Market Overview

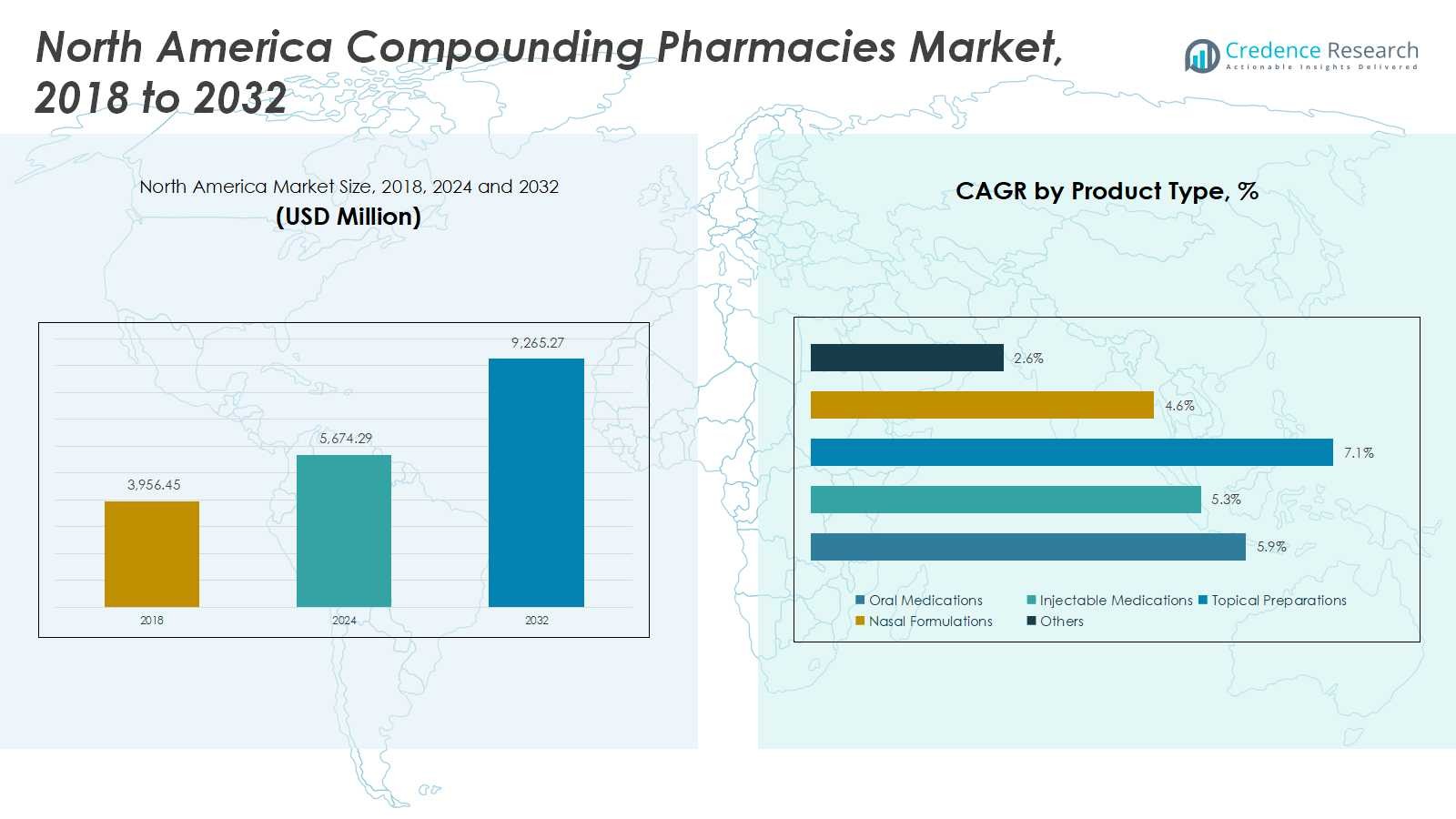

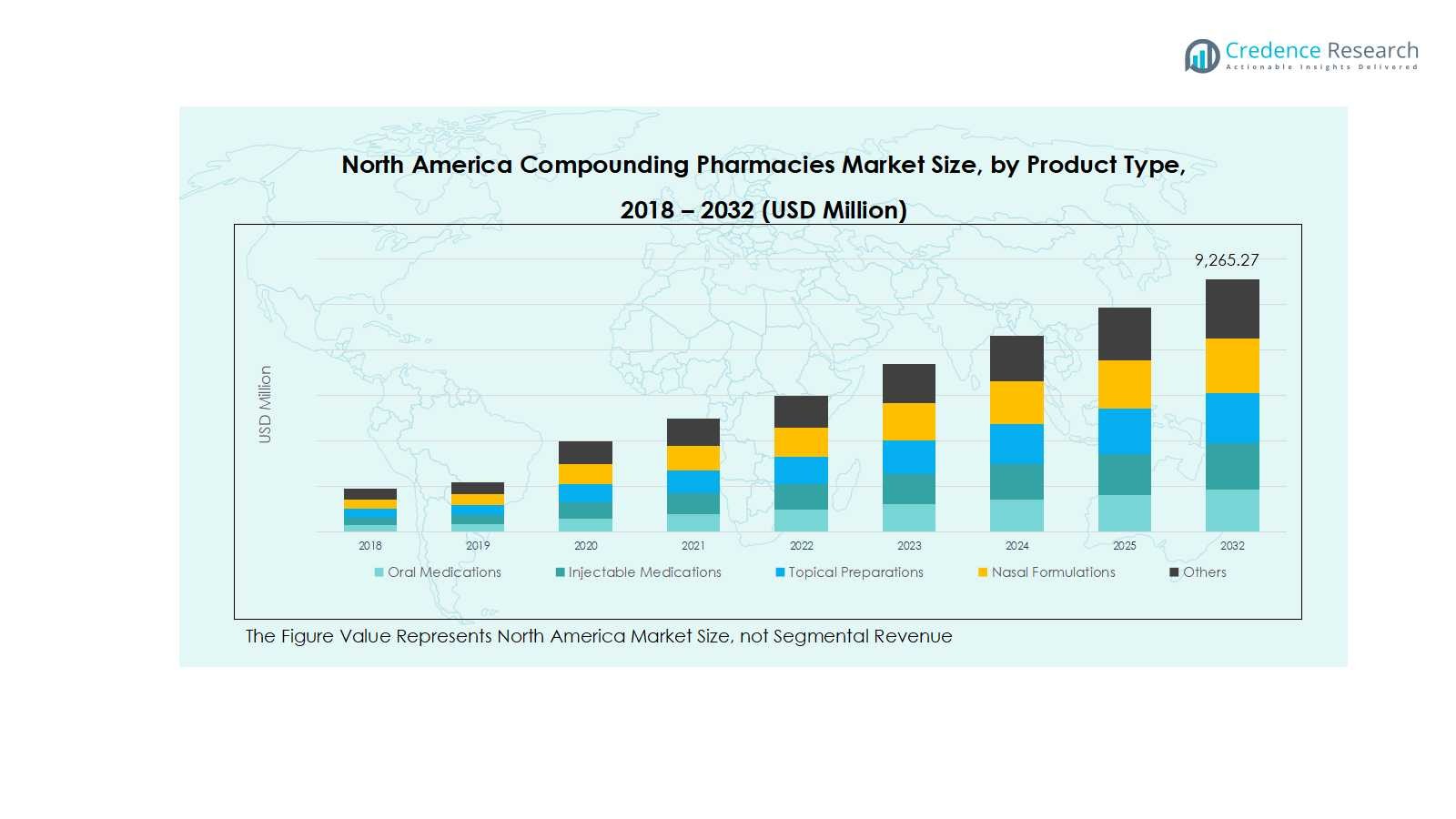

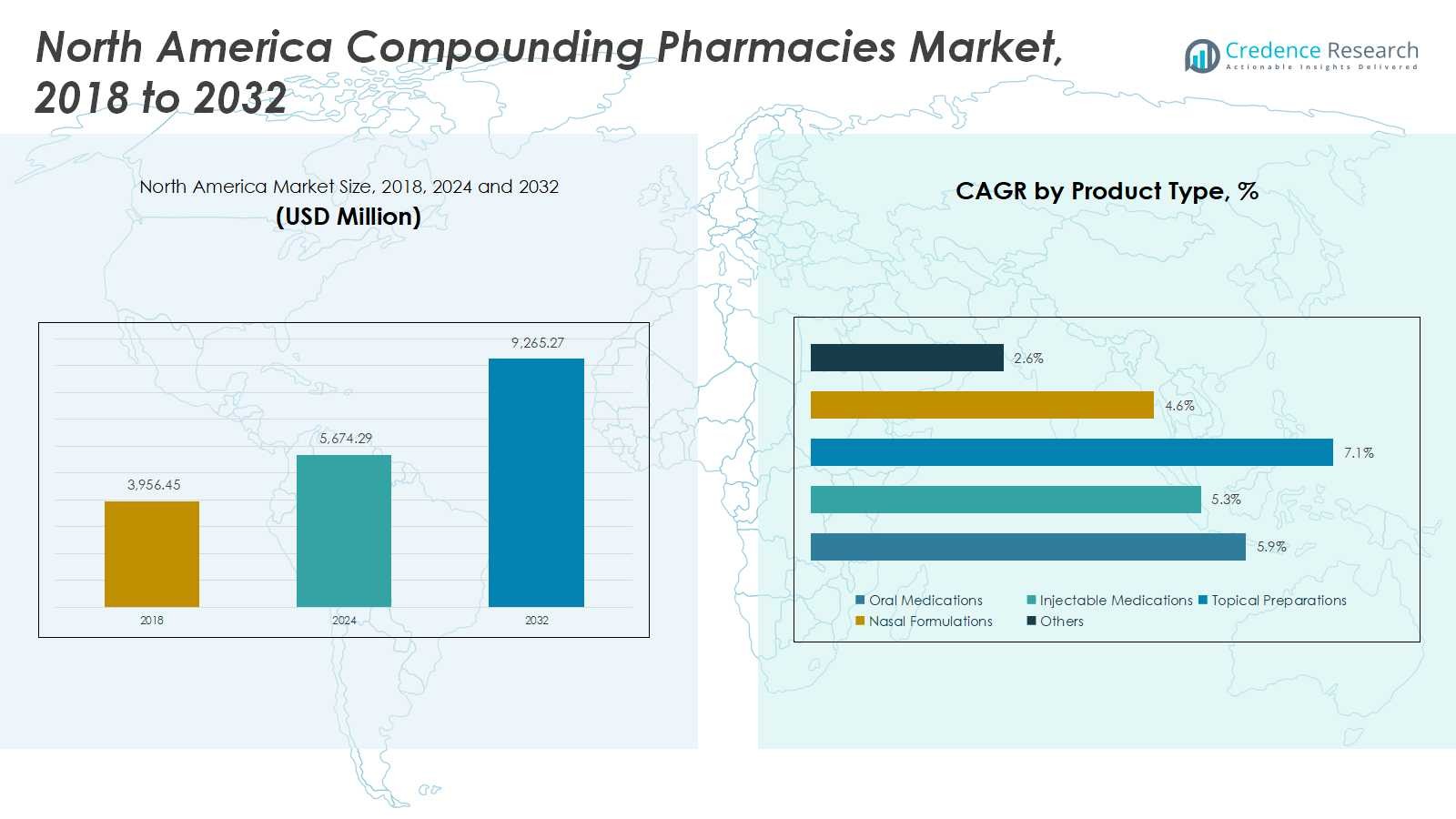

