Market Overview

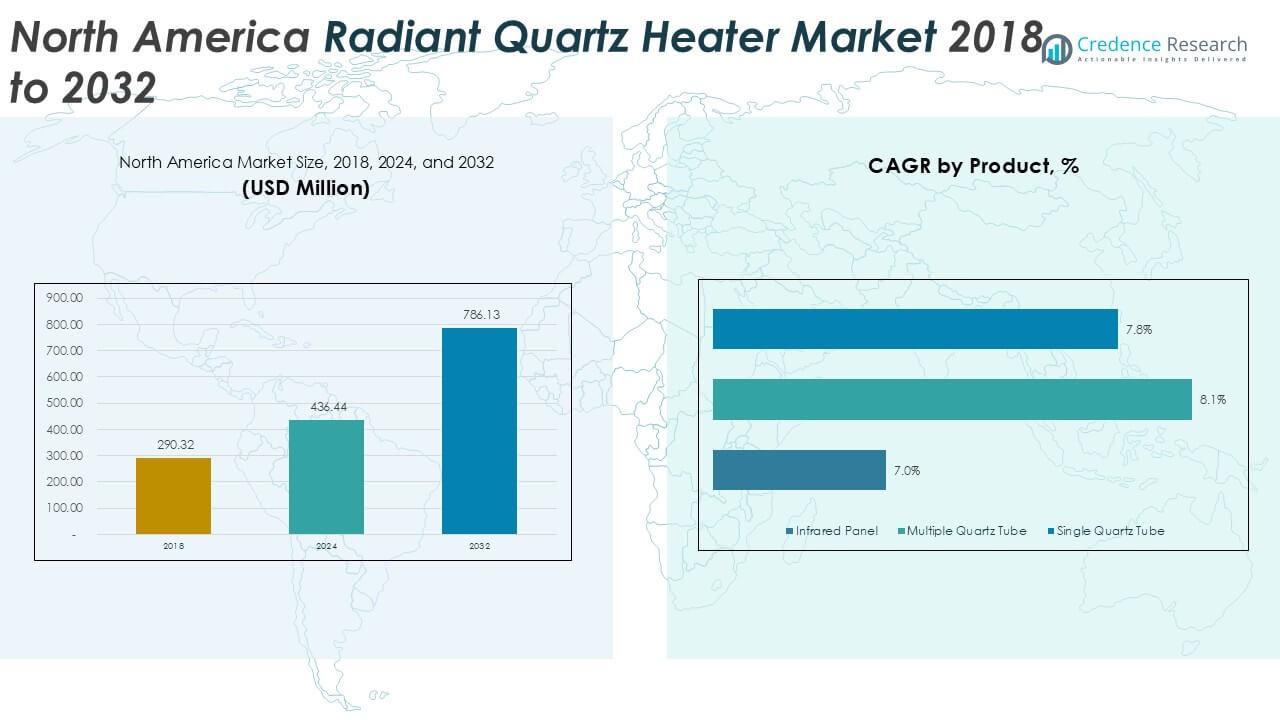

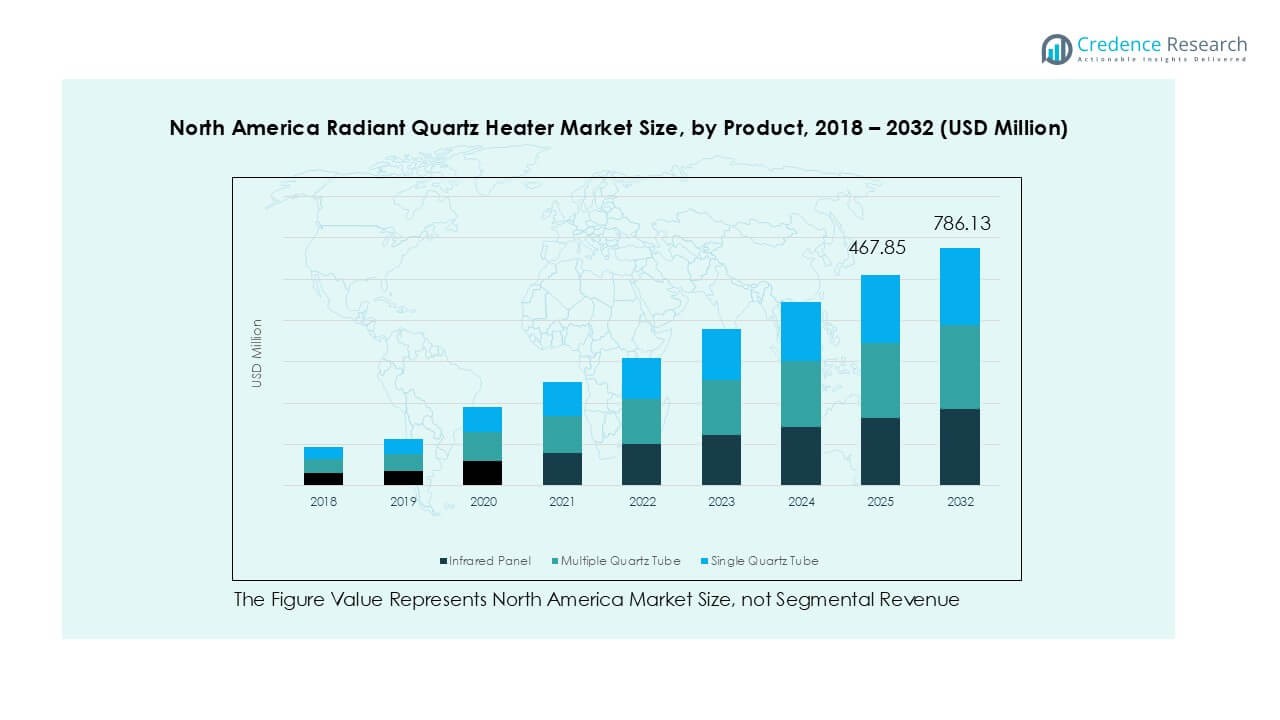

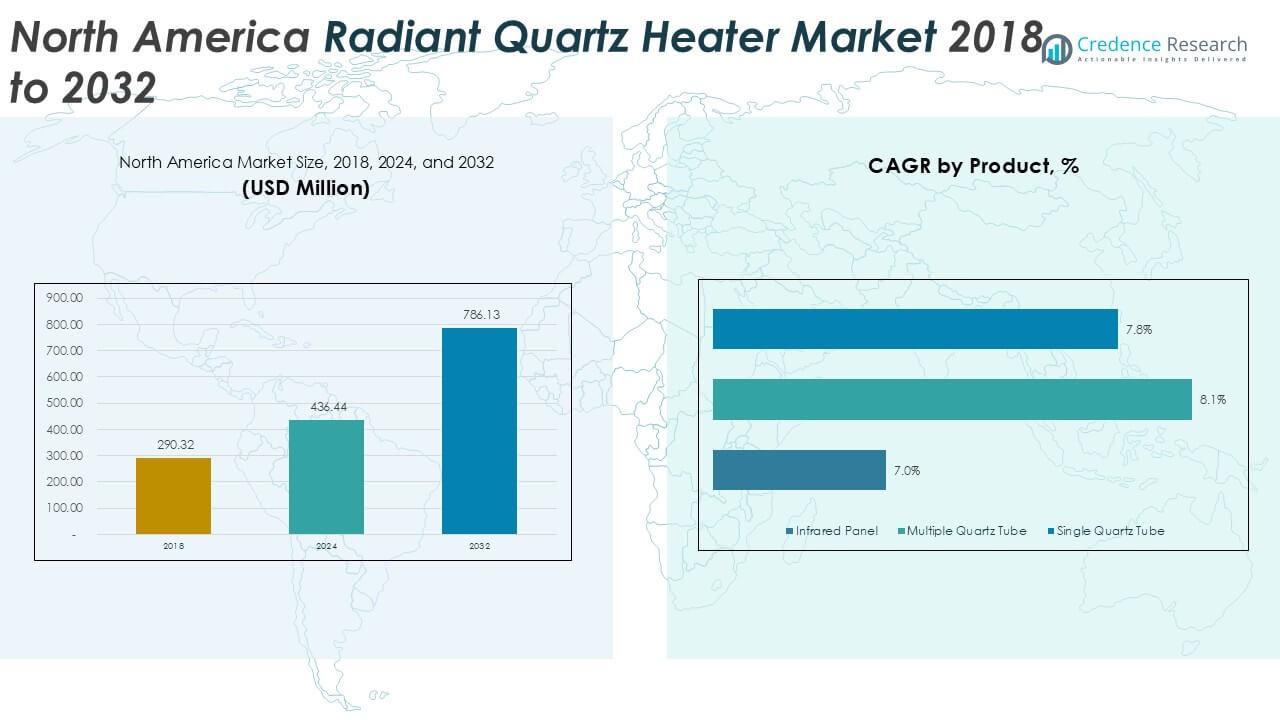

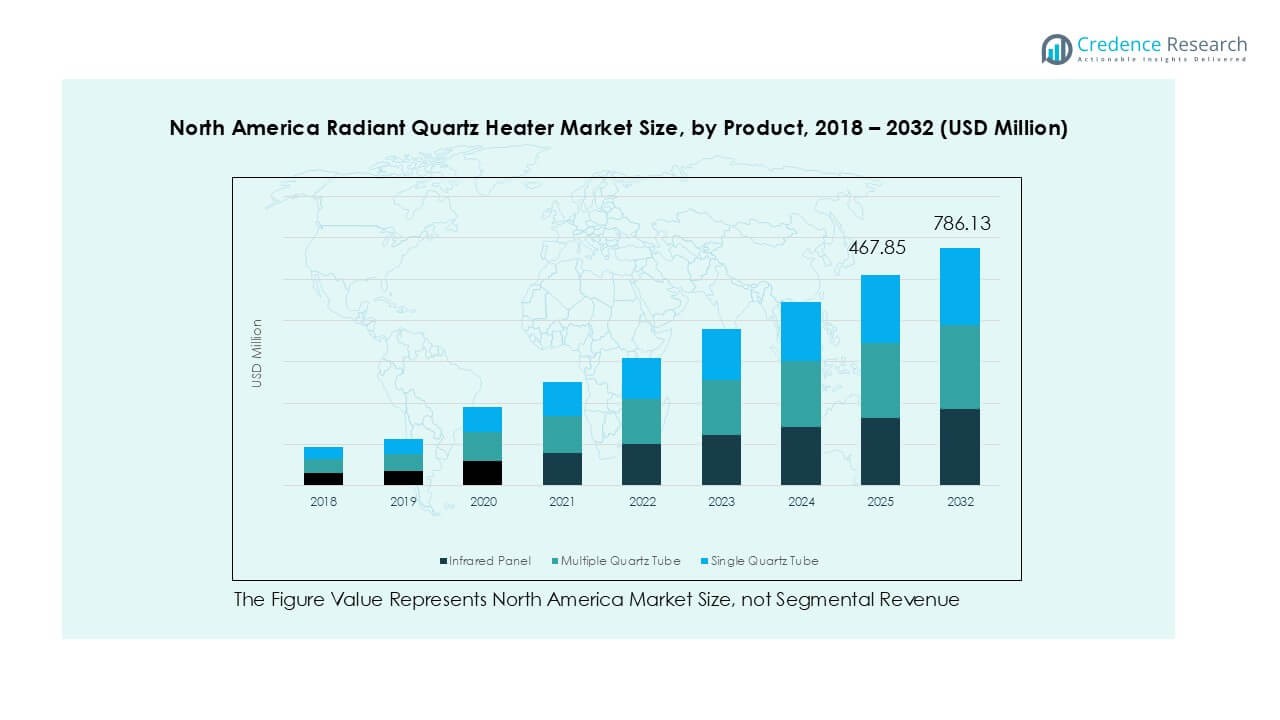

North America Radiant Quartz Heater market size was valued at USD 290.32 million in 2018 to USD 436.44 million in 2024 and is anticipated to reach USD 786.13 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Radiant Quartz Heater Market Size 2024 |

USD 436.44 Million |

| North America Radiant Quartz Heater Market, CAGR |

7.7% |

| North America Radiant Quartz Heater Market Size 2032 |

USD 786.13 Million |

The North America radiant quartz heater market is led by established appliance and heating equipment manufacturers. Major players include De’Longhi Appliance, Honeywell International, Lasko Products, Vornado Air, Duraflame, Pelonis Technologies, TPI Corporation, Backer Hotwatt, Sunpentown International, and Jaye Industry. These companies compete through energy efficiency, safety compliance, product design, and strong retail presence. The United States dominates the regional landscape, accounting for exactly 72% of total market share, driven by high residential adoption and replacement demand. Canada follows with an 18% share, supported by prolonged winter heating needs, while Mexico holds around 10%, reflecting emerging demand in colder and high-altitude regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America radiant quartz heater market reached USD 436.44 million in 2024 and is projected to reach USD 786.13 million by 2032, growing at a CAGR of 7.7% during the forecast period, supported by steady residential and light commercial demand across the region.

- Rising demand for energy-efficient and instant space-heating solutions drives market growth, as consumers prefer quartz heaters for quick warmth, lower energy loss, and suitability for targeted indoor and semi-outdoor heating applications.

- Key market trends include growth of smart and design-oriented heaters, rising online sales penetration, and increasing adoption of mid-wattage models, with the 1000–1500-watt segment holding nearly 48% share and multiple quartz tube products accounting for about 45% share.

- Competitive intensity remains high, with players focusing on pricing, safety certifications, design differentiation, and retail reach, while private-label products and seasonal promotions increase price competition.

- Regionally, the United States leads with about 72% market share, followed by Canada at around 18% and Mexico at nearly 10%, reflecting climate conditions, income levels, and heating demand patterns.

Market Segmentation Analysis:

By Product

The product segment includes infrared panels, multiple quartz tube heaters, and single quartz tube heaters. Multiple quartz tube heaters dominate this segment, holding about 45% market share. Strong dominance comes from higher heat output and faster warm-up performance. These heaters suit large rooms, garages, and commercial spaces. Infrared panels see rising use in modern homes due to slim design. Single quartz tube models remain popular in low-cost residential use. Demand growth is driven by energy efficiency, instant heating, and improved safety features across product designs.

- For instance, Havells India offers specific models like the Havells Ember 1200-Watt room Heater or the Havells Inclino Halogen Room Heater, which feature three quartz or halogen heating tubes respectively, typically with a total output of 1,200 W. These radiant heaters provide instant heat output, warming up within.

By Wattage Segment

The wattage segment covers below 1000 watt, 1000–1500 watt, and above 1500-watt heaters. The 1000–1500-watt range leads the market with nearly 48% share. This range balances heating power with energy savings. Consumers prefer this category for bedrooms and living spaces. Below 1000-watt units serve small rooms and spot heating needs. Above 1500-watt models support workshops and commercial areas. Growth drivers include rising electricity cost awareness and demand for efficient mid-power heating solutions.

- For instance, Bajaj Electricals markets quartz (radiant) heaters in the 1,200 W range that can provide instant, focused warmth to individuals and objects within their line of sight, making a small, enclosed room feel warmer quickly, although they do not typically raise the overall ambient room temperature by 6–8 °C within just 10 minutes through air convection alone.

By Distribution Channel

Distribution channels include offline and online sales formats. Offline channels dominate with about 62% market share. Physical stores allow product inspection and immediate purchase. Many buyers prefer in-store advice for heating products. Specialty appliance stores and home improvement chains drive offline sales. Online channels grow faster due to discounts and wider product choice. E-commerce platforms attract urban and tech-savvy consumers. Growth drivers include expanding retail networks, seasonal promotions, and rising trust in online appliance purchases.

Key Growth Drivers

Rising Demand for Energy-Efficient Space Heating

Growing focus on energy efficiency strongly drives the North America radiant quartz heater market. Households seek heating solutions that reduce electricity consumption. Radiant quartz heaters convert power directly into heat with minimal loss. This efficiency lowers operating costs for users. Governments promote energy-conscious appliances through standards and labeling programs. Consumers increasingly replace older convection heaters with radiant alternatives. Quartz heaters provide instant warmth without preheating time. This feature improves comfort during cold seasons. Commercial spaces value lower energy bills and fast heating response. Rising electricity prices further accelerate demand for efficient heating products. Manufacturers invest in improved reflector designs and quartz materials. These upgrades enhance heat transfer efficiency. Energy efficiency remains a core purchase criterion across residential and light commercial segments.

- For instance, Dr. Infrared Heater’s DR-968 quartz infrared heater operates at 1,500 watts (or 5,200 BTUs of heat output), delivers heat within seconds using a dual heating system (infrared quartz tube + PTC), and is effectively rated to warm spaces up to 400 square feet as a supplemental zone heater, which can reduce reliance on central heating.

Growth in Residential Renovation and Home Comfort Spending

Rising home renovation activity supports market growth across North America. Consumers invest more in comfort-focused home upgrades. Radiant quartz heaters fit well into renovation projects. Compact size supports easy installation in existing spaces. Many homeowners add heaters to basements, garages, and patios. Quartz heaters deliver localized heating without ductwork changes. This benefit reduces renovation complexity and cost. Increased remote work boosts demand for home office heating. Homeowners prioritize personal comfort and temperature control. Seasonal climate variation strengthens replacement demand. Aging housing stock also drives heater upgrades. Retail promotions during winter further support sales. Residential demand remains a stable growth pillar for the market.

- For instance, Bromic Heating’s Platinum Electric quartz heater delivers 2,300 watts of radiant output, provides quick, targeted heat, and is suitable for supporting outdoor patios and renovated living areas.

Expansion of Commercial and Semi-Outdoor Applications

Commercial adoption drives steady demand for radiant quartz heaters. Restaurants, warehouses, and workshops use radiant heating for targeted warmth. Quartz heaters perform well in semi-open environments. Radiant heat remains effective despite airflow or drafts. This advantage supports use in patios and loading areas. Hospitality businesses use heaters to extend outdoor seating seasons. Retail stores deploy heaters for spot heating. Industrial users value quick heat-up and durability. Quartz heaters reduce energy waste in large spaces. Facility managers prefer focused heating over whole-area systems. Growing commercial construction supports long-term demand. These applications expand the market beyond residential reliance.

Key Trends & Opportunities

Shift Toward Smart and Design-Oriented Heater Models

Smart and design-focused products create strong growth opportunities. Consumers favor heaters with modern appearance and slim profiles. Infrared panel-style quartz heaters match contemporary interiors. Smart thermostats and timers improve temperature control. Remote operation enhances user convenience and safety. App-based control supports energy monitoring. Design upgrades help brands target premium segments. Manufacturers differentiate products through aesthetics and features. Smart integration supports higher average selling prices. Retailers highlight smart heaters during seasonal campaigns. Urban consumers show strong interest in connected appliances. This trend opens value-driven opportunities across residential markets.

- For instance, Heat Storm’s HS-1500-PHX WiFi infrared quartz heater operates at 1,500 watts, supports 2.4 GHz Wi-Fi, and allows temperature adjustment from 40°F to 99°F through a mobile app.

Rapid Growth of Online Sales Channels

Online channels present a major growth opportunity. E-commerce platforms expand product reach across regions. Consumers compare prices and specifications easily online. Reviews influence heater purchase decisions strongly. Online-only models attract price-sensitive buyers. Seasonal discounts boost digital sales volumes. Direct-to-consumer strategies improve brand margins. Improved logistics support bulky appliance delivery. Return policies build buyer confidence. Younger consumers prefer online appliance purchases. Manufacturers invest in digital marketing and product listings. Online growth complements traditional retail channels. This channel expansion accelerates overall market penetration.

Key Challenges

High Competition and Price Sensitivity

Intense competition presents a key market challenge. Many brands offer similar quartz heater models. Price comparison pressures reduce profit margins. Consumers often prioritize cost over brand loyalty. Entry-level products dominate volume sales. Premium differentiation remains difficult for new entrants. Retail promotions intensify price competition during winter. Private-label products increase competitive pressure. Manufacturers face rising material and logistics costs. Passing costs to consumers remains challenging. Smaller players struggle to sustain margins. Continuous innovation becomes necessary to remain competitive. Price sensitivity limits aggressive pricing strategies across segments.

Safety Concerns and Regulatory Compliance

Safety concerns pose another key challenge. Quartz heaters operate at high surface temperatures. Improper use can increase burn or fire risks. Regulatory bodies enforce strict safety standards. Compliance increases product development and testing costs. Manufacturers must meet electrical and thermal safety norms. Product recalls can harm brand reputation. Consumer awareness of safety certifications continues to rise. Poor-quality imports create negative perceptions. Retailers prefer certified and tested products. Educating consumers on safe usage remains essential. Ongoing compliance adds operational complexity. Safety requirements shape product design and market entry strategies.

Regional Analysis

United States

The United States dominates the North America radiant quartz heater market, accounting for about 72% market share. Strong demand comes from residential and light commercial sectors. Cold winters in northern states increase seasonal heater purchases. Home renovation activity supports steady replacement demand. Consumers favor energy-efficient and smart heater models. Large retail chains and e-commerce platforms drive wide product availability. Commercial use in warehouses, garages, and hospitality venues further supports sales. Regulatory focus on energy efficiency shapes product design. The U.S. remains the primary revenue contributor and innovation hub in the regional market.

Canada

Canada holds nearly 18% share of the North America radiant quartz heater market. Long and harsh winters create consistent heating demand. Residential adoption remains strong across urban and suburban areas. Consumers prefer mid-wattage heaters for indoor use. Energy efficiency plays a key role in purchase decisions. Government energy standards influence product selection. Retail appliance stores dominate distribution, supported by growing online sales. Commercial demand exists in workshops and small businesses. Seasonal replacement cycles support stable growth. Canada offers steady volume demand with strong emphasis on safety and performance.

Mexico

Mexico accounts for around 10% of the North America radiant quartz heater market. Demand concentrates in northern and high-altitude regions. Residential usage drives most sales, focused on portable heaters. Price sensitivity influences product selection strongly. Single quartz tube and lower wattage models remain popular. Offline retail channels dominate distribution. Commercial adoption remains limited but growing in workshops and small facilities. Urbanization supports gradual market expansion. Energy cost awareness increases interest in efficient heating options. Mexico represents an emerging growth region with long-term demand potential.

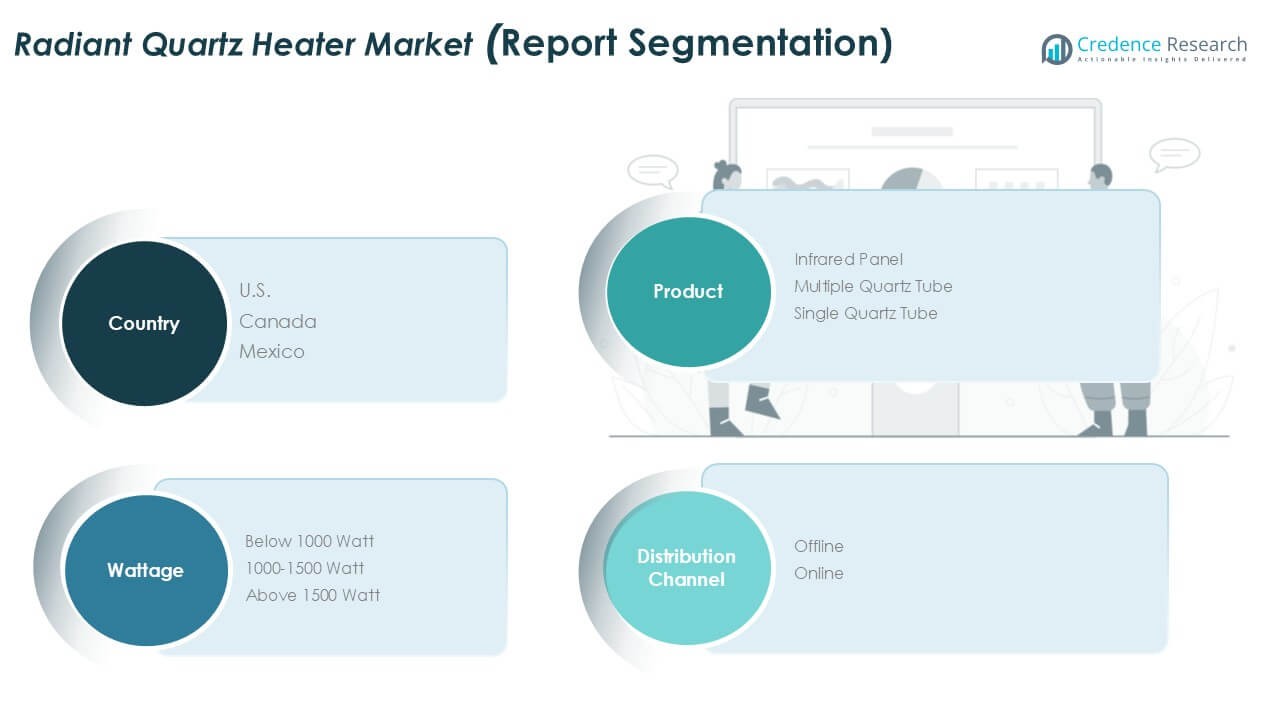

Market Segmentations:

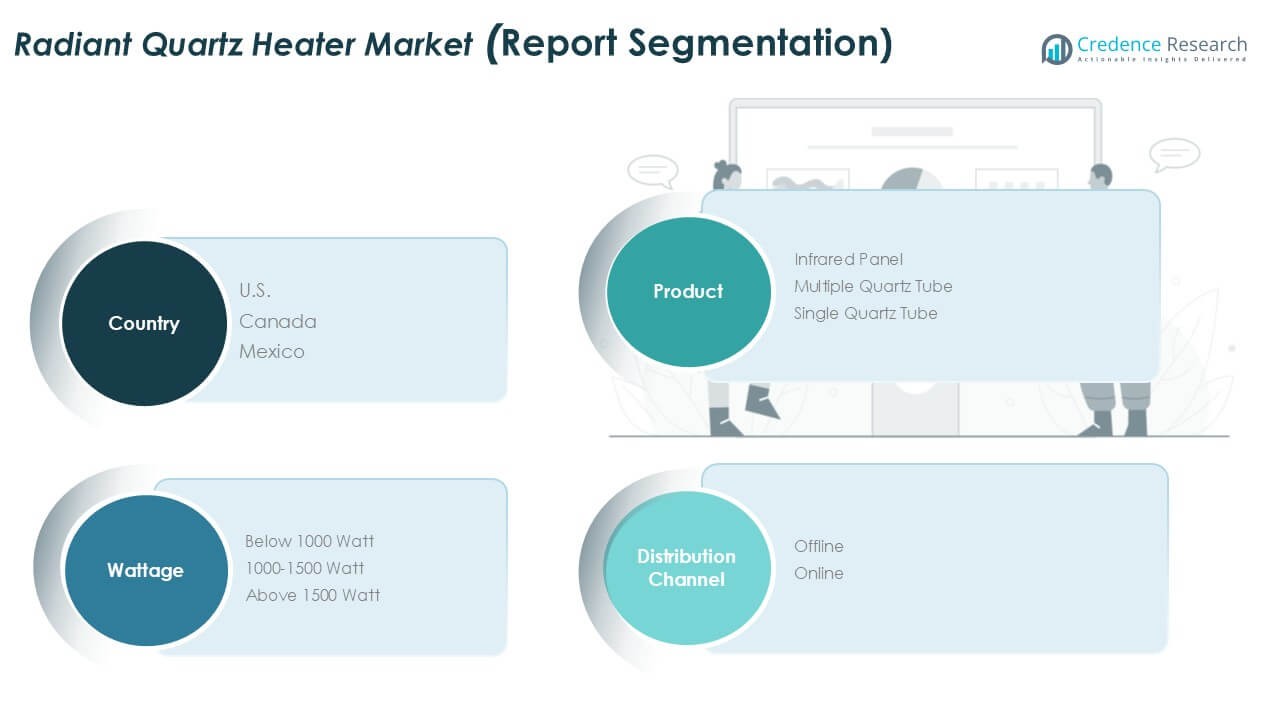

By Product

- Infrared Panel

- Multiple Quartz Tube

- Single Quartz Tube

By Wattage Segment

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The North America radiant quartz heater market shows moderate fragmentation with strong brand competition. Established appliance manufacturers and specialized heating companies dominate sales. Key players compete on product efficiency, safety features, and price positioning. Companies focus on residential and light commercial segments for volume growth. Retail presence across home improvement chains strengthens brand visibility. Online channels increase competitive intensity through price transparency. Product differentiation centers on wattage options, smart controls, and design. Manufacturers invest in compliance with safety and energy standards. Seasonal demand drives aggressive promotions and new model launches. Strategic focus remains on cost optimization and portfolio expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2023, The European Union revised its overarching Energy Efficiency Directive, and new, stricter Ecodesign standards for local space heaters, including radiant heaters, were adopted in April 2024 and will apply from July 1, 2025.

- In January 2023, Honeywell announced a new line of smart radiant quartz heaters with integrated Wi-Fi capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage Segment, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise steadily due to increasing focus on energy-efficient space heating.

- Residential replacement cycles will remain a key driver of market expansion.

- Smart controls and connected features will gain wider adoption.

- Design-focused and slim-profile heaters will attract premium buyers.

- Mid-wattage models will continue to dominate household applications.

- Online sales channels will grow faster than offline retail.

- Commercial and semi-outdoor usage will expand across hospitality spaces.

- Safety standards will increasingly influence product design and innovation.

- Price competition will remain intense among mass-market brands.

- The United States will continue to lead regional demand and innovation.