Market Overview:

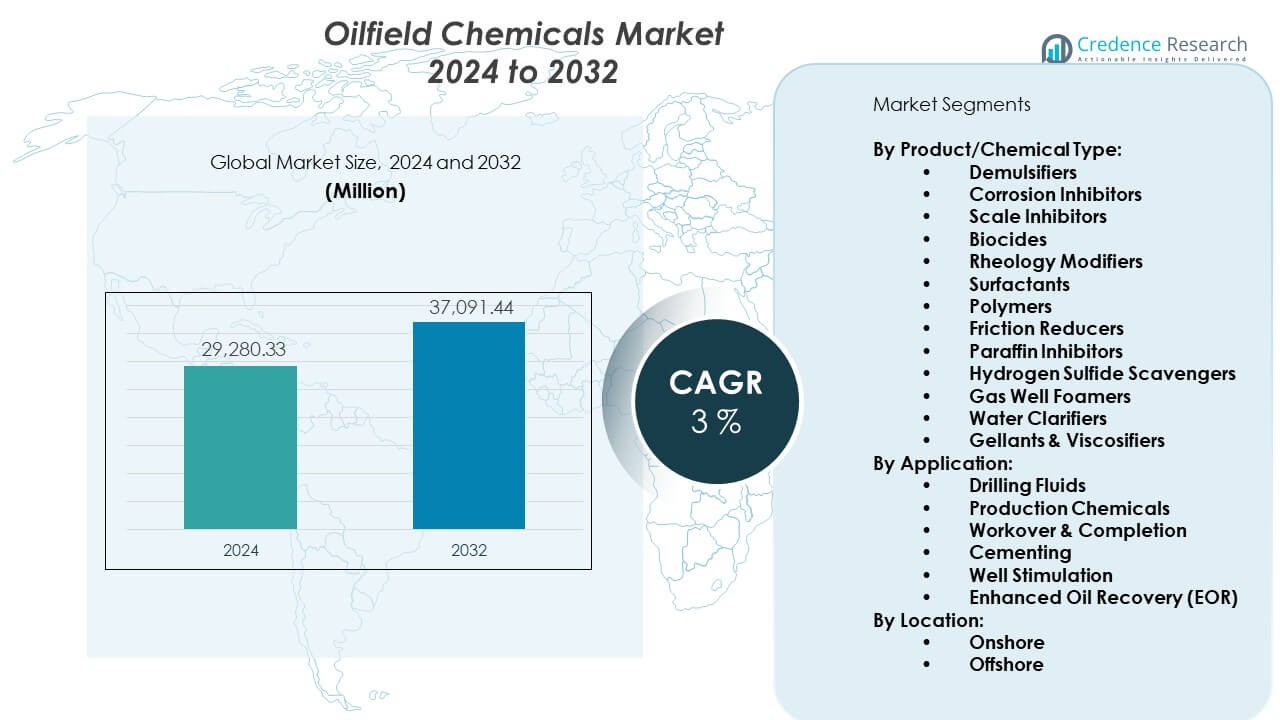

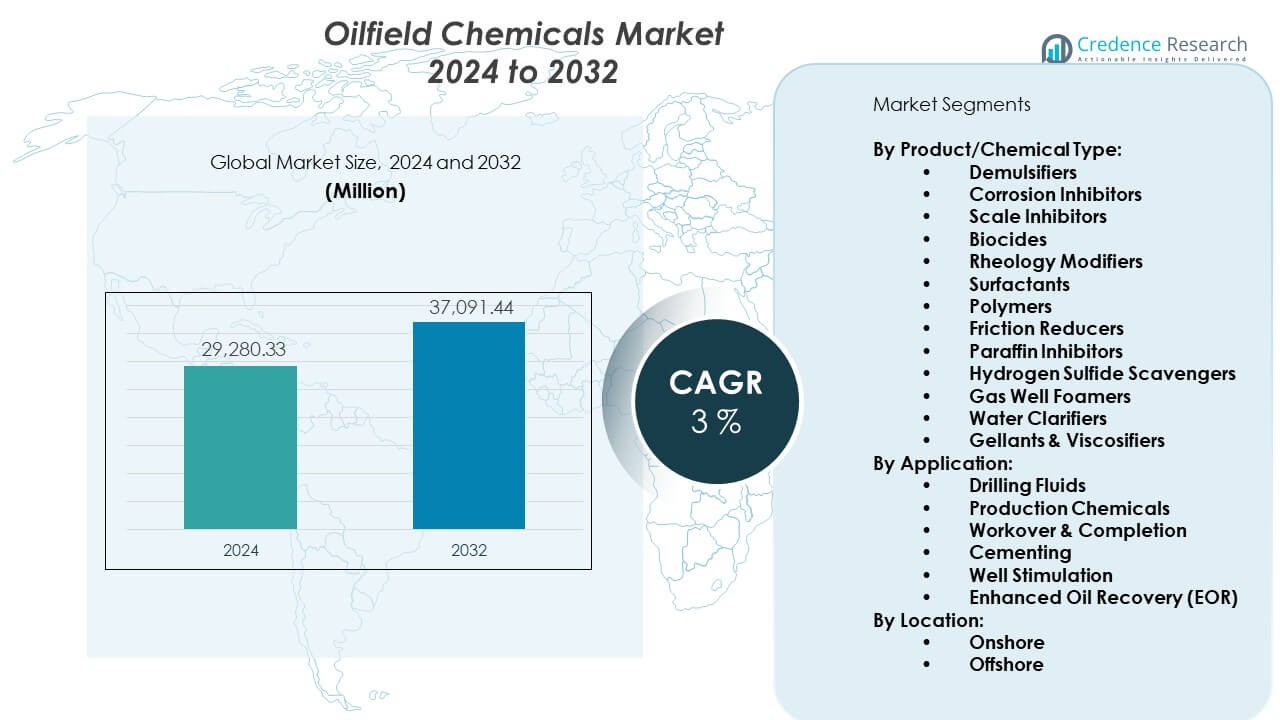

The Oilfield chemicals market is projected to grow from USD 29,280.33 million in 2024 to USD 37,091.44 million by 2032, recording a CAGR of 3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oilfield chemicals Market Size 2024 |

USD 29,280.33 Million |

| Oilfield chemicals Market, CAGR |

3% |

| Oilfield chemicals Market Size 2032 |

USD 37,091.44 Million |

The market gains momentum through the need for stronger extraction performance and higher production safety. Producers rely on advanced corrosion inhibitors, demulsifiers, surfactants, and scale removers to protect wells and maintain output under harsh conditions. Rising deepwater exploration pushes operators to adopt chemicals that stabilize fluid flow and reduce downtime. Enhanced oil recovery projects also lift consumption as companies aim to extract more from mature reservoirs. Growing shale development supports wider uptake of stimulation chemicals used in fracturing and treatment stages.

Regions with long-standing upstream activity lead the market due to established drilling fleets and steady production cycles. North America holds a strong position due to extensive shale operations and continuous well completions. The Middle East remains a key contributor because of large-scale conventional reservoirs and national strategies to expand output. Asia Pacific emerges at a faster pace due to rising investment in exploration and growing domestic energy demand across major developing countries. Latin America and Africa show growing potential as new offshore programs and deeper reserves attract capital and widen chemical use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Oilfield chemicals market is valued at USD 29,280.33 million in 2024 and is projected to reach USD 37,091.44 million by 2032, growing at a CAGR of 3% during the forecast period.

- North America (35%), Middle East & Africa (30%), and Asia Pacific (20%) lead the market due to strong drilling programs, long-life reservoir operations, and expanding exploration activities.

- Asia Pacific, holding 20%, is the fastest-growing region driven by rising exploration investments and increasing well interventions across China, India, and Southeast Asia.

