Market Overview

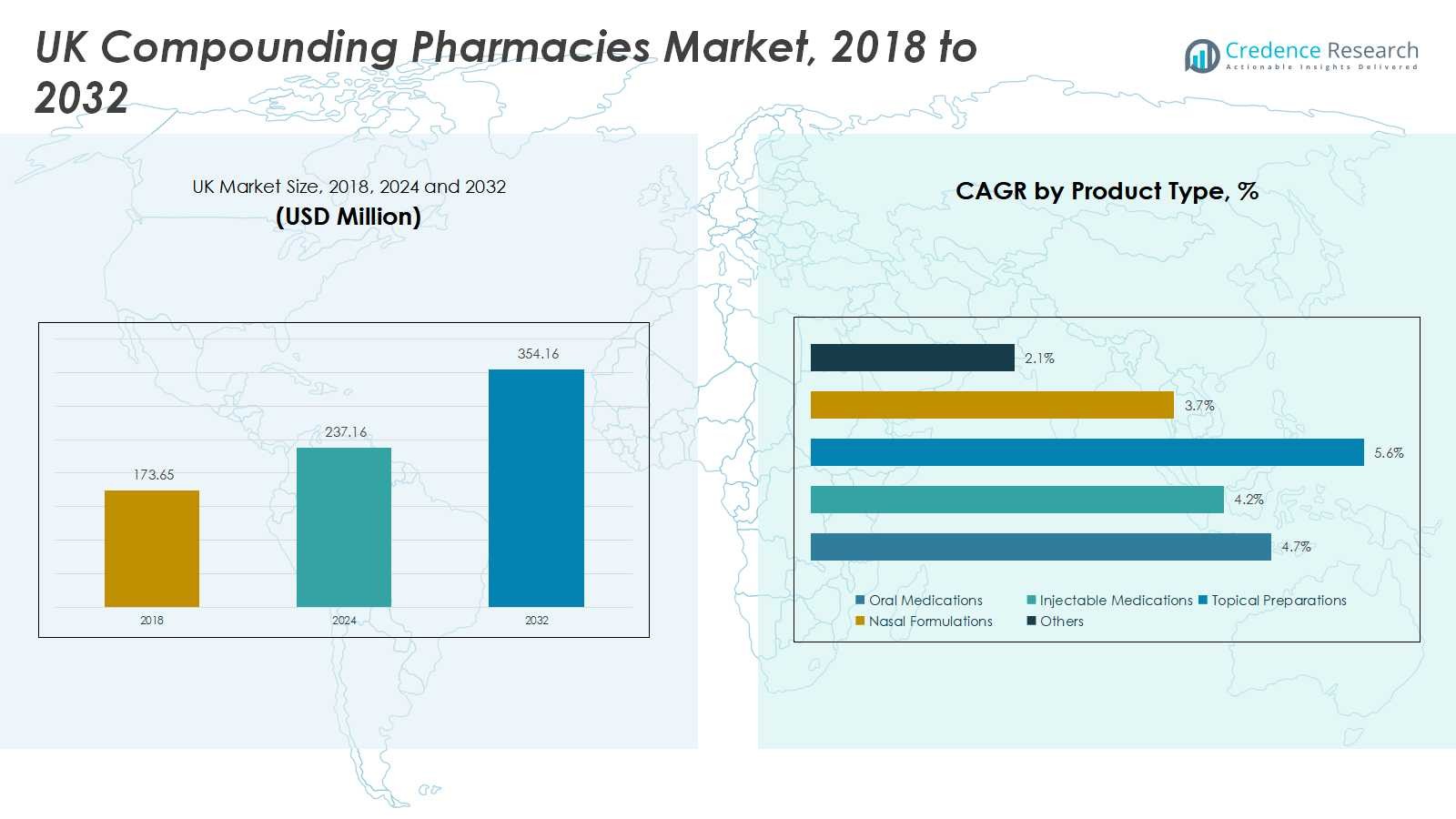

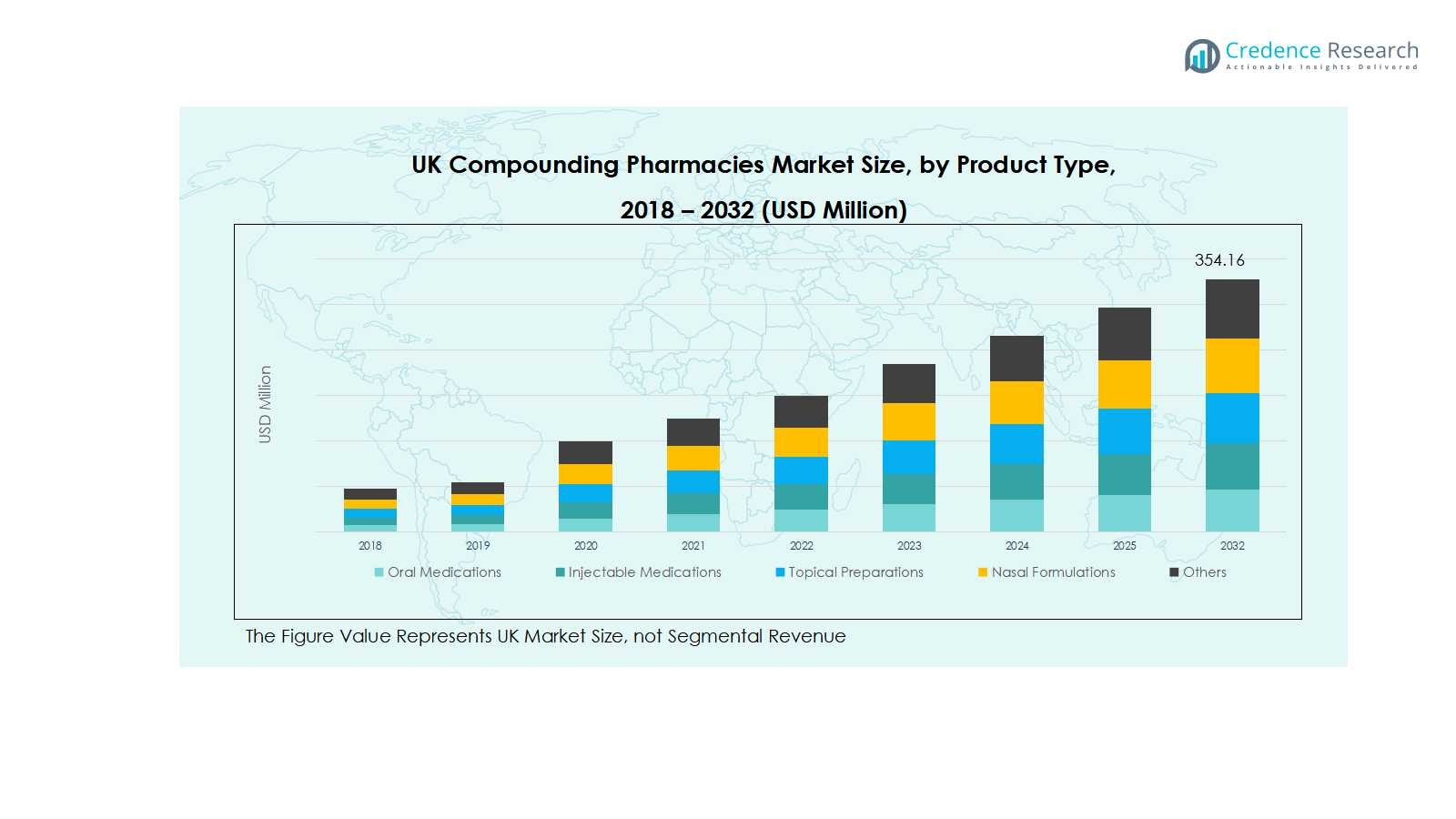

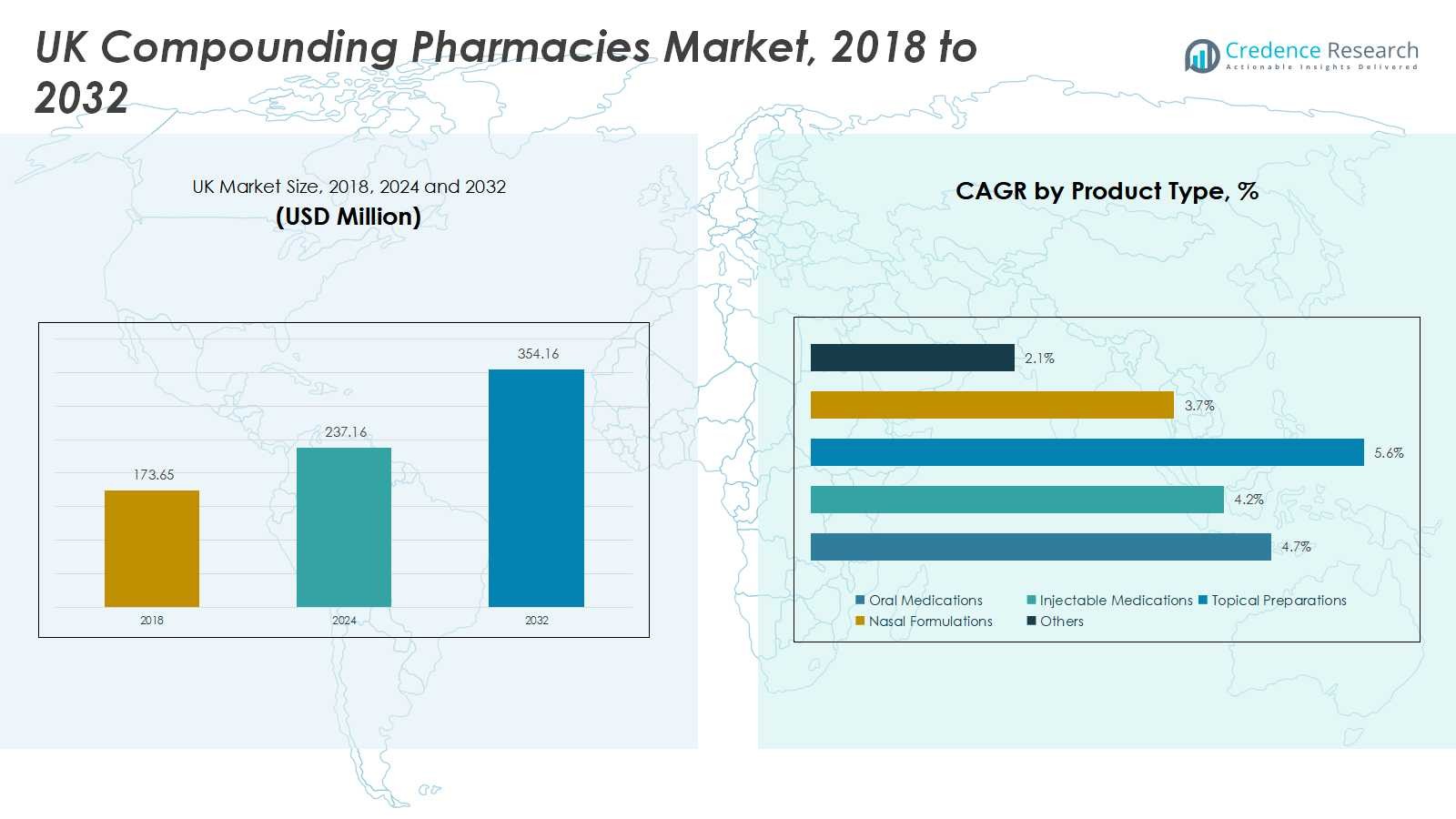

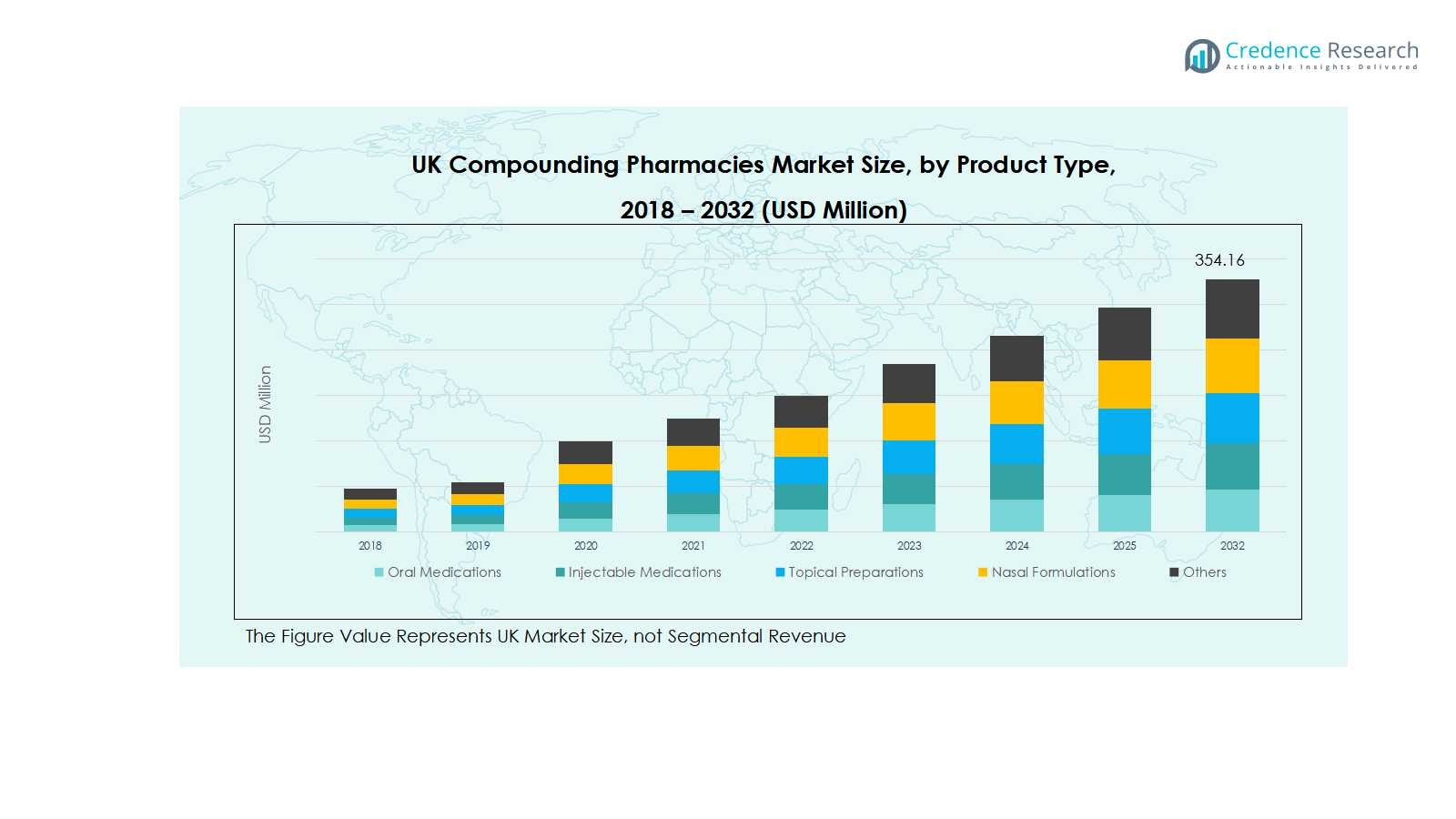

The UK Compounding Pharmacies market was valued at USD 173.65 million in 2018 and grew to USD 237.16 million in 2024. The market is projected to reach USD 354.16 million by 2032, registering a CAGR of 4.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Compounding Pharmacies market Size 2024 |

USD 237.16 Million |

| UK Compounding Pharmacies market , CAGR |

4.79% |

| UK Compounding Pharmacies market Size 2032 |

USD 354.16 Million |

The UK compounding pharmacies market is led by prominent players including Specialist Pharmacy, Nova Laboratories, Biofactors Ltd, Alloga UK, Pharmacompound Ltd, Medisca UK, Pharmacy2U, Wedgewood Pharmacy, Own Label Pharmacy, and Mulberry Pharmacy. These companies dominate through diversified product portfolios, strong regulatory compliance, and advanced compounding capabilities across oral, injectable, and topical formulations. England is the leading region, contributing 72% of the market share, supported by a dense population, advanced healthcare infrastructure, and high demand for personalized medications. Scotland, Wales, and Northern Ireland follow with shares of 12%, 8%, and 8% respectively, driven by growing patient awareness and increasing adoption of customized therapies. Market leadership is reinforced by strategic collaborations with hospitals, investment in sterile and non-sterile compounding technologies, and focus on specialty drugs and hormone therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK compounding pharmacies market was valued at USD 237.16 million in 2024 and is projected to reach USD 354.16 million by 2032, growing at a CAGR of 4.79%.

- Growth is driven by rising demand for personalized medicine, increasing chronic disease prevalence, and adoption of specialty drugs and hormone therapies, supporting both sterile and non-sterile formulations.

- Key trends include expansion of 503B outsourcing facilities for large-scale sterile compounding, increased patient awareness, and rising adoption of oral, injectable, and topical formulations across therapeutic areas.

- The market is competitive, led by Specialist Pharmacy, Nova Laboratories, Biofactors Ltd, Alloga UK, Pharmacompound Ltd, Medisca UK, Pharmacy2U, Wedgewood Pharmacy, Own Label Pharmacy, and Mulberry Pharmacy, with companies investing in technology, regulatory compliance, and partnerships to enhance capabilities.

- Regional analysis shows England with 72% market share, followed by Scotland 12%, Wales 8%, and Northern Ireland 8%, while oral medications dominate the product type segment.

Market Segmentation Analysis:

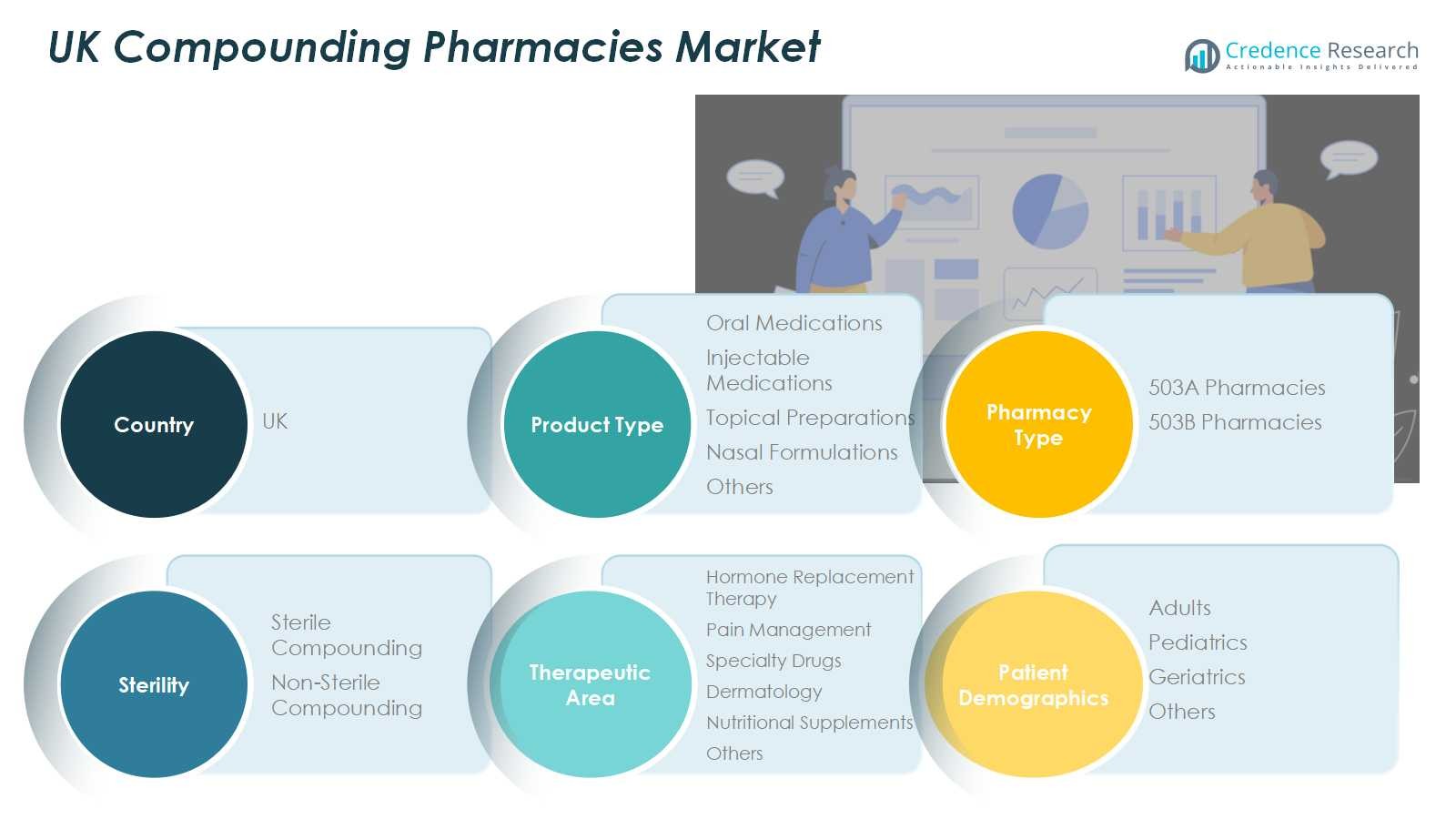

By Product Type

The UK Compounding Pharmacies market by product type is led by oral medications, accounting for 42% of the segment share. Oral formulations remain dominant due to their ease of administration, patient compliance, and rising demand for personalized dosing in chronic therapies. Injectable medications follow, driven by growth in specialty treatments and hormone therapies. Topical preparations and nasal formulations are gaining traction for dermatological and respiratory applications, while the “others” category contributes modestly. The expansion of personalized medicine and increasing patient preference for tailored therapies are key drivers supporting growth across all product types.

- For instance, AbbatiaLabs has developed POWDOSE, a flexible oral dosing technology that allows precise, individualized dose titration by patients, improving treatment adherence and safety.

By Pharmacy Type

In the pharmacy type segment, 503A pharmacies dominate with 65% of the segment share, reflecting their established presence in patient-specific prescriptions and adherence to USP <795>/<797> standards. These pharmacies focus on small-batch compounding, catering to local demand and chronic care requirements. Meanwhile, 503B outsourcing facilities are growing steadily due to increased hospital demand and regulatory support for larger-scale sterile compounding. The market’s growth is driven by rising patient awareness, expanding treatment options, and healthcare providers’ preference for customized formulations, supporting both patient convenience and therapeutic efficacy.

- For instance, Belmar Pharma Solutions operates a 503A facility that has been filling individualized compounded prescriptions tailored to patient-specific needs, such as hormone replacement and autoimmune disorder treatments, ensuring personalized medication options since 1985.

By Sterility

By sterility segment, non-sterile compounding holds the majority with 58% of the market share, mainly due to high demand in oral, topical, and nutritional supplement formulations. Sterile compounding, while smaller in share, is witnessing steady growth, driven by hospital and specialty drug requirements such as injectables and ophthalmic solutions. Market expansion in both sub-segments is fueled by increased prevalence of chronic diseases, aging population, and regulatory frameworks ensuring quality and safety. Investments in advanced compounding technologies and rising adoption of personalized therapies are further boosting segment growth.

Key Growth Drivers

Rising Demand for Personalized Medicine

The growing emphasis on personalized medicine is a major driver for the UK compounding pharmacies market. Patients increasingly seek customized formulations tailored to their unique needs, such as specific dosages, flavors, or combination therapies. This trend is particularly prominent in hormone replacement therapy, pain management, and pediatric care. Healthcare providers are also recommending compounded medications to improve patient compliance and therapeutic outcomes. As patient awareness and demand for individualized treatments rise, compounding pharmacies are expanding their product offerings, driving market growth across both sterile and non-sterile formulations.

- For instance, Roseway Labs creates personalized compounded medications for skin conditions and allergies by adapting dosage forms or removing allergenic ingredients, enabling better patient outcomes and adherence.

Aging Population and Chronic Disease Prevalence

The UK’s aging population and rising prevalence of chronic diseases are fueling the demand for compounded medications. Older adults often require multiple medications in precise doses, making standard formulations inadequate. Chronic conditions such as diabetes, arthritis, and cardiovascular disorders necessitate specialized compounding solutions. This demographic trend supports both oral and injectable formulations, while also boosting demand for non-sterile and sterile compounding. The combination of increasing healthcare needs and patient-specific treatments is a strong growth catalyst, encouraging investment and expansion within the compounding pharmacies sector.

Regulatory Support and Technological Advancements

Enhanced regulatory frameworks and adoption of advanced compounding technologies are driving market growth. Compliance with USP <795>/<797> and MHRA guidelines ensures quality and safety, which builds confidence among healthcare providers and patients. Additionally, automation and modern compounding equipment improve efficiency, accuracy, and scalability, particularly for sterile products. These developments allow pharmacies to meet increasing demand for high-quality, customized medications while reducing operational risks. Regulatory clarity combined with technological innovation continues to strengthen the market’s growth trajectory in the UK.

- For instance, APOTECAchemo, a robotic compounding system widely studied in hospital settings, has demonstrated mean dose accuracy of 0.8% with reduced contamination levels compared to manual compounding, enhancing safety in chemotherapy preparation.

Key Trends & Opportunities

Expansion of 503B Outsourcing Facilities

The growth of 503B outsourcing facilities presents a significant opportunity in the UK market. These facilities enable large-scale sterile compounding for hospitals and clinics, addressing shortages and increasing efficiency. Outsourcing reduces the burden on 503A pharmacies and ensures consistent quality standards. With rising hospital demand for injectables and specialty drugs, 503B facilities can capture a growing share of the market. This expansion trend offers strategic opportunities for partnerships, investments, and technological adoption, allowing companies to meet evolving healthcare needs while enhancing revenue potential.

- For instance, B. Braun integrates CAPS’ 503B sterile compounding operations into its pharmaceutical quality system, focusing on quality governance and regulatory compliance to ensure patient safety while addressing workforce shortages.

Rising Adoption of Specialty Drugs and Hormone Therapies

An increasing focus on specialty drugs and hormone therapies is shaping market opportunities. Treatments for conditions such as cancer, infertility, and chronic pain are often unavailable in standard formulations, requiring compounding pharmacies to provide tailored solutions. This trend drives growth in injectable and oral medications and expands the role of sterile compounding. By catering to niche therapeutic areas, pharmacies can differentiate themselves in a competitive market. The opportunity to address unmet medical needs while leveraging personalized medicine remains a strong growth lever in the UK.

- For instance, NHS England’s push for standardizing aseptically compounded injectable medicines aims to improve clinical outcomes and patient experience, with regional hubs expanding capacity for ready-to-administer injections used in cancer and critical care therapies.

Key Challenges

Stringent Regulatory Compliance

Stringent regulatory requirements pose a significant challenge for UK compounding pharmacies. Compliance with USP, MHRA, and other safety guidelines demands robust quality control, specialized equipment, and trained personnel. Non-compliance can result in product recalls, legal penalties, and reputational damage. Smaller pharmacies may struggle with high costs of compliance and certification, limiting their ability to expand operations. While regulations ensure patient safety, they also increase operational complexity, requiring companies to invest in training, technology, and rigorous monitoring to remain competitive in the market.

High Operational Costs and Limited Scalability

High operational costs and limited scalability challenge growth in the UK compounding pharmacy sector. Custom formulations, sterile compounding, and quality assurance processes require specialized equipment and skilled labor, driving up costs. Small-batch production limits economies of scale, impacting profitability. Additionally, sourcing raw materials and maintaining supply chain reliability can be costly and complex. These factors make expansion difficult, particularly for smaller pharmacies. Addressing cost efficiency and exploring partnerships or outsourcing solutions are critical for sustaining growth and competitiveness in the market.

Regional Analysis

England

England leads the UK compounding pharmacies market with a market share of 72%, driven by a dense population, advanced healthcare infrastructure, and high demand for personalized medications. Major urban centers such as London, Manchester, and Birmingham host a concentration of 503A and 503B pharmacies, supporting both sterile and non-sterile compounding. Growth is propelled by increasing chronic disease prevalence, rising adoption of hormone therapies, and expanding specialty drug requirements. The presence of large hospitals, research facilities, and strong regulatory frameworks further boosts market development. England continues to be the primary contributor to overall revenue in the UK market.

Scotland

Scotland holds a market share of 12% in the UK compounding pharmacies market, supported by growing patient awareness and expanding healthcare services in urban and semi-urban areas. Demand for oral and topical formulations, particularly in dermatology and pain management, is steadily rising. The market benefits from regional pharmacies’ compliance with MHRA and USP guidelines, ensuring quality and safety in compounding. Investments in modern compounding equipment and small-scale sterile facilities are supporting growth. Additionally, Scotland’s focus on personalized medicine and chronic disease management is expected to drive further adoption of customized therapies over the forecast period.

Wales

Wales accounts for a market share of 8%, driven by increasing demand for personalized therapies and the expansion of small-scale compounding pharmacies. The market is primarily supported by oral and non-sterile formulations, targeting chronic disease management, hormone replacement therapy, and pain relief. Regional hospitals and clinics are increasingly collaborating with compounding pharmacies to meet local healthcare needs. Market growth is facilitated by rising awareness among healthcare providers and patients, as well as regulatory support ensuring high-quality compounded medications. The Welsh market continues to witness steady growth, with opportunities in both 503A and limited 503B pharmacy operations.

Northern Ireland

Northern Ireland represents a market share of 8% in the UK compounding pharmacies market. Growth is supported by increasing healthcare infrastructure, awareness of personalized medicine, and a rising number of chronic disease cases requiring customized formulations. Oral medications and non-sterile compounding dominate the region, while sterile compounding is gradually expanding for hospital-based applications. Investment in regulatory compliance and modern equipment ensures high-quality compounded medications, meeting local demand. Small to medium-sized pharmacies are capitalizing on this growing need, and collaborations with healthcare providers are driving market development, making Northern Ireland an emerging yet important contributor to the UK compounding market.

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulations

- Others

By Pharmacy Type

- 503A Pharmacies

- 503B Pharmacies

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Competitive landscape in the UK compounding pharmacies market is dominated by key players such as Specialist Pharmacy, Nova Laboratories, Biofactors Ltd, Alloga UK, Pharmacompound Ltd, Medisca UK, Pharmacy2U, Wedgewood Pharmacy, Own Label Pharmacy, and Mulberry Pharmacy. These companies focus on expanding their product portfolios across oral, injectable, and topical formulations while maintaining high standards of quality and regulatory compliance. Market competition is driven by technological advancements, investments in sterile and non-sterile compounding capabilities, and strategic partnerships with hospitals and healthcare providers. Companies are also leveraging personalized medicine trends and specialty drug demand to differentiate themselves. The competitive dynamics are further shaped by pricing strategies, geographic reach, and customer-centric services, including home delivery and patient education. Continuous innovation and adherence to USP and MHRA regulations remain critical for maintaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Specialist Pharmacy

- Nova Laboratories

- Biofactors Ltd

- Alloga UK

- Pharmacompound Ltd

- Medisca UK

- Pharmacy2U

- Wedgewood Pharmacy

- Own Label Pharmacy

- Mulberry Pharmacy

Recent Developments

- In January 2025, Revelation Pharma expanded its portfolio by acquiring Cascade Specialty Pharmacy, a Washington-based compounding pharmacy specializing in ENT and animal health. This acquisition strengthens Revelation Pharma’s presence in niche therapeutic areas.

- In June 2025, H.I.G. Capital acquired ITH Pharma, a London-based compounding pharmaceutical company known for complex intravenous treatments and same-day compounding services.

- In October 2024, Valor Compounding Pharmacy announced plans to expand its services and form new partnerships with healthcare systems and medical practices, aiming to enhance its capabilities in providing personalized medications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand for personalized medications.

- Expansion of 503B outsourcing facilities will enhance sterile compounding capabilities.

- Oral medications will continue to dominate the product type segment.

- Injectable and topical formulations are projected to see increased adoption.

- Growth in hormone therapies and specialty drugs will drive market opportunities.

- Aging population and chronic disease prevalence will sustain demand for customized treatments.

- Technological advancements in compounding equipment will improve efficiency and quality.

- Strong regulatory compliance will ensure patient safety and support market credibility.

- Regional growth will remain concentrated in England, with Scotland, Wales, and Northern Ireland showing steady increases.

- Strategic collaborations between pharmacies, hospitals, and healthcare providers will strengthen market presence and competitive positioning.