Market Overview

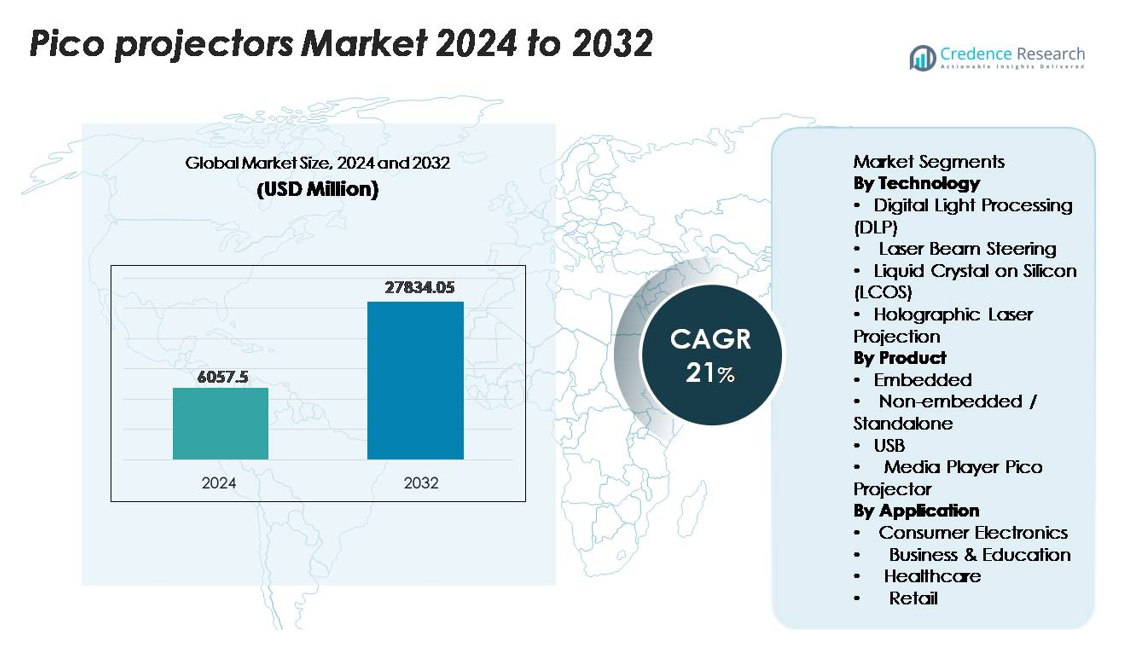

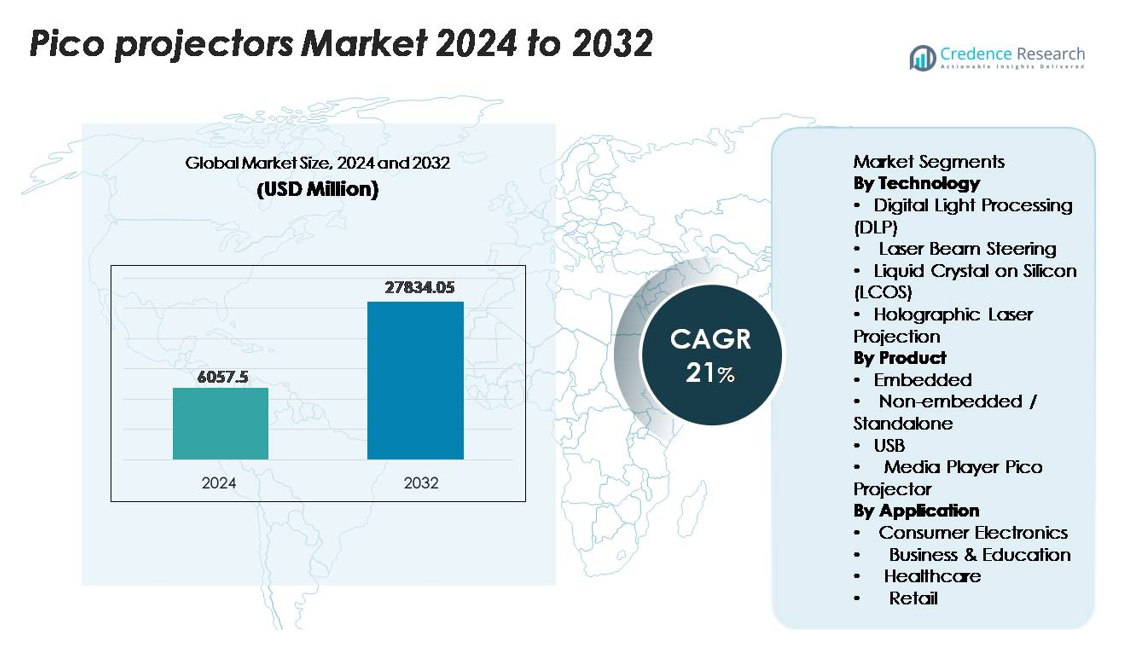

The global pico projectors market was valued at USD 6,057.5 million in 2024 and is projected to reach USD 27,834.05 million by 2032, expanding at a CAGR of 21% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pico Projectors Market Size 2024 |

USD 6,057.5 million |

| Pico Projectors Market, CAGR |

21% |

| Pico Projectors Market Size 2032 |

USD 27,834.05 million |

Leading players in the pico projectors market include major technology innovators such as Sony Corporation, Texas Instruments, Optoma Corporation, AAXA Technologies, LG Electronics, Dell Technologies, Philips Projection, ASUS, Xiaomi, and Anker Innovations, all of which actively advance miniaturized optical engines, laser-based modules, and high-efficiency DLP chipsets. These companies compete through improvements in brightness, battery efficiency, and smartphone-integrated projection capabilities. North America leads the global market with an exact share of 37.5%, supported by strong consumer electronics adoption and enterprise mobility demand, followed by Europe at 30% and Asia-Pacific at 25%, driven by large-scale manufacturing and rising portable entertainment usage.

Market Insights

- The pico projectors market was valued at USD 6,057.5 million in 2024 and is projected to reach USD 27,834.05 million by 2032, expanding at a 21% CAGR during the forecast period.

- Market growth is driven by rising integration into smartphones, wearables, portable entertainment devices, and mobile business tools, supported by advancements in miniaturized DLP and laser projection technologies.

- Key trends include increasing demand for ultra-compact laser modules, rapid expansion of wearable and AR-based projection, and growing use in automotive HUD concepts; DLP technology holds the largest segment share at around 45%, with standalone projectors leading product adoption.

- Competitive activity intensifies as companies enhance brightness, battery efficiency, and connectivity, with top players focusing on laser-based projection and energy-efficient optical engines while navigating restraints such as limited brightness and short battery life.

- Regionally, North America leads with 37.5%, followed by Europe at 30%, Asia-Pacific at 25%, Middle East & Africa at 5%, and Latin America at 3–4%, reflecting strong global demand dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology:

Digital Light Processing (DLP) remains the dominant technology in the pico projectors market, holding the largest share due to its superior brightness efficiency, compact optical engine architecture, and lower power consumption compared to LCOS and holographic systems. DLP’s proven reliability and ability to deliver high-contrast, color-accurate projections make it the preferred choice for consumer electronics and portable business devices. Laser beam steering and holographic laser projection are gaining traction in ultra-miniaturized applications, but their adoption is still emerging. LCOS continues to serve niche segments requiring smoother image textures and high pixel density.

- For instance, Texas Instruments’ DLP3010 chipset features a 0.3-inch micromirror array with 720p native resolution and enables system brightness levels typically up to 300 lumens, which provides strong performance in portable devices.

By Product:

Non-embedded/standalone pico projectors lead the product segment, capturing the highest market share as users prioritize flexible connectivity, higher lumen output, and compatibility with multiple devices for entertainment and professional use. These projectors offer larger batteries, superior thermal management, and better resolution compared to embedded units. Embedded pico projectors remain relevant in smartphones, tablets, and wearables, but integration challenges limit broad adoption. USB and media-player pico projectors continue expanding among budget-sensitive consumers seeking plug-and-play portability for home viewing and casual presentations.

- For instance, the AAXA P7 delivers 600 LED lumens, 1080p native resolution, and up to 90 minutes of battery runtime from its 38 Wh pack, making it one of the brightest pocket-class standalone units.

By Application:

Consumer electronics represent the largest application segment, accounting for the highest market share driven by demand for portable entertainment, mobile projection, and compact multimedia displays. The rise of smartphone-compatible pico projectors and pocket-sized laser units supports widespread consumer adoption. Business and education users follow closely, attracted by lightweight devices that streamline presentations and collaborative work settings. Healthcare applications are expanding gradually, supported by the use of compact projection in patient education, telemedicine visualization, and portable diagnostic tools, although the segment remains smaller compared to mainstream consumer demand.

