| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Protein Based Sports Supplements Market Size 2024 |

USD 2,585.75 Million |

| North America Protein Based Sports Supplements Market, CAGR |

7.42% |

| North America Protein Based Sports Supplements Market Size 2032 |

USD 4,582.75 Million |

Market Overview

North America Protein Based Sports Supplements Market size was valued at USD 2,585.75 million in 2024 and is anticipated to reach USD 4,582.75 million by 2032, at a CAGR of 7.42% during the forecast period (2024-2032).

The North America protein-based sports supplements market is primarily driven by the growing consumer awareness regarding health, fitness, and muscle recovery, particularly among athletes, bodybuilders, and fitness enthusiasts. The increasing popularity of high-protein diets and rising gym memberships across the region further support market growth. Additionally, the rising demand for convenient and on-the-go nutrition, coupled with the growing influence of social media and fitness influencers, is encouraging consumers to incorporate protein supplements into their daily routines. Technological advancements in product formulation and the introduction of plant-based and clean-label protein supplements are also enhancing product appeal across a broader demographic. Moreover, the trend toward personalized nutrition and the increasing availability of products through e-commerce platforms are reshaping purchasing behaviors. Manufacturers are focusing on innovative packaging, flavor variety, and functional ingredients to meet evolving consumer preferences, thereby contributing to sustained market expansion in the coming years.

The North America protein-based sports supplements market demonstrates strong regional penetration across the United States, Canada, Mexico, and other smaller regions, with each country contributing uniquely to the market’s growth. The United States leads in terms of product innovation, brand presence, and consumer awareness, while Canada and Mexico are witnessing rising demand driven by shifting lifestyles and growing fitness culture. E-commerce expansion and increased availability of international brands are further supporting regional adoption. The market is highly competitive and includes several key players actively shaping the landscape through strategic partnerships, new product launches, and marketing campaigns. Notable companies such as Glanbia PLC, Abbott Laboratories, MusclePharm Corporation, NOW Foods, and Iovate Health Sciences International Inc. (MuscleTech) play a pivotal role in meeting consumer demands across product categories and sources. These brands focus on quality, clean-label ingredients, and targeted formulations, enabling them to strengthen their market position and respond effectively to evolving consumer preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America protein-based sports supplements market was valued at USD 2,585.75 million in 2024 and is projected to reach USD 4,582.75 million by 2032, growing at a CAGR of 7.42% during the forecast period.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Rising health consciousness and increased participation in fitness activities are driving the demand for protein supplements across diverse age groups.

- Consumers are showing strong preference for plant-based protein options and clean-label formulations, boosting product innovation.

- Key players such as Glanbia PLC, Abbott Laboratories, and MusclePharm Corporation dominate the market through extensive product portfolios and brand visibility.

- Market growth is restrained by strict regulatory compliance requirements and quality concerns related to product authenticity.

- The U.S. leads the market due to high consumer awareness and advanced distribution channels, while Canada and Mexico show emerging growth potential.

- E-commerce platforms and digital marketing strategies are reshaping consumer buying patterns and expanding brand reach.

