Market Overview

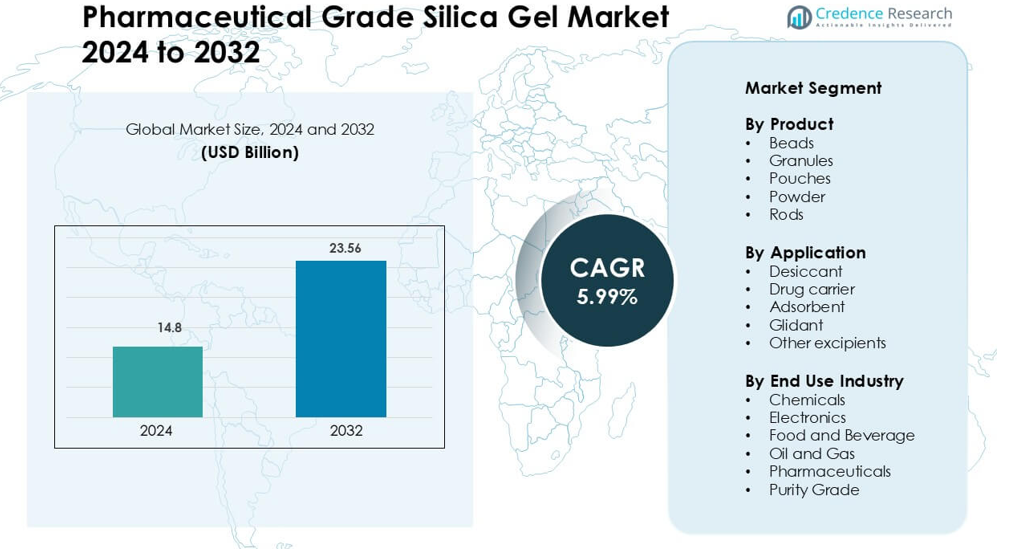

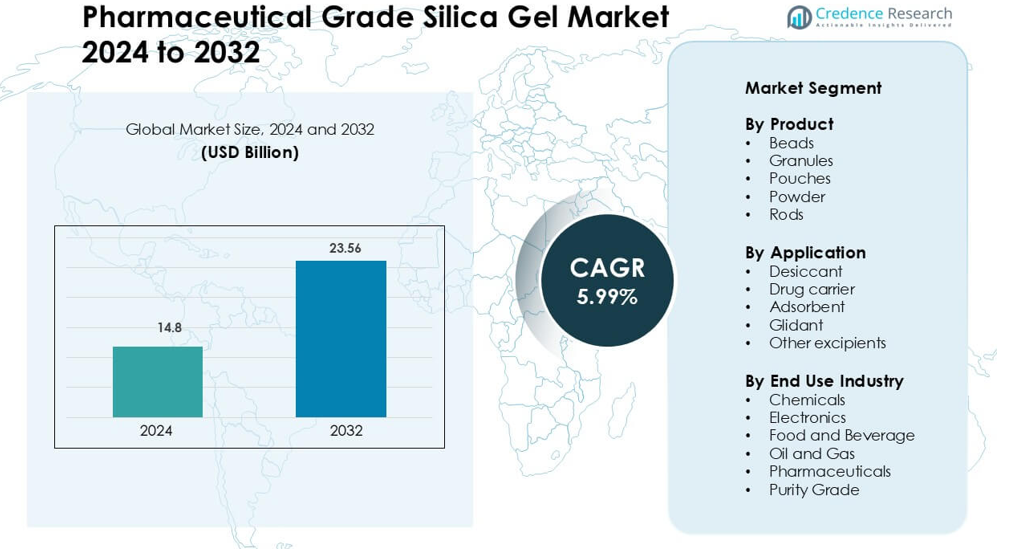

Pharmaceutical Grade Silica Gel Market was valued at USD 14.8 billion in 2024 and is anticipated to reach USD 23.56 billion by 2032, growing at a CAGR of 5.99 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Grade Silica Gel Market Size 2024 |

USD 14.8 billion |

| Pharmaceutical Grade Silica Gel Market, CAGR |

5.99% |

| Pharmaceutical Grade Silica Gel Market Size 2032 |

USD 23.56 billion |

Major participants in the Pharmaceutical Grade Silica Gel Market include Fuji Silysia Chemical Co., Ltd., Arkema S.A., Evonik Industries AG, Tokuyama Corporation, Gelest, LLC, Merck KGaA, Tosoh Corporation, The PQ Corporation, Clariant AG, and W. R. Grace & Co.-Conn. These companies focus on high-purity grades, controlled pore structures, and GMP-certified production to meet global pharmaceutical compliance. Product portfolios target desiccants, chromatography media, and drug-delivery carriers used in tablets, biologics, and diagnostic kits. Asia Pacific leads the market with 31% share, supported by large-scale generic drug manufacturing, rapid expansion of contract research and manufacturing organizations, and strong export pipelines for finished formulations.

Market Insights

- The Pharmaceutical Grade Silica Gel Market reached USD 14.8 billion in 2024 and is expected to grow at a 5.99% CAGR through the forecast period.

- Demand rises as moisture-sensitive tablets, biologics, and diagnostic kits require high-purity desiccants; beads remain the leading product with 42% share due to high surface area and strong adsorption.

- Trends include sustainable, dust-free packaging, regenerable silica grades, and tailored pore structures for controlled-release drug delivery and chromatography-based purification in R&D labs.

- Competition intensifies as Fuji Silysia, Arkema, Merck KGaA, Clariant, W. R. Grace & Co-Conn, and Tosoh invest in GMP facilities, validated supply chains, and pharma-compliant production.

- Asia Pacific leads with 31% share, driven by strong generic production and CMO/CRMO growth, while North America and Europe follow with high adoption in biologics, injectables, and stability-regulated packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Beads hold the dominant position in the product segment with 42% share, driven by high surface area and strong moisture control. Pharmaceutical makers use beads for capsule and vial protection because they deliver rapid adsorption without chemical interaction. Granules follow due to wide use in filtration units and moisture-sensitive packaging. Pouches gain traction in bulk packaging for diagnostic kits and medical devices, while powder grades serve chromatography and drug purification. Rods remain a niche product for laboratory columns. Rising demand for stable shelf life in solid dosage forms continues to support bead-based pharmaceutical silica gel.

- For instance, SYLOID® XDP silica is a type of mesoporous silica used in pharmaceutical formulations.

By Application

Desiccants lead the application segment with 56% share, supported by strict regulatory focus on humidity control in tablets, biologics, and diagnostic kits. Drug carriers show steady growth as silica gel supports sustained-release systems and improves solubility for poorly soluble drugs. Adsorbent grades are widely used in purification processes and chromatography workflows. As a glidant, silica gel helps improve powder flow during tablet compression. Other excipient uses include stabilizers for vitamins and enzymes. Robust expansion of sterile packaging and moisture-sensitive therapeutics keeps desiccant-grade silica gel ahead of other applications.

- For instance, Multisorb Technologies is a major, global leader in the desiccant industry, supplying innovative solutions to the healthcare sector for over 60 years.

By End-Use Industry

Pharmaceuticals dominate the end-use segment with 48% share, supported by constant demand for safe packaging, controlled humidity, and purification media. Food and beverage companies deploy silica gel pouches to protect dehydrated foods, spices, and nutraceuticals. Electronics firms use high-purity grades to prevent corrosion and short-circuiting in semiconductor shipments. Chemicals rely on silica gel for separation and drying processes, while oil and gas operators use high-absorbency grades in filtration and catalytic systems. High-purity pharmaceutical-grade silica gel remains the growth engine as global drug output and biologic storage requirements continue to increase.

Key Growth Drivers

Rising Demand for Moisture-Controlled Pharmaceutical Packaging

Growing use of moisture-sensitive drugs and biologics expands the need for high-grade silica gel. Capsule shells, diagnostic strips, vaccines, and enzyme-based formulations lose stability when exposed to humidity. Pharmaceutical-grade silica gel delivers controlled adsorption without chemical reactivity, which makes it suitable for vials, blister packs, and diagnostic kit packaging. Regulators continue to enforce strict shelf-life and quality standards, pushing producers to adopt reliable desiccants. The growth of specialty dosage forms, including orally disintegrating tablets and freeze-dried drugs, strengthens demand. As pharmaceutical supply chains move through varied climate zones, companies invest more in humidity-stable packaging to avoid spoilage and recalls.

- For instance, Aptar s Activ-Blister™ technology uses its proprietary 3-Phase Activ-Polymer™ material science (an active film material), not specifically micro-silica beads, which is integrated into the lidding of each blister cavity.

Adoption of Silica Gel as a Purification and Chromatography Medium

Silica gel remains a key stationary phase in laboratory and industrial chromatography. Drug developers use it to isolate APIs, remove impurities, and refine intermediates. Pharmaceutical-grade silica gel offers high porosity, uniform particle size, and controlled pH, supporting reliable separation in analytical and preparative setups. Rising R&D across generics, biologics, and novel molecules drives chromatography volume. Contract research and manufacturing organizations expand column-based purification lines to serve multiple clients. Growing focus on precise impurity profiling in regulatory submissions also encourages greater consumption of high-purity silica gel for consistent separation performance.

- For instance, SiliCycle does produce SiliaFlash F60 silica gel, which is used for flash chromatography, large-scale API purification, and impurity removal.

Expansion of Controlled-Release and Solubility-Enhancing Drug Delivery

Many APIs suffer from low solubility and poor bioavailability. Pharmaceutical manufacturers use silica gel carriers to improve dissolution, enhance stability, and enable controlled-release profiles. Its porous structure supports adsorption of active molecules and gradual release in the body. This helps drug makers reformulate existing medicines, develop patient-friendly dosages, and reduce dosing frequency. Growth in geriatrics and chronic disease management strengthens interest in modified-release tablets and capsules. As generic companies compete with value-added reformulations, silica-based carriers gain wider adoption in solid oral dosage technologies.

Key Trends & Opportunities

Shift Toward High-Purity and Pharma-Compliant Grades

Stringent regulatory frameworks drive the market toward ultrapure and pharma-compliant silica gel variations. Manufacturers invest in controlled production, tighter impurity screening, and validated supply chains to meet global pharmacopoeia standards. Demand rises for dust-free, allergen-free, and non-toxic grades suitable for injectable and biologic packaging. Companies that offer GMP-certified plants and validated quality data gain competitive edge. Growing collaboration between material suppliers and drug formulators creates scope for co-developed, formulation-specific silica gel grades.

- For instance, W. R. Grace’s SYLOID® FP line of pharma-compliant silica gels is produced under GMP-certified conditions and meets USP-NF and EP specifications, with residual metal impurities below 5 ppm, ensuring suitability for direct-contact applications.

Growth of Sustainable and Non-Toxic Moisture Control Solutions

Pharmaceutical companies shift from traditional desiccants toward non-toxic, odorless, and recyclable silica gel. The material is chemically inert and can be regenerated with heat, lowering environmental footprint. Rising sustainability commitments in drug manufacturing create opportunities for eco-friendly packaging solutions. Producers develop biodegradable pouches, reduced-dust formats, and bulk reusable systems for large-scale warehouse storage. This trend also expands adoption across nutraceuticals and sensitive food products seeking cleaner labels.

- For instance, Clariant offers products within its EcoTain portfolio, which are generally focused on sustainability.

Key Challenges

Stringent Quality and Compliance Requirements

Pharmaceutical-grade silica gel faces strict testing around purity, heavy metal content, biocompatibility, and extractables. Meeting these benchmarks increases production cost and slows product approvals. Any deviation in granule size, porosity, or adsorption rate can impact drug stability, making validation essential. Smaller manufacturers struggle with the capital needed for compliance systems, clean facility standards, and documentation. These regulatory pressures create high entry barriers and limit new entrants.

Competition from Alternative Desiccant and Carrier Materials

Although silica gel is well-established, alternatives such as molecular sieves, calcium chloride, clay minerals, and polymer-based desiccants pose competition. Some substitutes offer faster absorption rates, lower cost, or stronger performance in extreme humidity. Drug carriers also face competition from lipid-based and polymer-based delivery systems. As pharmaceutical companies experiment with new excipients, silica gel suppliers must innovate with tailored pore sizes, higher purity, and custom packaging formats to maintain market share.

Regional Analysis

North America

North America holds 33% share, supported by strong pharmaceutical production, advanced drug packaging, and widespread use of desiccants in biologics and diagnostics. The U.S. leads due to high R&D spending, expansion of contract manufacturing, and strict FDA stability requirements. Manufacturers adopt pharma-grade silica gel to protect capsules, vaccines, and rapid test kits across varied climate zones. Growing investments in personalized medicine and temperature-sensitive formulations further drive adoption. Canada shows rising demand in nutraceuticals and medical device packaging. Continuous packaging upgrades and humidity-controlled logistics keep North America a steady contributor to global consumption.

