Market Overview

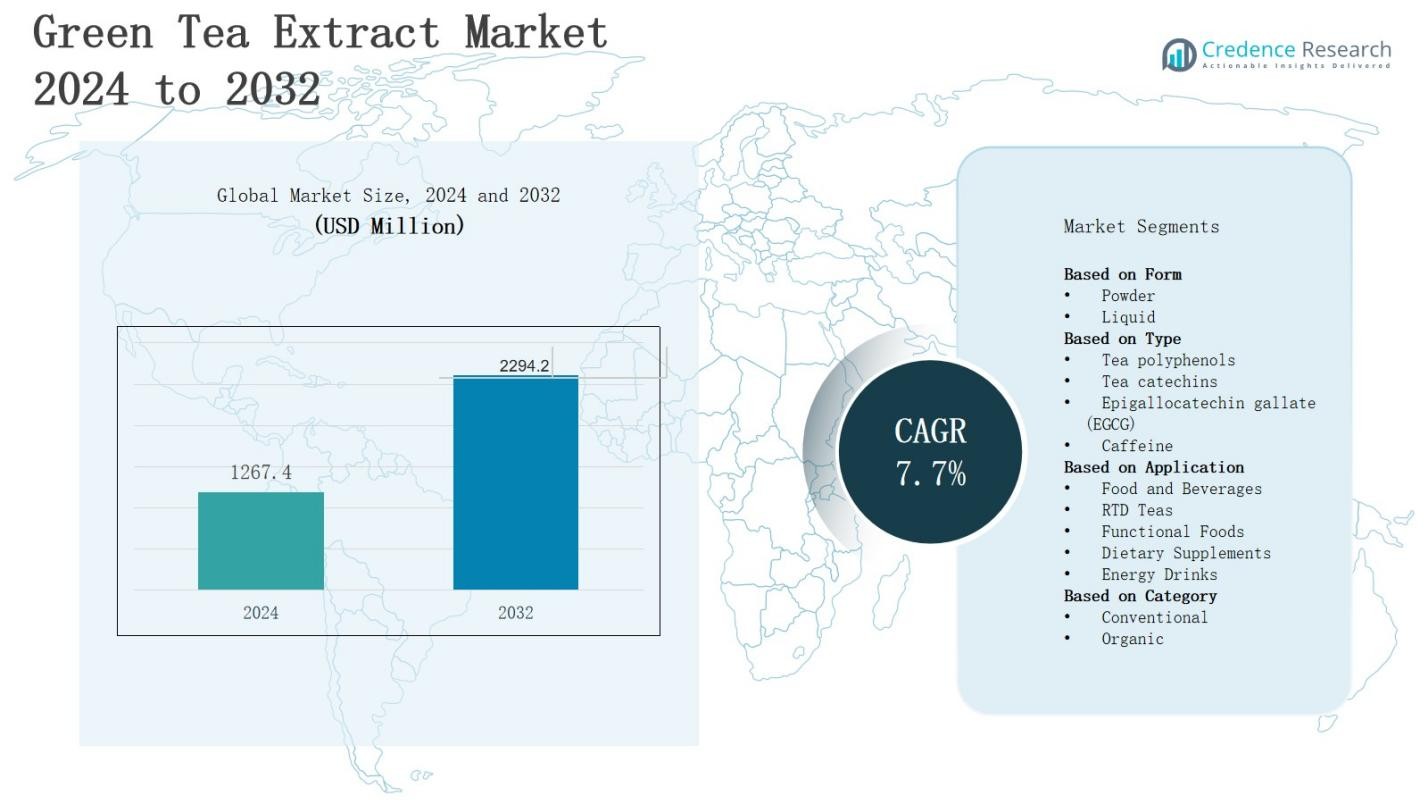

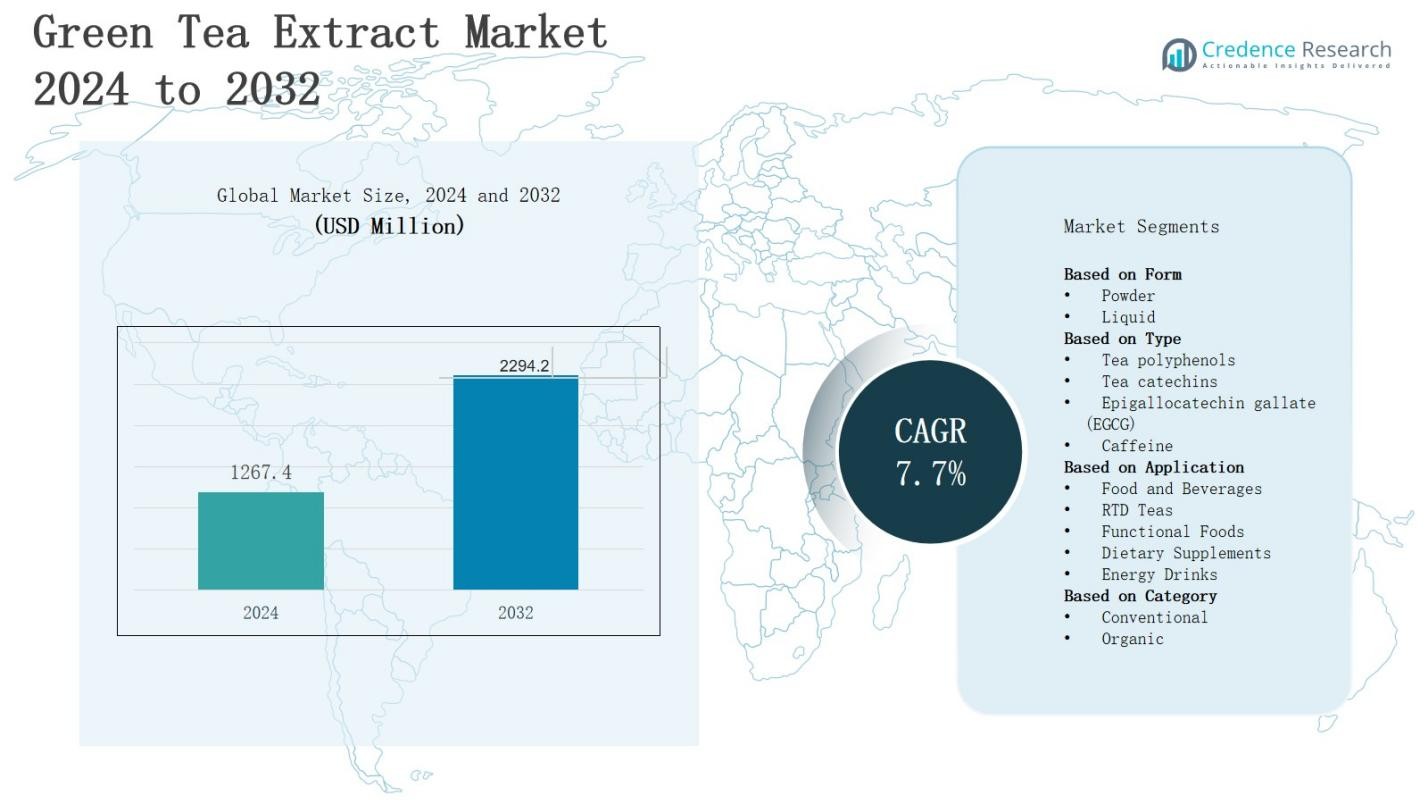

The green tea extract market is projected to grow from USD 1,267.4 million in 2024 to USD 2,294.2 million by 2032, registering a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Tea Extract Market Size 2024 |

USD 1,267.4 Million |

| Green Tea Extract Market, CAGR |

7.7% |

| Green Tea Extract Market Size 2032 |

USD 2,294.2 Million |

Market growth in the green tea extract sector is driven by rising consumer awareness of its health benefits, including antioxidant properties, weight management support, and cardiovascular health improvement. Increasing use in dietary supplements, functional foods, and personal care products is expanding demand. The shift toward natural and plant-based ingredients in food, beverage, and pharmaceutical formulations further supports adoption. Trends include the development of high-purity, standardized extracts, innovative delivery formats like gummies and ready-to-drink beverages, and expanding applications in sports nutrition. Growing popularity in emerging markets and the influence of clean-label and sustainability-focused purchasing behaviors continue to shape the market’s evolution.

The green tea extract market spans North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with Asia-Pacific leading due to strong production capacity and cultural tea consumption, followed by North America and Europe with high demand for functional foods and supplements. Latin America and Middle East & Africa show emerging growth driven by rising health awareness. Key players include Tata Consumer Product Limited, Unilever, Associated British Foods plc, Vahdam, Celestial Seasonings, Bombay Burmah Trading Corporation Limited, Stash Tea, Bigelow Tea, Shangri-la Tea, Yogi, Republic of Tea, Mighty Leaf Tea, and Numi, Inc. P.B.C.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The green tea extract market is projected to grow from USD 1,267.4 million in 2024 to USD 2,294.2 million by 2032, at a CAGR of 7.7%, supported by rising consumer focus on natural health solutions.

- Increasing awareness of antioxidant, weight management, and cardiovascular benefits is driving its adoption across dietary supplements, functional foods, RTD teas, and personal care products.

- The shift toward natural, plant-based, and clean-label ingredients is boosting demand in food, beverage, nutraceutical, and cosmetic industries worldwide.

- Technological advancements such as microencapsulation and improved extraction methods are enhancing purity, bioavailability, and integration into innovative delivery formats like gummies and effervescent tablets.

- Regulatory variations across regions and price volatility in green tea leaves pose challenges for manufacturers, impacting product launches, profitability, and supply chain stability.

- Asia-Pacific leads with 35% share, followed by North America at 28% and Europe at 25%, while Latin America holds 7% and Middle East & Africa 5%, reflecting diverse regional growth dynamics.

- Key players include Tata Consumer Product Limited, Unilever, Associated British Foods plc, Vahdam, Celestial Seasonings, Bombay Burmah Trading Corporation Limited, Stash Tea, Bigelow Tea, Shangri-la Tea, Yogi, Republic of Tea, Mighty Leaf Tea, and Numi, Inc. P.B.C.

Market Drivers

Rising Awareness of Health Benefits and Preventive Wellness Trends

The green tea extract market is benefiting from increasing consumer awareness regarding its role in supporting preventive healthcare. It is recognized for antioxidant properties, metabolism enhancement, and potential disease risk reduction. Growing prevalence of lifestyle-related disorders is encouraging consumers to include natural health boosters in their diets. Healthcare professionals and wellness influencers promote green tea extract for weight management, cardiovascular health, and skin benefits, further stimulating demand across multiple demographic groups globally.

- For instance, Finlays partnered with Firmenich to expand the marketing of its tea extracts portfolio across Europe, enhancing the availability of high-quality green tea extracts in that market.

Expanding Applications in Food, Beverage, and Nutraceutical Industries

The green tea extract market is experiencing growth due to its versatile use in functional foods, beverages, and dietary supplements. It is incorporated into energy drinks, flavored teas, fortified snacks, and health-focused meal replacements. Nutraceutical companies value its bioactive compounds for targeted health benefits. Manufacturers are introducing innovative product formats to attract younger consumers. This diversification strengthens its market penetration and broadens its appeal across health-conscious and mainstream audiences alike.

- For instance, Nestlé has incorporated green tea extract in its flavored teas and health-focused meal replacements to leverage its antioxidant benefits and appeal to younger, health-conscious consumers.

Shift Toward Natural and Plant-Based Ingredients

The global movement toward plant-based, clean-label products is significantly boosting the green tea extract market. It aligns with consumer preferences for natural alternatives over synthetic additives. Food, beverage, and personal care brands are reformulating products to include botanical extracts, enhancing both functionality and consumer perception. This shift is amplified by sustainability commitments from major manufacturers. It creates a favorable environment for green tea extract adoption in diverse product portfolios worldwide.

Technological Advancements and Product Innovation

Advances in extraction technology are enhancing the potency, purity, and bioavailability of green tea extract, fueling demand in high-performance applications. It enables manufacturers to produce standardized formulations for consistent efficacy. Innovations such as microencapsulation improve stability and taste in fortified foods and drinks. Product developers are launching new delivery formats like gummies, effervescent tablets, and ready-to-drink blends. These advancements strengthen competitiveness and expand the market’s reach into niche health and wellness categories.

Market Trends

Growing Demand for Functional Beverages and Fortified Foods

The green tea extract market is witnessing increasing incorporation into functional beverages, fortified snacks, and meal replacements. It is valued for its bioactive compounds, particularly catechins, which support metabolism and overall wellness. Beverage manufacturers are developing ready-to-drink teas, flavored waters, and energy drinks infused with green tea extract. Snack brands are also adopting it for functional benefits. This trend aligns with rising consumer interest in convenient, health-oriented products that integrate seamlessly into daily routines.

- For instance, Applied Food Sciences offers PurTea™, a USDA organic green tea extract designed for energy beverages. It is purified to remove bitterness and improve catechin absorption, making it popular among energy drink manufacturers targeting clean-label, natural energy formulations for active consumers

Expansion in Personal Care and Cosmetic Applications

The use of green tea extract in personal care and cosmetics is growing due to its anti-inflammatory and antioxidant properties. It is featured in skincare products, hair care formulations, and anti-aging treatments. Beauty brands are capitalizing on its natural origin to cater to clean beauty trends. Its ability to protect against environmental damage and improve skin appearance strengthens its appeal. This diversification supports long-term growth by tapping into wellness-driven beauty consumers worldwide.

- For instance, Lotus Botanicals incorporates green tea seed oil in their HydraDetox range, which includes day creams and face mists that enhance skin hydration and provide UV protection

Innovation in Extraction Methods and Formulation Technologies

Technological innovations are transforming the production of green tea extract, improving purity, potency, and stability. It now benefits from advanced techniques like cold-water extraction and microencapsulation, enabling broader applications. Standardized formulations ensure consistent health benefits, boosting consumer trust. These advancements allow for better integration into complex product matrices without compromising taste or texture. The ability to enhance shelf life and bioavailability is helping manufacturers meet the demands of competitive health-focused markets.

Rising Popularity in Sports Nutrition and Weight Management

The green tea extract market is gaining momentum in sports nutrition due to its potential to enhance fat oxidation and energy expenditure. It is used in pre-workout supplements, fat burners, and protein blends. Fitness-oriented consumers seek natural performance enhancers, driving this adoption. Brands are emphasizing its thermogenic and endurance-supporting properties in marketing strategies. This trend connects the extract’s health benefits with active lifestyle demands, strengthening its position in the performance nutrition segment.

Market Challenges Analysis

Regulatory Compliance and Quality Standardization Issues

The green tea extract market faces challenges related to varying regulatory requirements across regions, impacting product approvals and labeling standards. It is subject to strict guidelines on permissible dosages, purity levels, and health claims. Discrepancies between regional regulations create complexities for manufacturers operating globally. Ensuring consistent quality and standardization across supply chains can be difficult, particularly when sourcing raw materials from multiple origins. These challenges can delay product launches and increase compliance costs for producers.

Price Volatility and Raw Material Supply Constraints

The green tea extract market is vulnerable to fluctuations in green tea leaf prices due to climate conditions, crop yield variations, and geopolitical factors in key producing regions. It relies heavily on a stable supply chain to maintain production consistency. Seasonal dependency and potential shortages can lead to cost increases, affecting profitability. Manufacturers may struggle to balance competitive pricing with quality maintenance. Such supply-side challenges can also disrupt long-term contracts with food, beverage, and nutraceutical companies.

Market Opportunities

Rising Demand for Natural Health Supplements in Emerging Markets

The green tea extract market holds significant potential in emerging economies where rising incomes and growing health awareness are influencing purchasing behavior. It appeals to consumers seeking natural solutions for weight management, cardiovascular support, and overall wellness. Expanding urban populations in Asia-Pacific, Latin America, and the Middle East are driving demand for functional foods and nutraceuticals. Increasing retail penetration and e-commerce growth in these regions provide broader access. This environment creates opportunities for brands to introduce affordable, locally tailored product offerings.

Product Diversification and Expansion into Niche Segments

The green tea extract market can leverage innovation to tap into niche segments such as vegan supplements, plant-based sports nutrition, and clean-label personal care. It offers opportunities for collaboration between nutraceutical, food, and cosmetic manufacturers to create multifunctional products. Development of novel delivery formats like dissolvable strips, gummies, and effervescent tablets can attract younger demographics. Premiumization strategies, including organic-certified and sustainably sourced variants, appeal to environmentally conscious consumers. These approaches can strengthen market positioning and open high-margin growth avenues.

Market Segmentation Analysis:

By Form

The green tea extract market is segmented into powder and liquid forms, each serving distinct industry needs. Powder form dominates due to its longer shelf life, ease of transportation, and suitability for dry formulations in dietary supplements, functional foods, and instant beverages. It is preferred for standardized dosing and cost efficiency in large-scale manufacturing. Liquid form caters to applications requiring fast solubility, such as RTD teas and liquid nutraceuticals, offering convenience and higher bioavailability in targeted formulations.

- For instance, Aseschem’s green tea extract powder, with a 10:1 extract ratio, is widely used in anti-aging creams and serums due to its high concentration and long shelf life, supporting cost-efficient large-scale production.

By Type

The market includes tea polyphenols, tea catechins, epigallocatechin gallate (EGCG), and caffeine. Tea polyphenols lead due to their broad health benefits, while tea catechins are valued for their antioxidant properties in cardiovascular and metabolic health. EGCG holds a strong position in premium supplements for its potency in weight management and disease prevention. Caffeine-based extracts appeal to energy drink manufacturers seeking a natural stimulant source. It benefits from diverse applications across wellness and performance nutrition products.

- For instance, Unilever’s Lipton Clear Green tea contains notably high total phenolic content, with catechins such as EGCG as the most abundant, contributing to its antioxidant properties and cardiovascular benefits, as supported by chemical analysis using HPLC methods.

By Application

Applications span food and beverages, RTD teas, functional foods, dietary supplements, and energy drinks. Dietary supplements represent the largest share, driven by consumer demand for natural health boosters. RTD teas and functional foods leverage the extract for flavor, health appeal, and clean-label positioning. Energy drinks utilize it for natural energy enhancement without artificial stimulants. The food and beverage sector continues expanding its integration into mainstream products, creating steady growth opportunities across health-conscious and lifestyle-focused consumer segments.

Segments:

Based on Form

Based on Type

- Tea polyphenols

- Tea catechins

- Epigallocatechin gallate (EGCG)

- Caffeine

Based on Application

- Food and Beverages

- RTD Teas

- Functional Foods

- Dietary Supplements

- Energy Drinks

Based on Category

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 28% share of the green tea extract market, driven by strong demand for dietary supplements, functional beverages, and clean-label products. It benefits from a well-developed nutraceutical industry and high consumer awareness of preventive health. Manufacturers integrate green tea extract into RTD teas, fortified snacks, and sports nutrition products to meet evolving lifestyle preferences. Regulatory clarity supports consistent quality standards, encouraging innovation. It gains momentum from rising fitness culture and weight management trends. The region’s advanced retail and e-commerce infrastructure enhances accessibility and market penetration.

Europe

Europe accounts for 25% share of the green tea extract market, supported by the region’s emphasis on natural and plant-based ingredients. Strong demand comes from functional food, beverage, and personal care sectors. It aligns with the region’s clean-label and sustainability priorities, encouraging wider adoption. High consumption of herbal teas and wellness supplements drives steady growth. Regulatory frameworks ensure product quality, fostering consumer trust. Innovation in organic-certified and eco-friendly products further strengthens the region’s position in the market.

Asia-Pacific

Asia-Pacific dominates with 35% share of the green tea extract market, leveraging its position as the primary source of green tea cultivation and processing. Strong cultural association with tea consumption drives local demand, while export opportunities expand global reach. It experiences rapid growth in nutraceutical and RTD beverage sectors due to rising health consciousness. Manufacturers benefit from cost-effective raw material availability. Expanding middle-class populations in China, India, and Southeast Asia support sustained demand. The region remains the hub for both production and innovation.

Latin America

Latin America holds 7% share of the green tea extract market, with growing demand for functional beverages and dietary supplements. Rising awareness of natural health products fuels market entry for both local and international brands. It benefits from the increasing penetration of fitness culture and weight management products. Brazil and Mexico lead regional consumption. Development of specialized retail channels and online platforms enhances access. Regulatory improvements are fostering a more favorable business environment.

Middle East & Africa

Middle East & Africa account for 5% share of the green tea extract market, driven by growing urban populations and health-conscious consumers. It sees rising adoption in premium beverages, dietary supplements, and personal care products. The market gains traction through imports from major producing countries. Expansion of modern retail formats and wellness-focused marketing supports awareness. Countries like UAE and South Africa are key growth centers. Efforts to diversify product portfolios are attracting new consumer segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Celestial Seasonings (US)

- Mighty Leaf Tea (Canada)

- Bigelow Tea (US)

- Vahdam (India)

- Stash Tea (US)

- Republic of Tea (US)

- Tata Consumer Product Limited (India)

- Numi, Inc. P.B.C (US)

- Shangri-la Tea (US)

- Unilever (UK)

- Associated British Foods plc (UK)

- Bombay Burmah Trading Corporation Limited (India)

- Yogi (US)

Competitive Analysis

The green tea extract market is characterized by intense competition, with global and regional players focusing on product quality, innovation, and distribution expansion to strengthen market presence. It is driven by rising consumer demand for natural and functional ingredients, prompting companies to diversify applications across dietary supplements, beverages, functional foods, and personal care. Leading companies such as Tata Consumer Product Limited, Unilever, Associated British Foods plc, Vahdam, Celestial Seasonings, Bombay Burmah Trading Corporation Limited, Stash Tea, Bigelow Tea, Shangri-la Tea, Yogi, Republic of Tea, Mighty Leaf Tea, and Numi, Inc. P.B.C compete by introducing premium, organic-certified, and sustainably sourced products to meet evolving consumer preferences. Strategic initiatives include partnerships with nutraceutical manufacturers, investments in advanced extraction technologies, and expansion into emerging markets to capture growing demand. The industry also witnesses active brand marketing and e-commerce channel penetration to enhance visibility and accessibility. Companies leverage clean-label positioning and health-focused branding to differentiate in a crowded marketplace. The competition fosters continuous product development, with emphasis on purity, potency, and innovative delivery formats, ensuring that established and new entrants remain agile in responding to shifting consumer trends and regulatory requirements worldwide.

Recent Developments

- In August 2025, TrimIQ launched its “TrimIQ Weight Loss” product in the UK and Ireland, featuring a Green Tea Probiotic Complex aimed at enhancing weight management and wellness outcomes.

- In October 2024, PLT Health Solutions entered a global commercialization partnership with CellFlo6, a patented green tea extract designed to support energy, sports performance, and overall health.

- In May 2025, Finlays launched its evolved extracts division, Finlays Solutions, to support beverage industry partners in developing innovative tea and botanical products.

- In March 2025, Steaz Tea unveiled a brand refresh emphasizing its commitment to the Regenerative Organic Alliance (ROA), reinforcing its organic green tea beverage credentials.

Market Concentration & Characteristics

The green tea extract market demonstrates moderate to high concentration, with a mix of established multinational corporations and specialized regional players competing for market share. It is characterized by a strong focus on product quality, purity, and compliance with varying global regulatory standards. Leading companies emphasize innovation in extraction technology, formulation, and delivery formats to enhance product efficacy and appeal. Demand is diversified across dietary supplements, functional beverages, personal care, and sports nutrition, creating multiple growth avenues. The market is influenced by rising consumer preference for natural, plant-based ingredients and clean-label formulations. Competitive dynamics are shaped by brand positioning, sustainability initiatives, and global distribution networks. Strategic partnerships, acquisitions, and new product launches remain common strategies among key players to strengthen market presence. It benefits from expanding applications across industries and increasing penetration in emerging markets, where rising health awareness and income growth drive steady demand.

Report Coverage

The research report offers an in-depth analysis based on Form, Type, Application, Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as consumers increasingly choose natural, plant-based ingredients for overall wellness support.

- Functional beverages and ready-to-drink teas will become core growth drivers across global health-conscious markets.

- Advancements in extraction technologies will enhance green tea extract’s potency, purity, and formulation versatility.

- Clean-label, organic-certified product variants will attract greater consumer interest and strengthen brand market positioning.

- Sports nutrition and weight management sectors will integrate green tea extract for enhanced performance benefits.

- Personal care and cosmetics industries will adopt it for anti-aging, skin protection, and rejuvenation purposes.

- Expanding e-commerce platforms will accelerate market penetration and product accessibility in emerging and developed economies.

- Collaborations between nutraceutical and beverage manufacturers will create diversified, innovative, and functional consumer products.

- Sustainable sourcing and ethical production will influence consumer purchasing decisions and enhance brand credibility.

- Regional brands will expand globally through targeted launches, strategic alliances, and competitive pricing strategies.