Market Overview

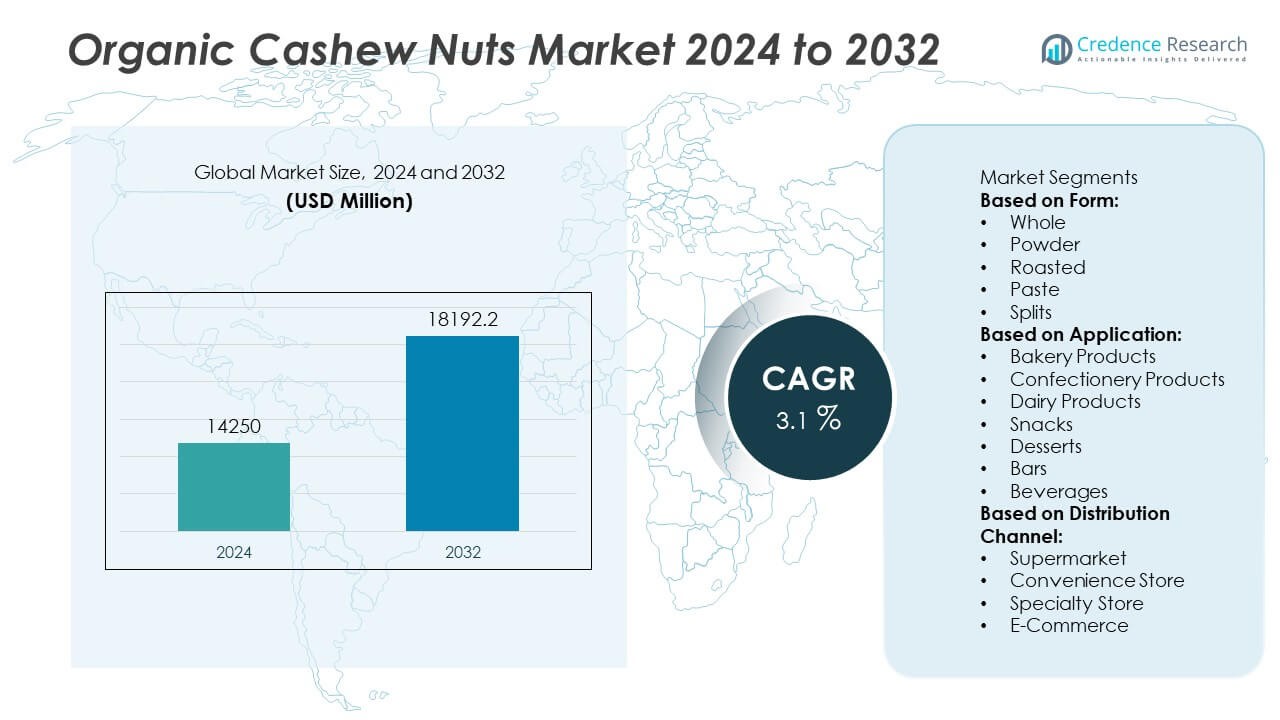

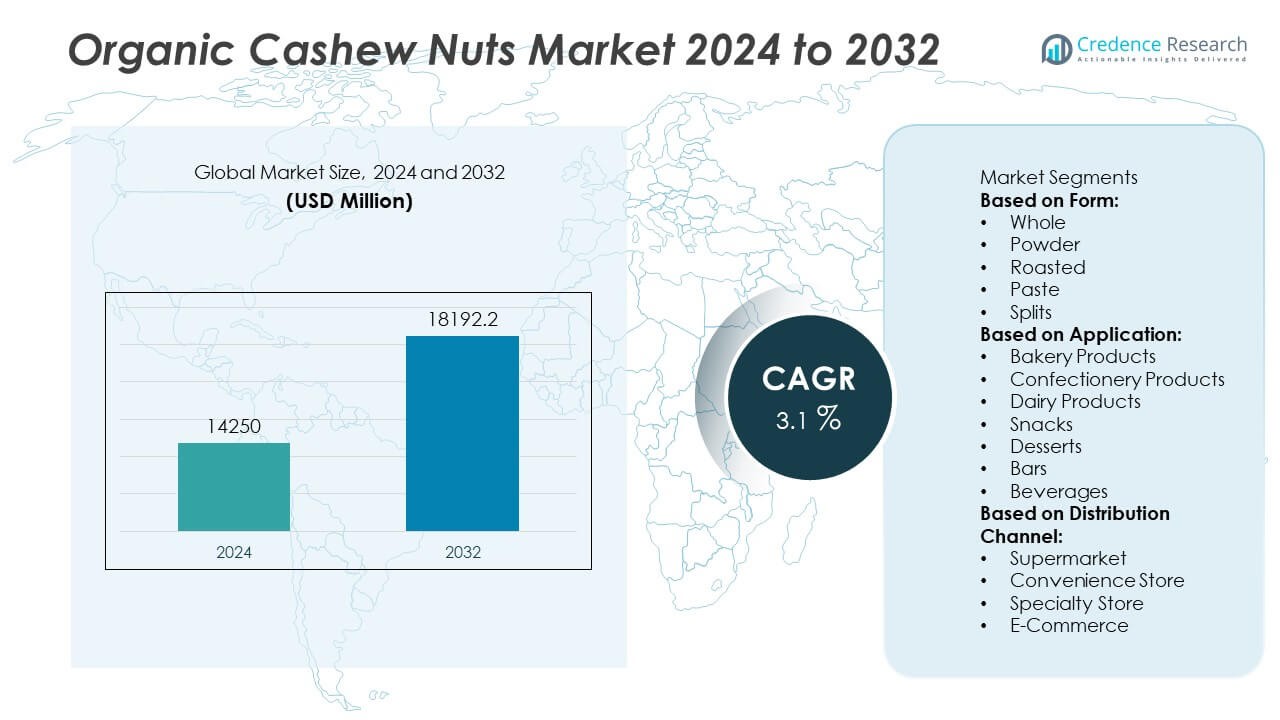

The Organic Cashew Nuts Market was valued at USD 14,250 million in 2024 and is projected to reach USD 18,192.2 million by 2032, growing at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Organic Cashew Nuts Market Size 2024 |

USD 14,250 Million |

| Organic Cashew Nuts Market, CAGR |

3.1% |

| Organic Cashew Nuts Market Size 2032 |

USD 18,192.2 Million |

The Organic Cashew Nuts Market grows on the strength of rising consumer preference for natural, chemical-free food products and increasing awareness of plant-based nutrition. It advances with strong demand from the bakery, confectionery, and snack sectors, where cashew-based ingredients enhance product value. Health-conscious consumers drive purchases due to the nut’s protein, fiber, and mineral content.

The Organic Cashew Nuts Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region contributing unique growth drivers. North America benefits from high consumer awareness of organic certifications and rising demand for healthy snacks, while Europe leads in premium organic food consumption supported by strict sustainability standards. Asia-Pacific emerges as a key producer and exporter, with India and Vietnam at the forefront of processing and supply. Latin America and the Middle East & Africa gradually expand through organic farming initiatives and growing urban demand. Key players driving this market include Mount Franklin Foods (USA), Left Coast Organics (Canada), CBL Natural Foods Pvt. Ltd. (India), and Tierra Farm (India), each leveraging advanced processing facilities, certified sourcing, and global distribution channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Organic Cashew Nuts Market was valued at USD 14250 million in 2024 and is projected to reach USD 18192.2 million by 2032, growing at a CAGR of 3.1% during the forecast period.

- Rising consumer preference for natural and chemical-free food products drives strong demand for organic cashew nuts across global markets.

- Growing trends include the use of organic cashew nuts in plant-based beverages, energy bars, and dairy alternatives, reflecting the rising popularity of vegan and clean-label diets.

- Competitive analysis highlights the presence of key players such as Mount Franklin Foods, Left Coast Organics, CBL Natural Foods Pvt. Ltd., and Tierra Farm, which strengthen their position through certified sourcing and expanding distribution networks.

- Market restraints include high production costs, limited supply of certified organic cashew nuts, and vulnerability of cultivation to climate fluctuations, which restrict scalability.

- Regional analysis shows North America and Europe dominating consumption with strong retail penetration, while Asia-Pacific remains the leading producer, supported by India’s extensive processing capacity and export strength.

- Increasing investments in sustainable farming practices, fair-trade certifications, and advanced processing facilities create opportunities for both established companies and new entrants in developed and emerging economies.

Market Drivers

Rising Consumer Preference for Healthy and Natural Snacks

The Organic Cashew Nuts Market advances with growing consumer preference for clean-label, chemical-free food options. Rising awareness of lifestyle-related diseases encourages individuals to replace conventional snacks with organic alternatives. Cashew nuts provide plant-based protein, healthy fats, and essential micronutrients that support immunity and heart health. Consumers with higher disposable incomes favor premium organic products for their nutritional and ethical value. Retailers expand shelf space for organic snacks, making them more accessible to health-conscious buyers. It reinforces the steady demand for organically certified cashews across global markets.

- For instance, Left Coast Organics (Canada) reported processing over 2,500 metric tons of certified organic cashews in 2024, supplying more than 1,200 retail outlets across North America with clean-label snack products.

Expanding Use of Organic Cashews in Food and Beverage Applications

Food processors incorporate organic cashew nuts into dairy alternatives, confectionery, and bakery products to meet vegan and clean-label trends. Organic cashew milk, butter, and cheese witness rising adoption in plant-based diets. Cashew-based confectionery products attract consumers seeking indulgence without artificial additives. The growing number of product launches across supermarkets and online platforms drives consistent demand for organically certified nuts. Restaurants and cafes also integrate organic cashew products into premium offerings. It highlights the role of value-added applications in fueling industry expansion.

- For instance, CBL Natural Foods Pvt. Ltd. (India) expanded its product line by producing 18,000 liters of organic cashew milk per month for the domestic and export markets, supported by its automated facility in Colombo with a daily processing capacity of 50 metric tons.

Government Support and Certifications Boosting Market Growth

Government initiatives supporting organic agriculture strengthen confidence in the supply chain. Certification programs ensure traceability and compliance with international organic standards. Export-driven economies in Africa and Asia expand certified production to meet stringent requirements in the U.S. and European markets. Subsidies and training programs encourage farmers to shift from conventional to organic cultivation. Compliance with global organic labeling enhances the credibility of cashew exporters. It builds trust among consumers who prioritize transparency and food safety.

Rising Demand from Vegan and Plant-Based Diet Consumers

The increasing shift toward vegan and flexitarian lifestyles elevates demand for organic cashew nuts. Consumers adopt them as a protein-rich, dairy-free alternative in everyday meals. Plant-based brands highlight cashews in product innovations ranging from desserts to energy bars. Retail chains market organic cashews as sustainable and ethically sourced, appealing to environmentally conscious buyers. The growth of plant-based communities worldwide sustains consistent consumption of organic cashews. It underlines the product’s strategic role in the global move toward plant-based nutrition.

Market Trends

Increasing Popularity of Plant-Based and Vegan Diets

The Organic Cashew Nuts Market aligns closely with the accelerating adoption of plant-based diets. Cashews serve as a core ingredient in dairy substitutes, protein bars, and vegan-friendly meals. Rising numbers of consumers seek alternatives to milk, cheese, and yogurt, and cashews provide a creamy texture and rich nutrition profile. Food companies highlight organic cashews in marketing to appeal to vegan and flexitarian buyers. Cashew-based innovations such as ice creams and spreads create new growth opportunities. It strengthens the role of organic cashews in mainstream plant-based consumption.

Growing Penetration of E-Commerce Platforms

E-commerce platforms expand access to organic cashew nuts by offering diverse product varieties and subscription-based delivery services. Online channels enable small-scale farmers and processors to reach global customers directly. The growing use of digital platforms also promotes traceability and transparency, with details on origin and certifications displayed for buyers. Increasing convenience of doorstep delivery drives steady adoption among urban consumers. Retailers invest in packaging innovations to extend shelf life during long-distance shipments. It reflects the growing influence of online retail in reshaping supply chains.

- For instance, Wildly Organic (USA) sells bulk “Soaked and Dried” certified organic cashews, offering 25 lb bulk packaging and nutritional data such as 2,179 mg of omega‑6 and over 20% daily value of manganese and magnesium per serving.

Rising Emphasis on Sustainable and Ethical Sourcing

Sustainability becomes a dominant trend influencing consumer choices in the Organic Cashew Nuts Market. Buyers prefer products linked to fair trade practices and environmentally responsible farming. Brands emphasize reduced pesticide use, water conservation, and farmer welfare in marketing campaigns. Certifications such as Fairtrade and Rainforest Alliance add value to organic cashew products. Consumers reward transparency, pushing companies to disclose sourcing and processing practices. It reinforces the premium positioning of organic cashews in competitive markets.

- For instance, Tolaro Global (Benin) supports a network of 7,000 cashew farmers, guiding 400 of them to achieve organic certification and increasing their earnings by up to 20%, while reducing carbon emissions by approximately 1.17 tonnes CO₂ equivalent per ton of kernel processed due to local processing.

Innovation in Product Diversification and Packaging

Manufacturers introduce organic cashew-based snacks in flavored, roasted, and value-added forms to attract diverse consumer groups. Packaged blends of cashews with fruits or seeds address demand for on-the-go nutrition. Brands invest in eco-friendly packaging to appeal to environmentally conscious buyers. Resealable packs, portion-controlled pouches, and biodegradable materials gain adoption. Foodservice players also expand menu offerings with organic cashew-based recipes, enhancing market visibility. It highlights innovation as a key driver of evolving consumer engagement.

Market Challenges Analysis

Supply Chain Complexity and Limited Organic Certification Infrastructure

The Organic Cashew Nuts Market faces challenges due to fragmented supply chains and limited access to certified organic farming infrastructure. Smallholder farmers dominate cashew production in regions such as Africa and Asia, but many lack the resources to obtain organic certification. Certification processes involve high costs, rigorous documentation, and regular audits that small producers struggle to meet. Seasonal variations and inconsistent post-harvest handling practices affect quality consistency. Exporters and processors find it difficult to maintain standardized organic quality across diverse sourcing regions. It creates pressure on global suppliers to strengthen traceability and ensure compliance with international organic standards.

Price Volatility and Competition from Conventional Cashews

Volatile pricing of organic cashew nuts presents a challenge for both producers and buyers. Fluctuations in raw cashew nut availability, coupled with higher processing costs, make organic variants significantly more expensive than conventional cashews. Price-sensitive consumers often choose cheaper alternatives, reducing the growth potential in emerging markets. Retailers face difficulties in justifying premium pricing when conventional options offer similar taste and texture. Limited economies of scale in organic farming further exacerbate the cost gap. It creates a competitive imbalance that requires strategic pricing and marketing interventions to maintain consumer interest in organic offerings.

Market Opportunities

Rising Health-Conscious Consumer Base Driving Premium Demand

The Organic Cashew Nuts Market presents strong opportunities driven by the rising global preference for healthy, natural, and chemical-free food products. Consumers in North America and Europe show growing interest in organic nuts as protein-rich snacks and plant-based alternatives. It benefits from the shift toward vegan diets and clean-label products, where cashews play a key role in dairy-free cheese, milk, and spreads. The expansion of e-commerce platforms enables direct access to premium buyers seeking authentic organic certifications. Retailers and foodservice providers incorporate organic cashews into product lines to meet this rising demand. The broader shift toward preventive health and wellness continues to strengthen the market outlook.

Expanding Applications in Food Processing and Value-Added Products

Value-added applications create significant opportunities for the Organic Cashew Nuts Market. Food processors increasingly use organic cashews in confectionery, bakery, ready-to-eat meals, and nutraceutical formulations. It gains momentum with the rising demand for organic protein bars, plant-based beverages, and gluten-free recipes. Manufacturers explore flavored, roasted, and coated cashews to expand premium snacking categories. Partnerships between growers and processors foster innovation in product development and branding. Emerging markets in Asia-Pacific and the Middle East also create demand for packaged organic snacks aligned with lifestyle changes. The widening application base ensures long-term growth prospects across consumer and industrial segments.

Market Segmentation Analysis:

By Form

The Organic Cashew Nuts Market segments by form into whole, powder, roasted, paste, and splits. Whole cashews dominate due to their use in snacks, cooking, and exports, appealing to both household and commercial buyers. Roasted cashews gain popularity in ready-to-eat formats, aligning with rising demand for convenient snacking. Cashew powder finds application in bakery and confectionery, delivering texture and flavor in cookies, cakes, and spreads. Cashew paste supports dairy alternatives, sauces, and health-based products, meeting the demand for plant-based diets. Splits remain relevant in cost-sensitive applications where appearance is secondary to nutritional value. It reflects balanced growth across both traditional and processed formats.

- For instance, Mount Franklin Foods in the USA processes over 100 million pounds of nuts annually, including organic cashews, and introduced value-added roasted and seasoned varieties that boosted its snack division’s capacity by 25% in 2023.

By Application

Applications extend into bakery products, confectionery, dairy products, snacks, desserts, bars, and beverages. Bakery products drive demand through cookies, bread, and pastries infused with cashew-based ingredients. Confectionery relies on cashews for chocolates and premium sweets, enhancing both flavor and texture. Dairy products use organic cashews for plant-based milk, cheese, and yogurt, strengthening the appeal among vegan and lactose-intolerant consumers. Snacks, including trail mixes and roasted products, maintain steady adoption for on-the-go consumption. Desserts and bars expand usage with high-protein and energy-focused offerings. The beverage sector also incorporates cashew-based drinks, highlighting its versatility across industries.

- For instance, Nature Bio-Foods Ltd. in India expanded its organic processing unit in 2022 to handle 25,000 metric tons of organic products annually, enabling larger-scale supply of cashew-based ingredients for dairy alternatives and confectionery applications.

By Distribution Channel

Distribution channels include supermarkets, convenience stores, specialty stores, and e-commerce. Supermarkets lead due to strong product variety and bulk availability, serving both mainstream and premium buyers. Convenience stores support impulse purchases, particularly in urban centers with high snack consumption. Specialty stores gain traction by promoting organic, fair-trade, and health-focused options, appealing to niche customers. E-commerce grows rapidly with the surge in online grocery platforms and direct-to-consumer health brands. It supports global reach, wider assortments, and subscription models for regular buyers. The balanced distribution network strengthens consumer accessibility and sustains growth across diverse regions.

Segments:

Based on Form:

- Whole

- Powder

- Roasted

- Paste

- Splits

Based on Application:

- Bakery Products

- Confectionery Products

- Dairy Products

- Snacks

- Desserts

- Bars

- Beverages

Based on Distribution Channel:

- Supermarket

- Convenience Store

- Specialty Store

- E-Commerce

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 28% in the Organic Cashew Nuts Market, driven by the rising adoption of plant-based diets and demand for clean-label snacks. The United States leads consumption, with strong demand from bakery, confectionery, and dairy alternative industries. Organic cashews are widely used in producing cashew milk, cheese, and nut-based spreads, meeting the needs of health-conscious and vegan consumers. Canada contributes with growing imports of organic-certified cashews to support its sustainable food retail sector. E-commerce platforms strengthen accessibility, as brands expand direct-to-consumer distribution. It reflects a market where premium organic products gain consistent traction among urban populations.

Europe

Europe accounts for a 25% share, supported by strong demand for organic-certified products and fair-trade cashews. Germany, the United Kingdom, and France dominate imports, with significant consumption in snacks, confectionery, and dairy alternatives. European Union regulations favor organic certifications, strengthening consumer trust and market growth. The region also shows strong adoption of cashew-based vegan cheese and plant-based desserts, aligning with its sustainability goals. Specialty stores and health-focused retailers capture a large portion of sales, while supermarkets expand premium organic assortments. It highlights Europe as a mature market with high value-added consumption.

Asia-Pacific

Asia-Pacific represents the largest share at 32%, benefiting from its dual role as both a production hub and a growing consumer market. India and Vietnam dominate global supply, processing significant volumes of raw cashews into organic-certified exports. Rising middle-class incomes in China, Japan, and South Korea boost demand for organic snacks and bakery items. The region’s e-commerce expansion accelerates accessibility, with online platforms offering bulk and premium organic cashew options. Cashew paste and powder find increasing use in desserts and beverages, catering to modern food trends. It strengthens Asia-Pacific’s leadership in both supply chain strength and consumption growth.

Latin America

Latin America contributes 8% of the market, with Brazil leading regional production and consumption. Organic cashews gain demand in snacks and confectionery as health awareness increases across urban populations. Exports from Brazil and surrounding nations expand to meet growing international demand for organic-certified products. Domestic adoption remains moderate but is rising in bakery and dairy-alternative sectors. Supermarkets and specialty stores serve as the main distribution channels, while online penetration gradually strengthens. It indicates a developing market with untapped potential in both domestic and export-focused segments.

Middle East & Africa

The Middle East & Africa account for 7% of the market, with Africa serving as a major production base and the Middle East driving consumption. Countries such as Ivory Coast and Tanzania play a critical role in raw cashew supply for global organic processing. The Middle East sees rising demand through premium retail outlets and e-commerce platforms, especially in the UAE and Saudi Arabia. Increasing use of organic cashews in snacks and confectionery fuels steady growth. Governments and trade bodies promote organic farming, enhancing the region’s role in exports. It balances production strength with rising consumption in selective markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aryan International (India)

- Mount Franklin Foods (USA)

- Tierra Farm (India)

- Left Coast Organics (Canada)

- Achal Cashew Nuts (India)

- CBL Natural Foods Pvt. Ltd. (India)

- Sahyadri Cashew Processors (India)

- Bata Food (India)

- Samruddhi Organic Farm Pvt. Ltd. (India)

- Nature Bio-Foods Ltd. (India)

Competitive Analysis

The Organic Cashew Nuts Market reflects a competitive structure shaped by regional producers and global distributors that focus on certified sourcing, product innovation, and supply chain efficiency. Leading companies such as Mount Franklin Foods (USA), Left Coast Organics (Canada), CBL Natural Foods Pvt. Ltd. (India), Bata Food (India), Tierra Farm (India), Samruddhi Organic Farm Pvt. Ltd. (India), Achal Cashew Nuts (India), Aryan International (India), Nature Bio-Foods Ltd. (India), and Sahyadri Cashew Processors (India) hold strong positions through integrated farming practices and export networks. Indian processors dominate global exports by leveraging large-scale cultivation and modern processing facilities, while North American and European firms drive premium demand through organic certifications and product diversification. Players invest in automation for shelling and grading, ensuring higher efficiency and consistent quality, while also focusing on fair-trade practices to strengthen consumer trust. Expansion into value-added formats such as cashew-based spreads, beverages, and snack mixes enhances portfolio competitiveness. The market exhibits strong rivalry where cost efficiency, sustainability credentials, and traceability serve as key differentiators. Global companies build partnerships with certified organic farms to secure raw material supply, while regional firms emphasize niche distribution strategies in retail and e-commerce platforms. This dynamic environment fosters both consolidation among established players and opportunities for emerging organic brands.

Recent Developments

- In 2025, Mount Franklin Foods (USA) also secured exclusive U.S. rights for the vegan gummy brand BUBS.

- In May 2025, Mount Franklin Foods (USA) secured exclusive rights to manufacture, distribute, and retail the vegan candy brand BUBS within the United States.

- In August, 2024, Mount Franklin Foods (USA) acquired the assets of Stuffed Puffs, LLC (a marshmallow brand) effective immediately.

Market Concentration & Characteristics

The Organic Cashew Nuts Market reflects moderate concentration with strong participation from regional processors and international distributors that focus on certified, traceable, and sustainably sourced products. It demonstrates characteristics of a niche food sector where demand is driven by rising consumer preference for organic, non-GMO, and chemical-free nuts across food, beverage, and snack industries. The market shows a dual structure, with smallholder farmers in India, Vietnam, and Africa supplying raw cashews and multinational brands in North America and Europe leading packaged and value-added product innovation. It emphasizes certifications such as USDA Organic, EU Organic, and Fairtrade, which act as key differentiators in procurement and distribution. The presence of companies integrating backward supply chain operations enhances control over quality and strengthens global reach. It benefits from growing e-commerce penetration and premium retail placement, creating opportunities for both established exporters and emerging organic brands. The market maintains a balance between traditional consumption patterns and expanding health-focused demand in developed economies.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic cashew nuts will rise with increasing global preference for clean-label and chemical-free foods.

- Companies will strengthen backward integration to ensure supply chain traceability and farmer engagement.

- Value-added formats such as roasted, flavored, and paste forms will expand adoption across snacks and confectionery.

- E-commerce will emerge as a stronger distribution channel for premium organic cashew brands.

- Certifications such as USDA Organic and Fairtrade will gain importance in international trade.

- Emerging markets in Asia-Pacific and Africa will increase production capacity through sustainable farming.

- Investments in processing technology will improve efficiency and quality consistency.

- Partnerships between cooperatives and multinational brands will enhance global export potential.

- Health-conscious consumers will drive new product launches in plant-based beverages and protein bars.

- Climate resilience strategies will become critical to stabilize supply in cashew-growing regions.