Market Overview

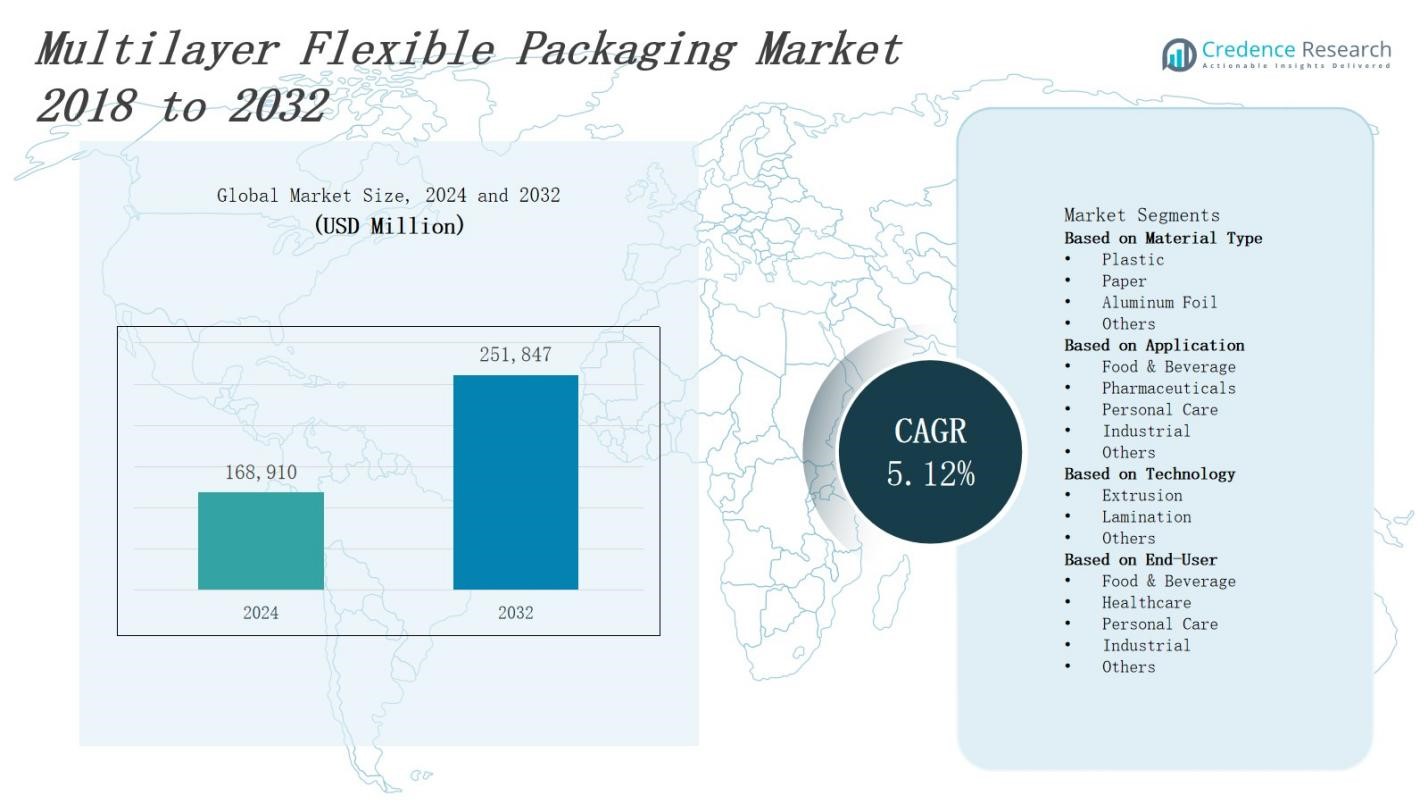

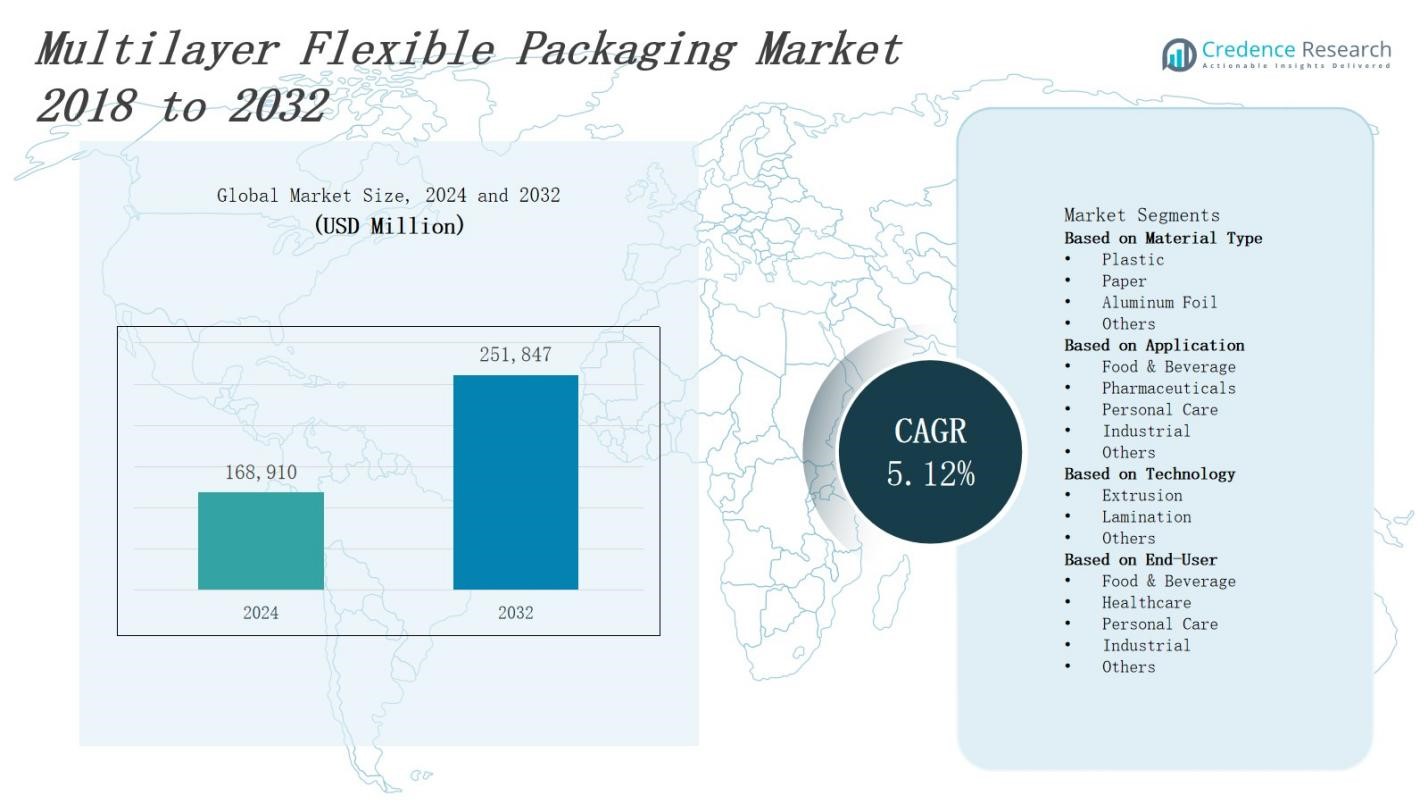

The Multilayer Flexible Packaging Market is projected to expand from USD 168,910 million in 2024 to USD 251,847 million by 2032, growing at a CAGR of 5.12%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multilayer Flexible Packaging Market Size 2024 |

USD 168,910 Million |

| Multilayer Flexible Packaging Market, CAGR |

5.12% |

| Multilayer Flexible Packaging Market Size 2032 |

USD 251,847 Million |

Rising demand for extended shelf life and product protection drives the Multilayer Flexible Packaging Market, as manufacturers adopt advanced barrier films to safeguard food, pharmaceuticals and consumer goods. Regulatory emphasis on sustainability pushes development of recyclable and compostable multilayer structures, while lightweight designs reduce transportation costs and carbon emissions. Growth in e‑commerce and direct‑to‑consumer channels fuels need for durable, puncture‑resistant packaging. Digital printing technologies enable personalized branding and shorter production runs. Collaboration between resin producers and converters accelerates innovation in high‑performance polymers. Investments in automation and smart packaging solutions optimize production efficiency, enhance supply chain traceability and support market growth.

