Market Overview

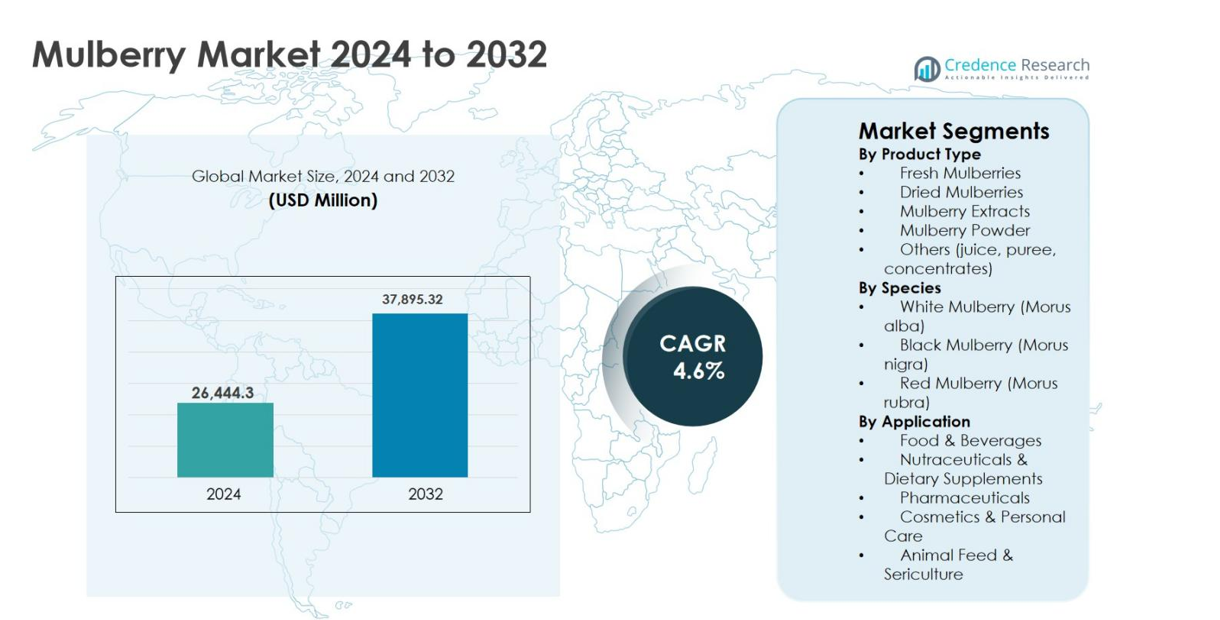

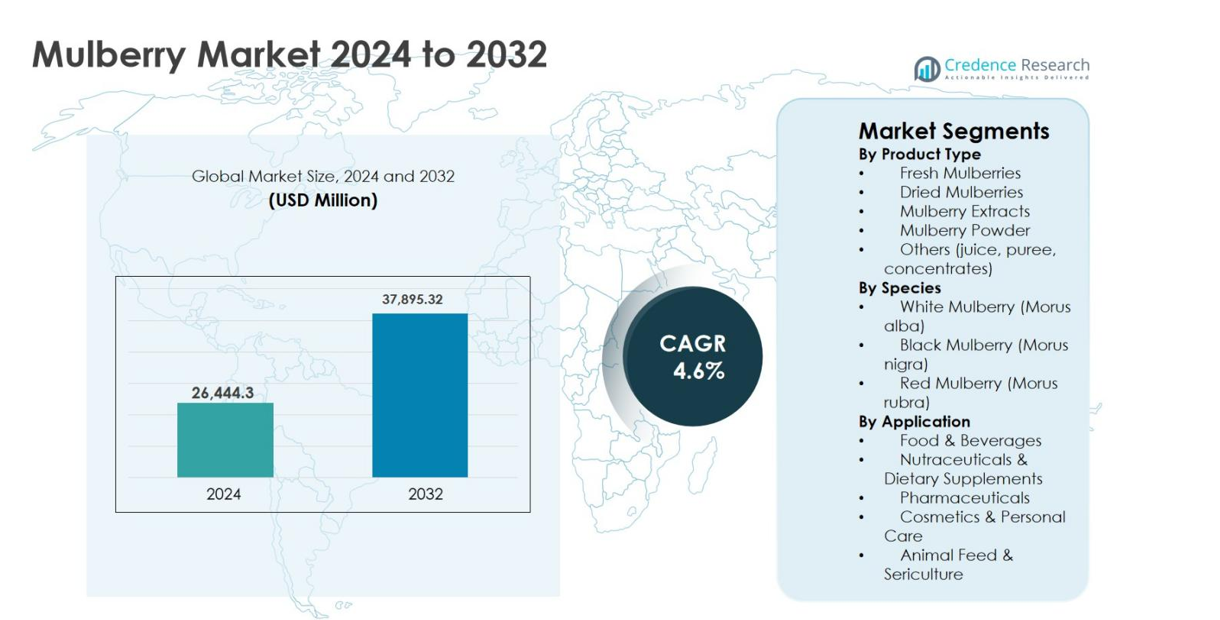

The Mulberry market size was valued at USD 26,444.3 million in 2024 and is anticipated to reach USD 37,895.32 million by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mulberry Market Size 2024 |

USD 26,444.3 million |

| Mulberry Market, CAGR |

4.6% |

| Mulberry Market Size 2032 |

USD 37,895.32 million |

The Mulberry market is supported by a diverse group of players focused on cultivation, processing, and value-added mulberry products across food, nutraceutical, pharmaceutical, and cosmetic applications. Key participants include BioSpectrum, Fuji-Sangyo, Natural Factors, Specialty Natural Products Co., Pure Ingredients Ltd, Twinstarts, Hunan Warrant, Geneham Pharmaceutical, Xi’an Xiaocao Botanical Development, and Zhejiang Wecan Bio Technology, all of which emphasize product standardization, extract potency, and clean-label offerings. Regionally, Asia Pacific leads the Mulberry market with an exact 54.2% market share, driven by large-scale cultivation, strong sericulture demand, and traditional consumption in China and India. Europe and North America follow, supported by rising demand for mulberry-based functional foods, dietary supplements, and natural cosmetic ingredients

Market Insights

- The Mulberry market was valued at USD 26,444.3 million in 2024 and is projected to reach USD 37,895.32 million by 2032, growing at a CAGR of 4.6% during the forecast period, supported by rising demand across food, nutraceutical, pharmaceutical, and cosmetic applications.

- Market growth is primarily driven by increasing consumption of functional and antioxidant-rich foods, expanding use of mulberry extracts in dietary supplements, and strong demand from sericulture, with Food & Beverages holding a dominant segment share of 41.3% in 2024.

- Key market trends include growing preference for dried mulberries, powders, and extracts, along with rising adoption of mulberry-based ingredients in clean-label foods, herbal medicines, and natural skincare formulations.

