Market Overview

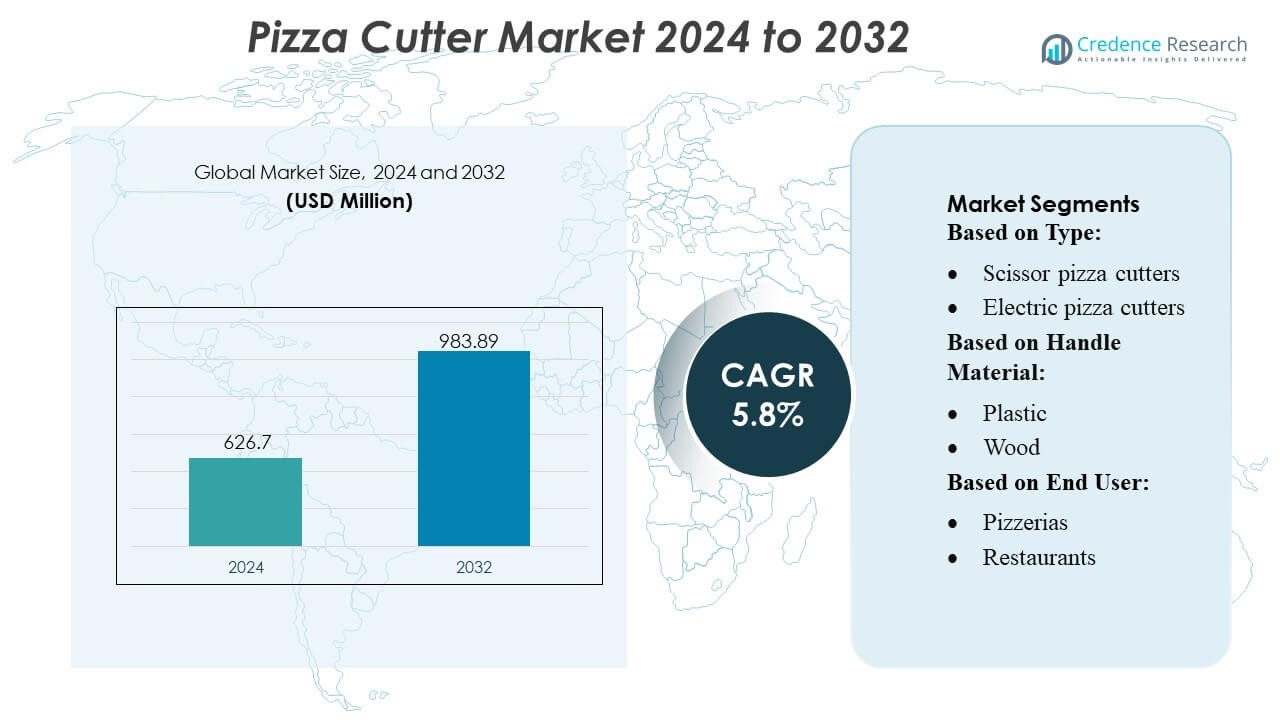

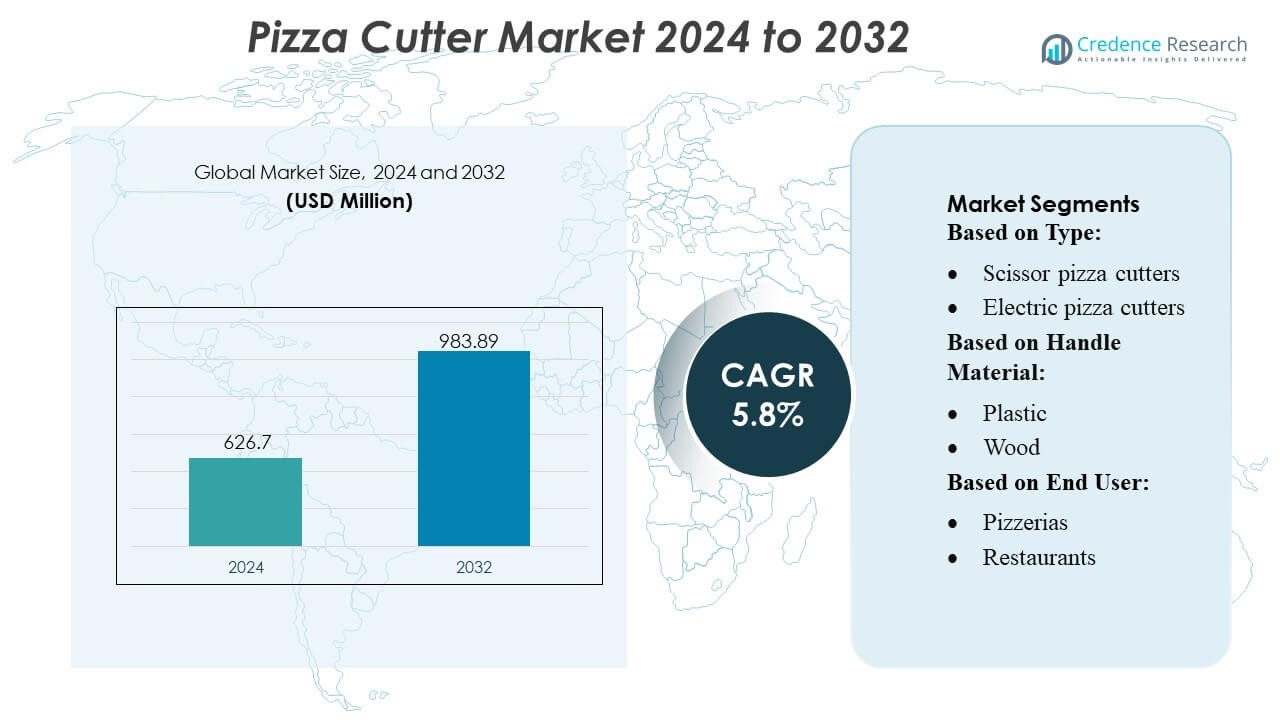

Pizza Cutter Market size was valued USD 626.7 million in 2024 and is anticipated to reach USD 983.89 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pizza Cutter Market Size 2024 |

USD 626.7 Million |

| Pizza Cutter Market, CAGR |

5.8% |

| Pizza Cutter Market Size 2032 |

USD 983.89 Million |

The Pizza Cutter Market is shaped by a mix of global kitchenware manufacturers, specialized blade producers, and rapidly scaling consumer brands that compete through durable materials, ergonomic handle designs, and precision-engineered cutting mechanisms. Companies focus on improving blade sharpness, edge retention, and safety features to strengthen product differentiation across both household and commercial segments. Strategic initiatives center on expanding e-commerce visibility, enhancing distribution networks, and introducing premium, dishwasher-safe cutters that meet rising user expectations. North America leads the market with an exact 38% share, supported by strong consumer spending on culinary tools, a well-established foodservice sector, and high adoption of premium kitchen accessories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pizza Cutter Market reached USD 626.7 million in 2024 and is projected to hit USD 983.89 million by 2032, reflecting a CAGR of 5.8% during the forecast period.

- Demand grows steadily due to rising consumer preference for durable stainless-steel blades, ergonomic handles, and safety-enhanced cutter designs adopted across both household and commercial segments.

- Trends highlight increased acceptance of dishwasher-safe, multifunctional, and premium cutters, supported by strong momentum in e-commerce channels that boost brand visibility and customer reach.

- Competitive intensity strengthens as manufacturers invest in precision engineering, quality certifications, and innovative materials, although pricing pressure and cheaper imported alternatives restrain margins and slow premium adoption.

- North America leads with a 38% share, followed by Europe at 32% and Asia Pacific at 24%, while stainless-steel cutters dominate product segments with nearly 55% share due to superior durability and cutting efficiency.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Wheel pizza cutters dominate the Australia Industrial Gases Market segmentation by type, holding over 32% share, supported by their wide availability, ergonomic designs, and consistent cutting performance suited for both commercial and household users. Standard wheel cutters lead due to durable stainless-steel blades, easy cleaning, and reliability in high-volume kitchens. Demand strengthens further as pizzerias and restaurants prioritize uniform slice thickness and faster service. Rocking cutters and multi-blade variants grow steadily due to improved efficiency in artisanal kitchens, while electric and scissor-style cutters remain niche options used for specialty applications.

- For instance, AMADA Co. Ltd.’s ENSIS-3015AJ fiber laser platform operates with a 3 kW to 9 kW (and higher in some configurations) laser output and uses AMADA’s proprietary Variable Beam Control technology, enabling precise material processing with a high repeatability accuracy of demonstrating the company’s capability in manufacturing high-precision cutting systems.

By Handle Material

Plastic handles lead this segment with approximately 38% share, driven by their lightweight construction, low heat conductivity, and cost-effective manufacturing suited for mass-market pizza cutters. Growth is reinforced by food-grade polypropylene handles used widely in commercial kitchens for enhanced hygiene and quick sanitation cycles. Wood handles retain a premium niche due to enhanced grip and aesthetic appeal in artisanal food spaces, while metal handles gain traction for heavy-duty usage. Rubber and silicone hybrids grow steadily as operators seek enhanced ergonomics and slip resistance, especially in high-temperature and high-throughput environments.

- For instance, Lincoln Electric Company documents that its advanced VRTEX® 360+ training platform achieves motion-tracking accuracy of 1.02 mm and real-time data processing at 60 frames per second, while its HyperFill® twin-wire welding system delivers deposition rates above 8 lb/hour with stable arc control.

By End User

Commercial users hold the dominant 41% share, led by pizzerias and restaurants that depend on high-durability and precision cutters to maintain slicing uniformity during peak demand periods. Growth is propelled by Australia’s expanding fast-casual dining sector, rising delivery volumes, and increasing adoption of premium stainless-steel and multi-blade cutters to improve throughput. Cafes and clubs add incremental demand through diversified menus that include flatbreads and gourmet pizzas. Household use grows moderately as consumers increasingly invest in durable kitchen tools for home-style pizza preparation supported by rising interest in home baking appliances.

Key Growth Drivers

Rising Global Consumption of Pizza Products

The increasing global consumption of pizzas across fast-casual, quick-service, and home-delivery formats strongly drives demand for efficient and durable pizza cutters. Growth in artisanal and gourmet pizza varieties encourages users to adopt specialized cutters that improve slice uniformity and presentation. Rapid expansion of pizzerias, café chains, and food trucks reinforces consistent equipment upgrades. The rise of meal-kit services and home-baking trends further supports household adoption, strengthening overall product demand across both commercial and residential environments.

- For instance, TRUMPF reports that its TruLaser 5030 fiber system achieves cutting speeds up to 4,000 mm/s and positioning accuracy of ±0.005 mm, powered by its TruDisk solid-state laser modules with output levels reaching 12 kW.

Expansion of Commercial Foodservice Establishments

The rapid spread of pizzerias, restaurants, cloud kitchens, and catering operations significantly boosts market growth, as these businesses require high-quality, long-lasting cutters suited for continuous use. Operators prioritize stainless-steel blades, ergonomic handles, and multi-blade systems to increase workflow efficiency during peak service hours. Growth in tourism-driven F&B outlets and quick-service chains adds momentum to procurement cycles. Replacement demand remains steady due to hygiene requirements and the need to maintain cutting precision, sustaining long-term market expansion.

- For instance, Bystronic Laser AG confirms that its ByStar Fiber 12 kW platform achieves feed rates up to 140 m/min with acceleration of 2.8 g and maintains a cutting precision of ±0.01 mm using its BeamShaper technology.

Product Innovation and Material Advancements

Continuous innovation in blade materials, handle ergonomics, and multipurpose cutting mechanisms drives strong product adoption. Manufacturers integrate hardened stainless steel, non-stick coatings, and heat-resistant polymers to enhance durability and user comfort. Launches of electric cutters and adjustable multi-blade designs appeal to high-volume commercial kitchens aiming to improve speed and consistency. Improved safety guards, dishwasher-safe constructions, and antimicrobial surfaces further support wide usage. These advances help differentiate products in a competitive market and align with rising expectations for efficiency and hygiene.

Key Trends & Opportunities

Rising Shift Toward Premium and Ergonomic Designs

Consumers increasingly prefer premium pizza cutters featuring ergonomic grips, reinforced blades, and high aesthetic appeal. This trend is especially visible in upscale pizzerias and home-kitchen enthusiasts who seek professional-grade tools. The demand for rocking blades, dual-wheel designs, and silicone-coated handles creates opportunities for specialized product lines. Manufacturers capitalize by offering customizable and visually appealing cutters that support both functionality and brand identity. The shift toward comfort-driven design enhances long-term usability and reduces fatigue in high-volume foodservice environments.

- For instance, Flow International Corporation reports that its Mach 500 waterjet platform operates at pressures up to 94,000 psi (6,480 bar) using the HyperJet® pump and achieves cutting tolerances of ±0.038 mm, with traverse speeds reaching 17.8 m/min.

Growth of E-commerce and Direct-to-Consumer Channels

Online retail expansion opens strong opportunities for brands offering diverse cutter designs, price points, and bundled kitchen accessories. E-commerce platforms enable rapid customer reach, easy product comparisons, and targeted promotions, supporting rising household adoption. Direct-to-consumer channels allow manufacturers to showcase unique innovations, provide detailed product demonstrations, and build niche communities around gourmet home cooking. Subscription-based kitchen tool kits and influencer-driven product launches further strengthen digital visibility. This channel shift accelerates product diversification and strengthens competitive positioning.

- For instance, Koike Aronson, Inc. specifies that its MasterGraph EX2 CNC cutting machine delivers positioning accuracy of ±0.2 mm and supports cutting speeds up to 25,400 mm/min while integrating a 200-amp plasma system capable of piercing 32-mm steel plate.

Increasing Demand for Multi-Functional and Specialty Cutters

The market benefits from rising interest in cutters that extend utility beyond pizzas, including pastries, flatbreads, and dough preparation. Multi-blade and adjustable cutting tools gain traction in commercial kitchens looking to streamline operations. Specialty cutters designed for deep-dish pizzas, gluten-free bases, or artisanal crusts unlock new niche segments. The shift toward multi-functionality helps reduce equipment clutter while improving speed and consistency. This trend encourages manufacturers to experiment with modular attachments and innovative blade geometries.

Key Challenges

Intense Market Competition and Price Sensitivity

The market faces strong competition from numerous local and international manufacturers, creating significant price pressure across mainstream product categories. Low-cost imports challenge premium brands by offering similar aesthetics at reduced prices, influencing purchasing decisions in both household and small-business segments. Retailers often prioritize volume-driven margins, further tightening competitive dynamics. As product differentiation remains limited for standard wheel cutters, manufacturers must rely on branding, quality, and specialized features to sustain market share in an increasingly commoditized environment.

Durability and Maintenance Concerns in High-Volume Use

Commercial kitchens often face challenges with blade longevity, handle wear, and sanitation requirements, especially under continuous usage. Frequent exposure to moisture, high temperatures, and thick crust varieties accelerates material degradation. This compels operators to replace cutters more frequently, increasing operational costs. Inconsistent cleaning practices can dull blades or damage bearings, reducing cutting efficiency. Manufacturers must address these challenges through improved materials, reinforced designs, and dishwasher-safe components to meet the demanding conditions of professional foodservice environments.

Regional Analysis

North America

North America leads the Pizza Cutter Market with a 38% share, driven by the region’s extensive network of pizzerias, fast-casual dining chains, and high household adoption of kitchen tools. Strong consumer inclination toward premium, ergonomic, and stainless-steel cutters further accelerates product upgrades. The U.S. dominates demand due to high pizza consumption per capita and strong penetration of e-commerce platforms offering diverse designs. Replacement cycles remain frequent in commercial kitchens because of hygiene regulations and heavy usage. Canada contributes steadily, supported by rising artisanal pizza outlets and growing preference for multifunctional cutters.

Europe (29% Market Share)

Europe holds a 29% share, supported by established pizza consumption traditions in Italy, France, Germany, and the U.K. Demand is strengthened by the region’s premiumization trend, where users increasingly prefer high-quality rocking blades and multi-blade designs that enhance precision and presentation. The professional foodservice sector adopts durable stainless-steel cutters to meet hygiene standards across restaurants and bakeries. Growth in home-cooking culture, especially in Northern and Western Europe, reinforces steady sales in retail channels. Manufacturers benefit from strong export opportunities within the EU, aided by uniform product safety and metal quality regulations.

Asia-Pacific

Asia-Pacific accounts for 23% of the market, supported by rapid urbanization, expanding café and pizzeria chains, and rising Western food influence across China, India, Japan, and Southeast Asia. Growing household interest in home baking and pizza preparation drives demand for affordable, lightweight, and easy-clean cutters. Commercial segments expand quickly due to the rising quick-service restaurant footprint. Regional manufacturers gain traction by offering cost-effective plastic-handle and stainless-steel wheel cutters. E-commerce growth and social-media–driven cooking trends significantly enhance product visibility, contributing to sustained long-term expansion.

Latin America

Latin America represents 6% of global demand, driven by growth in fast-food chains, expanding local pizzerias, and rising interest in home cooking across Brazil, Mexico, Argentina, and Chile. Affordability plays a major role in purchasing behavior, supporting strong adoption of standard wheel cutters with plastic handles. Restaurants increasingly upgrade to more durable stainless-steel units to handle thicker crust varieties and higher customer volumes. Online retail platforms widen access to diverse designs, although market penetration remains limited in rural areas. Opportunities grow as international pizza brands increase their regional presence.

Middle East & Africa

The Middle East & Africa region holds 4% share, supported by rising foodservice investments, growing Western dining influences, and expanding premium restaurant chains, particularly in GCC countries. Commercial kitchens prefer durable, heat-resistant, and easy-sanitize cutters to manage high throughput. Household adoption increases gradually as urban consumers embrace home-style pizza preparation supported by modern kitchenware retail. However, limited distribution networks and price sensitivity in parts of Africa slightly constrain market expansion. Growing retail modernization and the rise of international pizza franchises create new opportunities for both mid-range and premium cutter categories.

Market Segmentations:

By Type:

- Scissor pizza cutters

- Electric pizza cutters

By Handle Material:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pizza Cutter Market features a competitive landscape led by global and regional manufacturers, including TRUMPF, AMADA Co. Ltd., ESAB Corporation, Bystronic Laser AG, WARDJet, Koike Aronson Inc., Nissan Tanaka Corporation, Lincoln Electric Company, Water Jet Sweden AB, and Flow International Corporation. The Pizza Cutter Market reflects strong competition driven by continuous innovation in blade engineering, handle ergonomics, and material durability. Manufacturers focus on enhancing cutting precision through sharper stainless-steel edges, improved balance, and reinforced pivot mechanisms designed for both home kitchens and commercial foodservice environments. Companies expand product lines to include multifunctional cutters, dishwasher-safe designs, and protective blade covers that elevate safety and ease of use. The rise of e-commerce accelerates competitive intensity as brands strengthen digital visibility and customer engagement. Market participants also invest in streamlined manufacturing processes, quality certifications, and aesthetically refined designs to appeal to a wider consumer base and sustain long-term differentiation.

Key Player Analysis

- Water Jet Sweden AB

- AMADA Co. Ltd.

- Lincoln Electric Company

- TRUMPF

- Bystronic Laser AG

- Flow International Corporation

- Koike Aronson, Inc.

- ESAB Corporation

- Nissan Tanaka Corporation

- WARDJet

Recent Developments

- In April 2024, ZapBatt’s innovative battery technology is accurate, highlighting their use of Toshiba’s SCiB LTO chemistry combined with their own Battery Operating System (bOS) for fast charging (80% in under 6 mins), extended lifespan (20,000+ cycles), enhanced safety, and a universal adapter capability for diverse devices like power tools.

- In February 2024, Makita did release the powerful and compact 5″ Paddle Switch Angle Grinder (9558HP) designed for metal fabrication with its 7.5 AMP motor, 10,000 RPM, lightweight 4.5 lb build, and handy AC/DC switch for versatile power, making it a strong addition to their professional grinding lineup for demanding tasks.

- In February 2023, OSSIO launched its OSSIOfiber Compression Staples, its fifth product line, providing surgeons with strong, non-permanent, bio-integrative fixation for bone procedures, replacing traditional metal hardware, and allowing for natural bone healing and growth, eliminating the need for secondary removal surgeries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Handle Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as households and foodservice operators adopt higher-quality, ergonomically designed pizza cutters.

- Manufacturers will emphasize durable stainless-steel blades and advanced edge-retention technologies to improve product longevity.

- Demand will rise for multifunctional cutters that support slicing, lifting, and serving functions in a single tool.

- E-commerce channels will strengthen market penetration, supported by targeted digital marketing and user-generated reviews.

- Consumers will show increased preference for dishwasher-safe, low-maintenance, and safety-enhanced cutter designs.

- Premium cutters with non-slip, heat-resistant handles will gain popularity among frequent users and professional kitchens.

- Sustainable materials and eco-friendly packaging will influence brand differentiation and purchasing decisions.

- Customizable designs, including color-coordinated handles and personalized engraving options, will attract gift-oriented buyers.

- Commercial kitchens will drive demand for heavy-duty cutters capable of handling high-volume operations.

- Innovation in manufacturing processes, including precision machining and automated finishing, will support consistent product quality.

Market Segmentation Analysis:

Market Segmentation Analysis: