| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Loitering Munition MarketSize 2023 |

USD 690.73 Million |

| North America Loitering Munition Market, CAGR |

10.7% |

| North America Loitering Munition Market Size 2032 |

USD 1,727.32 Million |

Market Overview:

North America Loitering Munition Market size was valued at USD 690.73 million in 2023 and is anticipated to reach USD 1,727.32 million by 2032, at a CAGR of 10.7% during the forecast period (2023-2032).

Several factors are propelling the growth of the loitering munition market in North America. The escalating demand for precision strike capabilities, particularly in urban and asymmetric combat scenarios, necessitates the deployment of advanced munitions that can loiter over target areas and engage with minimal collateral damage. Loitering munitions, such as AeroVironment’s Switchblade and UVision’s Hero series, offer real-time intelligence, surveillance, and reconnaissance (ISR), enhancing battlefield awareness and operational effectiveness. Additionally, the integration of artificial intelligence (AI) and autonomous systems into loitering munitions is enhancing their targeting accuracy and operational flexibility. The U.S. Department of Defense’s continued investment in these technologies, including multi-launch array systems and swarm tactics, further drives market growth.

North America, particularly the United States, dominates the global loitering munition market. The U.S. military’s substantial defense budget and commitment to modernization are pivotal in this leadership. Contracts awarded to companies like AeroVironment and Anduril Industries for the development and production of loitering munitions, such as the Switchblade and OPF-L systems, highlight the region’s strategic focus on enhancing strike capabilities for dismounted troops. Furthermore, U.S. Special Operations Forces are increasingly incorporating drones, including loitering munitions, into their operations to minimize human risk and ensure machines make initial contact with the enemy. This trend reflects a broader shift towards unmanned systems in modern warfare, reinforcing North America’s position as a leader in loitering munition adoption and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Loitering Munition Market was valued at USD 690.73 million in 2023 and is expected to reach USD 1,727.32 million by 2032, growing at a CAGR of 10.7% during the forecast period (2023-2032).

- The global loitering munition market is valued at USD 1,967.89 million in 2023 and is expected to grow significantly, reaching USD 4,952.89 million at a CAGR of 10.8% by 2032, driven by increasing demand for precision strike systems.

- Increasing demand for precision strike capabilities in urban and asymmetric combat scenarios is driving the adoption of loitering munitions, which offer real-time intelligence, surveillance, and reconnaissance (ISR).

- Autonomous systems integrated with artificial intelligence (AI) are enhancing the targeting accuracy and operational flexibility of loitering munitions, boosting their effectiveness in modern warfare.

- The United States dominates the North American market, accounting for over 80% of the market share, driven by a significant defense budget and technological advancements in military capabilities.

- Canada’s market share is smaller, contributing about 15%, with a growing emphasis on unmanned systems and precision strike capabilities as part of its military modernization efforts.

- Mexico’s market share remains under 5%, but there is potential for growth due to the country’s increasing investment in precision strike and surveillance systems, particularly in addressing border security challenges.

- The U.S. military’s focus on unmanned systems and asymmetric warfare continues to support the growth of loitering munitions, reflecting the region’s leadership in the adoption and innovation of these technologies.

Market Drivers:

Increased Demand for Precision Strikes

The growing need for precision strike capabilities is one of the primary drivers for the expansion of the North American loitering munition market. For instance, AeroVironment’s Switchblade family of loitering munitions has been widely adopted by the U.S. Army and allied forces, with the company securing a $288 million delivery order in February 2025—its third such order in 12 months under the U.S. Army’s Directed Requirement for Lethal Unmanned Systems. In modern warfare, the ability to engage high-value targets with minimal collateral damage is critical, particularly in urban and asymmetric combat environments. Loitering munitions, capable of real-time surveillance and engagement, provide military forces with an effective solution. These systems, often equipped with advanced sensors and autonomous targeting capabilities, ensure precise strikes even in complex combat scenarios. The increasing prevalence of non-traditional warfare, such as counterterrorism and counterinsurgency operations, further amplifies the demand for loitering munitions. As nations focus on reducing civilian casualties and minimizing the environmental impact of military engagements, loitering munitions become an essential tool in achieving these objectives.

Technological Advancements in Autonomous Systems

Advancements in autonomous technology are playing a pivotal role in driving the growth of the loitering munition market in North America. The integration of artificial intelligence (AI) and machine learning into these systems enhances their operational efficiency, enabling loitering munitions to make real-time decisions and adapt to changing battlefield conditions. For instance, Autonomous loitering munitions, such as AeroVironment’s Switchblade 600 and UVision’s Hero series, feature advanced targeting algorithms and can operate independently of human control once launched. This autonomy increases the operational capabilities of military forces, providing them with a higher degree of flexibility and accuracy during missions. Furthermore, the ability to conduct swarm tactics, where multiple loitering munitions are deployed simultaneously, further enhances the efficiency of military operations. As these technologies continue to advance, loitering munitions are expected to become even more integral to modern military strategies.

Cost-Effectiveness and Operational Efficiency

The cost-effectiveness of loitering munitions is another significant driver for their increased adoption in North America. Traditional missile systems and airstrikes are often expensive and resource-intensive, requiring extensive infrastructure and personnel. In contrast, loitering munitions offer a more affordable alternative, especially when targeting high-value assets or specific threats. Loitering munitions are smaller, lighter, and more flexible than conventional missile systems, which makes them an attractive option for military forces looking to achieve high precision without the need for larger, costlier assets. Additionally, the operational efficiency of loitering munitions—especially in terms of reducing the number of weapons needed to engage multiple targets—further enhances their value. As defense budgets become increasingly constrained, the cost-benefit ratio of loitering munitions is likely to drive further market adoption.

Strategic Focus on Unmanned Systems

North America, particularly the United States, has increasingly focused on integrating unmanned systems into military operations. This shift is driven by the need for more flexible, responsive, and safer military strategies, as well as the desire to reduce reliance on manned systems in high-risk environments. Loitering munitions, as an extension of unmanned aerial systems (UAS), align with this strategic shift. The U.S. Department of Defense has significantly increased its investment in unmanned systems over the past decade, with loitering munitions forming a core part of this initiative. These systems are seen as force multipliers, capable of performing a variety of functions such as intelligence gathering, surveillance, and target engagement, all while minimizing the risks to personnel. As the demand for unmanned technologies grows, the loitering munition market in North America is expected to continue expanding, with increased investments and collaborations among defense contractors to further enhance the capabilities of these systems.

Market Trends:

Integration of Artificial Intelligence and Autonomous Capabilities

A prominent trend in the North American loitering munition market is the integration of artificial intelligence (AI) and autonomous systems. These technologies enable loitering munitions to perform complex tasks such as target identification, tracking, and engagement with minimal human intervention. For instance, Shield AI’s V-BAT drone features AI-powered autonomy, allowing it to conduct fully autonomous ISR (intelligence, surveillance, and reconnaissance) and precision strike missions. This trend reflects a broader shift towards enhancing operational efficiency and reducing the cognitive load on operators.

Expansion of Tactical Applications

Loitering munitions are increasingly being employed across various military branches, including land, air, and naval forces. Their versatility allows for a wide range of applications, from intelligence, surveillance, and reconnaissance (ISR) missions to precision strikes. For instance, Northrop Grumman’s GMLRS (Guided Multiple Launch Rocket System) Loitering Munition, developed under a U.S. Army contract, is designed for both ground and air launch, enabling rapid deployment in support of infantry, armored, and naval units. The U.S. Army’s adoption of loitering munitions, such as the Switchblade series, exemplifies this trend. These systems are particularly valuable in counterterrorism and asymmetric warfare scenarios, where traditional weaponry may be less effective.

