Market Overview

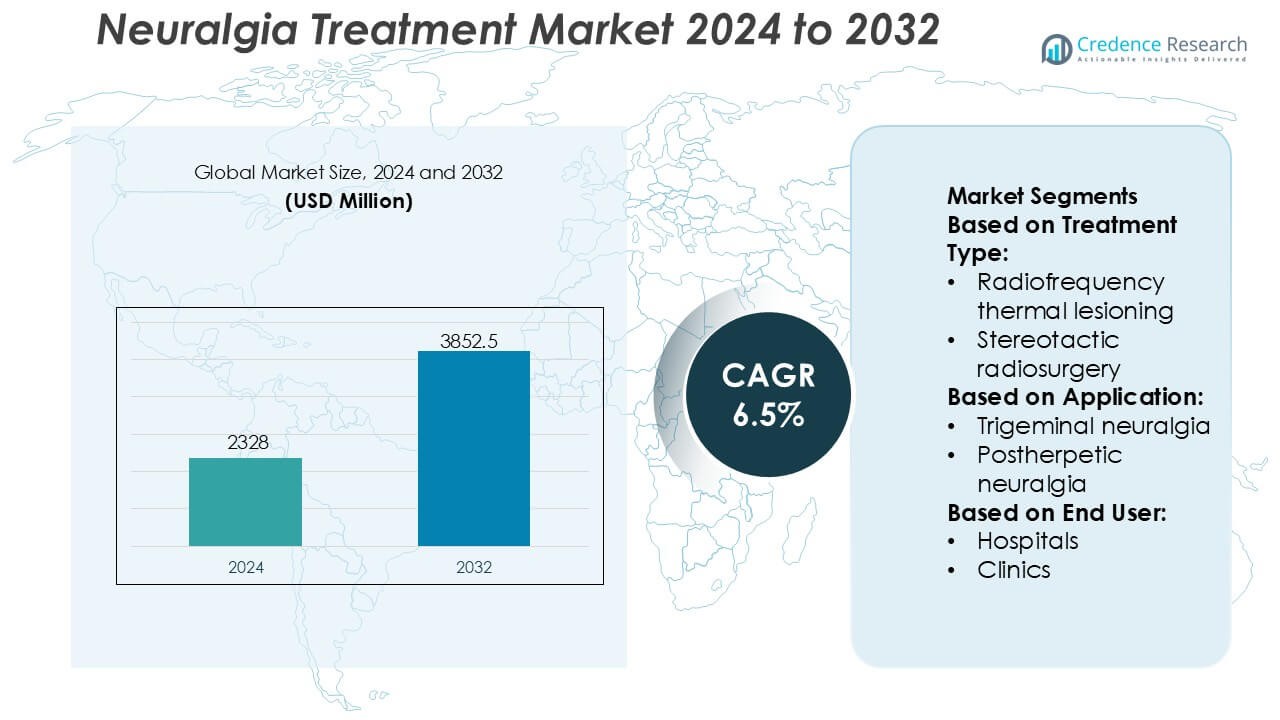

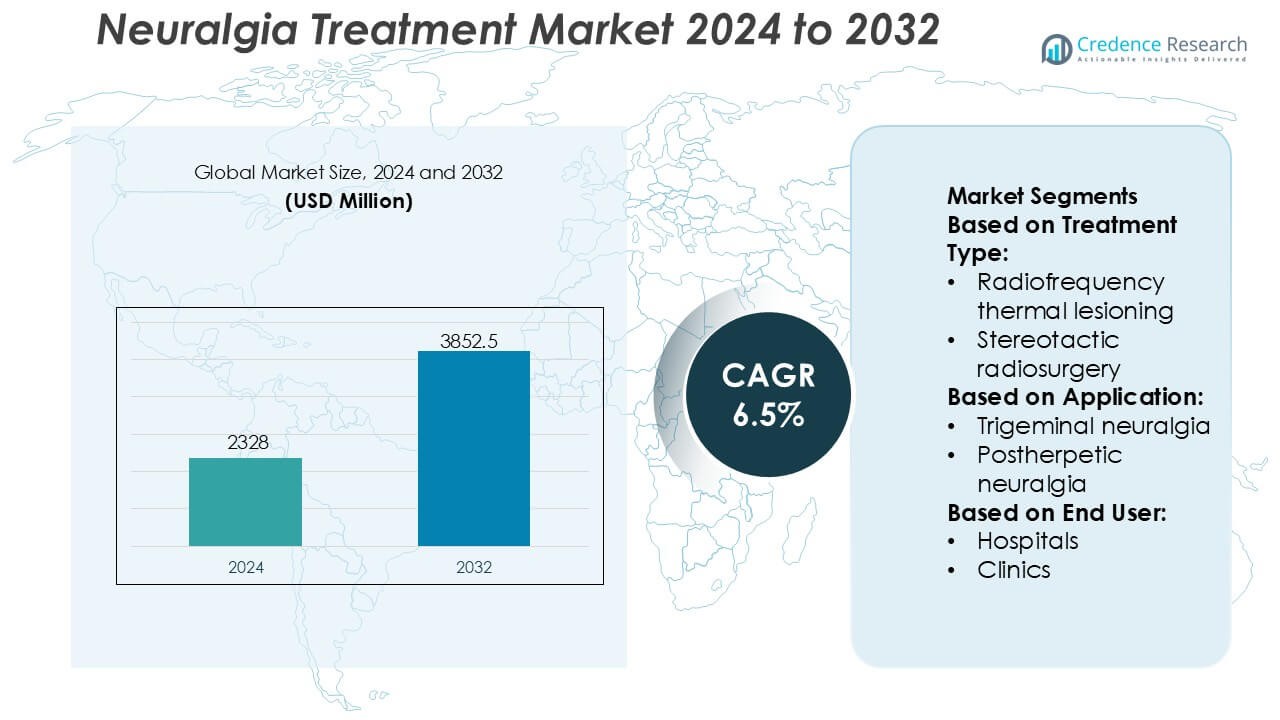

Neuralgia Treatment Market size was valued USD 2328 million in 2024 and is anticipated to reach USD 3852.5 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neuralgia Treatment Market Size 2024 |

USD 2328 Million |

| Neuralgia Treatment Market, CAGR |

6.5% |

| Neuralgia Treatment Market Size 2032 |

USD 3852.5 Million |

The neuralgia treatment market features strong competition among established pharmaceutical companies with broad neurology and pain management portfolios, including UCB S.A., Merck & Co., Inc., AbbVie Inc., Eli Lilly and Company, Pfizer Inc., Amgen Inc., Johnson & Johnson Services, Inc., Novartis AG, LEO Pharma A/S, and Evelo Biosciences, Inc. These players compete through robust R&D pipelines, expanded indications for anticonvulsants and antidepressants, and growing focus on biologics and targeted therapies for neuropathic pain. Strategic priorities center on clinical differentiation, lifecycle management, and global market penetration. Regionally, North America leads the neuralgia treatment market with an exact 41% market share, supported by advanced healthcare infrastructure, high diagnosis rates, favorable reimbursement policies, and early adoption of innovative pharmacological and interventional treatment options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The neuralgia treatment market was valued at USD 2,328 million in 2024 and is projected to reach USD 3,852.5 million by 2032, expanding at a CAGR of 6.5% during the forecast period.

- Rising prevalence of trigeminal and postherpetic neuralgia, aging populations, and improved diagnosis rates act as key market drivers, supporting sustained demand for long-term pharmacological and interventional therapies.

- Treatment trends highlight strong reliance on medications, which represent the dominant segment with an estimated 65% share, driven by widespread use of anticonvulsants and antidepressants as first-line therapies.

- Competitive intensity remains high, with leading pharmaceutical players focusing on pipeline expansion, biologics development, lifecycle management, and global market penetration amid growing generic pressure.

- Regionally, North America leads with an exact 41% market share, supported by advanced healthcare infrastructure and reimbursement systems, while cost constraints and limited specialist access act as key restraints in developing regions.

Market Segmentation Analysis:

By Treatment Type

The Neuralgia Treatment Market by treatment type is led by medications, which account for an estimated 65–70% market share, driven by first-line clinical preference and long-term disease management needs. Within medications, anticonvulsants dominate due to their proven efficacy in reducing neuropathic pain, rapid onset of action, and broad guideline support. Surgical procedures represent a smaller but growing segment, led by microvascular decompression, which gains adoption in refractory cases owing to durable pain relief outcomes. Cost-effectiveness, outpatient feasibility, and lower procedural risk continue to reinforce medication dominance.

- For instance, UCB’s clinical trials for brivaracetam (brand name Briviact) involved a massive database of over 1,550 patients across multiple Phase 3 studies. Clinical data confirmed that brivaracetam provides a statistically significant reduction in seizure frequency on the first day of treatment (onset within 24–48 hours) without needing a titration period.

