Market Overview

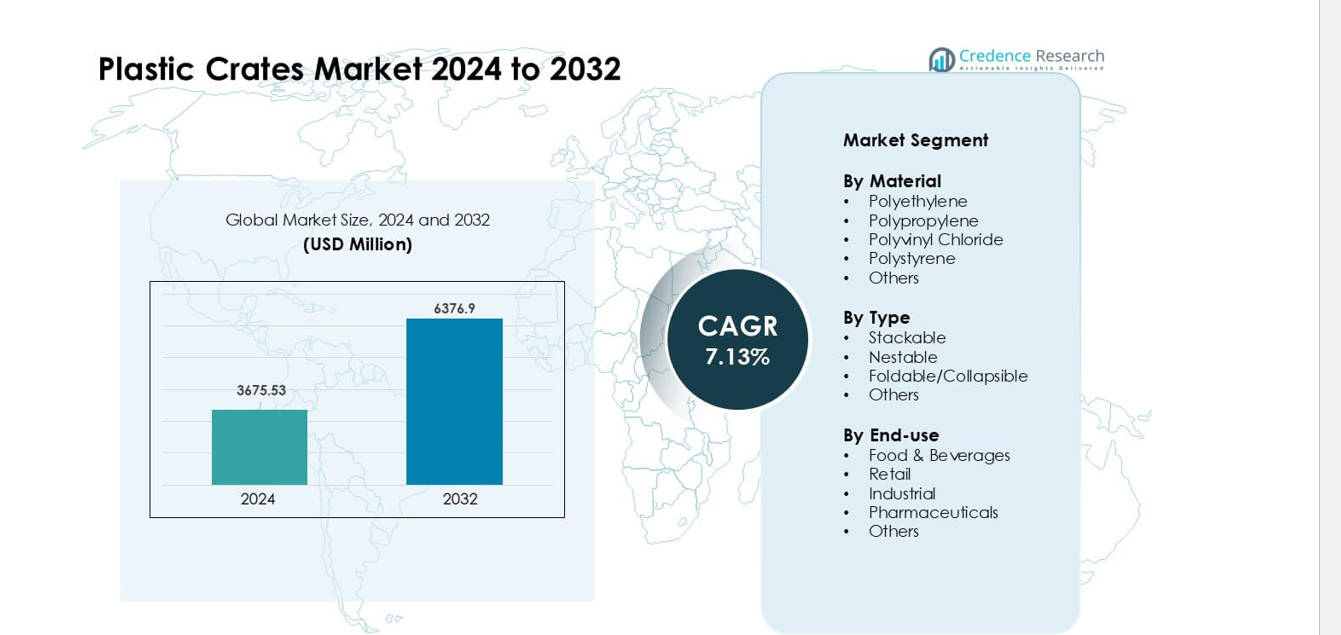

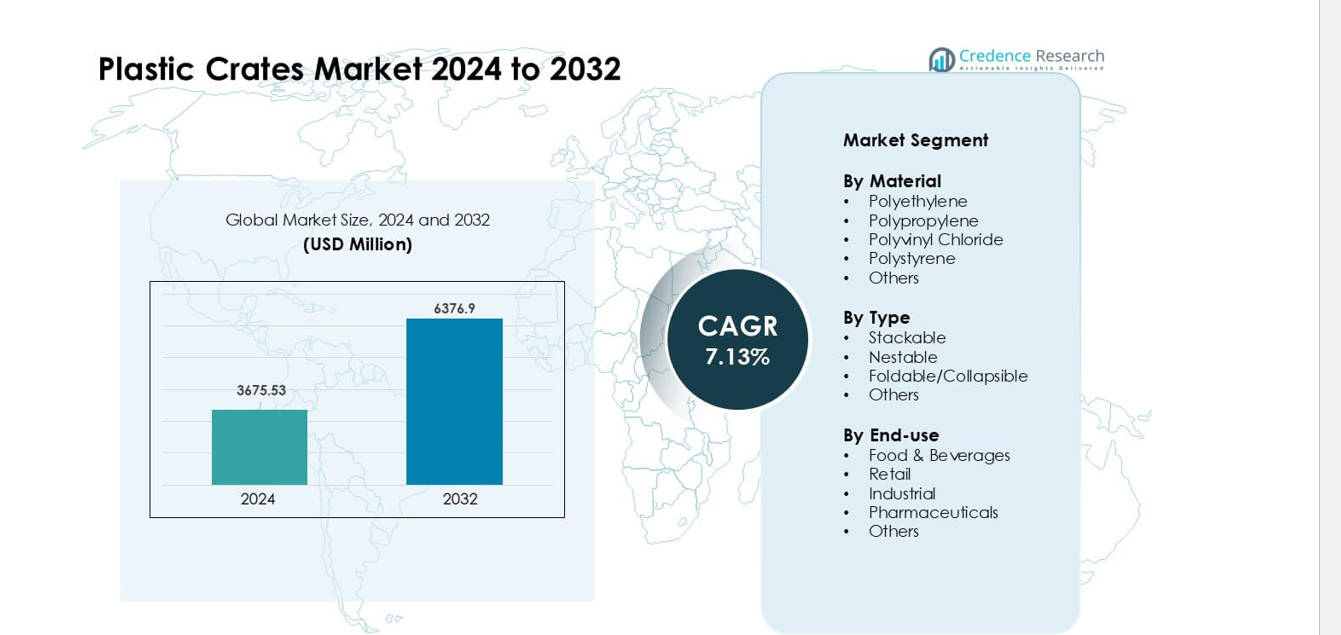

Plastic Crates Market was valued at USD 3675.53 million in 2024 and is anticipated to reach USD 6376.9 million by 2032, growing at a CAGR of 7.13 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Crates Market Size 2024 |

USD 3675.53 million |

| Plastic Crates Market, CAGR |

7.13% |

| Plastic Crates Market Size 2032 |

USD 6376.9 million |

The Plastic Crates Market is shaped by major players such as Schoeller Allibert, Brambles Limited, Monoflo International, Rehrig Pacific Company, ENKO Plastics, Gamma-Wopla, TranPak, RPP Containers, Ribawood, and Alfa Plastic Industry. These companies compete through durable crate designs, automation-ready formats, and growing use of recycled materials. Many suppliers also expand pooling and rental networks to support large retailers and food distributors. Asia Pacific emerged as the leading region in 2024 with about 36% share, supported by strong growth in food distribution, modern retail expansion, and rising adoption of reusable transport packaging across logistics networks.

Market Insights

- The Plastic Crates Market reached a strong valuation of USD 3675.53 million in 2024 and is projected to grow steadily by 9 million by 2032 at a healthy CAGR of 7.13%, supported by rising demand for reusable and durable transport packaging across industries.

- Growth is driven by rapid expansion in food distribution, modern retail, and e-commerce, where companies prefer long-life crates that reduce damage, support hygiene, and improve logistics efficiency.

- Key trends include higher use of recycled materials, adoption of automation-friendly crate designs, and rising integration of tracking features such as RFID for better crate circulation control.

- Competition intensifies as players like Schoeller Allibert, Brambles Limited, Monoflo International, and Rehrig Pacific improve material strength, lightweight engineering, and pooling services, while cost pressures and plastic waste concerns act as restraints.

- Asia Pacific held the largest regional share at about 36%, while food and beverages led end-use demand with roughly 39% share, supported by strong cold-chain and fresh food distribution growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Polyethylene led the material segment in 2024 with about 41% share. Buyers preferred polyethylene because this material offers strong durability, stress-crack resistance, and long life in cold-chain and warehouse use. Food and beverage brands adopted these crates to improve hygiene and reduce breakage during heavy handling. Polypropylene grew due to higher adoption in retail and pharma distribution, while PVC and polystyrene saw steady use in niche packaging tasks. Demand across all materials increased as companies replaced wood crates with reusable plastic systems to lower waste and reduce long-term costs.

- For instance, IFCO Systems a major supplier of reusable plastic trays reports that its polyethylene-based RPCs remain in circulation for more than 10 years before recycling, providing a long usable service life under repeated food-supply operations.

By Type

Stackable crates dominated the type segment in 2024 with nearly 44% share. Logistics firms favored stackable models because they save floor space, improve load stability, and support faster pallet movement. These crates performed well in long-haul transport, where higher stacking strength lowers damage risks. Nestable crates expanded due to rising back-haul efficiency needs, while foldable units gained traction in urban delivery. Each format benefited from growing warehouse automation, which pushed suppliers to design stronger, sensor-friendly crate structures that optimize movement through automated storage systems.

- For instance, global plastic-crate market analyses note that high-density polyethylene (HDPE) stackable crates are preferred in cold-chain shipments for their ability to handle frequent loading/unloading and resist deformation under heavy loads.

By End-use

Food and beverages held the leading end-use share in 2024 with about 39%. Producers used plastic crates to maintain hygiene, support cold-chain handling, and protect fresh produce during transit. Retailers increased demand for lightweight crates suited for fast shelf replenishment, while industrial buyers adopted heavy-duty options for assembly lines. Pharmaceutical use grew as firms sought contamination-free transport solutions. Rising e-commerce shipments and stronger focus on reusable transit packaging encouraged wider adoption across all end-use groups, strengthening demand for durable and washable crate systems.

Key Growth Drivers

Rising Demand for Reusable Transport Packaging

Growing focus on reusable logistics solutions drives strong adoption of plastic crates across supply chains. Many brands shift from wood and cardboard to reusable crates to cut waste, reduce long-term costs, and improve hygiene. Food and beverage suppliers favor these crates because they protect fresh produce and support cold-chain handling. Retailers boost use due to higher shelf-ready packaging needs linked to fast restocking cycles. Industrial users adopt heavy-duty crates for safer part movement. This broad push for reusable systems accelerates market growth and strengthens demand for strong, long-life crates.

- For instance, IFCO SYSTEMS a global provider of reusable plastic containers supplies its RPCs (Reusable Plastic Containers) to fresh-produce suppliers; these containers are used in cycles lasting more than 10 years before being recycled, which significantly reduces crate turnover compared with disposable packaging.

Rapid Expansion of E-commerce and Modern Retail

The rise of e-commerce increases the need for stable, lightweight, and stackable transport units. Fulfillment centers use plastic crates to reduce breakage and speed up order picking. Retail chains prefer them for quick shelf loading and better inventory flow. These crates also handle repeated movement through automated sorting lines, which reduces downtime. As quick-commerce and same-day delivery models grow, demand for robust and reusable crates increases. This shift helps cut packaging waste and supports smooth delivery operations, creating long-term growth for crate suppliers.

- For instance, a recent industry report highlights that the surge in e-commerce and online retail has been a major factor driving demand for plastic crates globally, as they offer better protection and handling for goods during multiple transport and storage cycles compared with traditional packaging.

Growth of Cold-Chain Distribution and Fresh Food Handling

Cold-chain networks expand due to rising demand for fresh produce, dairy, and meat. Plastic crates support this shift because they maintain strength at low temperatures and resist moisture. Food processors rely on them to protect products during storage and transport. Urban grocery chains use ventilated crates to keep produce fresh longer. Medical and pharmaceutical sectors also need clean and durable crates for sensitive items. Strong hygiene standards drive wider use of washable and disinfectant-safe crate designs. This trend supports continued market expansion across temperature-controlled supply chains.

Key Trends & Opportunities

Shift Toward Smart and Automated Material Handling

Automated warehouses need strong, sensor-friendly crates that move smoothly through conveyors and robotic systems. Manufacturers design crate bases and walls to match automation needs, which improves workflow and reduces operational delays. Smart tracking tools such as RFID and QR-coded crates gain traction as firms seek better asset visibility. These upgrades help reduce losses and optimize crate rotation cycles. The move toward digital inventory control and Industry 4.0 systems opens long-term opportunities for advanced crate formats tailored for automated facilities.

- For instance, a recent development by a packaging-logistics provider shows crates embedded with RFID and IoT sensors to track location and usage cycles in real time enabling firms to monitor crate flows automatically instead of relying on manual logging.

Rising Use of Sustainable and Recycled Plastics

More companies seek crates made with recycled resins to cut environmental impact. Brands and retailers push suppliers to increase recycled content while keeping strength and hygiene standards. Governments promote circular systems that support reuse and recycling of transport packaging. Material innovators develop tougher recycled blends that match virgin resin performance. This shift helps reduce carbon footprints and supports large-scale replacement of wood and single-use packaging. The trend opens a strong opportunity for suppliers offering eco-designed crate lines.

- For instance, in the European reusable-packaging sector, crates made with up to 100% recycled content are reportedly being used in closed-loop systems, then recycled again at end-of-life to produce new crates enabling full material reutilization.

Key Challenges

High Upfront Cost Compared to Single-Use Packaging

Plastic crates last long, yet many small buyers face higher upfront costs than cardboard or wood. This limits adoption among firms with tight budgets or low shipment volumes. Some users avoid reusable crates due to limited storage space and weak return logistics. Missing crate recovery systems lead to losses, which raise operating expenses. These factors slow expansion in cost-sensitive markets. Growth depends on better pooling networks, rental models, and shared logistics structures that reduce initial spending barriers.

Environmental Pressure on Plastic Use and Disposal

Plastic waste concerns push regulators to impose strict rules on material handling products. Some regions place limits on virgin resin use, which raises compliance pressure for crate suppliers. Poor recycling infrastructure in many countries increases end-of-life challenges. Buyers worry about waste management when crates break or lose usability. These issues force manufacturers to adopt cleaner materials, improve recycling programs, and redesign crates for longer life. Strong sustainability pressure shapes market strategies and increases the need for circular-ready crate systems.

Regional Analysis

North America

North America held about 28% share in 2024, driven by strong adoption of reusable transport packaging across food, beverage, and retail supply chains. Cold-chain expansion for fresh produce and dairy supported wider use of durable, stackable crates. Large retailers and e-commerce hubs preferred plastic crates to improve order handling speed and reduce product damage. Industrial users increased demand for heavy-duty designs suited for automated warehouses. Sustainability rules pushed companies to shift from wood to long-life plastic crates. These factors kept North America a steady and mature market with consistent replacement demand.

Europe

Europe accounted for nearly 31% share in 2024, supported by strict hygiene and sustainability standards across logistics networks. Food processors and grocery chains relied heavily on reusable crates to meet safety norms and reduce packaging waste. Strong recycling infrastructure helped suppliers scale recycled-content crates without losing strength or hygiene performance. Automotive and industrial sectors expanded demand for collapsible crates to optimize warehouse space. High adoption of RFID-enabled crate pooling systems improved asset tracking, which strengthened regional demand. Europe remained a leading innovator in reusable crate design and circular logistics practices.

Asia Pacific

Asia Pacific led the global market with about 36% share in 2024, driven by rapid growth in food distribution, modern retail, and e-commerce. Expanding cold-chain networks boosted demand for ventilated and insulated crates. Manufacturing hubs used sturdy reusable crates for part movement and export packaging. Population growth and rising urban consumption increased the need for high-volume transport systems. Many companies adopted plastic crates to replace wood in fresh produce handling. Growing investments in logistics automation and warehouse expansion kept Asia Pacific the fastest-growing region in the market.

Latin America

Latin America captured nearly 8% share in 2024, supported by increasing modernization of agriculture and food supply chains. Producers used plastic crates to reduce losses during fruit and vegetable transport. Retail consolidation boosted demand for stackable and nestable designs suited for centralized distribution centers. Economic growth in key countries encouraged manufacturers to adopt reusable solutions for industrial parts handling. Limited recycling infrastructure slowed uptake of recycled-content crates but created opportunities for rental and pooling models. The region showed steady growth as logistics networks became more organized.

Middle East & Africa

Middle East & Africa held about 7% share in 2024, with demand rising in food distribution, industrial logistics, and pharmaceuticals. Expanding cold-chain systems for fresh produce imports supported adoption of durable crates. Retail and wholesale markets used plastic crates to improve handling efficiency and reduce damage during transport. Industrial buyers relied on heavy-duty crates suited for high-temperature environments. Limited local manufacturing capacity led to increased imports, but new investments strengthened regional supply. Growth remained moderate, driven by gradual modernization of logistics and higher focus on reusable transport packaging.

Market Segmentations:

By Material

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Others

By Type

- Stackable

- Nestable

- Foldable/Collapsible

- Others

By End-use

- Food & Beverages

- Retail

- Industrial

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Plastic Crates Market features strong competition among global and regional players that focus on durability, design innovation, and reusable logistics solutions. Leading companies such as Schoeller Allibert, Brambles Limited, Monoflo International, Rehrig Pacific Company, ENKO Plastics, Gamma-Wopla, TranPak, RPP Containers, Ribawood, and Alfa Plastic Industry enhance their position by offering stackable, nestable, and collapsible crate systems tailored for food, retail, industrial, and pharmaceutical supply chains. Many firms invest in recycled-content materials and lightweight engineering to meet rising sustainability needs. Advanced molding processes, RFID integration, and automation-ready crate designs help players address modern warehouse demands. Partnerships with retailers and pooling providers strengthen long-term revenue through recurring crate circulation models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Gamma-Wopla nv (Belgium) Gamma-Wopla and sister firm Smart-Flow Europe showcased advanced reusable plastic load carriers, including stackable and nestable bins and other containers, and expanded their logistics hub by 40,000 m² to meet growing European demand for automated, returnable plastic packaging.

- In April 2025, Schoeller Allibert (Netherlands) Schoeller Allibert, in partnership with Tetra Pak, announced a new transport crate made from polyAl recycled from used beverage cartons, targeting replacement of over 50,000 crates at Tetra Pak’s Lund distribution center and positioning the crate as a circular, returnable logistics solution.

- In March 2025, Rehrig Pacific Company (U.S.) Rehrig Pacific promoted its reusable plastic containers for retail delivery, highlighting RPCs, bins, trays, and crates engineered to cut product damage, improve labor productivity, and support more sustainable e-commerce logistics.

Report Coverage

The research report offers an in-depth analysis based on Material, Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for reusable logistics packaging will rise as supply chains focus on waste reduction.

- Adoption of automation-ready crates will grow with the expansion of robotic warehouses.

- Recycled and bio-based materials will gain traction as sustainability rules tighten.

- Smart tracking tools such as RFID and QR coding will see wider use in crate pooling.

- Food and beverage distribution will remain the strongest end-use segment.

- Cold-chain growth will increase demand for ventilated and temperature-resistant crate designs.

- Retail and e-commerce networks will boost use of lightweight, stackable crate systems.

- Manufacturers will invest more in modular and collapsible crate formats for space savings.

- Regional players will expand production to cut import dependence and improve supply continuity.

- Circular logistics models will strengthen, pushing companies toward long-life and fully recyclable crate designs.