CHAPTER NO. 1 : GENESIS OF THE MARKET

1.1 Market Prelude – Introduction & Scope

1.2 The Big Picture – Objectives & Vision

1.3 Strategic Edge – Unique Value Proposition

1.4 Stakeholder Compass – Key Beneficiaries

CHAPTER NO. 2 : EXECUTIVE LENS

2.1 Pulse of the Industry – Market Snapshot

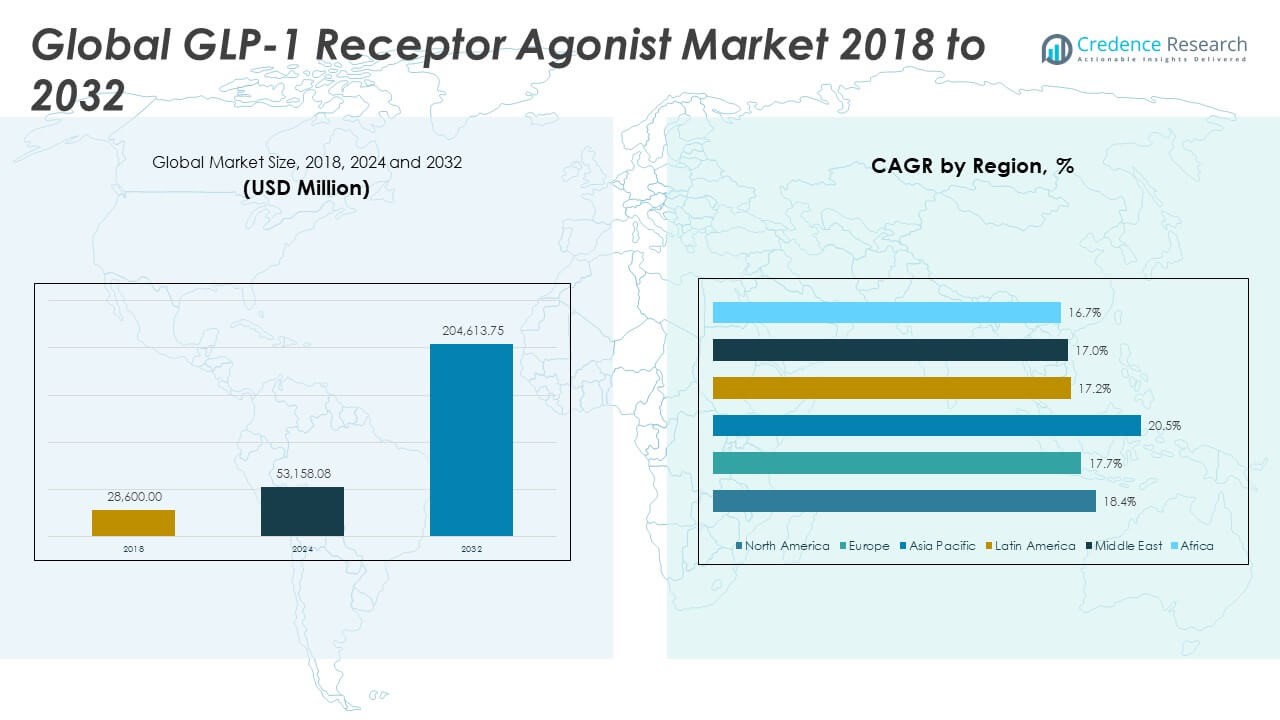

2.2 Growth Arc – Revenue Projections (USD Million)

2.3. Premium Insights – Based on Primary Interviews

CHAPTER NO. 3 : GLP-1 RECEPTOR AGONIST MARKET FORCES & INDUSTRY PULSE

3.1 Foundations of Change – Market Overview

3.2 Catalysts of Expansion – Key Market Drivers

3.2.1 Momentum Boosters – Growth Triggers

3.2.2 Innovation Fuel – Disruptive Technologies

3.3 Headwinds & Crosswinds – Market Restraints

3.3.1 Regulatory Tides – Compliance Challenges

3.3.2 Economic Frictions – Inflationary Pressures

3.4 Untapped Horizons – Growth Potential & Opportunities

3.5 Strategic Navigation – Industry Frameworks

3.5.1 Market Equilibrium – Porter’s Five Forces

3.5.2 Ecosystem Dynamics – Value Chain Analysis

3.5.3 Macro Forces – PESTEL Breakdown

3.6 Price Trend Analysis

3.6.1 Regional Price Trend

3.6.2 Price Trend by product

CHAPTER NO. 4 : KEY INVESTMENT EPICENTER

4.1 Regional Goldmines – High-Growth Geographies

4.2 Product Frontiers – Lucrative Product Categories

4.3 Application Sweet Spots – Emerging Demand Segments

CHAPTER NO. 5: REVENUE TRAJECTORY & WEALTH MAPPING

5.1 Momentum Metrics – Forecast & Growth Curves

5.2 Regional Revenue Footprint – Market Share Insights

5.3 Segmental Wealth Flow – Product & Application Revenue

CHAPTER NO. 6 : TRADE & COMMERCE ANALYSIS

6.1. Import Analysis by Region

6.1.1. Global GLP-1 Receptor Agonist Market Import Revenue By Region

6.2. Export Analysis by Region

6.2.1. Global GLP-1 Receptor Agonist Market Export Revenue By Region

CHAPTER NO. 7 : COMPETITION ANALYSIS

7.1. Company Market Share Analysis

7.1.1. Global GLP-1 Receptor Agonist Market: Company Market Share

7.2. Global GLP-1 Receptor Agonist Market Company Revenue Market Share

7.3. Strategic Developments

7.3.1. Acquisitions & Mergers

7.3.2. New Product Launch

7.3.3. Regional Expansion

7.4. Competitive Dashboard

7.5. Company Assessment Metrics, 2024

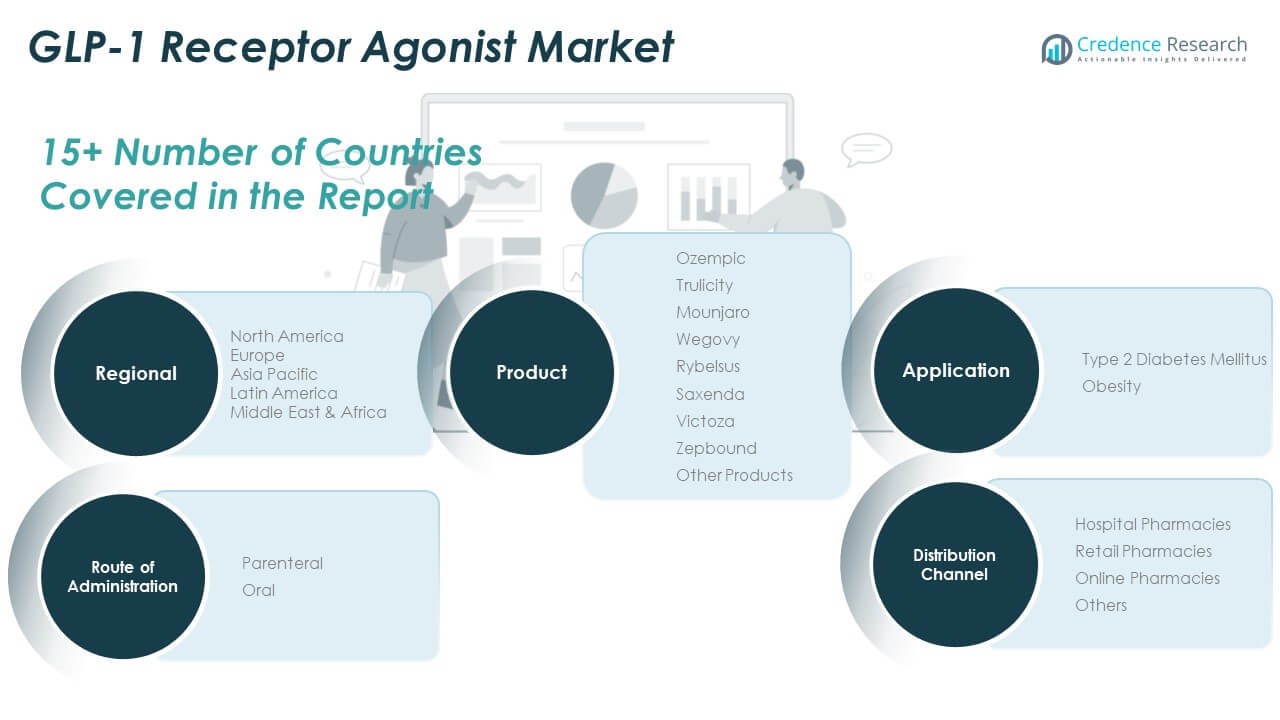

CHAPTER NO. 8 : GLP-1 RECEPTOR AGONIST MARKET – BY PRODUCT SEGMENT ANALYSIS

