Market Overview

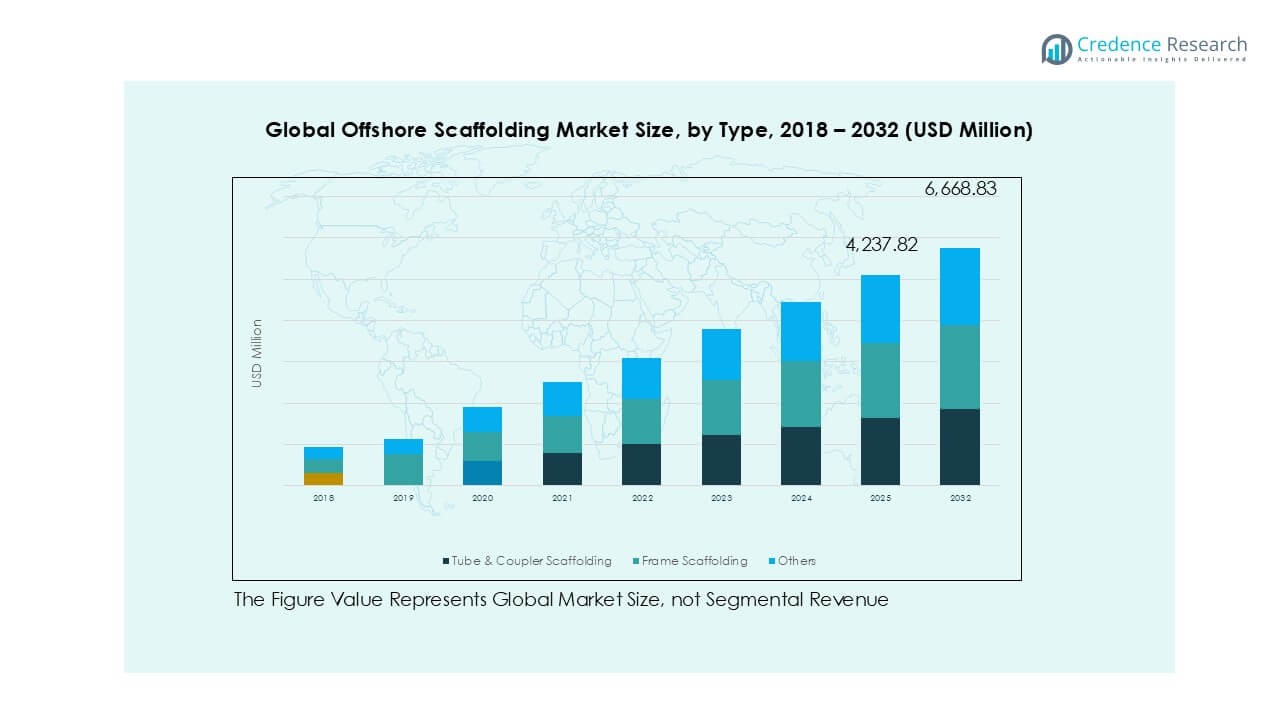

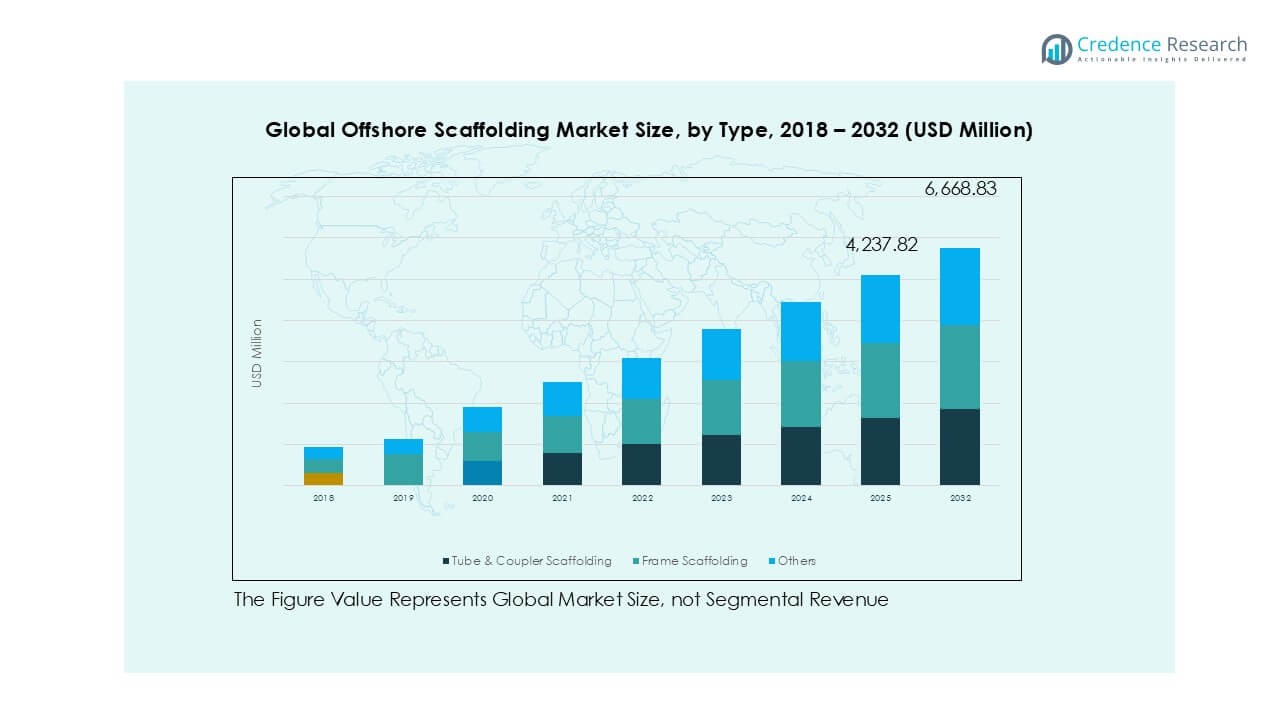

The Offshore Scaffolding market size was valued at USD 2,783.0 million in 2018, increased to USD 3,986.9 million in 2024, and is anticipated to reach USD 6,668.8 million by 2032, at a CAGR of 6.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Scaffolding market Size 2024 |

USD 3,986.9 Million |

| Offshore Scaffolding market, CAGR |

6.69% |

| Offshore Scaffolding market Size 2032 |

USD 6,668.8 Million |

The offshore scaffolding market is led by key players such as BrandSafway, Layher, PERI Group, PRISMEC, and AAIT Scaffold, all of which offer advanced, safety-compliant scaffolding solutions tailored for offshore construction and maintenance. These companies maintain a competitive edge through strong engineering capabilities, broad service portfolios, and strategic global presence. BrandSafway and Layher are particularly notable for their dominance in large-scale offshore projects, supported by innovation and modular design expertise. Regionally, Asia Pacific holds the largest market share at 26.6% in 2024, driven by rising offshore energy projects and cost-effective manufacturing. Europe and North America follow with shares of 19.7% and 18.2%, respectively, reflecting their mature offshore oil, gas, and wind infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The offshore scaffolding market was valued at USD 3,986.9 million in 2024 and is projected to reach USD 6,668.8 million by 2032, growing at a CAGR of 6.69% during the forecast period.

- Market growth is driven by increasing offshore oil and gas exploration activities, rising maintenance requirements for aging infrastructure, and stringent safety regulations in offshore operations.

- A key trend includes the adoption of lightweight, corrosion-resistant modular scaffolding systems and rising demand from offshore wind energy projects in Europe and Asia Pacific.

- The market is moderately fragmented, with major players like BrandSafway, Layher, PERI Group, and PRISMEC competing on innovation, service scope, and safety compliance.

- Regionally, Asia Pacific held the largest market share at 26.6% in 2024, followed by Europe (19.7%) and North America (18.2%), while by type, Tube & Coupler Scaffolding dominated due to its versatility and suitability for complex offshore structures.

Market Segmentation Analysis:

By Type

The Offshore Scaffolding market by type is categorized into Tube & Coupler Scaffolding, Frame Scaffolding, and Others. Among these, Tube & Coupler Scaffolding dominates the segment, accounting for the largest market share in 2024. This dominance is attributed to its superior flexibility, adaptability to complex offshore structures, and high load-bearing capacity. The system’s modular design makes it ideal for varied platform configurations and harsh marine environments. The increasing demand for safe and customizable scaffolding solutions in offshore oil and gas platforms continues to drive growth in this sub-segment, supported by strict safety regulations and evolving project complexities.

