| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant Health Technologies Market Size 2024 |

USD 200.23 million |

| Plant Health Technologies Market, CAGR |

5.34% |

| Plant Health Technologies Market Size 2032 |

USD 312.96 million |

Market Overview:

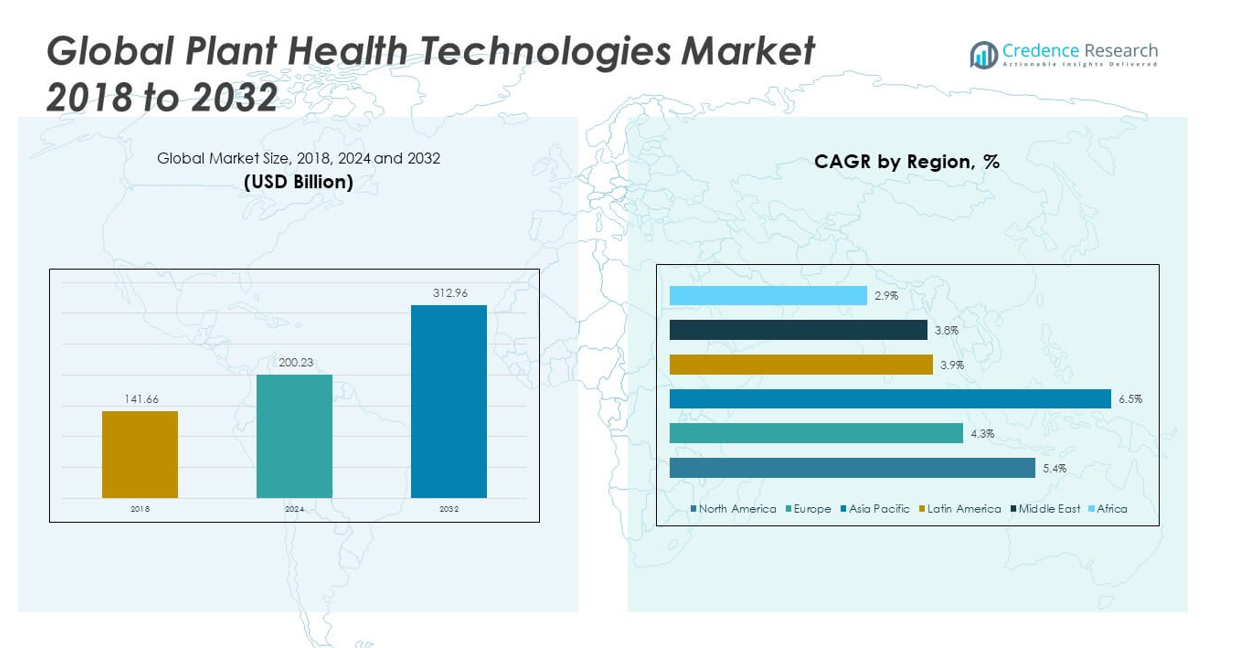

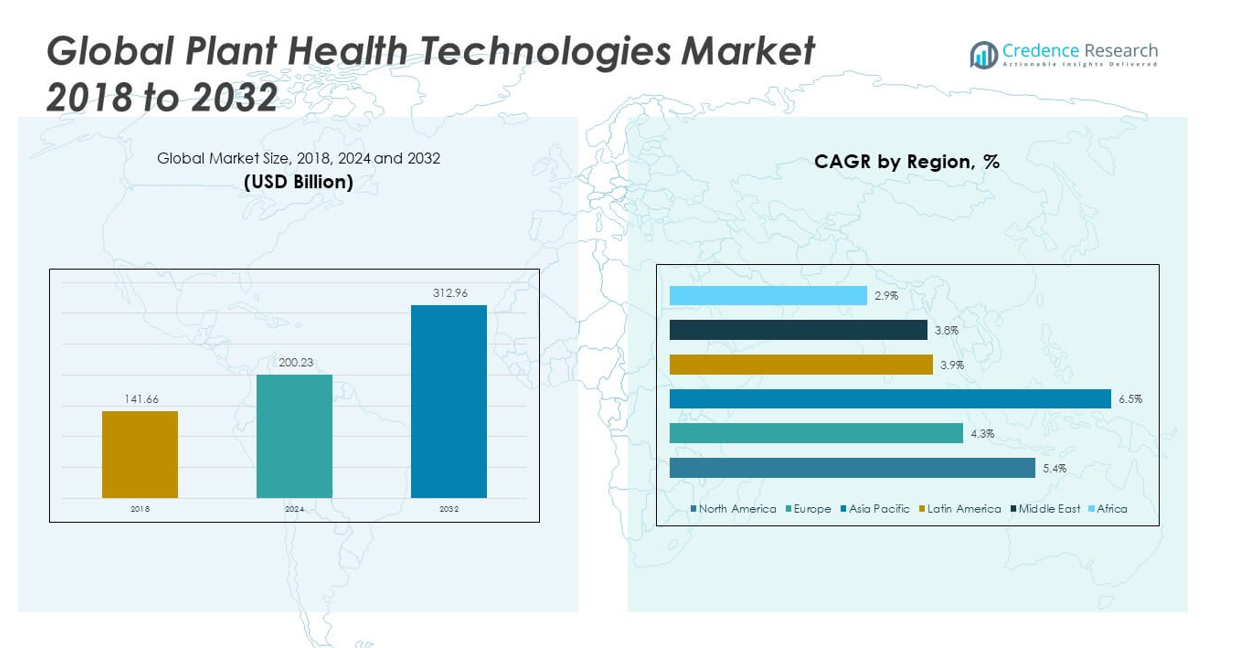

The Global Plant Health Technologies Market size was valued at USD 141.66 million in 2018 to USD 200.23 million in 2024 and is anticipated to reach USD 312.96 million by 2032, at a CAGR of 5.34% during the forecast period.

The growth of the Global Plant Health Technologies market is primarily driven by several key factors. First, the increasing demand for precision agriculture has led to the widespread adoption of advanced pathogen detection technologies, as they help identify and manage plant diseases at an early stage, minimizing crop loss. This is further supported by innovations in digital agriculture, including the use of AI-powered sensors, drones, and remote imaging systems that allow for accurate and timely intervention in farming practices. The demand for biostimulants, which are environmentally friendly and promote plant growth, resilience, and yield, is another significant driver. These biostimulants align with the growing consumer preference for sustainable and eco-friendly farming practices. Additionally, the rise in global population and the corresponding increase in food demand have prompted the adoption of controlled-environment agriculture (CEA) technologies, such as plant factories, that enable year-round cultivation in resource-constrained or urban areas.