- By application, Drilling Fluids hold 32%, driven by continuous global drilling cycles and high well-completion activity.

- By product type, Corrosion Inhibitors hold 18%, supported by the need for long-term protection in onshore and offshore production systems.

Market Drivers:

Rising Global Drilling Activity and Higher Need for Production Stability

The Oilfield chemicals market expands due to strong drilling momentum across mature and emerging fields. Operators increase chemical use to stabilize well operations under tougher geological conditions. It supports fluid control during drilling and strengthens wellbore integrity in high-pressure zones. Producers rely on corrosion inhibitors and scale-control products to reduce failures in long-term projects. Shale development pushes higher volumes of stimulation chemicals to maintain output. Enhanced oil recovery programs widen demand for surfactants and polymers. Offshore drilling creates deeper reliance on high-performance chemicals built for extreme temperatures. The market gains steady traction as companies target efficiency across diverse reservoir types.

- For instance, Schlumberger’s VeraTherm high-temperature water-based drilling fluid withstands up to 400°F without property reduction and enables multiple logging runs without circulation, eliminating conditioning trips and saving one day of rig time with each avoided trip in high-temperature applications.

Growing Focus on Efficiency Enhancement and Better Extraction Performance

The Oilfield chemicals market benefits from rising pressure to improve recovery rates from aging reservoirs. Operators depend on tailored chemical formulations to maintain flow and reduce blockage risks. It boosts system reliability in wells that face complex fluid behaviors. Corrosion and scaling risks push producers toward advanced protective chemicals. Companies expand the use of demulsifiers to separate water more efficiently in mature fields. Fluid-loss control agents help maintain drilling stability in challenging formations. Higher environmental expectations drive interest in cleaner blends with stronger performance. The market grows with wider adoption of chemicals that sustain long-term operational output.

Shift Toward Reservoir Optimization Through Advanced Chemical Formulation

The Oilfield chemicals market sees growth from increasing adoption of chemicals that optimize reservoir behavior. Operators apply surfactants and polymers to enhance sweep efficiency during recovery cycles. It strengthens the ability to displace trapped hydrocarbons in tight formations. Advanced biocides protect systems from bacterial contamination during production stages. New chemical blends support higher temperature and salinity levels across harsh reservoirs. Drilling programs integrate high-performance lubricants for smoother penetration. Producers seek chemicals that reduce downtime in aging assets. The trend accelerates as operators chase higher output through improved reservoir chemistry.

Expansion of Unconventional Oil and Gas Exploration Worldwide

The Oilfield chemicals market gains support from rapid development of unconventional fields across key regions. Hydraulic fracturing operations require large volumes of friction reducers and surfactants. It boosts demand for treatment chemicals that maintain fluid flow in horizontal wells. Shale producers use specialty blends to reduce formation damage. New projects adopt advanced viscosifiers to support stable fracturing stages. High-density drilling programs increase reliance on fluid additives. Operators target performance chemicals that enhance productivity in tight rock structures. The market strengthens with rising shale output in major producing countries.

Market Trends:

Growing Transition Toward Eco-Friendly Chemical Formulations and Cleaner Operations

The Oilfield chemicals market experiences a clear shift toward sustainable formulations driven by stricter compliance rules. Producers develop low-toxicity chemicals that reduce environmental risks in sensitive zones. It encourages operators to replace older blends with modern alternatives. Biodegradable products gain interest in offshore fields with tighter discharge limits. Companies invest in green friction reducers and plant-based surfactants. Cleaner demulsifiers support safer handling across production sites. Research improves product stability while keeping environmental impact low. The sustainability shift gains strength as global energy firms set cleaner operational goals.

- For instance, Clariant’s PHASETREAT WET employs nanoemulsion technology to reduce demulsifier dosages by up to 75% compared to conventional solutions, cutting freight, inventory, and offshore chemical movements while maintaining superior separation performance. Research improves product stability while keeping environmental impact low. The sustainability shift gains strength as global energy firms set cleaner operational goals.