Advancements in Swarming Technology

Another significant trend is the development of swarming technology, where multiple loitering munitions operate in coordination to overwhelm adversary defenses. This approach enhances the effectiveness of loitering munitions by enabling complex attack patterns and increasing the likelihood of mission success. Research and development efforts are focusing on improving the communication and coordination among swarming loitering munitions to maximize their potential on the battlefield.

Increased Military Collaborations and Strategic Partnerships

The North American loitering munition market is witnessing a surge in collaborations and partnerships among defense contractors and government agencies. These alliances aim to accelerate the development and deployment of advanced loitering munition systems. For example, the U.S. Army awarded a $20.6 million contract to AeroVironment for the procurement of Switchblade 300 loitering munitions, scheduled for delivery to customers, including Ukraine, by July 2023. Such strategic partnerships are crucial for enhancing the technological capabilities and operational readiness of loitering munitions.

Market Challenges Analysis:

High Development and Production Costs

One of the key restraints in the North American loitering munition market is the high development and production costs associated with these advanced systems. The integration of cutting-edge technologies such as artificial intelligence (AI), machine learning, and autonomous capabilities increases the overall expense of loitering munitions. For instance, the Switchblade loitering munition, produced by AeroVironment, is priced at approximately $6,000 per unit, which, while lower than some traditional guided missiles, still represents a significant investment when considering the need for large-scale procurement, integration of AI-driven targeting, and advanced sensor arrays. Furthermore, the specialized materials and components required for their development, such as advanced sensors and high-performance propulsion systems, further contribute to the high cost. These financial burdens can limit the widespread adoption of loitering munitions, particularly among smaller defense budgets and emerging markets. Despite the long-term cost-efficiency that loitering munitions offer, the initial investment remains a significant challenge for many stakeholders in the industry.

Regulatory and Ethical Concerns

Another challenge facing the loitering munition market is the growing scrutiny surrounding the use of autonomous weapon systems, including loitering munitions, and the associated regulatory and ethical concerns. The ability of these systems to operate independently and make real-time decisions raises questions about accountability, especially in the event of unintended consequences such as civilian casualties or misidentification of targets. Governments and military forces must navigate complex ethical dilemmas related to autonomous weapons, while international regulations on the use of such technologies remain unclear. These concerns could slow the adoption and deployment of loitering munitions in certain jurisdictions, as defense contractors and military agencies work to ensure compliance with evolving legal frameworks.

Countermeasures and Evolving Threats

The advancement of anti-drone and anti-loitering munition technologies presents a significant challenge for the loitering munition market. As more nations develop countermeasures, such as electronic warfare systems and interceptors designed to neutralize or disrupt loitering munitions, the effectiveness of these systems could be reduced. The evolving nature of threats, including the development of more advanced and cost-effective countermeasures, requires continuous innovation in loitering munition design and defense strategies. This arms race could increase the costs of loitering munition systems and limit their operational effectiveness in certain environments.

Market Opportunities:

The North American loitering munition market presents significant opportunities driven by the growing demand for precise, low-cost, and flexible strike capabilities. As military forces increasingly shift toward unmanned systems, loitering munitions offer a highly effective solution for engaging targets with minimal collateral damage. This trend is particularly valuable in counterinsurgency and counterterrorism operations, where precision and adaptability are paramount. The U.S. military’s ongoing investments in autonomous systems, including loitering munitions, further highlight the market’s potential. Companies focusing on developing and deploying advanced loitering munition systems, such as AeroVironment’s Switchblade series, are well-positioned to capitalize on this growing demand, especially as defense budgets prioritize cost-effective, scalable solutions.

Additionally, the increasing integration of artificial intelligence (AI) and autonomous technologies into loitering munitions creates new opportunities for enhanced functionality and operational efficiency. The ability to conduct swarm tactics, where multiple loitering munitions operate in coordination, is expected to become a key area of growth, offering military forces greater flexibility and effectiveness. As technological advancements continue to evolve, the market for loitering munitions is set to expand, with governments and defense contractors collaborating to accelerate the development of next-generation systems. The increasing focus on unmanned and autonomous military technologies, combined with growing defense budgets in North America, presents substantial growth opportunities for companies in the loitering munition sector.

