Market Overview:

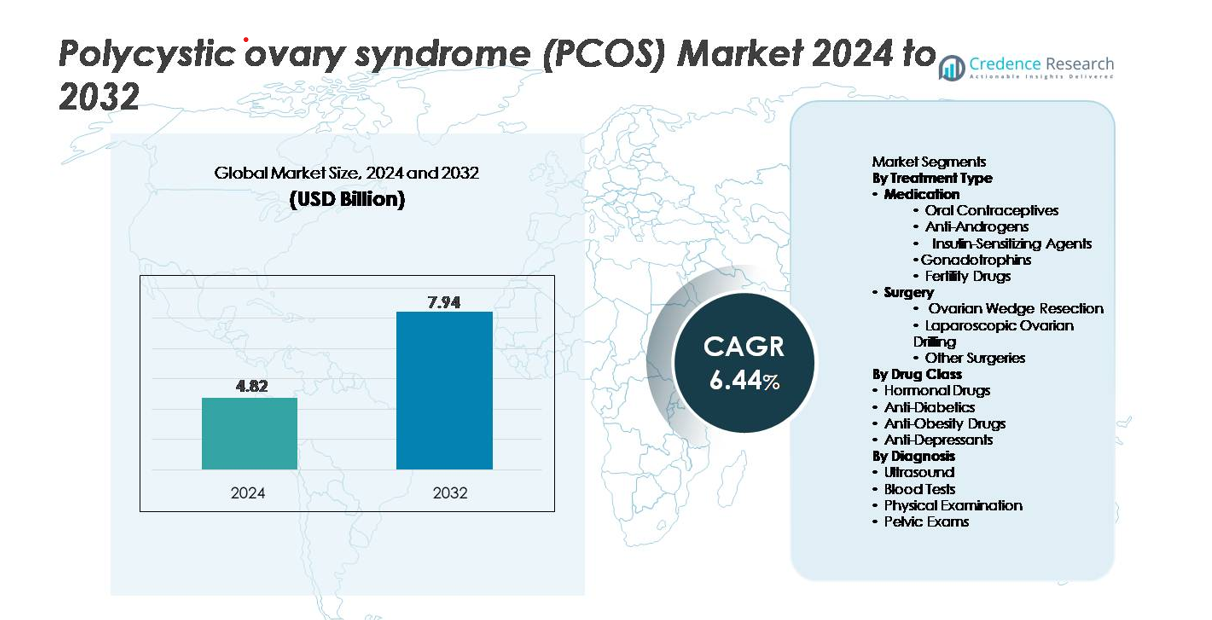

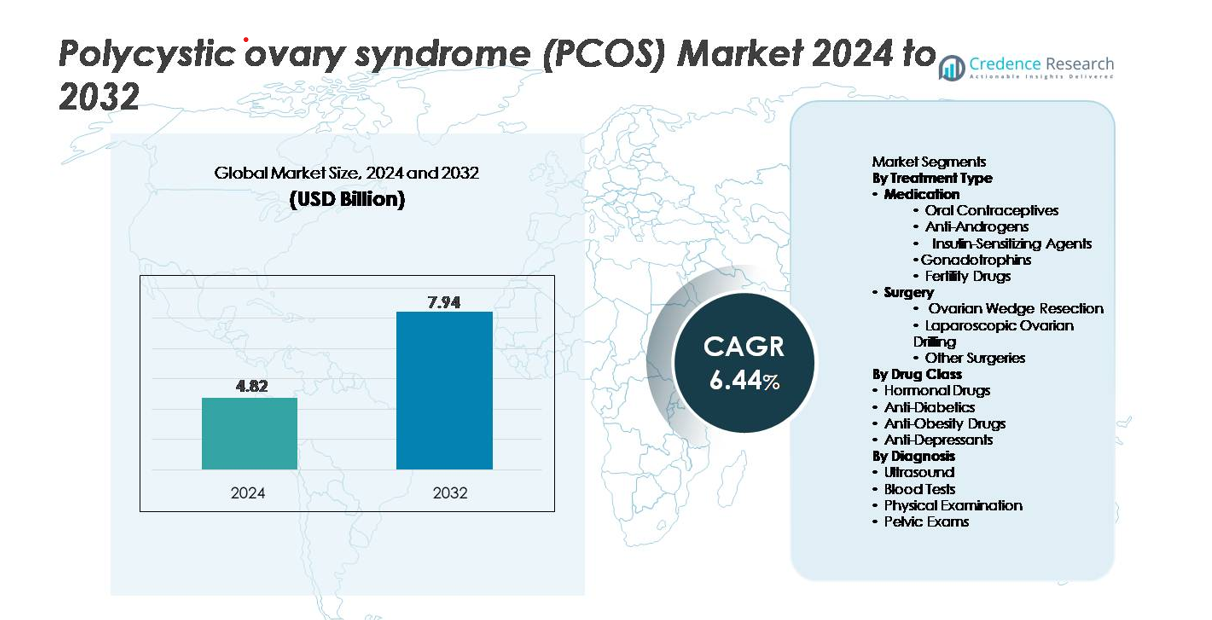

The global Polycystic Ovary Syndrome (PCOS) market was valued at USD 4.82 billion in 2024 and is projected to reach USD 7.94 billion by 2032, expanding at a CAGR of 6.44% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polycystic Ovary Syndrome (PCOS) Market Size 2024 |

USD 4.82 billion |

| Polycystic Ovary Syndrome (PCOS) Market, CAGR |

6.44% |

| Polycystic Ovary Syndrome (PCOS) Market Size 2032 |

USD 7.94 billion |

The Polycystic Ovary Syndrome (PCOS) market is shaped by a competitive mix of global pharmaceutical and healthcare leaders, including AstraZeneca, Novartis AG, GlaxoSmithKline plc (GSK), Bayer AG, Merck & Co., Inc., Sanofi S.A., Bristol-Myers Squibb, Abbott Laboratories, Teva Pharmaceuticals Industries Ltd., and Ferring Pharmaceuticals. These companies focus on advancing hormonal therapies, insulin-sensitizing agents, and diagnostic capabilities to improve PCOS management and patient outcomes. North America leads the market with approximately 38% share, supported by strong diagnostic infrastructure and high treatment adoption. Europe follows with around 28% share, driven by comprehensive reproductive health services and rising utilization of hormonal and metabolic therapies.

Market Insights

- The global Polycystic Ovary Syndrome (PCOS) market was valued at USD 4.82 billion in 2024 and is projected to reach USD 7.94 billion by 2032, expanding at a CAGR of 6.44% during the forecast period.

- Rising PCOS prevalence driven by obesity, insulin resistance, and lifestyle changes accelerates demand for hormonal therapies, insulin-sensitizing agents, and fertility treatments, strengthening overall market growth.

- Advancements in diagnostic imaging, automated hormonal assays, digital health tools, and personalized treatment protocols shape key market trends, enhancing early detection and long-term management efficiency.

- The competitive landscape features major players such as AstraZeneca, Novartis, GSK, Bayer, Sanofi, Merck & Co., and Abbott, who continue investing in improved drug formulations, diagnostic platforms, and integrated care solutions despite challenges related to diagnostic variability and treatment adherence.

- Regionally, North America holds 38% market share, followed by Europe at 28% and Asia-Pacific at 23%, while the medication segment accounts for the dominant share due to strong adoption of oral contraceptives and metabolic regulators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Treatment Type

The medication segment dominates the PCOS treatment market, accounting for the largest share due to its widespread use as first-line therapy and strong clinical efficacy in regulating hormonal imbalance and metabolic dysfunction. Within medications, oral contraceptives hold the leading sub-segment share, driven by their ability to normalize menstrual cycles, reduce hyperandrogenism, and manage acne and hirsutism. Insulin-sensitizing agents such as metformin continue to expand usage as metabolic symptoms rise globally. Surgical interventions primarily laparoscopic ovarian drilling remain reserved for drug-resistant infertility cases, while wedge resection and other procedures demonstrate declining adoption due to invasiveness and postoperative risks.

- “For instance, combined oral contraceptives (COC), including Bayer’s ethinylestradiol-drospirenone formulation, have demonstrated a significant reduction in mean total testosterone levels by approximately 49 nmol/L(nanomoles per liter) across various studies.

By Drug Class

The hormonal drugs segment leads the PCOS market with the highest share, supported by extensive prescription volume for estrogen-progestin combinations and anti-androgenic formulations that target core endocrine abnormalities. These therapies remain the clinical standard for menstrual regulation, ovulation management, and symptom suppression. Anti-diabetic drugs, particularly metformin, form the second-largest sub-segment as insulin resistance becomes increasingly prevalent among PCOS patients. Meanwhile, anti-obesity drugs gain traction in overweight populations, and antidepressants address comorbid anxiety and depression, though both remain supplementary compared to hormonal interventions.

- For instance, Bayer’s ethinylestradiol–cyproterone acetate formulation (Diane-35) has demonstrated a highly significant decrease in serum total testosterone after six treatment cycles, often reducing baseline levels by over 50% and bringing them into the normal physiological range for women, confirming substantial anti-androgenic efficacy.

By Diagnosis

Ultrasound represents the dominant diagnostic sub-segment, capturing the largest market share due to its non-invasive nature, accessibility, and high reliability in assessing ovarian morphology and follicle count. Its widespread use in both primary and specialized care settings sustains strong demand. Blood tests including LH/FSH ratio, testosterone levels, and metabolic panels serve as essential complements and form the second-largest sub-segment. Physical examinations and pelvic exams continue contributing to early screening, although they hold smaller shares as clinicians increasingly rely on imaging and biochemical markers for definitive PCOS evaluation.

Key Growth Drivers:

Rising Global Prevalence of Metabolic and Hormonal Disorders

The growing prevalence of obesity, insulin resistance, and lifestyle-related hormonal disorders significantly boosts PCOS case volumes, driving sustained market expansion. Urban lifestyles, sedentary work patterns, and dietary shifts contribute to rising metabolic dysfunction among reproductive-age women, accelerating the demand for both diagnostic screening and long-term therapeutic management. Increased awareness of reproductive health and timely diagnosis through fertility clinics and gynecology centers further supports growth. As more women seek medical intervention for irregular cycles, acne, hirsutism, and infertility, healthcare providers increasingly recommend hormonal therapies, insulin-sensitizing agents, and metabolic management programs. This surge in patient pools stimulates continuous product development, broader therapeutic availability, and deeper penetration of PCOS management solutions across emerging and developed markets.

- For instance, Abbott’s ARCHITECT i2000SR immunoassay analyzer can process up to 200 tests per hour, enabling high-throughput measurement of LH, FSH, estradiol, insulin, and androgen markers essential for PCOS evaluation.

Advancements in Diagnostic Imaging and Biomarker Testing

Rapid technological advancements in ultrasound imaging, automated hormonal assays, and biomarker testing strengthen diagnostic accuracy and expand the PCOS care pathway. High-resolution transvaginal ultrasound systems enable clearer visualization of ovarian follicles, accelerating early detection. Concurrently, innovations in blood chemistry analyzers and hormone quantification platforms enhance the identification of androgen excess, insulin abnormalities, and metabolic imbalances. Clinical laboratories increasingly adopt automated analyzers with improved sensitivity and lower detection thresholds, supporting more standardized diagnostic protocols. The integration of digital imaging archives and AI-enabled report generation also enhances workflow efficiency. As diagnostic methods become more reliable and accessible, patient identification improves, boosting demand for pharmacological therapies, physician consultations, and long-term disease management programs.

- For instance, GE HealthCare’s Voluson™ E10 ultrasound system uses its Radiance System Architecture to deliver four times the ultrasound processing power of earlier Voluson models, enabling high-resolution visualization of ovarian follicles as small as 2–3 mm, which is essential for PCOS follicular assessment.

Expanding Therapeutic Landscape and Focus on Personalized Treatment

The PCOS market benefits from a robust pipeline of advanced hormonal therapies, metabolic regulators, and adjunctive treatment approaches that support individualized patient management. Clinicians increasingly tailor therapy based on phenotypes, such as hyperandrogenic, ovulatory dysfunction, or metabolic-dominant PCOS, improving outcomes and patient satisfaction. Continuous innovation in insulin-sensitizing agents, ovulation-inducing drugs, and anti-androgenic compounds broadens treatment options. Furthermore, the growing emphasis on lifestyle modification programs, weight management solutions, and mental-health-aligned therapies strengthens holistic care delivery. Fertility-focused products gain momentum as more women delay pregnancy and rely on medically assisted reproductive technologies. These trends collectively drive steady adoption of both established and emerging PCOS therapeutics.

Key Trends and Opportunities:

Integration of Digital Health, Telemedicine, and Remote Monitoring

Digital health platforms are reshaping PCOS management by enabling remote consultations, continuous symptom tracking, and data-driven treatment adjustments. Mobile apps designed for menstrual cycle monitoring, hormonal tracking, and personalized lifestyle recommendations are gaining strong adoption among tech-enabled patients. Telemedicine enhances access to endocrinologists and gynecologists, particularly in underserved regions where specialist availability is limited. Wearables and digital biomarkers further support monitoring of metabolic parameters such as glucose levels, sleep quality, and physical activity, strengthening proactive care. These digital ecosystems open new commercial opportunities for integrated PCOS management solutions, subscription-based wellness programs, and AI-powered diagnostic support tools.

- For instance, Abbott’s FreeStyle Libre 2 continuous glucose monitoring system records interstitial glucose every 60 seconds and stores up to 8 hours of data, enabling precise monitoring of insulin resistance common in PCOS.

Growing Focus on Fertility Treatment and Reproductive Health Services

Expanding fertility awareness and rising demand for assisted reproductive technologies (ART) create substantial opportunities for PCOS-related fertility interventions. PCOS remains one of the leading causes of anovulatory infertility, prompting higher utilization of ovulation-inducing drugs, gonadotropins, and fertility-enhancing protocols. Advanced procedures such as IVF increasingly incorporate optimized ovarian stimulation strategies tailored for PCOS patients to mitigate hyperstimulation risks. Fertility clinics are investing in improved imaging, hormonal monitoring tools, and patient-specific treatment pathways that enhance safety and live-birth outcomes. As more women delay childbirth due to career priorities and lifestyle choices, fertility-focused PCOS management continues to expand as a lucrative market segment.

- For instance, Ferring Pharmaceuticals’ Rekovelle® (follitropin delta) demonstrated a 4% cumulative ongoing pregnancy rate in its multinational real-world study involving 944 women, while maintaining a low 3.9% incidence of OHSS, making it particularly valuable for PCOS patients who are hyper-response–prone.

Rising Development of Combination Therapies and Holistic Treatment Pathways

Combination therapies that integrate hormonal regulation, metabolic correction, and lifestyle intervention are emerging as a key trend in PCOS care. Manufacturers and healthcare providers are increasingly adopting multi-target approaches to address the syndrome’s complex endocrine and metabolic dimensions. This includes the co-administration of insulin-sensitizing agents with oral contraceptives, anti-androgens, or behavioral health therapies. Growing acceptance of nutrition-led interventions, gut health modulation, and weight management programs also supports comprehensive treatment pathways. As evidence for multidisciplinary care strengthens, opportunities arise for combination product development, cross-sector collaborations, and integrated patient management frameworks.

