Market Overview

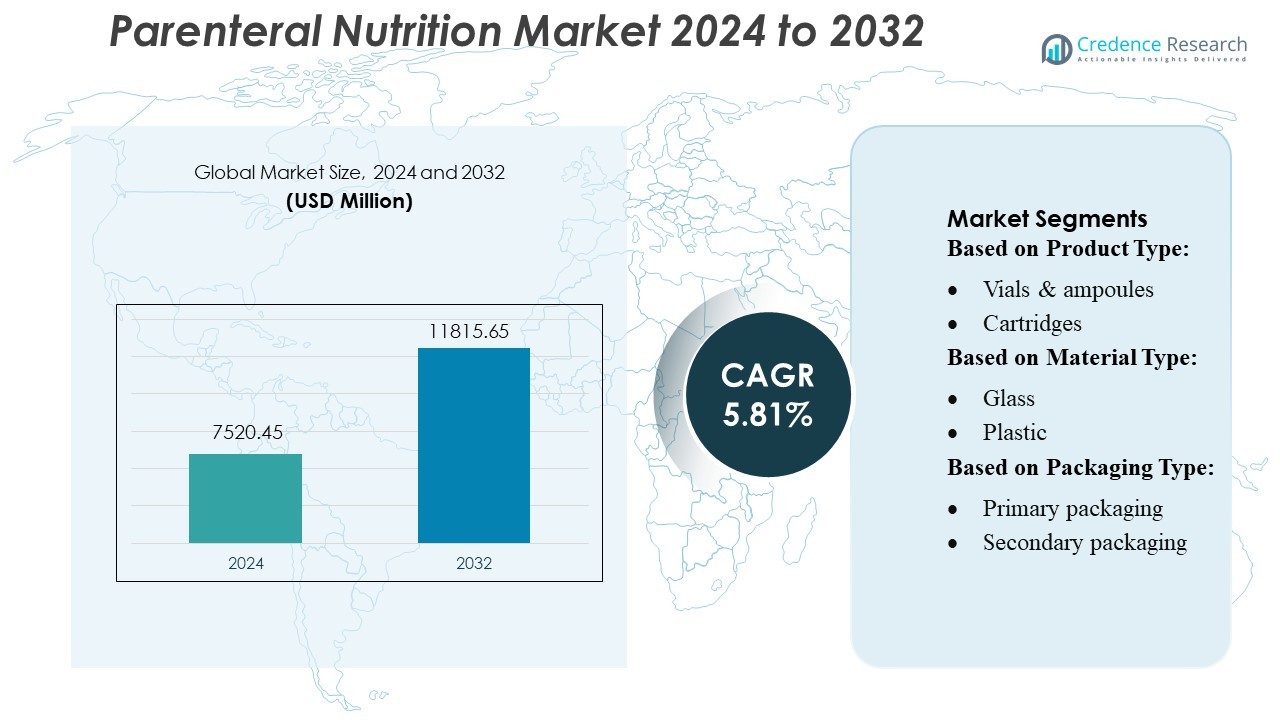

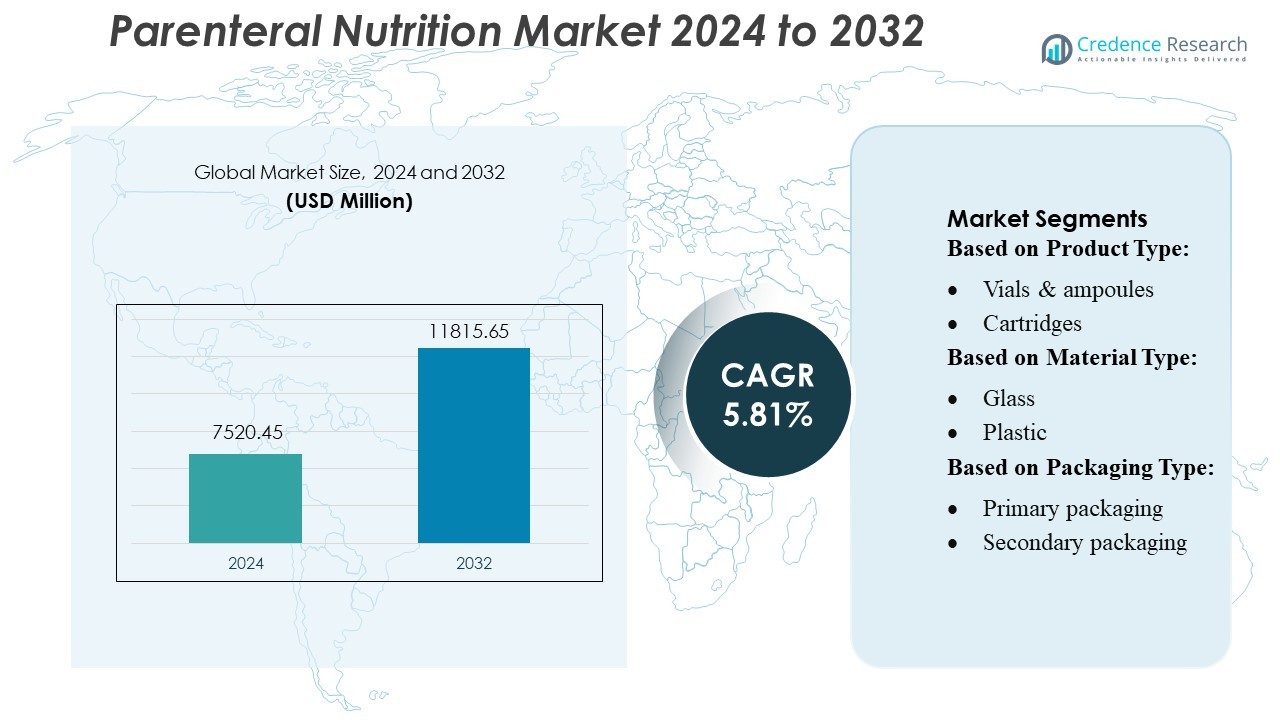

Parenteral Nutrition Market size was valued USD 7520.45 million in 2024 and is anticipated to reach USD 11815.65 million by 2032, at a CAGR of 5.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Parenteral Nutrition Market Size 2024 |

USD 7520.45 Million |

| Parenteral Nutrition Market, CAGR |

5.81% |

| Parenteral Nutrition Market Size 2032 |

USD 11815.65 Million |

The parenteral nutrition market include Abbott, GlaxoSmithKline plc (GSK), Nestlé, Ajinomoto Co., Inc., Danone, Otsuka Holdings, AAK AB, Herbalife Nutrition, The Vitamin Company India, and PepsiCo. These firms compete intensely by investing in research, launching advanced lipid emulsions and multi-chamber bags, and expanding their hospital and home-care footprint. Abbott and GSK currently dominate due to their strong R&D capabilities, global distribution networks, and high-quality sterile compounding technologies. Regionally, North America leads the market, capturing approximately 36 % of total market share, driven by its advanced healthcare infrastructure, favorable reimbursement environment, and high uptake of standardized PN formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Parenteral Nutrition Market was valued at USD 7,520.45 million in 2024 and is projected to reach USD 11,815.65 million by 2032, advancing at a CAGR of 5.81% during the forecast period.

- Rising critical-care admissions, growing neonatal nutrition needs, and expanding home-infusion services continue to drive demand, especially for amino acid and lipid-based formulations, which hold a significant share of overall product segments.

- The market shows strong innovation trends, with companies prioritizing advanced lipid emulsions, multi-chamber PN bags, and automation-driven sterile compounding to improve safety and efficiency.

- Competitive intensity remains high as global and regional players invest in R&D, yet challenges persist due to high formulation costs, strict regulatory requirements, and supply-chain complexities affecting product availability.

- Regionally, North America leads with about 36% share, while Europe and Asia-Pacific collectively account for a significant portion of the market; segment-wise, ready-to-use multi-chamber bags continue gaining share across hospitals and home-care settings.

Market Segmentation Analysis:

By Product Type:

In the parenteral nutrition market, product types include vials & ampoules, cartridges, prefilled syringes, infusion-solution bottles & bags, blister packs, and other formats. The vials & ampoules sub-segment is currently dominant, accounting for approximately 23.2 % of the market, driven by their cost-efficiency, strong chemical compatibility, and robust sealing capabilities. Their versatility for both liquid and lyophilized formulations makes them a preferred option among pharmaceutical manufacturers. Growing demand for sterile injectable nutrition and biologics further reinforces their market leadership.

- For instance, Nestlé Health Science supports its medical-nutrition innovation pipeline by leveraging Nestlé S.A.’s extensive global R&D network of 23 research facilities and more than 4,000 scientists, enabling the development and validation of advanced sterile-processing technologies used in clinical nutrition products.

By Material Type:

The materials used for parenteral nutrition packaging comprise glass, plastic, paper and paperboard, and other substrates. Plastic leads this segment, owing to its moldability, lightweight nature, and design flexibility. Manufacturers favor plastic for its ability to be shaped into complex formats such as infusion bags and prefilled syringes, while its barrier properties help maintain sterility. Additionally, plastic supports cost-effective high-volume production, making it a key driver in the growth of packaging for parenteral nutrition.

- For instance, Danone reported that it recovered 58% of the plastic it placed on the market, per its extra-financial data. The exact tonnage recovered is not 434,000 metric tonnes, but the company’s virgin plastic use was around 762,000 metric tonnes a figure it has since worked to reduce.

By Packaging Type:

Packaging types in this market are classified into primary, secondary, and tertiary packaging. Primary packaging is the dominant segment, capturing roughly 60 % or more of the market, as it comes into direct contact with the nutrition formulation. This segment is driven by the critical need for product protection, sterility maintenance, and accurate dose administration. Innovations such as smart packaging (e.g., sensors) and enhanced fill-finish technologies further fuel demand, particularly for ready-to-use parenteral nutrition formats.

Key Growth Drivers

Rising Prevalence of Chronic and Critical Illnesses

The increasing incidence of gastrointestinal disorders, cancer, sepsis, and severe malnutrition significantly drives demand for parenteral nutrition. Healthcare providers rely on intravenous nutrient delivery when oral or enteral feeding is not feasible, creating sustained utilization in ICUs, oncology units, and surgical settings. Expanding geriatric populations with higher susceptibility to metabolic and absorption complications strengthens demand further. Additionally, improvements in hospital infrastructure and greater adoption of clinical nutrition protocols across developed and emerging markets reinforce this growth driver.

- For instance, PepsiCo’s Nutrition team—which includes over 2,800 scientists across 18 global R&D centers—has developed science-based nutrition criteria that helped the firm reduce added sugars in its beverage portfolio.

Advancements in Nutrient Formulations and Compounding Technologies

Continuous innovation in lipid emulsions, amino acid solutions, and trace-element formulations enhances safety, stability, and metabolic compatibility. Automated compounding systems reduce contamination risks and improve dosing accuracy, supporting wider use in pediatric and neonatal care. The adoption of three-chamber bags and ready-to-administer formulations boosts workflow efficiency and reduces preparation time in hospitals. These technological improvements, along with tighter quality standards, expand the clinical acceptance of parenteral nutrition across diverse therapeutic applications.

- For instance, AAK’s technical-product segment saw volumes rise by 18% in Q2 2025 and its operating profit surge by 178%, highlighting strong demand for its advanced lipid solutions.

Expansion of Home Parenteral Nutrition (HPN) Programs

Growing preference for decentralized care and long-term nutritional support is accelerating home parenteral nutrition adoption. Advances in portable infusion pumps, sterile packaging, and remote patient monitoring allow safer administration outside hospital settings. Healthcare systems promote HPN as a cost-effective alternative for chronic intestinal failure and digestive disorders requiring sustained nutritional therapy. Increasing reimbursement support and specialized home-care service providers further stimulate this shift, making HPN a key contributor to long-term market expansion.

Key Trends & Opportunities

Shift Toward Multi-Chamber Bags and Ready-to-Use Systems

A major trend is the rapid adoption of multi-chamber bags that separate nutrients until point-of-use, improving sterility and extending shelf life. These systems reduce compounding errors, support faster clinical workflows, and enhance patient safety. Their growing acceptance in both hospitals and home-care settings creates opportunities for manufacturers to expand high-margin, ready-to-administer product lines. As healthcare providers prioritize efficiency and contamination prevention, demand for simplified parenteral nutrition delivery formats continues to rise globally.

- For instance, Herbalife Nutrition recently opened a Center of Excellence in Torrance, California, investing 7 million into a facility that integrates R&D, quality control, and sensory-science functions.

Integration of Digital Health and Remote Monitoring in HPN

Digital infusion pumps, connected devices, and telehealth platforms are enabling continuous monitoring of infusion parameters, patient compliance, and metabolic responses. This trend particularly benefits long-term home parenteral nutrition patients, where real-time data improves clinical oversight and reduces hospital readmissions. Manufacturers offering integrated digital ecosystems gain competitive advantage by supporting value-based care models. Growing investments in smart infusion technologies and remote nutrition management platforms open new innovation opportunities across the market.

- For instance, Otsuka Pharmaceutical Factory launched a cloud-based service “Pokenyu (Pocket Nutrition),” which includes a nutritional-assessment function that lists approximately 100 common dietary-nutrition problems and tracks patient data over time.

Sustainability and Eco-Friendly Packaging Development

Growing emphasis on environmental responsibility is pushing manufacturers to develop recyclable, lightweight, and lower-waste packaging for parenteral nutrition. Advances in medical-grade plastics, renewable materials, and reduced-resin designs support hospital sustainability goals without compromising sterility. Companies exploring biodegradable components or energy-efficient production processes also unlock differentiation opportunities. As regulatory bodies and healthcare providers strengthen sustainability requirements, eco-friendly packaging becomes a strategic area for long-term growth and competitive positioning.

Key Challenges

Risk of Complications and Stringent Safety Requirements

Parenteral nutrition carries inherent risks such as bloodstream infections, metabolic imbalances, and liver dysfunction, requiring strict adherence to aseptic preparation and monitoring protocols. Meeting rigorous quality and sterility standards increases manufacturing complexity and cost. Healthcare providers face challenges ensuring proper patient management, especially in home-care environments. These safety concerns limit rapid adoption in some regions and necessitate continuous investment in training, high-quality components, and advanced monitoring systems.

High Cost of Formulations, Equipment, and Skilled Administration

The market faces financial barriers due to the high cost of nutrient formulations, infusion pumps, compounding systems, and specialized clinical staffing. Hospitals in low- and middle-income regions often struggle with budget constraints that restrict access to advanced parenteral nutrition therapies. Reimbursement variability across countries further complicates adoption, particularly for long-term home-care patients. Limited affordability affects procurement decisions and slows market penetration, making cost optimization a critical challenge for providers and manufacturers.

Regional Analysis

North America:

North America leads the global parenteral nutrition market, holding about 34–38% of total share. The region benefits from strong healthcare systems, higher adoption of advanced nutrition therapies, and a large number of critical-care and chronic-illness patients. Demand is further supported by well-established reimbursement policies and the presence of major manufacturers. Hospitals increasingly use ready-to-use PN formulations to improve efficiency and safety. Growing home-infusion services and rising neonatal care requirements also contribute to the region’s steady market expansion.

Europe:

Europe accounts for roughly 28–30% of the global parenteral nutrition market. The region’s growth is supported by standardized nutritional care protocols, strong clinical awareness, and well-developed hospital networks. Countries such as Germany, France, and the U.K. drive demand through high volumes of oncology, surgical, and neonatal cases requiring PN therapy. Increasing preference for premixed solutions and regulatory focus on patient safety also support adoption. Although the market is mature, continuous improvements in clinical nutrition practices sustain a stable growth outlook.

Asia-Pacific:

Asia-Pacific holds around 20–23% of the market and represents the fastest-growing region. Rising hospital capacity, expanding critical-care infrastructure, and increasing awareness of clinical nutrition drive strong demand. Countries like China and India are investing heavily in healthcare modernization, leading to higher usage of PN in intensive care and neonatal units. Growing elderly populations, higher malnutrition rates, and improved access to treatment further accelerate market expansion. Local manufacturing and cost-effective PN products support broader adoption across emerging economies.

Latin America:

Latin America captures approximately 8–10% of the parenteral nutrition market. Growth is supported by improvements in public and private healthcare systems, especially in Brazil and Mexico. Increased prevalence of chronic diseases, higher surgical case volumes, and expanding intensive-care services contribute to rising PN demand. Although adoption remains lower than in North America and Europe, improving hospital infrastructure and growing awareness of specialized nutrition therapy support steady market progress. Limited reimbursement and cost constraints remain challenges, but the region shows moderate long-term growth potential.

Middle East & Africa:

The Middle East & Africa region holds around 4–8% of the global market. Growth is mainly concentrated in Gulf countries, where investment in tertiary care, neonatal units, and critical-care facilities is increasing. Rising incidence of preterm births and chronic illnesses drives gradual adoption of PN therapy. However, overall market penetration remains lower due to limited specialized nutrition services in several African countries. Improving healthcare spending and increasing focus on modern hospital infrastructure provide long-term opportunities, although access and affordability continue to restrict faster market expansion.

Market Segmentations:

By Product Type:

- Vials & ampoules

- Cartridges

By Material Type:

By Packaging Type:

- Primary packaging

- Secondary packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the parenteral nutrition market features key players such as Nestle, The Vitamin Company India, Danone, PepsiCo, AAK AB, Ajinomoto Co., Inc., Herbalife Nutrition, Otsuka Holdings Co., Ltd, Abbott, and GlaxoSmithKline plc (GSK). The parenteral nutrition market remains moderately consolidated, with competition driven by product innovation, clinical efficacy, and regulatory compliance. Companies are prioritizing advancements in amino acid blends, lipid emulsions, and multi-chamber bags to enhance patient safety, reduce preparation time, and ensure sterility. Increasing demand for standardized, ready-to-use formulations is prompting manufacturers to invest in automation, sterile compounding technology, and improved quality-assurance systems. Strategic partnerships with hospitals, home-care providers, and distribution networks are strengthening market reach, especially in emerging regions. Additionally, firms are expanding manufacturing capacity to ensure uninterrupted supply amid rising critical-care admissions and growing neonatal nutrition needs. Overall, competition centers on improving clinical outcomes, cost efficiency, and global availability of high-quality parenteral solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, Gatorade announced the launch of Gatorade Hydration Booster, an electrolyte drink mix designed to support hydration throughout the day. Gatorade Sports Science Institute backs the new product, and the formula contains essential vitamins such as vitamin A, B3, B5, B6, and vitamin C with no artificial flavors, colors, or sweeteners.

- In July 2024, Danone UK & Ireland launched GetPRO Professional, an initiative that provides funding and support to sports nutritionists to help athletes of all levels. The program includes the GetPRO Professional Sports Nutrition Grant Programme, which partners with the Nutrition Society to fund early-career sports nutritionists working with grassroots and community sports clubs.

- In January 2024, Nestlé Health Science UK&I launched the U.S. hydration brand Nuun, which provides effervescent tablets designed to enhance workout hydration and replenish electrolytes lost through sweat.

- In October 2023, SGD Pharma launched new 10ml and 20ml sizes of its Sterinity Ready-To-Use (RTU) molded glass vials, expanding the product line to include more options for sterile pharmaceutical packaging.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, Packaging Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ready-to-use multi-chamber PN bags will continue rising as hospitals prioritize safety and faster administration.

- Adoption of parenteral nutrition in home-care settings will expand due to improved infusion technologies and patient monitoring.

- Clinical focus on reducing infection risks will drive innovation in sterile compounding and advanced packaging systems.

- Growth in neonatal and preterm birth rates will increase the need for specialized pediatric PN formulations.

- Advances in lipid emulsions and amino acid blends will support better patient recovery and metabolic stability.

- Manufacturers will invest more in automated production lines to enhance quality control and supply reliability.

- Emerging markets will accelerate PN adoption as critical-care infrastructure and clinical awareness improve.

- Digital tools for PN therapy monitoring will enhance dosing accuracy and patient outcomes.

- Regulatory bodies will strengthen quality and safety standards for PN manufacturing and administration.

- Strategic collaborations between suppliers, hospitals, and clinical-nutrition specialists will shape long-term market competitiveness.