Market Overview:

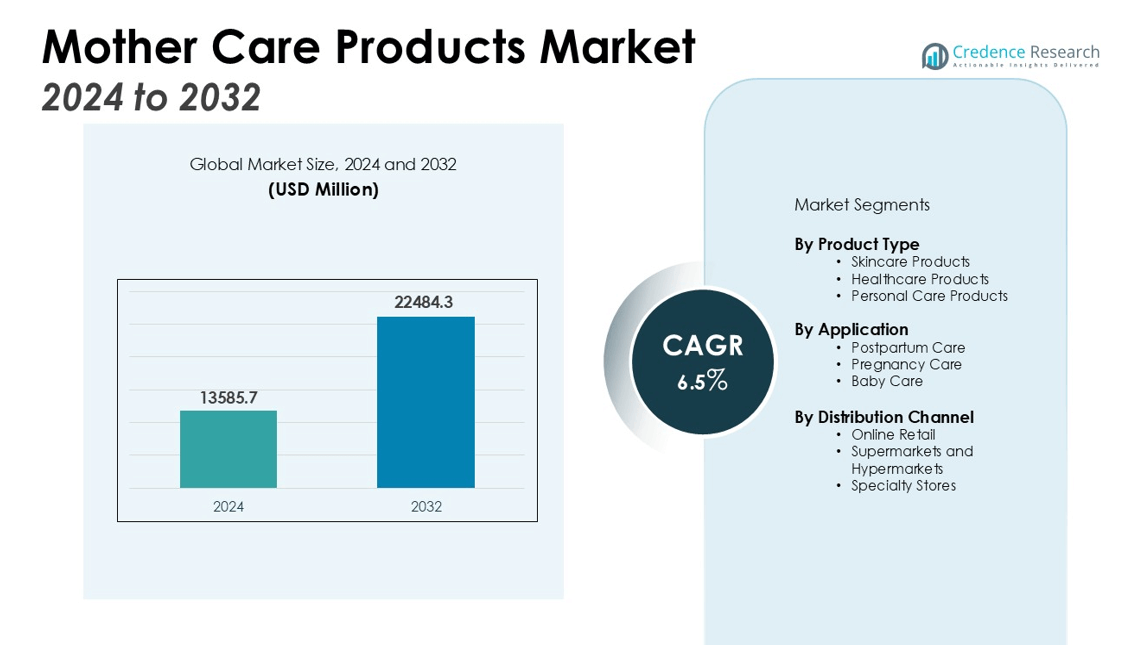

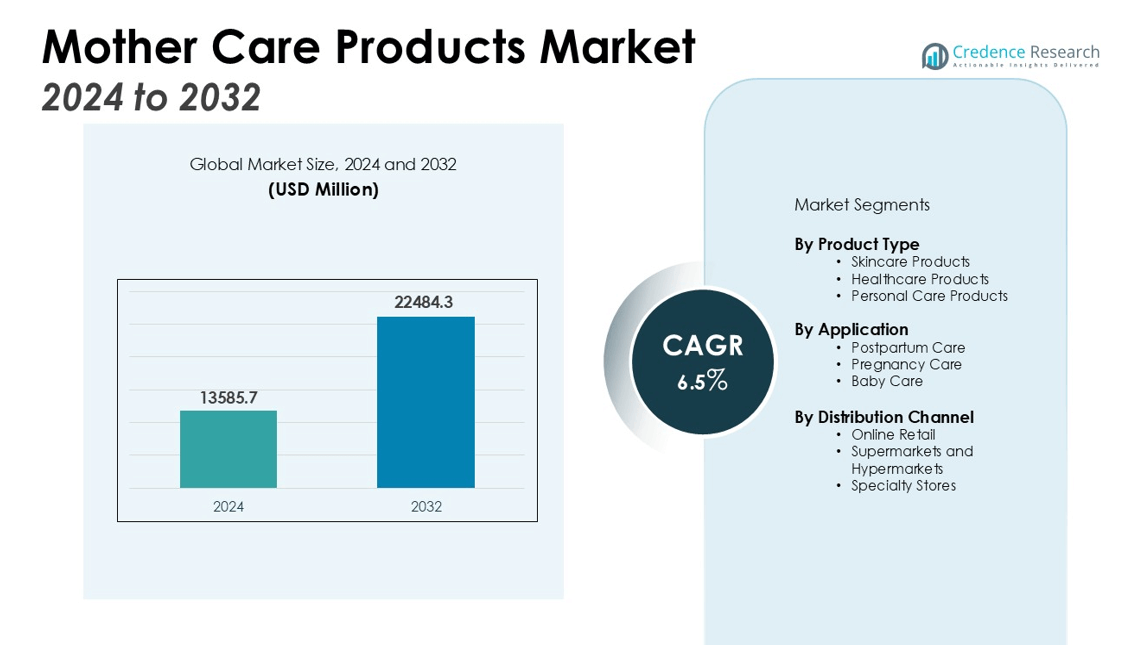

The Mother Care Products Market size was valued at USD 13585.7 million in 2024 and is anticipated to reach USD 22484.3 million by 2032, at a CAGR of 6.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mother Care Products Market Size 2024 |

USD 13585.7 million |

| Mother Care Products Market, CAGR |

6.5% |

| Mother Care Products Market Size 2032 |

USD 22484.3 million |

Key drivers of market growth include the growing focus on postpartum care, the surge in demand for organic and natural products, and rising disposable incomes. With a greater emphasis on product safety, hygiene, and sustainability, consumers are increasingly leaning towards eco-friendly and non-toxic solutions for mother and baby care. Additionally, advancements in product formulations, such as the development of hypoallergenic and dermatologically tested products, contribute to the market’s expansion.

Regionally, North America holds the largest market share, driven by high consumer spending and a well-established healthcare infrastructure. Europe follows closely with strong demand in countries like Germany and the UK, where there is a growing preference for premium and organic mother care products. The Asia-Pacific region is anticipated to witness the highest growth rate, fueled by increasing urbanization, rising disposable income, and growing awareness about maternal and child health in emerging markets like India and China. The rising middle-class population and increasing number of working mothers in these regions are also significantly contributing to the market’s growth.

Market Insights:

- The Mother Care Products Market was valued at USD 13,585.7 million in 2024 and is expected to reach USD 22,484.3 million by 2032, growing at a CAGR of 6.5% during the forecast period.

- Key market drivers include the increasing focus on postpartum care, with new mothers seeking products for skin care, recovery, and nourishment during the postnatal period.

- There is a rising demand for organic and natural products, driven by consumer concerns over product safety, environmental sustainability, and health risks associated with synthetic chemicals.

- Higher disposable incomes in emerging markets, particularly in Asia-Pacific, are contributing to market growth as parents invest in premium, high-quality products for maternal and baby care.

- Technological advancements in product formulations, such as hypoallergenic and dermatologically tested products, are meeting the demand for safe, effective solutions for sensitive skin.

- North America holds the largest market share, with 35%, driven by high consumer spending and a well-established healthcare infrastructure. The region continues to prioritize premium, organic, and safe products.

- The Asia-Pacific region, accounting for 25% of the global market, is growing rapidly due to urbanization, increasing disposable incomes, and a rising number of working mothers, presenting significant market opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Focus on Postpartum Care

The increasing focus on postpartum care is a key driver for the growth of the Mother Care Products Market. New mothers are becoming more aware of the importance of proper care during the postnatal period. This awareness is driving demand for products designed to address various needs, including skin care, recovery, and nourishment. With healthcare professionals highlighting the significance of post-delivery wellness, mothers are seeking products that promote comfort and healing, contributing to the market’s expansion.

Rising Demand for Organic and Natural Products

Consumers are shifting toward organic and natural products for mother and baby care. The Mother Care Products Market is benefiting from this growing trend due to heightened concerns about product safety and environmental sustainability. Organic and natural ingredients are perceived as safer and gentler, making them ideal for sensitive skin. This preference is also fueled by increasing awareness of the potential health risks of synthetic chemicals, further driving demand for eco-friendly and non-toxic alternatives.

- For instance, the Dubai-based company PureBorn has developed organic bamboo nappies that are super-absorbent, providing up to 12 hours of dry protection to keep babies comfortable.

Increase in Disposable Income

Higher disposable incomes in emerging markets have significantly impacted the growth of the Mother Care Products Market. With more disposable income, parents are willing to invest in premium products that promise higher quality and safety for their children. The ability to afford better care products is especially evident in regions such as Asia-Pacific, where improving economic conditions are enabling a larger segment of the population to purchase higher-end maternal and baby care items.

Advancements in Product Formulations

Technological innovations in product formulations are enhancing the growth prospects of the Mother Care Products Market. Companies are introducing hypoallergenic and dermatologically tested products that cater to sensitive skin, a common concern among new mothers. The availability of such products reassures consumers about safety and effectiveness, further driving adoption. These advancements also address the growing demand for customized solutions in the market.

- For instance, Burt’s Bees Baby Nourishing Lotion is clinically proven to provide moisturization for up to 24 hours. This pediatrician-tested formula contains natural ingredients like shea butter and sunflower seed oil to keep a baby’s delicate skin soft.

Market Trends:

Growing Preference for Eco-Friendly and Sustainable Products

A prominent trend in the Mother Care Products Market is the increasing preference for eco-friendly and sustainable products. Consumers are becoming more conscious of the environmental impact of the products they purchase, particularly for items related to maternal and baby care. This shift is driving demand for products made from biodegradable materials, reusable packaging, and natural ingredients. Companies in the market are responding by incorporating environmentally sustainable practices in their production processes. This trend aligns with the growing awareness of sustainability and the desire to reduce the carbon footprint of everyday products. As more brands focus on green initiatives, it is expected that the market will continue to shift toward these environmentally friendly alternatives.

- For instance, Seventh Generation took a significant step in reducing waste by launching its Zero Plastic line, introducing two home cleaning solutions in packaging that is completely free of plastic.

Rise in Technologically Enhanced Maternal Care Products

The Mother Care Products Market is witnessing a rise in the adoption of technologically enhanced maternal care products. This includes innovations such as wearable devices designed to monitor maternal health, app-integrated solutions for tracking postpartum recovery, and personalized skincare regimens powered by AI. These products offer greater convenience and accuracy, allowing mothers to take a proactive role in managing their health. Technological advancements in product formulations are also addressing the increasing demand for specialized solutions, such as hypoallergenic and dermatologist-tested items. This trend is likely to drive further innovation and growth, as consumers increasingly prioritize convenience, safety, and personalization in their purchasing decisions.

- For instance, Noodle & Boo’s Ultimate Baby Ointment has earned at least 1 Seal of Acceptance from the National Eczema Association for its formula developed for sensitive skin.

Market Challenges Analysis:

Regulatory Compliance and Safety Standards

One of the primary challenges in the Mother Care Products Market is ensuring compliance with stringent safety and regulatory standards. Products intended for mothers and babies require thorough testing to meet safety protocols, which vary across regions. Strict regulations regarding product ingredients, manufacturing processes, and labeling can slow down time-to-market and increase production costs. Companies must also invest in research and development to ensure their products adhere to these evolving standards. The complexity of navigating diverse regulations across countries can create barriers for global expansion, limiting the ability to tap into emerging markets where the demand for maternal and baby care products is growing.

High Competition and Price Sensitivity

The Mother Care Products Market faces intense competition, particularly with the proliferation of both established brands and new entrants offering similar products. This high level of competition puts pressure on companies to constantly innovate while maintaining product quality. Price sensitivity also poses a challenge, as consumers in price-conscious regions may prioritize affordability over premium features. Companies must strike a balance between offering high-quality, safe products and keeping costs manageable. Competitive pricing strategies, along with maintaining customer loyalty, remain key factors for success in a market where price wars and discounting are common.

Market Opportunities:

Expansion in Emerging Markets

The Mother Care Products Market presents significant growth opportunities in emerging markets, particularly in regions such as Asia-Pacific, Latin America, and the Middle East. Rapid urbanization, increasing disposable income, and growing awareness of maternal health are driving demand for premium and organic products. As more consumers in these regions embrace modern healthcare and wellness trends, the market for high-quality, safe mother and baby care items continues to expand. Companies that can offer tailored solutions to meet the specific needs and preferences of consumers in these regions are well-positioned for success. Emerging markets represent an untapped potential for global brands seeking to diversify their customer base and achieve long-term growth.

Technological Integration and Innovation

Technological advancements present substantial opportunities in the Mother Care Products Market. The rise of wearable health devices and mobile applications focused on maternal health allows companies to introduce more personalized and interactive solutions. Smart baby care products, such as monitors and smart clothing, are gaining traction, offering parents enhanced peace of mind. The incorporation of AI-driven platforms to monitor and manage health during pregnancy and post-pregnancy is another promising area. Innovations in product formulations, such as hypoallergenic and eco-friendly alternatives, further expand the market’s potential. As technology continues to evolve, the demand for high-tech, customized products is expected to drive further market development.

Market Segmentation Analysis:

By Product Type

The Mother Care Products Market is segmented by product type, including skincare, healthcare, and personal care products. Skincare products hold the largest share, driven by the demand for postpartum skin care, body lotions, and creams. Healthcare products, such as dietary supplements and prenatal vitamins, follow closely as new mothers seek to address nutritional needs and enhance their overall well-being. Personal care items, including baby wipes, diapers, and maternity wear, also contribute significantly to the market. These segments are expected to continue expanding as more mothers seek products that promote both their health and comfort.

- For instance, in 2024, the non-profit organization Vitamin Angels achieved a significant global impact by providing essential nutrition to over 74 million underserved pregnant women and children.

By Application

The market is further segmented by application, with key categories being postpartum care, pregnancy care, and baby care. Postpartum care products lead the market, with increasing demand for solutions that support recovery and physical wellness after childbirth. Pregnancy care products are also experiencing growth, fueled by the rising awareness of the importance of maternal health during pregnancy. Baby care products, such as feeding accessories, diapers, and skincare items, remain a significant segment, driven by the growing number of newborns and rising parental awareness of child care.

- For instance, the company Anya offers a Postpartum Recovery Kit that includes Recovery Drops designed for healing, with each bottle providing 30 servings to support new mothers.

By Distribution Channel

The distribution channels for the Mother Care Products Market include online retail, supermarkets and hypermarkets, and specialty stores. Online retail has gained significant traction, particularly due to the convenience and growing trend of e-commerce. Supermarkets and hypermarkets follow closely, providing a wide range of mother and baby care products in one location. Specialty stores that focus on organic and premium products are also growing in popularity, catering to consumers seeking high-quality and safe solutions for maternal and baby care.

Segmentations:

- By Product Type

- Skincare Products

- Healthcare Products

- Personal Care Products

- By Application

- Postpartum Care

- Pregnancy Care

- Baby Care

- By Distribution Channel

- Online Retail

- Supermarkets and Hypermarkets

- Specialty Stores

- By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

North America holds the largest share of the Mother Care Products Market, accounting for 35% of the global market. This region benefits from high consumer spending and a well-established healthcare infrastructure. The U.S. and Canada have robust maternal care systems that support the widespread availability of premium products. Consumers in this region increasingly prioritize high-quality, organic, and safe products, fueling demand for maternal and baby care items. A growing focus on postpartum care and wellness further contributes to market expansion. Companies offering innovative, customized solutions are capitalizing on these preferences, solidifying North America’s position as the leading market.

Europe

Europe represents 28% of the global Mother Care Products Market share, with significant demand for organic and sustainable products in countries like Germany, the U.K., and France. European consumers exhibit a high level of awareness regarding product safety, hygiene, and environmental impact. The shift towards natural and eco-friendly solutions, combined with rising disposable incomes, is driving market growth in the region. The preference for premium, dermatologically tested products continues to strengthen market opportunities. As sustainability trends continue to influence purchasing behavior, Europe remains a critical market for high-quality and eco-conscious maternal care solutions.

Asia-Pacific

The Asia-Pacific region holds 25% of the global market share in Mother Care Products, making it the fastest-growing market. Rapid urbanization, increasing disposable incomes, and the rising number of working mothers in countries like China, India, and Southeast Asia are driving demand for maternal and baby care products. Growing awareness of maternal health and wellness, along with modern healthcare adoption, is further propelling market growth. The expanding middle-class population and the increasing trend of online shopping significantly contribute to market opportunities in this region. As a result, Asia-Pacific presents promising growth prospects for global companies aiming to expand their reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott Laboratories

- Philips Avent

- Procter & Gamble Co.

- Johnson & Johnson

- Nestlé S.A.

- Unilever

- Kimberly-Clark Corporation

- Medela AG

- Pigeon Corporation

- Reckitt Benckiser Group plc

- Chicco (Artsana Group)

- Munchkin Inc.

- Dorel Industries Inc.

Competitive Analysis:

The Mother Care Products Market is highly competitive, with several global and regional players focusing on product innovation, quality, and consumer safety. Major companies in this market include Johnson & Johnson, Procter & Gamble, Kimberly-Clark, and Nestlé. These companies dominate due to their strong brand presence, extensive distribution networks, and diverse product offerings. New entrants and smaller brands are also making significant strides by targeting niche segments, such as organic and natural products, to cater to the increasing consumer demand for sustainable solutions. The market sees continuous innovation, particularly in hypoallergenic and dermatologically tested products, allowing companies to differentiate themselves. Strategic partnerships and acquisitions further help companies expand their product portfolios and geographic reach. With rising consumer preference for premium and safe products, key players are also focusing on enhancing product formulations and introducing eco-friendly packaging to maintain their competitive edge.

Market Concentration & Characteristics:

The Mother Care Products Market exhibits moderate concentration, with a few dominant global players such as Johnson & Johnson, Procter & Gamble, and Kimberly-Clark controlling a significant portion of the market. These companies lead due to their extensive product portfolios, strong distribution networks, and established brand recognition. However, the market also features numerous regional and niche players focusing on organic, natural, and eco-friendly products to cater to growing consumer preferences for sustainability and safety. The market is characterized by high product innovation, particularly in hypoallergenic and dermatologically tested products, and a shift toward personalized solutions. Consumer demand for premium, safe, and environmentally friendly products is driving companies to invest in research and development and enhance their product offerings. The presence of both large corporations and smaller, emerging brands ensures a competitive landscape with diverse options for consumers.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Mother Care Products Market will continue to expand due to increasing awareness about maternal and child health.

- A growing number of working mothers will drive the demand for convenient, high-quality products tailored to their needs.

- The shift towards organic, natural, and eco-friendly products will intensify, reflecting heightened consumer concerns over sustainability and safety.

- Innovations in product formulations, such as hypoallergenic and dermatologically tested solutions, will support market growth.

- The increasing focus on postpartum care and wellness will contribute to the demand for specialized recovery products.

- Technological advancements in maternal health products, such as wearable devices and app-integrated solutions, will gain traction.

- E-commerce will remain a key distribution channel, with online shopping providing convenience and greater access to diverse product options.

- Emerging markets, particularly in Asia-Pacific and Latin America, will offer substantial growth opportunities driven by rising disposable incomes and urbanization.

- Regulatory and safety standards will become even more stringent, prompting companies to prioritize compliance and product safety.

- Partnerships and acquisitions will be common strategies as companies expand their portfolios and reach in response to growing market demand.