By Application

By application, trigeminal neuralgia holds the dominant position with approximately 55–60% market share, reflecting its higher prevalence, severe pain intensity, and strong demand for sustained pharmacological and interventional care. This segment benefits from early diagnosis rates and established treatment protocols, particularly anticonvulsant therapy and targeted surgical options. Postherpetic neuralgia follows, supported by aging populations and rising herpes zoster incidence. Trigeminal neuralgia remains the primary revenue generator due to frequent treatment cycles, specialist involvement, and higher healthcare utilization per patient.

- For instance, ZOSTAVAX® (administered as 0.65 mL) resulted in 315 cases of zoster (2.0 per 1000 person-years) compared with 642 cases (6.6 per 1000 person-years) in placebo, and reduced the incidence of clinically significant postherpetic neuralgia from 80 to 27 cases (0.5 per 1000 person-years) over the follow-up period, demonstrating vaccine-mediated reduction in neuralgia outcomes supported by Merck’s clinical data.

By End User

The end-user segment is dominated by hospitals, accounting for nearly 50% market share, driven by access to multidisciplinary neurology teams, advanced imaging, and surgical infrastructure. Hospitals serve as primary centers for complex diagnosis, medication titration, and invasive procedures such as microvascular decompression and radiosurgery. Clinics and ambulatory surgical centers are expanding steadily, supported by outpatient medication management and minimally invasive interventions. However, hospitals maintain leadership due to higher patient volumes, reimbursement alignment, and capability to manage severe and refractory neuralgia cases.

Key Growth Drivers

Rising Prevalence of Chronic Neuropathic Pain Disorders

The increasing incidence of chronic neuropathic pain conditions, particularly trigeminal, postherpetic, and occipital neuralgia, strongly drives demand for effective treatment options. Aging populations, higher survival rates from viral infections, and improved diagnostic awareness contribute to a growing patient pool requiring long-term pain management. Clinicians increasingly recognize neuralgia as a distinct neurological condition rather than a secondary symptom, which supports earlier intervention. This shift encourages sustained utilization of pharmacological therapies and interventional procedures across hospital and specialty clinic settings.

- For instance, Evelo’s lead candidate EDP1815 demonstrated clinical activity in a randomized, double-blind Phase 1b/2 trial involving 149 patients, where once-daily oral dosing showed statistically significant reductions in inflammatory biomarkers, including C-reactive protein and interleukin-6, without detectable drug levels in systemic circulation, as measured by validated bioanalytical assays.

Advancements in Interventional and Surgical Treatment Modalities

Technological progress in minimally invasive neurosurgical and interventional pain procedures significantly accelerates market growth. Techniques such as radiofrequency thermal lesioning, stereotactic radiosurgery, and microvascular decompression deliver targeted pain relief with reduced recovery times. Improved imaging guidance, precision instruments, and refined patient selection protocols enhance clinical outcomes and safety profiles. These advancements increase physician confidence and patient acceptance, supporting wider adoption of procedural treatments for drug-resistant neuralgia and driving investment in specialized treatment centers.

- For instance, AbbVie Inc. has expanded the clinical utility of onabotulinumtoxinA (BOTOX®) within neurology and pain management, supported by extensive procedural-adjacent evidence. In the PREEMPT clinical program, which enrolled 1,384 patients across two randomized, double-blind trials, BOTOX® was administered at a total dose of 155 units across 31 standardized injection sites per treatment cycle, demonstrating sustained neuromuscular blockade through inhibition of acetylcholine release at peripheral nerve terminals.

Expansion of Multimodal and Personalized Treatment Approaches

The growing emphasis on personalized medicine supports the adoption of multimodal neuralgia treatment strategies that combine medications, interventional procedures, and supportive therapies. Clinicians tailor treatment plans based on pain severity, nerve involvement, and patient tolerance, improving symptom control and quality of life. This approach reduces dependence on single-drug regimens and addresses limitations associated with long-term medication use. Healthcare providers increasingly integrate neurology, pain management, and surgical expertise, strengthening comprehensive care models within the neuralgia treatment ecosystem.

Key Trends & Opportunities

Shift Toward Early Interventional Pain Management

A notable trend in the neuralgia treatment market involves earlier adoption of interventional procedures for patients who show limited response to first-line medications. Physicians increasingly recommend minimally invasive techniques before prolonged pharmacological escalation, aiming to prevent disease progression and reduce side effects. This shift creates opportunities for pain management centers and neurosurgical units to expand service offerings. It also supports demand for advanced equipment, specialized training, and integrated care pathways that prioritize timely procedural intervention.

