| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Book Paper Market Size 2024 |

USD 3,517.75 Million |

| North America Book Paper Market, CAGR |

4.29% |

| North America Book Paper Market Size 2032 |

USD 4,923.31 Million |

Market Overview:

The North America Book Paper Market is projected to grow from USD 3,517.75 million in 2024 to an estimated USD 4,923.31 million by 2032, with a compound annual growth rate (CAGR) of 4.29% from 2024 to 2032.

The North American book paper market is primarily driven by the resilience of print media, as physical books continue to be favored by readers for their tactile experience and collectability, despite the rise of digital formats. The educational sector plays a crucial role in maintaining steady demand for book paper, with a consistent need for textbooks, workbooks, and other educational materials in both K-12 and higher education institutions. Additionally, consumer preferences for physical books over digital alternatives remain strong, as many readers value the sensory experience of paper and the reduction of screen time. Technological advancements in printing technologies and paper production processes have further contributed to market growth, improving the efficiency and quality of book paper. Sustainability initiatives are also driving demand, with increasing consumer awareness of environmental concerns prompting a preference for recycled and sustainably sourced paper.

The North American book paper market is dominated by the United States, Canada, and Mexico, each contributing to the overall demand in distinct ways. The United States, as the largest market, benefits from a well-established publishing industry and high per capita paper consumption, driven by a strong educational system and a preference for printed books. Canada, with its high literacy rate and focus on education, is witnessing steady growth in book paper demand, particularly in the educational sector. It is projected to register the highest CAGR in the coming years. Meanwhile, Mexico, though smaller in comparison, is seeing growth driven by improving literacy rates and a growing publishing industry. As a whole, the North American region shows robust and diverse demand for book paper, influenced by both traditional and emerging factors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North American book paper market is expected to grow from USD 3,517.75 million in 2024 to USD 4,923.31 million by 2032, at a CAGR of 4.29%.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- The demand for print media remains strong, as physical books continue to be preferred by readers for their tactile experience, offering a connection that digital formats cannot replicate.

- The educational sector plays a pivotal role in driving the market, with steady demand for textbooks, workbooks, and educational materials in both K-12 and higher education institutions.

- Technological advancements in printing, such as digital and on-demand printing, have made production more efficient, allowing publishers to cater to niche markets with shorter print runs.

- Environmental sustainability is a significant trend, with increasing consumer demand for recycled and sustainably sourced paper, pushing paper manufacturers to adopt eco-friendly practices.

- Rising raw material prices, driven by supply chain disruptions and environmental regulations, pose a challenge to market growth, impacting both manufacturers and consumers.

- The growing preference for digital alternatives, such as e-books and audiobooks, is slowly reducing print media consumption, especially in non-essential categories like leisure reading.

Market Drivers:

Sustained Demand for Print Media

The North American book paper market is significantly driven by the continued preference for print media, despite the growing popularity of digital alternatives. Printed books remain a preferred medium for readers due to the tactile experience they offer, which cannot be replicated by digital formats. The physicality of books also provides a sense of permanence, and many readers still value the emotional connection and sensory aspects of handling a printed book. This sustained demand for physical books, particularly in genres like fiction, academic texts, and children’s literature, continues to fuel the demand for book paper in North America.

Educational Sector Requirements

The educational sector plays a vital role in driving the demand for book paper in North America. Textbooks, workbooks, and other educational materials are essential for both K-12 education and higher education institutions. The constant need for these educational resources ensures a steady consumption of book paper. With the expansion of online learning platforms and an increasing focus on hybrid learning models, the requirement for printed educational materials remains strong. Moreover, educational publishers are continuously producing updated editions of textbooks and reference books, further contributing to the demand for book paper.

Technological Advancements in Printing

Technological innovations in printing technologies and paper production processes are also key drivers of the book paper market in North America. For instance, Quad, a major U.S.-based printing company, has invested heavily in digital and offset printing technologies. Advances in digital printing, offset printing, and improved paper manufacturing techniques have made book production more efficient and cost-effective. These innovations allow for higher-quality printing at a lower cost, which is appealing to publishers. Additionally, modern printing techniques, such as on-demand printing, have facilitated smaller print runs, catering to niche markets and providing publishers with the flexibility to meet consumer demand more effectively. This increased efficiency and reduced production costs continue to stimulate the market for book paper.

