Market Overview:

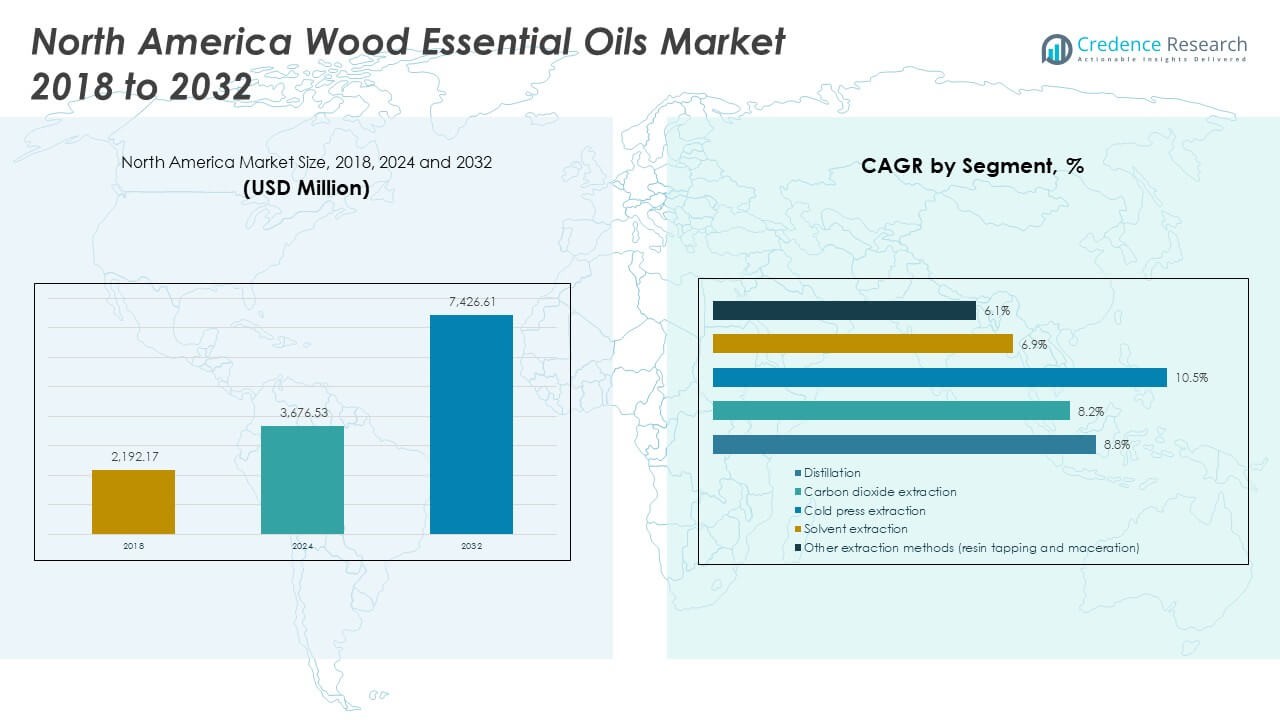

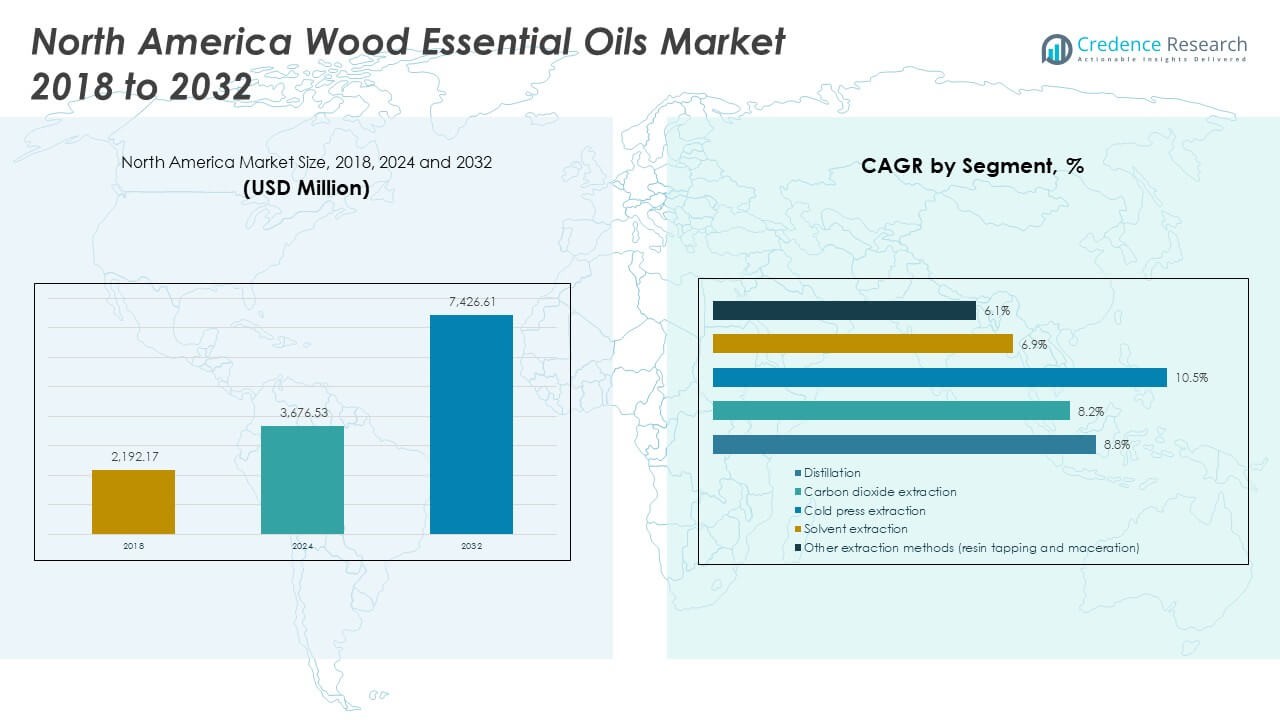

The North America Wood Essential Oils Market size was valued at USD 2,192.17 million in 2018 to USD 3,676.53 million in 2024 and is anticipated to reach USD 7,426.61 million by 2032, at a CAGR of 8.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Wood Essential Oils Market Size 2024 |

USD 3,676.53 Million |

| North America Wood Essential Oils Market, CAGR |

8.60% |

| North America Wood Essential Oils Market Size 2032 |

USD 7,426.61 Million |

Growing demand for essential oils is driven by rising health awareness. Consumers are shifting from synthetic fragrances to natural alternatives for personal care and therapeutic uses. Expanding product use in aromatherapy, spa treatments, and household cleaning adds momentum. Cosmetic manufacturers are incorporating essential oils into skincare and haircare lines. Food and beverage companies are also experimenting with natural flavoring agents. Increasing recognition of oils’ antimicrobial and stress-relief benefits boosts demand. Higher disposable incomes in North America accelerate purchases, while wellness tourism supports regional consumption.

Geographically, the United States dominates due to high consumer awareness, established wellness industries, and strong distribution networks. Canada shows emerging growth driven by rising natural product adoption and expanding wellness-focused retail outlets. Mexico contributes steadily, supported by traditional herbal practices and growing middle-class spending. Urban populations are driving market expansion across metro areas. Rising online distribution also makes oils accessible to broader demographics. North America’s diverse consumer base ensures steady demand across therapeutic, cosmetic, and household uses.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market was valued at USD 2,192.17 million in 2018, USD 3,676.53 million in 2024, and is projected to reach USD 7,426.61 million by 2032, growing at a CAGR of 8.60%.