- For instance, Eli Lilly and Company advanced peripheral pain modulation through galcanezumab (EMGALITY®), a humanized monoclonal antibody targeting calcitonin gene-related peptide. In the Phase III EVOLVE-1 and EVOLVE-2 trials, a 120 mg monthly subcutaneous dose following a 240 mg loading dose was evaluated in a combined population exceeding 1,700 patients, demonstrating a mean reduction of 4.7 monthly migraine headache days from baseline over 6 months, with onset of effect observed as early as Week 1, according to Lilly’s clinical study reports.

Innovation in Neuromodulation and Targeted Therapies

Emerging neuromodulation techniques and targeted drug delivery systems present significant growth opportunities. Research focuses on nerve-specific modulation to achieve sustained pain relief while minimizing systemic exposure. Innovations in implantable and non-implantable neuromodulation devices enhance precision and patient comfort. These developments align with the broader trend toward non-destructive, reversible treatments, positioning neuromodulation as an attractive option for patients unsuitable for conventional surgery and supporting long-term market expansion.

- For instance, LEO Pharma for inflammatory skin diseases with neuro-immune involvement, demonstrated high target specificity by selectively neutralizing interleukin-13 with a binding affinity of KD = 58 pM, according to company-published biochemical characterization data.

Growth of Specialized Pain Clinics and Outpatient Care

The expansion of specialized pain clinics and ambulatory surgical centers supports market growth by improving access to neuralgia treatments. These facilities offer focused expertise, shorter waiting times, and cost-efficient care compared to inpatient hospital settings. Outpatient delivery of procedures such as radiosurgery and radiofrequency treatments increases patient convenience and system efficiency. This trend creates opportunities for healthcare providers to decentralize care while maintaining high clinical standards and expanding regional treatment capacity.

Key Challenges

Limited Long-Term Efficacy and Medication Tolerability

A major challenge in the neuralgia treatment market involves variability in long-term treatment efficacy, particularly with pharmacological therapies. Many patients experience diminishing pain relief or adverse effects with prolonged medication use, leading to treatment discontinuation or escalation. Managing side effects while maintaining adequate pain control remains complex, especially in elderly populations. This challenge places pressure on clinicians to balance efficacy and safety, highlighting unmet needs for more durable and better-tolerated therapeutic options.

High Cost and Accessibility Barriers for Advanced Treatments

Advanced interventional and surgical treatments often involve high procedural costs, specialized infrastructure, and skilled personnel, limiting accessibility in resource-constrained settings. Reimbursement variability and uneven healthcare coverage further restrict patient access to innovative therapies. These barriers slow adoption in emerging markets and rural regions, despite growing clinical demand. Addressing affordability and infrastructure gaps remains critical for broader market penetration and equitable access to advanced neuralgia treatment solutions.

Regional Analysis

North America

North America dominates the neuralgia treatment market with an estimated 41% market share, driven by high disease awareness, early diagnosis rates, and strong access to advanced neurological care. The region benefits from widespread availability of anticonvulsants, antidepressants, and minimally invasive surgical options such as radiofrequency ablation and stereotactic radiosurgery. Favorable reimbursement frameworks, high healthcare spending, and strong adoption of novel pain management protocols support sustained demand. The presence of leading pharmaceutical and medical device companies accelerates clinical innovation and treatment accessibility. Additionally, an aging population and rising prevalence of trigeminal and postherpetic neuralgia continue to reinforce market leadership.

Europe

Europe holds approximately 29% of the global neuralgia treatment market, supported by well-established public healthcare systems and strong emphasis on evidence-based pain management. Countries such as Germany, the UK, France, and Italy drive demand through specialized neurology centers and structured referral pathways. Broad use of pharmacological therapies, combined with increasing adoption of microvascular decompression and radiosurgical procedures, strengthens treatment outcomes. Government-backed healthcare coverage improves patient access to long-term neuralgia management. Rising elderly demographics, coupled with growing focus on quality-of-life improvement and chronic pain control, continues to sustain steady market expansion across Western and Northern Europe.

Asia-Pacific

Asia-Pacific accounts for nearly 21% market share and represents the fastest-growing regional market for neuralgia treatment. Rapid improvements in healthcare infrastructure, increasing neurologist availability, and rising awareness of neuropathic pain disorders drive adoption. Countries such as China, Japan, India, and South Korea show increasing demand for cost-effective medications and expanding use of minimally invasive procedures. Growing healthcare expenditure, urbanization, and improved diagnostic capabilities support early treatment initiation. In addition, a large aging population and increasing incidence of diabetes-related neuropathies contribute to higher neuralgia prevalence, positioning Asia-Pacific as a key growth engine for future market expansion.

