Market Overview

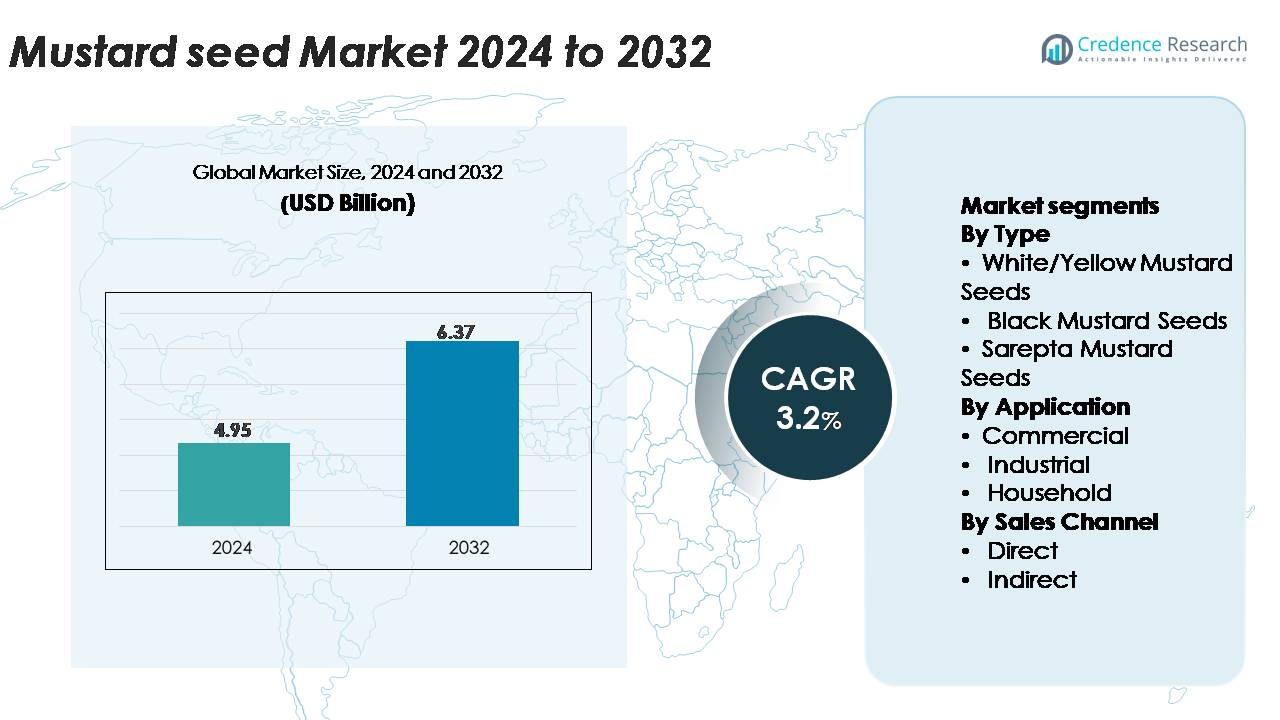

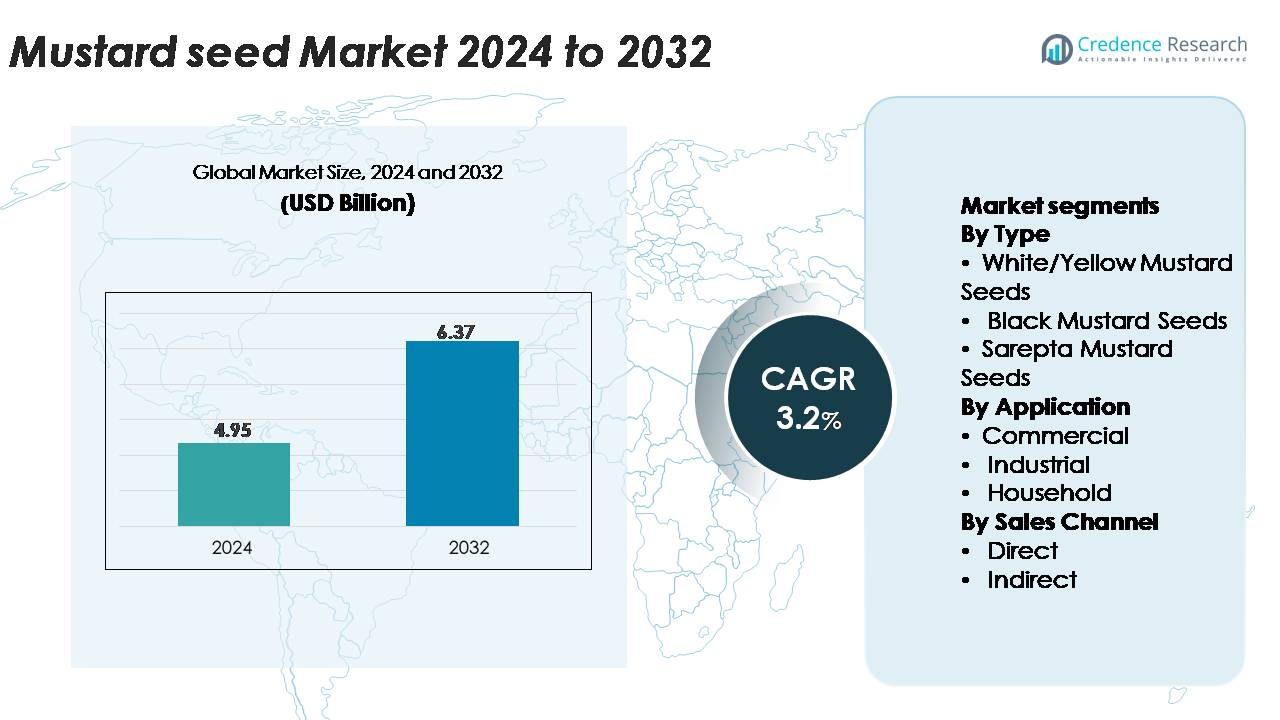

The global mustard seed market was valued at USD 4.95 billion in 2024 and is projected to reach USD 6.37 billion by 2032, exhibiting a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mustard Seed Market Size 2024 |

USD 4.95 Billion |

| Mustard Seed Market, CAGR |

3.2% |

| Mustard Seed Market Size 2032 |

USD 6.37 Billion |

The mustard seed market is shaped by a mix of established global brands and strong regional suppliers, including McCormick & Company, Inc., Sakai Spice (Canada) Corp, Megha Corporation, Organic Products India, Sun Impex, The Tracklement Company Ltd, and Kaveri Seeds. These companies compete through quality assurance, advanced cleaning and grading systems, organic-certified offerings, and strong export networks. Asia-Pacific remains the leading region with approximately 32% of the global market share, driven by large-scale production and high culinary consumption, particularly in India. Europe follows with around 28%, supported by its well-developed condiment and specialty mustard industries. North America captures nearly 24%, benefiting from strong demand for processed foods and premium spice blends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The mustard seed market was valued at USD 4.95 billion in 2024 and is projected to reach USD 6.37 billion by 2032, registering a CAGR of 3.2% during the forecast period.

- Steady growth is driven by increasing consumption of mustard seeds in processed foods, condiments, spice blends, and mustard oil production, supported by rising demand for natural flavoring agents and clean-label culinary ingredients.

- Product innovation in organic seeds, cold-pressed oils, and traceable, packaged spice formats is reshaping market trends, while premiumization and growing e-commerce penetration further accelerate adoption across household and commercial buyers.

- The market features strong competition from global and regional players focusing on purity grades, hybrid seed development, and export capabilities; white/yellow mustard seeds dominate type segmentation due to their widespread culinary and industrial usage.

- Key restraints emerge from climate-dependent crop yields and price volatility, while regionally Asia-Pacific leads with ~32%, followed by Europe at ~28% and North America at ~24%, collectively driving global demand dynamics.

Market Segmentation Analysis:

By Type

White/Yellow mustard seeds represent the dominant segment, accounting for the largest market share due to their extensive use in culinary applications, condiment manufacturing, and oil extraction. Their mild flavor profile, higher mucilage content, and suitability for large-scale processing enhance their commercial appeal. Black mustard seeds hold a notable share, driven by their strong pungency and popularity in regional cuisines, while Sarepta mustard seeds remain a niche segment due to their specific agro-climatic requirements. Demand across all types benefits from rising consumption of natural spices, expanding processed food sectors, and growing applications in traditional medicine and functional blends.

- For instance, in support of this trend, for instance, McCormick & Company has operations and offices in 29 countries globally through which it sources raw spices including mustard seeds from over 75 countries and utilizes various production facilities for processing.

By Application

The commercial segment leads the market with the highest share, supported by strong demand from foodservice chains, spice processors, condiment brands, and edible oil manufacturers. Large-volume procurement, standardized quality needs, and consistent year-round consumption drive this segment’s dominance. Industrial applications continue to expand, particularly in specialty oils, nutraceutical formulations, and natural preservative production. The household segment maintains steady growth, fueled by rising culinary experimentation, preference for natural ingredients, and increasing adoption of packaged, cleaned, and graded mustard seeds. Growth across all applications is reinforced by improved supply chains, digital retail penetration, and expanding global spice consumption.

· For instance, Organic Products India strengthens the household and retail segments by supplying certified mustard seed products across numerous international markets, enabling reliable access to packaged and traceable mustard varieties for end consumers.

By Sales Channel

Indirect sales channels dominate the market, capturing the largest share due to the extensive networks of distributors, wholesalers, and retail formats that ensure wide product accessibility. Supermarkets, hypermarkets, spice retailers, and online platforms significantly contribute to high-volume movement and offer diverse packaging formats suited for both consumers and businesses. Direct channels, though smaller, remain critical for bulk buyers such as food processors, oil mills, and commercial catering operations that require contractual sourcing for consistent quality and traceability. Growth across sales channels is strengthened by digitized procurement, enhanced logistics infrastructure, and rising demand for certified, quality-assured mustard seeds.

Key Growth Drivers

Expanding Demand from Food Processing and Condiment Industries

The rapid expansion of global food processing and condiment manufacturing drives sustained demand for mustard seeds. Food manufacturers increasingly incorporate mustard seeds into sauces, pickles, marinades, spice mixes, and ready-to-eat products, reinforcing their role as a versatile, natural flavoring ingredient. The rising popularity of ethnic and fusion cuisines further boosts commercial usage, particularly in North America, Europe, and Asia-Pacific. Clean-label trends and consumer preference for natural spices also strengthen demand for minimally processed mustard-based ingredients. Additionally, growth in global mustard oil consumption—especially in South Asian and African markets—supports steady procurement by large oil mills. Continuous innovations in cold-pressed and filtered mustard oils expand application versatility, enhancing the sector’s overall growth momentum.

- For instance, McCormick & Company has operations and offices in approximately 29 countries and sources its high-quality raw materials and ingredients from over 75 countries

Increasing Adoption in Nutraceuticals and Functional Ingredients

Growing consumer interest in natural health-promoting ingredients significantly contributes to mustard seed market expansion. Mustard seeds contain glucosinolates, selenium, omega-rich oils, and antioxidant compounds that support cardiovascular, metabolic, and digestive wellness. Nutraceutical manufacturers leverage these bioactive profiles to formulate supplements, herbal blends, and functional food products. Rising awareness of plant-based and anti-inflammatory diets encourages the inclusion of mustard-derived components such as mustard flour, seed extracts, and essential oils. Industrial processors benefit from growing R&D investments focused on extracting high-purity phytochemicals for use in therapeutic formulations. As demand for preventive healthcare and natural functional ingredients rises across developed and emerging markets, mustard seeds gain strategic importance within the broader functional food ecosystem.

- For instance, McCormick & Company supports functional-ingredient development through its global network of 20 technical innovation centers, which conduct advanced analytical testing including chromatographic profiling and volatile-oil quantification to optimize mustard-derived components for health-focused formulations.

Growth in Organic Farming and Sustainable Agricultural Practices

Increasing global adoption of organic and sustainable agricultural practices is strengthening the mustard seed market, particularly for high-grade export-oriented varieties. Mustard crops require fewer synthetic inputs compared to other oilseeds, making them attractive for organic cultivation. Rising consumer demand for organic spices, oils, and condiments encourages farmers to transition toward certified production systems. Governments and agricultural agencies further support cultivation through training programs, improved seed varieties, and incentives to enhance oilseed productivity. The crop’s rotational benefits including soil conditioning and natural pest suppression align with regenerative farming initiatives. As sustainability standards tighten across global food supply chains, mustard seeds cultivated under eco-friendly systems gain competitive advantages in both domestic and international markets.

Key Trends & Opportunities

Rising Penetration of E-Commerce and Packaged Spice Consumption

The rapid expansion of e-commerce platforms and modern retail formats presents strong opportunities for packaged mustard seeds, spice blends, and cold-pressed mustard oils. Digital channels enable spice brands to reach diverse consumer groups, offer customized packaging, and promote product traceability and quality certification. Online platforms also help small and mid-sized producers gain market visibility and tap into premium segments such as organic, single-origin, and non-GMO mustard seeds. Urban consumers increasingly prefer packaged, cleaned, and quality-graded mustard seeds over loose products, driving higher value realization for manufacturers. This shift toward branded and traceable spice consumption opens new opportunities for market expansion and differentiation.

- For instance, McCormick & Company leverages digital systems and technologies (such as SAP and enterprise labeling solutions) to manage its extensive global sourcing of raw materials from over 75 countries, which enables robust internal tracking, quality control, and compliance with labeling regulations (like GS1-128 barcodes and 2D barcodes) for its products.

Product Diversification into Specialty Oils, Extracts, and Industrial Applications

Increasing innovation in mustard-based derivatives creates new commercial opportunities beyond traditional culinary uses. Specialty segments such as cold-pressed mustard oil, high-volatility mustard essential oils, oleoresins, and mustard flour are gaining traction in food, cosmetics, and pharmaceutical applications. Manufacturers are also exploring mustard seed extracts for natural preservatives, flavor enhancers, and antimicrobial agents, aligning with clean-label and chemical-free product development. Growing industrial interest in mustard oil as a biodegradable lubricant or biofuel additive expands its relevance in niche markets. As downstream industries continue to diversify, mustard seed suppliers benefit from broader application portfolios and higher revenue-generating product pathways.

- For instance, The Tracklement Company Ltd manufactures an award-winning range of over 50 artisan condiments, several of which incorporate mustard-derived bases processed in its facility.

Key Challenges

Price Volatility and Weather-Dependent Production Cycles

Mustard seed production remains highly sensitive to climatic fluctuations, rainfall patterns, and pest pressures, leading to year-to-year yield variability. Unpredictable weather conditions such as droughts, excessive rainfall, or frost can significantly reduce output and cause price spikes. Since mustard cultivation is still concentrated in a few key producing regions, supply chain disruptions in these areas can affect global availability. Farmers also face challenges related to inconsistent seed quality, limited access to high-yield varieties, and fluctuating procurement prices. These factors create instability across processing industries, export markets, and retail segments, making long-term planning more complex for stakeholders throughout the supply chain.

Competition from Substitute Oils and Alternative Spice Ingredients

Mustard seeds face competitive pressure from alternative edible oils such as sunflower, soybean, and groundnut oils, which often benefit from larger production volumes and stable pricing. In regional cuisines, substitute spices like cumin, fenugreek, sesame, and black pepper can partially replace mustard seeds in certain culinary preparations, reducing usage intensity. Consumer perception challenges in some markets—where mustard oil faces regulatory restrictions or purity concerns—further limit adoption. The growing popularity of blended oils and processed spice mixes also diversifies consumer purchasing patterns. To remain competitive, mustard seed suppliers must focus on quality enhancement, standardized processing, and targeted product positioning across premium and functional segments.

Regional Analysis

North America

North America accounts for around 24% of the global mustard seed market, supported by strong consumption of specialty mustard-based condiments, premium spice blends, and organically certified seeds. The United States remains the dominant contributor due to large-scale industrial processing, rising adoption of clean-label ingredients, and continuous product innovation in gourmet sauces and artisanal foods. Canada plays a significant role as a leading producer of high-grade yellow mustard seeds, supplying both domestic and export markets. Growing interest in functional foods, healthier edible oils, and traceable spice sourcing further reinforces regional demand across retail and commercial channels.

Europe

Europe holds the largest share at around 28%, driven by extensive mustard consumption in sauces, dressings, pickled formulations, and traditional culinary applications. France, Germany, and the U.K. lead demand due to established condiment industries and high penetration of branded mustard products. The region benefits from strong regulatory emphasis on food quality, sustainability, and organic certification, which boosts demand for premium and single-origin mustard seeds. European processors actively source yellow and Sarepta mustard varieties to meet diverse product specifications. Growth is further influenced by expanding gourmet food trends and rising consumer preference for natural spice ingredients.

Asia-Pacific

Asia-Pacific dominates the global market with approximately 32%, driven by high consumption of mustard seeds and mustard oil across India, Bangladesh, Nepal, and parts of Southeast Asia. India acts as both a major producer and consumer, supported by extensive use in cooking, pickling, and traditional medicine. The region’s expanding food processing sector, rising household consumption, and preference for strong flavor profiles accelerate demand across all seed types. Growing adoption of packaged spices, improvements in post-harvest handling, and increasing exports of oilseed varieties further strengthen market growth. Agricultural modernization and hybrid seed cultivation also contribute to production stability.

Latin America

Latin America represents around 8% of the global market, led by moderate but steadily rising usage in processed foods, sauces, and seasoning blends. Countries such as Mexico, Brazil, and Argentina show increasing demand from commercial food manufacturers and bakeries integrating mustard-based ingredients. Growth is supported by expanding urban consumption and rising imports of yellow mustard seeds to meet industrial requirements. Although domestic cultivation is limited, improving supply chains and greater availability of packaged spices stimulate household adoption. The region’s foodservice expansion and rising interest in global cuisines create additional opportunities for mustard seed suppliers.

Middle East & Africa

The Middle East & Africa region accounts for roughly 8% of global market share, supported by diversified applications in culinary preparations, pickles, spice blends, and traditional condiments. North African countries such as Egypt and Morocco exhibit growing demand, while Gulf nations rely heavily on imports due to limited cultivation. Industrial usage in food processing and mustard oil blending is gradually increasing. Rising urbanization, expanding retail channels, and a shift toward packaged and hygienically processed spices are strengthening market penetration. Improvements in trade networks and growing interest in ethnic and fusion cuisine further enhance regional demand prospects.

Market Segmentations:

By Type

- White/Yellow Mustard Seeds

- Black Mustard Seeds

- Sarepta Mustard Seeds

By Application

- Commercial

- Industrial

- Household

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The mustard seed market features a moderately fragmented competitive landscape, characterized by a mix of regional producers, integrated oilseed processors, and global spice manufacturers. Key players compete on parameters such as seed purity, oil content, organic certification, supply reliability, and adherence to food safety standards. Large processors leverage contract farming, hybrid seed development, and advanced cleaning and grading technologies to ensure consistent quality for industrial buyers. Export-oriented companies focus on traceability systems and sustainability compliance to strengthen their presence in premium markets across Europe and North America. Meanwhile, smaller regional producers emphasize cost efficiency and cater primarily to local culinary and household demand. Growing interest in cold-pressed oils, packaged spices, and organic variants is prompting companies to diversify product portfolios and invest in value-added processing. Strategic expansion into e-commerce channels and partnerships with food processors further intensify competition as suppliers aim to capture rising global demand for high-quality mustard seeds.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Kaveri Seeds published a farmer-testimonial showing how their hybrid paddy seed (KPH 468) enabled farmers to follow with mustard cultivation as a second crop, hinting at mustard seed rotation benefits.

- In 2025, Organic Products India the company’s organic brand listing shows their certified organic whole mustard seeds product as of product listing online in highlighting focus on organic spice expansion.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mustard seeds will continue rising as food processors expand usage in condiments, marinades, spice blends, and value-added products.

- Adoption of cold-pressed and filtered mustard oils will increase as consumers prefer natural, minimally processed cooking oils.

- Organic and sustainably grown mustard seeds will gain stronger traction across export markets due to tightening quality and certification requirements.

- Hybrid and high-yield seed varieties will improve productivity, helping stabilize supply and reduce weather-related production risks.

- E-commerce and modern retail penetration will enhance visibility for branded, cleaned, and packaged mustard seed products.

- Industrial applications such as natural preservatives, mustard flour, and essential oils will expand due to clean-label formulation trends.

- Growing interest in functional and plant-based nutrition will boost demand for mustard seed extracts and bioactive compounds.

- Supply chains will modernize through better grading, storage, and traceability systems to meet global quality expectations.

- Export opportunities will strengthen as Europe and North America increasingly rely on high-quality imported mustard seeds.

- Market consolidation may accelerate as large processors invest in contract farming, backward integration, and value-added processing capabilities.