Market Overview:

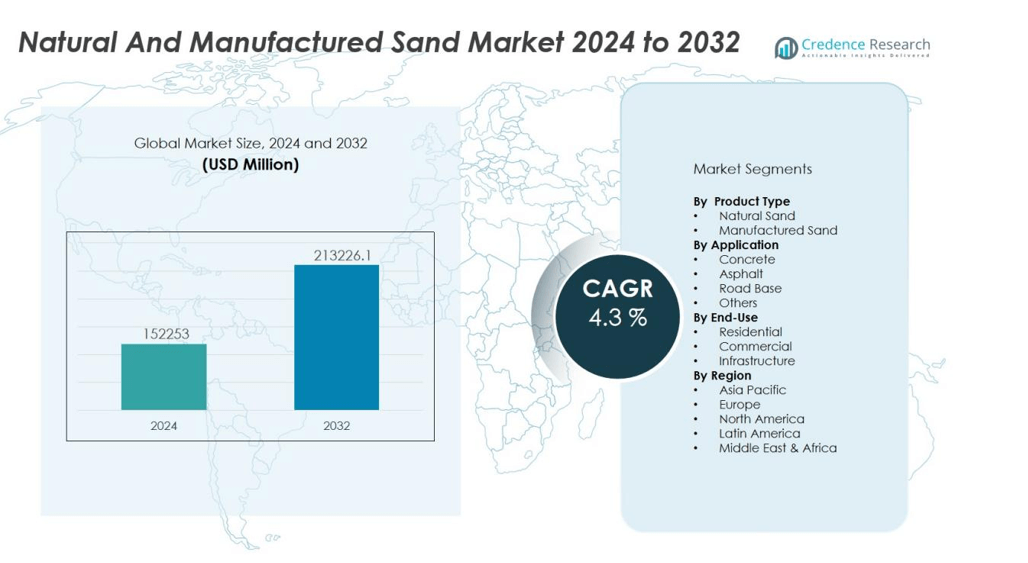

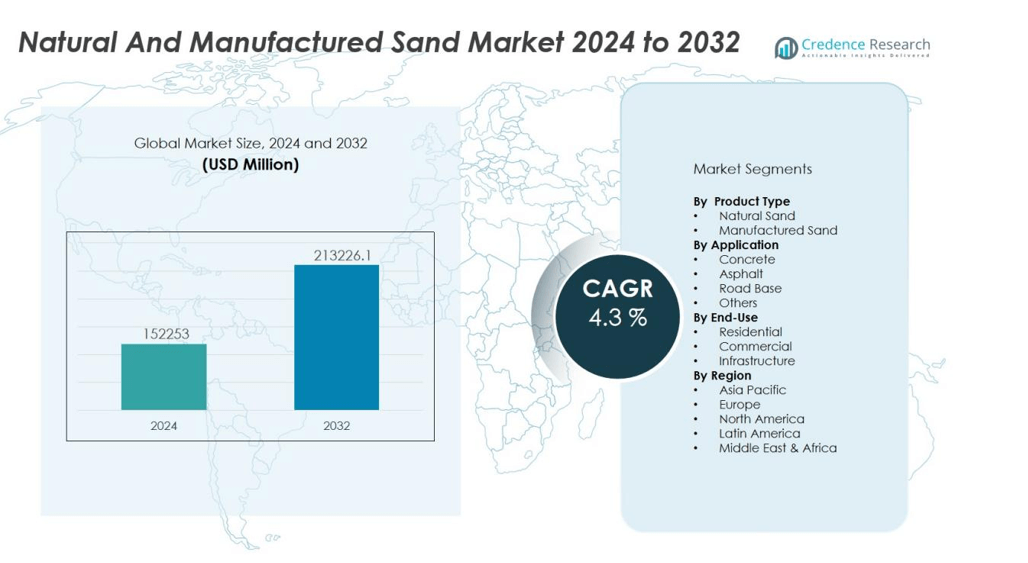

The natural and manufactured sand market size was valued at USD 152253 million in 2024 and is anticipated to reach USD 213226.1 million by 2032, at a CAGR of 4.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural and Manufactured Sand Market Size 2024 |

USD 152253 million |

| Natural and Manufactured Sand Market, CAGR |

4.3% |

| Natural and Manufactured Sand Market Size 2032 |

USD 213226.1 million |

Market growth is fueled by rapid urbanization, increasing residential and commercial construction activities, and large-scale infrastructure development projects. The adoption of manufactured sand is further supported by its consistent quality, cost efficiency, and suitability for high-strength concrete applications. Government initiatives promoting sustainable mining practices and eco-friendly building materials are also accelerating market adoption. Technological advancements in sand processing equipment enhance production efficiency and quality, strengthening the market outlook.

Regionally, Asia-Pacific dominates the natural and manufactured sand market due to extensive construction activities in China, India, and Southeast Asia, coupled with high infrastructure spending. North America shows steady growth, supported by highway rehabilitation and urban redevelopment projects, while Europe is driven by strict environmental regulations and a focus on sustainable construction material.

Market Insights:

- The natural and manufactured sand market was valued at USD 152,253 million in 2024 and is projected to reach USD 213,226.1 million by 2032, reflecting a CAGR of 4.3%.

- Rapid urbanization and large-scale infrastructure projects worldwide are creating sustained demand for high-quality sand in concrete, asphalt, and other construction applications.

- Strict environmental regulations on natural sand mining are accelerating the shift toward manufactured sand, favored for its quality consistency and suitability for high-strength concrete.

- Technological advancements in crushing, screening, and washing equipment are improving production efficiency, ensuring uniform particle size and reducing impurities.

- Rising adoption of eco-friendly construction practices and government promotion of sustainable building materials are boosting demand for manufactured sand.

- Asia-Pacific leads with 56% market share, driven by major construction activity in China, India, and Southeast Asia, followed by North America at 18% and Europe at 15%.

- High production costs, logistical constraints, and regulatory compliance requirements remain key challenges, but growing investment in advanced processing facilities is expected to enhance supply reliability and market competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Infrastructure Development and Urban Expansion Driving Sand Demand:

The natural and manufactured sand market is witnessing robust demand due to accelerated urbanization and large-scale infrastructure projects worldwide. Expanding residential, commercial, and industrial construction activities require high-quality sand for concrete, asphalt, and other building materials. Governments are prioritizing transportation networks, smart cities, and renewable energy infrastructure, further increasing consumption. This growth trend is particularly strong in emerging economies, where urban populations are rapidly increasing and housing demand is surging.

- For instance, CDE Global commissioned two EvoWash hydrocyclone sand-washing plants in Qatar, each processing 1,200 t/h of manufactured sand to meet stringent specifications for major urban developments.

Regulatory Restrictions on Natural Sand Mining Encouraging Manufactured Sand Adoption:

Stringent regulations on river sand extraction to protect ecosystems are encouraging the shift toward manufactured sand. It offers consistent quality, controlled gradation, and higher strength, making it suitable for modern construction needs. Builders and contractors are adopting manufactured sand to comply with environmental guidelines while meeting project specifications. The availability of advanced crushing and screening technologies supports efficient large-scale production.

Technological Advancements in Sand Processing Enhancing Quality and Efficiency:

Technological improvements in sand manufacturing and washing equipment are significantly improving efficiency, quality, and cost-effectiveness. Automation, precision screening, and advanced washing systems ensure uniform particle size, reduced impurities, and better workability in concrete mixes. These advancements are enabling suppliers to meet growing demand without compromising standards. It is also allowing producers to expand their reach in competitive construction markets.

- For instance, Collier Materials in Texas increased their production of C-33 spec sand by 50% and significantly reduced plant footprint after installing a CDE sand washing system.

Growing Emphasis on Sustainable and Eco-Friendly Construction Practices:

The increasing focus on sustainable construction is fueling demand for manufactured sand as an environmentally responsible alternative. Using crushed rock and quarry by-products reduces dependency on limited natural sand resources. Governments and industry bodies are promoting eco-friendly building materials, encouraging widespread acceptance. This shift aligns with global green building certifications and supports long-term environmental preservation goals.

Market Trends:

Rising Preference for Manufactured Sand in High-Performance Construction Applications:

The natural and manufactured sand market is experiencing a marked shift toward manufactured sand due to its consistent quality and suitability for high-strength concrete. Construction companies are increasingly relying on it for projects that demand precise particle size and improved durability, such as skyscrapers, bridges, and industrial facilities. Regulatory pressure on natural sand extraction is further accelerating this transition. Market participants are expanding production capacities and investing in modern crushing technologies to ensure supply reliability. The use of manufactured sand is also aligning with cost optimization strategies by reducing wastage and enhancing mix efficiency. This trend is expected to gain momentum in both developed and emerging construction markets.

- For instance, Heidelberg Materials Australia commissioned a 120 tonne-per-hour Kayasand VSI plant at Bass Point Quarry, achieving consistent particle grading with less than 1% fines under 75 µm and enabling up to two-thirds replacement of natural sand.

Integration of Advanced Processing Technologies and Sustainable Production Practices:

The adoption of advanced washing, screening, and grading systems is transforming the quality standards of sand production. It is enabling manufacturers to produce material with minimal impurities and optimal grain shape, enhancing performance in concrete and asphalt applications. Producers are incorporating energy-efficient machinery and water recycling systems to reduce environmental impact. The integration of digital monitoring and automation ensures higher productivity and consistent output. Sustainability-focused construction projects are creating a growing preference for eco-friendly and recycled aggregates. This combination of technology-driven quality improvement and environmental responsibility is shaping the competitive landscape of the market.

- For instance, at the Zawtika gas field in Myanmar, automated sand-prediction models and dashboard monitoring across 123 wells and 11 platforms have improved operational efficiency by streamlining sand production forecasts and reducing manual analysis time for well management.

Market Challenges Analysis:

Environmental Concerns and Regulatory Compliance Constraints:

The natural and manufactured sand market faces significant challenges from stringent environmental regulations and sustainability concerns. Many countries have imposed restrictions on natural sand mining to protect river ecosystems, leading to supply shortages in certain regions. It is increasing dependence on manufactured sand, which requires substantial investment in crushing, screening, and washing facilities. Small-scale producers often struggle to meet compliance standards and maintain consistent product quality. Delays in obtaining environmental clearances can disrupt production timelines and project schedules. These factors collectively create operational and cost pressures for industry participants.

High Production Costs and Logistics Limitations:

Manufactured sand production involves energy-intensive processes and advanced equipment, which elevate operational expenses. Transportation adds further cost burdens, particularly in regions with limited proximity to suitable raw material sources. The natural and manufactured sand market also contends with fluctuating fuel prices, impacting delivery costs and project profitability. Maintaining consistent supply during peak construction seasons becomes challenging in areas with underdeveloped logistics infrastructure. Market players must balance production efficiency with cost management to remain competitive. This challenge is more pronounced in emerging markets where infrastructure gaps and financing constraints hinder large-scale capacity expansion.

Market Opportunities:

Expansion of Infrastructure and Urban Development Projects:

The natural and manufactured sand market holds strong growth potential from ongoing and planned infrastructure investments worldwide. Rapid urbanization in emerging economies is creating demand for high-quality aggregates in housing, commercial spaces, transportation networks, and industrial facilities. It is driving opportunities for manufacturers to scale production and establish supply partnerships with large construction firms. Mega-projects such as smart cities, renewable energy parks, and transit corridors require consistent volumes of premium sand. Governments are prioritizing infrastructure upgrades, which will sustain long-term demand. This trend creates favorable conditions for both established players and new entrants to capture market share.

Advancements in Sustainable and High-Performance Construction Materials:

The increasing adoption of green building standards and sustainable construction practices is opening new avenues for manufactured sand producers. Advanced processing technologies enable the production of eco-friendly sand with optimized particle size and minimal impurities. The natural and manufactured sand market benefits from growing interest in replacing natural resources with recycled and engineered aggregates. Demand for high-performance concrete in complex structures further enhances the scope for value-added sand products. Strategic investments in technology, quality certification, and distribution networks can help suppliers penetrate premium market segments. This shift aligns with global priorities for environmental preservation and resource efficiency.

Market Segmentation Analysis:

By Product Type:

The natural and manufactured sand market is segmented into natural sand and manufactured sand. Natural sand remains in demand for applications where minimal processing is required, but its availability is declining due to mining restrictions. Manufactured sand is gaining market share due to consistent particle size, strength, and compliance with environmental regulations. It is widely used in high-performance concrete and asphalt production, supported by advancements in crushing and screening technologies.

By Application:

Key applications include concrete, asphalt, road base, and others such as landscaping and specialty mixes. Concrete production dominates consumption, driven by global infrastructure and residential projects. Asphalt applications benefit from urban road expansion and highway rehabilitation programs. Road base usage is increasing in developing regions with large-scale transport network construction. Specialty applications are emerging in industrial flooring and decorative concrete.

- For instance, BASF’s Ucrete industrial flooring system is installed at thicknesses of ¼ to ½ inch and has provided over 50th years of proven performance in harsh environments, ensuring high durability and sanitary conditions in facilities worldwide.

By End-Use:

End-use segments cover residential, commercial, and infrastructure sectors. Residential construction drives steady demand for both product types, supported by housing initiatives in emerging economies. Commercial projects, including retail spaces, offices, and industrial complexes, rely on high-strength sand for structural durability. Infrastructure remains the largest end-use segment, fueled by government investment in transportation, energy, and public facilities. It continues to shape demand patterns across both developed and developing regions.

- For instance, UltraTech Cement’s UltraTech Building Solutions (UBS) rollout enriched the lives of 3 million individual home builders across 1 million residential sites through its network of 150 UBS stores inaugurated in a single day.

Segmentations:

By Product Type:

- Natural Sand

- Manufactured Sand

By Application:

- Concrete

- Asphalt

- Road Base

- Others

By End-Use:

- Residential

- Commercial

- Infrastructure

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 56% market share, making it the largest regional contributor to the natural and manufactured sand market. Strong economic growth in China, India, and Southeast Asian nations fuels extensive infrastructure and real estate development. Government-backed initiatives such as smart cities, industrial corridors, and transport networks drive sustained demand. It benefits from abundant raw material availability and expanding manufacturing capacity for engineered sand. The adoption of manufactured sand is accelerating due to environmental restrictions on river sand mining. Increasing foreign investments in construction projects further support market expansion in this region.

North America :

North America accounts for 18% market share, supported by significant infrastructure rehabilitation and commercial development projects. Large-scale investments in road, bridge, and public transit upgrades are creating steady demand for high-quality sand. The natural and manufactured sand market in this region benefits from advanced production technology and strict quality standards. It is witnessing rising adoption of manufactured sand in response to environmental regulations and resource conservation policies. The presence of established construction firms and advanced logistics networks strengthens supply reliability. Growth is further supported by residential housing demand in urban and suburban areas.

Europe :

Europe holds 15% market share, driven by stringent environmental regulations and growing demand for sustainable construction materials. The region actively promotes the use of manufactured sand to reduce dependency on natural resources. It is seeing increased adoption in high-performance concrete for infrastructure, industrial, and residential applications. Investments in recycling facilities and advanced sand processing equipment enhance product quality and environmental compliance. The shift toward energy-efficient and eco-friendly building designs supports consistent demand. Cross-border construction collaborations within the EU also boost trade and supply chain efficiency for sand producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CRH Plc

- LafargeHolcim

- Sibelco

- HeidelbergCement AG

- CEMEX S.A.B. de C.V.

- Adelaide Brighton Ltd

- Vulcan Materials Company

- Johnston North America

- McLanahan

- Duo PLC

- DMAC

Competitive Analysis:

The natural and manufactured sand market features a competitive landscape with a mix of multinational corporations and regional producers. Key players include CRH Plc, LafargeHolcim, Sibelco, HeidelbergCement AG, CEMEX S.A.B. de C.V., Adelaide Brighton Ltd, Vulcan Materials Company, and Johnston North America. It is characterized by a focus on quality consistency, large-scale production capacity, and strategic geographic presence. Companies invest in advanced crushing, screening, and washing technologies to improve product performance and meet environmental regulations. Expansion strategies include acquisitions, joint ventures, and partnerships with construction firms to secure long-term supply contracts. Strong distribution networks and proximity to raw material sources enhance competitiveness. The market is expected to see intensified rivalry as demand grows for sustainable and high-performance sand products across global construction sectors.

Recent Developments:

- In July 2025, CRH Plc announced the acquisition of Eco Material Technologies, a leading supplier of Supplementary Cementitious Materials in North America, for $2.1billion.

- In January 2025, PQ Group completed the acquisition of Sibelco’s specialty silicate business in Lödöse, Sweden.

- In July 2025, McLanahan established a strategic partnership with Terran Resources to expand its dealer network and bring comprehensive mineral processing solutions to the CARICOM region.

Market Concentration & Characteristics:

The natural and manufactured sand market exhibits a moderately fragmented structure with a mix of global producers and regional suppliers competing for share. It is characterized by high demand from the construction, infrastructure, and industrial sectors, with manufactured sand gaining prominence due to environmental restrictions on natural sand mining. Market players differentiate through quality consistency, advanced processing technology, and reliable supply chains. Technological advancements in crushing, washing, and grading systems are enabling efficient large-scale production. Strategic partnerships with construction firms and government infrastructure projects strengthen market positioning. Regional availability of raw materials and logistics capabilities significantly influence competitive dynamics.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand will remain strong, driven by sustained global infrastructure development and urban expansion.

- Adoption of manufactured sand will accelerate due to tightening environmental regulations on natural sand mining.

- Technological innovations in crushing, screening, and washing equipment will enhance production efficiency and quality.

- Integration of automation and digital monitoring systems will improve operational consistency and reduce wastage.

- Sustainable construction practices will increase reliance on eco-friendly sand alternatives and recycled aggregates.

- Strategic investments in capacity expansion will help producers meet rising demand in high-growth regions.

- Partnerships between sand suppliers and large construction firms will strengthen supply chain reliability.

- Regional supply imbalances may create opportunities for cross-border trade and export growth.

- Development of premium sand products for high-performance concrete will open new revenue streams.

- The market will witness heightened competition, encouraging players to focus on cost optimization, quality certification, and value-added services.