Market Overview

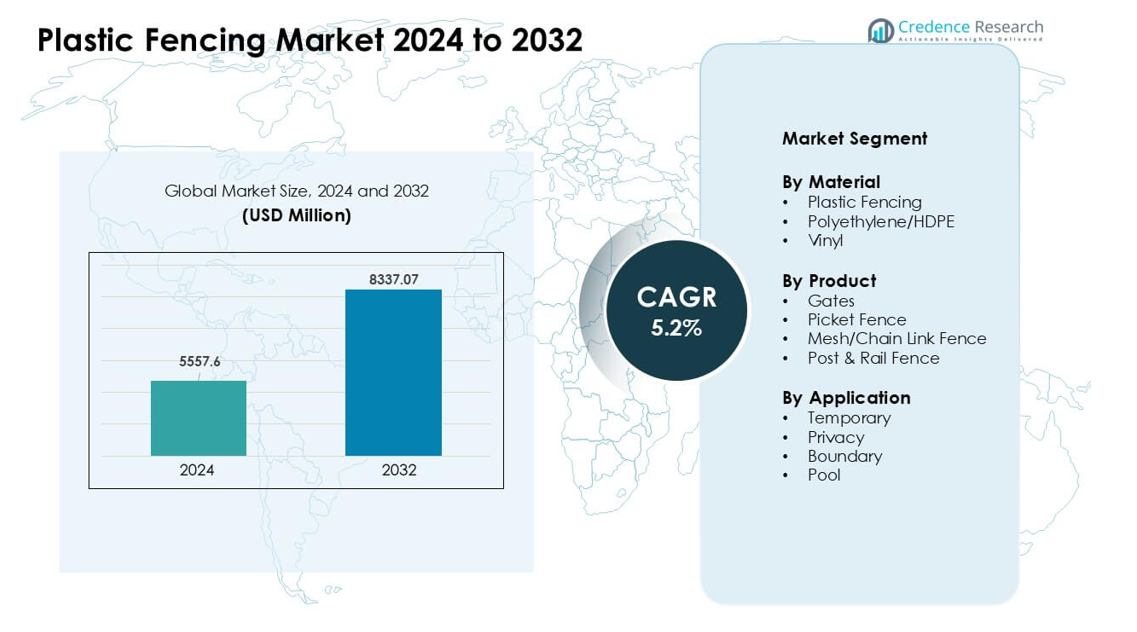

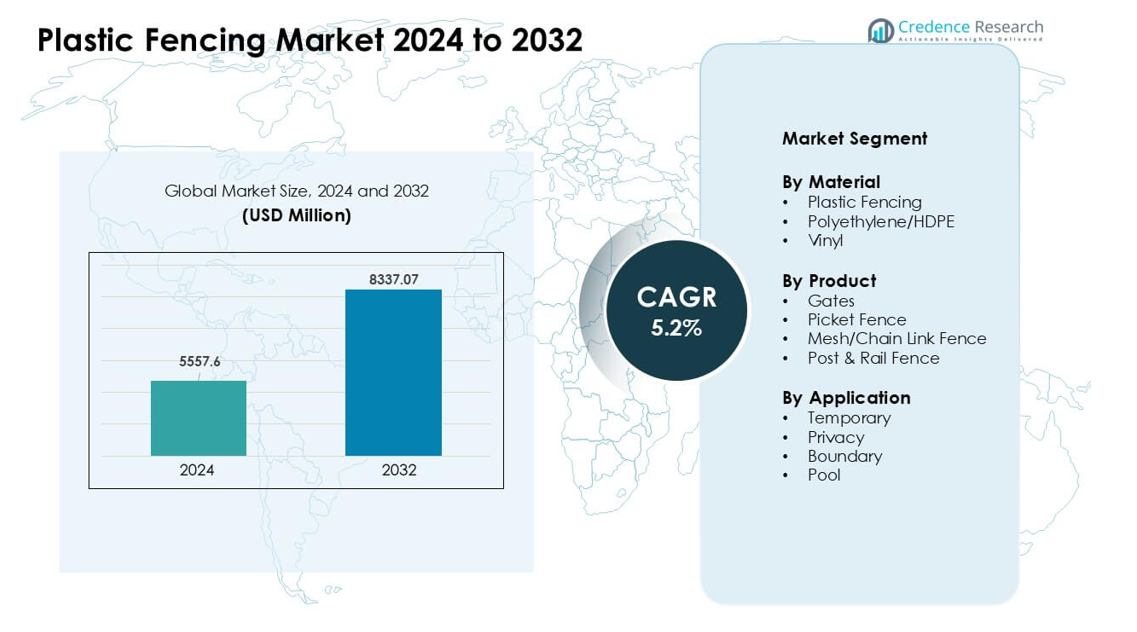

Plastic Fencing Market was valued at USD 5557.6 million in 2024 and is anticipated to reach USD 8337.07 million by 2032, growing at a CAGR of 5.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Fencing Market Size 2024 |

USD 5557.6 million |

| Plastic Fencing Market, CAGR |

5.2% |

| Plastic Fencing Market Size 2032 |

USD 8337.07 million |

The Plastic Fencing Market includes key players such as Tenax, Superior Plastic Products, Seven Trust, Barrette Outdoor Living, Veka AG, Durafence, Pexco, Planet Polynet, CertainTeed, and ITOCHU Corporation. These companies focus on durable vinyl and HDPE designs, wider color options, and modular systems that support fast installation. Many firms also invest in recycled materials to meet rising sustainability needs. North America led the market in 2024 with about 37% share, supported by strong home renovation activity, expanding housing projects, and high demand for low-maintenance outdoor structures.

Market Insights

- The Plastic Fencing Market reached USD 6 million in 2024 and is projected to hit USD 8337.07 million by 2032 at a CAGR of 5.2 %.

- Demand grew as vinyl held the largest segment share due to strong durability and low-maintenance needs across residential and commercial projects.

- Trends showed rising use of recycled materials, modular fencing kits, and expanding online sales channels that improved product reach and customization.

- Competition increased as Tenax, Superior Plastic Products, Seven Trust, Barrette Outdoor Living, Veka AG, Durafence, Pexco, Planet Polynet, CertainTeed, and ITOCHU Corporation focused on advanced designs and stronger dealer networks.

- North America led with about 37% share in 2024, supported by heavy renovation activity, while Asia Pacific showed fast growth and boundary fencing remained the dominant application segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Vinyl held the dominant share in 2024 with about 46% due to strong demand for durable and low-maintenance fencing. Vinyl products offered fade resistance and long service life, which supported higher adoption in residential and commercial projects. Polyethylene/HDPE followed due to rising use in flexible and impact-resistant structures. Broader acceptance of plastic fencing grew as buyers sought cost-effective options that resisted moisture and pests. Strong replacement demand and improved weather-proof designs also boosted interest in advanced material blends.

- For instance, Bufftech a major player in vinyl fencing offers vinyl privacy‑fence systems with a “ColorLast” fade‑resistant coating and steel‑reinforced rails that are engineered to withstand high wind loads, with panels that meet the strict wind‑load standard of up to 115 mph under Miami‑Dade County wind‑zone approval.

By Product

Picket fences led this segment in 2024 with nearly 38% share, driven by high use in residential yards and decorative boundary designs. Buyers preferred picket styles for clean looks and easy installation. Mesh/chain link fences grew with rising demand for lightweight and secure perimeter systems in schools, farms, and industrial sites. Gates and post & rail fences also advanced as modular systems expanded across landscaping and ranch applications. Improved UV resistance and color stability supported wider product adoption.

- For instance, Bufftech’s vinyl product catalog lists over a dozen distinct picket‑style railing and fence designs (with varying heights: 4 ft, 5 ft and 6 ft) using extruded vinyl pickets and steel‑reinforced rails providing homeowners with a robust picket‑fence solution without the maintenance burden of wood.

By Application

Boundary fencing held the leading share in 2024 at about 41% due to strong use across homes, commercial sites, and farms. Demand rose because boundary systems provided clear property separation with low upkeep needs. Privacy fencing expanded as urban housing density increased and homeowners sought better screening. Pool fencing showed steady growth with tighter safety rules on residential pools. Temporary fencing gained traction in events and construction due to light weight and quick setup. Enhanced strength and weather durability drove wider application adoption.

Key Growth Drivers

Rising Demand for Low-Maintenance Outdoor Structures

Homeowners and commercial users prefer fencing that needs little upkeep. Plastic fencing meets this need because the structure resists moisture, pests, and fading. Many buyers replace old wood systems with durable plastic designs that keep color and shape for many years. Outdoor renovation also increased as people spent more time at home, which raised interest in easy outdoor upgrades. Retailers expanded product ranges to meet this shift. Builders also favored plastic fencing because installation is fast and uniform. These factors pushed steady growth and strengthened demand across residential and light-commercial spaces.

