Market Overview

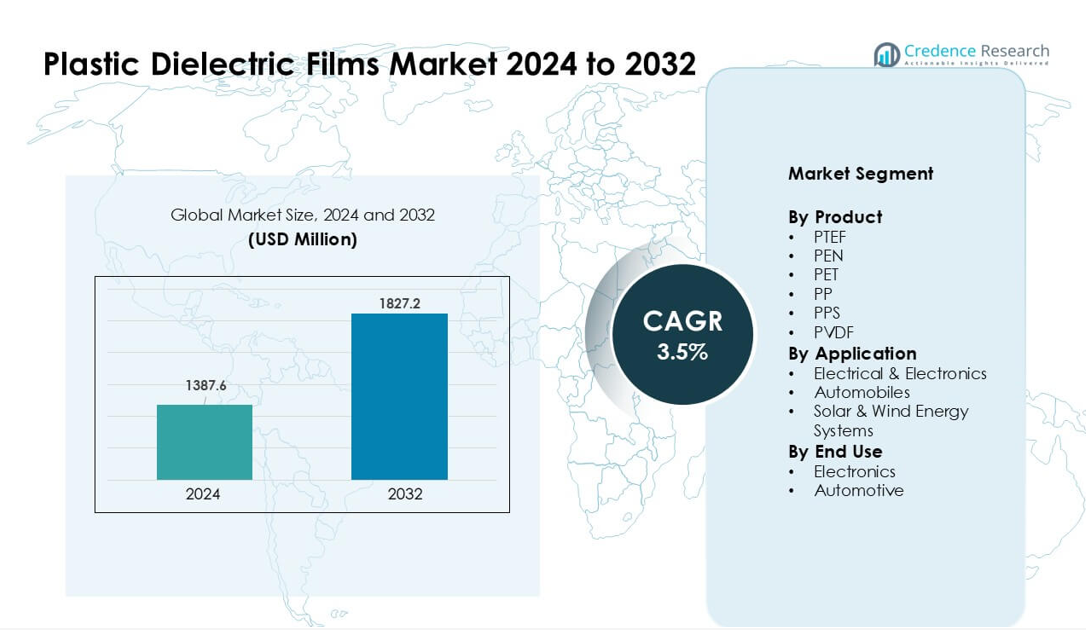

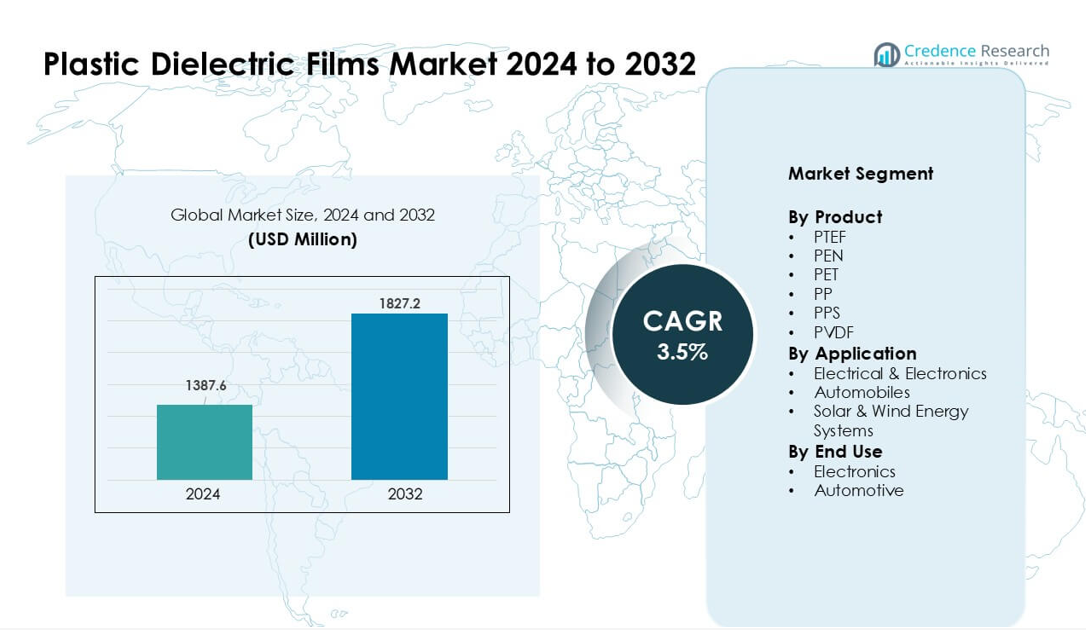

Plastic Dielectric Films Market was valued at USD 1387.6 million in 2024 and is anticipated to reach USD 1827.2 million by 2032, growing at a CAGR of 3.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Dielectric Films Market Size 2024 |