Environmental Sustainability Trends

The growing emphasis on sustainability is another significant driver for the North American book paper market. Consumers and businesses alike are increasingly prioritizing environmentally friendly products, and this extends to the paper industry. Publishers and paper manufacturers are focusing on utilizing recycled materials and sustainably sourced paper, responding to rising consumer demand for eco-friendly options. Moreover, many publishers are adopting practices that minimize waste and reduce the environmental impact of their operations. For instance, Macmillan Publishers reports that about two-thirds of the paper used in its American market books is directly sourced, with 80% of that coming from sawmill residuals-demonstrating a commitment to resource efficiency and the continued scale of physical book production. This shift towards sustainable practices not only meets regulatory requirements but also aligns with the values of eco-conscious consumers, thus driving demand for book paper made from sustainable sources.

Market Trends:

Shift Towards Sustainable Paper Production

One of the key trends shaping the North American book paper market is the growing demand for sustainable paper production. Consumers and publishers alike are increasingly aware of the environmental impact of paper production, prompting a shift towards eco-friendly practices. This has led to the rise of recycled and sustainably sourced paper, as well as innovations in eco-friendly printing processes. Paper manufacturers are now focusing on producing paper with lower environmental footprints, using renewable energy and reducing water and chemical consumption during production. This trend aligns with the broader sustainability movement, as more publishers commit to reducing their carbon footprint and meeting consumer preferences for greener products.

Growth in Self-Publishing and Digital Printing

The rise of self-publishing and digital printing has had a significant impact on the North American book paper market. With advancements in digital printing technologies, authors and small publishers can produce books in smaller print runs at a lower cost, allowing for greater flexibility and customization. Self-publishing platforms have also seen significant growth, offering authors the opportunity to print their works on demand, which eliminates the need for large print runs and minimizes waste. For instance, in 2023 alone, Bowker reported that self-published titles with ISBNs rose 7.2% over the previous year, surpassing 2.6 million new titles-more than quadruple the number of traditionally published books in the same period. This trend has led to an increase in demand for short-run book printing, creating a niche market for on-demand book paper production. As self-publishing continues to gain traction, the book paper market is expected to experience growth in smaller, more personalized book production.

Rising Demand for Specialty Paper Types

Another notable trend in the North American book paper market is the increasing demand for specialty paper types. For instance, The U.S. Environmental Protection Agency notes that over 68% of paper consumed in the U.S. is recycled, creating opportunities for eco-friendly specialty paper products. Publishers are increasingly turning to unique, high-quality paper varieties for specific book formats, such as coffee table books, art books, and limited editions. These specialty papers offer enhanced durability, texture, and visual appeal, catering to niche markets that value premium products. Additionally, the demand for paper with specific attributes, such as improved brightness, opacity, and surface texture, has been growing, especially among high-end publishers and print shops. This trend reflects consumers’ desire for products that offer both functional and aesthetic value, driving the production and consumption of specialized book paper.

Integration of Technology in Paper Manufacturing

The integration of advanced technologies in paper manufacturing processes is another emerging trend in the North American book paper market. Automation and artificial intelligence (AI) are being increasingly used to optimize paper production, improve quality control, and reduce operational costs. Smart manufacturing systems allow for real-time monitoring of production processes, enabling manufacturers to detect issues quickly and make necessary adjustments. Additionally, AI-driven analytics are helping paper manufacturers predict market demand, optimize inventory, and streamline distribution. The adoption of these technologies not only boosts operational efficiency but also contributes to the overall sustainability of paper production by reducing waste and energy consumption. This technological integration is expected to continue shaping the future of the book paper market in North America.

Market Challenges Analysis:

Rising Paper Prices

One of the key restraints in the North American book paper market is the rising cost of paper production. The prices of raw materials such as wood pulp and chemicals have seen significant increases, driven by supply chain disruptions, environmental regulations, and rising energy costs. These price hikes have put pressure on paper manufacturers and publishers, who are forced to either absorb the costs or pass them on to consumers. For publishers, especially those with tight margins, this can limit profitability and may even lead to higher prices for consumers. The fluctuation in raw material costs creates uncertainty within the market, which can hinder growth and affect the affordability of book paper.

Environmental Regulations and Compliance

Another challenge faced by the North American book paper market is the growing complexity of environmental regulations. As demand for sustainable products rises, so too does the regulatory burden on paper manufacturers. Compliance with regulations related to waste management, water usage, and emissions control has become more stringent, requiring significant investment in eco-friendly technologies and processes. For instance, WestRock, a leading North American paper manufacturer, highlighted in its 2023 Environmental, Social, and Governance (ESG) Report that compliance with evolving environmental regulations has required significant investments in cleaner technologies and sustainable sourcing. While many manufacturers are adapting by switching to recycled materials and eco-friendly production methods, the costs associated with these investments can be prohibitive, particularly for smaller players in the market. These regulations add to operational costs, potentially stalling growth in the sector.