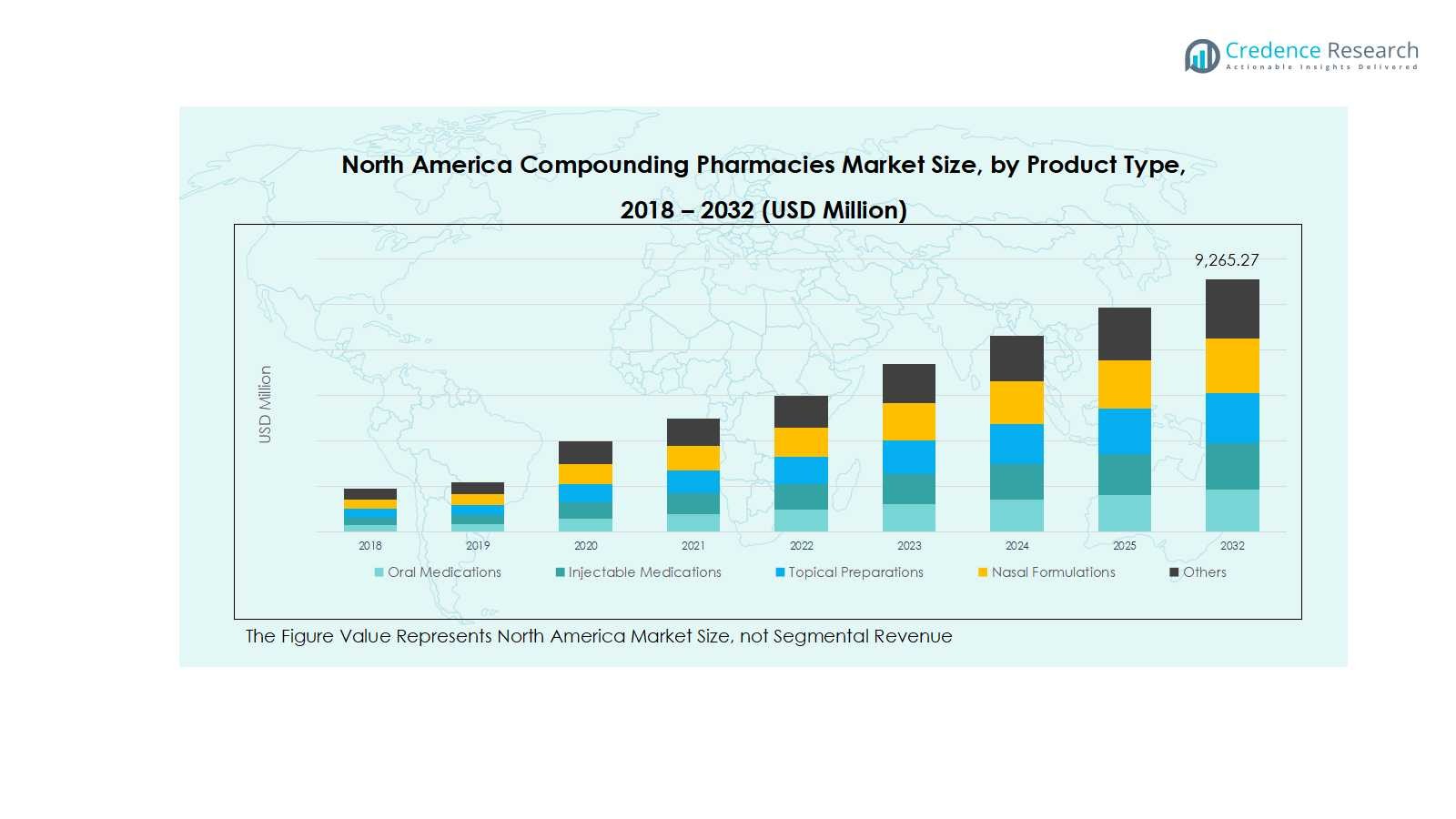

The North America Compounding Pharmacies Market size was valued at USD 3,956.45 million in 2018 and increased to USD 5,674.29 million in 2024. It is anticipated to reach USD 9,265.27 million by 2032, registering a CAGR of 5.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Compounding Pharmacies Market Size 2024 |

USD 5,674.29 Million |

| North America Compounding Pharmacies Market, CAGR |

5.89% |

| North America Compounding Pharmacies Market Size 2032 |

USD 9,265.27 Million |

The competitive landscape of the North America Compounding Pharmacies Market is shaped by key players such as Fagron N.V., Avella Specialty Pharmacy, Clinigen Group, CAPS, PharMEDium Services LLC, and Medisca Inc. These companies are focusing on expanding their product portfolios, enhancing quality control, and adopting advanced compounding technologies to meet increasing demand for personalized medicine. Strategic partnerships, acquisitions, and regulatory compliance remain central to their growth strategies. Regionally, the United States dominates the market, accounting for approximately 72% of the total share in 2024, driven by its advanced healthcare infrastructure, strong presence of specialized compounding facilities, and higher consumer awareness of customized pharmaceutical solutions. Canada follows, supported by an expanding base of independent compounding pharmacies and growing demand for tailored treatments. Overall, competitive differentiation hinges on innovation, quality assurance, and adherence to evolving safety standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Compounding Pharmacies Market was valued at USD 5,674.29 million in 2024 and is projected to reach USD 9,265.27 million by 2032, growing at a CAGR of 5.89% during the forecast period.

- Rising demand for personalized medications, increasing prevalence of chronic diseases, and expanding hospital and institutional outsourcing are the main drivers propelling the North America Compounding Pharmacies Market.

- Key trends include technological advancements in automated compounding systems, digital prescription integration, and increasing focus on pediatric and veterinary formulations to meet specialized patient needs.

- The market is moderately consolidated with leading players such as Fagron N.V., Avella Specialty Pharmacy, Clinigen Group, CAPS, PharMEDium Services LLC, and Medisca Inc., competing through product innovation, regulatory compliance, and strategic partnerships.

- Regionally, the United States leads with a 72% share, followed by Canada at 18% and Mexico at 10%, while oral medications dominate product type with over 35% market share, highlighting strong demand for tailored formulations.

Market Segmentation Analysis:

By Product Type:

In the North America Compounding Pharmacies market, oral medications held the dominant share of over 35% in 2024, driven by the high demand for customized capsules, tablets, and suspensions tailored to patient-specific dosage requirements. The segment benefits from increased prescriptions for chronic conditions and pediatric treatments that require precise formulations. Injectable medications followed closely, fueled by rising demand from hospitals and specialty clinics for sterile preparations. Meanwhile, topical and nasal formulations are gaining traction in dermatology and respiratory care, supported by the growing preference for localized and faster-acting therapies.

- For instance, injectable medications closely followed, with Baxter International launching 10 new injectable pharmaceutical products in the U.S. in 2024 alone, streamlining medication preparation and improving patient safety in critical care and oncology.

By Pharmacy Type:

The 503A pharmacies segment accounted for a larger market share of nearly 60% in 2024, attributed to their widespread presence and ability to meet patient-specific prescriptions from individual healthcare providers. These pharmacies serve diverse therapeutic needs, ensuring flexibility in compounding customized treatments. On the other hand, 503B outsourcing facilities are rapidly expanding, supported by the growing institutional demand for ready-to-administer sterile drugs and compliance with FDA quality standards. The rise of outsourcing trends among hospitals and clinics is expected to strengthen the 503B segment’s growth momentum during the forecast period.

- For instance, Belmar Pharma Solutions’ 503A facility has been providing individualized formulations tailored to patient allergies, dosages, and therapeutic needs since 1985, demonstrating flexibility in compounding customized treatments.

By Sterility:

Within the sterility segment, non-sterile compounding dominated the market with a share exceeding 55% in 2024, primarily due to the broad usage of creams, oral suspensions, and topical ointments in dermatology and hormone therapies. These products require simpler preparation processes and have lower regulatory complexities compared to sterile formulations. However, the sterile compounding segment is projected to witness significant growth, fueled by increasing hospital demand for injectable medications, ophthalmic solutions, and infusion therapies that require stringent aseptic conditions and advanced quality assurance practices.

Key Growth Drivers

Rising Demand for Personalized Medication

The growing emphasis on personalized treatment approaches is a major driver in the North America Compounding Pharmacies market. Patients increasingly seek customized formulations that address allergies, dosage adjustments, and alternative delivery forms not available in commercial drugs. This trend is particularly strong in pediatrics, geriatrics, and hormone replacement therapy, where individualized dosing is essential. Pharmacies offering tailored compounding solutions are gaining a competitive edge, as physicians and patients prioritize precision medicine to improve therapeutic outcomes and minimize adverse drug reactions.

- For instance, Walgreen Co. offers tailored hormone therapy medications for patients requiring specific dosages and formulations, addressing individual hormone imbalances that standard drugs cannot always meet.

Expanding Geriatric and Chronic Disease Population

The rising prevalence of chronic diseases and the aging population significantly boost demand for compounded medications. Older adults often require specialized dosages and combinations to manage complex health conditions such as diabetes, cardiovascular disorders, and arthritis. Compounding pharmacies cater to this need by formulating easier-to-administer dosage forms like transdermal creams or liquid suspensions. The increasing reliance on personalized care in long-term treatment plans continues to position compounding pharmacies as a critical link in chronic disease management across North America.

- For instance, Preston’s Pharmacy customizes hormone replacement therapy for elderly patients, providing tailored dosages and formulations to address hormonal imbalances and improve medication adherence

Growing Institutional and Hospital Demand

Hospitals and healthcare institutions are increasingly outsourcing drug preparation to licensed compounding facilities to meet regulatory standards and ensure patient safety. This outsourcing trend is a major growth driver, particularly benefiting 503B outsourcing facilities that provide sterile, ready-to-administer products. With rising scrutiny on drug safety and sterility, healthcare providers are shifting toward compliant compounders that maintain consistent quality and reliability. The demand for compounded injectables, ophthalmic solutions, and infusion therapies is reinforcing steady growth in institutional pharmacy collaborations.

Key Trends & Opportunities

Technological Advancements in Compounding Processes

Automation, digital prescription systems, and advanced formulation technologies are transforming the North America Compounding Pharmacies market. Modern equipment ensures enhanced precision, traceability, and sterility during production, reducing contamination risks and human error. The integration of software-driven quality control systems and robotic compounding units is further streamlining operations. These innovations not only enhance efficiency but also open opportunities for scaling production capacity, enabling pharmacies to handle higher prescription volumes while ensuring compliance with evolving FDA standards.

- For instance, companies like Fagron have introduced automated systems like the FagronLab™ series, which streamline the preparation of powders, liquids, and semi-solid formulations, reducing preparation time and ensuring consistency.

Increasing Focus on Veterinary and Pediatric Compounding

Growing awareness of specialized treatment needs in veterinary and pediatric care presents new market opportunities. Pet owners seek safer and more palatable compounded formulations for animals, while pediatric physicians prefer liquid or flavored medications to improve patient compliance. These niche segments are expanding rapidly due to limited availability of commercial drug options. Compounding pharmacies leveraging these opportunities with innovative formulations and dosage customization are likely to achieve sustained growth in these under-served yet lucrative segments.

- For instance, Zenith Pharmacy has integrated advanced automation in veterinary compounding, enabling precise dosing for small or exotic pets, improving safety and efficacy.

Key Challenges

Stringent Regulatory and Compliance Requirements

Compliance with evolving FDA and USP standards remains a major challenge for compounding pharmacies in North America. Frequent inspections, complex sterility requirements, and documentation demands increase operational costs and limit smaller players’ scalability. Non-compliance can result in warnings or facility shutdowns, impacting reputation and revenue. To stay competitive, compounding pharmacies must invest heavily in quality assurance, staff training, and technology upgrades, which can strain financial resources and slow expansion in a highly regulated environment.

Limited Insurance Reimbursements and High Production Costs

The lack of standardized insurance coverage for compounded medications poses a significant challenge. Many insurance providers classify compounded drugs as non-formulary or elective, leaving patients to bear the full cost. Combined with high production and material costs, this limits market accessibility and profitability. Pharmacies face increasing pressure to maintain affordability while ensuring compliance and quality. Addressing these cost and reimbursement barriers will be crucial for sustaining growth and expanding patient adoption across the North American compounding market.

Regional Analysis

United States

The United States dominated the North America Compounding Pharmacies market with a market share of 72% in 2024, driven by strong demand for personalized medications and advanced healthcare infrastructure. The country’s robust regulatory framework, coupled with a high prevalence of chronic diseases, continues to propel the need for customized dosage forms and sterile injectables. Increasing collaboration between hospitals and 503B outsourcing facilities further supports market expansion. Additionally, technological advancements in automated compounding systems and growing awareness among physicians and patients regarding tailored treatments are reinforcing the country’s leadership in the regional market.

Canada

Canada accounted for a market share of 18% in 2024, supported by growing adoption of compounded drugs across community pharmacies and specialty clinics. The market benefits from a rising preference for individualized therapies, particularly in dermatology, hormone replacement, and pediatric care. Increasing government initiatives to ensure quality and safety in compounding practices are strengthening industry confidence. Furthermore, the expanding geriatric population and higher incidence of lifestyle-related disorders are fueling the demand for customized formulations, while ongoing digitalization in pharmacy operations is improving prescription accuracy and service efficiency across the Canadian compounding landscape.

Mexico

Mexico captured a market share of 10% in 2024, driven by growing healthcare access, increasing patient awareness, and expanding private pharmacy networks. The country’s compounding sector is witnessing steady growth as healthcare professionals emphasize affordable and patient-specific medications to address unmet clinical needs. Demand is particularly strong for non-sterile preparations and hormone therapies. While regulatory frameworks are still developing, increasing investments in pharmaceutical manufacturing and partnerships with U.S.-based compounding firms are helping improve quality standards. Rising disposable income and enhanced healthcare infrastructure are further strengthening Mexico’s position within the North America Compounding Pharmacies market.

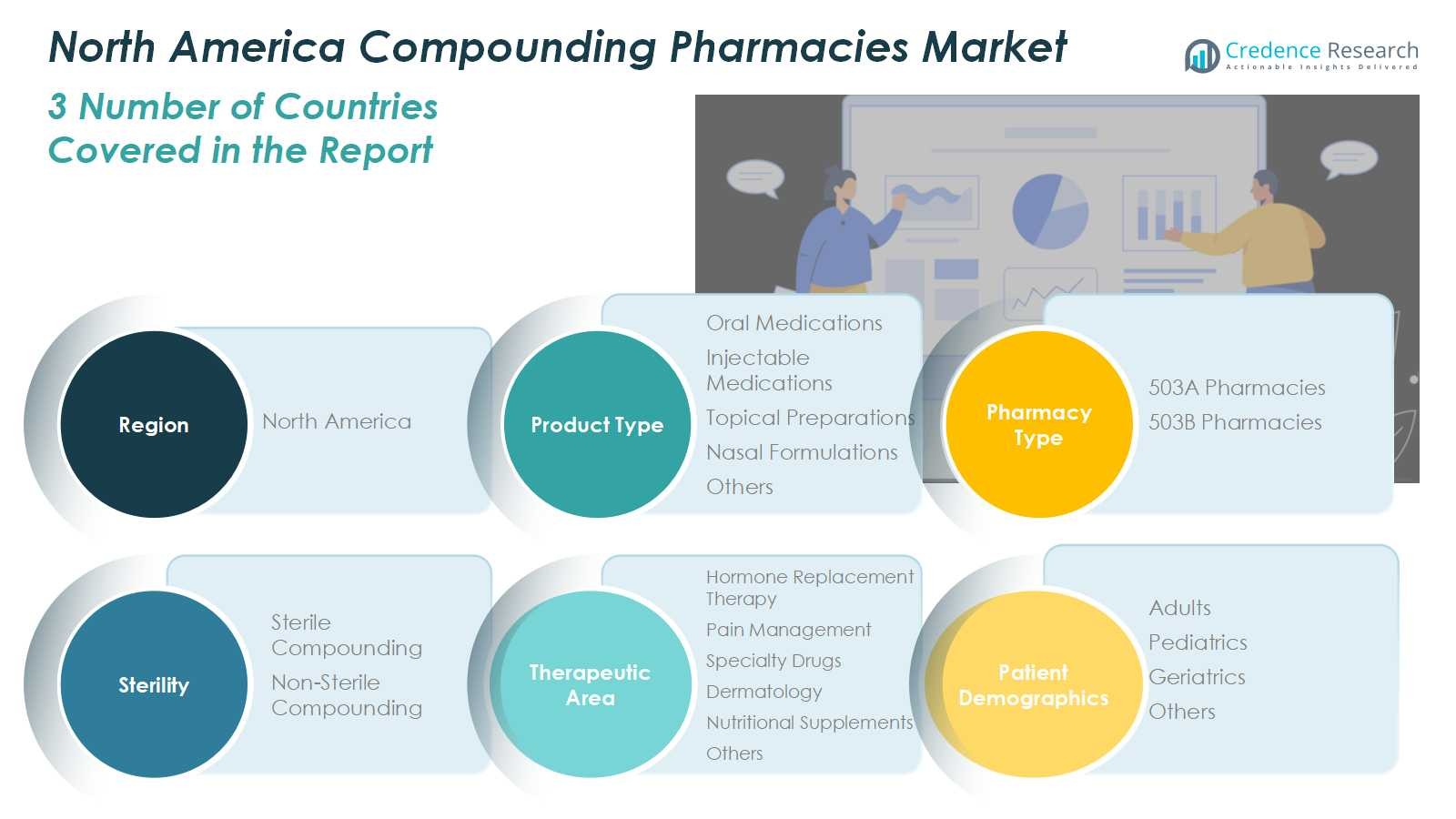

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulations

- Others

By Pharmacy Type

- 503A Pharmacies

- 503B Pharmacies

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- United States

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America Compounding Pharmacies market features major players such as Fagron N.V., Avella Specialty Pharmacy, Clinigen Group, Central Admixture Pharmacy Services Inc. (CAPS), Vertisis Custom Pharmacy, B. Braun Melsungen AG, PharMEDium Services LLC, PCCA, and Medisca Inc. These companies compete through product innovation, regulatory compliance, and advanced compounding capabilities. The market is moderately consolidated, with leading players investing heavily in sterile compounding facilities and automation technologies to enhance accuracy and safety. Strategic collaborations with hospitals and specialty clinics are strengthening distribution networks, particularly in 503B outsourcing. Moreover, expanding therapeutic portfolios and digital integration for prescription management are key growth strategies adopted by top firms. Continuous investments in R&D and compliance with stringent FDA and USP standards remain central to maintaining competitive advantage and ensuring consistent product quality across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fagron N.V.

- Avella Specialty Pharmacy

- Clinigen Group

- Central Admixture Pharmacy Services Inc. (CAPS)

- Vertisis Custom Pharmacy

- Braun Melsungen AG

- PharMEDium Services LLC

- 21st Century Pharmacy

- Professional Compounding Centers of America (PCCA)

- Medisca Inc.

Recent Developments

- In September 2025, Fagron N.V. acquired University Compounding Pharmacy (UCP), a 503A pharmaceutical compounder specializing in health and wellness in California.

- In February 2025, Clinigen Group expanded its collaboration with Essential Pharma to improve patient access in the JAPAC region.

- In 2025, Vertisis Custom Pharmacy continued offering customizable injectables and compounds for integrative and naturopathic treatments, enhancing its 503A pharmacy services.

- In September 2025, Clinigen Group acquired SSI Strategy to streamline the path from clinical strategy to global commercialization for biotech innovators.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand due to increasing demand for personalized and patient-specific medications.

- Technological advancements in automated compounding and digital prescription systems will enhance operational efficiency.

- Growing adoption of sterile compounding practices will strengthen partnerships with hospitals and healthcare institutions.

- Rising prevalence of chronic and age-related diseases will sustain long-term market growth.

- Regulatory compliance and quality assurance will remain central to maintaining industry credibility.

- Expansion of 503B outsourcing facilities will drive institutional demand for ready-to-administer formulations.

- Growing focus on pediatric and veterinary compounding will create new revenue opportunities.

- Strategic collaborations and acquisitions among key players will accelerate market consolidation.

- Increased awareness of customized hormone and pain management therapies will support specialty compounding.

- Continued digitalization and integration of AI-driven systems will improve accuracy, traceability, and patient safety.