Market Overview

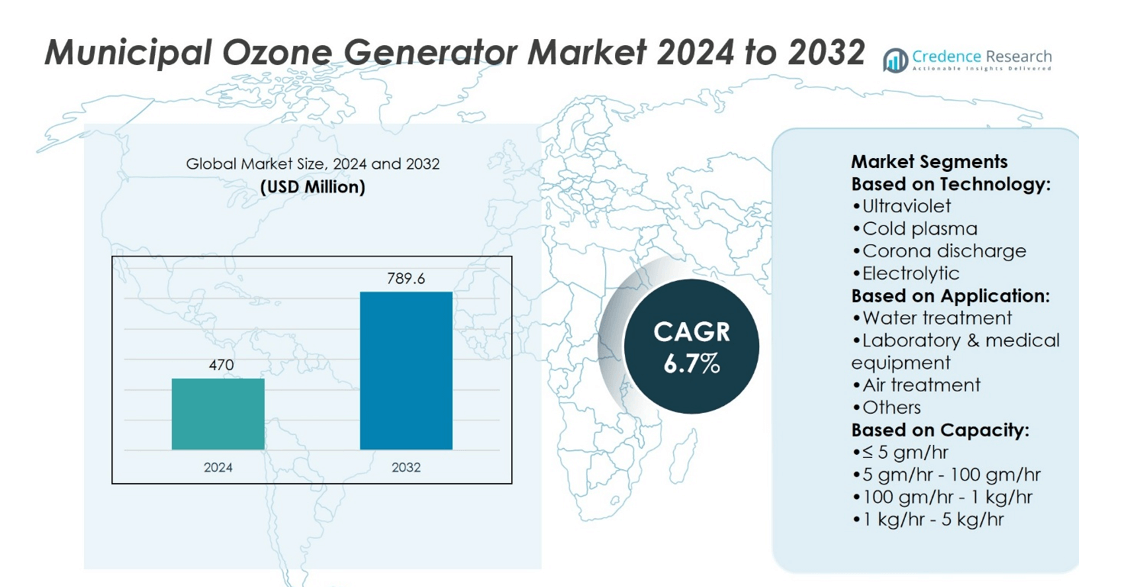

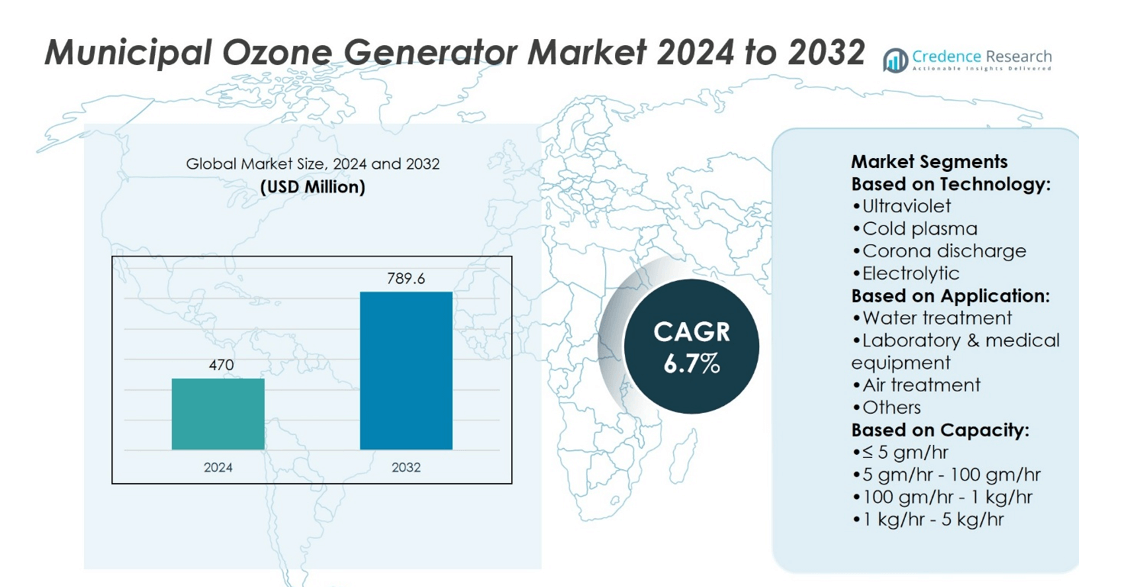

Municipal Ozone Generator Market size was valued at USD 470 million in 2024 and is anticipated to reach USD 789.6 million by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Municipal Ozone Generator Market Size 2024 |

USD 470 million |

| Municipal Ozone Generator Market, CAGR |

6.7% |

| Municipal Ozone Generator Market Size 2032 |

USD 789.6 million |

The Municipal Ozone Generator Market is driven by rising demand for chemical-free water and air treatment solutions in urban and industrial areas. Growing concerns over waterborne diseases and environmental pollution encourage municipalities to adopt ozone-based disinfection. Technological advancements in ultraviolet, corona discharge, and electrolytic ozone systems improve efficiency and reliability. Increasing focus on sustainable and energy-efficient infrastructure supports market growth. It trends toward smart, automated systems with real-time monitoring for better operational control. Expansion of municipal water treatment projects and stricter regulatory standards further stimulate adoption, positioning the market for steady long-term growth.

The Municipal Ozone Generator Market shows strong presence in North America and Europe, driven by advanced municipal infrastructure and strict environmental regulations. Asia-Pacific demonstrates rapid growth due to expanding urbanization and increasing water treatment projects. Key players focus on regional expansion, technological innovation, and strategic partnerships to capture market opportunities. Companies leverage high-capacity systems in developed regions and scalable, energy-efficient solutions in emerging markets. The combination of regulatory support, infrastructure investment, and localized solutions strengthens competitive positioning globally.

Market Insights

- The Municipal Ozone Generator Market was valued at USD 470 million in 2024 and is expected to reach USD 789.6 million by 2032, growing at a CAGR of 6.7%.

- Rising demand for chemical-free water and air treatment solutions in urban and industrial areas drives market growth.

- Growing concerns over waterborne diseases and environmental pollution encourage municipalities to adopt ozone-based disinfection.

- Technological advancements in ultraviolet, corona discharge, and electrolytic ozone systems improve efficiency and reliability.

- The market trends toward smart, automated systems with real-time monitoring for better operational control.

- Competition is high, with companies focusing on regional expansion, technological innovation, and partnerships to strengthen market presence.

- North America and Europe lead due to advanced infrastructure and regulations, while Asia-Pacific shows rapid growth from urbanization and expanding municipal water projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Water Treatment Solutions

The Municipal Ozone Generator Market grows steadily due to increasing concerns over water quality. Municipal authorities seek advanced technologies to reduce harmful microorganisms and chemical residues. Ozone systems deliver strong disinfection without creating harmful by-products. It supports compliance with global water safety standards and reduces reliance on chlorine-based treatments. Rising urban populations expand the need for large-scale purification systems. Municipalities adopt ozone generators to safeguard public health and improve water resource sustainability.

- For instance, Primozone GM series generator can produce anywhere from 4 grams to 2.9 kilograms of ozone per hour, with a modular system reaching up to 60 kilograms of ozone per hour.

Expansion of Wastewater Management Programs

Governments invest in wastewater treatment to protect ecosystems and reduce pollution. The Municipal Ozone Generator Market benefits from policies encouraging advanced treatment solutions. Ozone technologies break down complex organic compounds and pharmaceutical residues effectively. It enhances the efficiency of wastewater recycling for industrial and residential use. Large urban centers prioritize ozone adoption to meet sustainability goals. The growing focus on water reuse drives demand for cost-efficient and durable ozone systems.

- For instance, Oxidation Technologies’ ATL-series ozone generators, with models capable of generating up to 200 g/h of ozone, can be used in some industrial applications to treat contaminants.

Technological Advancements in Ozone Generation

Manufacturers introduce improved systems with higher energy efficiency and lower operational costs. The Municipal Ozone Generator Market integrates smart monitoring and automated controls. It allows municipalities to optimize disinfection levels and reduce energy waste. Compact and modular designs make ozone systems easier to install and scale. These advancements improve reliability across small and large treatment facilities. Technology-driven upgrades ensure the long-term appeal of ozone solutions in municipal applications.

Supportive Regulatory and Environmental Policies

Regulations supporting safe drinking water and clean wastewater encourage adoption of ozone-based systems. The Municipal Ozone Generator Market benefits from strict compliance requirements set by environmental agencies. It helps cities meet discharge standards and protect water resources. Incentives for sustainable infrastructure accelerate demand for advanced ozone units. Governments view ozone treatment as an essential component of public health policy. The alignment of technology with regulation strengthens the role of ozone systems in municipal frameworks.

Market Trends

Growing Shift Toward Sustainable Water Solutions

The Municipal Ozone Generator Market shows a clear shift toward eco-friendly water treatment practices. Municipalities seek solutions that reduce chemical dependence and minimize harmful by-products. Ozone systems fit these goals by offering strong disinfection without residual contaminants. It supports environmental conservation while addressing public health needs. Demand aligns with global efforts to cut carbon footprints in infrastructure projects. Municipal leaders adopt ozone to meet both safety and sustainability requirements.

- For instance, Lenntech modular ICT ozone generator units can produce up to 100 g/h of ozone. When used in municipal systems, the use of ozone can reduce chemical consumption and provide effective disinfection for drinking water without harmful residues.

Integration of Digital Monitoring and Automation

Smart controls and real-time monitoring gain traction in municipal treatment facilities. The Municipal Ozone Generator Market incorporates automated systems for precise ozone dosage and system performance. It helps reduce energy use and extends equipment life. Municipalities benefit from predictive maintenance and lower operational downtime. Integration with supervisory control systems makes operations more transparent and efficient. The use of digital tools enhances accountability and reliability in water treatment programs.

- For instance, Faraday Ozone offers a variety of ozone systems for large-scale applications, including a containerized system that can deliver 250 g/h of ozone for projects like wastewater treatment.

Rising Adoption in Large Urban Centers

Urbanization drives higher adoption rates across densely populated cities. The Municipal Ozone Generator Market supports the need for large-scale disinfection in municipal water plants. It addresses challenges of growing wastewater volumes and stricter health standards. Municipal utilities adopt scalable systems to handle demand from expanding urban populations. The trend includes investments in centralized facilities with high-capacity ozone generators. These solutions ensure long-term resilience in urban water infrastructure.

Expansion of Hybrid Treatment Approaches

Municipal operators increasingly combine ozone with other treatment methods. The Municipal Ozone Generator Market benefits from pairing ozone with UV, membrane filtration, or activated carbon. It improves removal of pharmaceutical residues and complex pollutants. Hybrid designs allow facilities to meet tougher regulations with higher efficiency. Municipal projects highlight the versatility of ozone within integrated treatment frameworks. This expansion broadens the scope of ozone applications beyond traditional disinfection.

Market Challenges Analysis

High Installation and Operational Complexity

The Municipal Ozone Generator Market faces obstacles linked to high installation and maintenance costs. Municipalities with limited budgets find it challenging to adopt large-scale ozone systems. It requires skilled technicians and specialized infrastructure for proper operation. Energy consumption during continuous disinfection adds to financial strain. Smaller towns often delay investments due to limited technical expertise. The complexity of integration restricts wider adoption across developing regions.

Concerns About System Reliability and Safety

Concerns about operational safety and reliability affect adoption across municipal facilities. The Municipal Ozone Generator Market must address risks of ozone leakage and equipment malfunction. It needs constant monitoring to maintain safe ozone levels for workers and communities. Breakdowns in high-capacity systems disrupt municipal water and wastewater treatment. Replacement of worn components leads to additional expenses for utilities. These challenges slow the pace of adoption despite proven disinfection benefits.

Market Opportunities

Expanding Infrastructure and Environmental Regulations Driving New Prospects

The Municipal Ozone Generator Market gains opportunities through stricter environmental standards and expanding municipal infrastructure. Governments continue to enforce regulations on water disinfection and air purification. Growing investment in wastewater treatment facilities increases demand for reliable ozone-based systems. Urban growth in developing regions creates large-scale requirements for advanced disinfection solutions. It benefits from the shift toward sustainable, chemical-free treatment methods. Rising public awareness of waterborne diseases strengthens adoption across municipalities, ensuring long-term market growth.

Technological Innovation and Integration with Smart Systems Supporting Adoption

The Municipal Ozone Generator Market also benefits from ongoing innovation in automation and digital monitoring. Smart ozone systems offer remote operation, predictive maintenance, and higher energy efficiency. It aligns with the broader adoption of smart city projects worldwide. Partnerships between technology providers and municipal authorities support large-scale deployments. Integration with renewable energy sources reduces operational costs and strengthens sustainability goals. Expanding pilot programs for ozone-based disinfection in developing economies encourage new investments. Growing collaborations create opportunities for advanced solutions that enhance safety and efficiency.

Market Segmentation Analysis:

By Technology

The Municipal Ozone Generator Market is segmented into ultraviolet, cold plasma, corona discharge, and electrolytic systems. Corona discharge technology holds strong adoption due to efficiency in large-scale water treatment. Ultraviolet systems find use in smaller facilities that prioritize compact, low-maintenance solutions. Cold plasma offers high performance with reduced energy consumption, creating opportunities for advanced applications. Electrolytic systems support decentralized treatment, often preferred in regions with moderate capacity requirements. It benefits from continuous improvements in durability and automation features, supporting diverse municipal demands.

- For instance, Ozone Solutions’ Total Generator (TG) series features water-cooled units that can produce up to 600 g/h of ozone from oxygen feed gas, supporting large-scale applications like industrial water treatment.

By Application

The market includes water treatment, laboratory and medical equipment, air treatment, and other applications. Water treatment dominates due to rising focus on safe municipal supply and wastewater management. Air treatment systems gain traction in urban areas where pollution levels drive higher demand. Laboratory and medical equipment rely on ozone’s sterilization capability for safe operations. Other uses include food processing support and odor control in public facilities. It strengthens adoption in municipalities aiming to reduce chemical-based processes. Increasing investments in public health and sanitation encourage steady growth in each application area.

- For instance, Mitsubishi Electric’s with a combined capacity of 5,600 pounds of ozone per day, which is several orders of magnitude larger than a 300 g/h system.

By Capacity

The Municipal Ozone Generator Market is segmented into ≤ 5 gm/hr, 5 gm/hr – 100 gm/hr, 100 gm/hr – 1 kg/hr, 1 kg/hr – 5 kg/hr, and > 5 kg/hr. Systems with 5 gm/hr – 100 gm/hr capacity serve small plants and pilot projects. Units ranging from 100 gm/hr – 1 kg/hr are widely deployed in mid-scale municipal operations. Higher capacity systems from 1 kg/hr – 5 kg/hr play a vital role in large-scale facilities. Generators exceeding 5 kg/hr capacity address mega projects in urban centers with extensive water and air treatment needs. Smaller units remain relevant for rural communities or limited-scope facilities. It ensures flexibility across regions with varying infrastructure capabilities and public service demands.

Segments:

Based on Technology:

- Ultraviolet

- Cold plasma

- Corona discharge

- Electrolytic

Based on Application:

- Water treatment

- Laboratory & medical equipment

- Air treatment

- Others

Based on Capacity:

- ≤ 5 gm/hr

- 5 gm/hr – 100 gm/hr

- 100 gm/hr – 1 kg/hr

- 1 kg/hr – 5 kg/hr

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America commands a market share of approximately 28% in the Municipal Ozone Generator Market. The region benefits from well-established water treatment and municipal sanitation infrastructure. Municipalities in the U.S. and Canada increasingly adopt ozone-based solutions to meet strict environmental and water safety regulations. Investments in modernizing aging water and air treatment facilities drive the adoption of high-capacity ozone generators. Research initiatives and pilot projects for smart city implementations further enhance market penetration. It gains momentum from technological partnerships between system manufacturers and municipal authorities. High awareness of public health and sustainability supports continued growth across North America.

Europe

Europe accounts for nearly 25% of the Municipal Ozone Generator Market. Countries such as Germany, France, and the U.K. focus heavily on chemical-free water disinfection technologies. Strict environmental standards and incentives for sustainable infrastructure accelerate the deployment of ozone generators. Municipalities prioritize advanced corona discharge and electrolytic systems to ensure operational efficiency and compliance. It benefits from the integration of smart monitoring and automated control in public water systems. Continuous innovation in ozone generation technology strengthens regional adoption. Growing investments in both urban and semi-urban areas ensure steady market expansion across Europe.

Asia-Pacific

The Asia-Pacific region captures around 30% market share and shows the highest growth rate globally. Rapid urbanization, increasing industrial wastewater, and expanding municipal infrastructure drive demand for ozone-based solutions. Countries like China, India, and Japan implement large-scale water treatment projects, integrating high-capacity ozone generators. Municipal authorities focus on sustainable and energy-efficient systems, including cold plasma and ultraviolet technologies. It benefits from government-backed initiatives to improve public health and sanitation standards. The rising population and industrial expansion create substantial opportunities for market players. Asia-Pacific’s adoption of smart water management systems further reinforces its growth trajectory.

Latin America

Latin America holds a market share of approximately 9% in the Municipal Ozone Generator Market. Municipalities in Brazil, Mexico, and Argentina increasingly deploy ozone generators for water purification and air treatment. It supports urban centers and industrial zones where chemical-based processes remain prevalent. Investment in upgrading water treatment plants and pilot projects for sustainable sanitation strengthens market adoption. Smaller cities and towns demonstrate interest in compact and mid-capacity ozone systems. Government initiatives to improve potable water access encourage steady growth. Partnerships with local technology providers accelerate regional deployment of innovative ozone solutions.

Middle East and Africa

The Middle East and Africa represent a combined market share of 8%, with growing adoption in the UAE, Saudi Arabia, and South Africa. Investments in water treatment, desalination plants, and municipal sanitation create demand for high-efficiency ozone generators. It supports arid regions where water scarcity drives sustainable purification solutions. Governments prioritize infrastructure development to meet growing urban populations and industrial needs. Technological collaboration between international manufacturers and regional municipalities accelerates deployment. Ozone-based systems are increasingly favored over chemical disinfectants due to environmental concerns. Expanding public and private investment ensures gradual but consistent market growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oxyzone International

- ORAIPL

- Eltech Ozone

- BIO-UV

- Primozone

- Oxidation Technologies

- Lenntech Water Treatment

- Faraday Ozone

- Ozone Solutions

- DEL Ozone

Competitive Analysis

The Municipal Ozone Generator Market include BIO-UV, DEL Ozone, Eltech Ozone, Faraday Ozone, Lenntech Water Treatment, ORAIPL, Oxidation Technologies, Oxyzone International, Ozone Solutions, and Primozone. The Municipal Ozone Generator Market remains highly competitive due to rapid technological advancements and growing municipal demand for sustainable water and air treatment solutions. Companies focus on improving efficiency, reliability, and energy performance of ozone systems to differentiate their offerings. High-capacity corona discharge units dominate large-scale municipal plants, while ultraviolet and cold plasma systems serve smaller facilities and specialized applications. Manufacturers emphasize integrated solutions with smart monitoring, automation, and modular designs to meet varying infrastructure needs. The market also sees strong competition in after-sales support, maintenance services, and custom system designs. It benefits from regulatory pressures, urbanization, and the need for chemical-free disinfection, encouraging continuous innovation. Competitive strategies focus on regional expansion, technology upgrades, and partnerships with municipalities, ensuring robust market positioning and long-term growth potential.

Recent Developments

- In August 2025, Primozone is innovating discover our generators that deliver energy savings, reduced operational costs and sustainable water treatment solutions enhancing operational efficiency and environmental compliance for municipalities seeking sustainable water management.

- In February 2024, BIO-UV Group expanded its ozone product capacity to over 30 kg/h through a collaboration with Pinnacle Ozone Solutions. This capacity enhancement supports growing demand for water disinfection and wastewater treatment applications in municipal sectors.

- In February 2024, Scottish and French-based water treatment expert BIO-UV joined forces with American-based Pinnacle Ozone. Through this association, their collective portfolio is increased to offer a total solution of water and wastewater treatment for aquaculture, municipal, industrial, and leisure industries.

- In January 2023, Konica Minolta, in collaboration with Tamura TECO Co., Ltd., developed and began mass production of BACTECTOR 2.0SC, an affordable ozone generator with advanced disinfection capabilities. Manufactured at the DMC-MIKAWA smart factory in Japan, the product aims to promote cleaner and safer living environments by effectively suppressing bacteria and viruses

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with increasing demand for sustainable water and air treatment solutions.

- Municipalities will adopt high-capacity ozone generators for large-scale water treatment projects.

- Energy-efficient and low-maintenance ozone systems will gain higher preference.

- Ultraviolet, cold plasma, and electrolytic technologies will see expanded adoption.

- Integration with smart monitoring and automation will enhance operational efficiency.

- Small and mid-capacity generators will support localized water and air treatment needs.

- Government regulations and environmental standards will drive widespread market adoption.

- Emerging regions will invest in modern municipal infrastructure, creating new opportunities.

- Companies will focus on modular and scalable designs to meet varied municipal requirements.

- Technological innovation and strategic partnerships will strengthen market presence globally.