- The market landscape remains moderately fragmented, with players focusing on product standardization, value-added processing, and expansion into nutraceutical and cosmetic segments to strengthen positioning.

- Regionally, Asia Pacific dominated with a 54.2% market share, followed by Europe at 19.6%, North America at 15.1%, Latin America at 6.3%, and Middle East & Africa at 4.8%, reflecting varied consumption and cultivation patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Mulberry market by product type is led by Fresh Mulberries, which accounted for 38.6% market share in 2024, driven by rising consumer preference for fresh, minimally processed fruits and expanding use in household consumption and traditional foods. Fresh mulberries benefit from high nutritional value, rich antioxidant content, and increasing demand from health-conscious consumers. Dried Mulberries and Mulberry Extracts follow, supported by longer shelf life and growing application in nutraceuticals. Meanwhile, Mulberry Powder and processed formats such as juice, puree, and concentrates gain traction due to convenience, clean-label trends, and increasing incorporation into functional foods and beverages.

- For instance, regional farm-to-table retailers in Japan and South Korea promote locally grown fresh mulberries for use in desserts and traditional confections, emphasizing their antioxidant profile and traceability from nearby orchards.

By Species

Based on species, White Mulberry (Morus alba) dominated the Mulberry market with a 46.9% share in 2024, primarily due to its extensive use in nutraceuticals, pharmaceuticals, and sericulture. White mulberry benefits from high bioactive compound content, including flavonoids and alkaloids, supporting its application in blood sugar management and cholesterol control products. Black Mulberry (Morus nigra) holds a significant share driven by strong antioxidant levels and demand from food and beverage formulations, while Red Mulberry (Morus rubra) maintains moderate growth, supported by regional consumption and expanding use in natural food colorants and specialty health products.

- For instance, Morus alba leaf extract is used in standardized nutraceutical formulations for type 2 diabetes and dyslipidemia, leveraging its documented hypoglycemic and antihyperlipidemic effects.

By Application

By application, Food & Beverages emerged as the dominant segment, capturing 41.3% of the Mulberry market share in 2024, fueled by growing use in jams, juices, bakery products, and functional beverages. Rising demand for natural ingredients and fruit-based formulations continues to strengthen this segment. Nutraceuticals & Dietary Supplements represent the fastest-growing segment, driven by increasing awareness of mulberry’s anti-diabetic and antioxidant properties. Additionally, Pharmaceuticals, Cosmetics & Personal Care, and Animal Feed & Sericulture contribute steadily, supported by expanding medicinal research, natural skincare trends, and sustained silk industry demand.

Key Growth Drivers

Rising Demand for Functional and Nutrient-Rich Foods

The growing consumer focus on health, wellness, and preventive nutrition remains a primary driver of the Mulberry market. Mulberries are rich in antioxidants, flavonoids, anthocyanins, and vitamins, supporting benefits such as blood sugar regulation, cholesterol reduction, and immune enhancement. These attributes have increased their adoption in functional foods, beverages, and dietary supplements. Rising incidences of lifestyle-related disorders, including diabetes and cardiovascular diseases, have further accelerated demand for natural, plant-based ingredients with therapeutic value. Food manufacturers increasingly incorporate mulberry fruit, powder, and extracts into clean-label products, reinforcing market expansion. Additionally, heightened awareness of traditional herbal ingredients across both developed and emerging economies continues to support sustained growth in mulberry consumption.

- For instance, Morinaga & Co. in Japan has developed mulberry leaf–based teas and tablets positioned for post‑meal blood sugar support, reflecting documented interest in natural glycemic control ingredients.

Expanding Applications in Nutraceuticals and Pharmaceuticals

The Mulberry market is strongly driven by its expanding use in nutraceuticals and pharmaceutical formulations. White mulberry, in particular, is widely used in supplements targeting glycemic control, weight management, and metabolic health. Ongoing clinical research highlighting mulberry’s anti-inflammatory, anti-oxidative, and anti-diabetic properties has strengthened its credibility in therapeutic applications. Pharmaceutical companies increasingly utilize standardized mulberry extracts in herbal medicines and preventive healthcare products. This trend is supported by regulatory acceptance of botanical ingredients and rising consumer trust in plant-based remedies. Growth in aging populations and increasing expenditure on preventive healthcare further reinforce mulberry’s role as a valuable medicinal ingredient.

- For instance, commercial formulations in Asia and Europe use Morus alba leaf extract in blood-sugar–support capsules or tablets, frequently combining it with other botanicals such as cinnamon or banaba to target metabolic health, reflecting documented clinical interest in multi-herb formulas for glycemic management.

Growth of Sericulture and Agricultural Cultivation

The continued expansion of sericulture, especially across Asia Pacific, serves as a critical growth driver for the Mulberry market. Mulberry leaves are the primary feed for silkworms, making large-scale cultivation essential for silk production. Countries such as China, India, and Vietnam continue to invest in mulberry farming to strengthen rural economies and textile supply chains. Government support programs, improved farming techniques, and high-yield mulberry varieties have enhanced productivity and supply consistency. In parallel, mulberry cultivation for fruit consumption benefits from sustainable farming practices and rising export demand, supporting long-term market stability and volume growth.

Key Trends & Opportunities

Shift Toward Natural Ingredients in Cosmetics and Personal Care

The increasing preference for natural and plant-based cosmetic ingredients presents a strong opportunity for the Mulberry market. Mulberry extracts are widely used in skincare formulations for skin brightening, anti-aging, and pigmentation control due to their high antioxidant content. Cosmetic manufacturers increasingly replace synthetic ingredients with botanical alternatives to meet clean beauty standards and regulatory expectations. Growing consumer awareness regarding ingredient transparency and sustainability further supports this trend. The integration of mulberry into premium skincare, haircare, and dermatological products creates new revenue streams and enhances product differentiation across global beauty markets.