Market Segmentation Analysis:

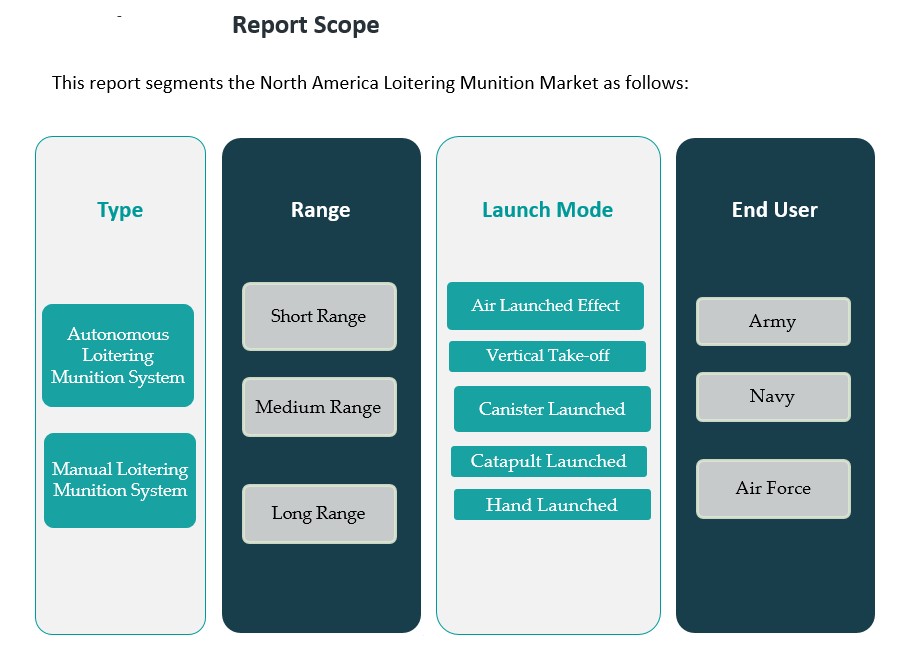

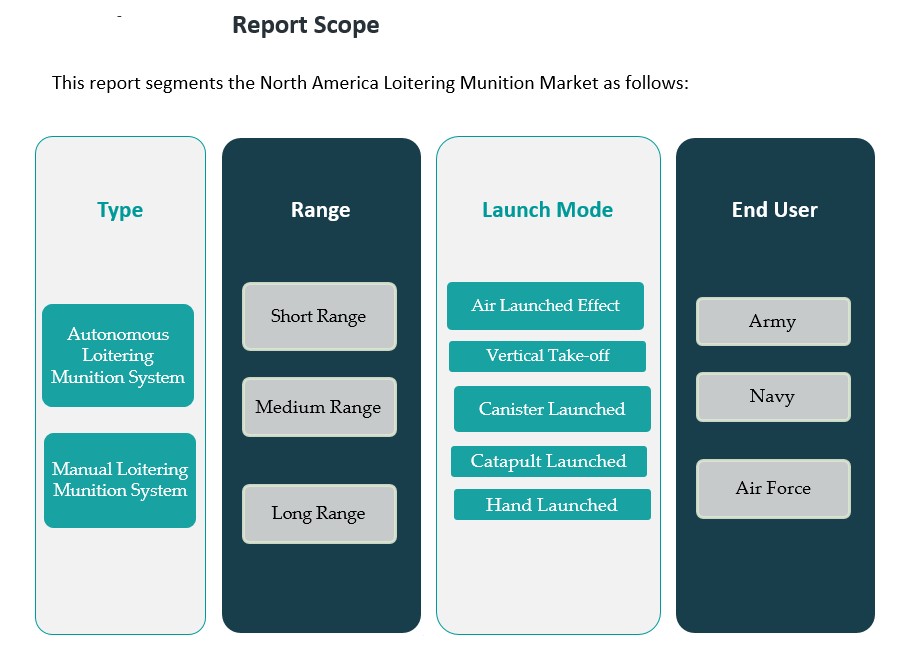

The North America loitering munition market can be segmented into various categories based on type, range, launch mode, and end user.

By Type: The market is primarily divided into two categories: Autonomous Loitering Munition Systems and Manual Loitering Munition Systems. Autonomous systems dominate the market due to their ability to operate independently, making them highly suitable for modern military applications that require precision and flexibility. These systems, equipped with advanced AI and machine learning capabilities, can autonomously identify and engage targets. Manual systems, while still in use, are less prevalent as the shift towards automation continues to enhance operational efficiency and reduce human intervention in complex combat scenarios.

By Range: Loitering munitions are further classified based on their operational range: Short Range, Medium Range, and Long Range. Short-range systems are typically used for tactical operations, such as surveillance and engaging nearby targets. Medium-range systems are more versatile, capable of reaching greater distances for precision strikes, while long-range systems are ideal for strategic missions where targets are located far from the launch point. Long-range systems are becoming increasingly significant due to the growing demand for extended operational capabilities.

By Launch Mode: Loitering munitions can be launched through various methods: Air Launched Effect, Vertical Take-off, Canister Launched, Catapult Launched, and Hand Launched. Each mode offers unique advantages in terms of mobility, deployment speed, and operational requirements, with air-launched systems often being favored for their ability to cover large areas and rapidly deploy in complex terrains.

By End User: The market is segmented by end user into Land, Air, and Navy sectors. The Land segment is currently the largest, driven by the increasing use of loitering munitions in ground-based combat scenarios. However, the Air and Navy segments are also growing as both branches increasingly adopt loitering munitions for their surveillance and strike capabilities.

Segmentation:

By Type:

- Autonomous Loitering Munition System

- Manual Loitering Munition System

By Range:

- Short Range

- Medium Range

- Long Range

By Launch Mode:

- Air Launched Effect

- Vertical Take-off

- Canister Launched

- Catapult Launched

- Hand Launched

By End User:

Regional Analysis:

The North America Loitering Munition Market is dominated by the United States, which holds the largest market share due to its significant defense budget and technological advancements in military capabilities. The growing demand for precision strike systems in military operations is driving the expansion of loitering munitions across the region. Loitering munitions, offering real-time surveillance and the ability to engage high-value targets with precision, are increasingly integrated into the U.S. military’s modernized arsenal, enhancing its defense capabilities. The U.S. military’s focus on asymmetric warfare and unmanned systems further supports the market’s growth. As a result, the United States accounts for more than 80% of the North American market, underscoring its critical role in the region’s defense industry.

Canada, while a smaller player in the loitering munition market compared to the U.S., is also contributing to the growth of the North American sector. The country’s defense sector has been progressively modernizing, with an increasing focus on unmanned systems and precision strike capabilities. This aligns with Canada’s broader defense strategy to enhance its military effectiveness in addressing emerging security threats. However, Canada’s market share in the North American loitering munition market remains relatively limited, contributing approximately 15%.

Mexico, although not as prominent in the loitering munition market, is beginning to invest in modern defense technologies. With ongoing concerns about border security and drug trafficking, there is potential for increased demand for precision strike and surveillance systems like loitering munitions in Mexico. The market share for Mexico remains under 5%, but future developments in the country’s defense infrastructure could create growth opportunities in the coming years.

Key Player Analysis:

- AeroVironment, Inc.

- UVision Air Ltd.