Report Scope

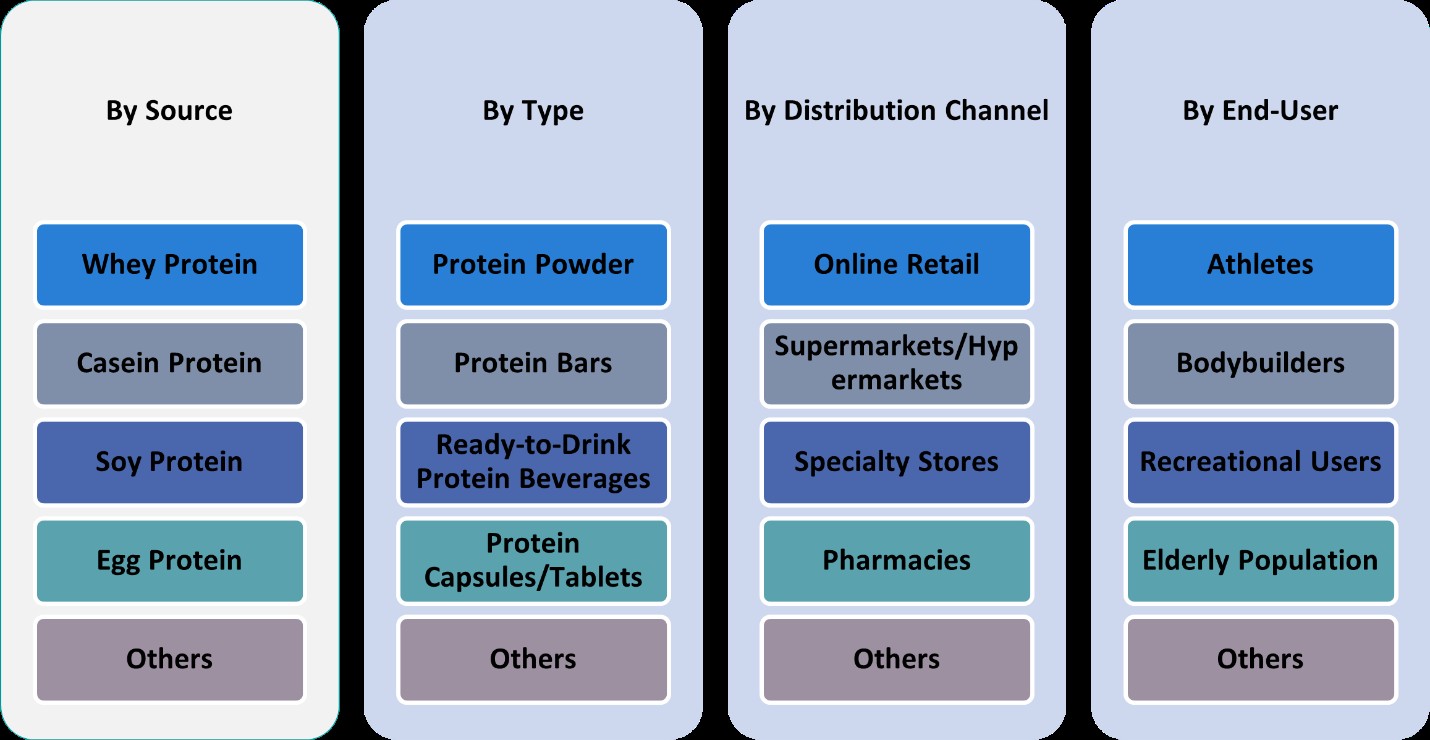

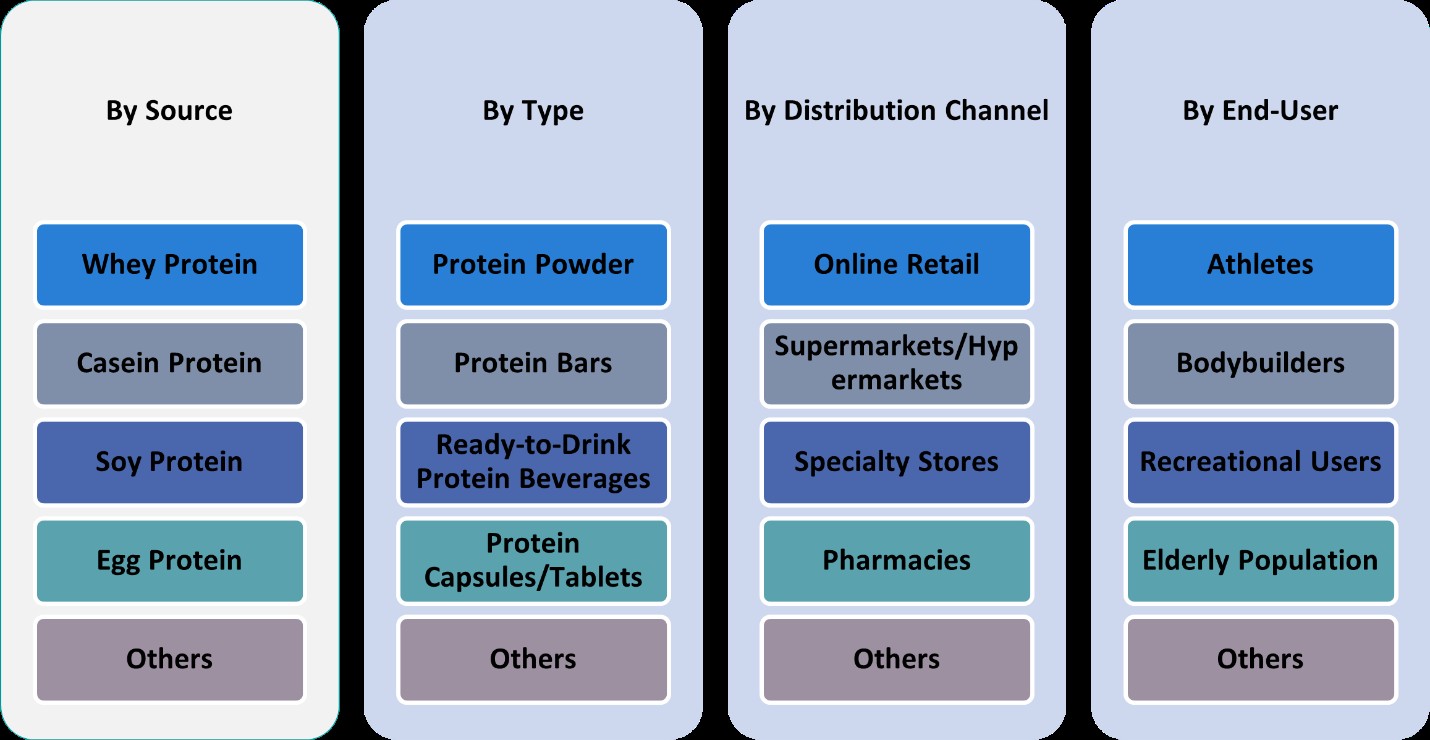

This report segments the North America Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health Awareness and Fitness Culture

The increasing health consciousness among consumers in North America is a primary driver of the protein-based sports supplements market. For instance, a report by the Centers for Disease Control and Prevention (CDC) highlighted that public health initiatives promoting active lifestyles and balanced nutrition have significantly influenced consumer behavior. A growing number of individuals are adopting healthier lifestyles, incorporating regular exercise and nutritious diets into their daily routines. This shift has significantly increased the demand for dietary supplements, particularly those rich in protein, which support muscle development, weight management, and post-workout recovery. Additionally, the rise in lifestyle-related diseases, such as obesity and cardiovascular issues, has encouraged consumers to make more informed nutritional choices. The growing emphasis on physical fitness and preventive healthcare is prompting a surge in gym memberships and participation in fitness activities, which directly contributes to the consumption of protein-based sports supplements. This trend is further reinforced by public and private health initiatives promoting wellness and active living across the region.

Expansion of Sports and Athletic Participation

The increasing participation in sports and athletic activities across all age groups is another major factor fueling market growth. For instance, a report by the International Health, Racquet & Sportsclub Association (IHRSA) noted a steady rise in gym memberships and participation in fitness activities across North America, reflecting a cultural shift toward active living. Schools, colleges, and community organizations are increasingly promoting sports as a part of educational and recreational programs, leading to a wider consumer base for sports nutrition products. Furthermore, the growing popularity of endurance sports, bodybuilding competitions, and fitness challenges has cultivated a strong market for protein-based supplements among both male and female consumers. The expanding demographic of fitness-conscious individuals looking for convenient sources of high-quality protein is encouraging manufacturers to introduce innovative, targeted products, thereby stimulating market development.

Technological Advancements and Product Innovation

Continuous advancements in supplement formulation, processing technologies, and ingredient innovation are reshaping the North American protein-based sports supplements market. Manufacturers are leveraging technology to develop clean-label, plant-based, and allergen-free protein supplements that align with evolving consumer preferences. These innovations cater to a diverse set of dietary requirements, including vegan, gluten-free, and keto-friendly lifestyles. Additionally, the incorporation of functional ingredients like probiotics, BCAAs (branched-chain amino acids), and adaptogens has significantly enhanced the value proposition of protein supplements. Enhanced solubility, improved taste profiles, and attractive packaging are also playing a crucial role in influencing consumer purchasing behavior. With R&D investments and collaborations with nutritionists and food technologists, companies are launching new products that deliver both performance and convenience, boosting market growth across various consumer segments.

E-commerce Growth and Influencer Marketing

The rapid expansion of online retail platforms and the widespread influence of digital marketing have significantly transformed the way protein-based sports supplements are marketed and distributed. E-commerce channels provide consumers with easy access to a wide range of supplement options, detailed product information, and personalized recommendations, thereby increasing overall sales. Additionally, the rise of fitness influencers, athletes, and health coaches on social media platforms has amplified consumer interest and trust in specific brands. Influencer-led marketing campaigns, user-generated content, and targeted digital advertising have emerged as powerful tools for brand visibility and customer engagement. This digital ecosystem not only enhances consumer education but also drives impulse buying and brand loyalty. The convenience of doorstep delivery and subscription models further contributes to the steady growth of protein-based sports supplement consumption across North America.

