Market Overview

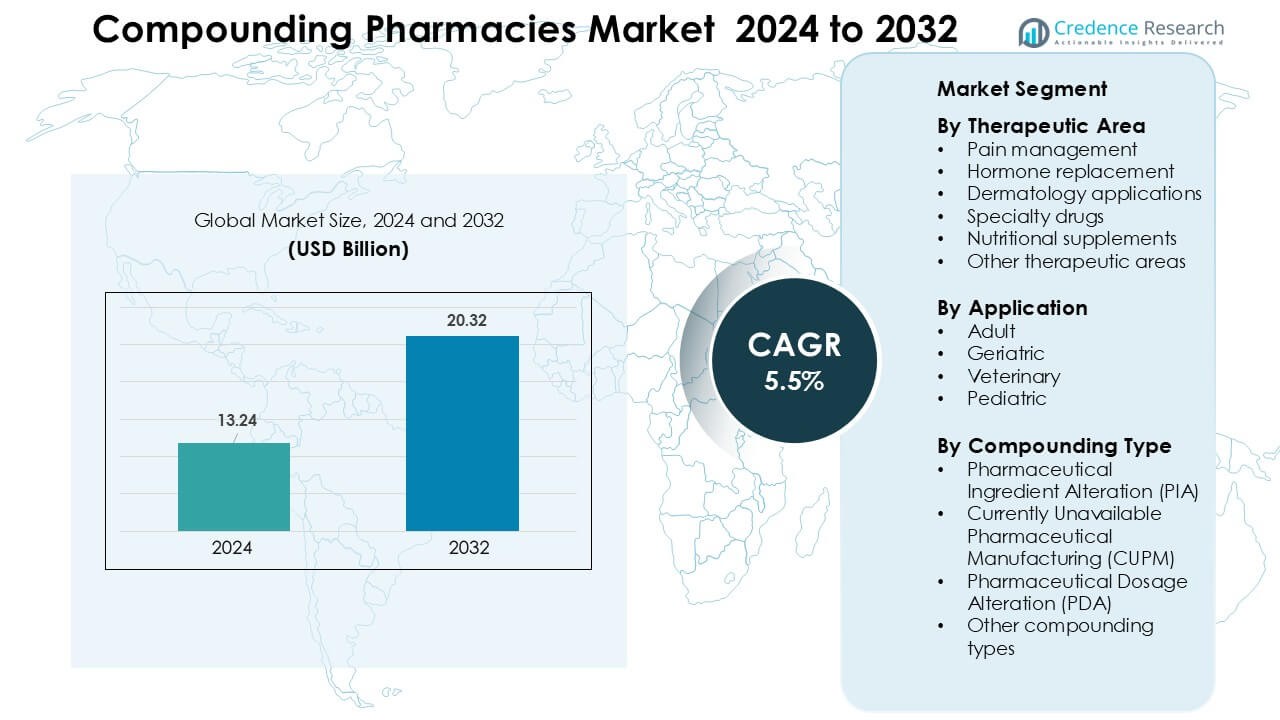

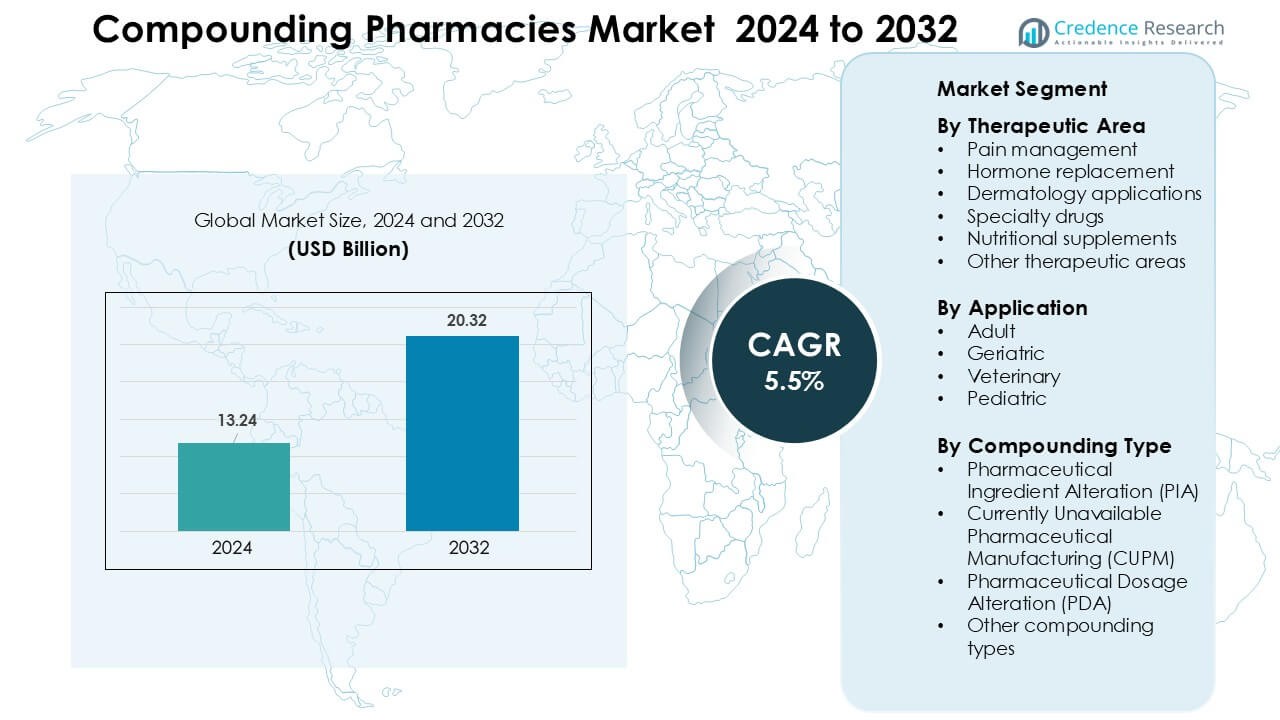

Compounding Pharmacies Market was valued at USD 13.24 billion in 2024 and is anticipated to reach USD 20.32 billion by 2032, growing at a CAGR of 5.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compounding Pharmacies Market Size 2024 |

USD 13.24 Billion |

| Compounding Pharmacies Market, CAGR |

5.5 % |

| Compounding Pharmacies Market Size 2032 |

USD 20.32 Billion |

The Compounding Pharmacies Market is shaped by leading players such as Nephron Pharmaceuticals Corporation, Clinigen Group PLC, Lorraine’s Pharmacy, Fagron NV, Institutional Pharmacy Solutions LLC, McGuff Compounding Pharmacy Services, Fresenius Kabi AG, ITC Compounding Pharmacy, B. Braun Melsungen AG, and Dougherty’s Pharmacy Inc. These companies expand sterile and non-sterile capabilities, strengthen regulatory compliance, and invest in personalized therapies across pain management, dermatology, hormone replacement, and pediatrics. North America emerged as the dominant region in 2024 with 41% share, supported by advanced compounding infrastructure, strong adoption of customized medications, and a mature network of 503A and 503B pharmacies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Compounding Pharmacies Market size reached approximately USD 13.24 billion in 2024 and is projected to grow at a CAGR of 5.5 % through 2032.

- Rising demand for personalized medicine and custom formulations in pain management, hormone therapy, dermatology and pediatrics fuels market growth across all segments.

- Growth trends include increased adoption of sterile outsourcing facilities, rising veterinary compounding demand, and higher use of tailored hormone and dermatology therapies.

- Major firms such as Nephron Pharmaceuticals, Fagron NV, B. Braun Melsungen AG, Fresenius Kabi AG, and others compete by expanding sterile and non-sterile compounding capabilities and by enhancing compliance and quality controls.

- Regulatory compliance burden, stringent quality-control requirements, and variability in compounded formulation standards restrain growth in regions with less mature infrastructure; North America leads the market with ~41 % share, followed by Europe (~28 %) and Asia-Pacific (~22 %).

Market Segmentation Analysis:

Market Segmentation Analysis:

By Therapeutic Area

Pain management led the therapeutic-area segment in 2024 with about 34% share, driven by rising prescriptions for customized analgesic blends used in chronic pain, neuropathic pain, and post-surgical recovery. Demand grew as clinicians sought non-opioid and lower-dose alternatives tailored to patient tolerance levels. Hormone replacement therapies also expanded due to higher use in women’s health and thyroid imbalance cases. Dermatology applications gained traction with personalized creams and gels. Specialty drugs and nutritional supplements advanced steadily, but pain management stayed dominant because physicians depend on flexible strengths and combinations to improve treatment response.

- For instance, PCCA’s Lipoderm ActiveMax™ base demonstrated transdermal delivery rates up to 25% higher for select analgesic APIs during controlled permeation studies, supporting broader use in chronic pain protocols.

By Application

Adult patients dominated the application segment in 2024 with nearly 46% share, supported by wide use of tailored medications for chronic diseases, hormonal imbalance, dermatology conditions, and lifestyle-linked disorders. Adults often require dosage adjustments, allergen-free formulations, and alternative delivery modes that standard products do not offer. Geriatric demand grew as older adults needed customized low-dose or easy-to-swallow formats. Pediatric use increased for flavored liquids and safer strengths, while veterinary compounding expanded through personalized treatments for companion animals. Adults remained the largest group because clinicians prescribe most compounded medications to support long-term disease management.

- For instance, PCCA’s various HRT bases, such as VersaBase Gel, leverage a proprietary polymer network that PCCA states is tested to deliver uniform hormone release and provide consistent results, enabling precise adult dosing when compounded as directed.

By Compounding Type

Pharmaceutical Ingredient Alteration (PIA) accounted for roughly 38% share in 2024, leading the compounding-type segment due to rising demand for allergen-free, preservative-free, and dye-free medications. Clinics relied on PIA to modify base ingredients for patients with intolerance or restricted therapeutic requirements. Pharmaceutical Dosage Alteration (PDA) grew further as pharmacists created adjusted strengths, flavored formats, and alternative dosage forms for adults and children. CUPM solutions rose in relevance as pharmacies filled gaps for discontinued or short-supply drugs. PIA remained dominant because ingredient modification offers flexibility that supports personalized safety and adherence needs.

Key Growth Drivers

Rising Demand for Personalized Medicine

Personalized medicine has become a major growth engine for the compounding pharmacies market as patients increasingly seek treatment plans tailored to individual needs. Physicians prescribe personalized formulations when standard-dose medications create side effects, offer limited efficacy, or lack suitable delivery modes. Compounding pharmacies address these gaps by adjusting strengths, removing allergens, and creating alternative formats such as gels, suspensions, or troches. Chronic disease cases continue to rise globally, and many patients require individualized therapeutic regimens that commercial drugs cannot meet. This dynamic strengthens demand for personalized medications across dermatology, hormone therapy, pain management, and pediatric care. The shift toward patient-centric healthcare, combined with active physician acceptance of customized therapies, ensures steady market expansion. Compounded medications also play a key role in cases involving drug intolerance or specific ingredient sensitivities. As patient expectations for tailored care grow, personalized medicine remains one of the strongest drivers of market growth.

- For instance, Fagron’s TrichoTest® analyzes 48 genetic variants across seven pathways to guide personalized dermatology and hair-loss formulations with higher treatment precision.