Geographical analysis reveals that North America, Europe, and Asia Pacific dominate the Multilayer Flexible Packaging Market, capturing major shares with strong manufacturing bases in the US, Germany, China, and India. Latin America and Middle East & Africa show rising demand through growing food, beverage, and pharmaceutical sectors. It leverages key players—Amcor Limited, Berry Global Inc., Sealed Air Corporation, Mondi Group, Huhtamaki Oyj, and Uflex Ltd.—to expand regional footprints and meet local requirements. These firms optimize production capacity and local partnerships to address market‑specific needs and regulatory landscapes across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Multilayer Flexible Packaging Market will grow from USD 168,910 million in 2024 to USD 251,847 million by 2032 at a 5.12% CAGR.

- Advanced barrier films extend shelf life and protect against moisture, oxygen and light.

- Regulatory mandates drive bio‑based and recyclable film adoption to meet sustainability targets.

- E‑commerce expansion fuels demand for puncture‑resistant, lightweight pouches that reduce shipping costs.

- Digital printing enables on‑demand branding and shorter production runs.

- North America (30%), Europe (27%) and Asia Pacific (32%) dominate global market share.

- Volatile resin prices and recycling complexity challenge margins and circularity efforts.

Market Drivers

Advanced Barrier Technologies Enhance Shelf Life

Rising demand for extended shelf life and product quality drives innovation in barrier structures. The Multilayer Flexible Packaging Market leverages multilayer films to protect sensitive goods from moisture, oxygen and light. Brands invest in specialized coatings to maintain freshness throughout distribution. It reduces waste and preserves nutritional integrity. Manufacturers collaborate with material suppliers to optimize layer composition. Companies prioritize film performance to meet consumer expectations for premium quality and safety.

- For instance, Graham Packaging uses advanced monobarrier PET containers with oxygen scavengers to prevent oxidation, discoloration, and taste loss in sensitive food and beverage products, effectively extending shelf life with a single plastic layer.

Regulatory Pressure Fuels Sustainable Development

Strict environmental regulations encourage adoption of recyclable and compostable film solutions. The Multilayer Flexible Packaging Market integrates bio-based polymers to reduce reliance on virgin plastics. It supports corporate sustainability targets and aligns with global zero-waste initiatives. Manufacturers refine extrusion processes to minimize resource consumption. Brand owners engage in circular economy partnerships to reclaim and reuse packaging materials. Regulators enforce eco-design mandates that shape material selection across multiple industries and transparency.

- For instance, SIG has partnered with the Ellen MacArthur Foundation to accelerate the development of circular packaging systems, aiming to reduce waste and increase the use of renewable materials in packaging production.

E‑Commerce Growth Demands Durable Packaging

Growth of e-commerce and direct-to-consumer channels drives demand for sturdy, puncture-resistant packaging formats. The Multilayer Flexible Packaging Market delivers flexible pouches and bags that withstand handling and transport stress. It protects products during rapid order fulfillment and last-mile delivery. Brands select reinforced films to reduce leakage and damage rates. Retailers benefit from lightweight formats that lower shipping costs. Supply chains gain resilience through standardized packaging designs and higher customer satisfaction.

Technological Innovations and Automation Boost Efficiency

Advanced digital printing technologies enable on-demand customization and brand updates. The Multilayer Flexible Packaging Market leverages variable data printing to enhance consumer engagement and traceability. It reduces lead times for short production runs and seasonal promotions. Companies adopt smart packaging features such as QR codes and NFC tags to provide real-time product information. Collaborations between converters and technology providers accelerate integration of embedded sensors. Investment in automated lines boosts throughput.