The Global Plant Health Technologies market shows varied growth across regions, influenced by technology adoption, regulatory frameworks, and investment priorities. North America leads the market, particularly in disease diagnostics and the adoption of digital agriculture technologies. Strong research and development infrastructure, along with supportive regulatory policies, have positioned the region as a hub for innovation and early adoption of plant health technologies. Europe dominates the biostimulants sector, benefiting from favorable regulations, consumer demand for sustainable agricultural practices, and strong market penetration in countries like France and Germany. Asia Pacific is experiencing the fastest market growth, driven by a combination of increasing food demand, urbanization, and significant investments in controlled-environment agriculture. Countries like China, Japan, and South Korea are spearheading advancements in vertical farming and plant factory technologies. Latin America, particularly Brazil, shows rapid growth in the bioinputs segment, with increasing use of biostimulants in crops like soybeans, corn, and sugarcane.

Market Insights:

- The Global Plant Health Technologies Market is projected to grow from USD 141.66 million in 2018 to USD 200.23 million in 2024, reaching USD 312.96 million by 2032, with a CAGR of 5.34% during the forecast period.

- Precision agriculture and advanced pathogen detection technologies are driving significant demand as farmers focus on early disease identification and improved crop management to reduce losses.

- The adoption of biostimulants continues to rise as consumers demand eco-friendlier and sustainable farming practices, contributing to soil health, plant resilience, and increased yields.

- Controlled-environment agriculture (CEA), including plant factories and vertical farming, is gaining momentum due to its ability to support year-round crop production in urban areas and resource-constrained regions.

- Digitalization in agriculture, driven by IoT, big data, and AI, is transforming plant health management, enabling real-time monitoring and optimized resource usage for improved yield outcomes.