Digital Substitution and Decline in Print Media Consumption

The increasing shift towards digital media poses a significant challenge for the North American book paper market. While print books continue to be in demand, the digital transformation of media consumption is steadily reshaping consumer habits. E-books and audiobooks have gained popularity due to their convenience, lower costs, and increasing integration into digital devices. This trend has led to a gradual decline in print media consumption, particularly in non-essential categories, such as leisure reading and certain educational materials. The growing preference for digital alternatives restricts the potential for growth in the book paper market, especially as younger generations increasingly favor digital formats over physical books.

Market Opportunities:

The North American book paper market presents significant opportunities driven by the growing demand for sustainable products and innovations in printing technologies. As environmental concerns continue to rise, consumers and publishers are increasingly prioritizing eco-friendly materials. The shift towards recycled and sustainably sourced paper opens up new avenues for manufacturers to tap into the green market. Additionally, technological advancements in printing processes, such as digital and on-demand printing, create opportunities for shorter print runs and more efficient production. Publishers can produce customized, high-quality books at lower costs, catering to niche markets and addressing consumer demand for personalized products. This growing trend of sustainability, coupled with more efficient manufacturing techniques, positions the book paper market to capitalize on the increasing shift towards environmentally conscious consumption.

Another opportunity lies in the expansion of self-publishing and digital printing platforms. As more authors opt for self-publishing, the demand for smaller print runs and on-demand printing is expected to grow. Digital printing technology allows for greater flexibility in book production, enabling authors and small publishers to create cost-effective, high-quality prints without committing to large volumes. This trend is particularly attractive to independent authors and small publishing houses, further driving demand for book paper in these segments. Additionally, the rise of educational resources and the continued need for printed materials in the academic sector provide long-term opportunities for growth, especially as hybrid learning models continue to evolve. As such, the North American book paper market is well-positioned to leverage these opportunities for sustained expansion.

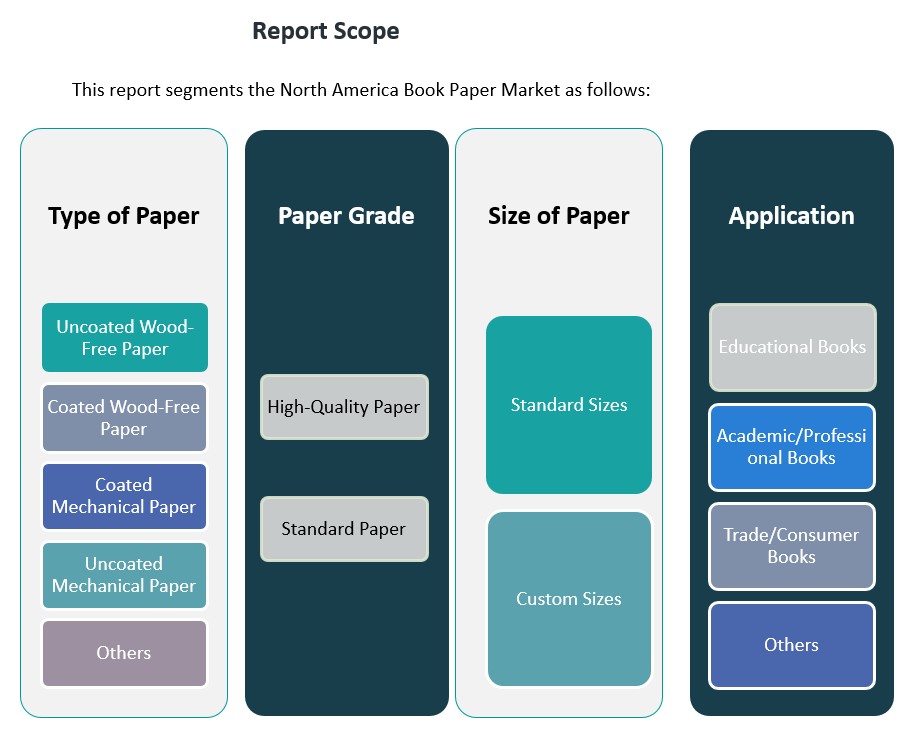

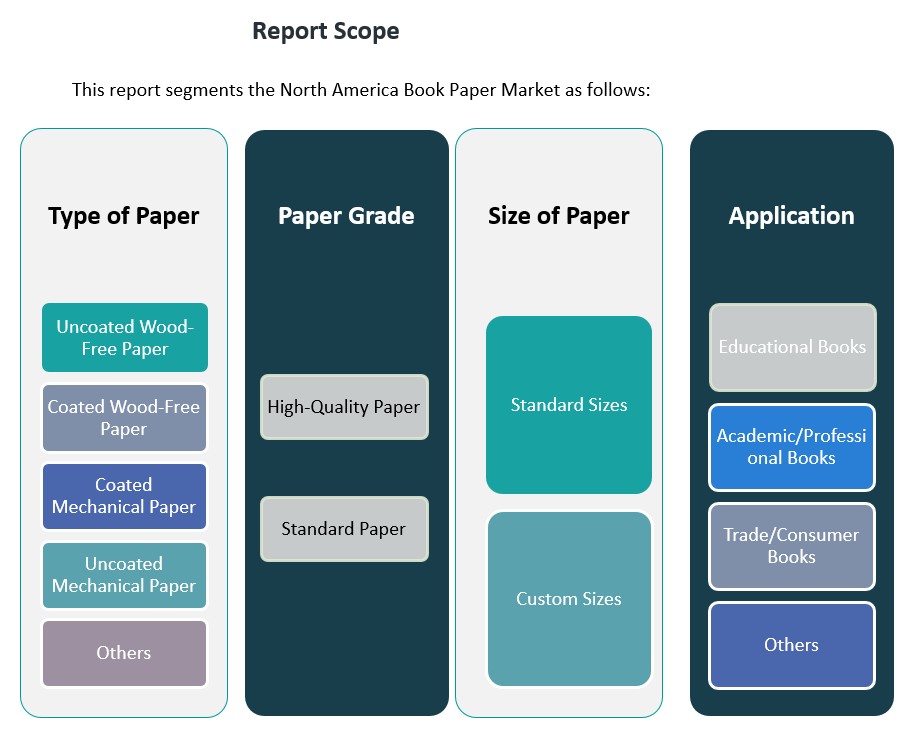

Market Segmentation Analysis:

The North American book paper market is diverse, with various segments driving demand based on paper type, grade, size, and application.

By type of paper, the market is primarily divided into uncoated wood-free paper, coated wood-free paper, coated mechanical paper, uncoated mechanical paper, and others. Uncoated wood-free paper dominates the market, known for its high-quality finish and suitability for a wide range of book types, including educational and trade books. Coated papers, both wood-free and mechanical, are preferred for books requiring high print quality, such as art books, coffee table books, and high-end publications.

By paper grade, high-quality paper accounts for a significant portion of the market, driven by the demand for premium products, especially in academic and professional books. Standard paper, while less expensive, is still widely used for mass-market trade and consumer books. The choice of paper grade depends on the specific requirements of the publication, balancing quality with cost efficiency.

By paper size, the market is divided into standard and custom sizes. Standard sizes are typically used for most books, while custom sizes cater to niche segments like art books, children’s books, and luxury editions.

By application, educational books lead the demand for book paper, followed by academic and professional books, where high-quality paper is crucial for durability and readability. Trade and consumer books also represent a substantial segment, with a preference for cost-effective, standard paper grades. This segmentation illustrates the variety of applications and the tailored nature of the North American book paper market.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The North American book paper market is primarily driven by the demand from the United States, Canada, and Mexico, each contributing uniquely to the overall market dynamics.

United States

The United States dominates the North American book paper market, accounting for over 70% of the region’s total market share. The U.S. has a well-established publishing industry, with a large number of educational, academic, and trade books produced annually. The country’s extensive educational system and high literacy rate ensure continued demand for textbooks and other printed materials. Additionally, the preference for physical books, particularly in academic and leisure reading segments, contributes significantly to the consumption of book paper. Technological advancements in printing processes, such as digital and on-demand printing, further fuel demand, especially in self-publishing and short-run printings. As sustainability concerns grow, there is also a rising demand for eco-friendly and recycled paper, which presents opportunities for manufacturers to cater to the environmentally conscious market.

Canada

Canada holds a smaller but growing share of the North American book paper market, representing approximately 15% of the region’s total market. The Canadian market is characterized by its high literacy rate and strong focus on education, which drives consistent demand for educational and academic books. Similar to the U.S., there is a significant preference for printed books, though the Canadian market is more likely to see growth in the demand for digital and on-demand printing technologies. Publishers in Canada are increasingly focusing on sustainable practices, using recycled paper and adopting eco-friendly production methods to meet consumer expectations. The growth in Canada’s publishing industry, particularly in bilingual and niche markets, provides further opportunities for book paper manufacturers.

Mexico

Mexico contributes to the North American book paper market with a smaller share of around 10%. The country’s growing literacy rate and expanding publishing industry present substantial opportunities for book paper demand. The Mexican market is still evolving but has witnessed steady growth in educational and academic sectors, particularly in the production of textbooks and professional reference materials. As Mexico continues to improve its educational infrastructure, the need for printed materials will rise, supporting the growth of the book paper market. Additionally, publishers in Mexico are increasingly adopting digital printing methods, which will contribute to a shift towards smaller print runs and more customized products, further driving demand for book paper.

Key Player Analysis:

- Penguin Random House

- HarperCollins

- WestRock

- Hachette Book Group

- Domtar

Competitive Analysis:

The North American book paper market is highly competitive, featuring a mix of global industry leaders and regional players. Major companies in the market are focused on producing various types of book paper, including uncoated and coated paper, to meet the needs of publishers across the region. These companies typically leverage strategic acquisitions, distribution networks, and advanced production techniques to maintain a strong market presence. Additionally, regional players have carved out niches by offering specialized products, including high-quality hardcover printing and services for both large publishers and independent authors. The market is also witnessing a trend toward consolidation, with larger companies merging to streamline operations and reduce costs, which indirectly benefits the book paper sector by optimizing supply chains. Overall, the competitive landscape is characterized by ongoing innovation, a growing emphasis on sustainability, and the pursuit of strategic partnerships to enhance market positioning.

Recent Developments:

- In April 2025, Penguin Random House highlighted its ongoing commitment to traditional print publishing, revealing that 50% of its sales still come from physical bookstores, despite the rise of digital and automated distribution channels. While the company continues to explore technological innovation, its core business in paper books remains robust, underscoring the enduring demand for print in North America.

- On April 8, 2025, Domtar and Pacific Woodtech Corporation (PWT) announced the long-term extension of their strategic distribution agreement. Under this partnership, Domtar will manufacture I-joists at its engineered wood facilities, which PWT will distribute under its brand, ensuring a seamless supply chain and enhanced product availability for customers throughout North America.

- In November 2024, Domtar also completed the acquisition of Iconex Paper’s point-of-sale receipt business, further strengthening its position as a leading supplier of paper-based products in the region. Iconex Paper, a major provider of POS receipt rolls, will continue to operate under Domtar’s management, expanding opportunities in the receipt paper market.

Market Concentration & Characteristics:

The North American book paper market exhibits moderate concentration, with a few dominant players controlling a significant portion of the market. Large companies, such as International Paper, Domtar, and Georgia-Pacific, hold substantial market shares due to their established presence, extensive production capabilities, and distribution networks. These companies benefit from economies of scale, allowing them to meet the demands of major book publishers across the region. However, the market also contains specialized regional players that cater to niche segments, such as high-quality hardcover printing and self-publishing services. The market is characterized by competitive pressures driven by factors such as sustainability concerns, the demand for eco-friendly paper options, and advancements in printing technologies. Innovation in production processes and increasing consumer preference for environmentally responsible products are shaping the competitive dynamics. As a result, companies in the market are focusing on sustainability, cost efficiency, and adapting to shifting consumer demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North American book paper market will continue to be driven by steady demand for printed educational materials.

- Increased adoption of digital and on-demand printing technologies will create growth opportunities for small print runs.

- Sustainability trends will lead to greater adoption of recycled and sustainably sourced paper in book production.

- Rising environmental concerns will prompt publishers to seek eco-friendly production methods and reduce waste.

- The demand for high-quality specialty papers for luxury and art books will fuel niche market growth.

- Technological advancements in printing processes will improve efficiency, reducing costs and enhancing production capabilities.

- The shift towards personalized and custom-sized books will cater to niche markets and self-publishing trends.

- The rise of e-books and digital formats may slow growth in certain segments of the market, especially for non-essential publications.

- Strategic mergers and acquisitions will further consolidate the market, creating stronger players with optimized supply chains.

- Growth in hybrid learning models will contribute to an ongoing need for printed educational resources, especially textbooks.