Market Overview:

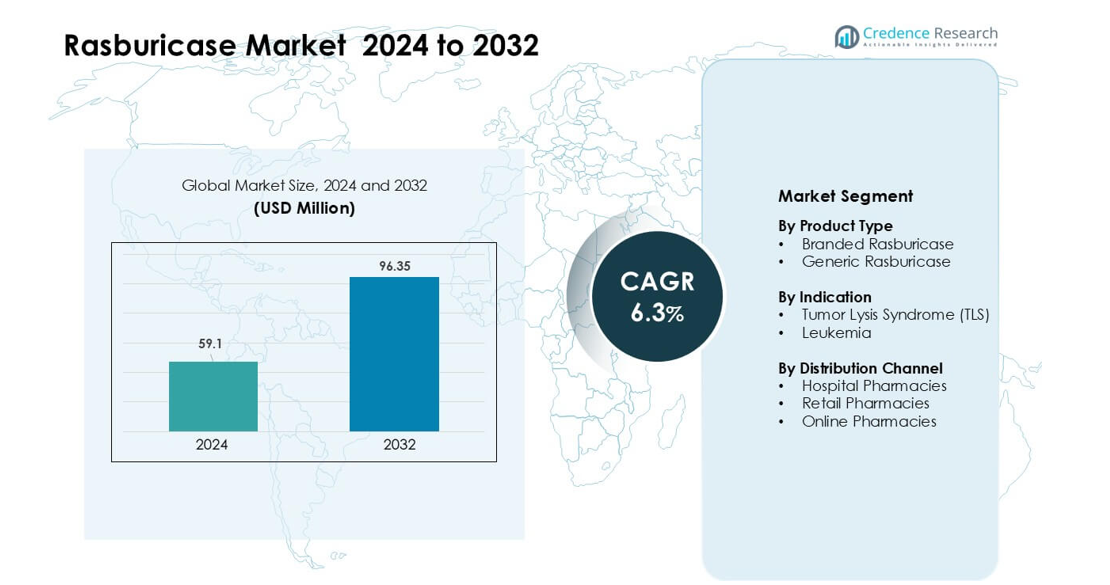

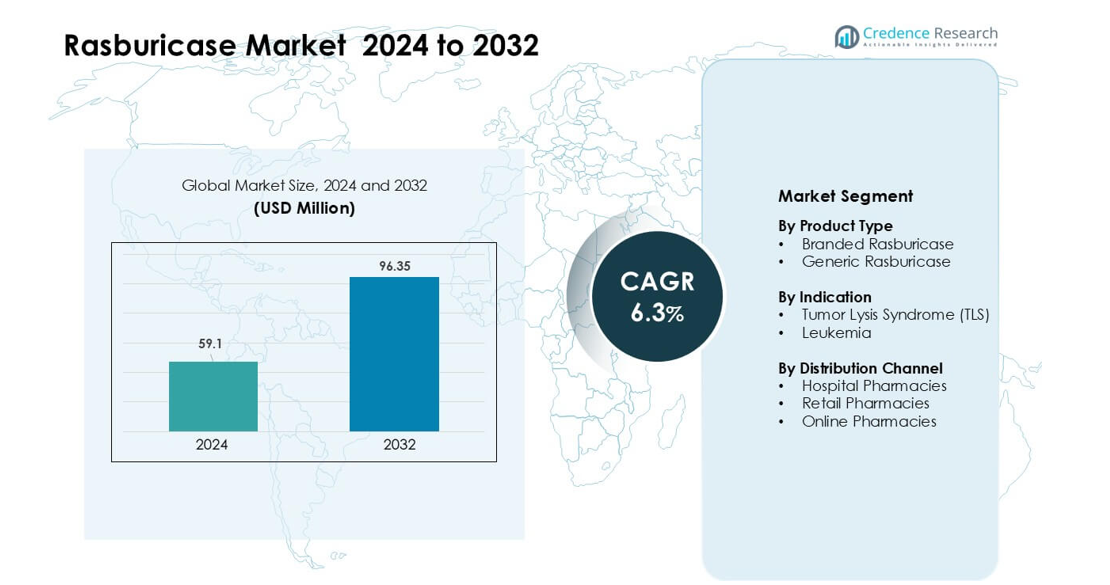

Rasburicase Market was valued at USD 59.1 million in 2024 and is anticipated to reach USD 96.35 million by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rasburicase Market Size 2024 |

USD 59.1 million |

| Rasburicase Market, CAGR |

6.3% |

| Rasburicase Market Size 2032 |

USD 96.35 million |

The Rasburicase Market is shaped by key companies such as Hikma Pharmaceuticals PLC, Sayre Therapeutics, AstraZeneca, G J Pharmaceuticals LLP, Takeda Pharmaceutical Company Limited, Manus Aktteva Biopharma LLP, Pfizer Inc., Merck KGaA, Trumac Healthcare, and Sanofi S.A. These players compete through strong oncology portfolios, reliable manufacturing capacity, and broad hospital partnerships that support rapid access for TLS management. North America emerged as the leading region in 2024 with about 38% share, driven by high cancer prevalence, strong clinical adoption, and well-established reimbursement systems that ensure consistent rasburicase availability across major treatment centers.

Market Insights

- The Rasburicase Market reached USD 59.1 million in 2024 and is projected to hit USD 96.35 million by 2032, growing at a 6.3% CAGR during the forecast period.

- Demand is driven by rising leukemia and lymphoma cases, which increase the risk of Tumor Lysis Syndrome; TLS held about 72% share in 2024 due to strong clinical dependence on rapid uric-acid reduction.

- Key trends include wider generic penetration, growing pediatric oncology use, and integration of rasburicase into standardized TLS risk-based protocols across advanced cancer centers.

- Competition intensifies among players such as Hikma, AstraZeneca, Pfizer, Takeda, Merck KGaA, and Sanofi, supported by strong oncology portfolios, hospital partnerships, and improved cold-chain logistics systems.

- North America led the market with nearly 38% share in 2024, driven by strong reimbursement, advanced oncology infrastructure, and high adoption in major cancer centers, while branded rasburicase dominated product type with about 63% share

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Branded rasburicase dominated the product type segment in 2024 with nearly 63% share. Strong clinical trust, broad regulatory approvals, and established use in acute care settings supported this lead. Hospitals continued to prefer branded formulations due to consistent efficacy and lower variability in critical tumor lysis cases. Generic rasburicase grew at a steady pace as more manufacturers entered the market, but adoption remained slower because clinicians showed caution with substitutes in high-risk emergency care. Increased cost-saving policies in several markets encouraged gradual uptake of generics.

- For instance, a retrospective study of 186 oncology patients (both pediatric and adult) receiving rasburicase some from a generic manufacturer and some the innovator brand reported that in the prophylactic group, a single dose (1.5 mg) prevented development of clinical tumor‑lysis syndrome in 87% of cases and reduced 24‑hour uric acid levels by ~58.6% per dose.

By Indication

Tumor Lysis Syndrome (TLS) held the dominant position in 2024 with about 72% share. Rasburicase remained the preferred therapy for rapid uric acid reduction in high-burden malignancies, especially during induction treatment for hematologic cancers. Its fast action and strong clinical outcomes kept demand high in TLS management protocols. Leukemia accounted for the remaining share, supported by growing use in pediatric and adult acute leukemias. Rising diagnosis rates and increased chemotherapy cycles continued to drive segment expansion.

- For instance, in a phase 2 trial of adult patients with acute leukemia and baseline uric acid levels around 9.8 mg/dL, a single low dose of rasburicase (1.5–3 mg) led to 83% of patients achieving uric acid < 7.5 mg/dL within 24 hours, and nearly all (23 of 24) patients reached target uric acid after one or two doses.

By Distribution Channel

Hospital pharmacies led the distribution channel segment in 2024 with nearly 68% share. Rasburicase is primarily used in inpatient and emergency oncology settings, which strengthened hospital-based dispensing. Fast access requirements, cold-chain storage needs, and oncology team oversight supported this dominance. Retail pharmacies saw limited activity because rasburicase use is restricted to controlled clinical environments. Online pharmacies recorded marginal growth, mainly from markets expanding digital procurement for institutional buyers. Growing hospital admissions and rising TLS management protocols continued to fuel demand in the leading segment.

Key Growth Drivers:

Rising Incidence of Hematologic Malignancies

Growing cases of leukemia, lymphoma, and aggressive solid tumors continue to drive strong demand for rasburicase worldwide. These cancers increase the likelihood of Tumor Lysis Syndrome (TLS), a life-threatening emergency that requires rapid uric acid reduction. Hospitals rely on rasburicase due to its superior speed compared to allopurinol, especially during chemotherapy initiation. Higher diagnostic rates, improved cancer screening, and greater access to oncology treatment centers have expanded the pool of patients at risk of TLS. This rise pushes healthcare systems to maintain greater rasburicase availability, strengthening consistent market expansion across both developed and emerging regions.

- For instance, in a multicenter phase III trial among adults with hematologic malignancies, patients receiving Rasburicase (0.20 mg/kg daily) achieved plasma uric acid control (≤ 7.5 mg/dL) in a median of 4 hours, compared with 27 hours for those receiving Allopurinol alone.

Strong Clinical Preference for Rapid TLS Management

Clinicians prefer rasburicase for TLS cases because the drug delivers fast enzymatic breakdown of uric acid, often within hours. Its rapid onset and predictable response give hospitals a reliable tool during high-risk chemotherapy cycles. Oncology guidelines across major regions—including North America, Europe, and parts of Asia—clearly recommend rasburicase for high-tumor-burden patients. This strong endorsement reinforces product adoption in both adult and pediatric oncology centers. Broader use in induction therapies and emergency departments continues to lift utilization rates. As cancer care intensifies and treatments become more aggressive, the need for fast-acting TLS interventions remains a central growth driver.

- For instance, in a multicenter phase III trial among adults with hematologic malignancies at risk for TLS, patients receiving rasburicase (0.20 mg/kg/day) achieved plasma uric acid control (≤ 7.5 mg/dL) with a response rate of 87%, compared to 66% with allopurinol; and in hyperuricemic patients, time to uric acid control was 4 hours with rasburicase versus 27 hours with allopurinol.

Expanding Access to Oncology Infrastructure

Improved cancer care networks in emerging markets have increased patient access to specialized therapies, including rasburicase. New hospitals, oncology wings, and chemotherapy units in Asia-Pacific, the Middle East, and Latin America have raised the number of patients eligible for TLS management. Governments and private providers are investing heavily in cancer treatment programs, strengthening supply chains and procurement systems for essential drugs. As oncology services decentralize beyond major cities, more facilities adopt rasburicase protocols. This expansion broadens the market base, supports treatment standardization, and positions the drug as a core component of modern hematologic cancer management.

Key Trend & Opportunity :

Growth of Generics and Cost-Optimization Programs

The rise of generic rasburicase offers both pricing relief and expanded access across cost-constrained markets. Many healthcare systems, especially in Asia-Pacific and Latin America, are shifting toward pharmacoeconomic models that encourage generic adoption. As patents expire and more manufacturers enter production, competitive pricing creates opportunities for wider treatment coverage. This trend enables hospitals to stock higher volumes and treat more TLS patients without budget strain. The affordability of generics also opens opportunities for inclusion in national oncology guidelines, insurance reimbursement plans, and value-based care models that aim to improve outcomes with controlled spending.

- For instance, a retrospective study published in 2024‑2025 showed that administering a single fixed dose of 3 mg generic rasburicase effectively maintained reduced uric acid levels for up to 96 hours in high-risk TLS patients.

Integration of Rasburicase into Standard TLS Risk-Stratification Protocols

Hospitals increasingly incorporate rasburicase into structured TLS management pathways, especially for high-burden leukemia and lymphoma cases. Many cancer centers now use predictive algorithms and risk scoring tools to determine early rasburicase administration. This integration expands the drug’s use beyond emergency settings into planned treatment pathways. As oncology protocols become more standardized worldwide, demand rises for therapies with documented effectiveness and predictable outcomes. This shift creates opportunities for manufacturers to partner with hospitals for education programs, clinical audits, and improved dosing optimization that help streamline TLS management workflows.

- For instance, a 2025 multicenter cohort study of 1,019 hospitalized adults with TLS found that 554 patients (54.4%) received rasburicase within 12 hours of meeting TLS criteria and early treatment was associated with significantly lower odds of acute kidney injury requiring renal replacement therapy (AKI-KRT) or death.

Expansion of Pediatric Oncology Applications

Pediatric centers continue to adopt rasburicase for managing TLS in children with acute lymphoblastic leukemia and other aggressive cancers. Children have higher metabolic response rates to chemotherapy, making them more vulnerable to rapid tumor breakdown. Rasburicase offers a safer and faster option for controlling uric acid levels in these cases. Expanded pediatric oncology programs, better diagnostic rates, and higher survival-driven treatment intensity support this trend. The growing number of specialized children’s cancer hospitals in Asia-Pacific, North America, and Europe creates strong opportunities for increased rasburicase integration into pediatric care pathways.

Key Challenge:

High Treatment Cost and Limited Reimbursement

Rasburicase remains significantly more expensive than traditional therapies like allopurinol, limiting its adoption in low-income regions. Many hospitals struggle to balance cost against clinical benefits, especially when treating large patient volumes. In several markets, reimbursement coverage is inconsistent or restricted to very high-risk TLS cases. This financial barrier often results in underutilization despite strong clinical evidence. Budget constraints in public hospitals further delay procurement and restrict multi-dose administration. High cost remains one of the biggest hurdles preventing universal adoption, especially in resource-limited healthcare systems worldwide.

Cold-Chain and Handling Constraints

Rasburicase requires strict temperature-controlled storage and careful handling, creating challenges for hospitals in remote or low-infrastructure regions. Cold-chain failures increase the risk of reduced efficacy, forcing facilities to invest in specialized equipment and trained staff. These requirements limit the drug’s availability in small oncology centers and emergency departments with limited storage capabilities. Supply disruptions and logistics delays further impact consistent access, especially in regions with weaker pharmaceutical distribution networks. This challenge restricts market penetration and complicates expansion into developing healthcare systems.

Regional Analysis:

North America

North America held the largest share of the rasburicase market in 2024 with about 38% share. Strong adoption across major oncology centers, high prevalence of hematologic malignancies, and established TLS management guidelines supported regional dominance. Hospitals in the United States and Canada rely on rasburicase due to its rapid uric acid–lowering action in high-risk leukemia and lymphoma patients. Advanced reimbursement systems, robust oncology infrastructure, and widespread use in pediatric centers further increased utilization. Continued chemotherapy intensity and growing cancer incidence are expected to maintain steady demand across the region.

Europe

Europe accounted for nearly 29% share of the rasburicase market in 2024. Broad clinical adoption stemmed from strong guideline recommendations in Germany, France, the United Kingdom, and Italy for treating high-burden TLS cases. Oncology networks across the region maintain well-structured treatment pathways that support the use of rasburicase during intensive chemotherapy cycles. Increased pediatric leukemia diagnoses and strong government investment in cancer care enhanced use across hospitals. Expansion of generic formulations also supported access in budget-sensitive markets. The region’s focus on standardizing hematologic cancer management continues to reinforce stable demand.

Asia-Pacific

Asia-Pacific captured about 24% share of the rasburicase market in 2024, driven by rising leukemia incidence and expanding oncology infrastructure. Countries such as China, Japan, South Korea, and India saw increasing adoption as hospitals upgraded TLS treatment protocols. Rapid growth in pediatric oncology units and rising chemotherapy volumes contributed to higher demand. Although access varies across countries, improving healthcare spending and broader availability of generics enhanced regional penetration. Emerging cancer centers and stronger diagnostic networks support ongoing expansion, making Asia-Pacific one of the fastest-growing markets for rasburicase.

Latin America

Latin America held nearly 6% share of the rasburicase market in 2024. Growth came from improved cancer diagnosis rates and rising use of intensive chemotherapy across Brazil, Mexico, and Argentina. Oncology centers in major cities increasingly adopt rasburicase for high-risk TLS cases, though access remains uneven across rural regions. Gradual expansion of government-funded cancer programs supported demand, especially where pediatric leukemia burden is high. Limited reimbursement coverage and drug affordability challenges restricted wider penetration. However, expanding hospital networks and rising awareness of TLS management continue to push steady regional growth.

Middle East & Africa

The Middle East & Africa region accounted for around 3% share in 2024, reflecting limited but growing adoption. Leading markets such as Saudi Arabia, the UAE, and South Africa improved access through expanded oncology services and greater investment in specialized cancer hospitals. Rising leukemia incidence and increasing use of high-intensity chemotherapy drove clinical demand for rasburicase. However, cold-chain challenges, inconsistent reimbursement, and high treatment costs restricted broader uptake across low-resource countries. Despite these barriers, ongoing healthcare modernization and improved procurement systems are expected to support gradual market expansion.

Market Segmentations:

By Product Type

- Branded Rasburicase

- Generic Rasburicase

By Indication

- Tumor Lysis Syndrome (TLS)

- Leukemia

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the rasburicase market features a mix of global pharmaceutical leaders and regional manufacturers that strengthen supply availability and product accessibility. Companies such as Hikma Pharmaceuticals PLC, Sayre Therapeutics, AstraZeneca, G J Pharmaceuticals LLP, Takeda Pharmaceutical Company Limited, Manus Aktteva Biopharma LLP, Pfizer Inc., Merck KGaA, Trumac Healthcare, and Sanofi S.A. compete through strong oncology portfolios, expanded distribution networks, and adherence to stringent quality standards. Many players focus on improving manufacturing efficiency, widening hospital partnerships, and enhancing cold-chain logistics to support dependable rasburicase delivery. Growing demand for TLS management encourages investments in production capacity, clinical education programs, and broader presence in emerging markets. Competitive pressure intensifies with the gradual entry of generics, pushing companies to refine pricing strategies and strengthen regional procurement relationships. This dynamic environment supports steady innovation in supply reliability and market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In August 2023, Sanofi S.A.: Sanofi updated the Canadian Fasturtec product monograph and patient information, dated 31 August 2023. The revision reaffirmed indications for adult and pediatric cancer patients and strengthened guidance on serious hypersensitivity risks and uric-acid monitoring with rasburicase

- In June 2023, Trumac Healthcare: Growth Plus Reports profiled Trumac Healthcare as one of the prominent companies in the global rasburicase market. The analysis highlighted Trumac among key suppliers serving leukemia, lymphoma, and solid-tumor hyperuricemia indications.

- In February 2023, Sanofi S.A.: The Malta Medicines Authority issued a notice that supply of Fasturtec (rasburicase) 7.5 mg/5 ml would be constrained from March 2023 to July 2024, following information from the marketing authorisation holder, Sanofi. Authorities advised switching to the 1.5 mg vial presentation to maintain access for patients needing rasburicase.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Indication, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will grow steadily as cancer incidence continues to rise worldwide.

- Wider adoption of generics will expand access in cost-sensitive regions.

- Hospitals will integrate rasburicase more deeply into TLS treatment pathways.

- Pediatric oncology centers will increase usage due to rising leukemia diagnoses.

- Emerging markets will strengthen demand as oncology infrastructure improves.

- Manufacturers will enhance cold-chain logistics to support stable supply.

- Clinical guidelines will continue endorsing rasburicase for high-risk TLS cases.

- Increasing chemotherapy intensity will raise the need for rapid uric-acid control.

- Collaborations between drug makers and cancer centers will improve treatment protocols.

- Digital procurement platforms will support broader distribution and faster hospital access.