| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polishing Grade Alumina Market Size 2024 |

USD 3689.7 Million |

| Polishing Grade Alumina Market, CAGR |

5.42% |

| Polishing Grade Alumina Market Size 2032 |

USD 5628.27 Million |

Market Overview:

The Polishing Grade Alumina Market is projected to grow from USD 3689.7 million in 2024 to an estimated USD 5628.27 million by 2032, with a compound annual growth rate (CAGR) of 5.42% from 2024 to 2032.

The growth of the polishing grade alumina market is primarily driven by the increasing demand for high-quality polishing materials across various industries. In sectors such as automotive, electronics, and optics, there is a constant need for superior surface finishes, and polishing grade alumina, known for its hardness and resistance to abrasion, meets these requirements effectively. The automotive industry, in particular, has driven market growth as manufacturers seek enhanced aesthetic and performance standards for vehicle components. Similarly, the expansion of the electronics industry, with its growing need for precise polishing of semiconductor wafers and components, has further fueled demand. Moreover, the market benefits from the increasing shift toward eco-friendly materials. Polishing grade alumina is non-toxic and recyclable, aligning with the sustainability goals of modern industries and driving its adoption as a preferred polishing agent.

The polishing grade alumina market exhibits varied dynamics across regions, with the Asia-Pacific region leading in market share. In 2023, the Asia-Pacific region accounted for approximately 40% of global revenue, driven by rapid industrialization, particularly in China and India. The automotive, electronics, and manufacturing sectors in these countries continue to increase demand for polishing materials, propelling regional market growth. North America follows closely behind, with significant contributions from the United States and Canada, where the automotive and electronics industries remain key drivers. While Europe holds a smaller market share compared to North America and Asia-Pacific, it continues to maintain a steady presence, supported by the strong automotive and manufacturing sectors in the region. The diverse regional dynamics underscore the global demand for high-quality polishing grade alumina across various industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polishing Grade Alumina Market is projected to grow from USD 3.69 billion in 2024 to USD 5.63 billion by 2032, with a CAGR of 5.42%, driven by high demand across automotive, electronics, and optics industries.

- Demand for superior surface finishes in automotive, electronics, and optics sectors is a key driver, as polishing grade alumina’s hardness and abrasion resistance meet stringent industry requirements.

- The automotive industry plays a pivotal role in market growth, with increasing demand for high-quality finishes on vehicle components like wheels and bumpers.

- Expansion in the electronics sector, especially for polishing semiconductor wafers and display screens, further fuels the demand for polishing grade alumina.

- A shift toward sustainable and eco-friendly materials is pushing industries to adopt polishing grade alumina, which is non-toxic, recyclable, and environmentally friendly.

- The high cost of production remains a challenge, as advanced technology and high-purity raw materials increase manufacturing expenses, particularly in cost-sensitive regions.

- Asia-Pacific dominates the market with around 40% of global revenue, driven by rapid industrialization in countries like China and India, followed by North America and Europe.

Market Drivers:

Market Drivers:

Demand for High-Quality Surface Finishes

The primary driver of the polishing grade alumina market is the increasing demand for high-quality surface finishes in various industrial applications. Polishing grade alumina is favored for its superior hardness, high abrasion resistance, and ability to achieve a smooth and polished surface. For example, Almatis offers specialized alumina products such as ULTIMATE P 2500, which provides scratch-free finishes for high-end applications, and ULTIMATE P 815, designed for economic yet efficient polishing of clear coats in automotive paints. Industries such as automotive, electronics, and optics require flawless finishes on their products to meet stringent performance and aesthetic standards. In the automotive sector, for example, there is a growing emphasis on achieving impeccable finishes for metal components to enhance the visual appeal and overall quality of vehicles. As these industries expand and evolve, the demand for polishing grade alumina continues to rise, solidifying its importance as a key material in polishing applications.

Growth of the Automotive Industry

The automotive industry is a significant contributor to the growth of the polishing grade alumina market. With the increasing focus on vehicle aesthetics and performance, automotive manufacturers are seeking advanced polishing agents that can provide superior surface finishes for their components. Polishing grade alumina is widely used for polishing automotive parts such as wheels, bumpers, and other metal components. The need for durable and visually appealing vehicles has led to an uptick in the adoption of high-purity alumina for polishing applications. As the automotive industry continues to expand globally, particularly in emerging markets, the demand for polishing grade alumina is expected to rise, further boosting market growth.

