| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Digital Oilfield Solutions Market Size 2024 |

USD 11,004.43 Million |

| North America Digital Oilfield Solutions Market, CAGR |

7.17% |

| North America Digital Oilfield Solutions Market Size 2032 |

USD 19,145.39 Million |

Market Overview

The North America Digital Oilfield Solutions Market is projected to grow from USD 11,004.43 million in 2024 to an estimated USD 19,145.39 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.17% from 2025 to 2032. This growth is driven by technological advancements and increasing investments in digital solutions within the oil and gas industry.

Key market drivers include the need to enhance production from mature oilfields, technological innovations such as IoT, AI, and cloud computing, and the pursuit of cost optimization in exploration and production operations. These factors collectively boost operational efficiency and reduce downtime.

Geographically, North America leads in digital oilfield adoption, with the U.S. and Canada at the forefront. Major players like Halliburton, Schlumberger, and Baker Hughes are actively investing in digital technologies to optimize operations and maintain competitiveness in the evolving energy sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Digital Oilfield Solutions Market is projected to grow from USD 11,004.43 million in 2024 to USD 19,145.39 million by 2032, with a CAGR of 7.17% from 2025 to 2032, driven by technological advancements and increasing digitalization in the oil and gas industry.

- The Global Digital Oilfield Solutions Market is projected to grow from USD31,374.00 million in 2024 to USD 54,897.18 million by 2032, with a CAGR of 7.24% from 2025 to 2032.

- Key drivers include the need for enhanced production from mature oilfields, adoption of IoT, AI, and cloud computing technologies, and the pursuit of operational cost optimization.

- Integration of AI, IoT, and big data analytics is optimizing operations, improving decision-making, and reducing operational downtime in the oil and gas sector.

- High initial investments in digital infrastructure, cybersecurity concerns, and the need for skilled labor to implement advanced technologies may hinder growth in some segments of the market.

- North America, led by the U.S. and Canada, is at the forefront of adopting digital oilfield solutions, leveraging advanced technologies to enhance production efficiency and reduce costs.

- Increasing environmental regulations and the need for sustainability in oilfield operations are driving the adoption of digital solutions for emissions monitoring and resource management.

- Major players like Schlumberger, Halliburton, and Baker Hughes are actively investing in digital oilfield solutions, aiming to enhance operational efficiency and maintain competitiveness in a rapidly evolving market.

Market Drivers

Increased Focus on Enhancing Production from Mature Oilfields

Mature oilfields, which have been in production for decades, are a significant contributor to North America’s oil output. However, production from these fields has begun to decline over time, and operators are seeking innovative ways to enhance recovery rates and extend the lifespan of these assets. Digital oilfield solutions offer tools that can help achieve these goals through real-time monitoring, automated well control, and enhanced reservoir management. Advanced digital technologies such as reservoir simulation models, remote sensing, and data-driven predictive maintenance provide operators with deep insights into the behavior of reservoirs and the performance of individual wells. With this information, companies can apply targeted interventions, such as enhanced oil recovery (EOR) techniques, that improve extraction rates and mitigate the effects of production decline. Furthermore, digital solutions support efficient management of well integrity and fluid injection processes, which are critical for maintaining long-term production in mature fields. As North American oil and gas companies continue to rely heavily on mature fields for a significant portion of their production, digital solutions will play an increasingly vital role in maximizing recovery rates and extending the operational life of these assets.

Environmental Concerns and Regulatory Pressures

As environmental concerns continue to take center stage globally, oil and gas operators are under increasing pressure to reduce their environmental footprint. In North America, stricter environmental regulations and a growing focus on sustainability are pushing the industry toward adopting digital solutions that can help reduce environmental impacts. Digital technologies enable more efficient resource utilization, such as minimizing water and energy consumption, optimizing drilling techniques, and managing waste streams. For instance, advanced monitoring and control systems allow for precise management of emissions, reducing the likelihood of leaks and spills. Moreover, the data provided by digital solutions helps companies track compliance with environmental regulations more accurately and in real-time, ensuring they meet increasingly stringent requirements. These digital tools also play a crucial role in optimizing drilling operations, making them more energy-efficient and less environmentally intrusive. As governments and regulatory bodies in North America continue to implement and enforce stricter environmental policies, the demand for digital oilfield solutions that support sustainability efforts will likely increase, further driving market growth.

Technological Advancements and Adoption of IoT, AI, and Big Data Analytics

The digital transformation of the oil and gas industry in North America is being driven by cutting-edge technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and Big Data analytics. These innovations are revolutionizing how oilfield operators monitor and optimize their operations. For instance, IoT devices such as sensors enable real-time data collection, providing insights into equipment performance and operational conditions. This data is processed by AI algorithms to predict potential failures, reducing downtime and maintenance costs. Additionally, AI-powered systems automate routine processes, allowing faster responses to dynamic field conditions. Big Data analytics further enhances decision-making by uncovering patterns that improve resource utilization and production efficiency. For instance, companies can now simulate drilling scenarios or optimize production schedules based on historical and real-time data. This integration of technology not only boosts operational efficiency but also minimizes risks, enabling oilfield operators to make informed decisions that enhance profitability in a volatile market environment.

Cost Optimization and Operational Efficiency

In North America’s competitive oil and gas market, cost optimization remains a critical priority for operators striving to maintain profitability amid fluctuating energy prices. Digital oilfield solutions have emerged as a key enabler of cost savings by enhancing operational efficiency. For instance, companies are leveraging automated systems to remotely monitor production assets, reducing labor costs and streamlining workflows. Real-time monitoring allows operators to identify inefficiencies swiftly, enabling adjustments that optimize production while minimizing wasteful expenditures. Moreover, predictive maintenance powered by AI helps companies avoid costly downtime by addressing potential equipment failures before they occur. Resource allocation is also improved through digital tools that analyze energy consumption patterns and environmental impacts, contributing to sustainable cost reductions. For instance, advanced analytics can guide operators in optimizing drilling operations or managing supply chains more effectively. As these digital technologies continue to evolve, they offer a compelling value proposition for companies aiming to thrive in an increasingly challenging market landscape.

Market Trends

Cloud Computing and Data Storage Solutions

Cloud computing is revolutionizing the way data is stored and accessed within the oil and gas industry, providing scalable and secure solutions for managing vast amounts of operational data. In the digital oilfield market, cloud-based platforms are being used to store, process, and analyze data from multiple sources, including IoT devices, drilling equipment, and geological surveys. Cloud computing offers the advantage of centralized data access, enabling operators and field engineers to access real-time information from anywhere, at any time, enhancing collaboration across geographically dispersed teams. Cloud platforms also allow oil and gas companies to handle big data more effectively, processing large datasets generated by IoT devices and AI algorithms. This is particularly crucial in the digital oilfield space, where data volumes are increasing rapidly, and the ability to analyze and interpret that data is essential for making informed decisions. Moreover, cloud computing offers cost advantages, as companies no longer need to invest in on-site data centers or infrastructure. Cloud solutions also provide high levels of security, ensuring sensitive operational data remains protected from cyber threats. As the industry continues to adopt cloud technologies, it is expected that digital oilfield solutions will become even more data-driven, enabling real-time insights, optimization, and enhanced decision-making.

Focus on Sustainability and Environmental Responsibility

Sustainability and environmental responsibility have become key priorities for the oil and gas industry, especially in North America, where regulators are increasingly focused on reducing the environmental impact of energy production. Digital oilfield solutions are playing an essential role in helping operators meet these sustainability goals. Advanced digital tools are being used to monitor emissions, manage water usage, and optimize energy consumption, ensuring compliance with environmental regulations while minimizing operational costs. For example, digital monitoring solutions are being deployed to track emissions levels from drilling and production activities, helping companies comply with regulatory standards. Automated systems can detect leaks or irregularities in real-time, allowing for rapid corrective actions that minimize the environmental impact. Additionally, digital technologies are helping to optimize drilling operations, reducing the need for excessive water usage or the release of harmful gases during the extraction process. As oil and gas companies face increasing pressure from both regulators and consumers to improve their environmental footprint, the adoption of digital oilfield solutions that support sustainability will continue to rise. By using data-driven insights to optimize operations and reduce environmental impact, digital oilfield technologies are helping the industry evolve toward more responsible and sustainable practices.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Oilfield Operations

Artificial Intelligence (AI) and Machine Learning (ML) have become integral to digital oilfield solutions, offering substantial improvements in efficiency and decision-making. AI and ML algorithms are now being deployed to optimize a variety of operations, including predictive maintenance, reservoir modeling, and real-time data analytics. For instance, companies are utilizing AI-driven predictive maintenance systems to reduce operational downtime by forecasting equipment failures before they occur. By analyzing historical and real-time data from sensors embedded in pumps, compressors, and drilling equipment, AI systems detect anomalies and predict wear and tear, enabling proactive maintenance rather than costly repairs or unplanned shutdowns. In reservoir management, AI-powered tools assist operators in developing more accurate models to predict oil and gas reservoir behavior. These models enhance decision-making by identifying optimal drilling locations, techniques, and enhanced oil recovery (EOR) strategies. Machine learning also plays a pivotal role in optimizing production by identifying patterns in large datasets, providing actionable insights that maximize recovery rates and operational efficiency. As AI and ML technologies continue to evolve, they are expected to further transform oilfield operations by enhancing performance, reducing costs, and boosting productivity across the oil and gas sector.

Adoption of the Internet of Things (IoT) for Real-Time Monitoring and Data Collection

The Internet of Things (IoT) has become a foundational element in the digital oilfield landscape, enabling real-time data collection from oilfield operations. IoT technologies such as sensors and smart devices are widely used on drilling rigs, pipelines, and production platforms to monitor parameters like temperature, pressure, flow rates, and equipment performance. For instance, IoT-based monitoring systems allow operators to track the health and performance of drilling equipment in real-time, detecting issues such as overheating or clogging before they escalate. The collected data is transmitted to centralized control systems where it is analyzed to provide actionable insights that improve operational efficiency. In upstream operations, IoT facilitates remote monitoring of production fields, allowing operators to make real-time adjustments that increase output while minimizing downtime. Additionally, IoT enhances safety by providing early warnings of hazardous conditions such as gas leaks or equipment malfunctions. This reduces the risk of accidents while ensuring compliance with environmental standards. With its ability to capture large amounts of data and enable predictive maintenance, IoT is transforming oilfield operations into smarter and more efficient ecosystems.

Market Challenges

Cybersecurity and Data Privacy Concerns

As the oil and gas industry increasingly adopts digital technologies such as IoT, AI, and cloud computing, the amount of sensitive data generated and transmitted has surged. This data includes information related to production processes, equipment performance, and operational metrics, which, if compromised, could lead to significant operational disruptions or even environmental hazards. For instance, a survey revealed that over half of oil and gas organizations experienced disruptive cyber incidents in recent years, highlighting the sector’s vulnerability to attacks targeting industrial control systems and critical infrastructure. The heightened connectivity and reliance on digital solutions make the oil and gas sector an attractive target or cyberattacks. As a result, companies must invest in advanced cybersecurity measures to protect their systems from potential breaches. However, these security investments can be costly and complex, particularly for smaller companies with limited IT resources. Furthermore, the lack of standardized cybersecurity protocols across the industry exacerbates vulnerabilities, making it challenging to create a unified defense strategy. Addressing these concerns while maintaining operational efficiency and cost-effectiveness is a key challenge that the digital oilfield solutions market must navigate.

High Initial Investment and Return on Investment (ROI) Concerns

The implementation of digital oilfield solutions often requires significant upfront investment in infrastructure, hardware, software, and training. These initial costs can be a barrier for smaller companies or those with limited capital, especially given the high complexity of integrating new technologies into existing systems. While digital solutions offer long-term operational efficiency gains, achieving a measurable return on investment (ROI) can take time, leading to hesitation among companies to make such substantial capital commitments. Moreover, the oil and gas industry’s cyclical nature, marked by periods of fluctuating oil prices and market uncertainties, makes long-term investments in digital infrastructure a risky proposition. Companies may be reluctant to invest in advanced technologies unless they are confident that these solutions will provide tangible benefits, such as reduced operational costs, enhanced production efficiency, and improved decision-making. Overcoming this challenge requires demonstrating clear, short-term benefits and ensuring that the technology provides long-term value.

Market Opportunities

Expansion of Smart Oilfield Technologies

The growing adoption of smart oilfield technologies presents a significant market opportunity for digital oilfield solutions in North America. Smart oilfields leverage advanced technologies such as IoT, AI, machine learning, and real-time data analytics to enhance the efficiency of exploration, drilling, and production operations. These technologies allow operators to monitor well performance, predict equipment failures, optimize production rates, and manage energy consumption more effectively. As North American oil and gas companies strive to reduce costs and improve production efficiency, the demand for smart oilfield solutions is expected to increase. The integration of these technologies enables operators to maximize output while minimizing operational downtime and resource waste, thus presenting a lucrative opportunity for companies offering digital oilfield solutions.

Sustainability and Regulatory Compliance

As environmental concerns become more prominent and regulatory requirements tighten, North American oil and gas companies are under increasing pressure to adopt sustainable practices. Digital oilfield solutions offer an opportunity to help companies meet these regulatory requirements while reducing their environmental footprint. Technologies such as real-time monitoring systems can track emissions, optimize water usage, and minimize waste generation, aiding companies in maintaining compliance with environmental regulations. Moreover, the growing emphasis on carbon footprint reduction and the industry’s transition toward cleaner energy solutions presents a market opportunity for digital oilfield technologies that enhance sustainability. The demand for environmentally responsible solutions will continue to rise, making sustainability-focused digital oilfield solutions a key growth driver for the market.

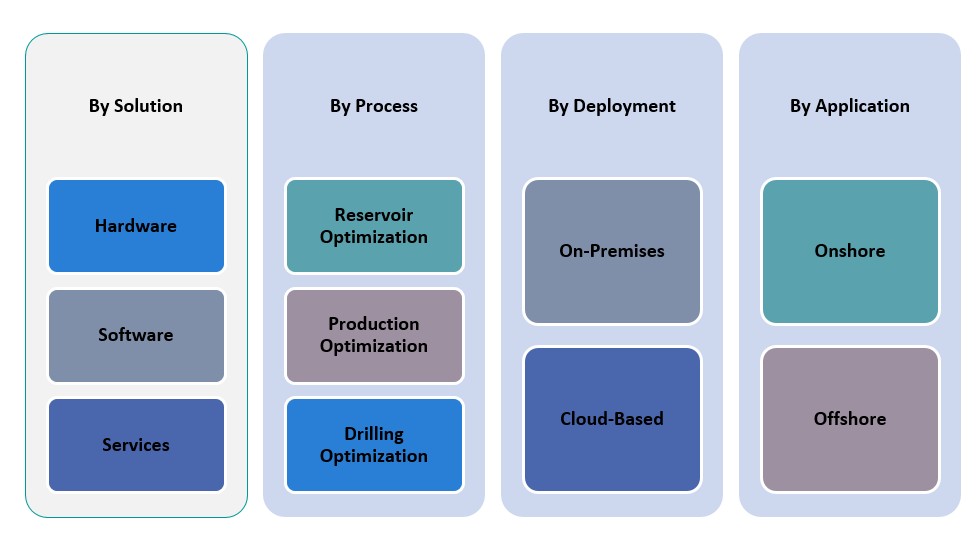

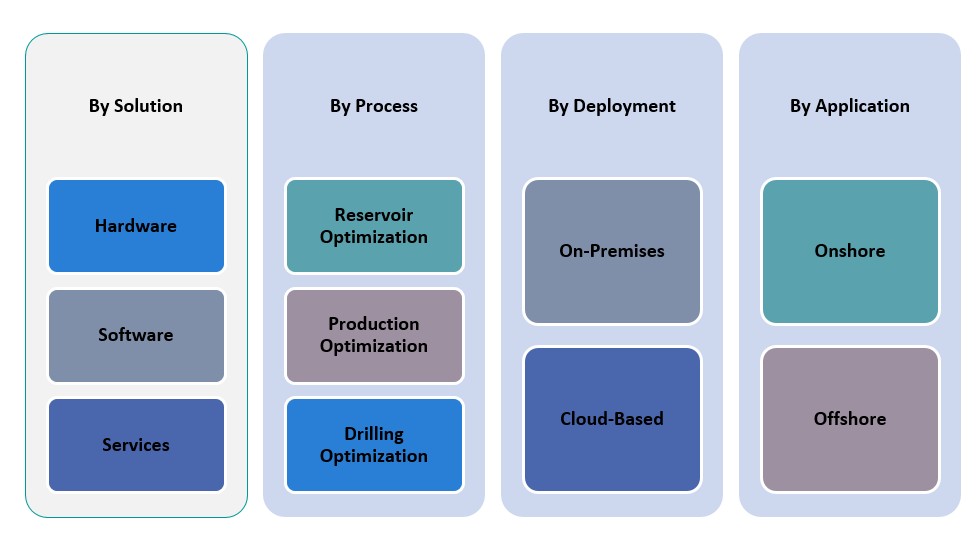

Market Segmentation Analysis

By Solution

The market is primarily driven by three main solutions: hardware, software, and services. Hardware includes the IoT sensors, automation tools, and other equipment used to collect real-time data from oilfields. The hardware segment holds a significant share due to the growing need for IoT-based sensors and automated systems that enable remote monitoring and data collection. Software solutions are gaining prominence, with applications in data analytics, predictive maintenance, and operational optimization. AI-driven software for reservoir and production optimization is increasingly adopted for its ability to enhance decision-making and improve efficiency. The services segment, which includes consulting, integration, and support, is also a vital part of the digital oilfield ecosystem, offering companies expertise in implementing and optimizing digital technologies.

By Application

The application segment is divided into onshore and offshore operations. Onshore oilfields are expected to dominate the market, driven by the large number of mature oilfields and the need for advanced technologies to optimize production. These oilfields benefit from digital solutions that enhance well performance and reduce maintenance costs. However, offshore oilfields are also experiencing significant growth due to the increasing complexity of offshore drilling operations, which require advanced monitoring, automation, and optimization solutions for cost reduction and efficiency improvement.

Segments

Based on Solution

- Hardware

- Software

- Services

Based on Application

Based on Process

- Reservoir Optimization

- Production Optimization

- Drilling Optimization

Based on Deployment

Based on Region

Regional Analysis

United States (75%)

The United States dominates the North America Digital Oilfield Solutions Market, accounting for a significant market share of approximately 75%. The country’s large number of mature oilfields, coupled with its advanced technological infrastructure, makes it a key player in the digital transformation of the oil and gas sector. The U.S. oil and gas industry is rapidly adopting digital solutions, such as IoT, AI, and machine learning, to improve operational efficiency and reduce production costs. This trend is particularly strong in the Permian Basin, one of the largest and most productive oilfields in the U.S., where digital technologies are being used for reservoir management, predictive maintenance, and production optimization. The U.S. government’s increasing focus on energy independence and sustainability also drives the adoption of digital oilfield solutions, as these technologies help companies optimize resource extraction and reduce environmental impact.

Canada (20%)

Canada holds a smaller, but significant, share of approximately 20% of the North American market. The country’s oil sands and conventional oil reserves, primarily in Alberta, contribute to a growing demand for digital oilfield solutions. Canada is leveraging digital technologies to enhance oil sands extraction and improve the efficiency of its upstream oil and gas operations. The adoption of digital oilfield solutions in Canada is driven by the need to reduce costs, improve operational performance, and meet increasingly stringent environmental regulations. Real-time monitoring and automated systems are playing a crucial role in optimizing oil sands production, enhancing the country’s competitiveness in the global market.

Key players

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- ABB Ltd.

- IBM Corporation

- GE Digital

Competitive Analysis

The North America Digital Oilfield Solutions Market is highly competitive, with several key players leading the charge in technological innovation and market share. Schlumberger, Halliburton, and Baker Hughes are the dominant players, offering a wide range of integrated digital solutions, including IoT sensors, automation systems, and data analytics platforms. These companies leverage their deep industry expertise and vast infrastructure to provide end-to-end solutions that improve operational efficiency and reduce costs. Emerson Electric, Honeywell, and Rockwell Automation complement this by offering advanced automation, control systems, and IoT solutions, focusing on enhancing real-time decision-making capabilities. Meanwhile, companies like IBM and GE Digital focus on AI, machine learning, and data analytics to optimize oilfield operations. The competitive landscape is marked by continuous investments in innovation, partnerships, and strategic mergers to maintain a competitive edge in this rapidly evolving market.

Recent Developments

- In March 2025, Schneider Electric unveiled the One Digital Grid Platform, an AI-powered platform designed to enhance grid resiliency and efficiency. This platform is set to be available later in 2025. The company announced a $700 million investment plan in the U.S. to enhance energy infrastructure and AI capabilities.

- In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil’s cross-country pipeline network, enhancing efficiency and safety through real-time monitoring and robust cybersecurity.

- In March 2025, Kongsberg Digital participated in the IPTC 2025, focusing on digital transformation in the oil and gas sector.

- In January 2025, SAP S/4HANA Cloud was highlighted as a key enabler for a smarter, more efficient energy ecosystem in the oil and gas industry.

- In April 2025, Schlumberger (SLB) announced a partnership with Shell to deploy Petrel™ subsurface software across Shell’s global assets. This collaboration aims to enhance digital capabilities and operational efficiencies through advanced AI-driven seismic interpretation workflows. This development underscores SLB’s ongoing commitment to advancing subsurface digital technology and fostering strategic partnerships in the energy sector.

Market Concentration and Characteristics

The North America Digital Oilfield Solutions Market is characterized by a moderate to high level of market concentration, with several key players dominating the industry. Companies such as Schlumberger, Halliburton, Baker Hughes, and Weatherford International account for a significant share, benefiting from their extensive product portfolios, technological expertise, and global presence. These market leaders offer a comprehensive range of digital solutions, including automation, data analytics, and real-time monitoring systems, which are essential for optimizing oilfield operations. Additionally, the market is witnessing increasing collaboration and partnerships between traditional oilfield services companies and technology providers like IBM, GE Digital, and Emerson Electric to integrate advanced AI, IoT, and cloud computing solutions. While the major players maintain a dominant position, the market also sees opportunities for smaller players and innovative startups to introduce niche solutions, especially in areas like predictive maintenance and remote monitoring, fostering competition and driving technological advancements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Solution, Application, Process, Deployment and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see ongoing integration of AI, IoT, and big data analytics to enhance operational efficiency and automate processes, transforming the oil and gas industry.

- Smart oilfield solutions will become more prevalent, with an increased focus on remote monitoring and real-time data analysis to optimize production and reduce operational costs.

- Cloud-based deployments will grow, offering oil and gas companies scalable, flexible, and cost-efficient ways to manage large datasets and enable seamless collaboration across teams.

- The use of predictive analytics will rise, enabling companies to predict equipment failures, reduce downtime, and enhance decision-making, leading to improved operational performance.

- As environmental regulations become more stringent, digital oilfield solutions will play a pivotal role in helping companies monitor emissions and reduce their environmental footprint.

- The demand for automation will grow, especially in drilling and production operations, to reduce human error, enhance safety, and lower operational costs.

- Edge computing will gain traction, processing data closer to the source and enabling faster decision-making while reducing latency and reliance on centralized cloud infrastructures.

- As digital technologies evolve, there will be a greater emphasis on cybersecurity to protect sensitive data and safeguard oilfield operations from increasing cyber threats.

- The market will witness more mergers and acquisitions as companies seek to enhance their digital capabilities and expand their technological portfolios through strategic collaborations.

- Smaller players will emerge, offering niche digital solutions tailored to specific aspects of oilfield operations, driving innovation and furthering competition within the market.