Market Trends

Shift Toward Plant-Based and Clean-Label Supplements

One of the most prominent trends in the North America protein-based sports supplements market is the growing consumer preference for plant-based and clean-label products. As awareness regarding animal welfare, environmental sustainability, and lactose intolerance increases, more consumers are opting for plant-derived proteins such as pea, rice, hemp, and soy. These alternatives not only cater to vegan and vegetarian populations but also appeal to health-conscious individuals seeking natural and minimally processed ingredients. Clean-label supplements that are free from artificial additives, preservatives, and allergens are gaining significant traction. Manufacturers are responding to this demand by launching organic and non-GMO certified products, which align with the values of transparency and health-consciousness among modern consumers.

Personalized Nutrition and Functional Formulations

The trend of personalized nutrition is reshaping the protein supplement landscape in North America. For instance, a study by Nutrigenomix emphasized the role of diagnostic tools and mobile apps in providing customized supplement recommendations based on individual health goals and dietary preferences. As a result, brands are investing in research and technology to create tailored formulations that target specific needs such as muscle gain, fat loss, recovery, and energy enhancement. Additionally, functional ingredients like collagen, creatine, electrolytes, and adaptogens are being integrated into protein blends to offer multifaceted health benefits. This trend not only increases the perceived value of supplements but also enhances brand differentiation. The rise of diagnostic tools and mobile apps offering customized supplement recommendations further supports this move toward individualized nutrition.

Innovation in Formats and Flavors

Consumers are increasingly favoring protein supplements available in innovative and convenient formats. For instance, a report by the International Health, Racquet & Sportsclub Association (IHRSA) highlighted the growing popularity of ready-to-drink (RTD) beverages, protein bars, and snacks among busy professionals and students. These on-the-go options cater to busy lifestyles and appeal to a broader consumer base beyond athletes, including working professionals and students. Moreover, manufacturers are expanding their flavor offerings beyond basic chocolate and vanilla to include indulgent, exotic, and seasonal flavors. This diversification not only enhances consumer experience but also boosts repeat purchases by minimizing flavor fatigue. The emphasis on texture and taste without compromising nutritional value continues to drive product development in the market.

Rise of Digital Influence and Community Engagement

The increasing impact of digital platforms on consumer buying behavior is a defining trend in the North American protein-based sports supplements market. Social media channels, health forums, fitness blogs, and YouTube reviews have become critical tools for brand discovery and consumer education. Influencer endorsements, testimonial videos, and before-and-after transformation stories help establish trust and authenticity among target audiences. Additionally, many brands are creating online communities and loyalty programs to encourage user engagement and build a sense of belonging. This digital-first approach not only strengthens brand-consumer relationships but also provides valuable feedback for continuous product improvement, positioning companies to better meet evolving market demands.

Market Challenges Analysis

Stringent Regulatory Framework and Quality Concerns

One of the major challenges confronting the North America protein-based sports supplements market is the complex and stringent regulatory environment. For instance, a report by the U.S. Food and Drug Administration (FDA) highlighted the lack of mandatory pre-market approval for dietary supplements, which can lead to the presence of unverified or adulterated products on shelves. This inconsistency in product quality can erode consumer trust and hinder market growth. Moreover, the increased scrutiny of manufacturing practices and the rising demand for third-party testing have imposed higher operational costs on manufacturers, particularly smaller players. As consumer awareness around ingredient transparency and certifications grows, companies must invest in compliance, traceability, and quality assurance, which can be resource-intensive and time-consuming.

Market Saturation and Intense Competition

The North American protein-based sports supplements market faces intense competition and increasing saturation, making it challenging for new entrants and existing players to sustain long-term growth. The market is populated with numerous international and regional brands offering a wide array of similar products, often with minimal differentiation. This high level of competition has led to aggressive pricing strategies and frequent promotional offers, which can erode profit margins. Additionally, the growing presence of private-label products from large retail chains is placing pressure on established brands to continuously innovate and maintain customer loyalty. With evolving consumer preferences, staying relevant requires continuous product development, targeted marketing efforts, and strong brand positioning. The rapid pace of change in consumer trends, such as the shift toward plant-based ingredients or functional nutrition, adds further complexity, compelling companies to remain agile and forward-thinking in their approach.

Market Opportunities

The North America protein-based sports supplements market is poised for substantial growth due to the increasing consumer demand for holistic wellness and preventive health solutions. As awareness around the importance of protein intake extends beyond traditional athletes to include lifestyle users, older adults, and individuals managing chronic health conditions, the market is expanding into new and underserved demographic segments. This diversification presents a significant opportunity for brands to develop age-specific and gender-specific formulations that cater to varying nutritional requirements. Moreover, the rising popularity of plant-based diets opens avenues for product innovation using novel protein sources such as algae, pumpkin seed, and chickpea. Companies that invest in R&D to deliver high-quality, allergen-free, and sustainably sourced supplements are well-positioned to tap into this expanding consumer base. Additionally, the integration of advanced technologies like artificial intelligence and wearable health devices in personalized nutrition planning is expected to enhance consumer engagement and drive long-term brand loyalty.

Another key opportunity lies in the increasing penetration of e-commerce and digital platforms across North America. With consumers seeking convenience and tailored shopping experiences, brands that leverage data-driven marketing, influencer partnerships, and subscription-based models are likely to gain a competitive edge. Online platforms allow companies to offer wider product assortments, collect real-time feedback, and expand their reach without the constraints of physical retail. Furthermore, the growing focus on clean-label transparency and sustainability creates opportunities for companies to differentiate themselves through eco-friendly packaging and ethical sourcing practices. As consumers become more informed and selective, there is a strong demand for brands that not only offer performance benefits but also align with their values and lifestyles. By strategically aligning innovation, digital presence, and ethical branding, companies can unlock substantial growth potential in the evolving North American protein-based sports supplements market.

Market Segmentation Analysis:

By Type:

The North America protein-based sports supplements market is segmented into protein powder, protein bars, ready-to-drink (RTD) protein beverages, protein capsules/tablets, and others. Among these, protein powders hold the largest market share due to their widespread availability, versatility, and established consumer trust. They are widely used by athletes and fitness enthusiasts for muscle recovery and performance enhancement. However, ready-to-drink protein beverages are witnessing rapid growth, driven by increasing demand for convenience and on-the-go nutrition. These beverages cater to busy professionals, students, and casual gym-goers who prefer quick and portable options. Protein bars are also gaining traction as a meal replacement or snack alternative, especially among consumers focused on weight management and energy boosting. Meanwhile, capsules and tablets, though less dominant, serve niche segments looking for controlled dosage and ease of use. Innovation in flavor, packaging, and formulation across all types is expected to further diversify consumer choices and support market expansion.

By Source:

Based on the source, the market is categorized into whey protein, casein protein, soy protein, egg protein, and others. Whey protein dominates the segment due to its high biological value, rapid absorption, and proven effectiveness in muscle repair and recovery. It remains the go-to choice for athletes and fitness professionals. Casein protein, known for its slow digestion properties, appeals to consumers seeking sustained amino acid release, especially during nighttime recovery. Soy protein, as a plant-based alternative, is gaining traction among vegans, vegetarians, and those with lactose intolerance. Egg protein is valued for its complete amino acid profile and is preferred by individuals seeking dairy-free options. The “others” category, which includes emerging sources like pea, rice, and hemp protein, is rapidly expanding in response to the growing demand for clean-label and allergen-free products. This diversification in protein sources reflects evolving consumer preferences and presents opportunities for brands to cater to specialized dietary needs across North America.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

Regional Analysis

United States

The United States holds the dominant position in the North America protein-based sports supplements market, accounting for approximately 72% of the regional market share in 2024. This leadership is primarily driven by a well-established fitness industry, high consumer awareness about nutrition, and strong demand for performance-enhancing supplements among athletes, bodybuilders, and health-conscious individuals. The country has a robust network of gyms, fitness centers, and health clubs, which promotes protein supplementation as part of workout routines. In addition, the rising trend of clean-label, non-GMO, and plant-based protein products is driving product innovation. E-commerce growth and the presence of major market players with extensive distribution channels further enhance accessibility and product reach. Moreover, aggressive marketing campaigns involving celebrity athletes and social media influencers continue to bolster brand visibility and consumer engagement, thereby reinforcing the U.S. market’s dominant position in the region.

Canada

Canada represents the second-largest market within North America, holding around 14% of the regional share in 2024. Increasing participation in sports, growing fitness trends, and greater awareness about preventive healthcare are key factors supporting market growth. Canadian consumers are increasingly adopting protein-based supplements to support muscle recovery, boost energy levels, and meet dietary protein requirements, especially in urban areas. The rising demand for plant-based and organic products aligns with national health trends and supports market expansion. Canadian regulations around food safety and supplement quality also encourage consumer trust and ensure product efficacy. Furthermore, rising e-commerce adoption and availability of international brands through both physical retail and online channels make protein-based supplements easily accessible. Ongoing investments in fitness infrastructure and wellness initiatives contribute further to market development in the region.

Mexico

Mexico holds a 9% share of the North American protein-based sports supplements market in 2024, and its market is growing steadily due to increasing urbanization, disposable income, and awareness of health and wellness. As the Mexican middle-class population becomes more conscious of nutrition and physical fitness, protein supplements are gaining popularity among gym-goers and younger consumers. The market is also benefitting from the growing influence of American fitness culture and social media fitness influencers. However, affordability and access to premium products remain challenges, especially in rural areas. Domestic brands offering cost-effective alternatives and localized formulations are likely to gain traction. The ongoing expansion of retail infrastructure and e-commerce platforms is gradually bridging the accessibility gap, positioning Mexico as an emerging growth market within the region.

Key Player Analysis

- Glanbia PLC

- Abbott Laboratories

- MusclePharm Corporation

- NOW Foods

- Dymatize Enterprises, LLC

- Iovate Health Sciences International Inc. (MuscleTech)

- CytoSport, Inc. (Muscle Milk)

- Garden of Life, LLC

- Quest Nutrition LLC

- Amazing Grass

Competitive Analysis

The North America protein-based sports supplements market is highly competitive, with several established players driving innovation, product expansion, and brand visibility. Leading companies such as Glanbia PLC, Abbott Laboratories, MusclePharm Corporation, NOW Foods, Dymatize Enterprises LLC, Iovate Health Sciences International Inc. (MuscleTech), CytoSport Inc. (Muscle Milk), Garden of Life LLC, Quest Nutrition LLC, and Amazing Grass play a pivotal role in shaping market dynamics. These players focus on developing diverse product offerings across various protein sources, including whey, casein, soy, and plant-based alternatives, to cater to a broad spectrum of consumers ranging from professional athletes to health-conscious individuals. Strategic initiatives such as mergers, acquisitions, and collaborations are commonly employed to strengthen market presence and enter emerging segments. Furthermore, strong branding, influencer partnerships, and digital marketing are central to their customer engagement strategies. Many of these companies invest heavily in research and development to introduce clean-label, non-GMO, and allergen-free products that align with evolving consumer preferences. Their robust distribution networks, which include e-commerce platforms and retail partnerships, enable wider product accessibility across North America. As competition intensifies, continuous innovation, transparent labeling, and sustainability practices remain key differentiators for these major players to maintain leadership and gain market share.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The North America protein-based sports supplements market exhibits a moderate to high level of market concentration, with a few dominant players accounting for a significant portion of overall revenue. Leading companies such as Glanbia PLC, Abbott Laboratories, and Iovate Health Sciences International Inc. (MuscleTech) have established strong brand recognition, extensive distribution networks, and diversified product portfolios, giving them a competitive edge. The market is characterized by high product differentiation, with offerings tailored to various consumer segments, including athletes, fitness enthusiasts, and individuals pursuing general wellness. Innovation, particularly in plant-based and clean-label formulations, continues to define the competitive landscape. Additionally, the market benefits from a well-informed consumer base that actively seeks high-quality, transparent, and convenient nutritional solutions. While entry barriers exist due to regulatory compliance and brand loyalty, new entrants focusing on niche segments and e-commerce-driven strategies can find growth opportunities. Overall, the market combines dynamic consumer demand with strategic brand positioning and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for protein-based sports supplements in North America is expected to grow steadily due to increasing health and fitness awareness.

- Rising participation in sports, gym, and fitness activities will continue to drive product consumption.

- The popularity of plant-based and clean-label protein supplements is anticipated to increase among health-conscious consumers.

- E-commerce platforms will play a significant role in expanding product accessibility and consumer reach.

- Technological advancements in protein extraction and formulation will enhance product effectiveness and consumer appeal.

- The market will likely benefit from the growing trend of personalized nutrition and customized supplement solutions.

- Strategic partnerships and product innovation will remain key focus areas for leading manufacturers.

- Regulatory support and favorable labeling guidelines are expected to encourage market expansion.

- Increasing disposable income and willingness to spend on premium health products will support market growth.

- Awareness campaigns and endorsements by athletes and fitness influencers will strengthen consumer trust and boost demand.