Market Overviews

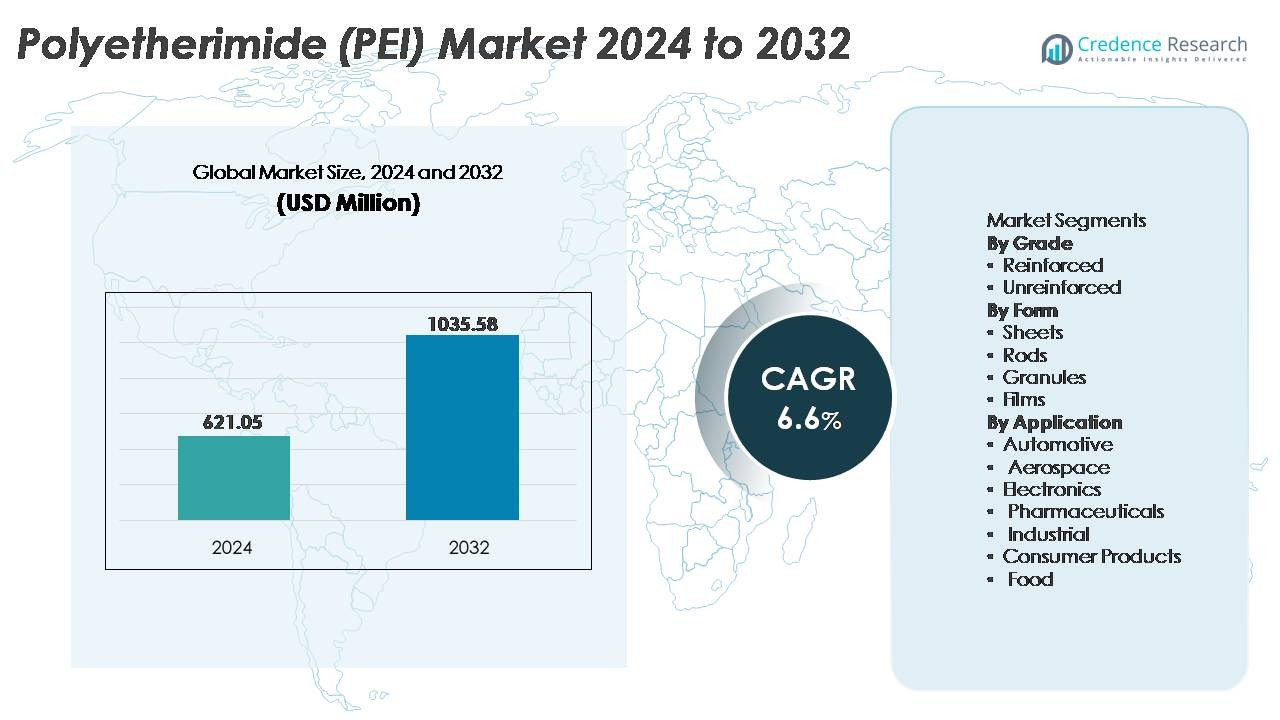

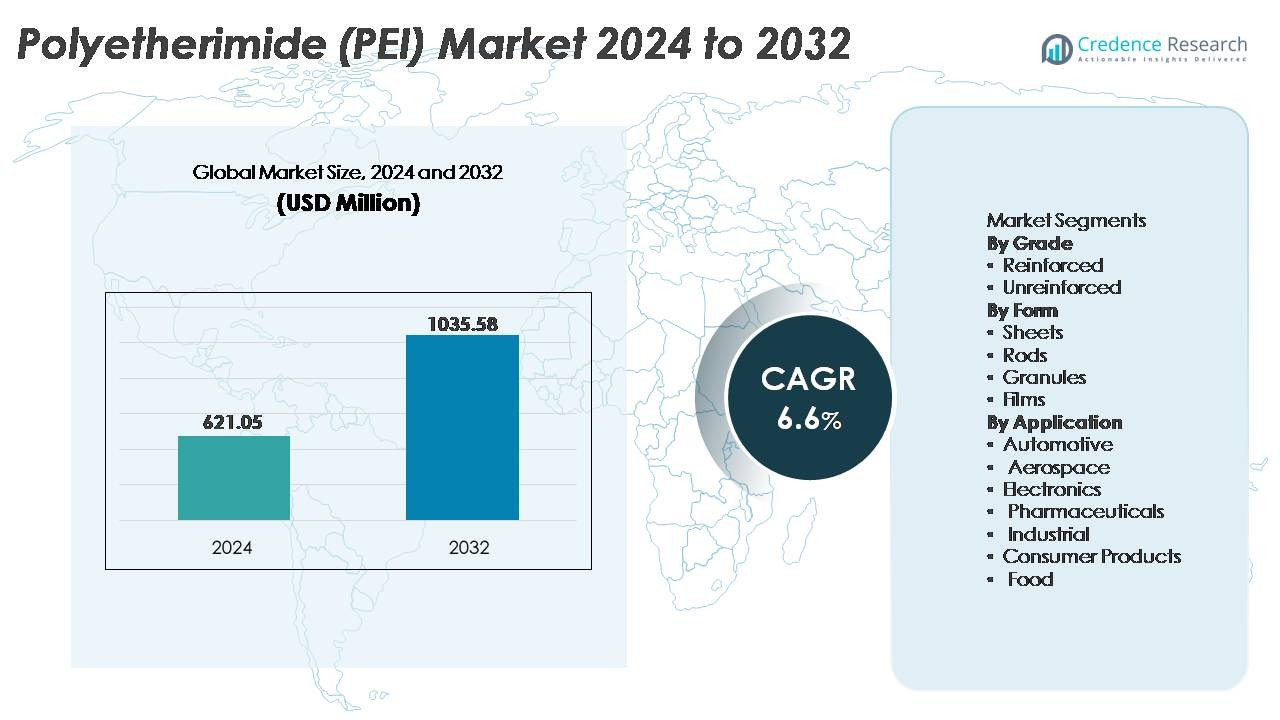

Polyetherimide (PEI) market size was valued at USD 621.05 million in 2024 and is anticipated to reach USD 1,035.58 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyetherimide (PEI) Market Size 2024 |

USD 621.05 Million |

| Polyetherimide (PEI) Market, CAGR |

6.6% |

| Polyetherimide (PEI) Market Size 2032 |

USD 1,035.58 Million |

The Polyetherimide (PEI) market features strong participation from global polymer suppliers, engineered plastics processors, and integrated chemical manufacturers. Key players include Mitsubishi Chemical Advanced Materials, Centroplast Engineering Plastics GmbH, PolyOne Corporation, Aetna Plastics, Ensinger, SABIC, Lehmann & Voss & Co., Westlake Plastics Company, RTP Company, and Röchling SE & Co. KG. These companies compete by offering high-heat, flame-retardant grades, precision-molding capabilities, and application-specific PEI solutions for aerospace, automotive electrification, and medical equipment. Asia Pacific leads the PEI market with approximately 34% share, supported by large-scale electronics manufacturing, industrial automation growth, and cost-efficient processing clusters that accelerate regional adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polyetherimide (PEI) market was valued at USD 621.05 million in 2024 and is projected to reach USD 1,035.58 million by 2032, expanding at a CAGR of 6.6% during the forecast period.