8.1. GLP-1 Receptor Agonist Market Overview by Product Segment

8.1.1. GLP-1 Receptor Agonist Market Revenue Share By Product

8.2. Ozempic

8.3. Trulicity

8.4. Mounjaro

8.5. Wegovy

8.6. Rybelsus

8.7. Saxenda

8.8. Victoza

8.9. Zepbound

8.10. Other Products

CHAPTER NO. 9 : GLP-1 RECEPTOR AGONIST MARKET – BY APPLICATION SEGMENT ANALYSIS

9.1. GLP-1 Receptor Agonist Market Overview by Application Segment

9.1.1. GLP-1 Receptor Agonist Market Revenue Share By Application

9.2. Type 2 Diabetes Mellitus

9.3. Obesity

CHAPTER NO. 10 : GLP-1 RECEPTOR AGONIST MARKET – BY ROUTE OF ADMINISTRATION SEGMENT ANALYSIS

10.1. GLP-1 Receptor Agonist Market Overview by Route of Administration Segment

10.1.1. GLP-1 Receptor Agonist Market Revenue Share By Route of Administration

10.2. Parenteral

10.3. Oral

CHAPTER NO. 11 : GLP-1 RECEPTOR AGONIST MARKET – BY DISTRIBUTION CHANNEL SEGMENT ANALYSIS

11.1. GLP-1 Receptor Agonist Market Overview by Distribution Channel Segment

11.1.1. GLP-1 Receptor Agonist Market Revenue Share By Distribution Channel

11.2. Hospital Pharmacies

11.3. Retail Pharmacies

11.4. Online Pharmacies

11.5. Others

CHAPTER NO. 12 : GLP-1 RECEPTOR AGONIST MARKET – REGIONAL ANALYSIS

12.1. GLP-1 Receptor Agonist Market Overview by Region Segment

12.1.1. Global GLP-1 Receptor Agonist Market Revenue Share By Region

12.1.2. Regions

12.1.3. Global GLP-1 Receptor Agonist Market Revenue By Region

12.1.4. Product

12.1.5. Global GLP-1 Receptor Agonist Market Revenue By Product

12.1.6. Application

12.1.7. Global GLP-1 Receptor Agonist Market Revenue By Application

12.1.8. Route of Administration

12.1.9. Global GLP-1 Receptor Agonist Market Revenue By Route of Administration

12.1.10. Distribution Channel

12.1.11. Global GLP-1 Receptor Agonist Market Revenue By Distribution Channel

CHAPTER NO. 13 : NORTH AMERICA GLP-1 RECEPTOR AGONIST MARKET – COUNTRY ANALYSIS

13.1. North America GLP-1 Receptor Agonist Market Overview by Country Segment

13.1.1. North America GLP-1 Receptor Agonist Market Revenue Share By Region

13.2. North America

13.2.1. North America GLP-1 Receptor Agonist Market Revenue By Country

13.2.2. Product

13.2.3. North America GLP-1 Receptor Agonist Market Revenue By Product

13.2.4. Application

13.2.5. North America GLP-1 Receptor Agonist Market Revenue By Application

13.2.6. Route of Administration

13.2.7. North America GLP-1 Receptor Agonist Market Revenue By Route of Administration

13.2.8. Distribution Channel

13.2.9. North America GLP-1 Receptor Agonist Market Revenue By Distribution Channel

13.3. U.S.

13.4. Canada

13.5. Mexico

CHAPTER NO. 14 : EUROPE GLP-1 RECEPTOR AGONIST MARKET – COUNTRY ANALYSIS

14.1. Europe GLP-1 Receptor Agonist Market Overview by Country Segment

14.1.1. Europe GLP-1 Receptor Agonist Market Revenue Share By Region

14.2. Europe

14.2.1. Europe GLP-1 Receptor Agonist Market Revenue By Country

14.2.2. Product

14.2.3. Europe GLP-1 Receptor Agonist Market Revenue By Product

14.2.4. Application

14.2.5. Europe GLP-1 Receptor Agonist Market Revenue By Application

14.2.6. Route of Administration

14.2.7. Europe GLP-1 Receptor Agonist Market Revenue By Route of Administration

14.2.8. Distribution Channel

14.2.9. Europe GLP-1 Receptor Agonist Market Revenue By Distribution Channel

14.3. UK

14.4. France

14.5. Germany

14.6. Italy

14.7. Spain

14.8. Russia

14.9. Rest of Europe

CHAPTER NO. 15 : ASIA PACIFIC GLP-1 RECEPTOR AGONIST MARKET – COUNTRY ANALYSIS

15.1. Asia Pacific GLP-1 Receptor Agonist Market Overview by Country Segment

15.1.1. Asia Pacific GLP-1 Receptor Agonist Market Revenue Share By Region

15.2. Asia Pacific

15.2.1. Asia Pacific GLP-1 Receptor Agonist Market Revenue By Country

15.2.2. Product

15.2.3. Asia Pacific GLP-1 Receptor Agonist Market Revenue By Product

15.2.4. Application

15.2.5. Asia Pacific GLP-1 Receptor Agonist Market Revenue By Application

15.2.6. Route of Administration

15.2.7. Asia Pacific GLP-1 Receptor Agonist Market Revenue By Route of Administration

15.2.8. Distribution Channel

15.2.9. Asia Pacific GLP-1 Receptor Agonist Market Revenue By Distribution Channel

15.3. China

15.4. Japan

15.5. South Korea

15.6. India

15.7. Australia

15.8. Southeast Asia

15.9. Rest of Asia Pacific

CHAPTER NO. 16 : LATIN AMERICA GLP-1 RECEPTOR AGONIST MARKET – COUNTRY ANALYSIS

16.1. Latin America GLP-1 Receptor Agonist Market Overview by Country Segment

16.1.1. Latin America GLP-1 Receptor Agonist Market Revenue Share By Region

16.2. Latin America

16.2.1. Latin America GLP-1 Receptor Agonist Market Revenue By Country

16.2.2. Product

16.2.3. Latin America GLP-1 Receptor Agonist Market Revenue By Product

16.2.4. Application

16.2.5. Latin America GLP-1 Receptor Agonist Market Revenue By Application

16.2.6. Route of Administration

16.2.7. Latin America GLP-1 Receptor Agonist Market Revenue By Route of Administration

16.2.8. Distribution Channel

16.2.9. Latin America GLP-1 Receptor Agonist Market Revenue By Distribution Channel

16.3. Brazil

16.4. Argentina

16.5. Rest of Latin America

CHAPTER NO. 17 : MIDDLE EAST GLP-1 RECEPTOR AGONIST MARKET – COUNTRY ANALYSIS

17.1. Middle East GLP-1 Receptor Agonist Market Overview by Country Segment

17.1.1. Middle East GLP-1 Receptor Agonist Market Revenue Share By Region

17.2. Middle East

17.2.1. Middle East GLP-1 Receptor Agonist Market Revenue By Country

17.2.2. Product

17.2.3. Middle East GLP-1 Receptor Agonist Market Revenue By Product

17.2.4. Application

17.2.5. Middle East GLP-1 Receptor Agonist Market Revenue By Application

17.2.6. Route of Administration

17.2.7. Middle East GLP-1 Receptor Agonist Market Revenue By Route of Administration

17.2.8. Distribution Channel

17.2.9. Middle East GLP-1 Receptor Agonist Market Revenue By Distribution Channel

17.3. GCC Countries

17.4. Israel

17.5. Turkey

17.6. Rest of Middle East

CHAPTER NO. 18 : AFRICA GLP-1 RECEPTOR AGONIST MARKET – COUNTRY ANALYSIS

18.1. Africa GLP-1 Receptor Agonist Market Overview by Country Segment

18.1.1. Africa GLP-1 Receptor Agonist Market Revenue Share By Region

18.2. Africa

18.2.1. Africa GLP-1 Receptor Agonist Market Revenue By Country

18.2.2. Product

18.2.3. Africa GLP-1 Receptor Agonist Market Revenue By Product

18.2.4. Application

18.2.5. Africa GLP-1 Receptor Agonist Market Revenue By Application

18.2.6. Route of Administration

18.2.7. Africa GLP-1 Receptor Agonist Market Revenue By Route of Administration

18.2.8. Distribution Channel

18.2.9. Africa GLP-1 Receptor Agonist Market Revenue By Distribution Channel

18.3. South Africa

18.4. Egypt

18.5. Rest of Africa

CHAPTER NO. 19 : COMPANY PROFILES

19.1. Eli Lilly and Company

19.1.1. Company Overview

19.1.2. Product Portfolio

19.1.3. Financial Overview

19.1.4. Recent Developments

19.1.5. Growth Strategy

19.1.6. SWOT Analysis

19.2. Sanofi

19.3. Novo-Nordisk A/S

19.4. AstraZeneca

19.5. Pfizer.Inc

19.6. Amgen, Inc.

19.7. Innovent Biologics, Inc.

19.8. PegBio Co., Ltd.

19.9. Sun Pharmaceutical Industries Ltd.

19.10. Boehringer Ingelheim International GmbH