- For instance, manufacturers of plastic fencing highlight that fences made from synthetic materials like PVC (or recycled plastic composites) require only occasional cleaning with soap and water unlike wood, which mandates periodic painting or sealing thereby drastically reducing maintenance workload for homeowners.

Growth in Housing Development and Urban Expansion

New housing projects created strong need for boundary and privacy fences. Developers used plastic options because they handled weather well and stayed stable in mixed climates. Urban areas saw rising plot divisions, which increased use of durable and low-cost fencing. Many city buyers wanted clean looks without repeated painting or repairs. Plastic designs matched these needs with long service life. Builders also preferred the lighter weight because shipment and setup became faster. These advantages increased plastic fencing use in both single-family units and large housing clusters. Strong construction activity kept the driver active.

- For instance, recent industry analysis notes that in large residential and commercial developments, plastic‑based fencing (PVC, HDPE, or composite) is favoured because its prefabricated, lightweight and easy‑install nature reduces labour and installation costs a benefit when deploying fencing en masse for multiple housing units.

Shift Toward Sustainable and Recyclable Materials

Producers developed recycled and blended plastic fencing to cut waste. Many buyers supported this shift because they valued long-life products with a smaller environmental load. New manufacturing lines used recovered plastic, which reduced raw-material needs. These products also kept strength and UV stability, making them suitable for wide use. Governments encouraged recycled-content goods in building projects, which helped demand. These steps made plastic fencing a strong option for users seeking value and sustainability. Better recycling systems and cleaner production boosted this growth path.

Key Trends & Opportunities

Rising Use of Modular and Customizable Designs

Producers launched modular fencing kits that reduced installation effort. Users liked systems that allowed height or color changes without full removal. Custom styles helped homeowners match yards and pool areas with simple additions. Builders used modular units to speed project timelines. These features improved the buying experience and encouraged repeat orders. Retail channels saw higher demand for ready-to-assemble designs. This trend increased product visibility across both online and offline stores. Broader customization choices will likely support stronger market expansion.

- For instance, modular fencing systems such as those from Greenwood Fence use standardized 4″×4″ chambered aluminum posts (with 1/8″ wall thickness, 12‑foot posts) that support fence heights up to 8 feet enabling homeowners or developers to choose between full-privacy, semi-private, or decorative configurations depending on their needs.

Expansion of Digital Retail and Direct-to-Consumer Sales

More buyers turned to online platforms to compare styles, colors, and panel sizes. Digital tools helped users estimate fence lengths and choose matching accessories. This improved confidence and drove online sales. Producers offered direct shipping, which reduced middle-layer costs. Reviews and real-use images also supported faster decisions. These shifts widened access to plastic fencing in new regions. The trend is expected to continue as logistics networks improve and digital catalogs expand.

- For instance, according to a recent industry review of distribution channels, direct‑to‑consumer (DTC) and online sales channels now account for a substantial share of plastic‑fencing market revenues globally with many contractors, developers, and individual buyers sourcing fencing directly via manufacturer websites or e‑commerce platforms rather than through traditional retail intermediaries.

Key Challenges

Fluctuating Raw-Material Prices

Plastic fencing depends on stable polymer supply. Price swings in PVC or HDPE raise production costs and limit planning for producers. When raw-material prices rise, fencing becomes less attractive compared with wood or metal alternatives. Makers must adjust product lines or reduce margins to stay competitive. Sudden shortages also delay shipments and weaken retailer stock levels. This challenge slows growth and creates pressure on manufacturers to secure long-term contracts or expand recycled-content use.

Perception Gaps Compared with Traditional Materials

Some buyers still see plastic fencing as less strong than wood or metal. This perception slows adoption in regions with high wind loads or strict building codes. Users may also hesitate because plastic panels can fade if lower-grade material is used. This forces producers to invest in education and quality upgrades. Strong branding and warranty programs help, but concerns remain in certain markets. These perception gaps keep growth uneven and limit use in heavy-duty projects.

Regional Analysis

North America

North America led the Plastic Fencing Market in 2024 with about 37% share. Strong residential renovation activity and high demand for low-maintenance fencing supported steady growth. Homeowners preferred vinyl and HDPE systems because these materials resisted moisture, pests, and color loss. Commercial sites also adopted plastic fencing for boundary and privacy needs. Retail expansion across home-improvement chains improved product access. Builders valued fast installation and long service life, which boosted adoption in new housing projects. Strong replacement demand and wider availability of recycled-content products continued to reinforce the region’s leading position.