Increasing Shortages of Commercially Manufactured Drugs

Recurring shortages of key pharmaceuticals remain a strong catalyst for the compounding pharmacies market, as healthcare providers rely on customized formulations to fill supply gaps. Many essential medicines including sterile injectables, analgesics, and diabetes drugs face supply disruptions due to manufacturing delays, regulatory actions, or raw-material issues. Compounding pharmacies support hospital systems and clinics by preparing equivalent formulations during such shortages, ensuring uninterrupted treatment. They often step in when discontinued products are required for niche therapeutic needs. The rising frequency of shortages has pushed healthcare facilities to develop long-term partnerships with compounding suppliers to maintain timely access to critical medications. Moreover, specialized outsourcing facilities operating under strict quality standards help deliver high-volume compounded solutions that meet hospital-grade requirements. As global supply chains face periodic instability, compounding pharmacies serve as a vital safety net, strengthening resilience in the pharmaceutical ecosystem and sustaining growth momentum.

Growing Demand for Customized Hormone and Pain Management Therapies

The compounding pharmacies market benefits from a strong surge in demand for customized hormone replacement therapy (HRT) and pain-management solutions. Patients often require individualized hormone levels based on age, gender, and metabolic rate, prompting physicians to prescribe compounded bioidentical hormone therapies tailored to specific physiological needs. Compounded formulations help address menopause, thyroid disorders, and adrenal imbalance more precisely than standardized products. In parallel, chronic pain patients increasingly depend on custom analgesic combinations that reduce opioid exposure while improving symptom control. Compounding pharmacies provide multi-drug formulations, lower-dose alternatives, and transdermal delivery options that enhance patient safety and adherence. These tailored hormone and pain treatments hold special relevance for aging populations, which exhibit higher incidence of endocrine imbalance and chronic pain. With rising awareness of non-standard treatment paths, compounded HRT and pain therapies continue to accelerate market expansion.

Key Trends & Opportunities

Expansion of Sterile and High-Quality Outsourcing Facilities

A major trend reshaping the compounding pharmacies market is the expansion of sterile outsourcing facilities operating under enhanced regulatory standards. Healthcare systems increasingly outsource sterile preparations to 503B outsourcing pharmacies to ensure consistent quality, reduce compounding errors, and maintain supply continuity. These facilities leverage automation, cleanroom technologies, and advanced quality-assurance practices that meet large-scale hospital requirements. The trend creates vast opportunities for providers capable of producing high-volume sterile injectables, ophthalmic solutions, and niche critical-care medications. As hospitals face mounting compliance pressures, they prefer outsourcing partners offering traceability, sterile infrastructure, and reliable production capacity. This shift opens strong business potential for compounding firms that invest in high-grade manufacturing systems. The ongoing expansion of sterile operations signals a long-term opportunity as demand rises for complex, clinical-grade formulations.

- For instance, Industry analysis and articles confirm that advanced technologies, such as robotics, isolator technology, and integrated automation, significantly boost efficiency and production capacity in pharmaceutical manufacturing.

Growing Adoption of Veterinary Compounding and Niche Therapeutic Solutions

Veterinary compounding has emerged as a fast-growing opportunity as pet ownership rises and veterinarians seek customized solutions for species-specific needs. Many animals require unique doses, delivery formats, or flavors that commercial drugs cannot provide. Compounding pharmacies create pet-friendly formulations such as chewables, flavored liquids, and transdermal gels that improve treatment compliance. Beyond veterinary care, niche areas such as dermatology, gastroenterology, and nutritional supplementation offer strong growth potential for compounding specialists. Increasing consumer awareness about personalized therapies for pets and specialized patient groups continues to support this trend. Veterinary compounding, combined with unmet needs in specialty human therapies, provides compounding pharmacies with expanding revenue opportunities across diverse healthcare segments.

- For instance, the American Pet Products Association (APPA) reports over 94 million U.S. households owned a pet as of their 2025 survey, a notable increase from 82 million in 2023, driving increased demand for compounded medications tailored to individual animals.

Rising Integration of Technology in Compounding Operations

Technology adoption is creating new opportunities in compounding pharmacies as systems such as automated dispensing, digital workflow platforms, and electronic prescription transfers strengthen safety and accuracy. Pharmacies increasingly use barcode verification, real-time quality monitoring, and cloud-based documentation to reduce contamination risk and eliminate formulation errors. Digital platforms also streamline physician communication, enabling faster prescription adjustments and improved transparency. Investment in robotic systems and smart labeling expands capacity and enhances productivity for both sterile and non-sterile compounding. As regulatory expectations intensify, technology-driven compounding operations gain strong competitive advantages. This trend unlocks opportunities for pharmacies that modernize operations and establish high-efficiency workflow models.

