Market Overview

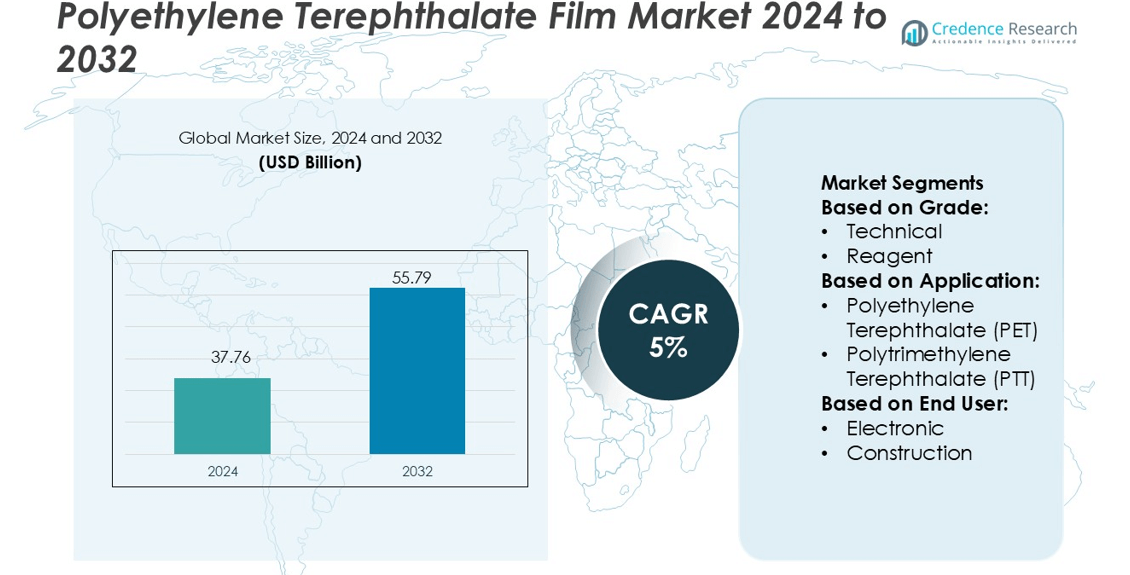

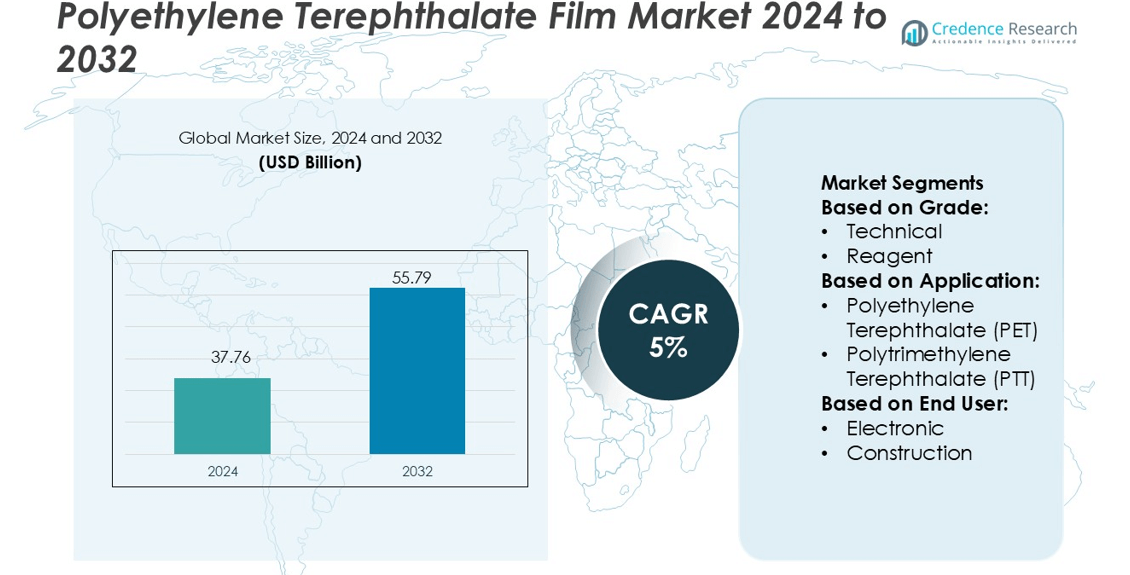

Polyethylene Terephthalate Film Market size was valued USD 37.76 billion in 2024 and is anticipated to reach USD 55.79 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyethylene Terephthalate Film Market Size 2024 |

USD 37.76 billion |

| Polyethylene Terephthalate Film Market, CAGR |

5% |

| Polyethylene Terephthalate Film Market Size 2032 |

USD 55.79 billion |

The Polyethylene Terephthalate (PET) Film market include TORAY INDUSTRIES, INC., Nuroll SpA., Qingdao Kingchuan Packaging, Polyplex, GLS Group, Bleher Folientechnik GmbH, Shenzhen KHJ Technology Co., Ltd, COVINIL S.A., Jiangsu Yuxing Film Technology Company, and Mitsubishi Chemical Group. These companies compete through innovation, capacity expansion, and strategic collaborations to strengthen their market positions across packaging, electronics, automotive, and industrial applications. The Asia Pacific region leads the market with a 34% share, driven by strong industrialisation, rapid urbanisation, and high demand for food, beverage, and flexible packaging films. Manufacturers in the region leverage cost-efficient production, expanding domestic consumption, and growing e-commerce sectors to capture volume growth. Continuous investment in advanced coating technologies, multi-layer films, and sustainable PET solutions further strengthens regional dominance while supporting long-term market growth across both industrial and consumer applications.Top of Form

Market Insights

- The Polyethylene Terephthalate Film market size was valued at USD 37.76 billion in 2024 and is expected to reach USD 55.79 billion by 2032, growing at a CAGR of 5% during the forecast period.

- Rising demand for flexible packaging in food, beverage, and pharmaceuticals drives market growth, along with increasing applications in electronics, automotive, and industrial sectors.

- Market trends include the development of multi-layer and high-performance films, adoption of recycled and sustainable PET, and innovation in barrier coatings to enhance durability and functionality.

- Competition is strong, with key players such as TORAY INDUSTRIES, INC., Nuroll SpA., Qingdao Kingchuan Packaging, Polyplex, GLS Group, and others focusing on innovation, capacity expansion, and strategic partnerships to strengthen market positions.

- Asia Pacific leads with a 34% share due to industrialisation, urbanisation, and high packaging demand, followed by North America and Europe; specialty films dominate the electronics and industrial segments, while flexible packaging holds the largest share across end-use applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

In the grade‑based segmentation of the PET film market covering Technical, Reagent, Pure, and Synthesis grades, the “Technical” grade emerges as the dominant sub‑segment with an estimated share of approximately 45 %. Demand for this grade is driven by its versatility in multiple applications, including packaging and insulation films, where cost‑effective performance meets quality requirements. Its dominance stems from manufacturers’ preference for a grade that balances mechanical strength and clarity with competitive pricing, enabling wide adoption across the value chain.

- For instance, Toray’s Lumirror® PET film line supports an annual global capacity of about 800 million pounds (≈ 362 880 tons) produced across its three manufacturing lines.

By Application

For the application‑based segmentation among Polyethylene Terephthalate (PET), Polytrimethylene Terephthalate (PTT) and Polybutylene Terephthalate (PBT), the PET application dominates the market with an estimated share near 65 %. This dominance is anchored in PET’s widespread use in packaging films, labels, and flexible displays, where its combination of barrier performance, transparency and recyclability appeals to manufacturers and consumers alike. The high volume and established processing infrastructure for PET films reinforce its leadership. PTT and PBT segments are emerging in high‑end applications (e.g., specialty automotive interior films, electronics), where enhanced thermal or mechanical properties are required. Yet their smaller scale, higher cost and niche positioning keep PET application as the primary driver of market expansion.

- For instance, Nuroll’s “Peelable-C” bi-axially oriented PET film is designed for use as heat-seal lidding and is dual ovenable, with temperature resistance from −60 °C up to 200 °C. The film provides strong, consistent peeling to substrates such as APET, CPET, PETG, and PVC.

By End‑User

Within the end‑user segmentation—covering Electronic, Construction, Automotive, Textile & Fiber, and Packaging—the Packaging segment holds the largest market share at approximately 40 %. Growth in e‑commerce, rising demand for lightweight and recyclable packaging, and requirements for shelf‑life extension in food and beverage products drive the lead of the packaging end‑use. Films used in flexible pouches, shrink sleeves, label overlays and form‑fill‑seal formats all boost uptake.The Electronics and Automotive segments follow, propelled by increasing use of films in high‑performance insulation, displays, and vehicle interior components. Despite strong growth in those segments, the sheer volume of film consumed in packaging maintains the segment’s dominance across the global PET films market.

Key Growth Drivers

Expansion of Electronics and Automotive Industries

The PET film market benefits from the growing demand in electronics, automotive, and packaging sectors. In electronics, films are critical for displays, touchscreens, and insulation layers, offering clarity, flexibility, and electrical insulation. Automotive manufacturers increasingly use PET films for interior laminates, insulation, and lightweight components, contributing to fuel efficiency. The rapid industrialisation and rise in consumer electronics globally further boost adoption. Continuous product development and capacity expansions by manufacturers ensure that PET films remain a preferred choice, reinforcing sustained growth across these high-volume end-use industries.

- For instance, Kingchuan’s “Heat Sealable PET Film” lists a heat‑seal strength of 5 N per 15 mm width at 30 µm thickness, with tensile strength of 190 MPa (MD) and 220 MPa (TD), and elongation at break of 160 % (MD) and 110 % (TD).

Rise in Sustainable Packaging

Sustainability concerns drive the use of PET films in food, beverage, and FMCG packaging. PET films offer recyclability, lightweight properties, and excellent barrier performance, which extend product shelf life and reduce material usage. Growing regulatory pressure on single-use plastics and increasing consumer awareness of eco-friendly packaging create strong demand. Companies adopt recycled PET content and bio-based films to align with circular economy initiatives. This focus on sustainability not only enhances brand image but also supports market expansion as manufacturers shift from conventional plastics toward recyclable and environmentally responsible solutions.

- For instance, Polyplex’s “RPET Range” provides up to 90 % post‑consumer recycled (PCR) content in thicknesses from 10 µm to 250 µm the company’s “BioPET / Plant PET” grade features a 32 % bio‑based component derived from renewable resources in thicknesses 12 µm to 100 µm.

Technological Improvements

Technological advancements in PET film manufacturing drive market growth by enhancing product performance and opening new applications. Innovations include thinner gauges, improved optical clarity, advanced barrier coatings, and incorporation of recycled or bio-based content. These improvements enable applications in flexible electronics, advanced packaging, automotive interiors, and specialty films for industrial use. Enhanced mechanical strength, dimensional stability, and thermal resistance make PET films more versatile and cost-effective. Continuous research and development also allow customization for niche applications, ensuring that PET films remain competitive against alternative materials while meeting evolving industrial and consumer requirements

Key Trends & Opportunities

Use of Recycled and Bio-based PET Films

The adoption of post-consumer recycled (PCR) and bio-based PET films is increasing due to environmental and regulatory pressures. Brands across food, beverage, and consumer goods sectors integrate recycled content to reduce carbon footprints and achieve sustainability goals. Bio-based PET films also cater to eco-conscious consumers while maintaining performance standards. This shift creates opportunities for suppliers to develop high-quality, certified sustainable films. Companies investing in recycling infrastructure and bio-based resin technologies gain competitive advantages, as environmental compliance and consumer preference increasingly influence procurement decisions across the market.