Europe

Europe held nearly 28% share in 2024, driven by strict building rules and rising interest in sustainable materials. Many users selected vinyl and HDPE fencing because the designs offered clean looks and long outdoor durability. Adoption increased in residential yards, garden areas, and pool sites. Western Europe drove most sales due to active home-upgrade cycles and wider retail access. Demand for recycled plastic fencing also grew as producers aligned with green policies. Cold-climate resistance and low upkeep needs further supported adoption. These factors kept Europe one of the strongest regional markets.

Asia Pacific

Asia Pacific accounted for about 25% share in 2024 and showed rapid expansion. Urban growth, rising housing construction, and higher disposable incomes supported broader use of plastic fencing. Many buyers valued the low upkeep and long service life compared with wood. Developers used plastic options in boundary and privacy projects across new housing clusters. Wider adoption in pool areas and community spaces also strengthened demand. Growing e-commerce access improved product visibility across China, India, and Southeast Asia. These conditions positioned the region as a major future growth driver.

Latin America

Latin America captured roughly 6% share in 2024, supported by rising adoption in residential and small commercial sites. Users favored plastic fences because they resisted moisture and insects, which are common issues in humid regions. Urban housing development in Brazil, Mexico, and Colombia increased demand for boundary and privacy fencing. Retail channels expanded product ranges, helping buyers compare color and style options. Builders chose plastic systems for faster setup and reduced maintenance needs. Economic shifts limited some investment, but long-term interest in cost-efficient fencing kept the region on a gradual growth path.

Middle East & Africa

The Middle East & Africa region held around 4% share in 2024, driven by selective use in residential compounds, schools, and recreational sites. Hot-climate durability and UV resistance made plastic fencing a practical choice for many outdoor spaces. Buyers valued reduced maintenance costs in areas with high heat and sand exposure. Expanding construction activity in Gulf countries supported moderate demand. Adoption in Africa grew slower due to price sensitivity and limited retail access. Still, interest in long-life fencing and improved supply networks is expected to create steady growth opportunities over time.

Market Segmentations:

By Material

- Plastic Fencing

- Polyethylene/HDPE

- Vinyl

By Product

- Gates

- Picket Fence

- Mesh/Chain Link Fence

- Post & Rail Fence

By Application

- Temporary

- Privacy

- Boundary

- Pool

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Plastic Fencing Market features companies such as Tenax, Superior Plastic Products, Seven Trust, Barrette Outdoor Living, Veka AG, Durafence, Pexco, Planet Polynet, CertainTeed, and ITOCHU Corporation. These firms compete by offering durable, low-maintenance vinyl and HDPE systems that meet residential, commercial, and recreational needs. Many producers focus on expanding modular and customizable designs to match landscaping and boundary applications. Investments in UV-resistant materials, recycled plastic blends, and improved color stability enhance product value. Several players also strengthen digital retail and dealer networks to improve reach in fast-growing regions. Strategic partnerships, capacity upgrades, and new style launches support ongoing market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Pexco LLC acquired K. Jabat Inc. to expand custom plastic extrusions. The added capacity supports construction and outdoor profiles, including components used in plastic fencing.

- In February 2024, Barrette Outdoor Living: launched EncloSure™, a DIY-friendly aluminum screen-enclosure solution, and announced updates to select RDI railings (company newsroom release). (This is the company’s recent product launch activity tied to outdoor living / fencing & railing portfolio).

- In February 2024, Planet Polynet released an updated corporate brochure on polymer mesh and fencing nets. The catalog highlights mesh net fencing, HDPE fencing nets, and windbreak nets for construction and landscaping projects.

Report Coverage

The research report offers an in-depth analysis based on Material, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for vinyl and HDPE fencing due to long service life.

- Recycled and eco-friendly materials will gain stronger adoption in new product lines.

- Urban housing growth will create higher need for boundary and privacy fencing.

- Modular and customizable fence systems will expand as users seek flexible designs.

- Digital retail channels will drive faster product selection and wider regional reach.

- Producers will invest in UV-resistant and impact-resistant formulations for harsh climates.

- Commercial and institutional sites will increase use of plastic fencing for low-maintenance needs.

- Supply chains will improve as manufacturers add new production units in growth regions.

- Partnerships with builders and landscaping firms will support steady long-term adoption.

- Asia Pacific will emerge as a major growth hub due to expanding residential construction.