- Paramount Group

- Elbit Systems Ltd

- Rheinmetall AG

- Thales

- Uvision

- KNDS

- RTX

- AEVEX Aerospace

- Teledyne FLIR Defense

- Northrop Grumman

Competitive Analysis:

The North America loitering munition market is highly competitive, with key players including AeroVironment, UVision, and Anduril Industries leading the charge. AeroVironment is a dominant force, particularly known for its Switchblade series, which has gained significant traction with the U.S. military for precision strike capabilities. UVision’s Hero series provides versatile solutions for various military applications, further enhancing its market presence. Anduril Industries, with its focus on autonomous systems, is rapidly gaining recognition for its advanced loitering munition technologies that integrate AI for enhanced battlefield performance. These companies are investing heavily in research and development to create more efficient, cost-effective, and advanced loitering munitions. Strategic partnerships, such as AeroVironment’s contracts with the U.S. Department of Defense, position these players as key contributors to defense modernization efforts. The increasing focus on autonomous systems and multi-domain operations continues to drive innovation and competition within the market.

Recent Developments:

- In October 2024, AeroVironment, a leading US defense contractor, received a $54.9 million delivery order from the US Army for the production of its Switchblade loitering munition systems. This order is part of a larger indefinite-delivery/indefinite-quantity (IDIQ) contract, with an additional contract ceiling of $743 million, underscoring the US Army’s commitment to expanding its precision-strike capabilities with advanced, expendable loitering munitions.

- In October 2024, Anduril Industries, in collaboration with AeroVironment and Teledyne FLIR, secured contracts from the US Marine Corps to develop loitering munitions for the Organic Precision Fires-Light (OPF-L) Program. The initiative aims to modernize strike capabilities for dismounted troops under the Force Design Initiative, with initial contracts totaling $27.5 million and the potential for a combined value of up to $249 million by April 2026.

- In November 2024, AeroVironment, Inc. announced a definitive agreement to acquire BlueHalo in an all-stock transaction valued at approximately $4.1 billion. This acquisition is set to create a more diversified leader in all-domain defense technologies, expanding AeroVironment’s reach into key segments such as space technologies, counter-uncrewed aircraft systems, directed energy, electronic warfare, cyber, artificial intelligence, and uncrewed underwater vehicles. The combined company aims to offer a comprehensive portfolio of high-growth franchises powered by cutting-edge technology, addressing critical defense priorities for the U.S. and its allies

Market Concentration & Characteristics:

The North American loitering munition market exhibits moderate concentration, characterized by a mix of established defense contractors and emerging technology firms. Leading players such as AeroVironment, Elbit Systems, and Israel Aerospace Industries (IAI) hold significant market shares, driven by long-standing relationships with defense agencies and a history of successful deployments. These companies leverage their extensive experience and established reputations to maintain a competitive edge in the market. However, the market also sees the entry of innovative startups like Anduril Industries, which are introducing advanced autonomous systems and AI-driven loitering munitions. These newcomers are challenging traditional players by offering cutting-edge technologies and novel operational concepts, thereby intensifying competition and fostering innovation within the sector. The competitive landscape is further shaped by strategic partnerships and collaborations between defense contractors and government agencies, facilitating the development and deployment of advanced loitering munition systems. Such alliances enable companies to pool resources, share expertise, and accelerate the introduction of new technologies to meet the evolving demands of modern warfare.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type. Range, Launch Mode and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America loitering munition market is expected to see steady growth, driven by increasing defense budgets and the demand for precision strike capabilities.

- Autonomous loitering munition systems will gain prominence, with advancements in artificial intelligence and machine learning enhancing their operational efficiency.

- Technological advancements in swarming tactics will lead to more effective multi-munition missions, boosting market adoption.

- U.S. military contracts for loitering munition systems will continue to drive the market, particularly as the Department of Defense modernizes its defense assets.

- The expansion of loitering munition applications in non-traditional warfare, such as counterinsurgency and border security, will broaden their usage.

- The rising focus on unmanned systems will fuel further growth, aligning with broader military strategies to reduce human risk.

- The integration of advanced sensors and real-time data analytics will enhance the accuracy and effectiveness of loitering munitions.

- The cost-efficiency of loitering munitions, compared to traditional missile systems, will attract more military forces globally.

- Increased collaboration among defense contractors and governments will expedite the development of next-generation loitering munitions.

- North America will continue to lead in market share due to its technological edge, defense spending, and military investments.