Key Growth Drivers

Increasing Integration in Consumer Electronics and Mobile Devices

The rapid integration of pico projectors into smartphones, tablets, AR/VR headsets, and portable entertainment systems is a major driver of market expansion. Consumers increasingly prefer on-the-go projection solutions that eliminate the need for bulky visual display equipment. Manufacturers are embedding compact optical engines with improved brightness, low heat output, and enhanced energy efficiency to support seamless multimedia experiences. This shift is fueled by advancements such as solid-state lighting, miniaturized DLP chips, and micro-laser modules that enable high-quality projection within ultra-thin device profiles. As mobile device usage rises globally, pico projectors play a crucial role in extending viewing capabilities for gaming, streaming, and content sharing. Their growing use in wearable applications, including next-generation smart glasses capable of projecting heads-up visual data, further reinforces demand. Combined with the expanding ecosystem of companion apps and wireless casting interfaces, consumer electronics remain a foundational engine for sustainable pico projector adoption.

- For instance, Sony’s MP-CL1A portable laser projector uses an HD 1920×720 laser-beam scanning engine capable of producing a 120-inch image from just 3.7 meters, while maintaining focus-free projection through its MEMS module.

Rising Demand for Portable Presentation and Collaboration Tools

The global shift toward hybrid work environments, remote collaboration, and mobile professional activity has significantly increased the need for portable projection devices. Pico projectors offer employees and educators the flexibility to conduct presentations, training sessions, and interactive discussions without relying on fixed-room AV systems. Their compact form factor, instant setup, and wireless connectivity make them ideal for travel-heavy roles and ad-hoc corporate interactions. Educational institutions are also adopting these devices for flexible classroom arrangements, outdoor learning initiatives, and resource-limited environments requiring low-cost projection solutions. Advances in brightness output, battery life, and keystone correction have made modern pico projectors far more capable, supporting clear visuals even in moderately lit rooms. This demand is reinforced by organizations emphasizing device portability and multi-user collaboration tools that facilitate seamless communication. As workplace mobility accelerates, pico projectors increasingly serve as essential presentation companions for professionals across diverse industries.

- For instance, the AAXA M7 portable projector provides 1,200 LED lumens, 1080p native resolution, and up to 3 hours of battery runtime in eco mode—making it suitable for on-the-go meetings. Likewise, the Anker Nebula Capsule II features 200 ANSI lumens, 720p resolution, and a built-in 8W speaker in a device the size of a soda can, enabling quick setup in ad-hoc collaboration spaces.

Advancements in Projection Technologies Enhancing Performance

Technological progress—including improved DLP chipsets, laser beam steering modules, holographic projection engines, and LCOS microdisplays—continues to elevate the performance of pico projectors. These innovations deliver sharper imaging, higher resolution, extended color gamut, and significantly better power efficiency, making the devices viable for both casual and professional applications. Solid-state light sources, particularly RGB lasers, offer longer lifespans and consistent brightness that outperform legacy LED systems. Additionally, optical miniaturization allows manufacturers to design ultra-light projectors compatible with pocket-sized and wearable platforms. Improvements in image stabilization, autofocus algorithms, and thermal management systems further enhance usability and reliability. As these technologies mature, pico projectors are increasingly positioned as substitutes for traditional projection systems in compact environments. Their improved durability and low maintenance requirements strengthen their appeal across consumer, commercial, and industrial applications, fueling continuous market adoption.

Key Trends & Opportunities

Growth of Ultra-Miniaturized and Wearable Projection Systems

A key trend shaping the market is the development of ultra-miniaturized projection engines designed for wearable devices, AR glasses, smart helmets, and future mixed-reality systems. Manufacturers are investing heavily in micro-laser modules and holographic waveguide technologies that enable crisp visual overlays without requiring bulky display hardware. These compact projection units allow hands-free visualization for navigation, industrial workflows, medical procedures, and real-time field operations. As the AR/VR industry expands, pico projectors represent a critical enabling technology for delivering eye-level image projection at low power consumption. The opportunity further extends into defense and aerospace, where wearable projection can enhance situational awareness. Innovations that reduce heat generation, improve light efficiency, and enhance contrast ratios are accelerating adoption. With the rising commercialization of smart wearables, ultra-miniaturized pico projectors are poised to become standard components in next-generation optical platforms.

- For instance, Bosch Sensortec’s BML500P smartglasses light drive module measures approximately 45-75 mm (L) x 5-10 mm (H) x 8 mm (W) (depending on customer integration) and weighs less than 10 grams. It uses a MEMS mirror scanning system to project contextual data, such as navigation, calls, and notifications, directly into wearable displays (smartglasses) by “painting” real-time imagery onto the user’s retina.

Expanding Use Cases in Automotive Displays and Smart Mobility

Automotive integration offers a significant opportunity as manufacturers explore pico projectors for head-up displays (HUDs), rear-seat entertainment, interior ambient projections, and interactive dashboards. Compact projection units enable dynamic, customizable visual interfaces that complement advanced driver-assistance systems (ADAS). Laser-based pico projectors can deliver high-brightness, glare-free imagery suitable for varying lighting conditions inside the vehicle cabin. As mobility solutions expand—including electric vehicles, shared mobility, and autonomous platforms—automotive OEMs prioritize modular display technologies that reduce hardware complexity. Pico projectors help achieve flexible display placement without the constraints of traditional LCD panels. Their ability to project large visuals from a compact footprint supports immersive passenger experiences and functional safety overlays. With the automotive sector’s growing emphasis on smart interiors, pico projector integration is emerging as a powerful opportunity for long-term market growth.

- For instance, Panasonic’s AR HUD system projects a 20° × 5° augmented-reality field of view at distances up to 10 meters, enabling real-time navigation overlays with minimal latency.

Rising Adoption in Healthcare Visualization and Medical Training

Healthcare applications are becoming an important niche opportunity as medical environments increasingly seek portable visualization tools. Pico projectors are being adopted for patient education, bedside monitoring displays, telemedicine consultations, and compact projection in small clinical spaces. Medical trainers and simulation labs use lightweight projectors to overlay anatomical visuals on mannequins or surfaces, enhancing procedural learning without costly equipment. Battery-powered projectors with laser illumination offer long operating times and sterilization-friendly casings suitable for clinical workflows. The technology also supports augmented visualization during minor procedures or rehabilitation programs where flexible image placement is needed. As the healthcare sector continues digitizing patient interactions and educational processes, pico projectors provide cost-efficient, mobile-friendly solutions ideal for modern medical environments.

Key Challenges

Brightness Limitations and Performance Constraints in Ambient Lighting

One of the most significant challenges for pico projectors is their limited brightness output, which restricts usability in daytime or well-lit environments. Despite advancements in laser and LED illumination, compact devices still struggle to achieve lumen levels comparable to traditional projectors. This limitation particularly affects business, education, and outdoor applications where environmental lighting conditions cannot be fully controlled. Users often experience reduced contrast, washed-out images, and smaller usable projection sizes. Thermal constraints further limit the ability to increase brightness without compromising device lifespan or portability. As customers increasingly expect display performance equivalent to mainstream screens, pico projector manufacturers must overcome the trade-off between miniaturization and luminance. Addressing this challenge requires substantial innovation in light source efficiency, optical engine design, and heat dissipation.

Short Battery Life and Power Efficiency Constraints in Portable Devices

Battery life remains a critical challenge for pico projectors, especially as users demand longer, uninterrupted projection times for entertainment, instructional use, and professional presentations. High-intensity light sources consume significant power, leading to limited operating durations and frequent recharging requirements. While solid-state lighting has improved efficiency, compact form factors restrict battery capacity, forcing manufacturers to balance brightness, resolution, and runtime. This issue becomes more pronounced in embedded units integrated into mobile devices and wearables. Inconsistent power performance also affects reliability in field operations and travel scenarios. Enhancing energy efficiency through optimized optical engines, improved driver circuitry, and smart power management remains essential for broadening market adoption and meeting user expectations for mobile projection technology.

Regional Analysis

North America

North America accounts for about 37.5% of the global pico projectors market, making it the largest regional share in 2024. The region benefits from high consumer spending power, rapid uptake of advanced portable display solutions, and strong enterprise and education demand for compact presentation tools. The U.S. leads with widespread integration of pico projectors into mobile devices, business environments, and professional AV settings. Robust R&D and established distribution networks further sustain the region’s dominance. Adoption of laser-based projection and wearable displays also reinforces North America’s leadership in this market segment.

Europe

Europe holds an estimated 30% share of the pico projectors market, ranking as the second-largest region. Growth is underpinned by increasing adoption of portable projection in corporate, educational, and residential settings across Germany, France, the UK, and the Nordics. Regulatory support for digital learning and sustainability drives demand for energy-efficient compact projectors. European manufacturers’ emphasis on miniaturization and green design strengthens competitiveness. However, slower consumer electronics replacement cycles compared to other regions moderate growth. Overall, Europe remains a steady and significant contributor to the global pico projector market.

Asia-Pacific

The Asia-Pacific region registers approximately 25% of the global pico projectors market and is the fastest-growing region. Major markets such as China, India, Japan and South Korea lead demand thanks to high smartphone penetration, large middle-class populations and thriving consumer electronics manufacturing. OEMs in this region are integrating pico projection modules into mobile and wearable devices at scale. Government-led digital education initiatives and growing interest in portable entertainment enhance growth momentum. As cost structures improve and local production scales, Asia-Pacific looks poised to challenge Europe’s share in the coming years.

Middle East & Africa

Middle East & Africa currently accounts for an estimated 5% of the global pico projectors market, representing a smaller yet expanding region. Growth is driven by rising investments in smart education, business modernization and infrastructure upgrades in Gulf countries and South Africa. Portable projectors serve classrooms, corporate training and retail experiences where fixed AV systems are less accessible. However, economic variability, import costs and lower penetration of high-end consumer electronics moderate adoption rates. The region offers long-term growth potential as digital transformation initiatives and youth-oriented entertainment demand accelerate.

Latin America

Latin America holds roughly 3–4% of the global pico projectors market, representing a modest but growing region. Brazil and Mexico lead regional uptake thanks to rising digital learning programmes, growing consumer interest in portable entertainment devices and improving retail availability. Price-sensitive buyers favour compact projectors as cost-effective alternatives to larger fixed displays. The region’s expansion is constrained by slower infrastructure roll-out and limited high-end device penetration. Nonetheless, increasing smartphone integration and portable projection for business and education offer notable opportunities for regional growth in the coming years.

Market Segmentations:

By Technology

- Digital Light Processing (DLP)

- Laser Beam Steering

- Liquid Crystal on Silicon (LCOS)

- Holographic Laser Projection

By Product

- Embedded

- Non-embedded / Standalone

- USB

- Media Player Pico Projector

By Application

- Consumer Electronics

- Business & Education

- Healthcare

- Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pico projectors market is characterized by strong participation from leading consumer electronics and optical technology companies focused on miniaturized projection systems, solid-state illumination, and high-efficiency DLP engines. Key players such as Sony, Texas Instruments, LG Electronics, Optoma, AAXA Technologies, Philips Projection, ASUS, Xiaomi, and Anker Innovations compete through advancements in brightness output, compact laser modules, and battery optimization to enhance portability and image clarity. Many manufacturers are integrating laser beam steering and holographic projection technologies to differentiate performance in ultra-thin and wearable devices. Strategic collaborations with semiconductor suppliers and smartphone OEMs continue to accelerate embedded projection capabilities. Companies also prioritize wireless connectivity, auto-focus algorithms, and thermal management improvements to strengthen user experience. As market competition intensifies, players increasingly focus on premium product lines, vertical-specific solutions for education and business mobility, and expansion into fast-growing Asia-Pacific markets, where large-scale manufacturing capabilities support cost competitiveness and rapid innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung Group

- Canon Inc.

- AAXA Technologies Inc.

- LG Electronics Inc.

- Sony Corporation

- Koninklijke Philips NV

- Acer Inc.

Recent Developments

- In January 2025, LG unveiled two “lifestyle projectors” at CES: the PF600U (a three-in-one device combining a floor lamp, Bluetooth speaker, and Full HD projector) and the CineBeam S (model PU615U, a compact ultra-short-throw 4K laser projector with Dolby Atmos support).

- In August 2024, Samsung introduced two new ultra-short throw projectors, The Premiere 9 and The Premiere 7, with 4K laser technology, AI up-scaling, smart streaming integration and premium home-cinema positioning.

- In August 2023, the company launched the Freestyle Gen 2 portable projector with 1080p resolution (up to 100″), integration of Samsung Gaming Hub and Bluetooth controller support.

Report Coverage

The research report offers an in-depth analysis based on Technology, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Pico projectors will increasingly integrate into smartphones, wearables, and compact consumer electronics as optical engines continue to shrink.

- Solid-state laser illumination will dominate future designs due to higher brightness stability and longer operational life.

- Advancements in holographic and laser beam steering projection will enable thinner, lighter, and more power-efficient devices.

- Demand for portable business presentation tools will rise with global growth in hybrid and mobile work environments.

- Automotive use cases, including head-up displays and in-cabin ambient projections, will expand rapidly.

- Education sectors in emerging markets will adopt pico projectors as cost-effective digital learning solutions.

- Battery performance improvements and energy-efficient chipsets will extend projection duration for mobile users.

- Enhanced wireless connectivity and AI-driven auto-focus and keystone correction will improve usability.

- Manufacturers will focus on ultra-miniaturized modules for AR glasses and smart wearable displays.

- Asia-Pacific will strengthen its position as the fastest-growing region due to large-scale manufacturing and rising consumer adoption.