Expansion of the Electronics Sector

The rapid expansion of the electronics sector is another key driver of the polishing grade alumina market. With the increasing miniaturization and sophistication of electronic devices, the demand for high-precision polishing of semiconductor wafers, display screens, and other components has surged. Polishing grade alumina, known for its ability to deliver fine finishes without causing damage, is essential for achieving the high-quality standards required in electronics manufacturing. For example, advancements in chemical-mechanical planarization (CMP) techniques have led to increased adoption of specialized alumina slurries tailored for semiconductor fabrication. As the electronics industry grows, driven by innovations in consumer electronics, telecommunications, and computing, the need for effective polishing agents like alumina is expected to increase, driving further growth in the market.

Shift Toward Sustainable and Eco-Friendly Materials

The global shift toward sustainability and environmentally friendly materials is also fueling the growth of the polishing grade alumina market. Polishing grade alumina is a non-toxic and recyclable material, which aligns with the increasing emphasis on sustainability in industrial processes. Industries are increasingly seeking eco-friendly alternatives to traditional polishing agents, which may contain harmful chemicals or produce significant waste. Polishing grade alumina offers a more sustainable option, making it an attractive choice for companies looking to meet environmental standards and reduce their carbon footprint. As sustainability continues to be a key priority for businesses across various sectors, the demand for eco-friendly polishing materials like alumina is expected to grow, contributing to the overall market expansion.

Market Trends:

Technological Advancements in Polishing Techniques

The polishing grade alumina market is experiencing significant growth, propelled by continuous technological advancements in polishing techniques. Innovations such as laser polishing and plasma polishing are gaining traction, offering enhanced precision and efficiency in achieving superior surface finishes. For instance, flame-assisted laser polishing has been shown to significantly reduce surface roughness of alumina ceramics, improving surface quality by up to 84.2% under optimized conditions. These advanced methods cater to the increasing demand for high-quality surfaces in industries like semiconductor manufacturing and optics, thereby expanding the applications of polishing grade alumina.

Integration of Automation and Artificial Intelligence

The integration of automation and artificial intelligence (AI) into manufacturing processes is emerging as a prominent trend influencing the polishing grade alumina market. Automated polishing systems, powered by AI, enable consistent and precise surface finishes, meeting the stringent requirements of modern industries. This technological shift enhances production efficiency and quality, driving the demand for high-purity polishing agents like alumina. Furthermore, the ability to optimize production processes using AI leads to cost reductions and more efficient use of resources, benefiting manufacturers in the long term.

Shift Towards Sustainable and Eco-Friendly Polishing Solutions

Environmental considerations are prompting a shift towards sustainable and eco-friendly polishing solutions within the industry. The development of biodegradable polishing agents and the adoption of chemical-free polishing processes are gaining momentum. This trend aligns with global sustainability goals and is influencing the formulation and application of polishing grade alumina, encouraging manufacturers to innovate in developing environmentally responsible products. As more industries emphasize green practices, the demand for sustainable polishing solutions is expected to rise, positioning polishing grade alumina as an environmentally friendly alternative.

Expansion of Production Capacities to Meet Growing Demand

To address the surging demand for polishing grade alumina, particularly from the semiconductor and optical industries, companies are expanding production capacities. For instance, Alpha HPA is constructing a state-of-the-art high-purity alumina refinery in Gladstone, Australia. Such expansions are essential to meet the increasing requirements of advanced manufacturing sectors and are expected to influence market dynamics significantly. As companies ramp up their production, they are better positioned to capture new market opportunities and accommodate the growing demand for polishing agents globally.

Market Challenges Analysis:

High Cost of Production

One of the key restraints in the polishing grade alumina market is the high cost of production. The manufacturing process for polishing grade alumina requires advanced technology and high-purity raw materials, which contribute to elevated production costs. Additionally, the energy-intensive nature of alumina refining and the need for specialized equipment further increase the overall expenses associated with producing high-quality polishing alumina. These costs can make it challenging for manufacturers, particularly smaller players, to remain competitive in the market, potentially limiting the growth of the market in cost-sensitive regions.

