Market Overview

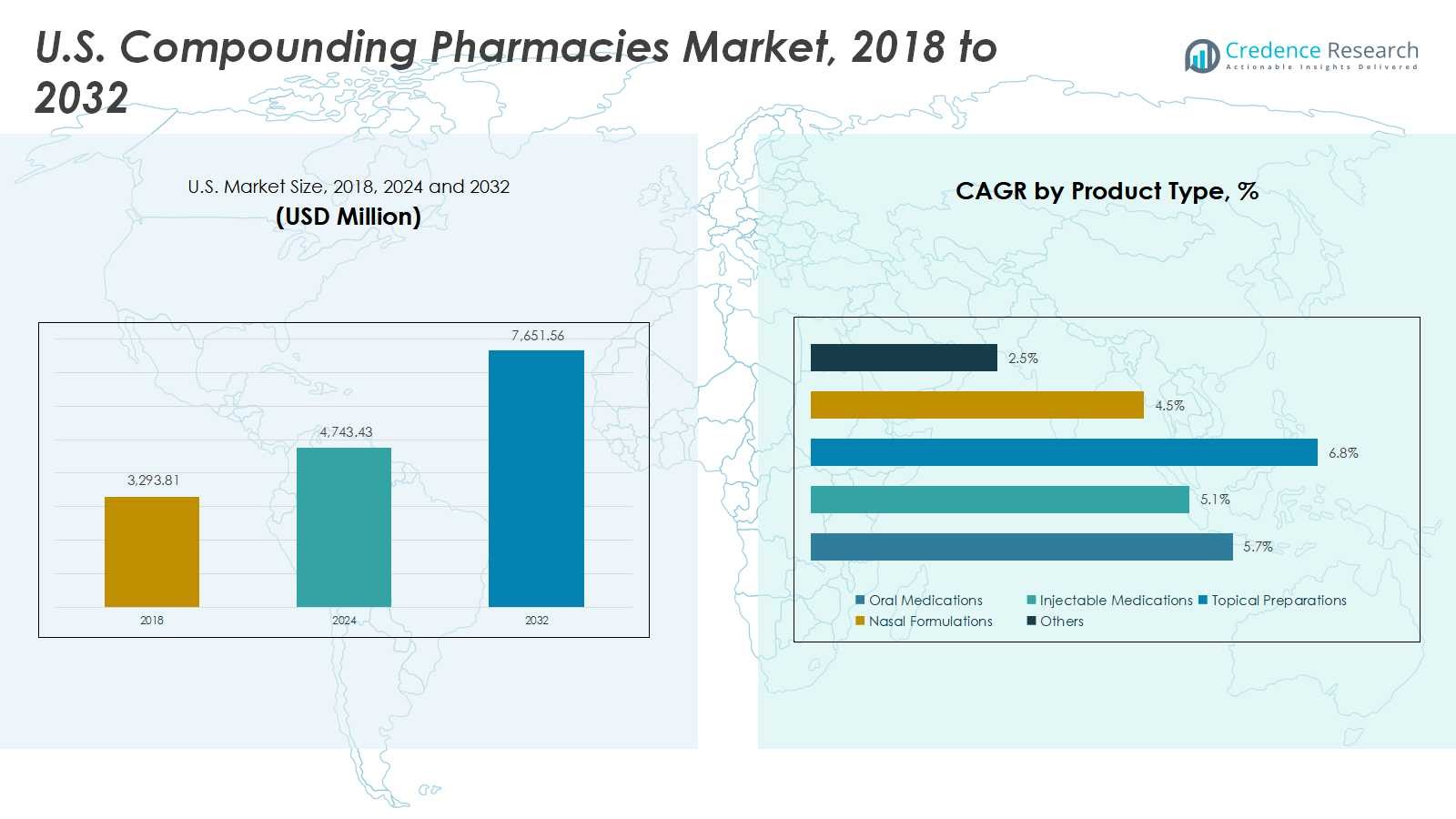

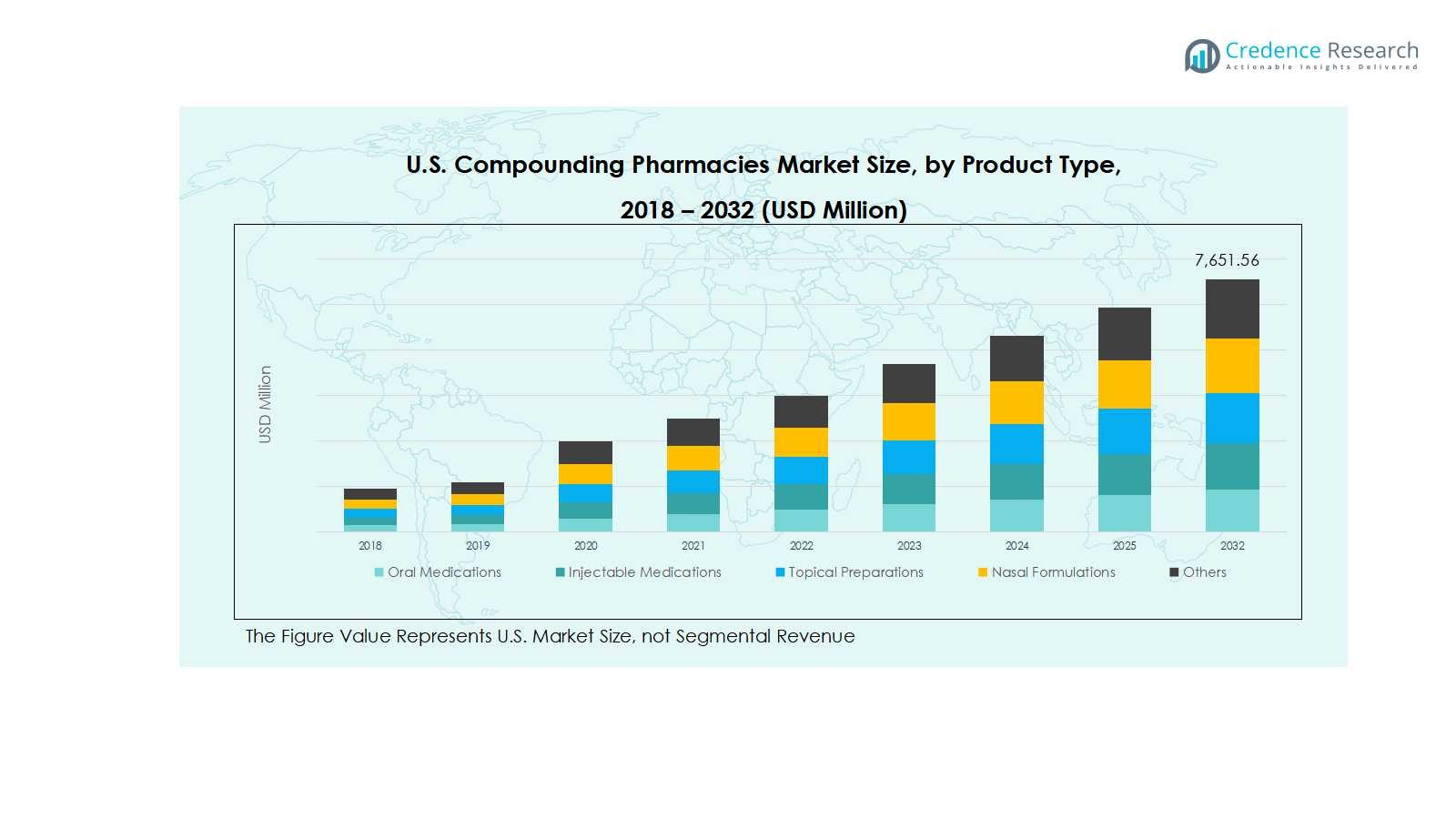

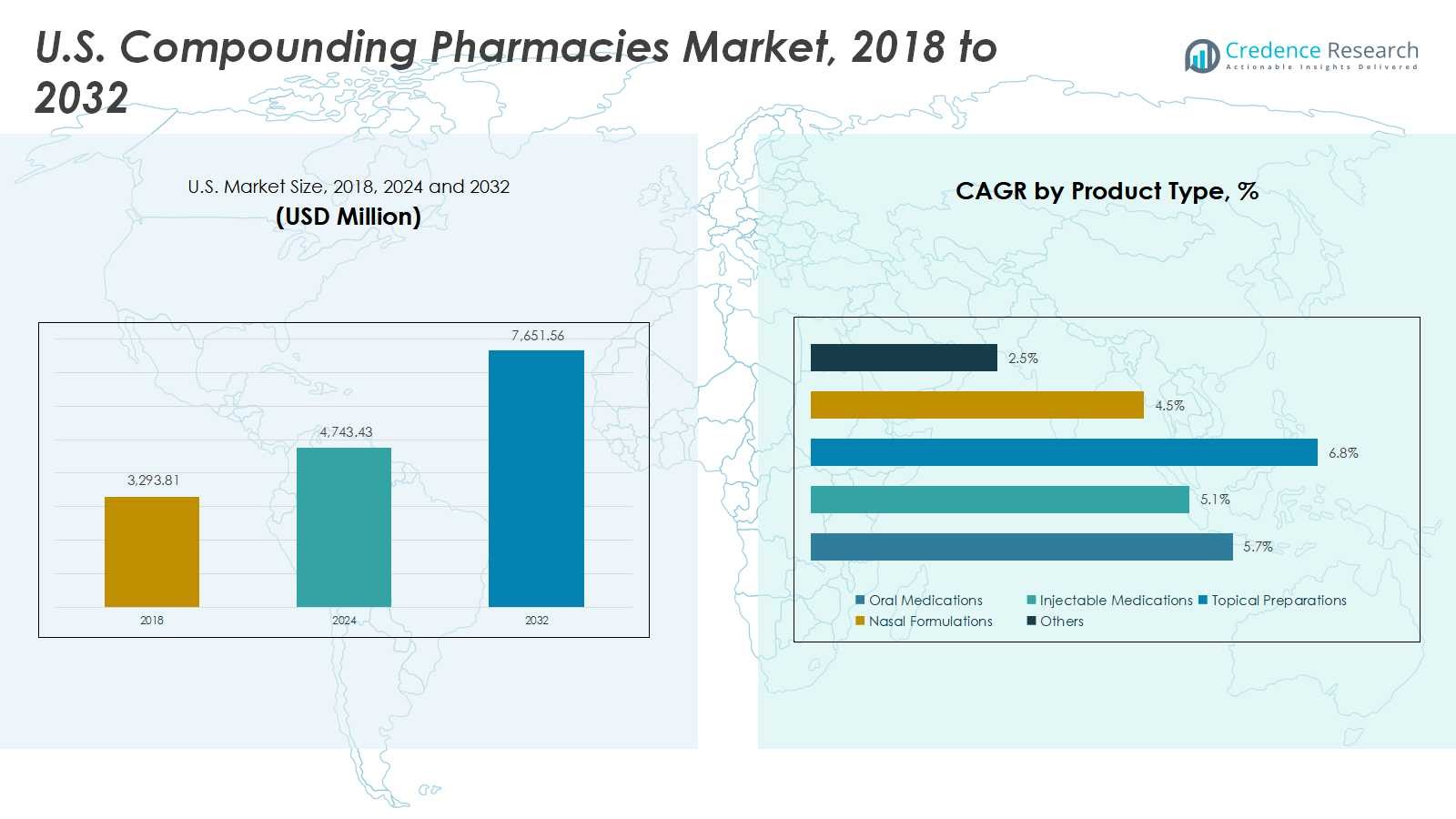

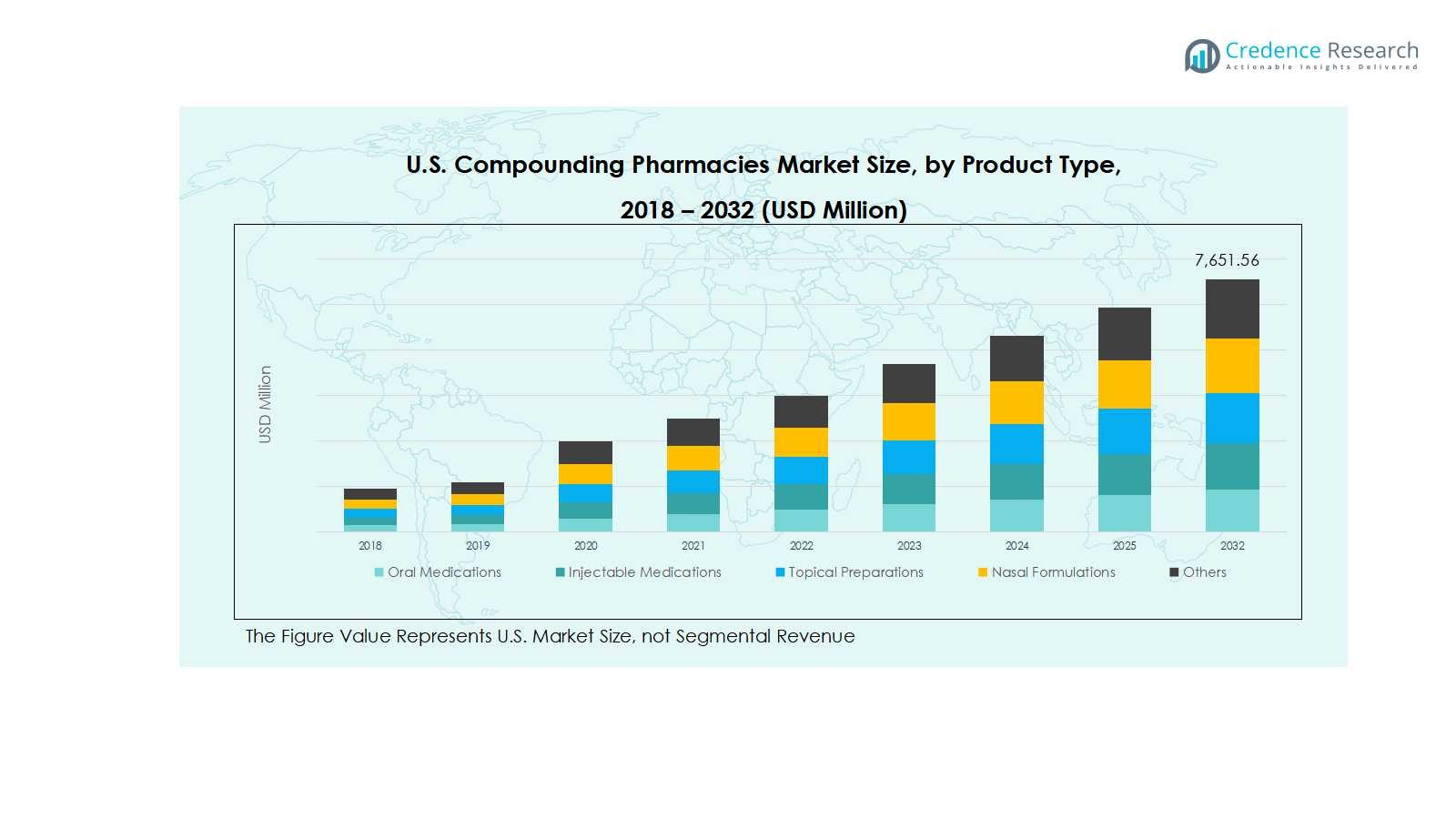

U.S. Compounding Pharmacies market size was valued at USD 3,293.81 Million in 2018, rising to USD 4,743.43 Million in 2024, and is anticipated to reach USD 7,651.56 Million by 2032, growing at a CAGR of 5.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Compounding Pharmacies market Size 2024 |

USD 4,743.43 Million |

| U.S. Compounding Pharmacies market, CAGR |

5.73% |

| U.S. Compounding Pharmacies market Size 2032 |

USD 7,651.56 Million |

The U.S. Compounding Pharmacies market is led by key players including Fagron N.V., Avella Specialty Pharmacy, Clinigen Group, Central Admixture Pharmacy Services Inc (CAPS), Vertisis Custom Pharmacy, B. Braun Melsungen AG, PharMEDium Services LLC, 21st Century Pharmacy, PCCA, and Medisca. These companies maintain strong positions through advanced sterile and non-sterile compounding services, strategic partnerships, and a focus on patient-centric formulations across oral, injectable, and topical medications. Regionally, the South dominates with a market share of 30%, followed by the Northeast at 28%, the Midwest at 22%, and the West at 20%. Growth is driven by rising chronic disease prevalence, aging populations, and the increasing demand for personalized therapies such as hormone replacement, pain management, and specialty drugs. Investment in technology, regulatory compliance, and innovative product offerings ensures sustained leadership and market expansion for these top players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The S. Compounding Pharmacies market was valued at USD 4,743.43 Million in 2024 and is projected to reach USD 7,651.56 Million by 2032, growing at a CAGR of 5.73%. Oral medications hold the largest product type share at 35%, while 503A pharmacies dominate pharmacy type at 60%, and sterile compounding leads sterility with 55%. Hormone replacement therapy accounts for 30% of the therapeutic area, and adults represent 50% of patient demographics.

- Growth is driven by rising demand for personalized medications, increasing chronic disease prevalence, and an aging population requiring patient-specific therapies.

- Key trends include technological advancements in compounding equipment and automation, and growing opportunities in pediatric and geriatric formulations.

- Competitive analysis shows top players such as Fagron N.V., Avella Specialty Pharmacy, Clinigen Group, CAPS, and Medisca focusing on partnerships, acquisitions, and innovation.

- Regionally, the South leads with 30% market share, followed by the Northeast at 28%, Midwest 22%, and West 20%.

Market Segmentation Analysis:

By Product Type

Oral Medications dominate the product type segment with approximately 35% market share, driven by ease of administration, growing prevalence of chronic diseases, and demand for patient-specific dosing. Injectable Medications follow closely, supported by increasing hospital and clinical applications. Topical Preparations and Nasal Formulations are witnessing steady growth due to rising dermatological treatments and localized therapies. Technological advancements in compounding processes and the need for customized formulations continue to fuel market expansion across all sub-segments.

- For instance, Pfizer’s PAXLOVID, an oral antiviral treatment for COVID-19, utilizes precise twice-daily dosing optimized for various patient renal functions, enhancing treatment efficacy and adherence.

By Pharmacy Type

503A Pharmacies lead the segment with around 60% share, attributed to their direct-to-patient compounding services and compliance with USP <795>/<797> standards. 503B Pharmacies are growing steadily by catering to hospitals and large-scale institutions with sterile preparations. In the sterility sub-segment, Sterile Compounding holds 55% market share, supported by rising demand for injectable and parenteral therapies, while Non-Sterile Compounding grows in dermatology and hormone replacement formulations. Safety regulations and patient-specific customization are key growth drivers in both pharmacy and sterility segments.

- For instance, SCA Pharma specializes in customized sterile injectable solutions serving hospitals and surgery centers nationwide.

By Therapeutic Area

Hormone Replacement Therapy dominates the therapeutic area segment with 30% market share, driven by aging populations and increasing awareness of personalized hormone treatments. Pain Management and Specialty Drugs contribute significantly due to rising chronic pain prevalence and demand for specialty therapies. Within patient demographics, Adults account for 50% share, reflecting high demand for chronic care and customized medications. Pediatrics and Geriatrics are emerging sub-segments, benefiting from growing focus on patient-centric formulations and tailored therapies across age groups.

Key Growth Drivers

Rising Demand for Personalized Medications

The U.S. compounding pharmacies market is significantly driven by increasing demand for personalized medications tailored to individual patient needs. Patients with chronic illnesses, allergies, or specific dosage requirements prefer customized therapies, enhancing the adoption of compounded oral, injectable, and topical medications. This trend is reinforced by growing awareness among healthcare providers and patients about the benefits of personalized therapies in improving treatment outcomes. Consequently, the market sees steady growth, particularly in hormone replacement therapy, pain management, and specialty drug segments, where patient-centric care is critical.

- For instance, B. Braun provides advanced compounding solutions that enhance patient care across various therapies, including sterile compounded medications tailored to individual patient needs.

Expansion of Sterile Compounding Services

Sterile compounding, including injectable and parenteral formulations, is a major growth driver, accounting for over 55% of the sterility segment. Hospitals, clinics, and long-term care facilities increasingly rely on sterile compounded medications for complex treatments. Regulatory compliance, adherence to USP <797> standards, and the need for safe, customized sterile preparations contribute to market expansion. Additionally, the rise in chronic disease prevalence and specialized therapies necessitates sterile compounding services, encouraging pharmacies to invest in advanced infrastructure and skilled personnel to meet growing clinical demands.

- For instance, Pfizer CentreOne is recognized for its expertise in complex sterile manufacturing, meeting high safety and regulatory standards to produce customized sterile injectables for specialized therapies.

Aging Population and Increasing Chronic Diseases

The aging U.S. population and rising prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and hormonal imbalances, drive compounding pharmacy growth. Older adults often require customized doses or alternative formulations that are not commercially available, boosting demand for patient-specific therapies. This demographic trend fuels the growth of hormone replacement, pain management, and nutritional supplement formulations. Additionally, awareness campaigns and physician recommendations for individualized treatment further support market expansion, ensuring that compounding pharmacies remain a crucial element in personalized healthcare delivery.

Key Trends & Opportunities

Technological Advancements in Compounding

The adoption of advanced compounding technologies, including automated dispensing systems, sterile compounding equipment, and digital prescription platforms, presents a significant opportunity for U.S. pharmacies. These innovations enhance accuracy, reduce preparation time, and improve patient safety. Integration of technology also supports remote prescription management and telepharmacy services, expanding reach to underserved populations. Market players leveraging technological solutions can optimize operations, increase efficiency, and meet growing demand for customized medications, particularly in injectable, topical, and hormone replacement therapies, creating a competitive advantage.

- For instance, BD’s Rowa Vmax robotic pharmacy system is widely used across Europe and by health systems like Henry Ford Health, providing 99.9% reliability in automated storage and dispensing, thus optimizing pharmacy workflow and resource allocation.

Growing Focus on Pediatric and Geriatric Formulations

Targeting pediatric and geriatric patients presents a promising opportunity, as these demographics require specialized dosing and formulations not typically available in standard pharmaceuticals. Compounding pharmacies can capitalize on this unmet need by offering age-appropriate oral liquids, transdermal gels, and other customized preparations. Rising awareness among caregivers and healthcare professionals about the benefits of personalized therapies further supports this trend. Expanding into these patient segments allows pharmacies to diversify their product offerings, enhance market penetration, and strengthen their position in the U.S. personalized medication landscape.

- For instance, Abbott Laboratories leads innovations in geriatric nutrition globally, developing science-backed products targeting malnutrition and muscle loss to address the unique needs of the elderly.

Key Challenges

Stringent Regulatory Compliance

Compounding pharmacies face challenges due to strict regulatory requirements enforced by the FDA and state boards. Compliance with USP <795>, <797>, and <800> standards, along with regular inspections, increases operational complexity and costs. Failure to meet these guidelines can lead to penalties, recalls, or business shutdowns. Smaller pharmacies may struggle to invest in sterile facilities, skilled personnel, and documentation systems necessary for regulatory adherence. Navigating this complex regulatory landscape remains a critical challenge, requiring continuous training, monitoring, and investment to maintain market credibility and patient safety.

Quality Control and Safety Concerns

Maintaining consistent quality and safety is a persistent challenge in the U.S. compounding pharmacies market. Errors in formulation, contamination, or improper handling of sterile medications can lead to severe patient health risks and legal liabilities. The need for rigorous quality control protocols, standardized procedures, and skilled compounding pharmacists adds operational pressure. Market growth is contingent upon building patient trust and ensuring safe, reliable medications. Addressing these challenges through advanced equipment, robust SOPs, and continuous staff training is essential for sustaining growth and mitigating risks in a highly regulated market.

Regional Analysis

Northeast U.S.

The Northeast region leads the U.S. compounding pharmacies market with a market share of 28%, driven by high population density, well-established healthcare infrastructure, and increasing adoption of personalized medications. States such as New York, Massachusetts, and Pennsylvania host numerous specialty and hospital-affiliated pharmacies focusing on hormone replacement, pain management, and sterile compounding services. Rising awareness among patients and physicians regarding customized therapies further supports growth. Additionally, the region benefits from stringent regulatory oversight, ensuring safety and quality, which enhances patient trust. Continuous investment in advanced compounding technologies also strengthens the Northeast’s position as a key market contributor.

Midwest U.S.

The Midwest accounts for 22% of the U.S. compounding pharmacies market, reflecting steady demand across both urban and rural healthcare facilities. States including Illinois, Ohio, and Michigan have witnessed growth in 503A and 503B pharmacies providing sterile and non-sterile compounded medications. The market is driven by increasing chronic disease prevalence, an aging population, and the expansion of specialized treatments like hormone replacement and dermatology preparations. Strong partnerships between pharmacies and hospitals, combined with regulatory compliance, support consistent market growth. Investment in customized oral, injectable, and topical medications continues to enhance patient-centric care, strengthening the Midwest’s contribution to the national market.

South U.S.

The Southern U.S. represents 30% of the national market, making it the largest regional contributor. States such as Texas, Florida, and Georgia show high demand for personalized medications, including injectable and oral therapies, driven by population growth and rising chronic disease incidence. The presence of large hospital networks and specialty pharmacies enhances access to sterile and non-sterile compounding services. Hormone replacement therapy, pain management, and nutritional supplements are major revenue-generating segments. Expanding awareness of patient-specific care and adoption of advanced compounding technologies further propel regional growth. The South continues to attract significant investments from leading market players targeting large patient populations.

West U.S.

The Western region contributes 20% to the U.S. compounding pharmacies market, supported by states like California, Washington, and Arizona, which have strong healthcare infrastructure and high patient demand for customized therapies. Growth is fueled by an aging population, rising chronic diseases, and increasing preference for personalized oral, injectable, and topical medications. Sterile compounding services are particularly prominent in urban centers, while rural areas benefit from 503A pharmacies. Technological adoption, regulatory compliance, and innovative therapeutic formulations strengthen the West’s market position. Focus on patient-centric treatments, including hormone replacement and specialty drugs, ensures sustained growth and competitive advantage in the region.

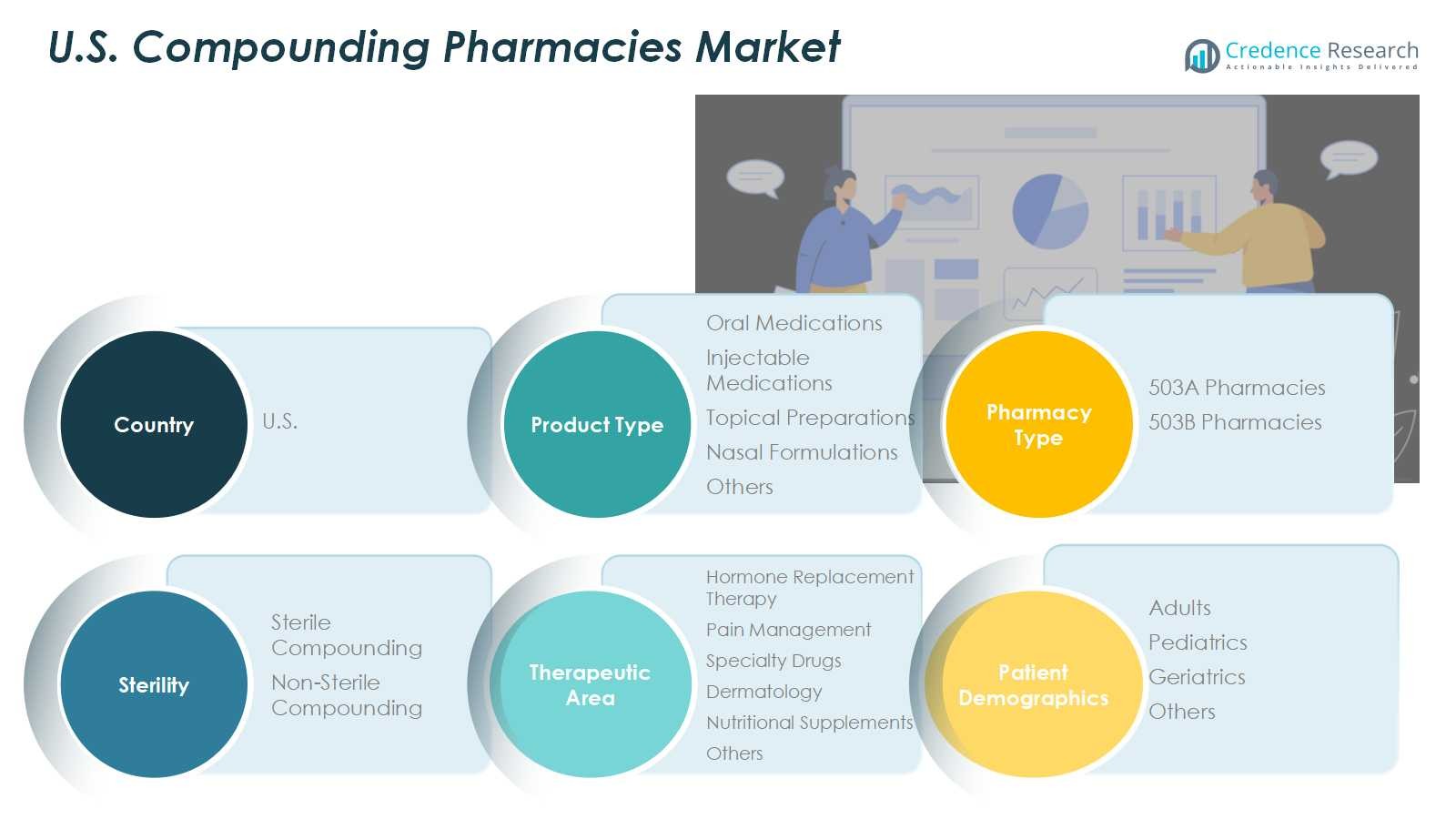

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulations

- Others

By Pharmacy Type

- 503A Pharmacies

- 503B Pharmacies

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Compounding Pharmacies market includes key players such as Fagron N.V., Avella Specialty Pharmacy, Clinigen Group, Central Admixture Pharmacy Services Inc (CAPS), Vertisis Custom Pharmacy, B. Braun Melsungen AG, PharMEDium Services LLC, 21st Century Pharmacy, PCCA, and Medisca. Market competition is driven by product innovation, expansion of sterile and non-sterile compounding services, and adoption of advanced technologies for customized medication preparation. Companies are focusing on strengthening their regional presence through partnerships, acquisitions, and strategic collaborations with hospitals and healthcare providers. Additionally, investment in research and development for specialized therapies such as hormone replacement, pain management, and pediatric formulations enhances differentiation. Regulatory compliance, quality assurance, and patient-centric services remain critical factors influencing competitiveness, while market players continue to leverage technological advancements to improve efficiency, reduce operational costs, and meet the growing demand for personalized medications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Pete Pharma formed a strategic partnership with FABRX to introduce advanced 3D printing technology in U.S. compounding pharmacies, enhancing automation, customization, and quality control in medications such as pediatric and hormone therapies.

- In August 2025, SCW.AI partnered with Asteria Health to launch a state-of-the-art 503B pharmaceutical manufacturing facility in Birmingham, Alabama, focusing on scalable production, predictive maintenance, and sustainable practices.

- In May 2025, Wesley Pharmaceuticals announced the launch of a new compounding facility in the U.S., aiming to produce over 300,000 vials per week to improve patient access to compounded medications.

- In September 2025, LifeMD, Inc., a major provider of virtual primary care services, expanded its affiliated pharmacy to include advanced non-sterile compounding capabilities for oral and topical medications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized medications will continue to grow across all patient demographics.

- Sterile compounding services will expand due to increasing hospital and clinical requirements.

- Technological advancements in compounding equipment and automation will enhance efficiency and accuracy.

- Growth in hormone replacement therapy and pain management treatments will drive market expansion.

- Pediatric and geriatric formulations will present significant opportunities for market players.

- 503A pharmacies will maintain dominance, while 503B pharmacies will see steady growth in institutional contracts.

- Rising awareness of patient-centric care will encourage adoption of customized oral, injectable, and topical medications.

- Partnerships, mergers, and acquisitions among key players will strengthen market presence and capabilities.

- Strict regulatory compliance and quality assurance will remain critical for market growth and trust.

- Emerging trends in telepharmacy and remote prescription management will further increase market accessibility and reach