Market Overview:

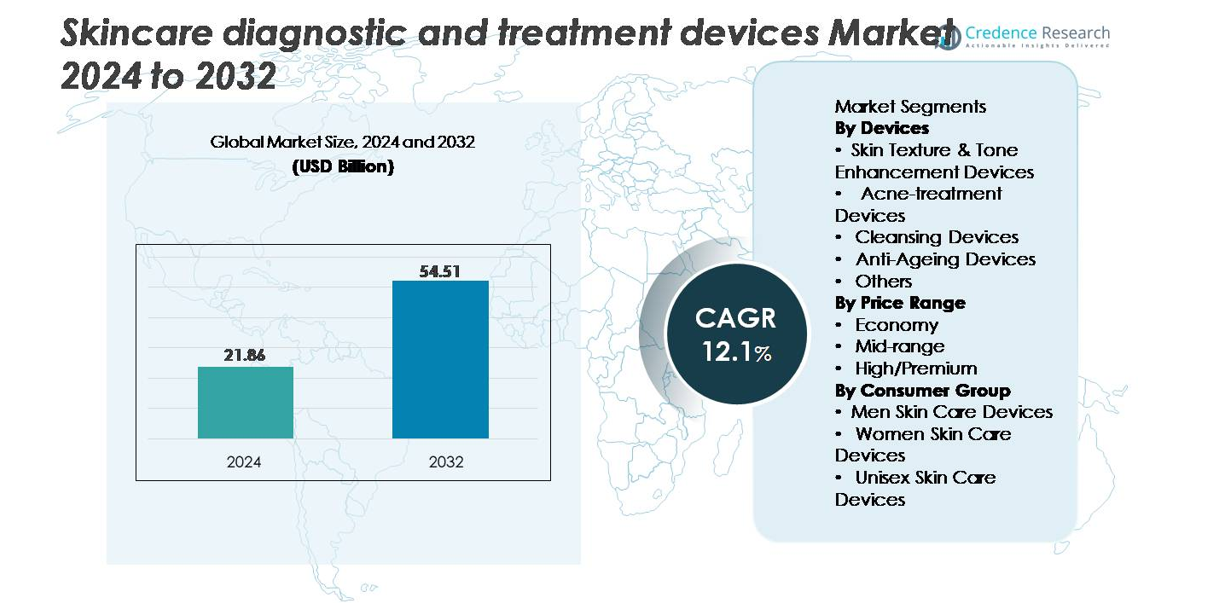

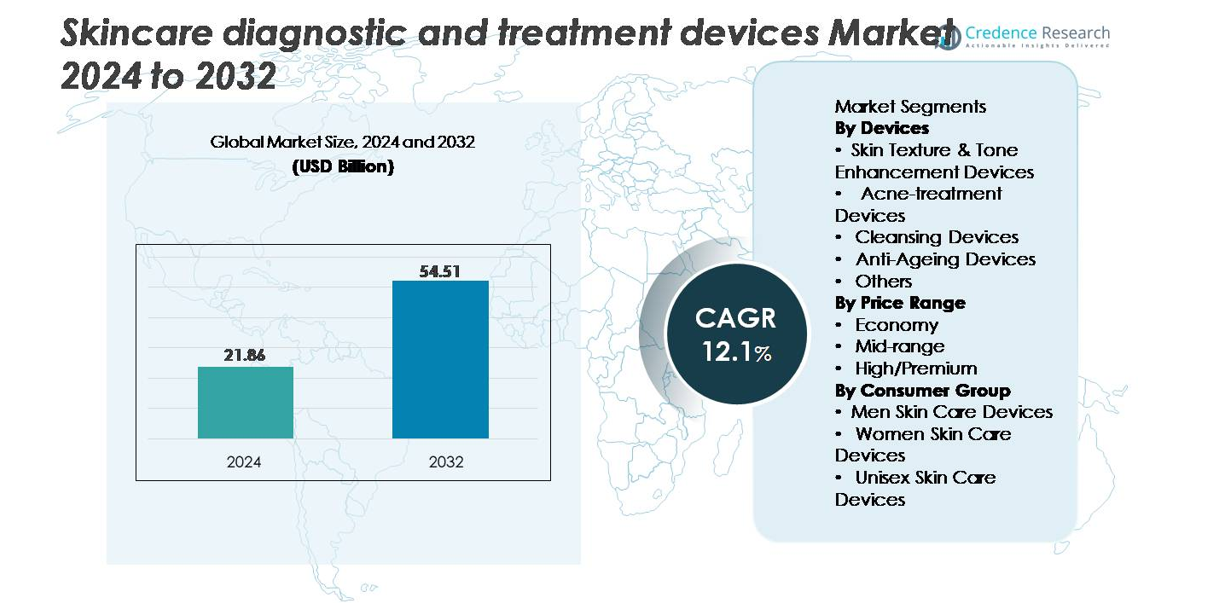

The global skincare diagnostic and treatment devices market was valued at USD 21.86 billion in 2024 and is projected to reach USD 54.51 billion by 2032, expanding at a CAGR of 12.1% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skincare Diagnostic and Treatment Devices Market Size 2024 |

USD 21.86 billion |

| Skincare Diagnostic and Treatment Devices Market, CAGR |

12.1% |

| Skincare Diagnostic and Treatment Devices Market Size 2032 |

USD 54.51 billion |

The skincare diagnostic and treatment devices market is shaped by strong participation from leading players such as Cynosure, Image Derm, 3Gen, Ambicare Health, Nu Skin Enterprises, Aesthetic Group, Cutera, Alma Lasers GmbH, Canfield Scientific, and Conair Corporation. These companies compete through advancements in LED therapy, AI-enabled skin analysis, microcurrent lifting systems, and multifunction at-home treatment platforms. North America leads the market with approximately 35% share, supported by high adoption of premium beauty technologies and robust dermatology infrastructure. Asia-Pacific follows with about 30%, driven by strong innovation hubs and rising beauty-tech penetration, while Europe accounts for nearly 28%, anchored by demand for clinically validated skincare devices.

Market Insights:

- The skincare diagnostic and treatment devices market was valued at USD 21.86 billion in 2024 and is projected to reach USD 54.51 billion by 2032, registering a CAGR of 12.1% during the forecast period.

- Market growth is driven by rising adoption of personalized skincare tools, increasing demand for non-invasive anti-ageing solutions, and high consumer interest in at-home devices such as cleansing systems, acne-treatment tools, and tone-enhancement technologies, with anti-ageing devices holding the largest segment share.

- Key trends include rapid integration of AI-powered skin analysis, multifunctional hybrid devices combining LED, microcurrent, and RF technologies, and expanding digital connectivity that enhances treatment precision and user engagement.

- Competitively, the market features strong innovation from leading players focusing on product miniaturization, clinical-grade results, and broader e-commerce penetration, while restraints include device cost, regulatory complexity, and inconsistent user awareness in emerging markets.

- Regionally, North America leads with ~35%, followed by Asia-Pacific at ~30% and Europe at ~28%, while Latin America and the Middle East & Africa collectively account for the remaining share, supported by rising beauty-tech adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Devices

Among device categories, Anti-Ageing Devices hold the dominant market share, driven by strong consumer demand for non-invasive wrinkle reduction, collagen stimulation, and skin-tightening technologies. LED phototherapy tools, microcurrent stimulators, and home-based RF devices continue to gain traction as consumers prioritize long-term skin rejuvenation. Acne-treatment devices attract younger demographics seeking blue-light therapy and precision spot-treatment solutions, while cleansing devices benefit from rising interest in deep-pore hygiene. Skin texture and tone enhancement systems grow steadily through adoption of ultrasonic exfoliators and microdermabrasion tools. The “Others” segment includes niche innovations supporting personalized skincare routines.

- For instance, Cynosure’s TempSure platform operates at a 300-W RF output with sustained tissue temperatures of approximately 42°C, enabling effective collagen remodeling without epidermal damage.

By Price Range

The Mid-range category leads the market, supported by its balance of affordability and advanced features that appeal to mass consumers and at-home skincare users. Devices in this tier offer strong performance through technologies such as multi-mode LED therapy, microdermabrasion, and RF-based tightening systems without the premium cost. Economy devices grow steadily due to rising penetration in emerging markets and increasing online access to low-cost cleansing and acne-relief tools. Meanwhile, the High/Premium range benefits from adoption in beauty salons and high-income households, largely driven by enhanced durability, multi-functionality, and dermatologist-grade performance.

- For instance, NuFACE’s Trinity+ microcurrent device delivers controlled electrical stimulation at a maximum output of 335 microamps (μA), which can be temporarily boosted by 25% to approximately 425 microamps (μA) using the ‘Boost Button’, supporting visible toning results while remaining accessible to mainstream consumers”.

By Consumer Group

Women Skin Care Devices dominate the consumer group segment, reflecting higher adoption of anti-ageing tools, skin-rejuvenation systems, and personalized cleansing technologies. Women-led demand is reinforced by strong engagement with at-home beauty routines and rapid acceptance of new device-based skincare trends. The Men Skin Care Devices segment grows faster as grooming awareness rises and men increasingly adopt acne-treatment, pore-cleaning, and beard-area exfoliation devices. Unisex devices gain momentum through brand-neutral designs and universal skin-health positioning, particularly in smart cleansing tools and LED-based treatment systems that target broad user needs across all demographics.

Key Growth Drivers:

Rising Demand for Personalized and At-Home Skin Diagnostics

Growing consumer preference for customized skincare solutions strongly accelerates demand for diagnostic and treatment devices. Users increasingly rely on tools that assess hydration levels, pore condition, pigmentation, and elasticity to guide personalized skincare routines. At-home diagnostic devices, powered by high-resolution imaging and dermal-analysis algorithms, enable consumers to obtain professional-quality assessments without clinic visits. The expansion of AI-driven skin mapping technologies enhances accuracy, encouraging adoption across all demographic groups. Younger consumers, in particular, value early detection of acne, sensitivity, sun damage, and premature ageing, driving sustained interest in preventive skincare. Additionally, the convenience of real-time skin monitoring supports higher device usage frequency, increasing replacement cycles and accessory sales. As digital personalization becomes central to beauty routines, diagnostic devices evolve into essential consumer tools, strengthening market growth.

- For instance, Canfield Scientific’s VISIA® Skin Analysis System uses a 15-megapixel sensor and captures UV, cross-polarized, and standard (parallel-polarized) images across eight facial regions, generating extensive measurable skin-data points per scan

Rapid Technological Advancements in Non-Invasive Treatment Platforms

Continuous innovation in non-invasive skincare technologies significantly boosts market expansion. LED phototherapy, microcurrent stimulation, ultrasonic cleansing, and radiofrequency tightening systems demonstrate improved safety, shorter treatment cycles, and more visible results. Enhanced device ergonomics and better heat-management systems increase user comfort, making advanced treatments suitable for at-home environments. Integration of AI to auto-calibrate intensity levels based on skin type further increases trust and adoption. Professional-grade features, once available only in dermatology clinics, are now incorporated into compact consumer devices. Meanwhile, salons and med-spas deploy higher-intensity treatment platforms to deliver collagen regeneration, acne reduction, pigmentation correction, and skin-resurfacing procedures. The shift toward non-invasive solutions reduces dependency on chemical-based treatments, appealing to consumers seeking long-lasting, low-risk skin improvements. As innovation accelerates, devices continue to offer multifunctional benefits, strengthening adoption in both home-care and professional settings.

- For instance, Cutera’s Secret RF platform delivers controlled fractional radiofrequency with adjustable needle penetration depths ranging from 0.5 mm to 3.5 mm. The device offers various power levels depending on the treatment tip used, such as up to 70 watts with the 64-pin tip, enabling precise collagen remodeling and dermal rejuvenation.

Expanding Preventive Skincare Adoption Driven by Lifestyle and Ageing Concerns

Increasing awareness of long-term skin health, combined with lifestyle-related stressors, accelerates uptake of treatment and monitoring devices. Consumers actively seek solutions that prevent age spots, wrinkles, and loss of elasticity, reinforcing demand for anti-ageing tools. Environmental factors such as pollution exposure, UV damage, and digital screen-induced blue light further fuel interest in daily use devices that protect and restore skin condition. Preventive care has become a multi-generational priority: millennials adopt early-care routines to delay ageing signs, while older demographics pursue corrective rejuvenation. This broadening user base strengthens market stability and encourages manufacturers to develop adaptable, multi-mode devices. The preventive-health movement also aligns with wellness trends, positioning skincare technology as part of holistic personal care. As consumers shift from reactive to proactive skincare habits, demand for diagnostic and treatment devices experiences sustained, long-term momentum.

Key Trends & Opportunities:

Integration of AI, Machine Learning, and Smart Connectivity

AI-driven skin analysis, automated treatment calibration, and smartphone-linked diagnostics represent one of the strongest opportunities in the market. Connected devices track skin changes over time, provide personalized recommendations, and adjust treatment intensities automatically. Machine learning algorithms enhance precision in detecting micro-level imperfections, enabling hyper-personalized product matching and treatment planning. Cloud-based data storage allows users to monitor long-term progress, while mobile apps improve user engagement and adherence. Smart connectivity also supports remote dermatology consultations, strengthening the bridge between at-home care and professional oversight. Manufacturers leveraging AI ecosystems gain a competitive advantage as digital skincare ecosystems become central to consumer beauty routines. This trend opens revenue streams in subscription models, app analytics, and digital skin coaching services.

- For instance, L’Oréal’s Vichy SkinConsult AI—developed in collaboration with ModiFace—uses a deep-learning system trained on more than 15,000 clinical-grade facial images and analyzes up to 7 distinct ageing biomarkers within seconds through smartphone capture.

Growing Popularity of Multifunctional and Hybrid Treatment Devices

Consumers increasingly favor multifunctional devices that combine cleansing, exfoliation, LED therapy, microcurrent lifting, and RF tightening within a single platform. This shift reflects demand for compact, cost-efficient solutions that deliver comprehensive treatment experiences at home. Hybrid devices appeal to younger users prioritizing convenience and versatility, as well as professionals seeking to maximize service offerings without expanding equipment inventory. Manufacturers benefit from reduced production costs through integrated chipset designs and modular accessory systems. The multifunction trend also aligns with personalized skincare routines, allowing users to alternate between treatment modes based on skin condition. As hybrid platforms gain momentum, opportunities expand for innovation in interchangeable heads, dual-mode technologies, and subscription-based accessory replacement models.

- For instance, FOREO’s UFO 2 device integrates full-spectrum LED with 8 distinct wavelengths and delivers thermotherapy heating up to 45°C, cryotherapy cooling down to 5°C, and sonic pulsations of up to 10,000 pulses per minute—combining multiple treatment modalities in one handheld unit.

Rising Adoption of Device-Based Treatments in Beauty Salons and Med-Spas

Professional beauty centers increasingly incorporate advanced skin-rejuvenation, pigmentation correction, and acne-treatment devices to enhance service portfolios. Demand for clinic-quality results with shorter downtime propels adoption of high-performance LED panels, RF-based tightening systems, and ultrasonic skin-resurfacing tools. Salons leverage device-based treatments to differentiate services, attract repeat clientele, and deliver measurable outcomes that boost customer loyalty. Additionally, hybrid models combining manual facials with device-assisted enhancements increase per-session revenue. As consumer trust in technology-driven aesthetics strengthens, professional environments become strong growth channels for mid- and premium-grade equipment. Manufacturers benefit from stable demand cycles, service-training revenues, and partnerships with aesthetic clinics seeking continuous device upgrades.

Key Challenges:

Safety Concerns, Incorrect Usage, and Lack of Standardized Regulations

Despite rising adoption, safety challenges persist due to inconsistent global standards and varying regulatory guidelines for at-home treatment devices. Improper usage—such as excessive exposure to RF heat, uncalibrated LED intensities, or misuse of microcurrent probes—can result in skin irritation, burns, or inflammation. The absence of universal certification frameworks complicates consumer confidence and creates barriers for new entrants. Manufacturers must invest in robust safety features, including auto-shutoff systems, real-time skin sensing, and adaptive temperature control. Meanwhile, professional-grade devices face rigorous compliance requirements that increase manufacturing costs. Strengthening regulatory clarity and enhancing user education remain essential to ensuring safe market expansion.

High Device Costs and Limited Consumer Awareness in Emerging Markets

Premium skincare diagnostic and treatment devices remain expensive for a large portion of consumers in developing regions, limiting penetration outside urban centers. Price sensitivity, combined with limited awareness of device benefits, slows adoption in middle-income segments. Many users still prioritize topical skincare products over technology-driven solutions due to affordability gaps and lack of long-term usage perception. Professional-grade devices require substantial investment from salons and dermatology clinics, further restricting uptake in low-resource markets. Manufacturers must balance cost optimization, localized marketing, and consumer education to strengthen market access. Without targeted strategies, growth potential in emerging economies remains constrained despite rising interest in beauty technology.

Regional Analysis:

North America

North America holds the largest share of the skincare diagnostic and treatment devices market at around 35%, supported by strong consumer spending on premium beauty technologies and early adoption of AI-driven diagnostic tools. High penetration of at-home anti-ageing devices, robust dermatology infrastructure, and widespread preference for non-invasive treatment solutions fuel regional expansion. The U.S. leads usage of LED therapy, microcurrent lifting, and skin-analysis platforms, reinforced by strong retail presence and med-spa uptake. Increasing awareness of preventive skincare and strong digital-health integration further solidify North America’s leadership in device adoption.

Europe

Europe accounts for approximately 28% of the global market, driven by strong demand for dermatology-grade devices and rising preference for evidence-based skincare technologies. Countries such as Germany, France, and the U.K. demonstrate high adoption of diagnostic imaging tools, RF-based rejuvenation devices, and multifunctional cleansing systems. The region benefits from supportive regulatory frameworks that emphasize device safety and clinical validation, increasing consumer confidence. Professional salons and aesthetic clinics across Europe continue integrating advanced treatment platforms to expand service portfolios. Additionally, growing interest in eco-friendly and skin-safe device materials strengthens premium device demand across the region.

Asia-Pacific

Asia-Pacific represents around 30% of the global market and is the fastest-growing region, driven by strong beauty-tech adoption in China, South Korea, and Japan. High skincare awareness, rising disposable incomes, and early integration of smart beauty devices propel regional expansion. South Korea remains a global innovation hub for LED, ultrasonic, and microcurrent technologies, while China benefits from rapid e-commerce penetration and strong domestic manufacturing capacity. Young consumers increasingly adopt at-home acne-treatment and anti-ageing devices, accelerating market maturity. The region’s beauty-centric culture and rapid technological innovation position Asia-Pacific as the next major growth engine.

Latin America

Latin America holds approximately 4% market share, with growth driven by increasing interest in affordable cleansing, acne-treatment, and anti-ageing devices. Brazil and Mexico lead adoption, supported by expanding beauty salon networks and strong consumer demand for non-invasive skincare routines. Budget-friendly and mid-range devices dominate due to price sensitivity, while premium solutions gain traction in urban centers. Improved online retail access and rising social-media influence promote awareness of beauty technology. However, limited availability of advanced professional devices and slower regulatory approvals temper broader adoption, creating opportunities for cost-optimized innovation tailored to regional needs.

Middle East & Africa

The Middle East & Africa region accounts for around 3% of the market, with growth concentrated in the Gulf states, where premium skincare technologies experience strong uptake. High income levels in the UAE and Saudi Arabia support demand for advanced anti-ageing, skin-tightening, and diagnostic platforms across clinics and luxury spas. Increasing skin-health awareness and rising influence of aesthetic tourism enhance market visibility. In Africa, adoption remains moderate due to affordability constraints, but expanding urbanization and improving retail distribution gradually support mid-range device penetration. Growing investment in dermatology centers strengthens long-term regional potential.

Market Segmentations:

By Devices

- Skin Texture & Tone Enhancement Devices

- Acne-treatment Devices

- Cleansing Devices

- Anti-Ageing Devices

- Others

By Price Range

- Economy

- Mid-range

- High/Premium

By Consumer Group

- Men Skin Care Devices

- Women Skin Care Devices

- Unisex Skin Care Devices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the skincare diagnostic and treatment devices market features a mix of global beauty-tech leaders, medical device companies, and rapidly emerging smart skincare innovators. Established brands focus on expanding portfolios with AI-enabled diagnostic tools, multifunction treatment platforms, and dermatologist-grade at-home devices. Companies strengthen competitiveness through advancements in LED phototherapy, microcurrent lifting, ultrasonic cleansing, and radiofrequency tightening technologies. Strategic priorities include product miniaturization, enhanced safety controls, and mobile-app integration to deliver personalized treatment experiences. Professional aesthetic clinics increasingly partner with leading manufacturers to upgrade service capabilities, while e-commerce channels boost visibility for mid-range and premium devices. Continuous R&D investment, patent-driven innovation, and collaborations with dermatology specialists remain crucial differentiators. As consumer preference shifts toward technologically advanced, non-invasive solutions, manufacturers compete on performance reliability, clinical validation, and multi-functionality. The market also sees rising competition from Asian players leveraging cost-efficient manufacturing and rapid innovation cycles to expand global presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cynosure, Inc.

- Image Derm, Inc.

- 3Gen

- Ambicare Health

- Nu Skin Enterprises, Inc.

- Aesthetic Group

- Cutera, Inc.

- Alma Lasers GmbH

- Canfield Scientific, Inc.

- Conair Corporation

Recent Developments:

- In September 2025, Nu Skin was ranked as the world’s No. 1 beauty and wellness device systems company for the second consecutive year by a major industry tracker. The company announced the upcoming launch of its new Prysm iO device, designed to non-invasively measure skin carotenoid levels providing consumers with real-time antioxidant status insights using data drawn from over 20 million skin scans accumulated over 20 years.

- In January 2024, Cynosure completed a strategic merger with Lutronic (after Lutronic’s acquisition by investment firm), forming a larger global medical-aesthetics technology company with expanded product portfolio and broad international distribution footprint.

- In October 2022, Promoitalia, a cosmetic product company announced the launch of iWave, which is a one-of-a-kind, body microwave contouring device. The device has shown safe and effective results in the process of fat reduction.

Report Coverage:

The research report offers an in-depth analysis based on Device, Price range, consumer group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see rapid expansion driven by increasing adoption of smart, AI-enabled skincare devices across home-use and professional settings.

- Advancements in LED, RF, and microcurrent technologies will enhance device performance and treatment precision.

- At-home skincare devices will gain stronger traction as consumers prioritize convenience and continuous skin monitoring.

- Professional clinics and med-spas will increasingly integrate multifunctional devices to offer higher-value, non-invasive treatments.

- Personalization will become a key competitive factor as brands leverage data analytics and skin-mapping algorithms.

- Hybrid devices combining cleansing, rejuvenation, and diagnostic capabilities will dominate new product launches.

- Premium and mid-range segments will grow as consumers shift toward long-lasting, dermatologist-grade skincare solutions.

- E-commerce and social media will strengthen device visibility and influence purchasing decisions globally.

- Emerging markets will experience rising adoption as awareness of device-based skincare improves.

- Regulatory standardization and enhanced safety features will shape future product development and market acceptance.