Volatility in Raw Material Prices

The prices of raw materials used in the production of polishing grade alumina, such as bauxite and energy inputs, are subject to fluctuations due to geopolitical factors, supply chain disruptions, and changes in global demand. This volatility can create uncertainty in the pricing and supply of polishing grade alumina, making it difficult for manufacturers to maintain stable profit margins. The reliance on a limited number of suppliers for high-purity bauxite further exacerbates this issue, as any disruptions in the supply chain could lead to production delays and price hikes. Such volatility poses a significant challenge for both manufacturers and consumers in the polishing grade alumina market.

Environmental and Regulatory Challenges

The production of alumina is associated with environmental concerns, particularly in terms of waste management and energy consumption. As global regulations surrounding environmental sustainability become more stringent, manufacturers face increasing pressure to adopt cleaner production methods and minimize their carbon footprint. For example, red mud, a byproduct of alumina refining, poses significant environmental risks due to its alkaline nature. The Central Pollution Control Board (CPCB) in India has outlined guidelines for its safe handling and disposal, requiring substantial investment in waste management infrastructure. Compliance with these environmental regulations often requires significant investment in technology and infrastructure, which can strain the financial resources of manufacturers. These environmental and regulatory challenges can limit the speed at which the polishing grade alumina market can expand, particularly in regions with stricter environmental policies.

Competition from Alternative Polishing Materials

Another challenge faced by the polishing grade alumina market is the growing competition from alternative polishing materials. Synthetic diamond abrasives, cerium oxide, and other advanced polishing agents are increasingly being explored as substitutes for alumina, particularly in industries that require specialized polishing solutions. These alternatives can sometimes offer superior performance or cost-effectiveness, creating competition for polishing grade alumina. As the demand for these alternatives grows, it could limit the market share of polishing grade alumina in certain applications.

Market Opportunities:

A significant market opportunity for the polishing grade alumina industry lies in the expansion of emerging markets, particularly in Asia-Pacific, Latin America, and parts of the Middle East. As these regions experience rapid industrialization and technological advancements, the demand for high-quality polishing materials is growing across various sectors, including automotive, electronics, and semiconductors. The increasing need for advanced manufacturing processes, especially in precision polishing for electronic devices and automotive components, presents a promising opportunity for manufacturers of polishing grade alumina to cater to these expanding markets. By establishing a strong presence in emerging economies, companies can capitalize on the growing demand for high-purity polishing agents and establish long-term customer relationships in high-growth industries.

Another key opportunity lies in the development and adoption of advanced polishing techniques and eco-friendly polishing solutions. As industries continue to prioritize sustainability, there is an increasing demand for non-toxic, recyclable, and biodegradable polishing agents. Polishing grade alumina, being a naturally occurring and environmentally friendly material, can meet these evolving needs, especially with the growing focus on reducing the environmental impact of manufacturing processes. Additionally, innovations in automated polishing systems and AI-powered technologies offer an opportunity to improve efficiency and precision in polishing applications, further driving the demand for alumina in high-precision sectors. Manufacturers who invest in these technological advancements and align with sustainability trends will be well-positioned to capture new market segments and lead the industry in innovation.

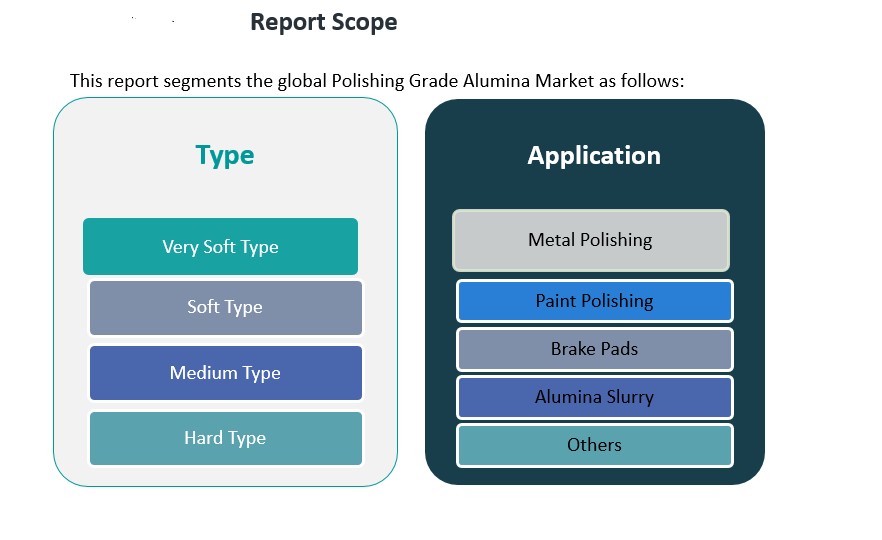

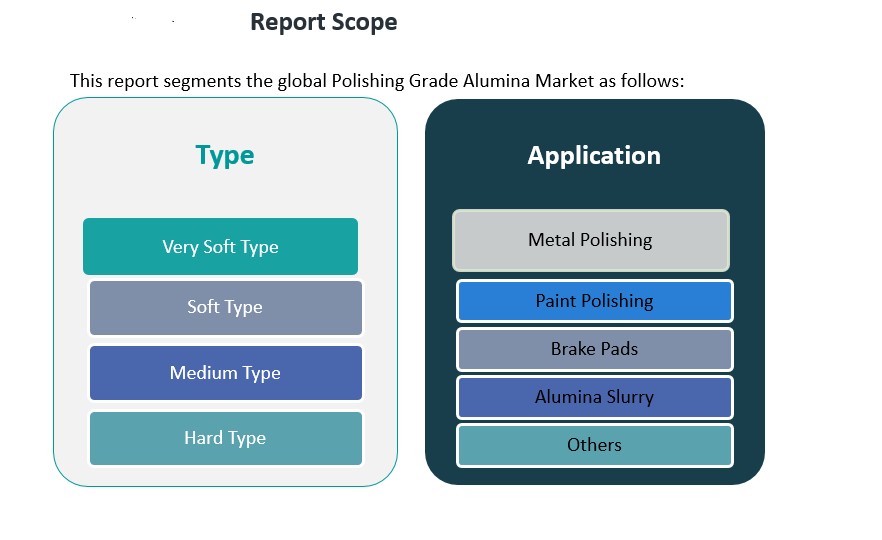

Market Segmentation Analysis:

The Polishing Grade Alumina Market is segmented based on type and application, catering to diverse industrial needs.

By Type Segment

The market is classified into four types: very soft, soft, medium, and hard types. Very soft type alumina is commonly used in applications requiring minimal abrasion, while soft type alumina is used for fine polishing in industries like automotive and electronics. Medium type alumina is ideal for general polishing tasks and is widely used in metal and paint polishing. Hard type alumina, with its high abrasion resistance, is used in applications requiring more aggressive polishing. The demand for each type is driven by the specific requirements of the polishing tasks, with medium and hard types seeing significant demand due to their broader application range.

By Application Segment

The application segment includes metal polishing, paint polishing, brake pads, alumina slurry, and others. Metal polishing dominates the market due to its extensive use in the automotive and manufacturing sectors, where a high-quality surface finish is essential. Paint polishing is primarily driven by its application in automotive refinishing and furniture industries. Brake pads are another significant application, as polishing alumina is used for enhancing friction materials. Alumina slurry is widely used in semiconductor and optical industries for precision polishing. The “others” category includes niche applications like polishing in the aerospace and medical sectors, which continue to grow as technology advances.

Segmentation:

By Type Segment:

- Very Soft Type

- Soft Type

- Medium Type

- Hard Type

By Application Segment:

- Metal Polishing

- Paint Polishing

- Brake Pads

- Alumina Slurry

- Others

Regional Analysis:

The polishing grade alumina market exhibits significant regional variations, influenced by industrial activities, technological advancements, and demand across various sectors.

Asia-Pacific

The Asia-Pacific (APAC) region leads the global polishing grade alumina market, contributing approximately 40% of the total revenue in 2023. This dominance is primarily due to the region’s robust industrial base, particularly in countries like China, Japan, and South Korea. The burgeoning electronics and automotive sectors in these nations drive the demand for high-quality polishing materials. China, as a key player, significantly influences the market dynamics, given its substantial manufacturing output and technological advancements.

North America

North America holds a substantial share of the polishing grade alumina market, accounting for approximately 25% of the global revenue in 2023. The United States and Canada are prominent contributors, with their advanced automotive and electronics industries fueling the demand for high-purity polishing agents. The emphasis on technological innovation and manufacturing excellence in this region supports the steady consumption of polishing grade alumina.

Europe

Europe represents about 20% of the global polishing grade alumina market share as of 2023. Countries like Germany, France, and Italy are key consumers, driven by their strong automotive and manufacturing sectors. The region’s focus on precision engineering and high-quality manufacturing processes sustains the demand for superior polishing materials.

Latin America

Latin America accounts for approximately 10% of the global market share in polishing grade alumina. The automotive industries in countries like Brazil contribute to the demand, although the market size is relatively smaller compared to other regions.

Middle East and Africa

The Middle East and Africa collectively hold about 5% of the polishing grade alumina market share. The market in this region is emerging, with increasing industrial activities and infrastructural developments gradually driving the demand for polishing materials

Key Player Analysis:

- Almatis

- AluChem

- Alteo

- Sumitomo Chemical

- Hindalco

Competitive Analysis:

The polishing grade alumina market is highly competitive, with several key players vying for market share through strategic initiatives such as capacity expansion, technological advancements, and product innovation. Leading companies in the market include Alpha HPA, Norsk Hydro, and Chalco, each contributing significantly to the production and supply of high-purity alumina. These companies leverage advanced refining processes and state-of-the-art technologies to meet the growing demand for high-quality polishing agents across industries like automotive, electronics, and semiconductor manufacturing. In addition, manufacturers are increasingly focusing on sustainability by adopting eco-friendly and recyclable materials, which aligns with global trends toward environmental responsibility. The competition in the market is further intensified by regional players in Asia-Pacific, where industrialization is rapidly increasing. As a result, companies are also focusing on geographic expansion, particularly in emerging markets, to capture new growth opportunities and maintain their competitive edge in this dynamic industry.

Recent Developments:

- In March 2025, Vedanta Aluminium inaugurated a 13.4 km railway line in Lanjigarh, Odisha, to support its 5 MTPA alumina refinery. This expansion will enhance inbound and outbound logistics for raw materials and commodities while reducing carbon emissions by 262 tonnes annually. The project also introduced six new loop lines and upgraded the signaling system to electronic interlocking, increasing the plant’s capacity to handle up to 25 million tonnes of materials annually.

- In September 2024, Press Metal Aluminium Holdings Bhd partnered with three Indonesian firms—PT Alakasa Alumina Refineri, PT Dinamika Sejahtera Mandiri, and PT Kalimantan Alumina Nusantara—to develop an alumina refinery in West Kalimantan, Indonesia. The first phase of the project, costing $750 million, will have an annual production capacity of 1 to 1.2 million tonnes, with potential for future expansion.

- On August 28, 2023, Sumitomo Chemical announced the mass production of its pioneering ultra-fine α-alumina products under the NXA series. These ultra-fine particles are designed for next-generation semiconductors and other advanced applications in ICT, energy-saving technologies, and life sciences.

Market Concentration & Characteristics:

The polishing grade alumina market exhibits moderate concentration, with a few large global players dominating the landscape. Major companies such as Alpha HPA, Norsk Hydro, and Chalco hold significant market shares, leveraging their advanced production capabilities and extensive distribution networks. These companies lead through economies of scale, established brand presence, and consistent investment in research and development to maintain high product quality and meet the increasing demand for high-purity alumina. The market characteristics are shaped by continuous technological advancements, particularly in refining processes and automation, which enhance production efficiency and precision. Furthermore, sustainability is becoming a key characteristic, with leading players focusing on eco-friendly manufacturing methods and the use of recyclable materials. The market also features regional players, particularly in Asia-Pacific, that contribute to the competition. As demand from sectors like automotive, electronics, and semiconductors grows, the market is expected to become increasingly competitive, with players focusing on innovation and geographic expansion to secure their positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment and Application Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The polishing grade alumina market is expected to experience steady growth in the coming years.

- Increasing demand from the automotive sector for high-quality finishes on components will fuel market expansion.

- The growing electronics and semiconductor industries will drive the need for precise polishing solutions.

- Sustainability trends will promote the adoption of eco-friendly and recyclable polishing agents.

- Emerging markets in Asia-Pacific, especially China and India, will continue to be key contributors to market growth.

- Technological advancements in polishing techniques, including AI-driven automation, will enhance efficiency.

- Competition from alternative polishing materials like synthetic diamonds may pose challenges to market growth.

- Expanding production capacities by major manufacturers will be necessary to meet rising demand.

- The adoption of electric vehicles will drive demand for advanced polishing solutions in the automotive industry.

- Regulatory changes and environmental policies will play a crucial role in shaping production processes and product development.

Market Drivers:

Market Drivers: