Market Overview:

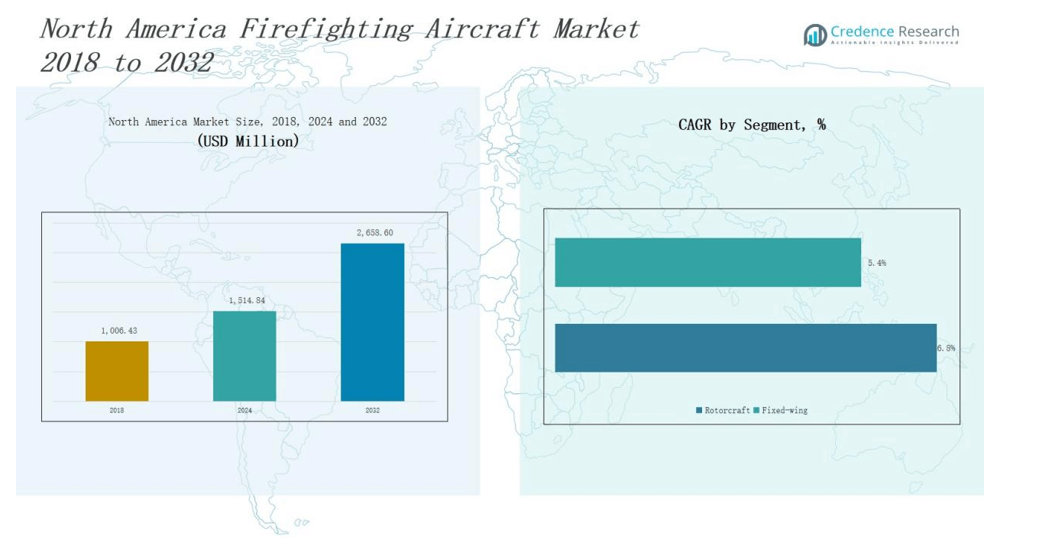

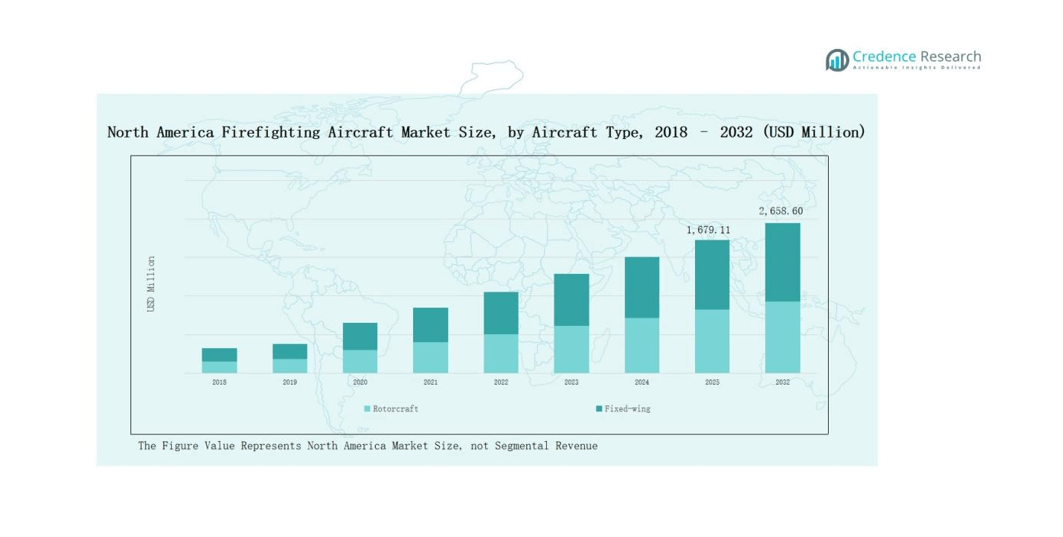

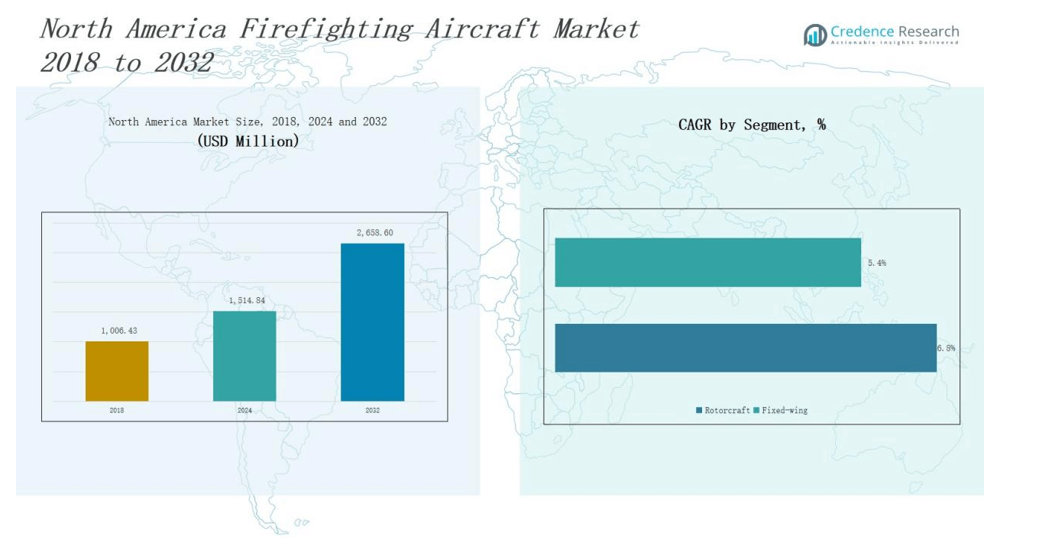

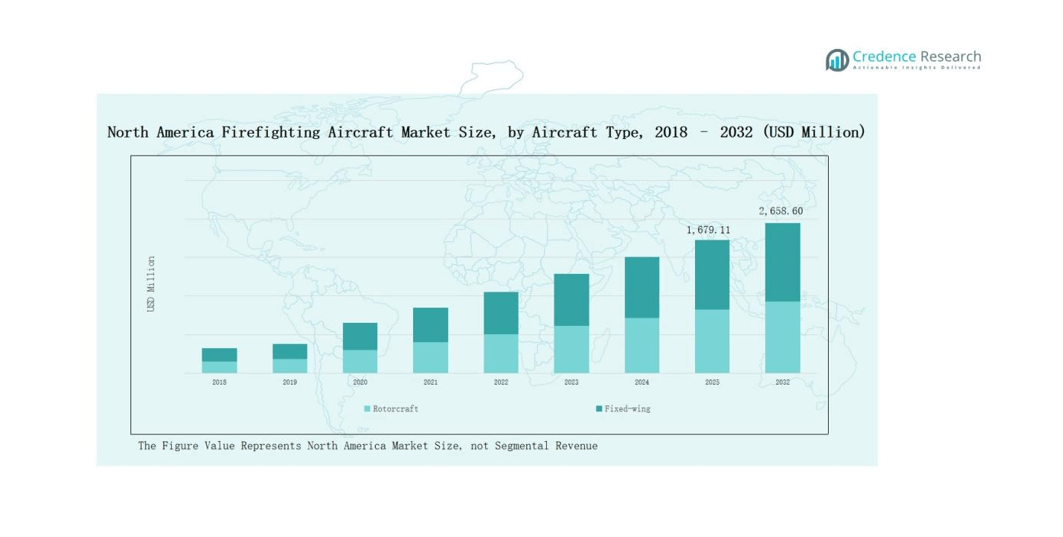

North America Firefighting Aircraft Market size was valued at USD 1,006.43 million in 2018 to USD 1,514.84 million in 2024 and is anticipated to reach USD 2,658.60 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Firefighting Aircraft Market Size 2024 |

USD 1,514.84 million |

| North America Firefighting Aircraft Market, CAGR |

6.8% |

| North America Firefighting Aircraft Market Size 2032 |

USD 2,658.60 million |

The North America Firefighting Aircraft Market is led by major players including Lockheed Martin Corporation, Boeing Commercial Airplanes, Erickson Incorporated, Coulson Aviation, Air Tractor Inc., Neptune Aviation Services, Kaman Corporation, and Marsh Aviation Company. These companies strengthen their positions through advanced aircraft portfolios, modernization initiatives, and long-term contracts with government agencies. They focus on enhancing payload efficiency, avionics, and operational safety while expanding private-public partnerships to address rising wildfire challenges. Among regions, the United States dominates with a 72% market share in 2024, driven by large-scale fleet investments, frequent wildfire occurrences, and robust funding support.

Market Insights

- The North America Firefighting Aircraft Market grew from USD 1,006.43 million in 2018 to USD 1,514.84 million in 2024 and will reach USD 2,658.60 million by 2032.

- Fixed-wing aircraft lead with 62% share in 2024, supported by large payload capacity, modernization programs, and increasing wildfire frequency across the U.S. and Canada.

- Aircraft above 30,000 Kg hold 58% share in 2024, driven by their effectiveness in large-scale wildfire suppression and preference by state agencies for extended endurance missions.

- The 1,000 to 3,000 km range segment dominates with 55% share in 2024, balancing endurance and efficiency for cross-state wildfire operations and extended mission capabilities.

- The United States leads regionally with 72% share in 2024, followed by Canada at 18% and Mexico at 10%, reflecting differences in fleet capacity, investments, and wildfire risk levels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Aircraft Type

In the North America Firefighting Aircraft Market, fixed-wing aircraft dominate with nearly 62% share in 2024. Their ability to carry larger water or retardant loads and cover longer operational ranges makes them the preferred choice for tackling extensive wildfires across the U.S. and Canada. Rotorcraft hold the remaining share, mainly used for precision drops and operations in rugged or hard-to-reach areas. The demand for fixed-wing aircraft is further supported by large government modernization programs and the recurring wildfire activity in western states.

By Maximum Take-off Weight

Aircraft above 30,000 Kg lead the market with 58% share in 2024, driven by their superior payload capacity, operational endurance, and suitability for large-scale fire suppression efforts. These aircraft are favored by state agencies for rapid response to widespread wildfire outbreaks. Smaller aircraft below 30,000 Kg maintain steady adoption due to their agility, lower operational costs, and effectiveness in localized missions.

- For instance, the U.S. Forest Service operates the DC-10 Air Tanker, which can carry up to 9,400 gallons of fire retardant, enabling it to cover large fire lines in a single drop.

By Range

The 1,000 to 3,000 km segment holds the largest share, accounting for 55% in 2024. This range allows aircraft to balance endurance and efficiency, supporting cross-state operations and extended coverage during wildfire emergencies. Aircraft with less than 1,000 km range remain essential for quick, localized missions where turnaround speed is critical. Meanwhile, aircraft with more than 3,000 km range are used selectively, primarily for strategic positioning and long-duration missions, though their higher costs limit widespread adoption.

- For instance, The firefighting variant, like Conair’s Dash 8-400AT, is designed to be multirole. It can be converted to carry passengers or cargo, but this is done on the ground—not mid-mission.

Market Overview

Rising Wildfire Incidents

Increasing frequency and intensity of wildfires in the U.S. and Canada drive demand for firefighting aircraft. Climate change, extended droughts, and hotter summers have expanded fire-prone zones across western and southern states. Governments are investing heavily in aerial firefighting fleets to strengthen preparedness and minimize economic losses from property damage and ecosystem disruption. This surge in wildfire activity has made firefighting aircraft an essential element of regional disaster management, supporting sustained procurement and modernization programs across North America.

- For instance, Coulson Aviation secured a contract with Chile’s National Forest Corporation to diversify their fleet with Boeing 737 FireLiner aircraft, enhancing wildfire response capabilities.

Government Funding and Modernization Programs

Federal and state-level agencies are allocating significant budgets toward upgrading aerial firefighting capacity. Contracts for next-generation fixed-wing and rotorcraft fleets are expanding, supported by agencies like the U.S. Forest Service and CAL FIRE. Funding initiatives focus on replacing aging aircraft with modern, fuel-efficient platforms equipped with advanced avionics and improved payload systems. This steady flow of public investment ensures stable market growth while encouraging private operators to expand service capabilities and integrate sustainable technologies into their fleets.

- For instance, the U.S. Forest Service awarded a $50 million contract in 2023 to Coulson Aviation to supply C-130 Hercules airtankers equipped with advanced RADS-XXL retardant delivery systems.

Adoption of Advanced Aerial Technologies

The integration of modern avionics, infrared imaging, GPS-based navigation, and automated retardant dispersal systems is reshaping firefighting effectiveness. Aircraft equipped with these technologies enhance situational awareness and deliver higher accuracy in fire suppression missions. North American agencies are prioritizing platforms that combine efficiency with safety, reducing crew risk during operations. Advanced retrofitting of legacy fleets and procurement of high-tech aircraft enable operators to achieve better performance with lower operational costs, strengthening demand for technologically advanced firefighting solutions.

Key Trends & Opportunities

Shift Toward Sustainable Propulsion

Growing emphasis on environmental sustainability is fostering the exploration of hybrid and electric propulsion systems in aerial firefighting fleets. Manufacturers are investing in prototypes that reduce carbon emissions while maintaining operational performance. While adoption is still emerging, regulatory support and research grants provide opportunities for early deployment of eco-friendly firefighting aircraft in North America. This trend positions sustainability as a future growth catalyst, attracting investments in cleaner technologies and strengthening compliance with environmental standards.

- For instance, MagniX has partnered with operators to retrofit regional aircraft, such as the De Havilland Beaver, with fully electric propulsion systems, proving the viability of emission-free flight in short-range missions.

Expansion of Private and Contracted Operators

Private aviation companies are playing a larger role in firefighting operations, supporting government agencies during peak wildfire seasons. Expanding public-private partnerships create new opportunities for operators to supply modern aircraft and aerial services. Flexible contracting models allow governments to enhance coverage without fully owning fleets, reducing budgetary strain. This trend is expected to encourage fleet expansion, technology upgrades, and competitive service offerings by private operators across the region, further diversifying market opportunities.

- For instance, Erickson Helicopters has long worked under contract with CAL FIRE, deploying its S-64 Air Crane heavy-lift helicopters, each capable of dropping 2,650 gallons of water per run, greatly enhancing aerial suppression capacity.

Key Challenges

High Acquisition and Operational Costs

Firefighting aircraft, particularly large fixed-wing models, require heavy capital investment and significant maintenance spending. High fuel consumption and complex retrofitting needs further elevate operating costs. These financial constraints limit smaller agencies and contractors from scaling up their fleets, often leaving them dependent on federal support. Balancing cost efficiency with fleet modernization continues to challenge operators, slowing down the pace of widespread adoption across North America.

Limited Availability of Aircraft During Peak Season

Fire seasons in North America often overlap, creating intense demand for firefighting aircraft across multiple states and regions. Limited fleet availability during such peaks hampers timely response and reduces suppression effectiveness. Operators must prioritize high-risk zones, leaving smaller or remote areas underserved. This shortage underscores the urgent need for fleet expansion and better resource coordination, as recurring wildfire surges continue to test existing capacity.

Regulatory and Certification Complexities

Strict aviation safety regulations and certification processes for retrofitting or deploying specialized firefighting aircraft present operational challenges. Compliance requirements extend development and deployment timelines, slowing down fleet modernization efforts. Additionally, cross-border regulations between the U.S., Canada, and Mexico add complexity for multinational operators. While necessary for safety, these regulatory hurdles often delay procurement cycles and increase operational costs, posing a barrier to rapid adoption of new firefighting technologies.

Regional Analysis

United States

The United States dominates the North America Firefighting Aircraft Market with a 72% share in 2024. It maintains the largest fleet capacity and benefits from strong federal and state-level investments, particularly through agencies like the U.S. Forest Service and CAL FIRE. The country faces some of the most severe wildfire seasons, driving procurement of both fixed-wing and rotorcraft platforms. Modernization initiatives emphasize advanced avionics, higher payload capacity, and sustainability-focused upgrades. It continues to expand private-public partnerships, enabling faster fleet deployment during peak fire periods. The focus on long-range, high-capacity aircraft highlights its strategy to improve nationwide wildfire response.

Canada

Canada accounts for 18% of the regional market share in 2024, supported by growing wildfire incidents across provinces like Alberta and British Columbia. The government relies heavily on fixed-wing aircraft due to vast geographical coverage and the need for long-range operations. Seasonal wildfire patterns encourage both federal and provincial authorities to expand aerial firefighting capacity. It prioritizes cross-border collaboration with the United States to strengthen operational readiness during intense fire seasons. Investments in modern water-bombing aircraft and advanced surveillance systems reflect its strategy to enhance efficiency. The rising need for regional fleet modernization strengthens long-term demand in Canada.

Mexico

Mexico holds a 10% share of the North America Firefighting Aircraft Market in 2024, with growing adoption driven by rising wildfire risks in northern and central regions. The government has focused on expanding its rotorcraft fleet, as helicopters provide effective coverage across mountainous terrains and rural zones. It also collaborates with international operators to supplement limited domestic capacity during high-risk periods. Budgetary constraints remain a barrier, limiting large-scale adoption of heavy fixed-wing aircraft. However, gradual investment in training and aircraft procurement supports steady growth. Mexico is expected to focus on cost-effective solutions and fleet partnerships to strengthen national resilience.

Market Segmentations:

By Aircraft Type

By Maximum Take-off Weight

- Below 30,000 Kg

- Above 30,000 Kg

By Range

- Less than 1,000 km

- 1,000 to 3,000 km

- More than 3,000 km

By Region

Competitive Landscape

The North America Firefighting Aircraft Market is characterized by the presence of major aerospace companies, specialized operators, and service providers competing for government and private contracts. Leading players such as Lockheed Martin Corporation, Boeing Commercial Airplanes, Erickson Incorporated, Coulson Aviation, Air Tractor Inc., and Neptune Aviation Services dominate the landscape through advanced product portfolios and long-standing partnerships with state agencies. These companies focus on enhancing payload efficiency, avionics integration, and sustainability-driven upgrades to maintain leadership. Private operators increasingly complement government-owned fleets, expanding market competition during peak wildfire seasons. Strategic moves include modernization of legacy aircraft, adoption of next-generation fixed-wing platforms, and investment in multi-role rotorcraft. Partnerships with federal agencies like the U.S. Forest Service and CAL FIRE provide stable revenue streams, while growing activity in Canada and Mexico creates fresh opportunities. The competitive environment remains dynamic, shaped by innovation, regulatory compliance, and the urgent demand for effective aerial firefighting solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In March 2025, Bridger Aerospace signed a Memorandum of Understanding to become the exclusive North American launch customer for the FF72 amphibious water-scooping aircraft. The agreement covers certification, training, support, and the acquisition of up to ten aircraft, with an option for ten additional units.

- In March 2025, United Rotorcraft and DART Aerospace announced that Custom Helicopters will serve as the launch customer for the Novel Super Puma Fire Attack System a new external belly‑mounted 4,000‑liter water tank upgrade for Airbus Super Puma helicopters.

- In 2024, Coulson Aviation partnered with Kawak Aviation to launch a modern, upgraded, and more cost-effective Firefighting Black Hawk aircraft platform. Coulson is a leading aerial firefighting company driving innovation in UH-60-based firefighting aircraft.

- In January 2025, Conair acquired the Daher TBM 960 aircraft to enhance its wildfire suppression capabilities in North America, leveraging its speed and advanced avionics for rapid firefighting response.

Report Coverage

The research report offers an in-depth analysis based on Aircraft Type, Maximum Take off Weight, Range and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Governments will expand investments in modern fixed-wing and rotorcraft firefighting fleets.

- Demand for heavy aircraft with higher payload capacity will continue to grow.

- Advanced avionics and precision drop systems will improve operational efficiency.

- Sustainability will influence fleet upgrades with hybrid and electric propulsion options.

- Private operators will gain a larger role through flexible contracting models.

- Cross-border collaboration will strengthen wildfire response between the U.S., Canada, and Mexico.

- Seasonal fleet shortages will drive outsourcing and international leasing opportunities.

- Retrofitting of legacy aircraft will remain a cost-effective strategy for agencies.

- Training programs and skilled pilot availability will become critical for market expansion.

- Rising wildfire frequency will secure long-term demand for aerial firefighting solutions.