Latin America

Latin America holds an estimated 6% share of the neuralgia treatment market, driven by gradual improvements in healthcare access and neurological care services. Brazil and Mexico serve as key contributors due to expanding hospital networks and rising adoption of standardized pain management protocols. Pharmacological treatments remain the primary therapy approach, while advanced surgical interventions gain traction in urban tertiary-care centers. Increasing awareness among healthcare professionals, supported by regional medical education initiatives, improves diagnosis rates. Although reimbursement limitations persist, government-led healthcare reforms and private sector investment continue to enhance treatment availability across the region.

Middle East & Africa

The Middle East & Africa region accounts for approximately 3% of the neuralgia treatment market, reflecting uneven healthcare access across countries. The Gulf Cooperation Council nations lead regional demand due to well-funded healthcare systems, advanced hospitals, and growing adoption of interventional pain therapies. Pharmacological management remains the primary treatment approach in most African countries, supported by essential medicine programs. Rising investments in healthcare infrastructure, expanding private hospitals, and increasing awareness of chronic neuropathic pain gradually improve diagnosis and treatment rates. Despite existing limitations, long-term demographic growth and healthcare modernization support incremental market development.

Market Segmentations:

By Treatment Type:

- Radiofrequency thermal lesioning

- Stereotactic radiosurgery

By Application:

- Trigeminal neuralgia

- Postherpetic neuralgia

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the neuralgia treatment market players such as UCB S.A., Merck & Co., Inc., Evelo Biosciences, Inc., AbbVie Inc., Eli Lilly and Company, LEO Pharma A/S, Pfizer Inc., Amgen Inc., Johnson & Johnson Services, Inc., Novartis AG. the neuralgia treatment market is moderately consolidated, characterized by the presence of large pharmaceutical companies and specialized neurology-focused players competing through innovation, portfolio depth, and global reach. Market participants emphasize the development of advanced pharmacological therapies, including next-generation anticonvulsants, antidepressants, and biologics, to improve efficacy and safety profiles. Continuous investment in clinical research supports pipeline expansion and differentiation across neuropathic pain indications. Companies also focus on lifecycle management strategies, such as new formulations and extended indications, to sustain revenue streams. Strategic collaborations, licensing agreements, and acquisitions strengthen technological capabilities and accelerate market entry. Intensifying generic competition and pricing pressure drive manufacturers to prioritize patient-centric solutions, real-world evidence generation, and targeted commercialization strategies to maintain competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- UCB S.A.

- Merck & Co., Inc.

- Evelo Biosciences, Inc.

- AbbVie Inc.

- Eli Lilly and Company

- LEO Pharma A/S

- Pfizer Inc.

- Amgen Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

Recent Developments

- In June 2024, Henkel is dedicated to increasing knowledge about the role advanced materials can play in enabling sustainability across the value chain, from R&D to manufacturing to field use, among heavy vehicle and equipment (heavy vehicle and equipment) designers, manufacturers, and tier suppliers.

- In January 2024, Zydus Lifesciences received final approval from the U.S. Food and Drug Administration for its generic Gabapentin tablets for managing postherpetic neuralgia (PHN). The approval covers 300 mg and 600 mg once-daily dosages, a drug used for pain relief following shingles.

- In Novemeber 2023, Pacira BioSciences announced FDA approval of its supplemental new drug application to expand the Exparel label to include administration in adults as an adductor canal block and as a sciatic nerve block in the popliteal fossa.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Advancements in targeted and mechanism-specific therapies will improve treatment efficacy and reduce adverse effects.

- Expanded clinical research will support the development of disease-modifying approaches beyond symptomatic pain control.

- Increasing adoption of minimally invasive surgical and interventional procedures will enhance long-term pain management outcomes.

- Integration of precision medicine and biomarker-driven diagnosis will enable more personalized neuralgia treatment pathways.

- Growing awareness and early diagnosis will increase treatment uptake across primary and specialty care settings.

- Development of long-acting and improved-tolerability formulations will strengthen patient adherence and quality of life.

- Rising geriatric populations will continue to elevate demand for chronic neuropathic pain management solutions.

- Digital health tools and remote monitoring will support treatment optimization and follow-up care.

- Expansion of treatment access in emerging economies will broaden the patient base and improve care continuity.

- Ongoing focus on real-world evidence and post-marketing studies will refine clinical guidelines and therapy selection.