USD 1387.6 million |

| Plastic Dielectric Films Market , CAGR |

3.5% |

| Plastic Dielectric Films Market Size 2032 |

USD 1827.2 million |

The Plastic Dielectric Films Market is driven by key players such as Jindal Films, Bolloré Group, Ganapathy Industries, Mitsubishi Chemical Corp., COVEME S.p.A., Steiner GmbH & Co. KG, SABIC, Dupont Teijin Films U.S. Ltd. Partnership, Tervakoski Film, and Jindal Poly Films Ltd. These companies compete through advanced polymer engineering, strong dielectric performance, and expanded production capacity for power electronics, EV systems, and renewable energy applications. Asia Pacific remained the leading region in 2024 with about 39% share, supported by its strong electronics manufacturing base, rising EV output, and rapid growth in solar and wind installations.

Market Insights

- The Plastic Dielectric Films Market reached a strong valuation at USD 1387.6million in 2024 and is projected to grow steadily by USD 1827.2 million by 2032 at a healthy CAGR of 3.5%, supported by rising demand across electronics, automotive, and renewable systems.

- Demand rises due to strong use in capacitors, inverters, converters, and EV power units, with polypropylene films holding the largest share because of high dielectric strength and low loss.

- Trends highlight increased adoption of high-temperature PEN, PPS, and PVDF films, driven by compact electronics, renewable grids, and fast expansion of EV platforms worldwide.

- Competition remains intense among major players that focus on advanced polymer engineering; many expand capacity in Asia while offering specialty films for high-reliability industrial uses.

- Asia Pacific led the market with about 39% share, while North America and Europe followed; electrical and electronics applications held the largest segment share due to broad use in power management and energy-conversion systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

PP led the product segment in 2024 with about 38% share due to strong demand in capacitors and insulation systems. Polypropylene films offered high dielectric strength, low loss factors, and strong heat resistance, which supported wide use across consumer electronics and industrial equipment. PET and PEN films grew as device makers needed better thermal stability for compact circuit designs. PVDF and PPS films saw rising traction in high-performance batteries and electric vehicles. Market growth stayed steady as manufacturers adopted lightweight polymer films to improve energy efficiency and reduce system weight.

- For instance, recent research on Polyphenylene Sulfide (PPS) shows that PPS membranes with crystallinity above 60% exhibit lithium-ion diffusion coefficients in the order of 10⁻⁷ to 10⁻⁸ cm²/s, making them suitable for high-temperature, high-reliability battery separators in EV applications.

By Application

Electrical and electronics dominated this segment in 2024 with nearly 60% share, supported by wide use in power capacitors, inverters, converters, and EMI shielding. Growth came from rising output of consumer electronics and expansion of grid-linked renewable systems. Solar and wind energy systems also advanced because dielectric films improved stability in power electronics used in inverters and storage units. Automobiles gained momentum as EV platforms adopted thin dielectric films for battery insulation and onboard electronics. Demand increased as industries shifted toward compact, high-power architectures.

- For instance, film capacitors using polypropylene dielectric are commonly applied in AC motor-run capacitor units or switched-mode power supplies, where the low dissipation factor (as low as 0.5×10⁻⁴ at 1 kHz for PP films) ensures minimal energy loss and stable long-term reliability.

By End Use

Electronics held the dominant position in 2024 with about 57% share due to strong adoption in semiconductors, circuit protection devices, and power management units. Manufacturers preferred advanced dielectric films to improve thermal control and extend device life in high-density electronic assemblies. Automotive end use grew quickly as EVs required improved insulation, higher dielectric strength, and lightweight components to boost battery safety. The shift toward smart mobility and digital interiors pushed further consumption. Market expansion continued as end users sought materials that deliver stability under variable voltage loads.

Key Growth Drivers

High Demand from Power Electronics

Growth stays strong as power electronics makers expand use of plastic dielectric films in capacitors, inverters, and converters. Many systems need thin, stable, and heat-resistant films to support higher voltage levels and compact layouts. Renewable energy grids, EV chargers, and industrial drives use large volumes of polypropylene and PET films because these materials keep power losses low. Rising installation of solar inverters and wind turbine converters pushes higher demand across global markets. Many factories also modernize equipment to improve power efficiency. These conditions create steady, long-term growth for dielectric films used in high-load electrical systems.

- For instance, Schneider Electric is a major global player in industrial automation and energy management solutions that uses standard components like film capacitors in its products.

Rising Adoption in Electric Vehicles

Electric vehicles increase the need for films that support battery insulation, onboard electronics, and power control units. Many EV makers prefer polypropylene and PEN films due to strong dielectric strength and stable performance under heat. Higher EV sales raise consumption in battery modules, DC-DC converters, and traction inverters. Governments promote EV adoption with incentives, which lifts production volumes across Asia, Europe, and North America. Automakers also shift toward lighter components to improve range, which drives steady use of thin dielectric films. This trend keeps demand growing through large global EV supply chains.

- For instance, Polypropylene (PP) films, particularly biaxially oriented polypropylene (BOPP), are the standard material for commercial film capacitors due to their excellent dielectric properties, low cost, and high current handling capabilities. They are widely used in power electronics, including EV traction inverters.

Growth in Consumer and Industrial Electronics

Consumer gadgets, smart appliances, and industrial automation systems use dielectric films in many circuit elements. Many devices run at higher power densities, which increases the need for safe insulation and stable dielectric layers. PET and PPS films gain traction because these materials support miniaturized components without losing performance. Factories also expand use of electronic control systems for robotics and process automation, which lifts demand for long-life capacitors and protective layers. As electronics production grows across Asia, film suppliers scale capacity to meet regional demand. This broad and steady adoption strengthens market expansion.

Key Trends & Opportunities

Shift Toward High-Temperature and High-Voltage Films

A clear trend is the move toward materials that tolerate higher heat and stronger voltage loads. Designers need thin films that work well in compact, high-power devices. PPS, PVDF, and PEN films gain interest because these materials support new energy systems, EV batteries, and industrial drives. Many companies explore improved polymer blends for better aging resistance and stable dielectric behavior. This shift creates opportunities for suppliers that introduce advanced formulations for mission-critical circuits, renewable inverters, and aerospace power units.

- For instance, researchers developing a composite film of Poly(vinylidene fluoride) (PVDF) with a matrix polymer achieved a discharged energy density of 11.42 J/cm³ at 100 °C under an applied field of 425 MV/m alongside a high energy storage efficiency (≈ 75.8%).

Opportunities in Renewable Energy Expansion

Solar and wind installations grow each year, driving large demand for dielectric films used in inverters, grid-tie converters, and protection circuits. Many new renewable systems operate at higher voltage levels, which requires high-grade polypropylene and PET films. Countries invest in storage systems and microgrids, which need more capacitors and insulated components. This transition opens strong opportunities for suppliers able to deliver materials with long service life and low energy losses across outdoor or high-temperature settings. The shift to clean energy keeps creating new use cases for advanced dielectric polymers.

- For instance, WIMA polypropylene film capacitors used in wind turbine converters handle voltages up to 1,500 V DC and provide low dissipation factors (~0.5×10⁻⁴ at 1 kHz), ensuring minimal energy loss and high efficiency.

Key Challenges

Raw Material Price Volatility

Fluctuating costs of polypropylene, PET, and specialty polymers add pressure on producers. Many suppliers depend on petrochemical feedstocks, which face price swings linked to crude oil markets and supply disruptions. These changes weaken margins and affect long-term planning for manufacturers. Many companies try to reduce risk through supply contracts or by expanding recycled content, but quality limits often restrict such options. This volatility remains a major challenge for stable production and pricing.

Technical Limits in Extreme Conditions

Some dielectric films still face performance limits under high heat, strong voltage spikes, or severe mechanical stress. Many advanced devices need materials that maintain dielectric strength without degradation. In EVs, inverters, and heavy industrial drives, these limits can restrict design freedom. Producers invest in new polymers, but development cycles take time and require heavy testing. This challenge slows adoption of high-performance films in the most demanding systems and creates barriers for rapid scaling.

Regional Analysis

North America

North America held around 28% share in 2024, supported by strong demand from power electronics, electric vehicles, and industrial automation. The region benefits from steady upgrades in grid infrastructure and rising investment in renewable energy systems, which increases use of dielectric films in inverters and converters. EV adoption continues to rise across the United States and Canada, lifting material demand for battery insulation and onboard electronics. Many local manufacturers also expand use of advanced polymer films in aerospace and defense systems. This broad industrial base keeps North America a stable and well-established market.

Europe

Europe accounted for nearly 26% share in 2024, driven by strict energy-efficiency regulations and strong EV production across Germany, France, and the U.K. The region advances fast toward renewable energy targets, which raises use of dielectric films in wind turbines, solar inverters, and grid-tie converters. Electronics makers prefer high-performance PPS, PEN, and PVDF films due to strong heat tolerance required in compact circuit designs. Growth also comes from rising automation in industrial plants. Europe’s focus on clean technology and electric mobility continues to strengthen market demand.

Asia Pacific

Asia Pacific led the Plastic Dielectric Films Market in 2024 with about 39% share, driven by strong electronics manufacturing in China, South Korea, Japan, and emerging Southeast Asian hubs. Many global EV supply chains operate in this region, which increases demand for dielectric films used in batteries, power control units, and converters. Expanding solar and wind energy installations also boost consumption in high-voltage capacitors and inverter systems. Regional producers scale capacity quickly to meet growing domestic and export demand. This strong industrial ecosystem ensures rapid and sustained market expansion.

Latin America

4Latin America held roughly 4% share in 2024, supported by moderate growth in industrial automation, automotive electronics, and renewable projects. Brazil and Mexico lead demand due to rising production of electronic components and steady EV market penetration. Solar energy adoption grows across the region, improving the need for dielectric films used in inverters and power conditioning units. Although manufacturing capacity remains limited, imports from Asia and North America meet most demand. Market expansion stays gradual but steady as countries push for cleaner energy policies and modernization of industrial systems.

Middle East & Africa

Middle East & Africa captured about 3% share in 2024, driven by early-stage adoption of renewable energy and rising investment in power grid modernization. Countries in the Gulf expand solar installations, increasing the need for dielectric films in inverter and control systems. Industrial growth in the UAE, Saudi Arabia, and South Africa supports steady demand for electrical insulation materials. The region also sees rising interest in EV infrastructure, which will lift long-term consumption. Although adoption remains low compared with other regions, improving energy programs create emerging opportunities.

Market Segmentations:

By Product

By Application

- Electrical & Electronics

- Automobiles

- Solar & Wind Energy Systems

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Plastic Dielectric Films Market is shaped by major players such as Jindal Films, Bolloré Group, Ganapathy Industries, Mitsubishi Chemical Corp., COVEME S.p.A., Steiner GmbH & Co. KG, SABIC, Dupont Teijin Films U.S. Ltd. Partnership, Tervakoski Film, and Jindal Poly Films Ltd. These companies compete through advanced material engineering, improved dielectric strength, and high-temperature film solutions used in capacitors, EV power units, and renewable energy inverters. Many leading firms expand manufacturing in Asia to serve large electronics and automotive supply chains, while others strengthen their portfolios with specialty polymer blends for industrial sectors. Strategic partnerships with capacitor producers, inverter makers, and EV battery suppliers help secure long-term contracts. Sustainability also rises as a competitive lever, with manufacturers improving recyclability and reducing energy losses in next-generation dielectric materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jindal Films

- Bolloré Group

- Ganapathy Industries

- Mitsubishi Chemical Corp.

- COVEME S.p.A.

- Steiner GmbH & Co. KG

- SABIC

- Dupont Teijin Films U.S. Ltd. Partnership

- Tervakoski Film

- Jindal Poly Films Ltd.

Recent Developments

- In September 2025, Bolloré Group (Bolloré Innovative Thin Films / Bolloré ITF) Bolloré’s corporate reporting (H1-2025 results) and product pages highlight ongoing activity in ultra-thin dielectric films for capacitors and packaging; Bolloré ITF continues to position its Dielectric Films business (capacity / exports noted on the company site ~20,000 t/year production cited on the group/product pages). The group’s H1 2025 results were published 17 Sep 2025.

- In May 2025, Jindal (Jindal Poly / Jindal Films group) Jindal Poly Films announced the acquisition of Enerlite (a solar-encapsulation film manufacturer) to expand its solar/film capabilities; the deal was reported by industry press on 6 May 2025.

- In December 2024, Tervakoski Film: Introduced its ECU polypropylene capacitor film in a 2024 company bulletin, designed as a new-generation capacitor film with enhanced electrical endurance and stability for industrial and power-electronics application.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as power electronics adopt higher-voltage designs.

- EV expansion will lift use of advanced dielectric films in batteries and inverters.

- Renewable energy projects will increase film consumption in grid-connected systems.

- Miniaturized electronics will drive development of thinner, higher-stability films.

- Manufacturers will invest more in high-temperature and high-frequency materials.

- Sustainability goals will push adoption of recyclable and low-loss polymer films.

- Global suppliers will expand production capacity in Asia to meet rising demand.

- Automation and industrial modernization will support long-term capacitor usage.

- New polymer blends will address performance gaps in extreme-condition applications.

- Regional energy transitions will create new growth opportunities across emerging markets.