- High initial costs for advanced technologies and the lack of technical expertise in emerging markets pose barriers to widespread adoption, particularly among small-scale farmers.

- Regulatory inconsistency and environmental factors, including climate change and soil health challenges, create hurdles for implementing consistent plant health technologies across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Precision Agriculture and Early Pathogen Detection

The demand for precision agriculture is growing rapidly within the Global Plant Health Technologies Market, driven by the increasing need for efficiency and productivity in farming. The adoption of advanced pathogen detection tools allows farmers to identify and address plant diseases at their early stages, thus reducing crop losses. Technologies such as sensor-based systems, drones, and remote imaging are being integrated into agricultural practices to ensure timely intervention, enabling farmers to monitor and manage plant health more effectively. Early detection plays a crucial role in minimizing the impact of diseases and pests, which is essential to maintaining crop yield stability in the face of climate change and evolving pest resistance. This trend is gaining traction across developed and emerging markets as farmers look for ways to optimize crop protection while reducing chemical usage.

- For instance, Lidar-equipped drones are now being used to scan large fields and predict areas prone to disease, enabling early intervention and targeted treatments that traditional scouting methods often miss. These drones have proven effective in cereal crops like wheat and maize, as well as in fruit orchards such as citrus and olive groves, where continuous monitoring has led to improved yield and fruit quality.

Adoption of Biostimulants and Eco-Friendly Farming Practices

The global shift toward sustainable agriculture is driving the adoption of biostimulants in the plant health sector. These natural or organic substances enhance plant growth, resilience, and productivity without relying heavily on synthetic chemicals. As consumer preference for organic and pesticide-free produce rises, the demand for biostimulants is increasing. Biostimulants also address environmental concerns by improving soil health, increasing nutrient efficiency, and promoting plant resistance to abiotic stress. Governments and regulatory bodies are supporting the use of biostimulants through policy initiatives that encourage eco-friendly farming. This trend aligns with the growing global focus on sustainability, reducing carbon footprints, and meeting food production needs in an environmentally responsible way.

- For example, Acadian Plant Health reports that North America’s seaweed extracts biostimulant market is expanding rapidly, with Mexico leading adoption due to its high-value specialty crops, and the U.S. and Canada seeing increased use in broadacre crops to improve soil health.

Expanding Role of Controlled-Environment Agriculture (CEA)

The adoption of Controlled-Environment Agriculture (CEA) technologies is another key driver in the Global Plant Health Technologies Market. CEA systems, such as plant factories and vertical farming, enable year-round crop production in urban environments and resource-constrained regions. These systems use optimized conditions to promote plant health, making agriculture more resilient to climate variability and reducing dependency on external factors such as weather patterns. The growing global population and the need for efficient, local food production systems in cities drive the demand for CEA solutions. These technologies support the sustainable growth of crops in both developing and developed countries, enhancing food security and reducing supply chain vulnerabilities.

Technological Integration and Digitalization in Agriculture

The integration of big data, IoT, and AI into agricultural practices is revolutionizing how plant health is managed and monitored. The digitalization of farming operations enables the collection of vast amounts of data that can be analyzed for insights on plant health, pest management, and environmental conditions. By leveraging this data, farmers can make more informed decisions that optimize resource use, minimize waste, and improve yield outcomes. The use of predictive analytics and smart farming technologies allows for more accurate forecasting and decision-making, contributing to greater efficiency in plant management. This technological advancement is expanding rapidly, and the incorporation of these tools into the farming ecosystem is likely to continue shaping the future of plant health technologies globally.

Market Trends:

Technological Advancements in Precision Agriculture and Monitoring Systems

The Global Plant Health Technologies Market is witnessing rapid technological advancements in precision agriculture. The integration of advanced sensors, drones, and satellite imagery enables more accurate monitoring of crop health and environmental conditions. These technologies allow farmers to detect diseases, pests, and nutrient deficiencies early, enhancing decision-making and reducing the reliance on pesticides and fertilizers. The increasing use of artificial intelligence (AI) and machine learning algorithms helps process large datasets, providing insights for better crop management. These innovations improve resource utilization, minimize waste, and optimize farming practices for higher productivity. Precision agriculture is becoming essential for farmers seeking to address the challenges of food security and sustainability.

Growth of Biostimulants and Sustainable Farming Solutions

The trend towards sustainable farming practices continues to gain momentum in the Global Plant Health Technologies Market. Farmers are increasingly adopting biostimulants to enhance crop growth, resilience, and yield without relying on synthetic chemicals. These eco-friendly solutions improve plant health, boost nutrient uptake, and enhance resistance to stress factors such as drought or extreme temperatures. The shift towards organic farming and pesticide-free agriculture is supporting the growth of biostimulants. Governments and regulatory agencies are encouraging the use of such solutions through favorable policies that promote sustainable agricultural practices. As a result, biostimulants are becoming an integral part of modern farming systems, offering a sustainable alternative to conventional agricultural inputs.

Expansion of Controlled-Environment Agriculture (CEA) Technologies

Controlled-Environment Agriculture (CEA) is a significant trend in the Global Plant Health Technologies Market, particularly in urban settings and regions facing resource constraints. Vertical farming, hydroponics, and aeroponics allow for efficient year-round crop production in controlled environments. These systems optimize growing conditions such as temperature, humidity, and light, ensuring healthy plant growth regardless of external climate conditions. CEA technologies contribute to food security by enabling local food production in densely populated urban areas. As the global population grows, demand for these solutions is expected to increase, further driving the adoption of CEA technologies worldwide.

- For instance, NASA-developed aeroponic systems are now widely adopted in commercial vertical farms for their efficiency and minimal space requirements.

Digitalization and Data-Driven Solutions in Agriculture

The digitalization of agriculture is transforming the plant health sector, with an increasing focus on data-driven solutions. The use of IoT devices, smart sensors, and cloud-based platforms is enabling farmers to monitor crops and field conditions in real-time. These technologies provide valuable insights that improve resource efficiency, optimize irrigation, and reduce environmental impacts. The integration of big data and predictive analytics allows for the proactive management of plant health, helping farmers address issues before they escalate. As the industry embraces digital solutions, the future of plant health management looks increasingly data-centric, allowing for more informed decision-making and enhanced operational efficiency.

- For example, Fasal’s AI-powered system collects real-time data from field sensors and provides farmers with recommendations on irrigation and crop management, resulting in increased yield and reduced resource consumption.

Market Challenges Analysis:

Challenges in Adoption and Integration of Advanced Technologies in the Global Plant Health Technologies Market

One of the primary challenges in the Global Plant Health Technologies Market is the high cost of advanced technologies such as precision agriculture tools, biostimulants, and controlled-environment agriculture systems. Small-scale farmers, especially in developing regions, face significant barriers in adopting these technologies due to the initial investment required. While these technologies offer long-term benefits, the upfront costs can be prohibitive, limiting their widespread use in certain markets. Furthermore, the integration of new systems with traditional farming methods can be complex and requires specialized knowledge, leading to resistance from some farmers. The lack of technical expertise and training can hinder effective deployment and utilization of these innovations, delaying the market’s full potential.

Regulatory and Environmental Challenges in the Global Plant Health Technologies Market

The regulatory landscape for plant health technologies presents another challenge. Different regions have varying standards and regulations regarding the use of biostimulants, plant disease management tools, and genetically modified organisms (GMOs). This inconsistency creates hurdles for companies trying to scale their products across borders. Furthermore, environmental factors, including unpredictable climate patterns and soil health variability, can limit the effectiveness of certain plant health technologies. These challenges impact the adoption of consistent practices and make it difficult for farmers to achieve optimal results across diverse conditions. As the market continues to evolve, navigating these regulatory and environmental barriers will be crucial for the continued growth and expansion of plant health technologies.

Market Opportunities:

Emerging Markets and Adoption of Sustainable Solutions in the Global Plant Health Technologies Market

The Global Plant Health Technologies Market presents significant opportunities in emerging markets, where agriculture is a primary economic activity. With increasing awareness of sustainable farming practices, there is growing demand for eco-friendly solutions such as biostimulants and disease detection technologies. As developing countries face challenges related to food security and environmental sustainability, the adoption of these technologies can help improve productivity while reducing the reliance on harmful chemicals. There is also potential for expanding the reach of controlled-environment agriculture (CEA) systems in regions with limited arable land, helping to meet local food demands in urbanized areas.

Technological Advancements and Integration of Data-Driven Solutions

Technological advancements, particularly in data analytics, IoT, and AI, offer new growth opportunities in the plant health sector. By integrating big data and predictive analytics, farmers can gain deeper insights into crop health, optimize resource usage, and enhance yield. These digital solutions can also support the management of climate-related challenges, providing tailored recommendations for crop protection. The increasing adoption of smart farming tools presents substantial opportunities for technology providers, offering a pathway for expanding their product portfolios and gaining a competitive edge in the rapidly evolving market.

Market Segmentation Analysis:

The Global Plant Health Technologies Market is characterized by a wide array of segments that contribute to its dynamic growth.

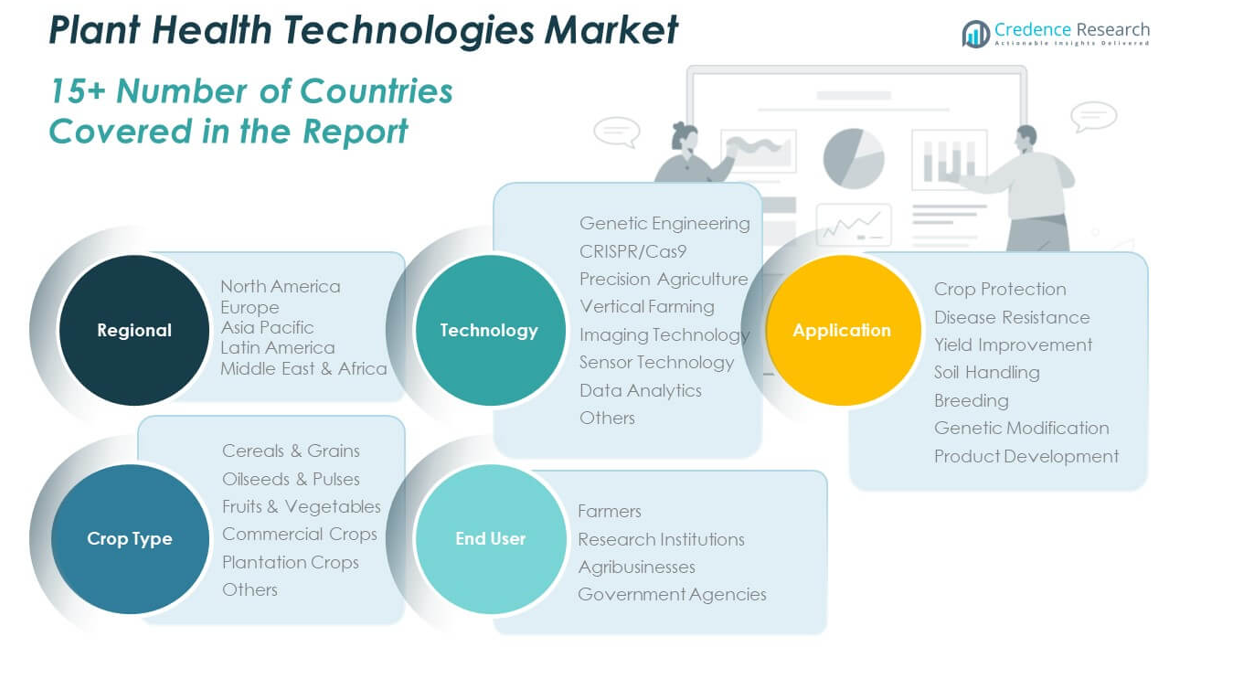

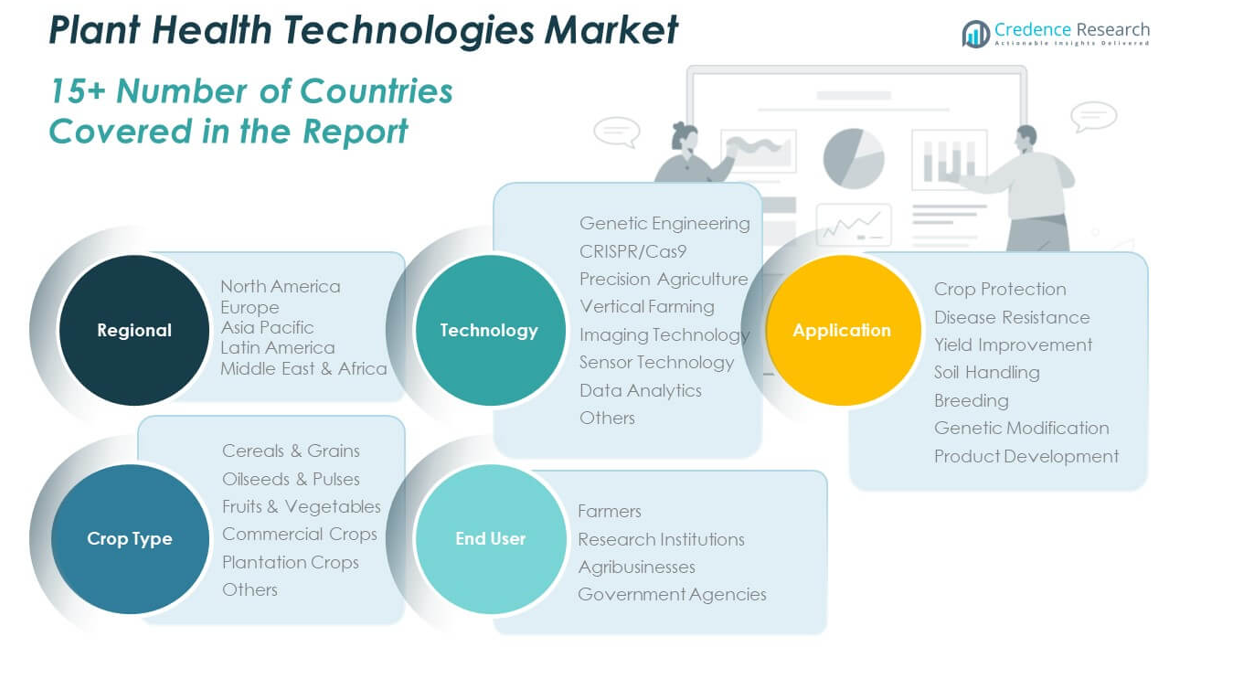

By technology, the market includes Genetic Engineering and CRISPR/Cas9, which are key for developing genetically modified crops with improved disease resistance and higher yields. Precision Agriculture, Vertical Farming, and Sensor Technology are driving the adoption of smarter, more efficient farming practices, while Imaging Technology and Data Analytics are enhancing disease detection and crop monitoring for better decision-making.

- For instance, Corteva Agriscience has reported that its CRISPR-edited waxy corn, which improves starch content and disease resistance, was planted on over 100,000 acres in the U.S. in 2024, demonstrating rapid farmer adoption.

By application, Crop Protection and Disease Resistance technologies are essential for mitigating risks from pests and plant diseases. Yield Improvement and Soil Handling segments focus on enhancing agricultural output while maintaining soil health. Breeding, Genetic Modification, and Product Development further drive advancements in plant genetics and crop development.

- For instance, blight-resistant potatoes and rust-resistant wheat have been developed using these technologies, reducing yield losses from disease outbreaks.

By crop type, the market spans Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Commercial Crops, and Plantation Crops. Each crop type benefits from specific plant health technologies tailored to its unique needs, such as improved disease resistance and yield optimization.

By end user segments include Farmers, who are the primary adopters of plant health technologies, as well as Research Institutions, Agribusinesses, and Government Agencies that play vital roles in research, policy-making, and large-scale adoption of these technologies. Each segment is crucial for the market’s overall expansion, shaping the future of plant health solutions globally.

Segmentation:

By Technology:

- Genetic Engineering

- CRISPR/Cas9

- Precision Agriculture

- Vertical Farming

- Imaging Technology

- Sensor Technology

- Data Analytics

- Others

By Application:

- Crop Protection

- Disease Resistance

- Yield Improvement

- Soil Handling

- Breeding

- Genetic Modification

- Product Development

By Crop Type:

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Commercial Crops

- Plantation Crops

- Others

By End User:

- Farmers

- Research Institutions

- Agribusinesses

- Government Agencies

Regional Analysis:

North America Regional Analysis

The North America Global Plant Health Technologies Market size was valued at USD 53.75 million in 2018, increasing to USD 75.07 million in 2024, and is anticipated to reach USD 117.71 million by 2032, at a CAGR of 5.40% during the forecast period. North America holds a significant share in the global market, driven by technological innovation and a well-established agricultural infrastructure. The United States and Canada are key players, where advanced farming technologies like precision agriculture, biostimulants, and pathogen detection tools are widely adopted. The region’s strong research and development capabilities, along with favorable government policies supporting sustainable farming practices, contribute to its dominance in the market. As the demand for sustainable agriculture grows, North America’s adoption of digital solutions and controlled-environment agriculture systems continues to rise, solidifying its market leadership.

Europe Regional Analysis

The Europe Global Plant Health Technologies Market size was valued at USD 31.79 million in 2018, rising to USD 42.88 million in 2024, and is expected to reach USD 62.02 million by 2032, at a CAGR of 4.30% during the forecast period. Europe’s market is driven by stringent environmental regulations and a strong push for sustainability in agriculture. Countries like Germany, France, and the UK are leading the adoption of biostimulants and eco-friendly plant protection solutions. The European Union’s support for organic farming and sustainable agricultural practices fosters growth in this sector. The market in Europe is also bolstered by innovations in controlled-environment agriculture and vertical farming, especially in urban areas. The region holds a significant market share, with demand increasing for technology solutions that address environmental concerns and food security.

Asia Pacific Regional Analysis

The Asia Pacific Global Plant Health Technologies Market size was valued at USD 40.70 million in 2018, growing to USD 60.77 million in 2024, and is projected to reach USD 103.63 million by 2032, at a CAGR of 6.50% during the forecast period. The Asia Pacific region is experiencing the fastest market growth, driven by the expanding agricultural sectors in countries like China, India, and Japan. Rising food demand, urbanization, and the adoption of advanced agricultural technologies such as precision farming and controlled-environment agriculture are key factors. The increasing need for sustainable farming solutions and climate-resilient crops is fueling the market’s expansion. As the region faces resource constraints and environmental challenges, technologies that optimize water use and improve crop health are in high demand, allowing Asia Pacific to capture a substantial share of the global market.

Latin America Regional Analysis

The Latin America Global Plant Health Technologies Market size was valued at USD 7.27 million in 2018, reaching USD 10.16 million in 2024, and is expected to grow to USD 14.21 million by 2032, at a CAGR of 3.90% during the forecast period. Latin America’s market is primarily driven by the agricultural dominance of countries like Brazil, Argentina, and Mexico. The region’s strong agricultural output in crops like soybeans, corn, and sugarcane creates a demand for plant health technologies that improve crop yield and sustainability. Biostimulants and precision agriculture tools are gaining traction as farmers focus on increasing productivity and reducing environmental impacts. Despite challenges related to infrastructure and high initial costs, the market in Latin America continues to grow steadily with increasing investments in agriculture technology.

Middle East Regional Analysis

The Middle East Global Plant Health Technologies Market size was valued at USD 5.45 million in 2018, rising to USD 7.23 million in 2024, and is anticipated to reach USD 10.04 million by 2032, at a CAGR of 3.80% during the forecast period. The market in the Middle East is driven by the region’s need for water-efficient and climate-resilient agricultural solutions due to harsh environmental conditions and limited arable land. Countries like the UAE, Saudi Arabia, and Israel are leading the adoption of controlled-environment agriculture and precision farming techniques. The region is increasingly focusing on food security and sustainable agricultural practices, which is encouraging the use of biostimulants and digital solutions. Although the market share remains smaller compared to other regions, it is expected to expand as governments push for modern agricultural practices to ensure long-term food security.

Africa Regional Analysis

The Africa Global Plant Health Technologies Market size was valued at USD 2.69 million in 2018, increasing to USD 4.12 million in 2024, and is projected to reach USD 5.36 million by 2032, at a CAGR of 2.90% during the forecast period. Africa’s market is characterized by a large rural agricultural base that is gradually embracing modern plant health technologies. The need for sustainable farming solutions is growing as the region faces challenges such as climate change, soil degradation, and water scarcity. Countries like South Africa, Kenya, and Nigeria are beginning to adopt biostimulants and digital farming tools to improve crop yields and protect crops from diseases. Despite slower growth compared to other regions, the market presents long-term opportunities as African countries work to enhance food security and agricultural productivity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Syngenta AG

- Bayer AG

- BASF SE

- Corteva Agriscience

- UPL Limited

- Indigo Agriculture

- AgroSustain SA

- NewLeaf Symbiotics Inc.

- Symborg

- Locus AG

- Plant Sciences Inc.

- Pheronym

- Afingen

- Inari Agriculture Inc.

Competitive Analysis:

The competitive landscape of the Global Plant Health Technologies Market is highly dynamic, with key players focusing on innovation and strategic partnerships to expand their market presence. Companies such as BASF SE, Syngenta International AG, and Bayer CropScience dominate the market, leveraging their expertise in chemical solutions, biostimulants, and pest management technologies. These industry leaders invest heavily in research and development to drive advancements in precision agriculture, pathogen detection, and controlled-environment agriculture systems. Smaller players are also gaining traction by offering specialized solutions tailored to specific crops or regional needs. Strategic collaborations between technology providers and agricultural firms are increasingly common, enabling access to cutting-edge technologies and enhancing product offerings. With a growing emphasis on sustainability, companies are focusing on eco-friendly solutions such as biostimulants and organic crop protection, positioning themselves to meet the rising demand for sustainable agricultural practices.

Recent Developments:

- In March 2025, Syngenta AG strengthened its global leadership in agricultural biologicals by acquiring the natural products and genetic strains assets from Novartis, including the transfer of Novartis’s Natural Products and Biomolecular Chemistry team. This acquisition builds on a successful research collaboration since 2019 and gives Syngenta access to novel leads for agricultural research, enhancing its bioengineering and data science capabilities.

- In Jan 2025, Syngenta Crop Protection announced a pioneering collaboration with TraitSeq, an artificial intelligence company, to accelerate the development of next-generation biostimulants. This partnership aims to leverage AI to identify biomarkers that can rapidly assess the efficacy of biostimulants in enhancing plant health, supporting Syngenta’s sustainability and regenerative agriculture goals.

- In June 2025, Bayer launched new tomato hybrids featuring multi-stacked resistance genes against Tomato Brown Rugose Fruit Virus (ToBRFV), targeting all major glasshouse tomato categories. This multi-gene approach is designed to provide longer-lasting protection against viral mutations, with commercial rollout scheduled for 2025.

- On April 26, 2025, BASF India’s Board approved the acquisition of 100% equity interest in BASF Agricultural Solutions India from BASF SE, Germany. The transaction, completed by mid-May 2025, makes BASF Agricultural Solutions India a wholly owned subsidiary, streamlining operations and strengthening BASF’s presence in the Indian market.

Market Concentration & Characteristics:

The Global Plant Health Technologies Market exhibits moderate concentration, with a few key players holding significant market shares, including BASF SE, Syngenta International AG, and Bayer CropScience. These major companies dominate through their extensive product portfolios and substantial investments in research and development, allowing them to offer innovative solutions in areas such as biostimulants, pest management, and precision agriculture technologies. While large corporations lead the market, there is increasing competition from smaller firms and regional players who focus on niche technologies or specialized solutions tailored to local agricultural needs. The market is characterized by rapid technological advancements, growing demand for sustainable and eco-friendly agricultural practices, and a shift towards digital solutions such as IoT and AI. This combination of large players and emerging innovators creates a competitive and evolving landscape.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, Crop Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Plant Health Technologies Market will continue to expand as demand for sustainable farming solutions grows.

- Increased adoption of precision agriculture technologies will drive efficiency and crop yield improvements.

- Biostimulants will gain market share due to the rising preference for eco-friendly and organic farming practices.

- The market will witness greater investment in research and development, leading to innovation in pathogen detection and crop protection technologies.

- Controlled-environment agriculture (CEA) will expand, especially in urban areas with limited arable land.

- Integration of digital technologies like IoT, AI, and big data will enable real-time crop monitoring and smarter decision-making.

- Emerging markets will see accelerated growth as farmers adopt modern plant health solutions to combat climate challenges.

- Regulatory support for sustainable agriculture will fuel the growth of biostimulants and digital farming technologies.

- Increasing awareness of food security will drive demand for innovative, resilient plant health solutions.

- The competitive landscape will remain dynamic, with both established players and new entrants pushing for technological advancements.