Key Challenges

Stringent Regulatory Requirements and Compliance Burden

Regulatory requirements pose a significant challenge for compounding pharmacies, as they must meet strict quality, sterility, and documentation standards. Compliance with USP <795>, <797>, and <800> guidelines, along with oversight from national health authorities, creates high operational burdens. Facilities must invest heavily in cleanrooms, air-quality systems, staff training, and continuous environmental monitoring. Regulatory inspections also demand complete traceability for every compounded product, increasing administrative complexity. Non-compliance can result in penalties, recalls, or shutdowns, creating financial risk. Smaller independent pharmacies struggle most with these heightened expectations, leading many to limit operations or shift to non-sterile compounding. As regulations evolve, pharmacies face ongoing pressure to maintain rigorous systems, making compliance a core barrier to market growth.

Quality-Control Risks and Variability in Formulations

Ensuring consistent quality across customized formulations remains a key challenge for compounding pharmacies. Since compounded medications lack standardized manufacturing processes, formulation variability may occur due to differences in raw materials, equipment accuracy, or operator experience. Errors in dosing, stability, or sterility can jeopardize patient safety and lead to adverse events. Maintaining stable shelf-life and reliable bioavailability also proves difficult for certain complex therapies. Compounding errors have previously triggered regulatory action and raised concerns among healthcare providers. These risks force pharmacies to adopt strict validation protocols, advanced testing, and continuous monitoring—factors that increase operational cost and complexity. Addressing quality-control variability remains essential for building trust and strengthening market credibility.

Regional Analysis

North America

North America held the largest share of the compounding pharmacies market in 2024 with about 41%, driven by strong demand for personalized medicine, advanced compounding infrastructure, and wide adoption of bioidentical hormone therapies. The region benefits from a mature network of 503A and 503B pharmacies that support both individualized and large-volume sterile preparations. Growth strengthened as physicians increasingly prescribed custom analgesics, dermatology blends, and allergen-free formulations. Rising chronic disease cases, drug shortages, and supportive reimbursement trends further expanded service demand. Strong regulatory oversight also encouraged investment in high-quality sterile compounding facilities.

Europe

Europe accounted for around 28% of the market in 2024, supported by a well-established pharmacy compounding tradition and strong demand for customized dermatology, hormone replacement, and pediatric formulations. Countries such as Germany, France, and the Netherlands operate structured compounding frameworks that ensure product safety and uniform dispensing practices. Growing adoption of personalized therapies for aging populations, along with increased use of preservative-free and dose-adjusted solutions, strengthened market growth. Hospitals also relied on compounded preparations during recurring drug shortages. Expansion of clinical compounding services and rising preference for tailored therapies continued to support steady regional demand.

Asia-Pacific

Asia-Pacific reached nearly 22% share in 2024, emerging as the fastest-growing region due to rising chronic disease incidence, expanding healthcare spending, and increasing awareness of personalized treatments. Demand grew across Australia, Japan, India, and South Korea as patients sought customized hormone therapies, dermatology formulations, and pediatric solutions unavailable in standard formats. Drug shortages in several markets also pushed hospitals to rely on compounded preparations. Investments in training, sterile infrastructure, and digital pharmacy platforms supported market expansion. Growing pet ownership further boosted veterinary compounding. The region’s large population base and improving healthcare access will continue to accelerate long-term growth.