- The United States accounted for about 70% of the regional share in 2024, followed by Canada with 20% and Mexico with 10%, driven by strong wellness adoption and retail presence.

- Asia Pacific is the fastest-growing region with a share of nearly 25% in the global market, fueled by rising middle-class income and expanding wellness culture.

- Distillation dominated extraction methods, contributing nearly 50% of the market share in 2024 due to efficiency and scalability.

- Carbon dioxide extraction held close to 20% share in 2024, driven by growing demand for premium, high-purity essential oils.

Market Drivers:

Rising Consumer Awareness of Natural Wellness and Lifestyle Products:

The North America Wood Essential Oils Market is experiencing strong momentum from consumer preference for natural wellness solutions. It is supported by the shift toward chemical-free and sustainable products across personal care, aromatherapy, and household applications. Growing awareness of therapeutic benefits such as stress relief, improved sleep, and antimicrobial properties is increasing demand. Rising social media influence has further educated consumers about holistic health. Urban populations are adopting oils for everyday use in diffusers, skin applications, and natural cleaning. E-commerce platforms provide broad product access. Large brands and boutique companies capitalize on this trend through diverse product launches and tailored blends.

- For instance, For example, studies show lavender and cedarwood oils provide anxiolytic and sleep-enhancing effects, promoting their use in everyday wellness routines. Social media has amplified consumer education about holistic health, resulting in urban populations widely adopting wood essential oils in diffusers, skincare, and natural cleaning products.

