Market Overview

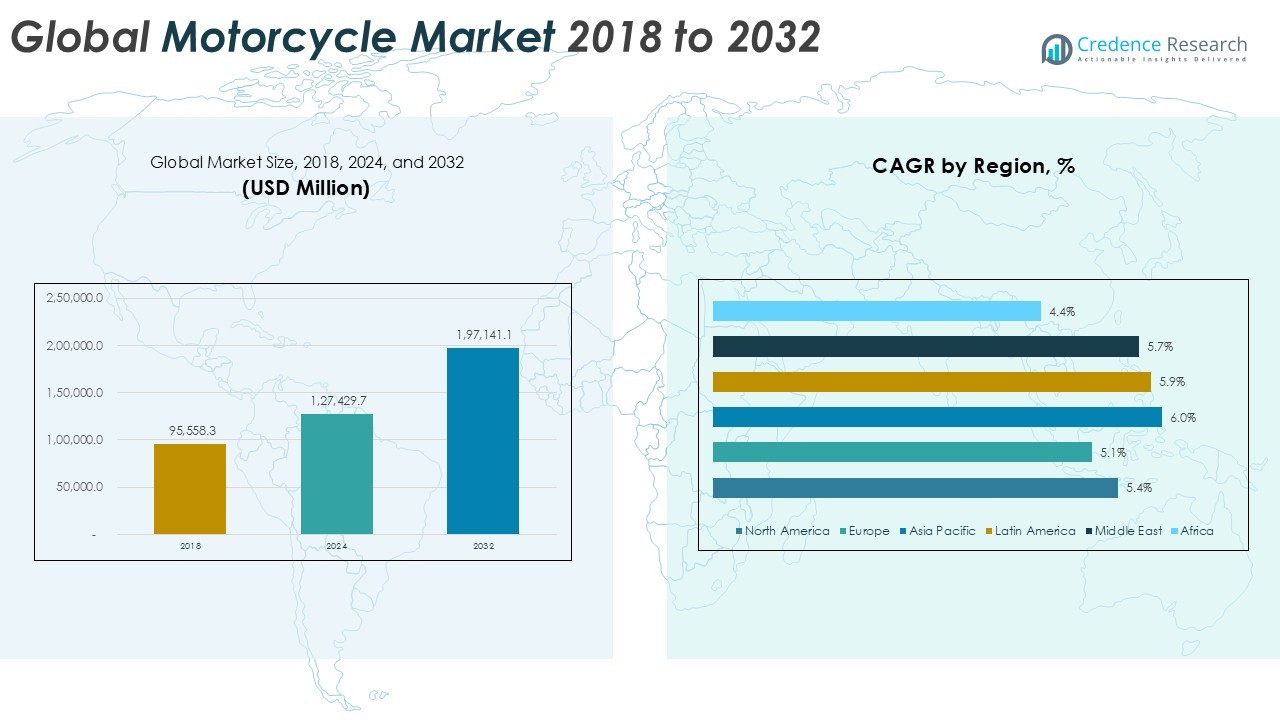

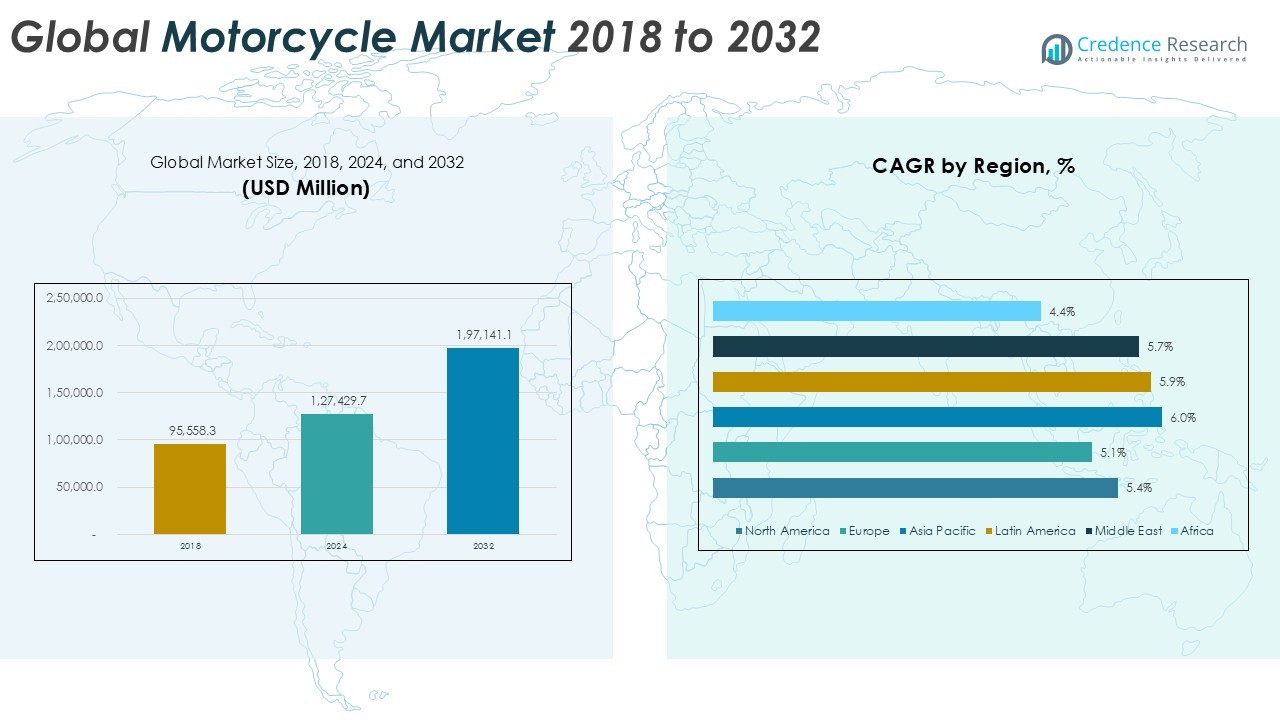

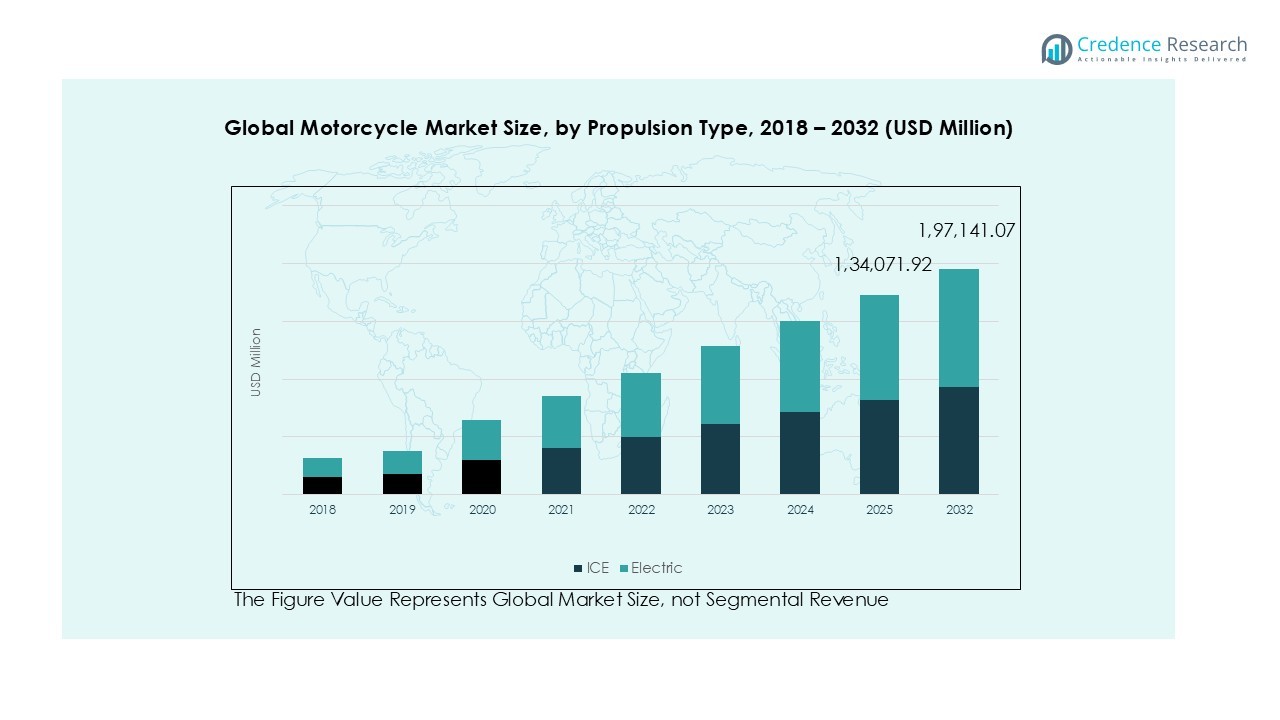

The Global Motorcycle Market size was valued at USD 95,558.3 million in 2018, increased to USD 127,429.7 million in 2024, and is anticipated to reach USD 197,141.1 million by 2032, growing at a CAGR of 5.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motorcycle Market Size 2024 |

USD 127,429.7 Million |

| Motorcycle Market, CAGR |

5.66% |

| Motorcycle Market Size 2032 |

USD 197,141.1 Million |

The Global Motorcycle Market is dominated by leading manufacturers such as Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Hero MotoCorp Ltd., Bajaj Auto Ltd., TVS Motor Company Ltd., Suzuki Motor Corporation, Harley-Davidson, Inc., BMW AG, Triumph Motorcycles, and Kawasaki Motors Corp. These companies maintain strong market positions through diverse product portfolios, advanced technologies, and extensive global distribution networks. Japanese and Indian manufacturers lead the commuter and mid-range segments, while European and American brands dominate the premium and touring categories. Strategic investments in electric mobility, connectivity, and performance upgrades continue to shape competition across regions. Asia Pacific emerged as the leading regional market in 2024, capturing 34% of the global share, driven by high two-wheeler demand in India, China, and Indonesia, supported by rising disposable incomes, urbanization, and strong manufacturing capabilities among key market players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Motorcycle Market was valued at USD 127,429.7 million in 2024 and is projected to reach USD 197,141.1 million by 2032, expanding at a CAGR of 5.66% during the forecast period.

- Rising urbanization, increasing commuting demand, and affordability are driving market growth, with motorcycles serving as a cost-effective and fuel-efficient mode of transport across developing regions.

- The market is witnessing strong trends toward electric mobility, smart connectivity, and technological advancements such as ABS and AI-based safety systems, enhancing rider experience and sustainability.

- The competitive landscape is led by key players including Honda, Yamaha, Hero MotoCorp, Bajaj, and TVS, focusing on innovation, local manufacturing, and electric model launches to strengthen their global presence.

- Asia Pacific held the largest regional share of around 34% in 2024, while the standard motorcycle segment accounted for over 38% of revenue, driven by affordability, reliability, and widespread consumer adoption.

Market Segmentation Analysis:

By Motorcycle Type:

The standard motorcycle segment dominated the global market in 2024, accounting for over 38% of total revenue share, owing to its affordability, fuel efficiency, and suitability for daily commuting. Its versatile design appeals to a wide consumer base, particularly in emerging economies where motorcycles are a primary mode of transportation. The sports segment is witnessing steady growth driven by rising demand for performance-oriented models and lifestyle biking trends. Increasing urbanization and expansion of two-wheeler rental services further support the demand across all motorcycle types globally.

For instance, Hero MotoCorp’s Splendor Plus, known for its 97.2cc engine and over 70 km/l mileage, remained one of India’s best-selling commuter bikes in 2024.

By Propulsion Type:

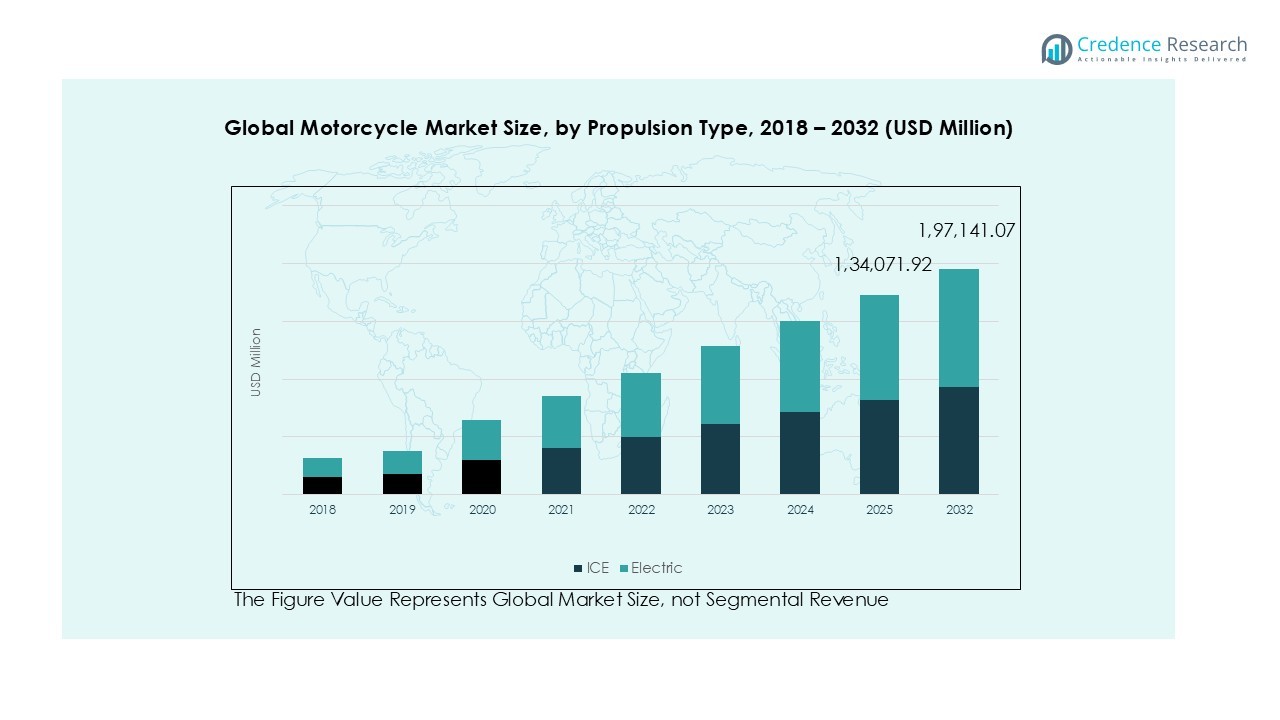

The Internal Combustion Engine (ICE) segment led the market in 2024 with a dominant share of around 87%, supported by its established infrastructure, lower initial cost, and wide product availability. However, the electric motorcycle segment is expanding rapidly, driven by government incentives, technological improvements in battery systems, and growing environmental awareness. Leading manufacturers are investing in hybrid and electric variants to align with sustainability goals and emission regulations, suggesting a gradual market transition toward electric propulsion over the forecast period.

By Engine Capacity:

Motorcycles with up to 200cc engine capacity held the largest market share of nearly 45% in 2024, driven by high demand in Asian and Latin American markets where affordability and fuel economy are key purchase factors. These models are preferred for city commuting and short-distance travel. The 200cc–400cc segment is also growing steadily, supported by youth preference for mid-range bikes offering better performance. Meanwhile, the above 800cc segment caters to premium consumers in developed regions, driven by increasing adoption of luxury and adventure touring motorcycles.

For instance, Royal Enfield expanded its 350cc class with models like the Meteor 350 and Hunter 350, contributing noticeably to its mid-range category sales.

Key Growth Drivers

Rising Urbanization and Commuting Demand

Increasing urban congestion and the need for affordable personal mobility are major drivers of the global motorcycle market. Motorcycles offer a cost-effective and fuel-efficient transportation solution, especially in densely populated regions such as Asia Pacific and Latin America. The rising working-class population and growing two-wheeler ownership in urban centers are further accelerating demand. Manufacturers are introducing compact, low-maintenance models tailored for city travel, contributing to steady market expansion and strengthening the motorcycle’s role as a primary urban mobility option.

For instance, Yamaha Motor Co., Ltd. has launched electric scooter models like the E01 across several Asian markets, supporting eco-friendly urban travel with smart features and contributing to the growth of sustainable mobility options.

Technological Advancements and Product Innovation

Continuous advancements in engine technology, safety features, and connectivity systems are driving the motorcycle market forward. The integration of ABS, traction control, GPS, and smart connectivity enhances performance, rider comfort, and safety. Manufacturers are investing in electric propulsion systems, lightweight materials, and modular designs to appeal to evolving consumer preferences. Such innovations not only improve riding experience but also align with regulatory norms, supporting long-term market sustainability and encouraging premium motorcycle adoption globally.

For instance, Harley-Davidson’s LiveWire electric motorcycle uses a liquid-cooled motor and advanced telematics through its H-D Connect app to monitor charge levels and vehicle diagnostics remotely.

Growing Popularity of Recreational and Sports Motorcycling

Rising disposable income and lifestyle changes are fueling the demand for sports and leisure motorcycles. Adventure touring, racing, and recreational biking have gained popularity in developed regions like Europe and North America. Motorcycle clubs, events, and adventure tourism trends are boosting premium motorcycle sales. Leading brands are expanding their performance and touring bike portfolios to capture this growing consumer base, while customization and brand experience strategies further enhance customer engagement and brand loyalty.

Key Trends & Opportunities

Rapid Expansion of Electric Motorcycles

The shift toward sustainability is creating strong growth opportunities for electric motorcycles. Governments worldwide are supporting electric mobility through subsidies, tax incentives, and charging infrastructure development. Advancements in battery efficiency, lower maintenance costs, and improved range are making electric motorcycles a viable alternative to ICE models. Manufacturers are leveraging partnerships and R&D to introduce affordable electric variants, positioning this segment as one of the fastest-growing areas in the global motorcycle market.

For instance, Energica Motor Company’s strategic R&D partnership with Electra Vehicles, leveraging AI-powered battery management systems to optimize battery performance, vehicle range, and charging, enhancing the overall electric motorcycle experience.

Emergence of Connected and Smart Motorcycles

The integration of digital technologies such as IoT, telematics, and AI-based systems is redefining the riding experience. Smart motorcycles equipped with real-time diagnostics, navigation, and communication features enhance rider safety and convenience. These innovations create new opportunities for manufacturers to differentiate products and establish recurring revenue streams through connected services. Growing consumer demand for technologically advanced motorcycles is expected to reshape the competitive landscape and accelerate premium segment growth globally.

For instance, electric motorcycles like those equipped with app integration offer battery monitoring, theft alerts, and adaptive ride modes, allowing riders to remotely monitor condition and customize performance, driving smarter and safer riding experiences.

Key Challenges

Stringent Emission Regulations and Compliance Costs

Tightening global emission standards pose a significant challenge to motorcycle manufacturers. Compliance with regulations such as Euro 5 and similar norms in emerging markets requires investment in cleaner technologies and engine redesigns. These compliance costs increase production expenses and may impact affordability, especially in price-sensitive regions. Additionally, the transition toward electric and hybrid systems demands high R&D investment, compelling smaller players to adapt or risk losing competitiveness in a rapidly evolving regulatory environment.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating prices of steel, aluminum, and critical components, along with supply chain disruptions, have created operational challenges for motorcycle manufacturers. The global shortage of semiconductors and rising logistics costs affect production timelines and profit margins. Manufacturers are focusing on localizing supply chains and adopting digital manufacturing solutions to mitigate these risks. However, maintaining cost efficiency while ensuring product quality remains a key hurdle, especially for brands competing in the mid- and low-cost motorcycle segments.

Regional Analysis

North America:

The North America motorcycle market was valued at USD 22,618.64 million in 2018, increased to USD 29,802.15 million in 2024, and is projected to reach USD 45,362.16 million by 2032, growing at a CAGR of 5.4%. The region accounted for nearly 19% of the global market share in 2024, driven by strong demand for premium, touring, and adventure motorcycles. The U.S. dominates regional sales, supported by established brands such as Harley-Davidson and Indian Motorcycle. Rising adoption of electric motorcycles and a growing enthusiast community further bolster market expansion across North America.

Europe:

Europe’s motorcycle market was valued at USD 27,291.44 million in 2018, rose to USD 35,869.63 million in 2024, and is expected to reach USD 54,410.94 million by 2032, registering a CAGR of 5.1%. Holding about 21% of the global market share in 2024, the region benefits from a strong base of luxury and performance motorcycle manufacturers such as BMW, Ducati, and Triumph. Increasing demand for electric and adventure motorcycles, combined with favorable emission regulations and a strong touring culture, continues to drive market growth across major economies like Germany, Italy, and France.

Asia Pacific:

The Asia Pacific motorcycle market was valued at USD 31,324.00 million in 2018, surged to USD 42,710.78 million in 2024, and is anticipated to reach USD 68,013.67 million by 2032, expanding at a CAGR of 6.0%. The region accounted for the largest share of around 34% of the global market in 2024, fueled by strong two-wheeler demand in India, China, and Indonesia. Affordable prices, rising middle-class income, and urban mobility needs are key growth drivers. Major players such as Honda, Yamaha, and Hero MotoCorp continue to dominate, supported by a growing shift toward electric mobility.

Latin America:

The Latin America motorcycle market stood at USD 6,994.86 million in 2018, increased to USD 9,453.46 million in 2024, and is projected to reach USD 14,884.15 million by 2032, growing at a CAGR of 5.9%. The region captured around 8% of the global market share in 2024, driven by affordability and increasing use of motorcycles for daily commuting and delivery services. Brazil and Argentina lead in market volume due to strong local manufacturing and distribution networks. Growing demand for low-cost and fuel-efficient two-wheelers continues to stimulate regional sales.

Middle East:

The Middle East motorcycle market was valued at USD 4,873.47 million in 2018, reached USD 6,526.22 million in 2024, and is expected to attain USD 10,152.77 million by 2032, expanding at a CAGR of 5.7%. The region held about 7% of the global market share in 2024, driven by the rising popularity of high-performance and leisure motorcycles in the UAE and Saudi Arabia. Increasing disposable income, better road infrastructure, and expanding dealer networks of global brands like Harley-Davidson and Ducati continue to boost demand across the Middle East.

Africa:

Africa’s motorcycle market was valued at USD 2,455.85 million in 2018, rose to USD 3,067.41 million in 2024, and is projected to reach USD 4,317.39 million by 2032, growing at a CAGR of 4.4%. The region accounted for nearly 5% of the global market share in 2024, driven by increasing use of motorcycles for commercial transport and delivery services. Countries such as Nigeria, Kenya, and South Africa dominate regional demand due to affordability and convenience. However, limited financing options and inadequate road infrastructure remain key barriers to faster market expansion.

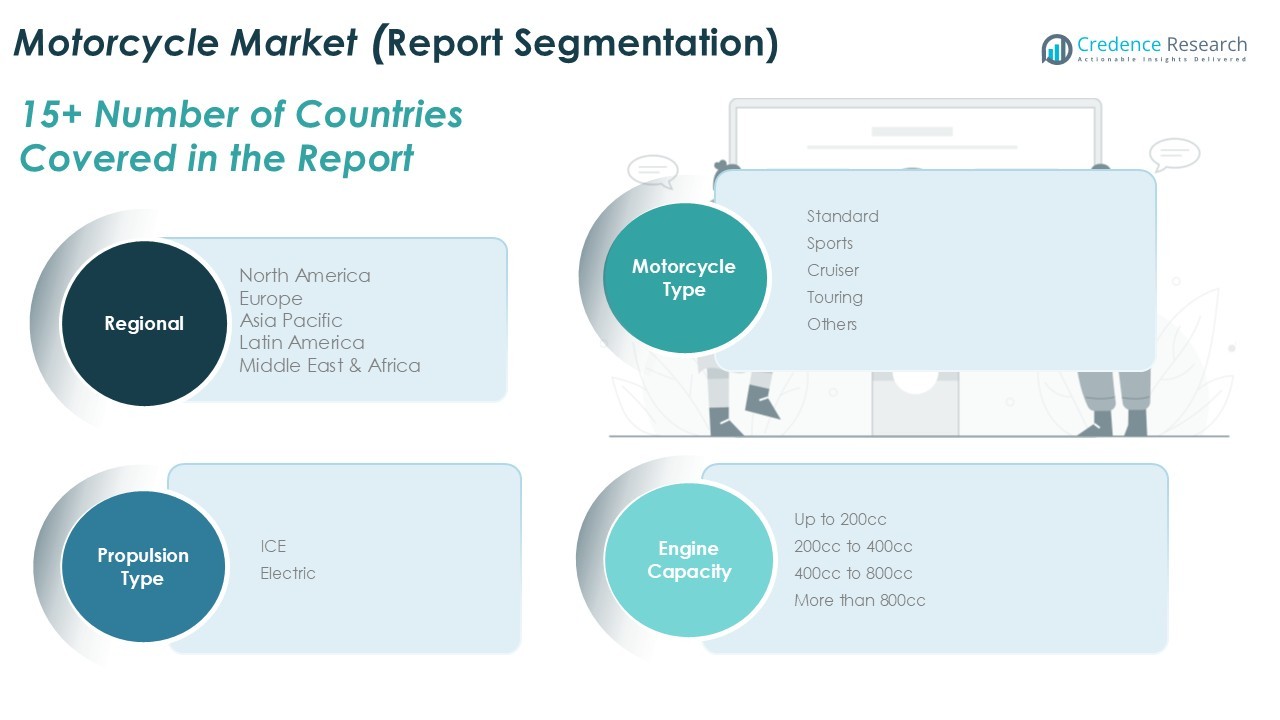

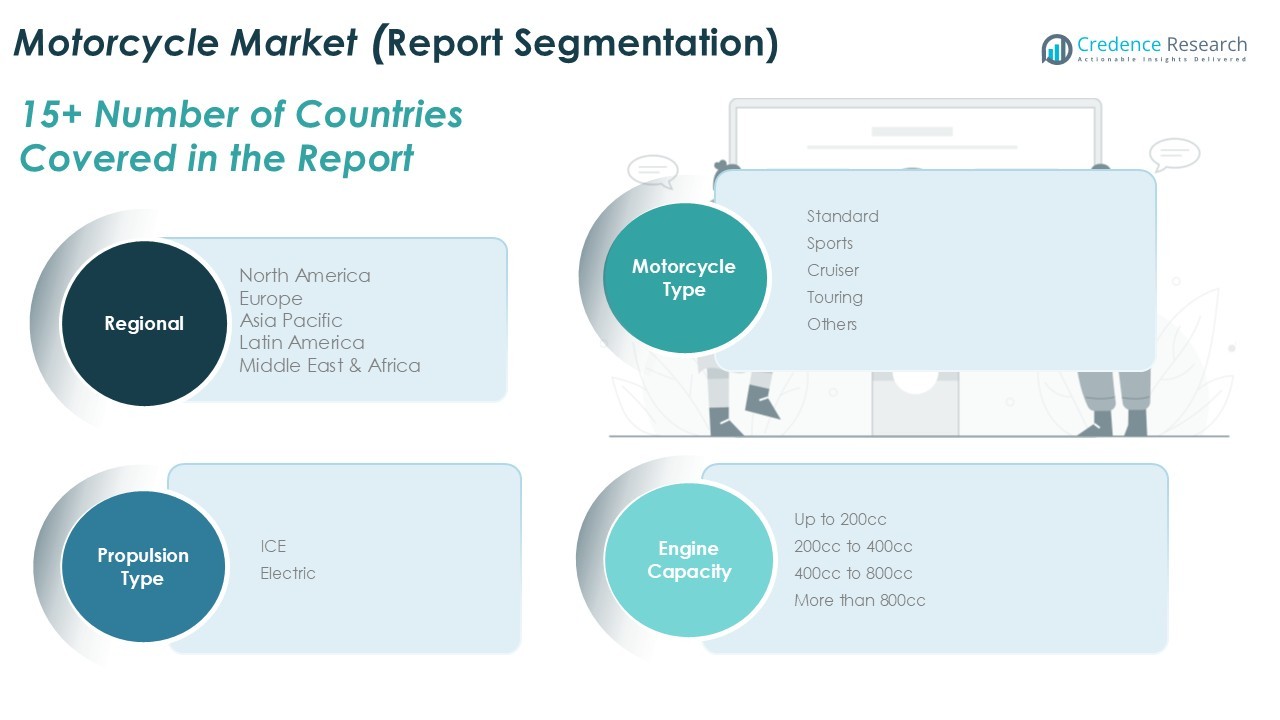

Market Segmentations:

By Motorcycle Type

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Motorcycle Market is dominated by major players such as Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Hero MotoCorp Ltd., Bajaj Auto Ltd., TVS Motor Company Ltd., Suzuki Motor Corporation, Harley-Davidson, Inc., BMW AG, Triumph Motorcycles, and Kawasaki Motors Corp. These companies lead the market through extensive product portfolios, strong brand recognition, and wide distribution networks. The industry is characterized by continuous innovation, with a focus on electric mobility, connectivity, and advanced safety technologies. Strategic alliances, local manufacturing expansion, and new model launches are common approaches to sustain competitiveness. Asian manufacturers, particularly from Japan and India, maintain a stronghold in the commuter and mid-range segments, while European and American brands dominate the premium and touring categories. The growing emphasis on electric motorcycles and digital transformation is reshaping competition, compelling leading players to invest heavily in R&D and sustainable manufacturing solutions to secure long-term market leadership.

Key Player Analysis

- Honda Motor Co., Ltd.

- TVS Motor Company Ltd.

- Bajaj Auto Ltd.

- Yamaha Motor Co., Ltd.

- Suzuki Motor Corporation

- Triumph Motorcycles

- Bayerische Motoren Werke (BMW) AG

- Harley-Davidson, Inc.

- Hero MotoCorp Ltd.

- Kawasaki Motors Corp.

- Other Key Players

Recent Developments

- In October 2025, Hero MotoCorp entered the UK market through a partnership with MotoGB Ltd., launching its Euro 5+ range led by the Hunk 440 motorcycle.

- In October 2025, Polaris Inc. announced plans to sell a majority stake in its Indian Motorcycle brand to private-equity firm Carolwood LP, transitioning it into a standalone company.

- In October 2025, TVS Motor Company and its UK subsidiary Norton Motorcycles revealed the first official design sketch of their upcoming Norton Superbike, marking a key step in their “Resurgence” global product strategy.

- In September 2025, Holley Performance Brands, through its Simpson Motorcycle division, entered a strategic partnership with Buell Motorcycle to co-develop safety helmets and expand into the global motorcycle safety gear market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global motorcycle market will continue to grow steadily, driven by rising urban mobility needs and affordable transportation demand.

- Electric motorcycles will gain strong momentum as manufacturers expand their sustainable mobility portfolios.

- Asia Pacific will remain the largest and fastest-growing region due to increasing two-wheeler adoption in emerging economies.

- Technological advancements such as smart connectivity and AI-based safety features will enhance user experience and attract new consumers.

- Premium and sports motorcycle segments will expand as lifestyle-oriented riding trends strengthen globally.

- Expansion of shared mobility and ride-hailing services will create new opportunities for motorcycle manufacturers.

- Strategic collaborations between OEMs and technology firms will accelerate innovation and product diversification.

- The aftermarket and customization sector will witness strong growth due to rising demand for accessories and performance upgrades.

- Stricter emission norms will drive a faster shift toward hybrid and electric propulsion technologies.

- Manufacturers will increasingly focus on regional production hubs and supply chain resilience to mitigate global disruptions.