Key Challenges:

High Variability in Symptoms and Lack of Standardized Diagnostic Criteria

PCOS presents significant diagnostic challenges due to its heterogeneous symptoms and variations across ethnic, metabolic, and hormonal profiles. Different diagnostic frameworks such as NIH, Rotterdam, and AE-PCOS criteria create inconsistencies in clinical evaluation and contribute to underdiagnosis or misdiagnosis. Patients may exhibit only a subset of symptoms, complicating screening and treatment alignment. This variability also impedes the development of universal therapeutic protocols, affecting both clinical outcomes and market penetration of standardized solutions. Moreover, limited provider training on differential diagnosis and overlapping symptoms with thyroid disorders or metabolic syndrome further challenge accurate, timely PCOS management.

Limited Long-Term Treatment Compliance and Side-Effect Profiles

Many PCOS medications require prolonged use, yet adherence remains a major challenge due to side effects associated with hormonal drugs, insulin sensitizers, and fertility medications. Weight gain, gastrointestinal discomfort, mood disturbances, and metabolic fluctuations often reduce patient compliance and disrupt treatment continuity. Long-term therapies such as oral contraceptives face hesitancy in certain populations due to concerns around cardiovascular or hormonal risks. Lifestyle modification programs also suffer from low adherence despite being clinically effective. These limitations hinder sustained therapeutic outcomes and diminish the effectiveness of holistic care frameworks, restricting broader market progression.

Regional Analysis:

North America

North America holds the largest share of around 38%, driven by high disease awareness, advanced diagnostic infrastructure, and strong adoption of hormonal and metabolic therapies. The region benefits from widespread availability of transvaginal ultrasound, biomarker testing, and fertility treatment services, leading to early diagnosis and effective long-term management. Rising cases linked to obesity and sedentary lifestyles further expand the patient pool. Robust healthcare spending, supportive insurance coverage for reproductive health, and active research initiatives from academic institutions strengthen market leadership. Increasing integration of digital health tools continues to accelerate patient engagement and treatment adherence.

Europe

Europe captures approximately 28% of the global market, supported by well-established gynecology networks, strong public health awareness programs, and growing utilization of ovulation-inducing therapies. Countries such as Germany, the U.K., and France lead in diagnostic adoption due to improved access to hormonal assays and imaging modalities. A rising focus on fertility preservation and reproductive wellness drives greater testing volumes across clinical settings. Government-backed metabolic screening initiatives and structured care pathways enhance early detection. Increasing preference for evidence-based hormonal therapies and structured lifestyle management programs reinforces Europe’s stable and growing position in the PCOS market.

Asia-Pacific

Asia-Pacific accounts for roughly 23% of the market, driven by a rapidly expanding population of reproductive-age women and increasing incidence of metabolic syndromes. Countries such as India, China, and Japan witness rising diagnostic rates as healthcare access improves and women’s health awareness expands. Urbanization, dietary transitions, and rising obesity fuel the surge in PCOS prevalence. Fertility treatment demand, particularly IVF and ovulation support therapies, grows sharply due to delayed parenthood trends. Investments in digital health platforms and affordable diagnostic services strengthen regional uptake, positioning Asia-Pacific as the fastest-growing PCOS market globally.

Latin America

Latin America holds an estimated 7% market share, supported by increased recognition of women’s reproductive health disorders and broader availability of diagnostic services in urban centers. Countries such as Brazil, Mexico, and Argentina experience rising PCOS prevalence linked to lifestyle changes and metabolic risk factors. Improved access to ultrasound imaging, hormonal profiling, and fertility services strengthens early evaluation. However, regional disparities in healthcare access limit consistent treatment adoption. Growing private healthcare expansion and rising demand for hormonal therapies, metformin-based treatments, and fertility medications support steady market improvement across the region.

Middle East & Africa

The Middle East & Africa region represents approximately 4% of the global market, shaped by growing awareness of metabolic and reproductive health problems, especially in Gulf countries where obesity and insulin resistance are widespread. Investment in women’s health clinics, fertility centers, and advanced diagnostic imaging expands access to PCOS evaluation. However, limited specialist availability and lower diagnostic penetration across parts of Africa restrain broader uptake. Rising demand for hormonal regulation therapies and ovulation support treatments, along with government initiatives promoting metabolic health, supports moderate but steadily improving market growth.

Market Segmentations:

By Treatment Type

- Medication

- Oral Contraceptives

- Anti-Androgens

- Insulin-Sensitizing Agents

- Gonadotrophins

- Fertility Drugs

- Surgery

- Ovarian Wedge Resection

- Laparoscopic Ovarian Drilling

- Other Surgeries

By Drug Class

- Hormonal Drugs

- Anti-Diabetics

- Anti-Obesity Drugs

- Anti-Depressants

By Diagnosis

- Ultrasound

- Blood Tests

- Physical Examination

- Pelvic Exams

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the Polycystic Ovary Syndrome (PCOS) market is characterized by a diverse mix of pharmaceutical companies, diagnostic solution providers, and fertility treatment specialists competing to enhance therapeutic effectiveness and patient outcomes. Leading players focus on developing advanced hormonal therapies, insulin-sensitizing agents, and metabolic regulators to address the multifactorial nature of PCOS. Companies increasingly invest in improved oral contraceptive formulations, combination therapies, and targeted anti-androgenic drugs to strengthen product differentiation. Diagnostic firms expand capabilities in high-resolution ultrasound, automated hormonal assays, and biomarker testing platforms that support early detection and personalized treatment pathways. Fertility treatment providers integrate optimized ovarian stimulation protocols and safer ovulation-inducing medications tailored for PCOS patients. Strategic partnerships between pharmaceutical manufacturers, digital health platforms, and reproductive health clinics are accelerating innovation in remote monitoring, lifestyle management, and patient engagement. As market competition intensifies, companies emphasize clinical research, safety optimization, and region-specific expansion to capture unmet needs across global patient populations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AstraZeneca

- Bristol-Myers Squibb

- Novartis AG

- Ferring Pharmaceuticals

- GlaxoSmithKline plc (GSK)

- Merck & Co., Inc.

- Bayer AG

- Teva Pharmaceuticals Industries Ltd.

- Abbott Laboratories

- Sanofi S.A.

Recent Developments:

- In March 2023, Ferring Pharmaceuticals started a new clinical trial of its new fertility treatment, Rekovelle®, designed only for women with PCOS. The clinical trial will provide a safer alternative for women undergoing ovulation induction with more exact dosing and improved results in ART.

- In December 2023, Abbott published a public health-awareness piece addressing PCOS and related metabolic disorders. This indicates Abbott’s interest in PCOS awareness and possibly preventative care, but does not constitute a clinical-trial announcement or new therapy launch.

- In April 2022, Bayer AG expanded its women’s-health R&D scope by forging a new strategic alliance with Evotec SE to develop multiple drug candidates for PCOS a multi-target, preclinical drug discovery program.

Report Coverage:

The research report offers an in-depth analysis based on Treatment type, Drug class, Diagnosis and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The PCOS market will continue expanding as diagnosis rates rise and awareness of metabolic and reproductive health improves globally.

- Advancements in hormonal therapies and targeted metabolic treatments will enhance personalized care pathways.

- Digital health platforms, including cycle-tracking apps and teleconsultations, will increasingly support remote monitoring and disease management.

- AI-driven diagnostic tools and biomarker-based screening will improve early detection and reduce diagnostic variability.

- Fertility-focused interventions and assisted reproductive technologies will see stronger adoption among PCOS-related infertility cases.

- Combination therapies integrating hormonal, metabolic, and lifestyle treatments will gain wider acceptance.

- Growth in preventive healthcare will drive higher engagement in weight management, nutrition, and behavioral programs for PCOS patients.

- Pharmaceutical companies will intensify research on safer anti-androgen therapies and novel insulin-sensitizing agents.

- Emerging markets will experience faster penetration of diagnostic services and affordable treatment options.

- Collaborative care models involving endocrinologists, gynecologists, nutritionists, and digital health providers will shape the next stage of PCOS management.