Latin America

Latin America captured roughly 6% of the market in 2024, driven by rising adoption of customized therapies in Brazil, Mexico, and Argentina. Regional growth accelerated as physicians prescribed compounded solutions for dermatology, hormone imbalance, fertility, and pain management. Increasing middle-class healthcare spending and higher demand for alternative dosage forms supported the sector. Pharmacies expanded capabilities in allergen-free and preservative-free formulations to serve sensitivity-prone patients. Although regulatory variability remains a challenge, ongoing improvements in compounding standards and expanding clinical awareness contributed to steady demand across major urban centers.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, with demand primarily concentrated in the UAE, Saudi Arabia, and South Africa. Growth stemmed from rising chronic disease prevalence, expanding private healthcare networks, and increasing acceptance of customized dermatology and hormone therapies. Hospitals and clinics relied on compounded products to address shortages of specialty and pediatric drugs. Investment in modern pharmacy infrastructure and rising awareness of personalized treatments improved market penetration. However, limited regulatory harmonization and uneven access to trained compounding professionals restricted broader expansion across developing markets.

Market Segmentations:

By Therapeutic Area

- Pain management

- Hormone replacement

- Dermatology applications

- Specialty drugs

- Nutritional supplements

- Other therapeutic areas

By Application

- Adult

- Geriatric

- Veterinary

- Pediatric

By Compounding Type

- Pharmaceutical Ingredient Alteration (PIA)

- Currently Unavailable Pharmaceutical Manufacturing (CUPM)

- Pharmaceutical Dosage Alteration (PDA)

- Other compounding types

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Compounding Pharmacies Market features strong competition among major players such as Nephron Pharmaceuticals Corporation, Clinigen Group PLC, Lorraine’s Pharmacy, Fagron NV, Institutional Pharmacy Solutions LLC, McGuff Compounding Pharmacy Services, Fresenius Kabi AG, ITC Compounding Pharmacy, B. Braun Melsungen AG, and Dougherty’s Pharmacy Inc. These companies compete by expanding sterile and non-sterile compounding capabilities, enhancing cleanroom infrastructure, and strengthening compliance with USP <795>, <797>, and <800> standards. Market leaders focus on broad therapeutic coverage across pain management, hormone therapy, dermatology, pediatrics, and veterinary care. Several players invest in 503B outsourcing facilities to supply high-volume sterile injectables to hospitals facing shortages. Technology integration, including automated compounding systems, digital prescription workflows, and advanced quality-control tools, further shapes competitive performance. Strategic partnerships with healthcare networks, physician groups, and specialty clinics support market positioning. Continuous innovation in personalized formulations and safety standards remains central to competitive success.

Key Player Analysis

- Nephron Pharmaceuticals Corporation

- Clinigen Group PLC

- Lorraine’s Pharmacy

- Fagron NV

- Institutional Pharmacy Solutions, LLC

- McGuff Compounding Pharmacy Services

- Fresenius Kabi AG

- ITC Compounding Pharmacy

- B. Braun Melsungen AG

- Dougherty’s Pharmacy, Inc.

Recent Developments

- In June 2025, Clinigen Group PLC announced securing rights for six medac therapies to expand patient access to specialist medicines (strategic expansion in specialty/compounded/managed-access space).

- In January 2025, Clinigen Group PLC formed a partnership with Santhera Pharmaceuticals to expand access to a treatment for Duchenne muscular dystrophy (clinical access / specialty medicines activity).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Therapeutic Area, Application, Compounding Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as demand grows for personalized therapies across major therapeutic areas.

- Sterile outsourcing facilities will gain stronger adoption among hospitals and large clinics.

- Technology-driven compounding systems will improve accuracy, safety, and workflow efficiency.

- Bioidentical hormone therapy will remain a major growth catalyst in aging populations.

- Veterinary compounding will rise as pet health spending and species-specific needs increase.

- Drug shortages will continue to boost reliance on compounded alternatives in critical care.

- Regulatory frameworks will tighten, pushing pharmacies to invest more in quality systems.

- Digital prescription platforms and telehealth integration will expand patient access to custom medications.

- Pediatric and geriatric dose-flexible formulations will see stronger adoption in clinical settings.

- Market competition will intensify as leading players invest in sterile infrastructure, automation, and broader therapeutic portfolios.

Market Segmentation Analysis:

Market Segmentation Analysis: