Market Overview

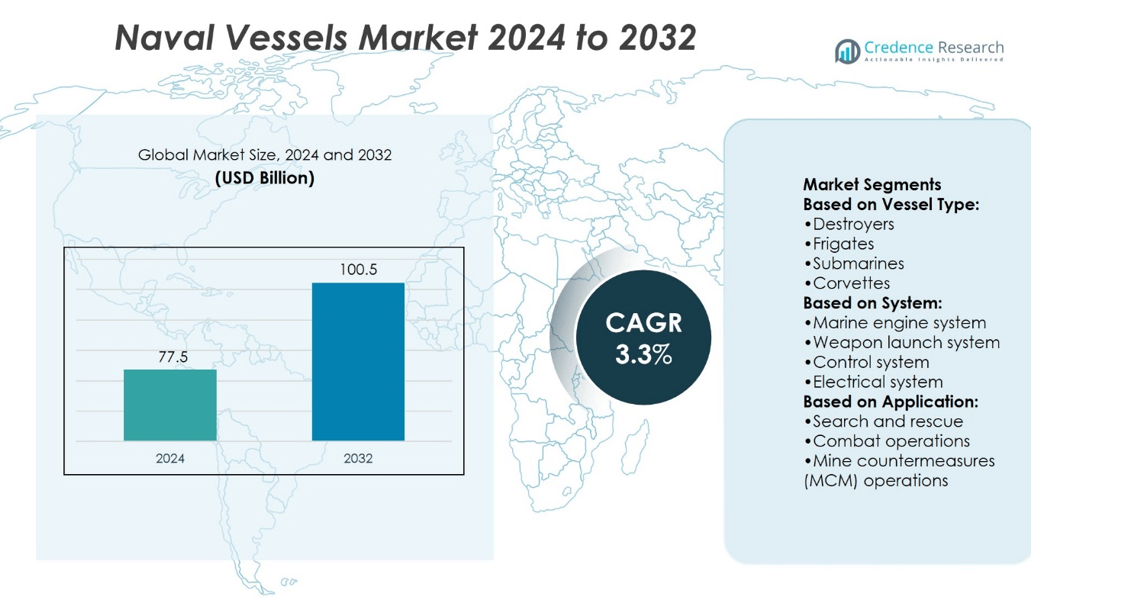

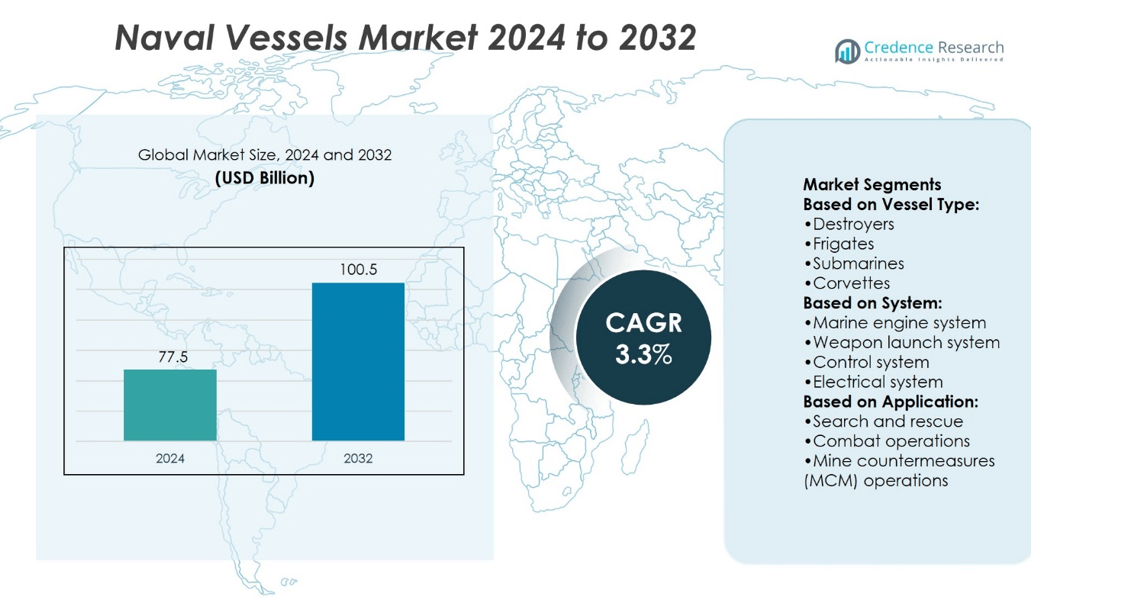

Naval Vessels Market size was valued at USD 77.5 billion in 2024 and is anticipated to reach USD 100.5 billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Naval Vessels Market Size 2024 |

USD 77.5 billion |

| Naval Vessels Market, CAGR |

3.3% |

| Naval Vessels Market Size 2032 |

USD 100.5 billion |

The Naval Vessels Market is driven by rising geopolitical tensions, expanding defense budgets, and the need to modernize aging fleets with advanced technologies. Governments emphasize naval strength to secure sea lanes, protect exclusive economic zones, and counter emerging maritime threats. It benefits from increasing demand for multi-role platforms capable of combat, surveillance, and humanitarian missions. Trends highlight the integration of digital command systems, stealth features, and sustainable propulsion solutions that enhance efficiency and reduce environmental impact. Growing adoption of unmanned and autonomous vessels further strengthens naval capabilities, positioning the market for steady technological and strategic transformation.

The Naval Vessels Market shows strong regional presence, with North America leading through advanced shipbuilding programs, Europe focusing on collaborative defense projects, and Asia-Pacific emerging as a rapidly growing hub driven by rising security concerns. The Middle East & Africa and Latin America maintain steady demand supported by coastal defense priorities. Key players shaping the market include Austal, BAE Systems, Damen Shipyards, Fincantieri, General Dynamics, Hanwha Ocean, HD Korea Shipbuilding, Huntington Ingalls, Larsen & Toubro, and Lockheed Martin.

Market Insights

- Naval Vessels Market size was valued at USD 77.5 billion in 2024 and is projected to reach USD 100.5 billion by 2032, growing at a CAGR of 3.3%.

- Rising geopolitical tensions and expanding defense budgets drive strong investments in naval modernization programs.

- Increasing demand for multi-role vessels supports operations across combat, surveillance, and humanitarian missions.

- Advanced trends include digital command systems, stealth technology, and sustainable propulsion solutions.

- Competitive landscape is defined by leading global shipbuilders focusing on innovation and long-term government contracts.

- High procurement costs and complex production cycles remain key restraints for market expansion.

- Regional analysis shows North America leading with large-scale programs, Europe advancing collaborative defense projects, Asia-Pacific experiencing rapid growth, and Middle East, Africa, and Latin America maintaining steady coastal defense demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Geopolitical Tensions and Maritime Security Priorities

The Naval Vessels Market experiences strong momentum due to heightened geopolitical tensions and maritime disputes worldwide. Governments allocate significant defense budgets to secure sea lanes, deter aggression, and protect national interests. It strengthens naval fleets with modern vessels capable of multi-domain warfare. The demand for aircraft carriers, destroyers, frigates, and submarines rises as nations emphasize force projection. Investments in regional naval expansion enhance security presence in contested waters. It positions naval vessels as critical assets for maintaining strategic balance.

- For instance, as of 2025, BAE Systems is building the HMS Glasgow, the first of eight Types 26 Global Combat Ships (or City-class frigates) for the Royal Navy. The ship was launched in 2022 and ceremonially named in May 2025 but is currently undergoing its final stages of outfitting. It is designed with advanced anti-submarine warfare capabilities, has a capacity for up to 208 crew members, and a displacement of 6,900 tons. HMS Glasgow is expected to be delivered to the Royal Navy in late 2026, begin sea trials in 2027, and achieve full operational capability in 2028.

Technological Advancements and Fleet Modernization Programs

Rapid technological progress drives the Naval Vessels Market, pushing nations to replace aging platforms with advanced warships. It integrates cutting-edge systems such as stealth features, integrated combat management, and advanced propulsion. Countries prioritize automation and digital systems to reduce crew requirements and improve operational efficiency. It supports interoperability among allied fleets through standardized systems. Demand for multi-mission ships grows, covering roles from anti-submarine warfare to humanitarian assistance. This continuous modernization ensures vessels remain adaptable to evolving threats.

- For instance, in 2022, Huntington Ingalls Industries delivered the USS Fort Lauderdale (LPD-28), a San Antonio-class amphibious transport dock. The ship, which has a full load displacement of approximately 25,000 tons, was initially equipped with the AN/SPS-48E radar system. The AN/SPS-48E is a 3D air-search radar that supports three-dimensional air search over a range exceeding 400 kilometers.

Rising Threat of Non-Traditional Maritime Challenges

The Naval Vessels Market grows as nations face piracy, terrorism, smuggling, and illegal fishing. It compels governments to strengthen patrol and surveillance capabilities with versatile vessels. Offshore security and protection of exclusive economic zones demand agile platforms with advanced sensors. It encourages procurement of corvettes, patrol vessels, and littoral combat ships for rapid deployment. Humanitarian and disaster relief missions also increase the relevance of flexible naval assets. The expansion of such multi-purpose fleets boosts long-term market stability.

Expanding International Collaboration and Defense Partnerships

The Naval Vessels Market benefits from joint defense initiatives and multinational programs that promote cost-sharing and capability development. It fosters collaboration in shipbuilding, research, and technology transfer among allied nations. Procurement programs often involve co-production to strengthen domestic industries. It expands defense diplomacy through joint naval exercises and cooperative security arrangements. Shared projects enhance interoperability and reduce operational gaps between partner navies. This cooperative environment accelerates demand for standardized and scalable naval platforms.

Market Trends

Growing Demand for Multi-Role and Modular Platforms

The Naval Vessels Market shows a clear trend toward multi-role ships capable of handling diverse missions. Nations prefer vessels that can transition between combat operations, surveillance, and disaster response. It encourages the adoption of modular designs that allow rapid reconfiguration of weapons and systems. Fleets emphasize versatility to reduce procurement costs while maximizing capability. The shift supports interoperability between allied navies during joint operations. It reflects a global preference for adaptable and cost-efficient warship solutions.

- For instance, the HNLMS Den Helder, a combat support ship built by Damen Naval, was delivered to the Royal Netherlands Navy in March 2025. It was officially received at its homeport in Den Helder on March 24, 2025. The ship measures approximately 180 meters (590 feet) in length and has a displacement of around 22,300 tons. It is designed to resupply up to six vessels simultaneously and can carry over 8 million liters of fuel, along with water, ammunition, and other supplies.

Integration of Advanced Combat and Surveillance Systems

The Naval Vessels Market evolves with advanced radar, sonar, and electronic warfare systems that enhance situational awareness. It accelerates the integration of AI-driven command platforms for faster decision-making. Nations invest in digitalization and automation to reduce crew sizes and improve efficiency. Cybersecurity measures strengthen resilience against evolving threats. It highlights a movement toward network-centric operations where vessels operate as part of integrated defense grids. The trend reinforces the value of intelligence-driven maritime superiority.

- For instance, the vessel has a displacement of approximately 7,500 tons, length of 163 meters, and can operate with a crew of around 300 personnel, reflecting the integration of automation and advanced digital platforms to enhance efficiency.

Rising Adoption of Green and Sustainable Technologies

The Naval Vessels Market embraces environmentally responsible solutions in propulsion and energy efficiency. Hybrid engines, fuel cells, and renewable integration reduce emissions and operational costs. It drives innovation in lightweight materials and energy-saving hull designs. Governments promote sustainability mandates, encouraging eco-friendly naval programs. It reflects a strategic shift to balance combat capability with environmental stewardship. The trend also enhances operational endurance during long deployments at sea.

Expansion of Unmanned and Autonomous Naval Assets

The Naval Vessels Market experiences strong focus on unmanned surface and underwater vehicles. It broadens operational scope by enabling surveillance, mine countermeasures, and reconnaissance without human risk. Advances in autonomy allow vessels to operate independently or as part of manned-unmanned teams. It creates new opportunities for navies to extend reach while optimizing manpower. The growing investment in robotic platforms reshapes future naval strategy. It signals a long-term transformation in maritime defense capabilities.