Increased Use of Digital Monitoring for Chemical Optimization and Waste Reduction

The Oilfield chemicals market integrates digital tools to monitor chemical dosing and well conditions in real time. Sensors track fluid behavior across drilling and production stages. It helps operators control chemical volumes with more precision. Automated systems reduce wastage and improve cost efficiency. AI models support predictive planning for treatment schedules. Remote monitoring strengthens safety in high-risk fields. Data tools enhance decision-making for complex reservoirs. The digital adoption trend grows as companies pursue higher control across chemical workflows.

- For instance, wireless chemical injection monitoring systems send updated information every five minutes to cloud platforms, providing real-time data on tank levels, injection rates, and pump health, enabling operators to achieve accurate correlation between chemical programs and production data.

Rising Adoption of High-Temperature-High-Salinity Chemical Solutions

The Oilfield chemicals market moves toward advanced formulations that withstand extreme operating conditions. Producers design chemicals that maintain stability in ultra-deepwater and high-pressure wells. It supports consistent performance where temperatures rise sharply. New polymers and surfactants target salinity-resistant behavior in challenging reservoirs. Offshore operators use robust demulsifiers for better separation efficiency. Harsh environments increase demand for corrosion-resistant technologies. Companies widen R&D to upgrade thermal performance. The trend accelerates with expansion into deeper and hotter reserves.

Wider Use of Nanotechnology and Smart Chemical Systems

The Oilfield chemicals market benefits from interest in nano-enabled chemicals that improve recovery and flow efficiency. Nano-additives help reduce interfacial tension in tight formations. It supports better mobility of hydrocarbons toward the wellbore. Smart chemicals respond to pressure or temperature to release active agents. Nano-coatings protect equipment in corrosive fields. New research explores targeted chemical delivery for enhanced recovery. Companies examine smart systems for controlled release during drilling. Nanotechnology gains traction as operators push for precision performance.

Market Challenges Analysis:

Higher Environmental Pressures and Strong Regulatory Oversight Across Key Basins

The Oilfield chemicals market faces rising scrutiny over ecological risk in sensitive regions. Regulations tighten around chemical discharge, treatment, and safe handling. It forces companies to reformulate many legacy chemicals with safer inputs. Compliance costs rise for producers that operate across offshore and tight-gas fields. Operators adjust workflows to manage stricter reporting rules. Environmental groups push for deeper oversight on chemical toxicity. New approvals require extensive testing before deployment. The challenge increases pressure on companies to balance performance and compliance.

Volatile Raw Material Prices and Supply Chain Instability Across Production Hubs

The Oilfield chemicals market experiences disruption from fluctuating raw material costs. Feedstock availability varies across global hubs due to transportation issues. It affects production timelines for key chemical categories. Operators face higher procurement risks during periods of supply imbalance. Unexpected delays raise operational uncertainty during drilling cycles. Companies adjust inventories to avoid sudden shortages. Price swings influence final treatment costs for wells. The challenge intensifies as supply networks stretch across multiple continents.

Market Opportunities:

Rising Investment in Enhanced Oil Recovery and Chemical-Based Production Optimization

The Oilfield chemicals market gains opportunity from larger EOR commitments across mature fields. Operators expand surfactant-polymer projects to maximize extraction. It supports stronger recovery from declining reservoirs. High-viscosity modifiers help sustain fluid flow in late-life wells. New chemicals enable improved performance in complex carbonates. Companies invest in pilot programs to test next-generation blends. Interest grows in chemical flooding to extend field life. The opportunity expands with global focus on maximizing existing reserves.

Growth of Unconventional Projects and Expansion into Deepwater Zones

The Oilfield chemicals market benefits from the rise of shale and deeper offshore exploration. Fracturing programs need high-performance additives that support demanding operations. It pushes producers to design advanced friction and scale-control solutions. Deepwater wells require chemicals built for extreme temperatures. Operators look for stable formulations that maintain flow efficiency. New blocks open across emerging regions with strong drilling plans. Companies gain scope to introduce specialized blends for high-pressure operations. The opportunity strengthens with new exploration cycles worldwide.

Market Segmentation Analysis:

By Product/Chemical Type

The Oilfield chemicals market expands across a broad range of chemical categories that support drilling, production, and recovery operations. Demulsifiers, corrosion inhibitors, and scale inhibitors remain core products due to their essential role in protecting equipment and maintaining flow efficiency. Biocides and rheology modifiers strengthen well stability under variable conditions. Surfactants, polymers, and friction reducers show strong demand in stimulation and hydraulic fracturing programs. Paraffin inhibitors, hydrogen sulfide scavengers, gas well foamers, water clarifiers, and gellants & viscosifiers support field-specific needs across complex reservoirs. The diversity of products helps operators maintain operational continuity across onshore and offshore assets.

- For instance, scale inhibitor squeeze treatments using extended-release technology achieve treatment lifetimes exceeding 16 months compared to conventional treatments averaging 5 months, representing more than 300% lifetime extension while maintaining residuals above minimum effective concentrations.

By Application

The Oilfield chemicals market serves critical applications that drive drilling performance and production optimization. Drilling fluids dominate due to constant global drilling activity. Production chemicals support flow assurance and protect wells during long operational cycles. Workover and completion treatments require targeted chemicals to stabilize newly accessed zones. Cementing applications rely on additives that secure well integrity. Well stimulation projects use surfactants and friction reducers to improve reservoir contact. Enhanced oil recovery (EOR) operations benefit from polymers and surfactants that lift output from mature fields.

- For instance, Halliburton inaugurated a state-of-the-art specialty oilfield chemical manufacturing reaction plant in Saudi Arabia in March 2022, the first of its kind in the Kingdom, creating approximately 100 jobs and strengthening regional chemical supply capabilities for the entire oil and gas value chain.

By Location

The Oilfield chemicals market operates across both onshore and offshore environments, each with distinct requirements. Onshore fields contribute strong volume demand due to extensive drilling programs and wider use of stimulation chemicals. Offshore operations require high-performance, corrosion-resistant, and thermally stable formulations that operate under extreme pressure and temperature conditions. The dual-location presence strengthens market resilience and supports continuous industry adoption across global exploration and production landscapes.

Segmentation:

By Product/Chemical Type:

- Demulsifiers

- Corrosion Inhibitors

- Scale Inhibitors

- Biocides

- Rheology Modifiers

- Surfactants

- Polymers

- Friction Reducers

- Paraffin Inhibitors

- Hydrogen Sulfide Scavengers

- Gas Well Foamers

- Water Clarifiers

- Gellants & Viscosifiers

By Application:

- Drilling Fluids

- Production Chemicals

- Workover & Completion

- Cementing

- Well Stimulation

- Enhanced Oil Recovery (EOR)

By Location:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The oilfield chemicals market holds a strong base in North America with a share of 35%. The region benefits from extensive shale development and high drilling intensity across major basins. It drives large-scale consumption of friction reducers, surfactants, and stimulation chemicals. Operators rely on advanced formulations to support tight oil and gas production. The market grows with strong adoption of digital monitoring tools that improve dosing accuracy. It gains further support from steady well completion activity in the United States. The region maintains leadership due to a mature supply chain and advanced production practices.

Middle East & Africa

The oilfield chemicals market secures a sizable presence in the Middle East & Africa with a 30% share. National oil companies invest in enhanced oil recovery and large-scale reservoir maintenance programs across major fields. It strengthens demand for demulsifiers, corrosion inhibitors, and polymers. Offshore developments in the Persian Gulf elevate the use of high-temperature chemical blends. The region benefits from long-term production strategies that require consistent chemical support. Africa contributes through offshore exploration programs and new deepwater licenses. The segment grows due to efforts to improve output from complex carbonate reservoirs.

Asia Pacific, Europe, and Latin America

The oilfield chemicals market sees diverse growth across Asia Pacific, Europe, and Latin America, holding 20%, 10%, and 5% shares respectively. Asia Pacific expands with rising exploration programs across China, India, and Southeast Asia. It adopts chemicals that support high-salinity and deeper reservoir conditions. Europe maintains steady demand driven by North Sea operations and enhanced recovery projects. Latin America grows through offshore developments in Brazil and onshore activity in Argentina’s shale fields. Each region uses tailored chemicals to manage basin-specific challenges. The combined segment strengthens global demand as drilling and production activities broaden.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Schlumberger (SLB)

- Halliburton

- Baker Hughes

- BASF SE

- Champion X

- Solvay

- Clariant

- Dow

- Nouryon

- Nalco Champion (Ecolab)

- The Lubrizol Corporation

- Kemira

- Chevron Phillips Chemical Company

- Huntsman Corporation

- Thermax Limited

- SMC Global

- Stepan Company

- Innospec

- Evonik Industries

- Albemarle Corporation

Competitive Analysis:

The Oilfield chemicals market features strong competition driven by global service companies, chemical specialists, and integrated oilfield solution providers. Leading firms expand portfolios with high-performance formulations built for deepwater, shale, and enhanced recovery operations. It strengthens competitive positioning through advanced R&D, regional expansions, and wider digital integration. Service giants maintain influence with bundled chemical and field-support packages that improve well performance. Specialty chemical companies focus on customized blends for flow assurance and corrosion control. Players use partnerships to improve reach in offshore and high-temperature environments. The market evolves through steady innovation in safer, more efficient, and reservoir-specific chemical solutions.

Recent Developments:

- In October 2025, BASF and Carlyle, in partnership with Qatar Investment Authority, entered into a binding agreement for BASF’s automotive OEM coatings, automotive refinish coatings, and surface treatment businesses. The enterprise value of the transaction amounts to €7.7 billion, with BASF retaining a 40% equity stake in the coatings business and receiving pre-tax cash proceeds of approximately €5.8 billion at closing. The transaction is expected to close in the second quarter of 2026, subject to customary regulatory approvals. While this transaction involves the coatings division rather than oilfield chemicals specifically, it represents BASF’s strategic focus on portfolio optimization.

- In September 2025, Macquarie Asset Management expanded its equity stake in Diamond Infrastructure Solutions.

- In August 2025, Clariant Oil Services demonstrated its innovative chemical solutions through two case studies involving specialized corrosion inhibitors for high-shear environments and specialty squeeze scale inhibitors for high-temperature applications. These solutions were designed to address critical challenges in oil production environments, extending equipment life and ensuring production reliability.

- In June 2025, Nouryon launched an Innovation Center for oilfield solutions in Houston, Texas. The Innovation Center focuses on research and development for sustainable drilling and completion, production, and stimulation processes. This marks Nouryon’s first Innovation Center in Houston and represents a significant expansion of the company’s capabilities and presence in the oilfield market. The facility features state-of-the-art testing facilities and capabilities in demulsification, corrosion and scale inhibition, as well as stimulation.

Report Coverage:

The research report offers an in-depth analysis based on By Product/Chemical Type, By Application, and By Location. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand rises for high-performance chemicals tailored to deeper and hotter reservoirs.

- Digital tools shape dosing precision and chemical optimization across major fields.

- Eco-friendly and low-toxicity formulations gain wider adoption in regulated zones.

- EOR growth strengthens the need for polymers and surfactants in mature assets.

- Offshore expansion fuels demand for corrosion-resistant and thermally stable blends.

- Shale activity supports higher consumption of friction reducers and stimulation fluids.

- Flow-assurance chemicals gain relevance in longer and more complex subsea tiebacks.

- Partnerships between producers and NOCs accelerate product deployment.

- Supply chains improve through regional manufacturing expansions.

- High-salinity and HPHT solutions shape new R&D priorities for global suppliers.