Market Trends

Shift Toward Bio‑Based and Recyclable Materials

The Multilayer Flexible Packaging Market responds to shifting consumer demand for eco‑friendly solutions. Companies incorporate bio‑based polymers and mono‑material films that simplify recycling. It reduces environmental impact and meets brand sustainability targets. Manufacturers partner with resin suppliers to introduce compostable layers and barrier enhancements. Government environmental regulations drive broader adoption. Consumer scrutiny drives brands toward transparent sourcing credentials. Investors allocate capital to sustainable film ventures globally each quarter.

- For instance, Mondi partnered with a Swedish meat producer to develop recyclable multilayer films that replace traditional non-recyclable laminates, using water-based adhesives and bio-based polymers, reducing environmental impact and enhancing compostability.

Integration of Smart and Interactive Packaging Solutions

The Multilayer Flexible Packaging Market embraces smart packaging technologies to enhance consumer engagement and product safety. Brands embed QR codes and NFC chips to share product information. It improves traceability throughout the supply chain. Companies integrate humidity and temperature sensors to ensure quality control. Manufacturers partner with technology providers to develop tamper‑evident features. Regulators recognize benefits of digital authentication. Retailers leverage interactive displays to drive brand loyalty and repeat purchases.

- For instance, BASF, Borealis, Südpack, and Zott collaborated to produce a multilayer film packaging for Zott Gourmet Dairy’s mozzarella, integrating chemically recycled polyamide and polyethylene, which enhances sustainability while maintaining product quality and safety.

Rise of Personalization and Flexible Manufacturing

The Multilayer Flexible Packaging Market offers brands opportunities for customized packaging designs that reflect consumer preferences. It supports short‑run production and rapid changeover. Companies deploy digital printing to vary graphics and text for regional campaigns. Manufacturers streamline workflows to accommodate seasonal promotions and limited editions. Brands target niche markets with tailored pouch sizes and resealable closures. Collaboration with converters accelerates prototype approval. Industry leaders invest in flexible lines that reduce setup time and waste.

Rapid Growth in Emerging Market Demand

Emerging regions show robust adoption of flexible packaging solutions in food and beverage, pharmaceuticals and personal care. The Multilayer Flexible Packaging Market expands in Asia Pacific, Latin America and Middle East. It adapts to local requirements and provides region‑specific film formulations. Manufacturers establish local production hubs to cut lead times. Brands benefit from cost‑effective transport due to lightweight pouches. Investment in trade partnerships fuels market penetration. Industry stakeholders track consumer trends to optimize product portfolios.

Market Challenges Analysis

Complexity of Recycling and Material Compatibility

The Multilayer Flexible Packaging Market faces complexity in recycling due to its layered composition. Existing sorting systems struggle to separate films with different barrier layers. Consumers expect clear disposal guidelines yet often find no local programs. Regulators enforce extended producer responsibility yet infrastructure lags. It increases processing costs and reduces circularity rates. Brands must invest in R&D to develop mono‑material alternatives within tight timelines. Mislabeling by manufacturers further confuses end users and hampers collection efforts.

Volatile Raw Material Prices and Supply Chain Disruptions

The Multilayer Flexible Packaging Market suffers from volatile resin costs driven by global oil price swings. Suppliers struggle to secure consistent feedstock and force price adjustments. It places margin pressure on converters and brand owners. Transport bottlenecks delay film deliveries and impact production schedules. Trade restrictions and regional lockdowns create sudden shortages of critical additives. Companies must maintain larger inventories and negotiate flexible contracts to ensure continuity.

Market Opportunities

Collaboration with Innovators to Advance Sustainable Solutions

The Multilayer Flexible Packaging Market can leverage partnerships with material innovators to develop mono‑material films that simplify recycling. It encourages joint investment in R&D focused on barrier coatings made from bio‑based resins. Companies can secure advantage by introducing fully recyclable pouch solutions. Brands that champion circular economy models boost public trust and brand value. Governments may offer incentives for packaging that meets strict sustainability criteria. Converters stand to gain from early adoption of new extrusion and lamination methods. Consumers reward products featuring eco‑friendly certification and transparent labeling.

Expansion into Emerging Regions and Digital Customization

Digital printing advances present an opportunity for personalized packaging that resonates with regional preferences. The Multilayer Flexible Packaging Market can utilize on‑demand printing to lower inventory costs and waste. It can enter high‑growth markets in Asia and Latin America where demand for packaged goods rises. Establishing local production hubs in these regions shortens lead times and cuts logistics expenses. Use of QR codes and sensors unlocks data‑driven marketing and supply chain visibility. Retailers favor flexible packaging that supports promotional campaigns and limited editions. Manufacturers can boost margins by offering tiered service packages that include design and fulfillment assistance.

Market Segmentation Analysis:

By Material Type

Plastic films dominate the Multilayer Flexible Packaging Market, offering high barrier performance and design versatility. It incorporates paper layers for printable surfaces and sustainable credentials. Aluminum foil layers deliver superior moisture and light protection for sensitive products. Other materials, including bio‑based and specialty polymers, address niche requirements and emerging sustainability targets. Producers tailor layer compositions to meet industry standards and regulatory mandates. Collaboration with resin suppliers ensures material consistency and performance across production batches.

- For instance, Amcor’s polypropylene (PP) and polyethylene terephthalate (PET) films provide strong moisture and oxygen barriers in food packaging, extending shelf life while ensuring durability.

By Application

Food & Beverage applications drive volume demand, where films ensure freshness and extend shelf life. It secures pharmaceuticals with tamper‑evident structures and moisture control. Personal Care products rely on flexible pouches for convenient, single‑use formats. Industrial uses include chemical packaging that resists corrosion and mechanical stress. Other end uses encompass agricultural and pet food segments needing customized barrier solutions. Manufacturers align film properties with application‑specific safety and handling requirements.

- For instance, bell peppers packaged with polypropylene modified atmosphere packaging (MAP) films saw shelf life increased from 4 days to 20 days, while bananas stored in HDPE and LDPE microporous films lasted 36 days compared to 15 days without packaging.

By Technology

Extrusion techniques enable seamless film construction and precise layer thickness control. It leverages co‑extrusion to integrate multiple barrier materials in a single process. Lamination methods bond printed films to barrier substrates, enhancing print quality and structural integrity. Other technologies, such as solvent‑free coating, introduce functional layers without adding volatile compounds. Process optimization reduces cycle times and energy consumption. Equipment modernization supports rapid format changes for diverse product runs.

Segments:

Based on Material Type

- Plastic

- Paper

- Aluminum Foil

- Others

Based on Application

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Industrial

- Others

Based on Technology

- Extrusion

- Lamination

- Others

Based on End-User

- Food & Beverage

- Healthcare

- Personal Care

- Industrial

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Multilayer Flexible Packaging Market holds 30% share in North America driven by robust food and beverage demand. It benefits from mature manufacturing infrastructure and advanced extrusion technology. Brand owners prioritize high‑barrier films to meet stringent safety standards. Suppliers collaborate with converters to streamline material development. Regulatory bodies enforce recycled content mandates that shape production strategies. Strong e‑commerce growth sustains demand for durable, lightweight pouches.

Europe

Europe captures 27% share in the Multilayer Flexible Packaging Market thanks to strict sustainability regulations. It integrates mono‑material films to improve recyclability and meet European Green Deal targets. Manufacturers adopt bio‑based polymers to reduce carbon footprint. Film producers invest in solvent‑free coating methods for functional barriers. Retailers demand clear labeling and traceability features. Industry players co‑invest in circular economy partnerships to reclaim post‑consumer films.

Asia Pacific

Asia Pacific commands 32% share in the Multilayer Flexible Packaging Market supported by expanding consumer goods sectors. It scales local production facilities to serve growing populations in China and India. Manufacturers leverage cost‑effective resin sourcing and labor efficiencies. Film converters introduce digital printing to appeal to regional branding preferences. Governments incentivize investments in recycling infrastructure. Companies strengthen supply chains by establishing inland distribution hubs.

Latin America

Latin America accounts for 7% share in the Multilayer Flexible Packaging Market driven by rising packaged food consumption. It upgrades extrusion and lamination lines to enhance film quality. Multinational brands partner with local converters to expand product portfolios. Market players adjust layer compositions to withstand tropical climates. Retail networks expand refrigerated and ambient channels. Firms pilot compostable film trials to test consumer acceptance.

Middle East & Africa

Middle East & Africa holds 4% share in the Multilayer Flexible Packaging Market amid growing pharmaceutical and personal care industries. It imports advanced barrier films to secure high‑value exports. Local converters adopt co‑extrusion techniques to meet diverse application needs. Governments support industrial free zones that attract packaging investment. Companies explore solar‑powered lamination units to lower energy costs. Stakeholders monitor regional trade policies to optimize logistics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coveris Holdings S.A.

- Mondi Group

- ProAmpac LLC

- Berry Global Inc.

- Huhtamaki Oyj

- Uflex Ltd.

- Sealed Air Corporation

- Clondalkin Group Holdings B.V.

- Amcor Limited

- Winpak Ltd.

- Constantia Flexibles Group GmbH

- Bemis Company, Inc.

- Sonoco Products Company

Competitive Analysis

The Multilayer Flexible Packaging Market hosts several global leaders addressing diverse end‑user needs. It features Amcor Limited, Berry Global Inc. and Sealed Air Corporation operating extensive manufacturing networks to ensure reliable supply. It emphasizes sustainable film solutions, with Mondi Group and Huhtamaki Oyj introducing recyclable and bio‑based structures. It competes on technology, as Constantia Flexibles Group and Winpak Ltd. deploy advanced co‑extrusion and lamination capabilities. It balances price and performance through strategic sourcing of polymers and scale advantages. It leverages regional expertise, with Uflex Ltd. dominating Asia-Pacific and Coveris Holdings strengthening its European footprint. It pursues growth via joint ventures and capacity expansions, exemplified by Sonoco Products Company’s recent facility upgrades. It prioritizes service flexibility, offering custom print runs and rapid changeovers. It adapts to regulatory shifts, investing in circular economy partnerships. It maintains margins by optimizing logistics and reducing material waste.

Recent Developments

- On April 30, 2025, Blaige & Company completed the sale of Hamilton Plastics, Inc., a leader in multilayer barrier flexible packaging, to Soteria Flexibles Corp.

- On May 21, 2025, ProAmpac partnered with ScottsMiracle‑Gro to launch PRO‑EVO® Recyclable SOS Bags for the O.M. Scott & Sons brand.

- In August 2023, Camvac introduced a new multi-layered metalized laminate as a substitute for aluminum foil, aimed to be used in various flexible packaging applications.

- In February 2023, Northwest Frozen LLC partnered with Preferred Packaging (a branch of C-P Flexible Packaging) to create new prepared chilled meals with extended shelf life using multilayer packaging materials.

Market Concentration & Characteristics

The Multilayer Flexible Packaging Market exhibits moderate concentration, with the top ten players accounting for over 60% of global production capacity. It features a blend of multinational leaders—such as Amcor Limited, Berry Global Inc. and Sealed Air Corporation—and regional specialists like Uflex Ltd. and Coveris Holdings S.A. Companies compete on film performance, sustainability credentials and service flexibility, leveraging scale to secure favorable resin contracts and invest in advanced extrusion lines. It balances high entry costs for specialized equipment with steady demand from food, pharmaceutical and personal care sectors. Niche converters carve out positions in emerging markets by offering local production and rapid changeovers. It sustains margins through strategic partnerships and capacity expansions. Market dynamics favor firms that integrate circular‑economy models and optimize logistics to reduce waste and lead times.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brands will adopt mono‑material films to simplify recycling and meet sustainability goals.

- Companies will expand digital printing capacity to offer personalized packaging at scale.

- Producers will integrate smart features like QR codes and NFC tags for enhanced traceability.

- Converters will invest in automated lines to reduce changeover times and boost throughput.

- Material innovators will introduce bio‑based resins that match performance of traditional polymers.

- Manufacturers will establish regional hubs in Asia Pacific and Latin America to shorten supply chains.

- Firms will develop barrier coatings that require fewer layers and lower material consumption.

- Packaging lines will incorporate inline quality sensors to monitor film integrity in real time.

- Partnerships between resin suppliers and converters will accelerate new film formulations.

- Stakeholders will leverage data analytics to optimize production planning and reduce waste.