- For instance, premium “clean beauty” ranges often highlight mulberry extract on front-of-pack and in marketing materials as a naturally derived active, aligning with demand for recognizable plant ingredients and cruelty‑free formulations.

Rising Demand for Processed and Value-Added Mulberry Products

Value-added mulberry products such as dried fruits, powders, concentrates, and ready-to-drink beverages are gaining traction, creating significant growth opportunities. Urbanization, busy lifestyles, and demand for convenient nutrition have increased consumption of shelf-stable mulberry formats. Food processors are innovating with mulberry-based snacks, functional drinks, and bakery ingredients to cater to evolving consumer preferences. Expansion of e-commerce platforms has further improved accessibility of mulberry products globally. This trend enables producers to enhance profit margins, reduce post-harvest losses, and extend market reach beyond traditional fresh fruit consumption.

- For instance, beverage and wellness brands have introduced ready-to-drink mulberry leaf or fruit–based teas and juices, formulated as no-added-sugar or low-calorie options and promoted for their polyphenol and antioxidant content.

Key Challenges

Supply Chain Volatility and Seasonal Dependency

Seasonal production and climatic sensitivity pose significant challenges to the Mulberry market. Mulberry cultivation depends heavily on favorable weather conditions, making yields vulnerable to climate change, droughts, and irregular rainfall. Fresh mulberries also have a short shelf life, leading to post-harvest losses and supply fluctuations. Inconsistent availability affects pricing stability and limits large-scale commercialization, particularly in export markets. Limited cold-chain infrastructure in developing regions further intensifies these challenges. Addressing supply volatility requires investment in processing facilities, improved storage solutions, and resilient agricultural practices.

Limited Consumer Awareness in Emerging Markets

Despite its nutritional and medicinal benefits, mulberry consumption remains limited in several emerging and non-traditional markets. Low consumer awareness, lack of standardized products, and minimal branding restrict market penetration outside key producing regions. In many countries, mulberries are perceived as niche or traditional ingredients rather than mainstream functional foods. Additionally, fragmented supply chains and limited marketing investments hinder global expansion. Overcoming this challenge requires strategic awareness campaigns, product innovation, and partnerships with food, pharmaceutical, and wellness brands to position mulberry as a versatile, value-added ingredient across industries.

Regional Analysis

Asia Pacific

Asia Pacific dominated the Mulberry market with a 54.2% market share in 2024, driven by extensive mulberry cultivation and strong demand from food, nutraceutical, and sericulture industries. China and India lead regional growth due to large-scale mulberry farming, deep-rooted traditional consumption, and high silk production volumes. The region benefits from favorable climatic conditions, government support for sericulture, and rising use of mulberry extracts in herbal medicines. Increasing urbanization and growing awareness of functional foods further support demand. Expansion of processed mulberry products and export-oriented production continues to reinforce Asia Pacific’s leading position.

Europe

Europe accounted for a 19.6% share of the Mulberry market in 2024, supported by growing demand for organic fruits, plant-based ingredients, and natural nutraceuticals. Countries such as Germany, Italy, and France drive consumption through rising use of mulberry extracts in dietary supplements and cosmetics. Strong regulatory support for botanical ingredients and increasing consumer preference for clean-label products boost market growth. The region also witnesses steady demand for dried mulberries and powders used in bakery and functional food applications. Expansion of premium wellness and skincare products further strengthens Europe’s contribution to the global market.

North America

North America held a 15.1% market share in 2024, driven by rising health consciousness and increasing adoption of mulberry-based dietary supplements. The United States leads regional demand due to high consumption of functional foods and nutraceutical products targeting blood sugar and weight management. Growing interest in natural antioxidants and plant-derived ingredients supports the use of mulberry extracts across food, beverage, and cosmetic formulations. Well-established retail and e-commerce channels enhance product accessibility. Additionally, innovation in functional beverages and clean-label snacks continues to create new growth opportunities across the regional mulberry market.

Latin America

Latin America represented a 6.3% share of the Mulberry market in 2024, supported by expanding fruit cultivation and growing interest in natural health products. Countries such as Brazil and Chile contribute through increasing use of mulberry in juices, jams, and traditional foods. Rising awareness of antioxidant-rich fruits and gradual adoption of nutraceutical supplements support market growth. The region also benefits from improving agricultural practices and export-oriented fruit production. However, limited processing infrastructure restrains faster expansion, creating opportunities for investment in value-added mulberry products and regional supply chain development.

Middle East & Africa

The Middle East & Africa accounted for a 4.8% market share in 2024, reflecting emerging demand for mulberry across food, traditional medicine, and animal feed applications. Countries such as Turkey and Iran contribute significantly through mulberry cultivation and dried fruit consumption. Growing interest in herbal remedies and natural sweeteners supports market penetration. Expansion of health-conscious urban populations and rising imports of mulberry extracts further aid growth. However, limited consumer awareness and fragmented supply chains restrict rapid adoption, positioning the region as a long-term growth opportunity for mulberry producers and exporters.

Market Segmentations:

By Product Type

- Fresh Mulberries

- Dried Mulberries

- Mulberry Extracts

- Mulberry Powder

- Others (juice, puree, concentrates)

By Species

- White Mulberry (Morus alba)

- Black Mulberry (Morus nigra)

- Red Mulberry (Morus rubra)

By Application

- Food & Beverages

- Nutraceuticals & Dietary Supplements

- Pharmaceuticals

- Cosmetics & Personal Care

- Animal Feed & Sericulture

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Mulberry market features a moderately fragmented competitive landscape, with key players focusing on product diversification, quality enhancement, and expansion of application areas across food, nutraceutical, pharmaceutical, and cosmetic sectors. Leading companies such as BioSpectrum, Fuji-Sangyo, Natural Factors, Specialty Natural Products Co., Pure Ingredients Ltd, Twinstarts, Hunan Warrant, Geneham Pharmaceutical, Xi’an Xiaocao Botanical Development, and Zhejiang Wecan Bio Technology actively invest in standardized mulberry extracts, value-added processing, and clean-label formulations. These players emphasize sourcing reliability, sustainable cultivation, and compliance with regional regulatory standards to strengthen their market presence. Strategic initiatives including capacity expansion, partnerships with nutraceutical and cosmetic brands, and development of high-potency mulberry derivatives support competitive positioning. Increasing focus on export markets, especially in Europe and North America, along with innovation in dried, powdered, and extract formats, continues to shape competition and long-term growth in the global mulberry market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BioSpectrum

- Fuji-Sangyo

- Natural Factors

- Specialty Natural Products Co.

- Pure Ingredients Ltd

- Twinstarts

- Hunan Warrant

- Geneham Pharmaceutical

- Xi’an Xiaocao Botanical Development

- Zhejiang Wecan Bio Technology Co., Ltd.

Recent Developments

- In October 2025, Mulberry published its 2024/2025 Impact Report highlighting progress in circular and regenerative design efforts, with sales from The Mulberry Exchange resale platform surpassing £1 million and strengthening its sustainability positioning.

- In September 2025, Mulberry relaunched its iconic Roxanne bag family with new modern shapes including the Roxanne Shoulder and Mini Roxanne Shoulder bags featured in a campaign starring Cynthia Erivo, expanding its product range for the year

- In July 2025, British luxury brand Mulberry Group plc raised £20 million (about $27 million) through convertible debt from its largest shareholders to support operations, strengthen its turnaround strategy, and bolster growth initiatives

Report Coverage

The research report offers an in-depth analysis based on Product Type, Species, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Mulberry market is expected to witness steady growth driven by rising global demand for natural and functional food ingredients.

- Increasing adoption of mulberry-based nutraceuticals and dietary supplements will continue to support market expansion.

- Growing consumer preference for plant-based and clean-label products will enhance the use of mulberry extracts and powders.

- Expansion of sericulture activities, particularly in Asia Pacific, will sustain consistent mulberry cultivation and supply.

- Innovation in value-added products such as dried mulberries, concentrates, and functional beverages will strengthen market penetration.

- Rising application of mulberry extracts in cosmetics and personal care products will create new revenue opportunities.

- Improved agricultural practices and high-yield mulberry varieties will enhance productivity and quality.

- Expansion of e-commerce and specialty retail channels will improve global accessibility of mulberry products.

- Increasing research into the therapeutic properties of mulberry will broaden pharmaceutical applications.

- Strategic partnerships and geographic expansion by key players will reinforce long-term market growth.