Market Overview

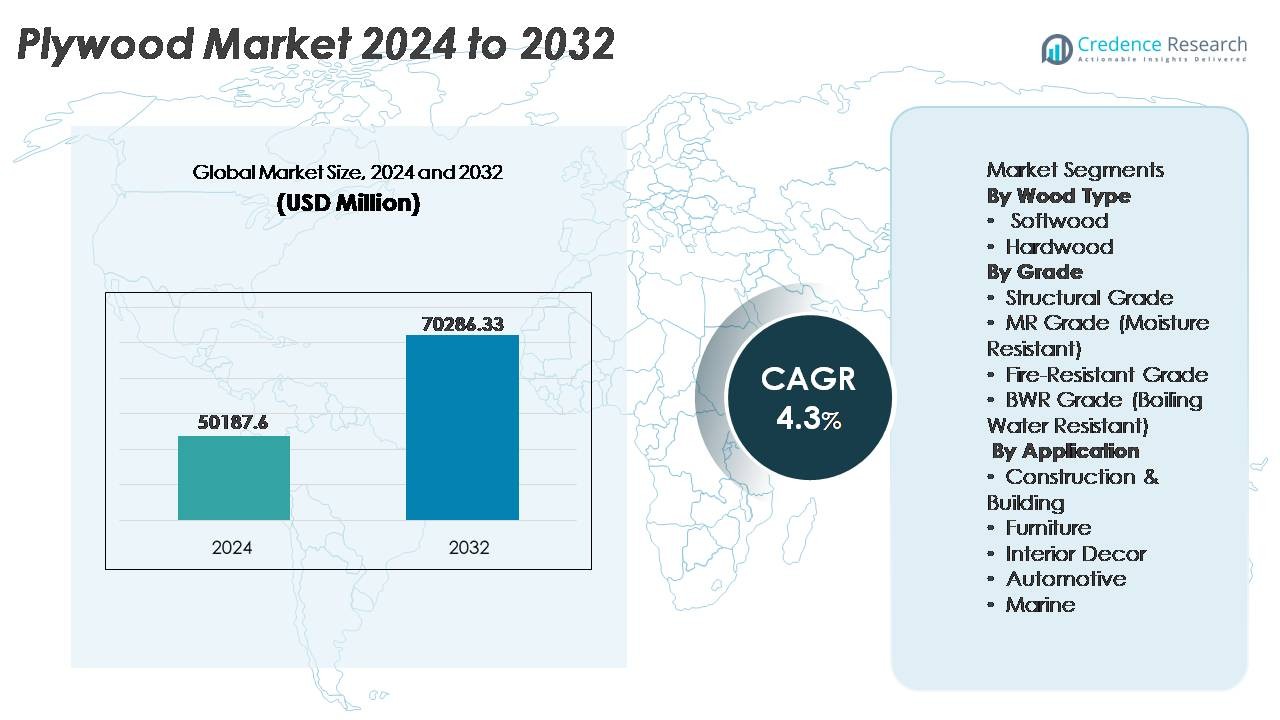

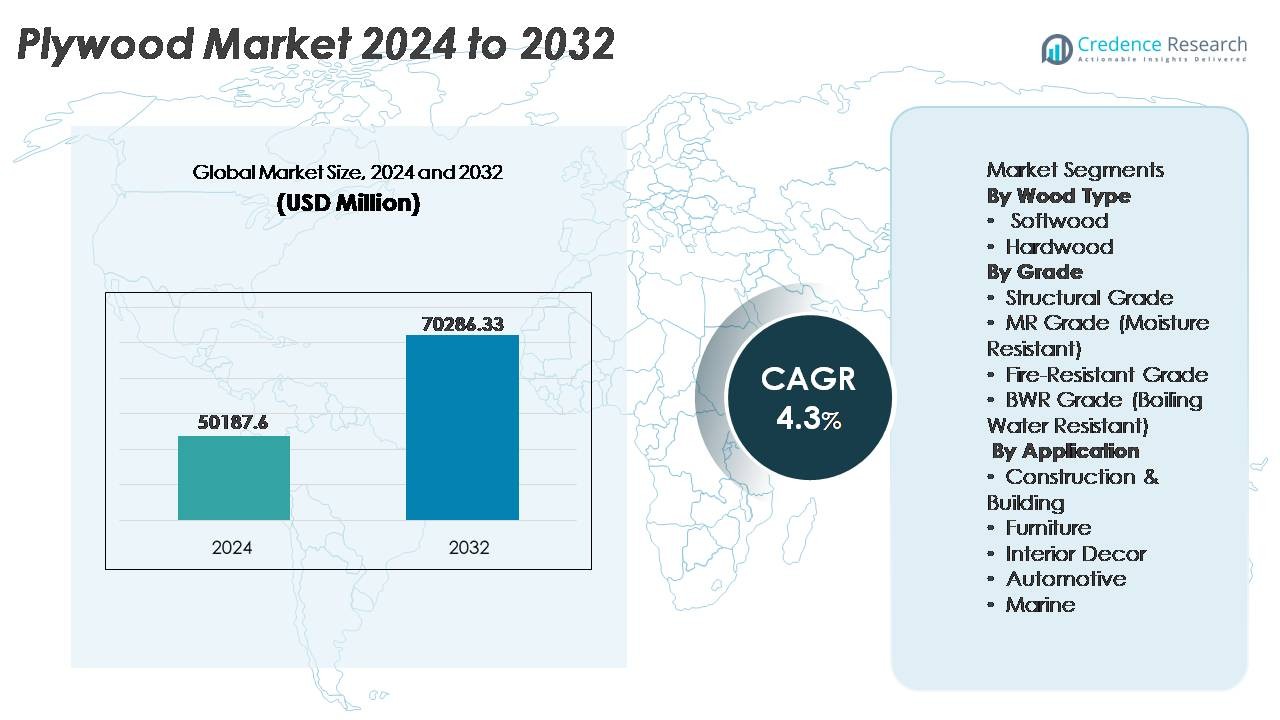

The global plywood market was valued at USD 50,187.6 million in 2024 and is projected to reach USD 70,286.33 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plywood Market Size 2024 |

USD 50,187.6 Million |

| Plywood Market, CAGR |

4.3% |

| Plywood Market Size 2032 |

USD 70,286.33 Million |

The global plywood market features prominent players such as Columbia Forest Products, Martco LLC (RoyOMartin), West Fraser Timber Co. Ltd., Georgia-Pacific LLC, Louisiana-Pacific Corporation (LP), PotlatchDeltic Corporation, Roseburg Forest Products, Boise Cascade Company, Weyerhaeuser Company, and UFP Industries, Inc. These companies compete through integrated forestry operations, capacity expansion, and advancement in engineered and specialty plywood. Asia-Pacific leads the market with more than 50% share, driven by large-scale construction and furniture manufacturing, followed by North America holding around 18-20% due to demand for premium certified plywood and sustainable wood products in residential, commercial, and modular building applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global plywood market was valued at USD 50,187.6 million in 2024 and is projected to reach USD 70,286.33 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Demand is driven by rising construction activity, expanding modular furniture production, and increased adoption of engineered and water-resistant grades, particularly BWR plywood, which holds the largest grade-based share due to its suitability for kitchens, offices, and high-humidity environments.

- Market trends include a shift toward certified sustainable wood products, lightweight calibrated sheets for automated cutting, and fire-rated plywood for commercial real estate and public infrastructure developments.

- Competitive activity centers on capacity upgrades, forest resource integration, and product differentiation, with major players enhancing portfolios through specialty plywood variants, environmentally friendly adhesive systems, and export-focused distribution networks.

- Asia-Pacific accounts for over 50% of global share, followed by North America with 18-20%, supported by premium décor demand, while the furniture application segment remains the leading consumer due to design flexibility and lifecycle benefits.

Market Segmentation Analysis:

By Wood Type

Hardwood plywood holds the dominant share in the market, accounting for the majority of global consumption due to its superior strength, durability, and aesthetic grain patterns ideal for premium furniture and architectural woodwork. Hardwood variants such as oak, birch, teak, and maple offer better screw-holding capacity and resistance to impact, making them preferred for structural interiors and high-traffic residential and commercial installations. Softwood plywood, while cost-efficient, caters mainly to temporary structures and utility applications; however, hardwood maintains leadership driven by rising interior renovation trends and demand for long-life, premium-grade wooden surfaces.

- For instance, Columbia Forest Products’ PureBond® hardwood plywood has surpassed more than 100 million panels produced since its introduction, manufactured using formaldehyde-free resin technology derived from soy-based adhesives, demonstrating both durability performance and environmentally safe bonding innovation across hardwood applications.

By Grade

BWR (Boiling Water Resistant) Grade leads the plywood segment with a considerable market share, supported by its water-resistant bonding that makes it suitable for kitchens, semi-outdoor wooden structures, and high-humidity environments. BWR plywood withstands fluctuating moisture and temperature, extending product life and reducing repair frequency, which appeals strongly to residential and commercial builders. Structural Grade plywood remains essential for load-bearing applications, while MR Grade continues to be adopted for indoor, low-moisture usage. Fire-Resistant plywood is witnessing increased uptake in public infrastructure and hospitality, yet BWR Grade sustains dominance due to its broad, cost-effective functional versatility.

- For instance, Georgia-Pacific’s DryGuard® enhanced sub-floor panels are engineered with advanced moisture resistance and backed by a 200-day “no-sand” warranty covering edge swell during construction, while LP® FlameBlock® panels meet ASTM E119 requirements as a component in UL-Listed assemblies, providing a 1-hour fire-resistance rating in specific wall and floor systems used in multifamily and commercial projects.

By Application

Construction and Building represent the dominant application segment, capturing the largest share of plywood usage due to extensive dependence in roofing, sub-flooring, walls, formwork, and modular construction components. The segment benefits from expanding real estate development, urban housing, and infrastructure upgrades in emerging markets. Furniture manufacturing remains a fast-growing use case, fueled by demand for lightweight engineered panels and modular, ready-to-assemble products. Interior décor applications gain traction through rising customization trends, while automotive and marine sectors adopt specialized plywood for lightweight framing and moisture-resistant bodywork, yet Construction retains leadership due to its sheer volume of structural demand.

Key Growth Drivers

Expansion of Residential and Commercial Construction

The plywood market’s growth is heavily linked to the global expansion of residential housing and commercial infrastructure. Urbanization drives new construction activity, including apartments, retail units, educational facilities, and healthcare institutions. Plywood’s versatility across subflooring, roofing, wall bracing, and décor applications reinforces its relevance in modern building systems. The preference for lightweight engineered materials supports plywood adoption in modular construction and prefabricated structures. Increasing renovation and remodeling expenditures further propel plywood usage for interior paneling, cabinetry, and flooring replacement. Moreover, supportive government policies, housing subsidies, and infrastructure revitalization initiatives in developing nations amplify demand, making construction expansion a fundamental growth catalyst.

- For instance, Louisiana-Pacific Corporation upgraded its Houlton, Maine line to manufacture LP® SmartSide® siding and trim, enabling annual output of approximately 220 million square feet of engineered siding panels.

Rising Adoption of Engineered and Value-Added Wood Products

The demand for engineered wood products including laminated, film-faced, calibrated, and fire-rated plywood is increasing as manufacturers enhance durability, moisture resistance, fire performance, and finish compatibility. Industries such as hospitality, retail, office, and residential development are shifting toward value-added plywood to reduce lifecycle maintenance. Precision-calibrated sheets enable CNC machining and standardized modular assembly, improving design precision for mass-produced furniture and interior solutions. Additionally, the integration of enhanced adhesives and surface coatings creates plywood variants supporting sustainable and luxury décor applications. As end-users prioritize longer product life and design flexibility, engineered plywood emerges as a critical driver of market advancement.

· For instance, Greenpanel Industries operates MDF and plywood facilities with a current annual MDF capacity of 891,000 cubic meters and offers various products including moisture-resistant and high-density boards.

Growth in Furniture and Interior Décor Manufacturing

The rise of modern living standards and lifestyle-upgrade consumption accelerates demand for plywood within furniture and décor manufacturing. The shift toward modular kitchens, walk-in wardrobes, office workstations, and multifunctional living spaces fuels plywood needs due to its machinability, uniform thickness, and compatibility with laminates and veneers. E-commerce-driven ready-to-assemble furniture increases mass production and global distribution of plywood-based products. Interior themes emphasizing natural textures and wood aesthetics further strengthen consumption of premium-grade plywood. The strong influence of real estate turnover, short-term rental properties, and smart-home furnishings sustains growth, positioning the furniture sector as a long-term plywood demand engine.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Certified Wood Products

Sustainability influences procurement choices as consumers, developers, and governments prefer products sourced responsibly and produced with low-emission adhesives. Growing certification adoption (such as FSC and PEFC) builds market credibility for environmentally compliant plywood. Manufacturers are innovating with low-VOC resins, recycled wood content, and alternative fibers. Green infrastructure initiatives, sustainable building codes, and carbon footprint disclosure policies promote certified plywood. This trend unlocks opportunities for transparent supply chains, bio-based chemical usage, reusable packaging optimization, and export penetration in regions enforcing strict environmental regulations. Eco-friendly plywood transitions from niche to mainstream, reshaping production dynamics.

- For instance, Weyerhaeuser manages more than 12 million acres of timberlands in the United States and Canada under Sustainable Forestry Initiative® certification, ensuring traceable and responsibly harvested wood inputs.

Growth of Specialty Plywood for High-Value Industrial Uses

Specialty plywood variants engineered for fire resistance, impact strength, waterproofing, and chemical stability create opportunities in maritime, automotive body-building, cold storage, and container flooring markets. Infrastructure projects in metro rail, transportation terminals, and public utilities require high-specification plywood conforming to safety and performance standards. The rising need for moisture-stable materials in coastal regions and industrial corridors drives investment in BWR, marine-grade, and laminated plywood. Manufacturers offering customization, sheet tolerances, digital cutting compatibility, and specialized surface treatments gain first-mover advantage. The evolution of plywood from commodity to performance-engineered material opens higher-margin revenue segments globally.

- For instance, Viance, LLC, licenses independent facilities to manufacture fire-rated plywood panels treated with its proprietary D-Blaze®fire-retardant chemicals, which achieve performance standards in accordance with ASTM E84 (Class A/Class 1 with an FR-S rating) and are used in assemblies that meet ASTM E119 testing protocols for fire endurance.

Key Challenges

Raw Material Availability and Pricing Volatility

Fluctuations in timber availability and rising log prices pose persistent challenges for plywood manufacturers. Deforestation controls, export restrictions, and forest degradation limit supply, especially in countries dependent on imported hardwood. Transportation costs, labor shortages, and resin price inflation further escalate manufacturing expenses. Small and mid-scale producers struggle to compete with integrated players sourcing certified plantations. Inventory management risks arise from seasonal timber harvesting cycles. Without consistent raw material pipelines and sustainable forestry solutions, the sector faces margin pressure, production delays, and limited capacity expansion, impacting the long-term cost competitiveness of plywood products.

Competition from Substitute Materials

Engineered substitutes such as medium-density fiberboard (MDF), high-density fiberboard (HDF), PVC foam boards, aluminum composite panels, and plastic laminates challenge plywood consumption, particularly in cabinet making, interior partitions, and décor panels. These alternatives offer advantages such as lower cost, smoother finish for painting, and resistance to termite and warping issues. In markets where price sensitivity is high, substitutes disrupt demand for traditional plywood. Advancements in polymer composites and hybrid boards intensify this competition. Manufacturers must differentiate through durability, sustainability, lifecycle value, and advanced engineering to retain market relevance against fast-growing replacement materials.

Regional Analysis

Asia-Pacific

Asia-Pacific dominates the global plywood market with over 50% market share, driven by rapid urban infrastructure expansion, population growth, and large-scale residential housing construction in China, India, Indonesia, and Vietnam. The region benefits from abundant raw material availability, cost-efficient labor, and strong manufacturing clusters that support both domestic consumption and export shipments. Rising disposable incomes, modernization of living spaces, growth of modular furniture, and increasing commercial real estate investment further enhance plywood demand. Government initiatives promoting affordable housing and public infrastructure amplify volume consumption, positioning Asia-Pacific as the primary growth engine for the plywood industry.

North America

North America holds around 18-20% market share, supported by stable demand from home renovation, revitalization of multi-family housing, and expanding wood-based modular construction. The region’s furniture and interior décor industries remain strong users of hardwood plywood, particularly in the U.S. Growth in green-certified and low-emission engineered plywood accelerates adoption among residential builders adhering to environmental compliance standards. Improved mortgage availability and rising investment in premium kitchen and cabinetry solutions also foster plywood usage. Despite competition from MDF and composite boards, North America maintains consistent demand through premium architectural, commercial, and luxury timber interior applications.

Europe

Europe accounts for approximately 15% of the plywood market, with demand concentrated in Germany, the U.K., France, and Poland. The region emphasizes stringent sustainability standards, pushing the adoption of certified plywood sourced from responsibly managed forests. Growth in remodeling, eco-conscious interiors, and energy-efficient construction drives plywood consumption within the residential and commercial segments. European furniture manufacturing remains a major end-user, particularly in Scandinavia and Eastern Europe, where engineered wooden products lead production. While economic fluctuations moderately affect construction cycles, Europe’s focus on quality, fire performance, and low-carbon materials ensures steady plywood demand across specialty and structural categories.

Latin America

Latin America captures approximately 8% market share, with Brazil and Chile leading production and export due to extensive forestry resources and established plywood manufacturing bases. Construction expansion associated with urbanization, retail infrastructure, tourism facilities, and low-cost housing programs contributes to plywood consumption. The region demonstrates rising interest in engineered and moisture-resistant plywood for kitchens, cabinetry, and industrial use in coastal environments. However, economic instability and currency volatility impact import affordability and supply chain investments. Nonetheless, forestry sustainability programs and export-focused manufacturing strengthen the region’s long-term position in the global plywood industry.

Middle East & Africa

Middle East & Africa represent around 6-7% market share, driven by commercial real estate development, hospitality expansion, and modern housing projects in the UAE, Saudi Arabia, and South Africa. The region heavily relies on plywood imports due to limited domestic timber availability, creating opportunities for global suppliers. Demand remains strong for BWR, construction formwork, and decorative plywood for high-end interior projects. Infrastructure mega-projects, retail complexes, and entertainment hubs increase consumption, whereas pricing sensitivity and supply chain dependencies pose challenges. Nonetheless, continued government investment in non-oil infrastructure sustains demand momentum for plywood applications.

Market Segmentations:

By Wood Type

By Grade

- Structural Grade

- MR Grade (Moisture Resistant)

- Fire-Resistant Grade

- BWR Grade (Boiling Water Resistant)

By Application

- Construction & Building

- Furniture

- Interior Decor

- Automotive

- Marine

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The plywood market is moderately fragmented, with a mix of large-scale integrated manufacturers, regional mills, and specialized engineered wood producers competing across price, product quality, and distribution capabilities. Key players focus on expanding production capacity, securing certified raw material sources, and enhancing product portfolios with fire-resistant, water-resistant, and calibrated precision plywood to meet application-specific demand. Strategic partnerships, export penetration, and technology-led manufacturing improvements—such as automated pressing, moisture monitoring, and resin optimization—strengthen competitiveness. Companies with sustainable forestry programs and environmental certifications gain preference in regulated markets. Meanwhile, smaller producers compete on cost efficiency and localized supply but face challenges from fluctuating timber prices and compliance requirements. Growing emphasis on branded plywood, standardized dimensions, and value-added surface finishes also intensifies differentiation. As construction, modular furniture, and interior décor businesses scale, competition continues to favor manufacturers offering consistent quality, timely delivery, and diversified performance-engineered plywood solutions aligned with evolving building standards globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, West Fraser Timber Co. Ltd. announced indefinite curtailment of its High Level, Alberta OSB mill (spring 2026 wind-down) and continuation of a previous 2023–2024 production line idling at Cordele, Georgia — reflecting weakening demand for OSB.

- In October 2025, West Fraser Timber Co. Ltd. released Q3-2025 results, citing tough market conditions amid high mortgage rates and tariff pressures that impacted earnings across lumber and engineered wood segments.

- In September 2022, Potlatch Deltic Corporation, a major integrated timber REIT was formed as a result of the previously disclosed merger between PotlatchDeltic Corporation and CatchMark Timber Trust, Inc. in an all-stock deal.

Report Coverage

The research report offers an in-depth analysis based on Wood type, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Plywood demand will continue rising with sustained growth in residential and commercial construction activities worldwide.

- Adoption of engineered, fire-rated, and water-resistant plywood will accelerate as building safety compliance strengthens.

- Modular furniture manufacturing is expected to drive higher consumption of calibrated and CNC-compatible plywood panels.

- Sustainable and certified plywood will gain preference as environmental regulations and green building standards expand.

- Technological enhancement in pressing, drying, and adhesive systems will improve durability and production efficiency.

- Export opportunities will increase for manufacturers offering performance-grade plywood for marine, infrastructure, and industrial uses.

- Digital supply chain tracking will support transparency in sourcing and improve global trade acceptance.

- Specialty plywood variants tailored for coastal, high-moisture, or seismic zones will create niche revenue segments.

- Competition from MDF and composite boards will encourage manufacturers to differentiate through innovation and branding.

- Strategic capacity expansion and backward integration into plantation resources will shape competitive positioning globally.