Expanding Applications in Personal Care, Cosmetics, and Skincare:

Wood essential oils are becoming integral in cosmetics, skincare, and haircare formulations. The North America Wood Essential Oils Market is shaped by rising demand for natural and organic beauty products. It is growing as consumers reject synthetic fragrances and harsh chemicals. Skincare brands now add essential oils for their soothing and rejuvenating properties. The anti-aging and skin-repair benefits are also gaining attention. Haircare lines utilize oils for scalp treatment and hair strengthening. Natural deodorants, serums, and moisturizers are key growth areas. The segment benefits from premiumization and growing consumer willingness to pay higher prices for quality.

- For instance, Haircare products increasingly incorporate these oils for scalp treatment and hair strengthening, while natural deodorants, serums, and moisturizers represent key growth areas.

Influence of Aromatherapy and Alternative Healing Practices:

The growing popularity of aromatherapy continues to drive demand across spas, wellness centers, and households. The North America Wood Essential Oils Market benefits from increasing use of oils in relaxation therapies. It is expanding in mental health applications such as stress management, mood balancing, and sleep therapy. Spas and massage centers widely use essential oils for therapeutic treatments. Rising interest in yoga and meditation further encourages use of diffusers and oil blends. Alternative medicine practitioners highlight oils as complementary treatment for anxiety and fatigue. Online communities share knowledge, building awareness and trust. Consumers increasingly link oils to improved well-being and holistic living.

Expanding Food, Beverage, and Household Product Applications:

Beyond wellness, the North America Wood Essential Oils Market is witnessing adoption in food, beverage, and household products. It is used in natural flavoring, functional beverages, and herbal teas. Growing consumer interest in herbal-infused drinks drives demand for wood-derived oils. Household cleaning products are increasingly formulated with essential oils for fragrance and antibacterial properties. Consumers prefer eco-friendly and safe cleaning alternatives. The fragrance industry also integrates oils into candles, air fresheners, and perfumes. Growing eco-consciousness is leading to oils replacing synthetic chemicals. Industrial players invest in extraction technologies to maintain quality and expand scalability.

Market Trends:

Premiumization and Growth of High-Value Essential Oils:

The North America Wood Essential Oils Market is shaped by the premiumization trend, with consumers seeking high-quality, sustainably sourced oils. It is supported by rising disposable incomes and willingness to pay more for authentic products. Rare oils like sandalwood and cedarwood are gaining traction in niche segments. Luxury brands integrate them into perfumes and skincare lines. Certification labels such as organic and fair-trade influence purchase decisions. Consumer awareness of sourcing practices drives transparency demands. E-commerce and specialty stores promote premium blends. The trend highlights a shift toward value-driven consumption rather than volume purchases.

- For example, subcritical water extraction of Aquilaria malaccensis yields higher quantity and quality oils compared to conventional hydro-distillation, preserving valuable compounds and enhancing therapeutic efficacy. Automation in packaging and enhanced supply chain digital tracking for sustainability and authenticity also improve production efficiency and regulatory compliance.

Technological Advancements in Extraction and Production:

The industry is witnessing innovations in extraction processes that enhance yield and maintain purity. The North America Wood Essential Oils Market benefits from advanced distillation and CO2 extraction methods. It is enabling producers to improve efficiency and reduce environmental impact. Manufacturers adopt sustainable harvesting techniques to ensure supply chain stability. Digital tools track sourcing and authenticate origin for regulatory compliance. Investment in R&D focuses on maximizing therapeutic value while reducing costs. Smaller players collaborate with research institutions to enhance competitiveness. Automation in packaging and distribution improves supply chain consistency.

- For instance, Citrus oils dominate food and beverage applications, while peppermint and tea tree oils remain popular for personal care and household uses. Specialty oils like jasmine and geranium attract premium consumers within fragrance and skincare sectors due to their unique therapeutic properties.

Growing Role of Digital Platforms and E-commerce Channels:

E-commerce expansion is transforming distribution dynamics. The North America Wood Essential Oils Market is increasingly shaped by online sales and digital engagement. It is expanding as consumers buy directly from brand websites and e-commerce marketplaces. Digital platforms allow education on product benefits and usage methods. Subscription-based delivery models improve customer loyalty. Influencer marketing builds awareness and trust among younger demographics. Brands leverage social media campaigns to target wellness communities. Cross-border e-commerce makes global oils accessible to North American consumers. Digital-first strategies reduce reliance on traditional retail.

Integration into Holistic and Preventive Healthcare Practices:

Preventive healthcare is becoming a significant demand driver. The North America Wood Essential Oils Market benefits from growing integration into holistic healthcare practices. It is increasingly adopted in complementary therapies for stress, sleep, and mild ailments. Healthcare providers recognize oils as part of lifestyle management. Wellness centers recommend oils for immune support and respiratory health. Rising chronic stress levels fuel adoption. Oils are integrated into home remedies and daily routines. Regulatory acceptance in dietary supplements supports broader medical use. Preventive healthcare adoption strengthens market sustainability.

Market Challenges Analysis:

Regulatory and Quality Standardization Barriers Across the Region:

The North America Wood Essential Oils Market faces challenges related to regulatory compliance and standardization. It is impacted by varied regulations on labeling, claims, and purity standards. Inconsistent testing methods complicate quality assurance for consumers and producers. Mislabeling and adulteration undermine trust in the market. Smaller firms struggle to meet certification costs. Regulatory delays affect product launches and expansion plans. International trade laws create additional barriers for cross-border operations. Maintaining high quality across large-scale production remains a complex issue.

Supply Chain Instability and Raw Material Availability Risks:

The industry experiences supply chain disruptions due to overharvesting and climate impacts. The North America Wood Essential Oils Market is vulnerable to fluctuations in raw material supply. It is affected by unsustainable logging practices in source regions. Weather variations reduce availability of certain wood types. Rising demand strains resource management. High dependence on imports in some categories increases cost volatility. Transportation disruptions add to instability. Sustainable sourcing partnerships and reforestation projects are critical solutions for long-term growth.

Market Opportunities:

Expansion into Wellness Tourism and Lifestyle Products:

The North America Wood Essential Oils Market offers opportunities in wellness tourism and lifestyle integration. It is supported by rising demand for spa experiences, yoga retreats, and aromatherapy sessions. Hotels and resorts are incorporating essential oils into guest experiences. Consumer demand for premium home diffusers and lifestyle kits is expanding. Cross-sector partnerships between hospitality and oil brands enhance visibility. The growing focus on stress management and wellness supports adoption. Lifestyle-oriented product packaging attracts urban consumers.

Rising Potential in Organic and Eco-Friendly Certification Markets:

Sustainability is opening new opportunities in certified product categories. The North America Wood Essential Oils Market is gaining traction in organic and eco-friendly oils. It is influenced by rising consumer trust in certified goods. Brands are pursuing organic certifications to enhance credibility. Eco-friendly sourcing and recyclable packaging resonate with eco-conscious buyers. Premium buyers prioritize transparency and ethical sourcing. Retailers dedicate shelves to certified natural products. This trend strengthens differentiation and pricing power.

Market Segmentation Analysis:

Type-Based Segmentation

The North America Wood Essential Oils Market is strongly driven by oils such as sandalwood, cedarwood, and lavender, which are widely used in cosmetics, aromatherapy, and perfumery. Citrus-based oils like orange and lemon dominate food and beverage applications, while peppermint and tea tree oils remain popular for personal care and household uses. Specialty oils such as jasmine and geranium attract premium consumers in the fragrance and skincare sector. Growing awareness of therapeutic benefits strengthens adoption across multiple industries.

- For instance, Specialty oils such as jasmine and geranium attract premium consumers in fragrance and skincare, with the jasmine essential oil market alone valued at over USD 1 billion in 2024, reflecting substantial growth driven by natural product demand and premium brand incorporation.

Method of Extraction Segmentation

Distillation continues to dominate due to cost efficiency and scalability across large volumes. The North America Wood Essential Oils Market is also witnessing rising demand for carbon dioxide extraction, which preserves higher purity and potency, making it ideal for premium oils. Cold press extraction is primarily used for citrus oils, maintaining their natural aroma profile. Solvent extraction caters to complex fragrances like jasmine, while resin tapping and maceration serve niche markets. Innovation in extraction technology is enhancing efficiency and sustainability.

- For instance, Increasing demand for carbon dioxide (CO2) extraction is noted because it preserves higher purity and potency, ideal for premium oils such as rare sandalwood variants. Cold press extraction, mainly utilized for citrus oils, maintains the natural aroma profile crucial for food and beverage applications. Solvent extraction serves complex fragrances like jasmine, while traditional methods such as resin tapping and maceration are reserved for niche markets with specific oil profiles.

