Market Overview:

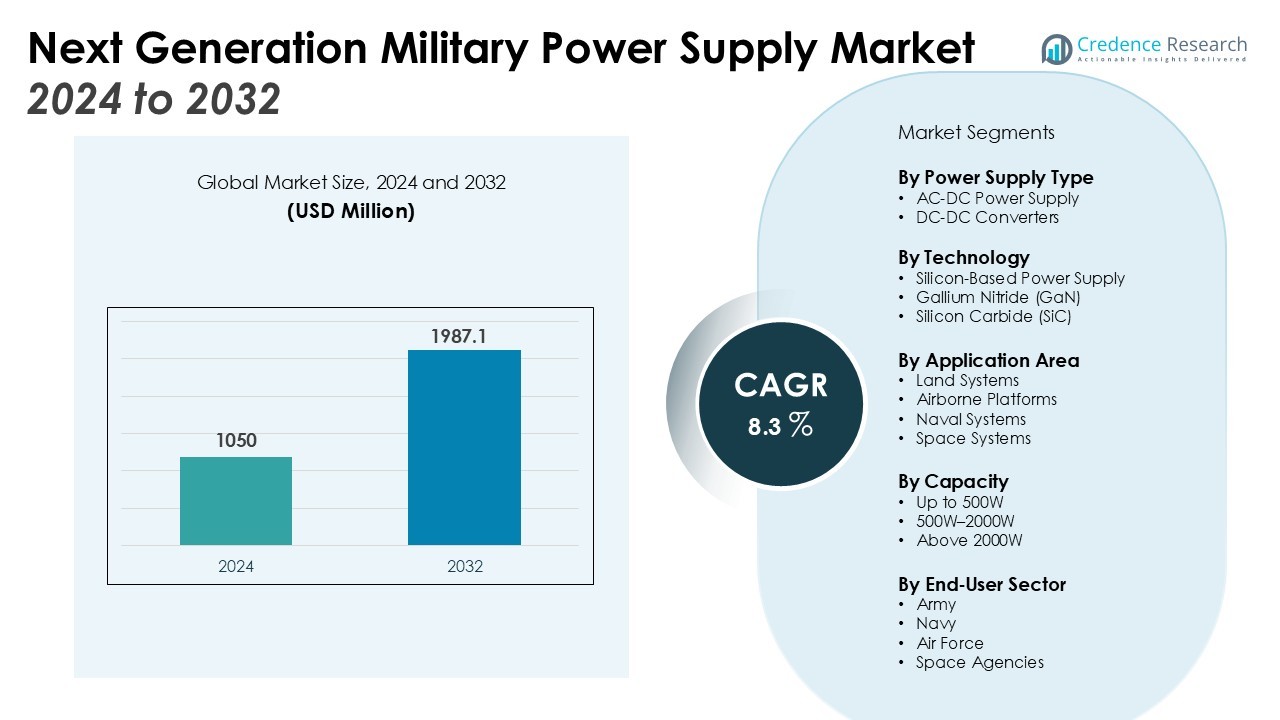

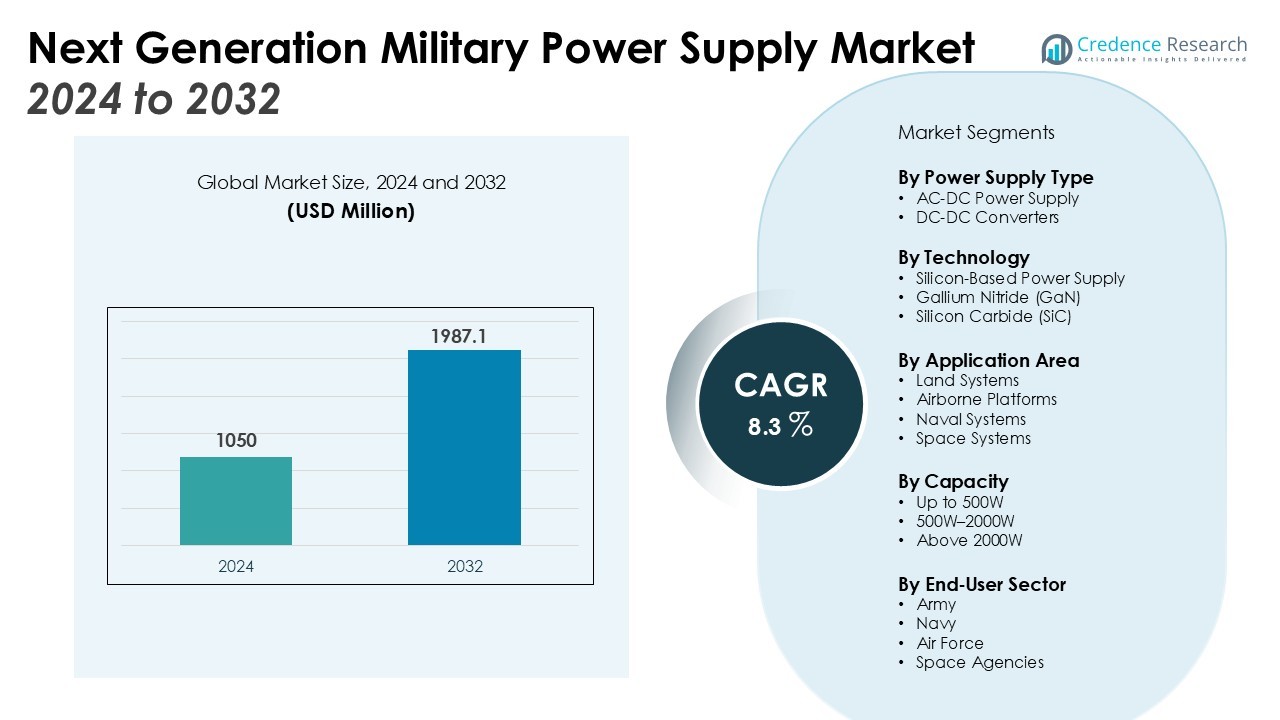

The Next Generation Military Power Supply Market size was valued at USD 1050 million in 2024 and is anticipated to reach USD 1987.1 million by 2032, at a CAGR of 8.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Next Generation Military Power Supply Market Size 2024 |

USD 1050 Million |

| Next Generation Military Power Supply Market, CAGR |

8.3% |

| Next Generation Military Power Supply Market Size 2032 |

USD 1987.1 Million |

Market growth is driven by the rising demand for compact, rugged, and high-efficiency power supplies that can withstand harsh environments. Defense forces are increasingly focused on solutions that support advanced electronics, unmanned vehicles, radar, and communication systems, which require stable and secure power delivery. Continuous investment in next-generation technologies, such as gallium nitride (GaN) and silicon carbide (SiC) semiconductors, is further enhancing efficiency, reducing weight, and extending mission endurance.

Regionally, North America holds the largest share due to extensive defense spending by the U.S. and ongoing modernization programs. Europe follows closely, supported by NATO-led initiatives and defense upgrades across Germany, the U.K., and France. Asia Pacific is the fastest-growing region, fueled by rising military budgets in China, India, and Japan, alongside regional security concerns. The Middle East is also emerging as a key market, driven by rising defense procurement and modernization initiatives across GCC nations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Next Generation Military Power Supply Market was valued at USD 1050 million and is projected to reach USD 1987.1 million at a CAGR of 8.3%.

- Market expansion is supported by rising demand for compact, rugged, and high-efficiency power supplies for harsh defense environments.

- Growth is fueled by advanced applications in unmanned platforms, radar, electronic warfare, and secure communication systems requiring stable power delivery.

- Continuous adoption of GaN and SiC semiconductors is improving efficiency, reducing weight, and enabling high-power density solutions.

- North America holds 42% share, driven by high defense spending, modernization programs, and a mature defense ecosystem.

- Europe captures 28% share, supported by NATO-led initiatives, defense upgrades, and increasing focus on energy-efficient power systems.

- Asia Pacific accounts for 21% share, emerging as the fastest-growing region due to rising military budgets and indigenous defense manufacturing.

Market Drivers:

Rising Demand for Advanced and Ruggedized Power Systems

The Next Generation Military Power Supply Market is expanding due to the rising need for compact, durable, and energy-efficient systems. Modern defense operations require power supplies that can withstand harsh environments such as extreme temperatures, shock, and vibration. These systems support critical functions in land, air, naval, and space missions where reliability cannot be compromised. Growing military reliance on high-performance electronics strengthens the demand for next-generation power supply solutions.

- For instance, Vicor’s DCM non-isolated regulated DC-DC converter modules support up to 2000 Watts of power with a 6-fold reduction in size compared to conventional converters, offering exceptional power density for military applications.

Increasing Deployment of Unmanned and Autonomous Defense Platforms

The rapid adoption of unmanned aerial vehicles (UAVs), ground systems, and autonomous naval platforms is driving market growth. These systems depend heavily on stable and efficient power delivery to maintain communication, navigation, and surveillance functions. The market benefits from rising investments in autonomous technologies that demand compact and lightweight power supplies. It is helping defense organizations enhance operational efficiency while extending mission capabilities.

Growing Emphasis on Electronic Warfare and Advanced Communication Systems

Electronic warfare, radar, and communication systems require uninterrupted and secure power to function effectively in combat scenarios. The Next Generation Military Power Supply Market is supported by increasing investments in advanced defense electronics designed for network-centric warfare. Rising threats in cyber and electronic domains push governments to prioritize resilient power infrastructure. It ensures seamless integration of advanced technologies into existing defense networks.

- For instance, Lockheed Martin’s AN/ALQ-217 Electronic Support Measures system provides full 360° radio frequency acquisition coverage across three bands with four antennas and four active front ends, ensuring powerful performance in dense environments and fast emitter identification.

Technological Advancements in Semiconductor and Power Conversion Materials

Innovations in gallium nitride (GaN) and silicon carbide (SiC) semiconductors are transforming the efficiency of military power supplies. These materials enable higher power density, reduced system weight, and improved thermal management. The market gains momentum as defense contractors adopt these technologies to meet modern combat requirements. It reflects a broader industry shift toward advanced materials that enhance performance while reducing maintenance costs.

Market Trends:

Integration of Smart Power Management and Modular Designs

The Next Generation Military Power Supply Market is witnessing a strong shift toward modular and intelligent power solutions. Defense organizations are adopting power systems with built-in diagnostics, predictive maintenance, and remote monitoring features to improve mission reliability. Modular designs allow easy scalability and faster deployment across diverse platforms, including aircraft, naval vessels, and ground vehicles. The demand for flexible architectures that reduce downtime and enhance adaptability is rising. It is also enabling militaries to customize power configurations based on specific mission requirements. Growing interest in digital control systems further highlights the importance of smart power management in improving efficiency and operational readiness.

- For instance, Leonardo DRS has fielded over 3,000 units of its Digital Vehicle Distribution Box (DVDB) within the Bradley Fighting Vehicle platform, which includes embedded diagnostics to monitor power lines and sensors, significantly enhancing operational reliability.

Adoption of Renewable and Hybrid Energy Solutions in Defense Applications

Global defense agencies are increasingly focusing on renewable and hybrid power supply technologies to reduce fuel dependency and enhance sustainability. The Next Generation Military Power Supply Market is benefiting from research efforts aimed at integrating solar, fuel cell, and hybrid energy systems into field operations. Militaries are deploying mobile microgrids and energy storage systems to power advanced electronics, radar, and command centers in remote or contested areas. It reflects a growing commitment to improving energy security while minimizing logistical risks related to fuel transport. The market is also observing a shift toward hybrid architectures that combine conventional and renewable sources to deliver reliable, uninterrupted power. This trend is strengthening the industry’s role in supporting greener and more resilient defense strategies.

- For instance, Schweitzer Engineering Laboratories (SEL) offers tactical mobile microgrids with the powerMAX control system that enables seamless parallel operation of multiple diesel generators, enhancing power resiliency and operational efficiency for forward operating bases.

Market Challenges Analysis:

High Development Costs and Stringent Compliance Requirements

The Next Generation Military Power Supply Market faces challenges linked to high development costs and strict regulatory compliance. Advanced designs using GaN and SiC semiconductors require significant investment in R&D and specialized manufacturing. Defense-grade power supplies must also meet rigorous standards for safety, reliability, and electromagnetic compatibility. These requirements increase costs and lengthen development timelines, creating barriers for smaller suppliers. It restricts broader adoption and slows product commercialization in certain regions. Rising procurement scrutiny further adds complexity to meeting diverse defense specifications.