- Strong demand for lightweight, high-performance polymers in aerospace, automotive electrification, and industrial automation continues to drive market expansion as OEMs prioritize thermal-resistant and flame-retardant materials.

- Emerging trends include the growing integration of PEI in 3D printing filaments, semiconductor components, and medical sterilization-safe devices, supported by material innovation and recyclable engineering-grade polymers.

- Competitive dynamics remain shaped by specialty compounders and global resin producers offering application-specific grades, with cost sensitivity and processing complexity restraining wider adoption across general-purpose industries.

- Asia Pacific holds the largest regional share at 34%, followed by North America at 32% and Europe at 29%, while the reinforced grade segment leads consumption, supported by its dominance in high-strength aerospace and automotive components.

Market Segmentation Analysis:

By Grade

The reinforced PEI grade captures the dominant market share, driven by its superior tensile strength, dimensional stability, and flame-resistant characteristics that meet rigorous industrial and aerospace standards. Its ability to retain mechanical strength above 200°C positions it competitively against metals in high-stress applications. Unreinforced PEI gains traction where flexibility, insulation, and lightweight design are critical, particularly in electronics and medical components. However, reinforced PEI remains the preferred choice due to its enhanced modulus and durability, supporting advanced manufacturing in automotive structural parts and aircraft seating systems.

- For instance, SABIC’s ULTEM™ 2200, a 20% glass fiber reinforced PEI, delivers a tensile strength of approximately 140 MPa (ISO 527) and a heat deflection temperature of 210°C at 1.8 MPa load, enabling replacement of aluminum in structural housings.

By Form

Granules hold the leading position within the PEI form segment, primarily fueled by their applicability in injection molding and extrusion for mass-scale component production. Their ease of processing, recyclability, and compatibility with complex geometries make them an essential feedstock for automotive housings, connectors, and medical device casings. Sheets and rods support structural fabrication and prototyping, while PEI films cater to insulation and membrane applications in electronics. Despite the growing utility of films, granules maintain dominance due to cost-efficient downstream fabrication and alignment with high-volume OEM manufacturing lines.

- For instance, SABIC produces ULTEM™ PEI granules supporting melt flow rates ranging from 3 to 24 g/10 min (at 337°C/6.6 kg) enabling precision molding for medical and aerospace components with wall thicknesses below 0.75 mm.

By Application

The aerospace sector represents the dominant application segment, propelled by its demand for lightweight, flame-retardant materials with minimal outgassing and compliance with stringent safety standards. PEI’s high strength-to-weight ratio and resistance to jet fuels and chemicals enable its adoption in seat frames, ducting, and avionics housings. Automotive applications continue expanding through electric vehicle components requiring thermal stability. Electronics leverage PEI for connectors and semiconductors due to its dielectric properties. Pharmaceuticals, food processing, and consumer products increasingly adopt PEI for sterilizable, chemically inert, and regulatory-compliant functional designs.

Key Growth Drivers

Expanding Demand for High-Performance Engineering Thermoplastics

The market benefits from industries increasingly shifting from metals and conventional polymers to high-performance engineering thermoplastics. Polyetherimide’s exceptional mechanical strength, dimensional stability, and thermal resistance support its adoption in aerospace components, electric vehicle systems, rail interiors, and industrial automation solutions. Its high dielectric strength and flame-retardant properties make PEI a preferred material for circuit protection, connectors, and semiconductor packaging. Rapid industrial automation accelerates the need for materials that sustain exposure to heat, chemicals, and vibration without deformation. With regulatory bodies emphasizing reduced emissions and energy efficiency, manufacturers prefer strong lightweight substitutes that optimize operational economies. PEI therefore positions itself as a future-proof industrial material aligned with global engineering transformation.

- “For instance, SABIC’s ULTEM™ 1010 resin provides high tensile strength (up to approximately 110 MPa for injection-molded parts) and a glass transition temperature near 217°C, allowing its use as a lightweight, high-performance alternative to machined aluminum in structural aerospace brackets and interior cabin components.”

Growing Integration in EV Platforms and Electrification Systems

The polyetherimide market experiences substantial growth through its integration in electric vehicle platforms and advanced electrification systems. Its high temperature tolerance, resistance to battery electrolytes, and low smoke toxicity enable the design of EV connectors, charging sockets, busbar insulation, and power electronics housings. As EV manufacturers aim to minimize vehicle weight and enhance passenger safety, PEI competes directly with traditional alloys and offers cost-efficient processing through injection molding and additive manufacturing. The expanding charging infrastructure ecosystem further strengthens demand for durable thermoplastics that operate under variable loads and outdoor conditions. PEI’s compatibility with precision molding supports its incorporation into compact high-voltage device architectures.

- For instance, Stratasys 3D prints ULTEM™ 9085 PEI-based parts for electric mobility platforms, producing flame-resistant lightweight brackets and ducts with tensile strengths around 70 MPa.

Regulatory Alignment and Suitability for Sterilization-Critical Applications

Stringent food safety, medical-grade manufacturing, and cleanroom regulations stimulate the use of PEI in pharmaceutical and healthcare environments. Its intrinsic biocompatibility, resistance to repeated steam autoclaving cycles, and chemical stability support applications such as dental tools, diagnostic cartridges, device handles, and pump housings. The material’s low extractables and compliance with quality standards enable safe interaction with consumables and sterile liquids. In food processing, PEI withstands high-temperature continuous-service conditions without degradation. The increasing global emphasis on infection prevention, reusable instruments, and waste-reduction policies further solidifies its value proposition as a long-life polymer for hygienic infrastructure.

Key Trends & Opportunities

Adoption of PEI in Additive Manufacturing and Lightweight Component Design

Additive manufacturing opens new opportunities for PEI as a material optimized for prototyping and low-volume precision production. The increasing adoption of 3D printing in aerospace tooling, EV assemblies, and customized medical implants favors PEI powders and filaments known for heat deflection and rigidity. Manufacturers seek engineering polymers compatible with fused filament fabrication and selective laser sintering to build complex shapes previously limited by machining constraints. This trend accelerates design flexibility, reduces lead time, and enables localized production. Lightweight structures that maintain performance under mechanical stress represent a significant commercial opportunity, particularly in defense systems and satellite components.

- For instance, Stratasys offers ULTEM™ 9085 and ULTEM™ 1010 PEI filaments certified for aerospace applications, with the 9085 grade achieving a tensile strength of approximately 70 MPa and a heat deflection temperature near 153°C under load.

Emergence of Recyclable and Sustainable PEI Solutions

Sustainability drives material innovation, leading to emerging opportunities for recyclable and partly bio-based PEI formulations. Circular manufacturing models encourage the use of thermoplastics that can be recovered without losing performance characteristics. With global directives targeting reduced industrial waste and low-carbon material selection, PEI aligns with efforts to replace thermoset components that cannot be reprocessed. Technological advancements in mechanical reclamation and polymer chain preservation enable industries to repurpose scrap and end-of-life components. This presents new revenue channels for resin compounders and OEMs prioritizing compliance with environmental, social, and governance frameworks.

- For instance, SABIC has demonstrated closed-loop recovery of ULTEM™ PEI, enabling mechanical recycling of scrap materials while retaining tensile strength values above 100 MPa after multiple reprocessing cycles.

Key Challenges

High Material Cost and Price Sensitivity Among End Users

Despite its advantages, PEI faces adoption challenges in cost-sensitive markets where metal replacements or conventional polymers remain viable. Pricing reflects the complexity of synthesis, reliance on specialty feedstock, and high-precision processing requirements. Small and mid-tier manufacturers hesitate to transition when lifecycle benefits are long-term rather than immediate. Competitive engineering plastics such as PEEK and PPS also create pricing pressure, shifting buyers toward materials optimized for specific rather than broad functionality. This cost barrier limits application penetration in consumer products and general-purpose equipment where alternative blends meet basic specifications.

Processing Complexity and Requirement for Specialized Manufacturing Infrastructure

PEI’s high glass transition temperature and melt processing characteristics require specialized molding equipment capable of maintaining elevated temperatures and strict dimensional tolerances. Manufacturers without dedicated tooling infrastructures incur higher processing costs and longer setup times, discouraging rapid scaling. The risk of defects such as voids or warpage demands skilled operators and stringent quality control systems. These factors restrain adoption among regions with limited polymer engineering capability. Furthermore, integrating PEI into hybrid assemblies may require new bonding and finishing techniques, increasing overall production complexity.

Regional Analysis

North America

North America accounts for approximately 32% of the global Polyetherimide (PEI) market, driven by aerospace, defense, medical devices, and electric vehicle components manufacturing. The United States dominates regional demand with strong OEM activity and long-term adoption of PEI in wire insulation, compact electronic housings, and structural aircraft parts. Increasing FDA-compliant material usage in sterilization-resistant surgical tools and laboratory consumables reinforces market expansion. Partnerships between resin compounders and 3D printing technology providers further stimulate advanced manufacturing adoption. Growing environmental compliance and lightweighting initiatives encourage material shift from metals toward high-performance polymers such as PEI across engineering industries.

Europe

Europe represents nearly 29% of the Polyetherimide (PEI) market, supported by stringent regulatory standards in transportation, pharmaceuticals, and industrial safety. Germany, France, and the U.K. accelerate usage of PEI due to aerospace Tier-1 supplier networks, expanding renewable energy infrastructure, and automation-intensive industrial operations. PEI’s fire-retardant classification and chemical resistance align with EU regulations emphasizing passenger safety and sustainable manufacturing. Rising investments in electric mobility and lightweight composite materials also support its integration into electronic connectors, motor insulation, and charging components. European research institutions continue leveraging PEI in additive manufacturing for prototyping and precision tooling.

Asia Pacific

Asia Pacific captures the largest share at approximately 34%, fueled by rapid industrialization, cost-efficient manufacturing ecosystems, and expanding electronics and automotive production hubs in China, Japan, South Korea, and India. PEI adoption advances through high-speed connectors, semiconductor parts, and heat-resistant components molded for EV platforms. The region’s strong presence in industrial automation technology supports the use of PEI in pump components, robotics systems, and high-voltage insulation assemblies. Favorable government policies and foreign investments in aerospace and healthcare manufacturing further elevate demand. Cost competitiveness and scaling capacity position Asia Pacific as a global production and consumption center for PEI.

Latin America

Latin America accounts for approximately 3% of global PEI consumption, with growth emerging in automotive aftermarket components, food processing equipment, and industrial maintenance applications. Brazil and Mexico drive demand through expanding manufacturing bases and greater interest in flame-resistant and corrosion-resistant polymers that replace metal parts in machinery. Adoption remains slower than in developed markets due to cost considerations and limited high-performance polymer processing capacity. However, the growing pharmaceutical packaging industry, combined with regional investment in industrial automation and export-driven electronics assembly, provides opportunities for increased PEI penetration over the forecast horizon.

Middle East & Africa

The Middle East & Africa region holds around 2% of market share, primarily driven by demand from oil and gas, medical device distribution, and food processing sectors that require high-temperature, chemically resilient materials. PEI tubing, valve components, and sensor housings find application in corrosive or sterilized operating environments. The UAE and Saudi Arabia support technologically advanced manufacturing clusters, while South Africa represents emerging industrial usage. Higher costs and limited polymer engineering capacity restrain faster adoption. Nevertheless, infrastructure diversification programs and foreign investments in healthcare and industrial equipment manufacturing gradually expand regional market potential.

Market Segmentations:

By Grade

By Form

- Sheets

- Rods

- Granules

- Films

By Application

- Automotive

- Aerospace

- Electronics

- Pharmaceuticals

- Industrial

- Consumer Products

- Food

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polyetherimide (PEI) market is characterized by the presence of global resin manufacturers, specialty polymer suppliers, and value-added compounders that focus on high-performance materials for critical end-use industries. Market participants compete through product purity, heat and chemical resistance, process optimization for injection molding and 3D printing, and customized grades for aerospace, electronics, and medical applications. Companies emphasize lightweight innovation, sustainability-driven formulations, and regulatory-compliant materials to meet stringent industry standards. Strategic initiatives include capacity expansions, R&D partnerships, and downstream integration to strengthen supply chain security and serve niche precision-engineered applications. Competitive differentiation increasingly derives from technical advisory services, application-specific testing capabilities, and alignment with OEM specifications. Additionally, growing EV production, increased industrial automation, and additive manufacturing adoption provide further avenues for competitive positioning, enabling leading manufacturers to enhance market penetration through performance enhancements and tailored engineering support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025 the company refreshed its product specification for “CENTRO HPM / PEI,” indicating ongoing material maintenance and supply readiness.

- In July 2024, SABIC officially commissioned a new manufacturing facility in Singapore to produce its ULTEM™ PEI resin, boosting global resin capacity.

- In July 2023, Mitsubishi Chemical Advanced Materials The firm updated datasheets (e.g., for its “Duratron U1000 PEI” line) reflecting revised technical data and reaffirmed availability of PEI shapes and parts.

Report Coverage

The research report offers an in-depth analysis based on Grade, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PEI is expected to increase as more industries replace metals with high-strength engineering polymers.

- Electric vehicle platforms will expand opportunities for PEI in high-voltage insulation, connectors, and battery-adjacent components.

- Aerospace applications will continue driving material innovation focused on lightweight, heat-resistant, and flame-retardant structures.

- Adoption of PEI in additive manufacturing will accelerate low-volume production and design-flexible industrial tooling.

- Medical and pharmaceutical industries will increase usage of sterilization-resistant PEI components.

- Recyclable and sustainable PEI formulations will gain prominence as environmental standards tighten.

- Integration into semiconductor and 5G infrastructure parts will advance due to its dielectric performance.

- Material customization and compound blending will expand niche applications in industrial automation.

- Strategic collaborations between polymer suppliers and OEMs will shape customized product development.

- Asia Pacific will strengthen its role as a manufacturing and consumption hub for PEI materials.