Market Overview

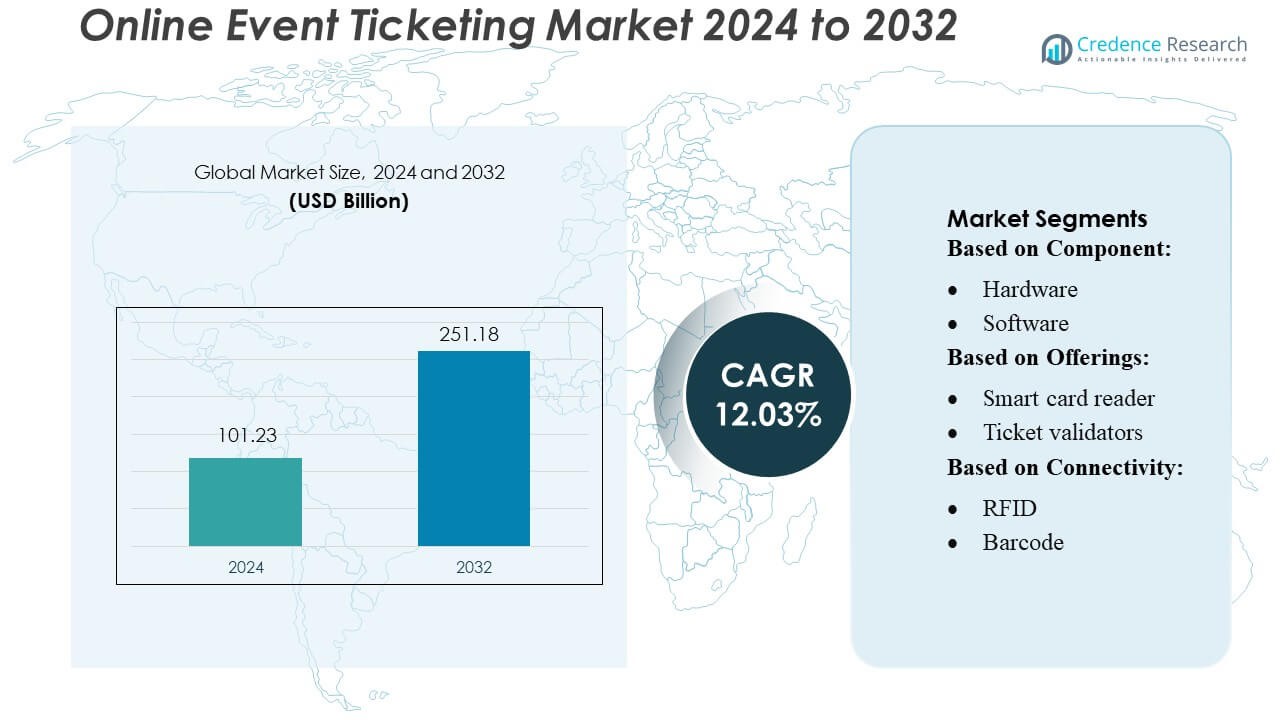

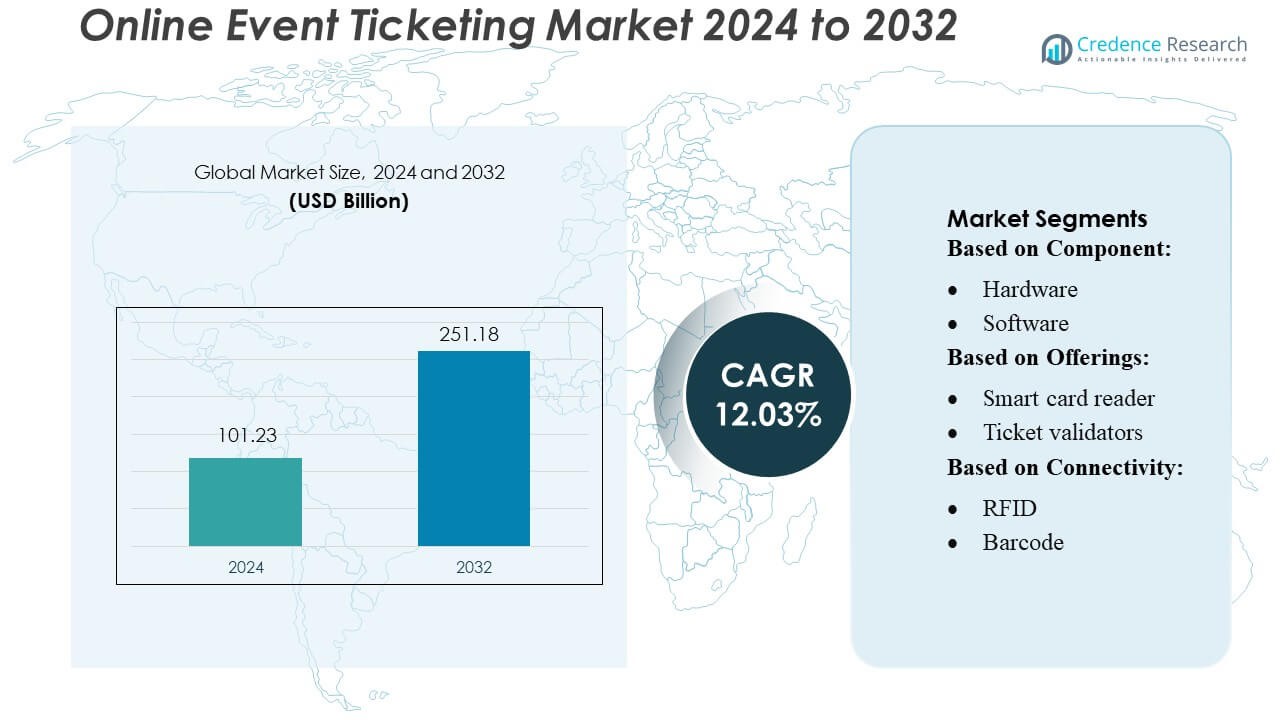

Online Event Ticketing Market size was valued USD 101.23 billion in 2024 and is anticipated to reach USD 251.18 billion by 2032, at a CAGR of 12.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Online Event Ticketing Market Size 2024 |

USD 101.23 Billion |

| Online Event Ticketing Market, CAGR |

12.03% |

| Online Event Ticketing Market Size 2032 |

USD 251.18 Billion |

The online event ticketing market is highly competitive, and companies such as TickPick LLC, AOL Inc. (Yahoo), Cineplex Inc., Cinemark Holdings, Inc., PVR Ltd., VOX Cinemas, KyaZoonga, Inc., Carnival Cinemas, EasyMovies, and Bigtree aggressively vie for market share. These firms differentiate themselves by investing in mobile-first platforms, AI-driven pricing, loyalty programs, and real-time seat selection. Many also explore partnerships with event organizers and venue chains to broaden distribution. North America leads the market, accounting for approximately 38.8% of global revenue, leveraging its advanced digital infrastructure, mature entertainment industry, and high disposable incomes.

Market Insights

- The online event ticketing market reached USD 101.23 billion in 2024 and is projected to hit USD 251.18 billion by 2032, expanding at a 12.03% CAGR, driven by rising digital adoption and increasing demand for seamless ticketing experiences.

- Growing use of mobile-first platforms accelerates market growth, with mobile channels accounting for the majority of online ticket bookings due to convenience and faster checkout.

- Competitive activity intensifies as leading companies invest in AI-driven pricing, loyalty programs, and real-time seat selection, while forming partnerships with venues and event organizers to expand reach.

- Market restraints include high platform fees, fraud risks, and inconsistent digital infrastructure in emerging regions, which slow adoption and limit platform accessibility for some users.

- North America leads the global market with 38.8% share, supported by strong digital infrastructure, while Asia-Pacific registers the fastest growth; cinema ticketing remains a dominant segment, benefitting from expanding entertainment spending and digital payments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

In the component segment, software holds the dominant market share, accounting for the largest portion of overall adoption in online event ticketing. Its leadership is driven by the rapid shift toward cloud-based ticketing platforms, automated seat selection, integrated payment systems, and real-time analytics used by event organizers. Software solutions also enable smooth mobile ticket delivery, fraud detection, and multi-channel distribution, making them essential for managing large volumes of digital attendees. As digital engagement increases, organizers prioritize flexible, scalable software over hardware-heavy systems, reinforcing its leading position.

- For instance, TickPick LLC implemented an AI-powered fraud detection system (Adaptive Checkout) in partnership with Riskified, which enabled it to recover $3 million in previously declined orders within three months.

By Offerings

Within offerings, ticket validators and mobile ticketing terminals represent the largest sub-segment, holding a significant share of market deployments. Their dominance is driven by widespread use at concerts, sports events, and entertainment venues where fast check-ins and secure verification are critical. Portable validation devices simplify crowd management, reduce entry bottlenecks, and support QR/barcode scanning and contactless checking. Operators prefer these solutions because they integrate easily with mobile apps and cloud back-ends, enabling smoother operations and reducing staffing needs. Their growing adoption reinforces their leadership in the offerings category.

- For instance, Cinemark Holdings, Inc. enhanced its mobile ticketing infrastructure by expanding support for digital validation across its U.S. circuit, and its official mobile app has been downloaded more than 10,000,000 times, enabling large-scale deployment of QR and barcode scanning at entry points.

By Connectivity

In the connectivity segment, barcode technology remains the dominant sub-segment, holding the highest share of active ticketing transactions. Its leadership is supported by low implementation cost, universal smartphone compatibility, and quick scanning capability across venues of all sizes. Barcodes also require minimal hardware investment and integrate easily with mobile apps, making them the preferred choice for digital event tickets. While RFID and NFC are growing, barcode systems remain the most widely adopted due to their simplicity, reliability, and ease of deployment, particularly for high-volume events and budget-sensitive organizers.

Key Growth Drivers

- Rising Adoption of Mobile Ticketing

Mobile penetration and smartphone-based transactions continue to accelerate the shift toward digital ticketing. Consumers prefer app-based platforms that offer seamless browsing, instant purchasing, and secure digital ticket storage. Event organizers benefit from real-time sales insights, dynamic pricing options, and the elimination of physical ticket distribution. The widespread use of QR codes and mobile wallets enhances user convenience, reduces waiting times, and minimizes fraud risks. As mobile-first behavior expands across entertainment and sports sectors, mobile ticketing remains a major driver for market growth.

- For instance, KyaZoonga, Inc. demonstrated the scalability of mobile ticketing by managing ticketing operations for 49 international cricket matches and processing more than 2,000,000 tickets during the ICC Cricket World Cup, showcasing the operational strength of mobile-first platforms.

- Expansion of Live Events and Entertainment Ecosystem

The global rise in concerts, festivals, sports leagues, and exhibitions significantly boosts demand for online ticketing platforms. Organizers increasingly digitize ticket distribution to reach wider audiences, manage high-volume bookings, and reduce operational overheads. Online systems allow flexible seat management, promotional discounting, and personalized communication, strengthening event engagement. Growth in hybrid events and large-scale entertainment productions further elevates the need for automated ticketing solutions. This expanding event ecosystem provides strong momentum for online ticketing adoption across geographies.

- For instance, Cineplex Inc. documented its ability to scale by serving 8.4 million guests in just the first quarter of 2025, leveraging its new mobile app and digital event-cinema offerings to streamline bookings and boost registration for alternative programming.

- Advancements in Secure Digital Payment Infrastructure

Improved payment infrastructure—such as UPI, digital wallets, tokenization, and instant settlements—greatly enhances user trust in online ticketing. Platforms benefit from faster checkout processes, reduced transaction failures, and enhanced transparency through secure gateways. Enhanced fraud monitoring and two-factor authentication add layers of protection, encouraging first-time digital users. As regulatory bodies promote cashless transactions and fintech integrations mature, consumers increasingly shift to online channels for ticket purchases. These technological improvements form a foundational driver for steady market expansion.

Key Trends & Opportunities

- Increasing Use of AI for Personalization and Dynamic Pricing

AI-driven engines are transforming how platforms forecast demand, personalize recommendations, and optimize ticket prices. Event organizers use machine learning models to adjust pricing based on real-time demand, seat availability, and historical buying patterns. Personalized marketing—such as targeted notifications and curated event lists—boosts conversions and reduces cart abandonment. This trend creates opportunities for platforms to enhance user engagement and improve revenue management. As AI tools become more accessible, personalized ticketing experiences will remain a key opportunity for market differentiation.

- For instance, AOL Inc. (Yahoo) enhances personalization performance across its digital ecosystem through its AI-powered Yahoo Advertising platform, which processes over 200 billion daily data signals to refine audience targeting and recommendation accuracy—demonstrating how large-scale AI capabilities directly support more dynamic and customized ticketing experiences.

- Growth of Contactless and Smart Access Solutions

Adoption of QR codes, NFC-based passes, and RFID wristbands is reshaping entry management at events. These technologies enable fast, touch-free access control, reduce queue times, and minimize ticket fraud. Organizers increasingly deploy digital validation devices to streamline operations, particularly at large venues and festivals. The rising preference for frictionless check-ins supports opportunities for platforms to integrate advanced access tools into their services. This trend aligns with global moves toward hygienic, technology-led experiences, especially in high-traffic entertainment environments.

- For instance, VOX Cinemas supports contactless e-ticket scanning across its network of 573 cinema screens, leveraging digital ticket validation through its mobile app to enable smooth, touch-free entry across its venues.

- Expansion of Cross-Platform and Omnichannel Ticketing

Consumers expect ticket access across apps, websites, kiosks, and partner channels, prompting platforms to invest in omnichannel capabilities. Integration with social media, streaming platforms, and travel apps allows broader event visibility and more convenient purchasing. Organizers leverage these interconnected systems to boost reach and create bundled offerings such as travel-and-event packages. This opportunity strengthens customer engagement and opens new revenue streams. As digital ecosystems expand, cross-platform ticket distribution will remain a major trend within the market.

Key Challenges

- High Incidence of Fraud and Scalping Activities

Despite improvements in digital security, the market continues to face challenges related to counterfeit tickets, unauthorized reselling, and large-scale bot-driven bulk purchases. These issues impact consumer trust and strain platform operations. Organizers must invest heavily in secure verification systems, anti-bot technologies, and authentication protocols to mitigate risks. Fraud also increases customer service overheads and disputes, affecting brand reputation. Addressing these persistent threats remains a key challenge, especially during high-demand events where unauthorized resale activity peaks.

- Infrastructure Gaps in Emerging Markets

While digital adoption is rising, many developing regions still face challenges such as inconsistent internet connectivity, limited digital payment adoption, and low smartphone penetration. These factors restrict the shift from offline to online ticketing. Smaller organizers may lack resources to adopt automated ticketing systems, slowing market expansion. Furthermore, regulatory inconsistencies and fragmented payment ecosystems add complexity for platform operators. Bridging these infrastructure gaps is essential for broader market penetration, but remains a major challenge in underserved areas.

Regional Analysis

North America

North America holds the largest share of the online event ticketing market, accounting for around 38–39% of global revenue. The strong position comes from widespread internet access, high smartphone usage, and a mature entertainment industry with frequent concerts, sports events, and theatre shows. Major companies such as Ticketmaster and Eventbrite lead the market, offering secure digital payments and mobile ticketing options. Consumers in the region prefer online booking because it is fast, reliable, and convenient. Continuous investments in digital platforms and strong demand for live events help North America maintain its leading role.

Europe

Europe accounts for about 27% of the global online event ticketing market. The region benefits from strong digital infrastructure and a large number of cultural, music, and sports events. Countries such as the United Kingdom, Germany, and France contribute heavily to online ticket sales. Consumers increasingly prefer mobile and digital tickets, especially for concerts, festivals, and football matches. Clear regulations and data protection laws help strengthen user trust in online platforms. As digital adoption increases and more events shift to online booking systems, Europe continues to remain a major and stable market.

Asia-Pacific

Asia-Pacific holds around 24–30% of the global online event ticketing market and is the fastest-growing region. Rising internet use, a young population, and strong smartphone growth support rapid expansion. Countries such as China, India, Japan, and Australia drive the majority of sales. Digital payments, especially mobile wallets and super-apps, make booking easier and more popular. The growing interest in concerts, sports events, and entertainment shows also boosts demand. As more people shift to online purchasing and hybrid events increase, Asia-Pacific continues to show strong growth potential.

Latin America

Latin America represents a smaller but rising portion of the market, with a steadily growing share driven mainly by Brazil, Mexico, and Argentina. Online event ticketing adoption is increasing as internet access and mobile payment options expand. More consumers now book tickets online for concerts, sports, and cultural festivals due to improving platform reliability and convenience. Local ticketing companies and regional apps are gaining popularity as they offer localized pricing and secure transactions. Although the market share is lower compared with other regions, Latin America is becoming a promising growth area as digital usage continues to rise.

Middle East & Africa

The Middle East & Africa region captures about 5–11% of the global online event ticketing market. Growth is supported by increasing smartphone ownership, rising disposable incomes, and strong interest in entertainment events, cultural festivals, and sports tournaments. Countries such as the UAE, Saudi Arabia, South Africa, and Egypt lead adoption. Governments are investing heavily in digital transformation, making online payments and mobile ticketing more secure and accessible. As more venues adopt QR-based and contactless ticketing systems, the region’s online event ticketing market continues to expand gradually.

Market Segmentations:

By Component:

By Offerings:

- Smart card reader

- Ticket validators

By Connectivity:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the online event ticketing market features a diverse mix of global and regional companies, including TickPick LLC, Cinemark Holdings, Inc., KyaZoonga, Inc., Cineplex Inc., AOL Inc. (Yahoo), VOX Cinemas, PVR LTD., Carnival Cinemas, EasyMovies, and Bigtree. The online event ticketing market is characterized by rapid digital transformation, strong mobile adoption, and increasing demand for seamless booking experiences. Companies compete by enhancing platform reliability, expanding digital payment options, and integrating real-time seat selection and personalized recommendations. Advanced technologies such as AI-driven pricing, automated fraud detection, and secure QR-based ticketing strengthen user trust and reduce operational risks. Market participants are also focusing on loyalty programs, cross-platform integration, and partnerships with entertainment venues to broaden their reach. As consumers shift toward mobile-first ticketing, competitive advantage increasingly depends on user-friendly interfaces, fast checkout processes, and consistent customer support. Continuous innovation, strategic collaborations, and differentiated service offerings shape the evolving competitive dynamics, enabling firms to capture growth opportunities in both mature and emerging markets.

Key Player Analysis

- TickPick LLC

- Cinemark Holdings, Inc.

- KyaZoonga, Inc.

- Cineplex Inc.

- AOL Inc. (Yahoo)

- VOX Cinemas

- PVR LTD.

- Carnival Cinemas

- EasyMovies

- Bigtree

Recent Developments

- In January 2025, HID (part of the ASSA ABLOY Group) announced it had signed an agreement to acquire the companies 3millID Corporation and Third Millennium Systems Ltd. The acquisition aimed to expand HID’s physical access control portfolio by adding specialized multi-technology readers and secure, encrypted mobile access credentials, particularly benefiting customers transitioning from older systems.

- In October 2024, Cubic Transportation Systems (CTS) secured a contract with the Tasmanian government to implement a new smart ticketing system for its public transport network. This multiyear agreement aims to provide more convenient and accessible fare payment options, leveraging Cubic’s account-based ticketing technology, which is also used in Queensland.

- In September 2024, FPT IS and Mastercard signed a partnership to integrate an open-loop EMV electronic payment system for Ho Chi Minh City’s Metro Line 1. This collaboration, formalized by a Memorandum of Understanding (MoU), will allow passengers to pay fares using bank cards, QR codes, or citizen ID cards, which is expected to streamline traffic management and ticketing.

- In July 2024, Conduent Transportation will modernize Saint-Étienne Métropole’s STAS bus and tram network by implementing a new account-based ticketing system and installing various new equipment to improve efficiency and accessibility. The three-phase improvement process will enhance regional interoperability and introduce mobile ticketing options.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Offerings, Connectivity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward mobile-first ticketing as smartphone usage and digital wallets expand.

- AI-driven personalization will improve event recommendations and dynamic pricing accuracy.

- Hybrid and virtual events will maintain steady demand for online booking platforms.

- Contactless and QR-based ticketing will become the standard for security and convenience.

- Integration with social media and super-apps will enhance event discovery and faster ticket purchases.

- Cloud-based platforms will support faster scaling and improved real-time inventory management.

- Subscription models and loyalty programs will gain traction to drive customer retention.

- Stronger fraud prevention tools will emerge as platforms adopt blockchain and advanced verification.

- Localized ticketing solutions will grow in emerging markets with rising digital adoption.

- Strategic partnerships between event organizers, venues, and tech platforms will shape competitive advantage.