Market Challenges Analysis

High Procurement Costs and Complex Production Cycles

The Naval Vessels Market faces persistent challenges linked to high procurement costs and long production timelines. It requires massive investments in design, shipbuilding, and advanced combat systems, making projects financially demanding for governments. Delays in technology integration often extend delivery schedules, creating capability gaps for navies. It also pressures budgets when nations must choose between modernizing existing fleets or commissioning new builds. The complexity of integrating propulsion, weaponry, and digital platforms further complicates development. It underscores the difficulty of balancing technological ambition with fiscal responsibility.

Workforce Limitations and Supply Chain Vulnerabilities

The Naval Vessels Market encounters obstacles tied to skilled workforce shortages and fragile global supply chains. It depends on specialized labor for shipbuilding and system integration, yet talent gaps limit production speed. Global supply disruptions, including shortages of steel, semiconductors, and propulsion components, slow down vessel completion. It increases reliance on imports, raising concerns about strategic autonomy. Maintenance and lifecycle support also strain resources when critical parts face delays. It highlights the structural challenges of sustaining long-term naval readiness.

Market Opportunities

Expansion of Emerging Naval Powers and Fleet Modernization

The Naval Vessels Market creates significant opportunities through the expansion of emerging naval powers and their modernization agendas. Nations in Asia-Pacific, the Middle East, and Latin America allocate larger defense budgets to strengthen maritime security. It encourages partnerships with global shipbuilders to transfer technology and expand domestic capabilities. Governments prioritize fleet renewal programs, replacing outdated platforms with modern multi-role vessels. It opens avenues for companies offering modular designs and scalable technologies. The broad demand for submarines, frigates, and patrol vessels establishes long-term growth potential.

Rising Demand for Unmanned Systems and Advanced Technologies

The Naval Vessels Market benefits from opportunities linked to unmanned platforms and next-generation technologies. It drives procurement of unmanned surface vessels and autonomous underwater vehicles that support surveillance, mine warfare, and reconnaissance. Artificial intelligence and advanced sensors expand naval capabilities and reduce manpower requirements. It also stimulates investment in cyber defense solutions to protect digital infrastructures on warships. Shipbuilders gain advantage by integrating sustainable propulsion and energy-efficient systems. The shift toward technological innovation creates new prospects for both established defense contractors and emerging firms.

Market Segmentation Analysis:

By Vessel Type

The Naval Vessels Market demonstrates diverse demand across destroyers, frigates, submarines, corvettes, aircraft carriers, and others. Destroyers dominate with their advanced combat and air-defense capabilities, making them essential for blue-water operations. Frigates remain a key choice for nations seeking cost-efficient, multi-role platforms suitable for anti-submarine warfare and escort duties. Submarines gain prominence with stealth features and nuclear propulsion, offering strategic deterrence and intelligence capabilities. Corvettes attract interest for coastal defense and patrol functions due to agility and affordability. Aircraft carriers continue to represent power projection, providing air superiority and rapid response in contested waters. It highlights a balanced preference for both heavy combat assets and flexible smaller vessels.

- For instance, in December 2021, Austal USA delivered the USS Canberra (LCS-30), an Independence-class littoral combat ship. The ship, which was commissioned in July 2023, has a full displacement of 3,104 metric tons and a length of 127.4 meters. It can achieve a top speed of over 40 knots, powered by a combined system of two gas turbines and two diesel engines.

By System

The Naval Vessels Market expands across marine engine systems, weapon launch systems, control systems, electrical systems, communication systems, and others. Marine engine systems form the backbone of propulsion, with emphasis on efficiency and endurance for long missions. Weapon launch systems evolve with vertical launch platforms supporting multi-missile configurations for varied threats. Control systems integrate digital automation, improving operational precision and reducing crew requirements. Electrical systems adapt to power-intensive technologies such as directed energy weapons and radar arrays. Communication systems ensure secure, network-centric operations across allied navies. It underscores the importance of integrated and interoperable systems for modern fleets.

- For instance, the U.S. Navy’s Littoral Combat Ships (LCS) demonstrate modularity for surface warfare, mine countermeasures, and anti-submarine missions, with crew sizes that vary by ship class. The Independence-class LCS has a core crew of 40 and accommodates a total of up to 75 personnel, while the Freedom-class LCS has a core crew of 50 and can accommodate up to 98. After initial plans for interchangeable mission modules, the Navy has transitioned to a model where each deployed ship focuses on a single mission.

By Application

The Naval Vessels Market finds wide application in search and rescue, combat operations, mine countermeasures, and coastal operations. Combat operations remain the leading application, driving demand for advanced warships equipped for multi-domain missions. Search and rescue activities require agile and well-equipped vessels to respond quickly in humanitarian and disaster scenarios. Mine countermeasure operations expand with the deployment of specialized platforms and autonomous underwater systems to safeguard shipping lanes. Coastal operations maintain importance for nations focused on territorial defense and exclusive economic zone monitoring. It illustrates how diversified applications continue to shape procurement priorities across global navies.

Segments:

Based on Vessel Type:

- Destroyers

- Frigates

- Submarines

- Corvettes

Based on System:

- Marine engine system

- Weapon launch system

- Control system

- Electrical system

Based on Application:

- Search and rescue

- Combat operations

- Mine countermeasures (MCM) operations

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Naval Vessels Market at 35%, driven primarily by the United States Navy’s extensive fleet modernization and expansion programs. The U.S. operates the world’s largest naval force with more than 490 active ships, including 11 aircraft carriers and advanced nuclear-powered submarines. It invests heavily in next-generation destroyers such as the DDG-1000 Zumwalt class and the Virginia-class submarines to maintain global maritime dominance. Canada supports the region’s share with the Canadian Surface Combatant (CSC) program, which includes the procurement of 15 new warships valued at tens of billions of dollars. Ongoing technological integration, including missile defense systems, unmanned platforms, and AI-enabled command systems, secures North America’s leadership position. It underscores the region’s focus on global power projection and maritime superiority.

Europe

Europe accounts for 27% of the Naval Vessels Market, supported by strong defense industries in the United Kingdom, France, Germany, Italy, and Spain. The UK Royal Navy strengthens the segment with its Queen Elizabeth-class aircraft carriers and Dreadnought-class submarine program. France contributes through its Charles de Gaulle carrier, Barracuda-class submarines, and FREMM frigates, enhancing blue-water capabilities. Germany emphasizes submarine production with the Type 212 and Type 214 classes, recognized for their advanced propulsion and stealth features. Italy and Spain actively expand their fleets with multi-role destroyers and amphibious ships. It benefits from joint defense collaborations such as the European Defence Fund and multinational naval exercises. This regional focus on interoperability and technology advancement reinforces Europe’s strong global presence.

Asia-Pacific

Asia-Pacific represents 25% of the Naval Vessels Market, reflecting rapid naval modernization and rising regional security challenges. China holds the largest fleet in the world by ship count, exceeding 370 vessels, including its expanding aircraft carrier program and advanced Type 055 destroyers. India strengthens the segment with nuclear-powered submarines and indigenous aircraft carrier INS Vikrant, highlighting its shift toward self-reliance in defense production. Japan advances capabilities with Aegis-equipped destroyers and next-generation submarines, while South Korea emphasizes frigates and amphibious ships for regional security. Australia contributes through its Hunter-class frigate program and submarine projects under the AUKUS partnership. It demonstrates strong growth driven by territorial disputes, expanding defense budgets, and international partnerships.

Latin America

Latin America accounts for 6% of the Naval Vessels Market, led by Brazil, Mexico, and Chile. Brazil spearheads the region’s share with its PROSUB program, which includes the construction of four Scorpène-class submarines and a nuclear-powered submarine project. Mexico expands its fleet with patrol vessels and amphibious ships to safeguard coastal waters and support humanitarian missions. Chile continues to modernize its fleet with frigates and offshore patrol vessels designed for multi-role operations. Argentina, though constrained by budget limitations, invests in selective upgrades to its naval forces. It reflects a regional focus on coastal defense, drug trafficking prevention, and disaster relief missions. Despite financial constraints, Latin America shows gradual growth supported by international collaboration and selective procurement programs.

