotive, and aerospace manufacturers enable product integration into critical applications. Manufacturers emphasize sustainable production methods and eco-friendly materials to align with global energy and environmental standards. Emerging markets drive growth opportunities, encouraging firms to expand manufacturing footprints and enhance supply chain efficiency. Competitive differentiation is built on advanced material quality, pricing strategies, and customization capabilities. Rising demand from sectors such as semiconductors, energy, and healthcare fuels intense competition, prompting players to prioritize long-term contracts and innovative solutions. The market remains highly dynamic, with continuous technological improvements and strategic collaborations enhancing competitiveness while meeting the growing demand for durable and lightweight ceramic components.

Recent Developments

- In February 2025, Saint‑Gobain announced plans to invest in a new manufacturing facility in Wheatfield, New York, to expand ceramic catalyst carrier production. Construction was slated to begin later in the year

- In May 2024, Kyocera Corporation company presented a wide range of semiconductor, fine ceramic, and automotive components at the exhibition.

- In September 2023, CeramTec held a groundbreaking ceremony for a new production building at its Marktredwitz site, aimed at expanding capacity in medical technology.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow among semiconductor, aerospace, and automotive sectors.

- Growth will come from innovation in lightweight, high-strength ceramic materials.

- Manufacturers will increase capacity through investments in scalable processing.

- Adoption will rise in clean energy applications like fuel cells and thermal systems.

- Improved manufacturing methods will drive cost reduction and material efficiency.

- Market players will focus on development of customizable ceramic solutions.

- Emerging economies will become key contributors to overall market expansion.

- Sustainability standards will push adoption of eco-friendly production methods.

- Strategic collaborations will boost regional supply chains and tech transfer.

- Advancements in miniaturization will fuel demand for precision ceramic components.