- For instance, PERI Group supplied over 25,000 linear meters of Tube & Coupler scaffolding to the Johan Sverdrup oil field in the North Sea, enabling high-capacity support for multiple platform decks during complex maintenance operations under extreme wind and corrosion conditions.

By Application:

Based on application, the market is segmented into Maintenance & Repair Operations and New Construction & Commissioning. Maintenance & Repair Operations held the largest market share in 2024, driven by the aging infrastructure in offshore platforms and the growing emphasis on asset integrity management. Frequent inspection and refurbishment needs, especially in mature oilfields, have significantly increased the deployment of scaffolding systems for ongoing operations. Additionally, the rising number of scheduled shutdowns for offshore rigs and platforms contributes to consistent demand in this sub-segment. Its dominance is reinforced by the high frequency and urgency of repair activities compared to new construction projects.

- For instance, Cape PLC (a brand under Altrad) deployed scaffolding systems for maintenance on Shell’s Brent Delta platform, requiring over 120,000 scaffold man-hours for safe access and structural integrity checks during the decommissioning phase.

Key Growth Drivers

Increasing Offshore Oil & Gas Exploration Activities

The growing demand for energy and the depletion of onshore reserves have pushed operators to expand exploration and production activities offshore. This surge in offshore projects, particularly in deepwater and ultra-deepwater fields, drives the demand for robust and adaptable scaffolding solutions. Offshore scaffolding plays a critical role in construction, maintenance, and repair work on rigs and platforms. As oil prices stabilize and investments in offshore assets resume globally, the need for reliable access and safety infrastructure like scaffolding is expected to rise steadily.

- For instance, Bilfinger Salamis UK supported BP’s Clair Ridge project by providing scaffolding for over 4,500 individual offshore activities, including access to flare towers, pipe racks, and module interconnections during commissioning and hook-up.

Rising Focus on Worker Safety and Regulatory Compliance

Strict safety regulations enforced by authorities such as OSHA, HSE, and other maritime agencies are compelling offshore operators to adopt high-quality scaffolding systems. Offshore environments pose high risks, making safety-critical scaffolding essential for all construction and maintenance activities. The industry’s emphasis on fall protection, safe access, and load-bearing capacity encourages companies to invest in advanced and standardized scaffolding. This regulatory push not only ensures worker safety but also creates steady demand for innovative scaffolding systems that comply with evolving offshore safety standards.

- For instance, Layher developed its Allround Scaffolding system with integrated guardrails and self-locking decks, which was deployed across 17 offshore platforms operated by Equinor, reducing scaffold-related incidents by 42 cases over a 12-month safety audit period.

Aging Offshore Infrastructure and Maintenance Requirements

A significant portion of global offshore infrastructure is nearing or surpassing its design life, necessitating ongoing inspection, repair, and maintenance. This aging infrastructure creates a consistent need for scaffolding services, especially in regions like the North Sea and the Gulf of Mexico. Scaffolding systems are vital for safe and efficient access during structural assessments, upgrades, and emergency repairs. The rising maintenance budgets of oil companies and governments alike contribute to the increased deployment of scaffolding equipment to prolong the operational life of offshore platforms.

Key Trends & Opportunities

Integration of Modular and Lightweight Scaffolding Materials

A key trend in the offshore scaffolding market is the growing use of modular and lightweight materials such as aluminum alloys and composite components. These materials reduce installation time and improve portability, especially in harsh marine environments where logistics and labor costs are high. The trend toward modular scaffolding enhances efficiency in both new construction and maintenance tasks. Manufacturers are leveraging this opportunity to offer tailored scaffolding systems that combine strength, corrosion resistance, and ease of assembly to meet offshore demands.

- For instance, Cuplok® Modular Scaffolding, developed by SGB (Brand Energy & Infrastructure Services), reduced scaffold erection time by 30 hours per deck on ExxonMobil’s Banyu Urip offshore project, where over 3,600 modules were assembled in lightweight aluminum for easier handling and rapid deployment.

Expansion of Offshore Wind Energy Projects

The global shift toward renewable energy, especially offshore wind farms, is creating a new avenue for scaffolding providers. Offshore wind turbine installations require scaffolding for foundation construction, turbine assembly, and maintenance. Europe and parts of Asia are witnessing rapid expansion in offshore wind projects, boosting demand for specialized scaffolding solutions. This trend represents a major opportunity for scaffolding companies to diversify beyond oil and gas into the renewable sector, aligning with global decarbonization goals and long-term energy transition strategies.

- For instance, HAKI AB provided temporary access scaffolding for Ørsted’s Hornsea One project in the UK, covering 174 offshore turbines, with over 2,800 scaffold bays used during nacelle and blade maintenance phases.

Key Challenges

Harsh Environmental Conditions and Corrosion Risk

Operating in offshore environments exposes scaffolding systems to high humidity, saltwater corrosion, and strong winds, significantly impacting material durability and safety. Ensuring structural stability and long-term performance under these conditions presents a major challenge. Frequent maintenance, anti-corrosion treatments, and specialized coatings add to operational costs. Companies must invest in corrosion-resistant materials and conduct rigorous testing to meet offshore performance standards, making initial project costs and lifecycle maintenance relatively high.

High Installation and Labor Costs

Offshore scaffolding installation is labor-intensive and requires specialized equipment and skilled personnel, leading to high setup costs. The complexity of working in remote offshore locations increases the logistical burden and inflates project budgets. Delays due to weather disruptions and stringent safety checks further escalate costs. These challenges can limit adoption in small or cost-sensitive offshore operations, where budget constraints hinder investment in comprehensive scaffolding solutions despite clear safety and operational benefits.

Regional Analysis

North America

North America accounted for approximately 18.2% of the global offshore scaffolding market in 2024, with a market size of USD 725.55 million, rising from USD 519.58 million in 2018. The market is projected to reach USD 1,171.71 million by 2032, expanding at a CAGR of 6.2%. The region’s strong offshore oil and gas infrastructure, particularly in the Gulf of Mexico, continues to drive demand for scaffolding systems in both maintenance and new construction activities. Stringent safety regulations and continuous investments in platform upgrades also contribute to regional market growth.

Europe

Europe held a 19.7% market share in 2024, with its offshore scaffolding market valued at USD 1,088.87 million, up from USD 745.29 million in 2018. The market is forecasted to grow at a CAGR of 7.0%, reaching USD 1,868.61 million by 2032. The region benefits from well-established offshore oil fields in the North Sea and expanding offshore wind energy projects. Strong regulatory frameworks supporting workplace safety and sustainability in construction are propelling demand for high-performance scaffolding solutions across European offshore facilities.

Asia Pacific

Asia Pacific dominated the global offshore scaffolding market with the largest share of 26.6% in 2024, recording a market size of USD 1,441.08 million, up from USD 992.69 million in 2018. The market is expected to reach USD 2,452.80 million by 2032, growing at a CAGR of 6.9%. Countries such as China, India, and Australia are investing heavily in offshore exploration and infrastructure, boosting scaffolding requirements. Rising industrial activity, infrastructure expansion, and the presence of cost-competitive manufacturing are positioning Asia Pacific as a high-growth region.

Latin America

Latin America captured a 5.9% market share in 2024, with the offshore scaffolding market growing from USD 235.16 million in 2018 to USD 322.37 million. The market is forecast to reach USD 506.83 million by 2032, reflecting a CAGR of 5.9%. The region’s growth is driven by increased offshore oil investments, particularly in Brazil and Mexico. Government reforms and growing private-sector participation in oilfield development are stimulating offshore construction and maintenance, resulting in a steady demand for scaffolding solutions suited for harsh marine conditions.

Middle East

The Middle East offshore scaffolding market held a 4.9% share in 2024, with revenues rising from USD 179.50 million in 2018 to USD 272.36 million. With a robust CAGR of 7.6%, the market is projected to reach USD 489.49 million by 2032. Regional growth is fueled by increased offshore oil and gas activities in the UAE, Saudi Arabia, and Qatar, where mega-projects demand high-performance scaffolding for construction and ongoing maintenance. Favorable government initiatives and investments in offshore energy infrastructure continue to support long-term market expansion.

Africa

Africa held the smallest share of 2.5% in the offshore scaffolding market in 2024, with a market size of USD 136.64 million, up from USD 110.76 million in 2018. The market is expected to grow at a CAGR of 3.5%, reaching USD 179.39 million by 2032. Limited infrastructure, regulatory challenges, and political instability in some regions have hindered faster growth. However, exploration activities off the coasts of West and East Africa, especially in Nigeria, Angola, and Mozambique, offer long-term potential for scaffolding demand in the offshore sector.

Market Segmentations:

By Type:

- Tube & Coupler Scaffolding

- Frame Scaffolding

- Others

By Application:

- Maintenance & Repair Operations

- New Construction & Commissioning

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the offshore scaffolding market is characterized by the presence of both global and regional players offering a wide range of scaffolding solutions tailored for offshore environments. Key companies such as BrandSafway, Layher, PERI Group, and PRISMEC hold substantial market shares due to their extensive service portfolios, advanced engineering capabilities, and adherence to international safety standards. These players compete on factors such as customization, safety compliance, durability, and project execution efficiency. In addition, companies like AAIT Scaffold, PEAK Scaffolding, and Safetech Scaffold are strengthening their positions by focusing on regional expansion, strategic partnerships, and innovation in lightweight and corrosion-resistant materials. Market participants are increasingly investing in modular systems and integrated service offerings to support both maintenance and new construction projects. With the growing demand for scaffolding in offshore oil, gas, and renewable sectors, competition is expected to intensify, prompting firms to enhance operational efficiency and adopt digital tools for project planning and safety monitoring.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PRISMEC

- BrandSafway

- AAIT Scaffold

- Layher

- PEAK Scaffolding

- Safetech Scaffold

- Wellmade Scaffold

- Classic Industrial Services, Inc.

- Guangzhou AJ Building Application Co., Ltd

- PERI Group

Recent Developments

- In July 2025, AAIT Scaffold published a technical focus on tubular scaffolding systems, emphasizing their reliability and adaptability for large industrial and offshore applications. Though not a press release of a product launch, this highlights AAIT’s continuing R&D and client education on offshore project requirements.

- In February 2025, AAIT Scaffold focused on the future of modern scaffolding, highlighting advancements in safety, efficiency, modular designs, and their application to increasingly complex construction projects, particularly in offshore and industrial settings.

Market Concentration & Characteristics

The Offshore Scaffolding Market exhibits moderate to high market concentration, with a few global players such as BrandSafway, Layher, PERI Group, and PRISMEC accounting for a significant share of total revenue. These companies dominate due to their strong distribution networks, adherence to international safety standards, and ability to deliver turnkey scaffolding solutions for offshore oil, gas, and wind projects. It features a mix of multinational firms and regional suppliers, each targeting specific project needs and geographies. Entry barriers remain high due to strict regulatory requirements, capital investment in corrosion-resistant materials, and the technical complexity of offshore environments. The market is defined by project-specific customization, operational safety, and durability in extreme marine conditions. Demand is cyclical, closely linked to oil price fluctuations and infrastructure maintenance cycles. Product innovation focuses on modular systems, lighter materials, and ease of assembly to reduce labor and installation time. Long-term contracts and performance reliability influence supplier selection.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for tailored modular scaffolding systems will rise to support diverse offshore projects.

- Operators will favor lightweight and corrosion-resistant materials for enhanced durability.

- Regulatory emphasis on safety certification will push stakeholders to upgrade outdated scaffolding.

- Offshore wind expansion will diversify demand beyond traditional oil and gas sectors.

- Digital tools like 3D planning and on-site monitoring will gain traction in project execution.

- Service providers will forge strategic partnerships to access new geographic markets.

- Customized scaffolding packages will grow in popularity to support complex platform geometry.

- Lifecycle maintenance services will attract repeat work as infrastructure ages.

- Focus on rapid deployment methods will improve worker efficiency in remote offshore conditions.

- Contract terms will increasingly reward suppliers with proven performance and reliability in marine settings.