Segmentat

By Type

- Orange oil

- Lemon oil

- Lime oil

- Peppermint oil

- Cornmint oil

- Citronella oil

- Spearmint oil

- Geranium oil

- Clove leaf oil

- Eucalyptus oil

- Jasmine oil

- Tea tree oil

- Rosemary oil

- Lavender oil

- Other oils (sandalwood, cedar, chamomile, anise, ginger, thyme, cinnamon, ylang-ylang, basil)

By Method of Extraction

- Distillation

- Carbon dioxide extraction

- Cold press extraction

- Solvent extraction

- Other methods (resin tapping, maceration)

By Region

Regional Analysis:

United States

The North America Wood Essential Oils Market is led by the United States, holding nearly 70% of the regional share in 2024. It is driven by high consumer awareness, advanced wellness infrastructure, and widespread retail presence. Strong adoption across cosmetics, aromatherapy, and household products supports continued dominance. The U.S. also benefits from extensive e-commerce penetration, where online platforms account for a significant share of sales. Key players such as doTERRA and Young Living strengthen their foothold with large distribution networks and product innovation. Premiumization trends and demand for sustainably sourced oils keep the U.S. as the largest and most influential market.

Canada

Canada accounted for about 20% of the regional market share in 2024, reflecting steady growth. It is shaped by consumer preference for eco-friendly, organic-certified, and wellness-focused products. Rising disposable incomes support premium purchases, while aromatherapy is increasingly integrated into healthcare and spa services. Expanding wellness retail outlets enhance accessibility across urban centers. Canadian buyers prioritize transparency, boosting demand for certified oils. Government support for sustainability and eco-labeling adds further credibility. Wellness tourism also drives growth, with hotels and spas integrating oils into their services.

Mexico

Mexico contributed nearly 10% of the North America Wood Essential Oils Market in 2024, supported by strong cultural traditions in herbal remedies. It is influenced by rising middle-class spending and urban consumer demand for personal and household applications. Essential oils are increasingly popular among younger demographics for stress relief and skincare. Expanding retail and e-commerce platforms enhance market reach, while cross-border trade with the U.S. boosts product flow. Local producers are slowly entering formal distribution channels, increasing competition. Demand is reinforced by consumer interest in affordable yet effective natural wellness solutions. Mexico’s growth trajectory remains steady, with opportunities in urban wellness adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- doTERRA Holdings, LLC

- Young Living Essential Oils, LC

- Plant Therapy

- Rocky Mountain Oils

- Eden’s Garden

- Mountain Rose Herbs

- Aura Cacia (Frontier Co-op)

- Isagenix International

- Starwest Botanicals

- NOW Foods

Competitive Analysis:

The North America Wood Essential Oils Market is highly competitive, with global and regional players focusing on innovation, sustainability, and quality. It is led by companies such as doTERRA, Young Living, and Plant Therapy, which maintain dominance through diverse product portfolios and strong distribution networks. Smaller firms like Eden’s Garden and Rocky Mountain Oils compete by offering specialized blends and organic certifications. Online channels are key battlegrounds, with brands leveraging e-commerce and social media for growth. Mergers, product launches, and sustainability partnerships remain central strategies.

Recent Developments:

- In October 2024, doTERRA Holdings, LLC launched four new foundational wellness products, including a nutrient complex drink, omega-3 fatty acids supplement, and two Frankincense essential oil products, along with a limited-edition essential oil trio called The Escape Series. This was unveiled at their annual convention in Salt Lake City and reflected their ongoing innovation in wellness solutions.

- In July 2019, Young Living Essential Oils completed the acquisition of Nature’s Ultra, a hemp farm operator with over 1,500 acres in Colorado. This acquisition allowed Young Living to integrate high-quality CBD products infused with their essential oils under their Seed to Seal® standards, enhancing their product offerings legally under federal law.

- In January 2025, Eden’s Garden was acquired by Kian Capital Partners, a private investment firm specializing in e-commerce businesses. Eden’s Garden, known for its extensive seed and bulb offerings, aims to expand product lines and channels under this new partnership while maintaining leadership continuity.

- Mountain Rose Herbs recently focused on revitalizing its affiliate marketing program, generating over $140,000 in revenue by partnering with high-quality affiliates who co-create educational content. This strategy strengthens their brand and enhances customer engagement beyond traditional marketing.

Report Coverage:

The research report offers an in-depth analysis based on type, method of extraction, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing role of eco-friendly packaging and certified sourcing.

- Expansion of aromatherapy in healthcare and wellness sectors.

- Rising adoption of oils in premium cosmetics and skincare.

- Increasing penetration of digital and subscription-based retail channels.

- Strong demand for CO2-extracted premium oils.

- Growth in organic-certified product lines to meet consumer trust.

- Expansion of wellness tourism using essential oils in luxury resorts.

- Rising role of partnerships between wellness centers and oil companies.

- Technological advances in extraction improving efficiency and purity.

- Steady expansion in Canada and Mexico strengthening regional balance.