Europe

Europe accounts for 28% share, led by Germany, Switzerland, and the U.K., where pharmaceutical exports and GMP-compliant facilities are expanding. The region emphasizes high-purity, allergen-free desiccants for oral solids, injectables, and biologics. Stringent EMA guidelines and strict impurity control push adoption of validated silica gel packaging solutions. Demand grows in diagnostic test kits, chromatography labs, and moisture-regulated cold-chain shipments. Manufacturers invest in sustainable and regenerable silica products to meet eco-compliance targets. Broad presence of biotechnology firms and strong generics manufacturing keeps Europe a key revenue base.

Asia Pacific

Asia Pacific leads the market with 31% share, driven by large-scale pharmaceutical manufacturing in India, China, and Japan. Expanding generic drug exports, rising demand for moisture-safe packaging, and rapid growth of contract manufacturing organizations boost silica gel usage. Regional suppliers produce pharma-grade beads, pouches, and chromatography media at competitive costs. Multinational firms invest in new plants to serve formulation and packaging hubs. Growing biologics production and cold-chain logistics further increase demand for high-purity desiccants. The region remains the fastest-growing market due to strong export pipelines and regulatory upgrades.

Latin America

Latin America captures 5% share, led by Brazil and Mexico, where pharmaceutical packaging and nutraceutical products are growing. Companies adopt pharma-grade silica gel to reduce spoilage of tablets, vitamins, test kits, and herbal products in humid climates. Expansion of local manufacturing and increased import of diagnostic kits support demand. However, adoption remains slower than major regions due to limited GMP facilities. Rising investments in healthcare infrastructure and contract manufacturing are expected to expand silica gel usage over time.

Middle East & Africa

Middle East & Africa hold 3% share, driven by demand for moisture-stable pharmaceuticals, nutraceuticals, and medical devices. Hot climate conditions increase reliance on desiccants during storage and transport. GCC countries lead due to expanding pharma manufacturing and medical imports. Africa shows growing consumption in essential drug packaging and diagnostic products, though cost sensitivity limits premium grades. Ongoing upgrades in healthcare distribution and local drug production support gradual market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product

- Beads

- Granules

- Pouches

- Powder

- Rods

By Application

- Desiccant

- Drug carrier

- Adsorbent

- Glidant

- Other excipients

By End Use Industry

- Chemicals

- Electronics

- Food and Beverage

- Oil and Gas

- Pharmaceuticals

- Purity Grade

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Pharmaceutical Grade Silica Gel Market features global chemical producers and specialized silica manufacturers focused on high-purity, pharma-compliant grades. Companies compete on adsorption efficiency, particle uniformity, controlled pore size, and regulatory certification to meet stringent packaging and formulation standards. Leading participants invest in advanced processing lines, validated GMP facilities, and dust-free packaging solutions to gain preference from drug makers, diagnostic kit producers, and contract manufacturing organizations. Strategic priorities include product customization for solid dosage forms, chromatography media, and controlled-release drug delivery. Several manufacturers expand footprints in Asia Pacific and North America to serve growing formulation hubs and export markets. Sustainability initiatives gain importance, with producers developing recyclable pouches and regenerable silica media to meet environmental expectations. Partnerships with pharmaceutical companies and research institutions support co-developed materials tailored to new drug formats, positioning innovative suppliers at a competitive advantage.

Key Player Analysis

Recent Developments

- In January 2025, Evonik combined its Silica and Silanes lines into a new unit, Smart Effects, and announced closures of two U.S. silica plants to streamline the network and secure regional supply.

- In December 2024, Arkema closed the acquisition of Dow’s flexible packaging laminating adhesives business, strengthening pharma packaging ties; its Siliporite® NK10 grades meet USP 670 for moisture protection in drug packs.

- In October 2024, Fuji Silysia Chemical USA won Pitt County s Industry of the Year, spotlighting expansion and reliability at its Greenville, NC silica facility used across pharma moisture-control lines.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for high-purity, low-residue silica gel suitable for biologics and injectables.

- Drug makers will adopt customized pore sizes and particle designs for controlled-release delivery.

- Chromatography-grade silica will gain wider use in impurity profiling and API purification.

- Sustainable and regenerable silica products will replace single-use desiccants in bulk packaging.

- Asia Pacific will expand production capacity as global CMOs and CRAMs increase outsourcing.

- Dust-free pouches and pharma-compliant packaging formats will see stronger adoption.

- Partnerships between material suppliers and formulation developers will create application-specific grades.

- Automated filling and sterile packaging lines will increase usage of silica in diagnostics.

- R&D for solubility enhancement and reformulated generics will support silica-based drug carriers.

- Regulatory pressure on product stability will keep pharmaceutical-grade silica a preferred desiccant.