Supply Chain Vulnerabilities and Technological Integration Issues

The market also struggles with supply chain disruptions and difficulties in integrating new technologies into legacy defense systems. Dependence on specialized raw materials and semiconductor components exposes the industry to delays and cost fluctuations. It complicates production planning and impacts timely delivery of critical equipment. Integrating modern power supplies with existing platforms is technically demanding and resource-intensive. The challenge grows as defense forces push for interoperability across land, sea, air, and space domains. Limited availability of skilled personnel in advanced power electronics further intensifies these constraints.

Market Opportunities:

Expanding Demand for Power Solutions in Emerging Defense Technologies

The Next Generation Military Power Supply Market holds strong opportunities with the rapid adoption of unmanned systems, directed-energy weapons, and advanced radar platforms. These technologies require compact, lightweight, and efficient power supplies capable of operating in demanding conditions. Governments are increasing defense budgets to support modernization programs that prioritize advanced electronic warfare and communication systems. It creates a favorable environment for manufacturers offering innovative and high-performance power solutions. Rising investments in hybrid energy systems and field-deployable microgrids also expand market potential across diverse missions. The growing need for reliable and flexible power delivery strengthens opportunities for both established and emerging suppliers.

Strategic Focus on Renewable and Energy-Efficient Defense Operations

The transition toward energy efficiency and renewable integration presents another avenue for market growth. The Next Generation Military Power Supply Market is benefiting from initiatives aimed at reducing fuel dependency and improving sustainability in field operations. Defense agencies are exploring hybrid systems combining traditional, renewable, and storage-based power supplies to enhance operational endurance. It enables militaries to lower logistical risks while ensuring uninterrupted mission capability. Growing emphasis on digital power management and smart control systems provides new prospects for technological innovation. The trend aligns with global defense strategies focused on greener, resilient, and future-ready military infrastructure.

Market Segmentation Analysis:

By Power Supply Type

The Next Generation Military Power Supply Market is segmented by power supply type, reflecting the diverse needs of modern defense systems. AC-DC power supplies dominate due to their extensive use in ground vehicles, naval systems, and communication platforms. DC-DC converters are witnessing strong demand for integration into advanced electronics, unmanned systems, and portable field equipment. It highlights the growing requirement for compact, lightweight, and high-efficiency solutions that can adapt to various mission conditions.

- For instance, Advanced Energy’s Evergreen™ Vento series offers a power density of 38 W/in³, delivering more power in less space for rugged military applications.

By Technology

By technology, the market is advancing through the adoption of gallium nitride (GaN) and silicon carbide (SiC) semiconductors. These materials deliver higher efficiency, improved power density, and better thermal management compared to conventional silicon-based systems. Their use reduces system weight while enhancing durability and performance in harsh environments. It strengthens the ability of defense organizations to deploy next-generation platforms with longer operational lifecycles.

- For instance, Qorvo’s GaN power amplifiers used in military radar systems achieve power outputs up to 150 watts per device, supporting advanced radar performance in extreme conditions.

By Application Area

By application area, the market serves land, air, naval, and space defense operations. Land systems hold a major share, driven by the demand for secure and reliable power in armored vehicles and tactical equipment. Airborne platforms, including fighter jets and UAVs, require lightweight, high-density solutions to maximize mission range. Naval and space segments are also expanding, driven by advanced radar, communication, and satellite systems that depend on uninterrupted and efficient power delivery.

Segmentations:

By Power Supply Type

- AC-DC Power Supply

- DC-DC Converters

By Technology

- Silicon-Based Power Supply

- Gallium Nitride (GaN)

- Silicon Carbide (SiC)

By Application Area

- Land Systems

- Airborne Platforms

- Naval Systems

- Space Systems

By Capacity

- Up to 500W

- 500W–2000W

- Above 2000W

By End-User Sector

- Army

- Navy

- Air Force

- Space Agencies

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Strong Position of North America Driven by Defense Modernization

North America accounted for 42% share of the Next Generation Military Power Supply Market. The region’s growth is supported by the U.S. Department of Defense’s high military spending and continuous modernization initiatives. The focus on advanced combat systems, electronic warfare, and unmanned platforms drives strong demand for rugged and efficient power supplies. Major defense contractors and technology providers contribute to innovation through significant investments in research and development. It ensures rapid adoption of GaN and SiC-based systems that improve energy efficiency and performance. The presence of a mature defense manufacturing ecosystem further strengthens the region’s leadership.

Europe’s Steady Growth Through NATO Initiatives and Defense Upgrades

Europe captured 28% share of the global market. The region benefits from NATO-led programs and national defense upgrades, especially in Germany, France, and the U.K. Heavy investments are directed toward next-generation power systems for aircraft, naval fleets, and ground-based platforms. The emphasis on secure communication, radar modernization, and electronic warfare enhances demand for reliable power delivery solutions. It also gains from collaborative projects between governments and defense technology firms. Europe’s defense industry focus on sustainability supports wider integration of energy-efficient systems.

Asia Pacific’s Rapid Expansion Supported by Rising Defense Budgets

Asia Pacific accounted for 21% share of the Next Generation Military Power Supply Market. The region’s growth is supported by rising defense budgets in China, India, Japan, and South Korea. Increasing investments in indigenous defense manufacturing and platform modernization drive regional expansion. Security concerns and border tensions push governments to prioritize advanced power technologies for mission readiness. It is creating strong opportunities for both domestic and international suppliers to expand. Growing adoption of hybrid and renewable-based power solutions reflects the region’s commitment to long-term energy security and operational resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- XP Power

- Advanced Conversion Technology

- Eaton Corporation

- Aegis Power System

- TDK-Lambda Americas

- Abbott Technologies

- AGMA Power Systems

- Mitsubishi Electric

- Energy Technologies

- Synqor

- Prime Power

- Powerbox Inteational

- Milpower Source

- Astrodyne TDI

Competitive Analysis:

The Next Generation Military Power Supply Market is highly competitive, driven by continuous innovation and rising defense investments. Leading companies focus on developing rugged, compact, and energy-efficient systems tailored to advanced defense applications. It emphasizes high reliability, extended durability, and compliance with strict military standards. Key players are expanding their portfolios with GaN and SiC-based solutions that offer higher power density, reduced weight, and improved thermal management. Strategic partnerships with defense agencies and long-term supply contracts strengthen their global presence. The market also reflects competition among established defense contractors and specialized electronics firms aiming to secure large-scale modernization projects. It highlights strong investment in R&D, product differentiation, and regional expansion to meet the evolving requirements of land, air, naval, and space defense operations.

Recent Developments:

- In June 2025, Advanced Conversion and W. L. Gore & Associates announced the start of volume production for high-temperature film capacitors, following a partnership agreement made in June 2024.

- In May 2025, Eaton launched the 9PX Gen2, a new uninterruptible power supply (UPS) system designed for data centers.

- In January 2025, Synqor, Inc. announced the release of its new military-grade, isolated, 3-phase power factor correction module, the MPFIC-115-3PD-28R-FG.

Report Coverage:

The research report offers an in-depth analysis based on Power Supply Type, Technology, Application Area, Capacity, End-User Sector and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of compact and rugged power supplies will strengthen operational readiness across diverse defense platforms.

- Growing reliance on unmanned aerial, ground, and naval systems will expand demand for lightweight and efficient solutions.

- Advancements in GaN and SiC semiconductors will enhance power density, reduce weight, and improve durability in harsh environments.

- Expansion of electronic warfare and secure communication systems will create continuous demand for resilient power delivery.

- Integration of smart monitoring and predictive maintenance features will improve efficiency and reduce downtime.

- Hybrid and renewable-based power systems will gain traction as defense agencies pursue sustainability and energy security.

- Increasing defense budgets in emerging economies will provide growth opportunities for global and regional suppliers.

- Collaboration between defense contractors and technology firms will accelerate innovation and deployment of next-generation systems.

- Interoperability requirements across land, air, naval, and space operations will drive development of standardized solutions.

- Strategic investments in R&D and supply chain resilience will shape long-term competitiveness in the market.