Middle East & Africa

The Middle East & Africa region captures 7% of the Naval Vessels Market, reflecting steady but smaller-scale growth compared to larger regions. Countries such as Saudi Arabia and the United Arab Emirates prioritize modernization of corvettes and patrol vessels to protect vital sea routes in the Gulf and the Red Sea. Israel strengthens capabilities with advanced missile boats and submarines, ensuring strategic deterrence. African nations, including South Africa and Egypt, invest selectively in frigates and patrol vessels to secure coastal areas and exclusive economic zones. It reflects the importance of maritime security in protecting oil shipping lanes and countering piracy in critical waters such as the Gulf of Aden. Partnerships with European and U.S. shipbuilders support fleet expansion and technology adoption.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Larsen & Toubro

- Fincantieri

- Huntington Ingalls

- Lockheed Martin

- Damen Shipyards

- BAE Systems

- Austal

- Hanwha Ocean

- General Dynamics

- HD Korea Shipbuilding

Competitive Analysis

The competitive landscape of the Naval Vessels Market players includes Austal, BAE Systems, Damen Shipyards, Fincantieri, General Dynamics, Hanwha Ocean, HD Korea Shipbuilding, Huntington Ingalls, Larsen & Toubro, and Lockheed Martin. The Naval Vessels Market is defined by high competition, driven by advanced shipbuilding capabilities, evolving defense requirements, and continuous technological innovation. Companies emphasize modular designs, integrated combat systems, and digital automation to meet the demand for multi-role platforms. The market focuses on long-term fleet modernization, where procurement programs often span decades and involve significant government investment. Strong collaboration between shipbuilders, defense contractors, and national governments enhances capacity to deliver complex vessels such as aircraft carriers, submarines, and destroyers. Emphasis on lifecycle support, sustainable propulsion technologies, and interoperability with allied navies further shapes the competitive dynamics. The industry remains influenced by geopolitical tensions, maritime security challenges, and the need for agile platforms capable of handling diverse naval missions.

Recent Developments

- In August 2024, from the General Dynamics Electric Boat shipyard located along the Thames River, the US Navy’s planned Attack Submarine was unveiled. Idaho SSN 799 is expected to be launched next. This event denotes a phase in the manufacture of the submarine and is termed as a ‘float off’ as it indicates the completion of a portion of the construction of the submarine.

- In February 2023, the U.S. Department of Defense (DoD) awarded Gibbs & Cox, a naval architecture firm contract to assist the U.S. Navy with its future surface combatant force. The contract focuses on efforts to support the development of the guided missile destroyer’s next generation, DDG(X), and to evaluate why other emerging ship concepts might be more effective.

- In January 2023, Team Resolute awarded a contract to Navantia as Team Resolute to build the vessels supplying munitions, stores, and provisions to the Royal Navy’s aircraft carriers, frigates, and destroyers. With Navantia, the team comprising Harland&Wolff and BMT will supply three Fleet Solid Support (FSS) ships for the Royal Fleet Auxiliary.

Report Coverage

The research report offers an in-depth analysis based on Vessel Type, System, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Naval Vessels Market will expand with rising demand for modernized fleets across major economies.

- Governments will prioritize investments in multi-role and modular platforms for diverse missions.

- It will integrate advanced combat management, radar, and electronic warfare systems for superior capabilities.

- Growing adoption of unmanned and autonomous vessels will reshape future naval strategies.

- Regional security tensions will drive higher procurement of submarines, destroyers, and frigates.

- Sustainability will influence ship design through hybrid propulsion and energy-efficient systems.

- Joint defense programs and international collaborations will accelerate technology sharing.

- Digitalization and AI-enabled platforms will improve command, control, and operational efficiency.

- Lifecycle support and maintenance services will remain critical for long-term fleet readiness.

- Expanding roles in humanitarian missions and coastal security will strengthen demand for versatile vessels.