Market Overview

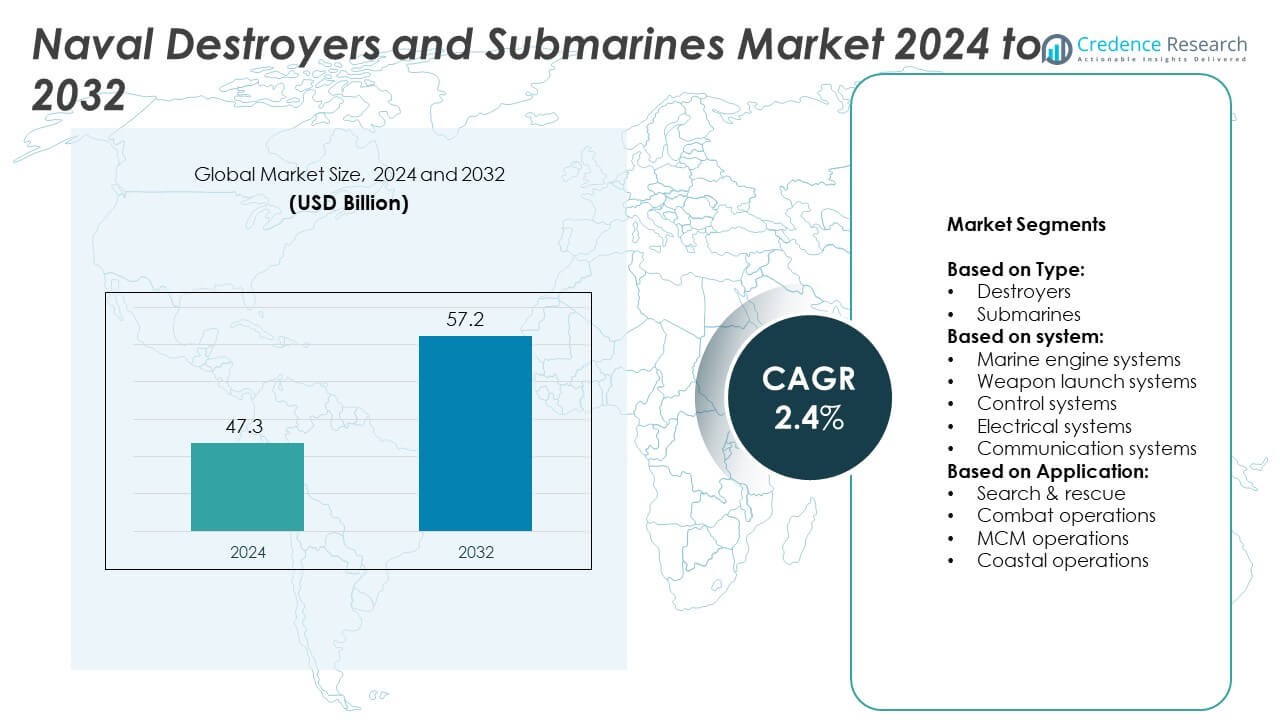

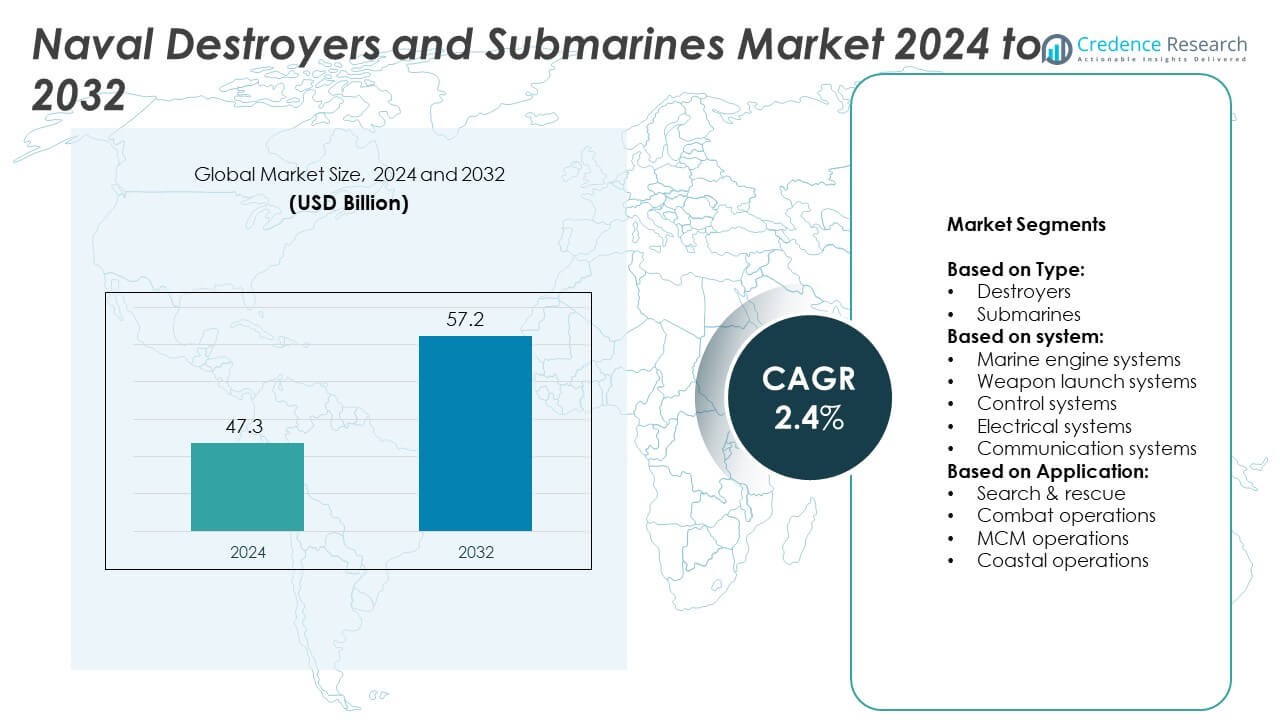

Naval Destroyers and Submarines Market size was valued at USD 47.3 billion in 2024 and is anticipated to reach USD 57.2 billion by 2032, at a CAGR of 2.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Naval Destroyers and Submarines Market Size 2024 |

USD 47.3 Billion |

| Naval Destroyers and Submarines Market , CAGR |

2.4% |

| Naval Destroyers and Submarines Market Size 2032 |

USD 57.2 Billion |

The Naval Destroyers and Submarines market is driven by rising geopolitical tensions, increasing defense budgets, and the need for advanced maritime security. Nations invest in modern fleets equipped with stealth technologies, AI-enabled systems, and precision weaponry to enhance deterrence and power projection. Trends highlight the adoption of nuclear and hybrid propulsion for extended endurance, integration of unmanned systems for multi-domain operations, and collaborative multinational programs. It reflects a shift toward technologically advanced, versatile platforms that ensure maritime dominance and strategic resilience.

North America leads the Naval Destroyers and Submarines market with strong investments in modernization and next-generation programs, supported by established shipbuilders and advanced defense infrastructure. Europe follows with active submarine and destroyer projects driven by collaborative defense initiatives, while Asia-Pacific shows rapid growth fueled by regional security concerns and indigenous naval programs. Key players shaping the market include General Dynamics, BAE Systems, ThyssenKrupp Marine Systems, and Fincantieri, each focusing on innovation, partnerships, and long-term contracts to strengthen global naval capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Naval Destroyers and Submarines market size was valued at USD 47.3 billion in 2024 and is projected to reach USD 57.2 billion by 2032, growing at a CAGR of 2.4% between 2025 and 2032.

- Rising geopolitical tensions and increasing defense budgets are major drivers pushing nations to modernize naval fleets with advanced technologies and enhanced deterrence capabilities.

- Trends highlight the adoption of stealth features, nuclear and hybrid propulsion, and AI-enabled command systems, along with growing use of unmanned and autonomous technologies.

- The market shows high concentration with a few leading players dominating, including General Dynamics, BAE Systems, Lockheed Martin, ThyssenKrupp Marine Systems, and Fincantieri, supported by strong government contracts.

- High development costs, long procurement cycles, and technological vulnerabilities such as cyber threats and hypersonic missile challenges act as restraints to expansion.

- Regional analysis shows North America leading with advanced programs, Europe advancing through collaborative naval projects, and Asia-Pacific expanding rapidly through indigenous shipbuilding and rising security concerns.

- The market outlook reflects sustained growth opportunities through fleet modernization, multinational defense collaborations, and the integration of sustainable and modular designs to ensure adaptability in evolving maritime environments.

Market Drivers

Rising Geopolitical Tensions and Maritime Security Needs

The Naval Destroyers and Submarines market is driven by increasing geopolitical rivalries and territorial disputes across strategic maritime zones. Nations invest heavily in advanced naval fleets to secure sovereignty and protect exclusive economic zones. It reflects a strong emphasis on deterrence capabilities to counter potential threats from adversaries. The market gains momentum from heightened defense budgets allocated to naval modernization programs. Governments prioritize destroyers and submarines with advanced sensors, stealth features, and weapon systems to maintain maritime dominance. Heightened regional conflicts accelerate procurement cycles and strengthen international naval collaborations.

- For instance, Mazagon Dock Limited completed INS Surat’s delivery in just 31 months from launch, setting a production record for destroyers.

Technological Advancements and Modernization Programs

The Naval Destroyers and Submarines market benefits from rapid technological progress in propulsion, automation, and weapons integration. It incorporates nuclear propulsion, advanced sonar, and AI-driven command systems to increase effectiveness in combat scenarios. Defense contractors collaborate with governments to modernize existing fleets with cost-efficient upgrades. Cutting-edge missile systems and cyber-resilient platforms expand operational roles beyond traditional warfare. Emerging technologies such as unmanned underwater vehicles integrate seamlessly with submarines for reconnaissance missions. Continuous innovation enhances endurance, speed, and survivability of naval assets.

- For instance, U.S. Flight III Arleigh Burke class destroyers adopted the SPY‑6 radar, raising sensitivity by 30-fold compared to earlier radar arrays.

Expanding Naval Operations and Power Projection

The Naval Destroyers and Submarines market strengthens through rising demand for long-range operational capacity. It supports maritime strategies aimed at power projection in contested waters. Nations deploy submarines and destroyers to secure global shipping lanes, respond to piracy threats, and provide humanitarian assistance. Increasing focus on multi-domain operations drives demand for versatile vessels capable of offensive and defensive missions. The market aligns with requirements for sustained deployments in blue-water operations. Investments in joint exercises and multinational fleet interoperability further boost acquisition programs.

Growing Focus on Defense Alliances and Strategic Partnerships

The Naval Destroyers and Submarines market expands with defense alliances and collaborative shipbuilding programs among allied nations. It leverages joint development initiatives to reduce costs and accelerate technological innovation. Bilateral and multilateral agreements facilitate technology transfers and strengthen global supply chains. Collaborative defense projects enhance interoperability, which is critical for multinational missions. Governments support co-production agreements to secure domestic industrial bases and create advanced shipyards. Expanding partnerships ensure access to advanced naval platforms while fostering regional stability.

Market Trends

Integration of Advanced Combat Systems

The Naval Destroyers and Submarines market demonstrates a strong trend toward integration of sophisticated combat and surveillance technologies. It incorporates multi-mission radar, electronic warfare systems, and long-range precision strike capabilities. Navies focus on equipping vessels with modular weapon systems to adapt to evolving threats. The trend emphasizes smart technologies that provide real-time situational awareness and tactical advantage. Artificial intelligence and data fusion are increasingly used to enhance decision-making speed and accuracy. Continuous system upgrades ensure long-term relevance and operational superiority.

- For instance, Lockheed Martin’s MK 41 Vertical Launching System (VLS) is a combat-proven, multi-mission launcher used on destroyers and other surface combatants by the U.S. and allied navies. The modular system allows ships to carry a variety of missiles, including anti-air, anti-submarine, and ballistic missile defense types. In December 2024, for example, Lockheed Martin received a $73.1 million contract to support VLS module production and ancillary equipment, with work expected to be completed by December 2026.

Adoption of Stealth and Survivability Enhancements

The Naval Destroyers and Submarines market reflects rising emphasis on stealth technologies and improved survivability. It prioritizes low acoustic signatures, radar cross-section reduction, and electronic countermeasures to evade detection. Advanced materials and design features strengthen resilience against modern anti-ship and submarine warfare systems. Nations demand vessels with higher survivability in contested environments where threats are rapidly advancing. The trend aligns with broader naval strategies centered on resilience and endurance during extended missions. Investments in stealth ensure competitiveness in high-intensity conflict scenarios.

- For instance, Raytheon’s AN/SPY‑6 radar offers a sensitivity improvement of 30 times over its predecessors, significantly enhancing detection range and target tracking capabilities.

Shift Toward Green Propulsion and Energy Efficiency

The Naval Destroyers and Submarines market embraces eco-efficient propulsion systems to meet sustainability goals and operational efficiency. It integrates hybrid and nuclear propulsion technologies that enhance range and reduce fuel dependence. Navies explore renewable energy solutions to lower carbon footprints and improve logistical sustainability. Advanced battery systems in submarines increase underwater endurance and reduce reliance on traditional fuel. Energy-efficient designs support long-duration missions with minimal resupply needs. The trend positions energy efficiency as both a tactical and strategic advantage.

Growing Role of Unmanned and Autonomous Capabilities

The Naval Destroyers and Submarines market incorporates unmanned and autonomous technologies to extend operational reach. It deploys unmanned surface and underwater vehicles for reconnaissance, mine detection, and surveillance. Integration of autonomous systems reduces risks to crew and enhances mission flexibility. Artificial intelligence-driven platforms complement manned vessels, enabling hybrid naval operations. The trend underscores the shift toward automation for cost efficiency and effectiveness in high-risk environments. Collaborative use of unmanned assets with destroyers and submarines creates a force-multiplier effect in naval warfare.

Market Challenges Analysis

High Development Costs and Complex Procurement Cycles

The Naval Destroyers and Submarines market faces significant challenges due to high development costs and extended procurement timelines. It requires substantial financial investments in research, design, and integration of advanced technologies. Governments often encounter budgetary constraints, which delay or scale down planned acquisitions. Complex procurement cycles involving multiple stakeholders further increase the risk of cost overruns and schedule slippages. The challenge intensifies when balancing modernization needs with maintenance of existing fleets. Limited defense budgets in some regions restrict participation in large-scale naval programs.

Evolving Threat Landscape and Technological Vulnerabilities

The Naval Destroyers and Submarines market encounters obstacles from rapidly evolving threats and vulnerabilities in modern warfare systems. It must address challenges related to cyberattacks, electronic warfare, and hypersonic missile technologies that can bypass traditional defenses. Adversaries continuously develop countermeasures that reduce the effectiveness of advanced naval platforms. Ensuring resilience against multi-domain threats requires constant upgrades and innovation, which strain resources. Dependence on complex digital systems increases risks of operational disruption. Maintaining technological superiority in a dynamic threat environment remains a persistent challenge for global navies.

Market Opportunities

Expansion of Modernization and Fleet Replacement Programs

The Naval Destroyers and Submarines market presents opportunities through large-scale modernization and fleet replacement initiatives. It benefits from aging fleets in need of upgrades or replacement with advanced platforms equipped with next-generation capabilities. Governments in both developed and emerging economies allocate resources for long-term naval expansion. The demand for vessels with modular designs creates opportunities for defense contractors to deliver scalable and adaptable solutions. Fleet renewal programs also encourage domestic shipbuilding industries, fostering job creation and technological advancement. These initiatives open pathways for sustained growth and cross-border collaborations.

Rising Demand for Multirole and Autonomous Capabilities

The Naval Destroyers and Submarines market creates opportunities by integrating multirole and autonomous systems to meet evolving mission requirements. It supports a shift toward platforms that can conduct surveillance, anti-submarine warfare, and humanitarian operations with equal efficiency. Increased adoption of unmanned underwater vehicles and AI-driven technologies enhances operational flexibility. Nations prioritize procurement of vessels capable of interoperability in multinational operations, expanding the market for versatile solutions. Strategic partnerships in autonomous technologies enable suppliers to secure long-term defense contracts. Growing demand for hybrid manned-unmanned naval capabilities establishes strong opportunities for innovation and market expansion.

Market Segmentation Analysis:

By Type:

Destroyers and submarines, each playing a vital role in maritime security and defense. Destroyers dominate surface operations with advanced radar, missile systems, and multi-role adaptability, making them essential for fleet protection and power projection. Submarines provide unmatched stealth, endurance, and underwater strike capabilities, ensuring strategic deterrence and intelligence gathering. It benefits from growing demand for both platforms, with nations investing heavily in advanced vessels tailored for regional security challenges. The balance between surface and underwater fleets defines procurement strategies across global navies.

- For instance, Kongsberg Defence & Aerospace developed the Naval Strike Missile (NSM) for integration on naval platforms, enabling vessels to deploy lightweight anti-ship missiles while maintaining a lower radar cross section.

By System:

The Naval Destroyers and Submarines market integrates marine engine systems, weapon launch systems, control systems, electrical systems, and communication systems. Marine engine systems remain critical for propulsion efficiency and operational range, with nuclear and hybrid technologies gaining traction. Weapon launch systems form a significant share, driven by demand for vertical launch modules and advanced missile integration. Control systems enhance operational precision and automation, reducing crew workload and improving mission execution. Electrical and communication systems support advanced sensors, radar, and network-centric warfare, ensuring seamless interoperability. It underscores the importance of system-level innovation in improving performance, survivability, and effectiveness.

- For instance, the U.S. Navy uses the Mk 45 Mod 4 naval gun, manufactured by BAE Systems, to significantly increase firing range for naval surface fire support. The Mk 45 Mod 4’s enhancements, which include a 62-caliber barrel and advanced digital controls, enable it to fire extended-range projectiles more than 20 nautical miles (36 km). This capability extends beyond close-range engagements and improves the Navy’s overall mission performance.

By Application:

The Naval Destroyers and Submarines market addresses search and rescue, combat operations, mine countermeasure (MCM) operations, and coastal operations. Combat operations account for a major segment, with vessels designed to perform offensive and defensive missions across multiple domains. Search and rescue applications gain importance through humanitarian roles, disaster relief, and maritime safety missions. MCM operations are increasingly relevant in contested waters where mine warfare poses serious risks to naval fleets. Coastal operations remain vital for protecting territorial waters and exclusive economic zones. It highlights the diverse roles of naval platforms in addressing both traditional and non-traditional security challenges.

Segments:

Based on Type:

Based on system:

- Marine engine systems

- Weapon launch systems

- Control systems

- Electrical systems

- Communication systems

Based on Application:

- Search & rescue

- Combat operations

- MCM operations

- Coastal operations

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Naval Destroyers and Submarines market, accounting for 37% in 2024. The region benefits from robust naval capabilities led by the United States, which invests heavily in advanced destroyers, nuclear-powered submarines, and next-generation technologies. It maintains a dominant position through continuous fleet modernization programs such as the DDG-51 Arleigh Burke-class destroyers and Virginia-class submarines. Canada also contributes with investments in submarine upgrades and coastal defense projects, although at a smaller scale compared to the U.S. The strong presence of leading defense contractors, such as General Dynamics and Huntington Ingalls Industries, reinforces North America’s leadership. It demonstrates long-term stability due to high defense budgets and a focus on maintaining maritime superiority in both the Atlantic and Pacific theaters.

Europe

Europe captures 28% of the Naval Destroyers and Submarines market, driven by strong contributions from countries such as the United Kingdom, France, Germany, and Italy. The region emphasizes advanced submarine fleets, particularly nuclear-powered submarines, which serve as critical deterrence tools. It is also active in destroyer development programs, with the UK’s Type 45 destroyers and France’s Horizon-class platforms being notable examples. European nations invest in cooperative defense programs under NATO to enhance interoperability and shared naval capabilities. Regional shipbuilders such as BAE Systems, Naval Group, and ThyssenKrupp Marine Systems play a pivotal role in advancing innovation. Europe’s emphasis on both coastal protection and global power projection contributes to steady demand across applications.

Asia-Pacific

Asia-Pacific accounts for 22% of the Naval Destroyers and Submarines market, supported by expanding naval capabilities in China, India, Japan, and South Korea. The region reflects growing security concerns in the South China Sea, Indian Ocean, and East China Sea, which drive accelerated investments in advanced fleets. It demonstrates significant growth potential with China’s Type 055 destroyers and nuclear-powered submarines forming a major part of its naval strategy. India focuses on indigenous submarine construction under its Project 75 and destroyer programs aimed at boosting maritime security. Japan and South Korea contribute with advanced destroyer platforms, integrating cutting-edge missile defense systems. The region’s rapid defense modernization and geopolitical tensions make it a dynamic and fast-growing contributor to the market.

Middle East & Africa

The Middle East & Africa region holds 7% of the Naval Destroyers and Submarines market, primarily driven by regional security needs and maritime defense in the Persian Gulf and surrounding waters. It demonstrates rising demand for advanced naval assets to safeguard strategic trade routes and energy infrastructure. Countries such as Saudi Arabia, Israel, and the UAE lead investments in modern destroyers and submarines to enhance deterrence capabilities. African nations show limited adoption, but South Africa maintains a small submarine fleet for coastal defense. Regional programs often depend on partnerships with Western defense suppliers for technology transfer and procurement. Growing maritime security concerns, including counter-piracy operations, further support the need for fleet expansion in this region.

Latin America

Latin America accounts for 6% of the Naval Destroyers and Submarines market, with Brazil, Chile, and Argentina being the primary contributors. It shows gradual progress in naval modernization, particularly through Brazil’s submarine program, which includes nuclear-powered submarine development. Chile maintains a capable submarine fleet to secure its Pacific coastline, while Argentina focuses on selective modernization. The region experiences slower growth compared to others due to budgetary limitations and competing domestic priorities. Partnerships with European shipbuilders strengthen modernization projects, enabling access to advanced technologies. Latin America continues to emphasize coastal defense, counter-narcotics operations, and protection of exclusive economic zones, sustaining moderate demand within the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saab

- Fincantieri

- Lockheed Martin

- DCNS

- Navantia

- Korea Aerospace Industries

- Leonardo

- ThyssenKrupp Marine Systems

- BAE Systems

- General Dynamics

Competitive Analysis

The competitive landscape of the Naval Destroyers and Submarines market is shaped by leading players such as Korea Aerospace Industries, General Dynamics, Navantia, ThyssenKrupp Marine Systems, Lockheed Martin, Leonardo, Fincantieri, BAE Systems, DCNS, and Saab. These companies focus on delivering advanced naval platforms that integrate cutting-edge technologies in propulsion, combat systems, and stealth design. Competition emphasizes innovation, with firms investing in research and development to produce vessels capable of addressing evolving multi-domain threats. Strategic collaborations, joint ventures, and government contracts strengthen their positions in global markets, enabling access to new customers and regional expansion. Companies prioritize modular shipbuilding approaches to improve efficiency, reduce costs, and support flexible upgrades over long service lives. Digitalization and autonomous technologies are increasingly incorporated to enhance operational effectiveness and reduce crew requirements. Environmental considerations also influence competition, with growing adoption of energy-efficient propulsion systems and reduced emission designs. Overall, the market reflects intense rivalry driven by technological advancements, long-term defense contracts, and expanding requirements for naval modernization across diverse geographies.

Recent Developments

- In 2024,General Dynamics (Electric Boat) received a contract modification to procure long-lead materials for Virginia-class submarines

- In 2024, Lockheed Martin Aegis Combat System achieved a successful live intercept during FTM-32.

- In 2023, Korea Aerospace Industries delivered the final MUH-1 Marineon shipborne helicopters to the ROK Marine Corps.

Report Coverage

The research report offers an in-depth analysis based on Type, System, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced destroyers and submarines will rise with growing geopolitical tensions.

- Nations will prioritize stealth, automation, and survivability in new naval platforms.

- Hybrid and nuclear propulsion systems will gain wider adoption for extended endurance.

- Integration of AI-driven command and control systems will enhance mission efficiency.

- Unmanned underwater and surface vehicles will complement manned fleets in operations.

- Modular ship designs will support faster upgrades and cost-effective maintenance.

- Defense alliances will encourage more multinational shipbuilding and technology partnerships.

- Cybersecurity and electronic warfare resilience will become critical design priorities.

- Emerging economies will expand indigenous naval programs to reduce foreign dependence.

- Sustainability goals will drive investments in energy-efficient and low-emission naval technologies.