- For instance, GLS Polyfilms reports that it offers BOPET films with up to 90 % PCR content, enabling laminate/pouch structures with over 50 % recycled content when combined with its Heat Seal PET films.

Growth in Display and Optical Applications

PET films are increasingly used in touchscreens, OLED displays, flexible electronics, and optical applications. High clarity, ultra-thin gauges, dimensional stability, and barrier properties make them essential in advanced device manufacturing. As electronic devices evolve toward flexible, foldable, and wearable formats, demand for high-performance films rises. This trend creates opportunities for manufacturers to supply specialty films for niche, high-value applications. Expansion in optical and display segments not only increases revenue potential but also encourages innovation in coatings, transparency, and functional additives to meet stringent industry standards.

- For instance, Bleher’s optimont® basic films cover thicknesses from 7 µm up to 500 µm with variants described as “crystal‑clear transparent, opaque or reflective,” giving material design flexibility for optical windows or coatings.

Expansion in Emerging Regions

Emerging markets in Asia-Pacific, Latin America, and parts of the Middle East present significant growth opportunities for PET films. Rapid urbanisation, increasing disposable incomes, and rising demand for packaged food, beverages, and industrial applications drive adoption. Manufacturers can strategically locate production facilities in these regions to reduce costs, improve supply chain efficiency, and capture growing market share. Growth in regional packaging, textiles, automotive components, and electronics further supports market expansion. Focused regional strategies allow companies to address local regulatory requirements, consumer preferences, and distribution challenges effectively.

Key Challenges

Raw Material Price Fluctuations

The PET film market faces volatility in key feedstocks such as purified terephthalic acid (PTA) and monoethylene glycol (MEG). Fluctuating raw material prices impact production costs, pricing strategies, and profit margins. Supply chain disruptions or limited availability in certain regions exacerbate the challenge, particularly for manufacturers with global operations. Price instability can hinder long-term planning and investment in new capacities. Companies must adopt risk mitigation strategies, such as long-term procurement contracts and diversified sourcing, to maintain stable production and competitive pricing.

Competition from Alternative Materials

PET films face competition from polypropylene, biodegradable films, and other flexible packaging alternatives. These materials are increasingly used in applications where environmental impact, cost, or material properties influence procurement decisions. Regulatory pressures on single-use plastics also compel manufacturers to consider alternative materials, potentially limiting PET film adoption. Continuous innovation and value-added features are necessary to maintain competitiveness. Companies must emphasize product performance, recyclability, and sustainability to differentiate PET films and retain market share against emerging materials that offer cost or environmental advantages.

Regional Analysis

North America

North America holds about 35% of the global PET film market. The region grows because of high demand in food and beverage packaging, electronics, and medical applications. Companies have strong manufacturing facilities and good recycling systems, which help meet customer needs. Innovation focuses on improved barrier properties, durability, and recyclability. Rising costs of raw materials, such as PET resin, and competition from alternative materials create challenges. However, steady industrial demand, supportive regulations, and strong consumer preference for high-quality packaging continue to drive market growth across the United States and Canada.

Europe

Europe commands roughly 19% of the PET film market. Growth is supported by strict packaging and environmental regulations, advanced automotive and electronics industries, and a focus on sustainable materials. Manufacturers invest in multi-layer films and recycled-content PET to meet EU rules. Demand is high for food packaging, medical films, and specialty industrial applications. Feedstock price fluctuations and strong competition from Asia create challenges. Despite these issues, European countries maintain steady market growth, with companies adopting circular-economy practices, improving recycling processes, and expanding production capacity to meet both industrial and consumer demand.

Asia Pacific

Asia Pacific leads the market with around 34% share. The region grows rapidly due to industrialisation, urbanisation, and strong demand for food and beverage, electronics, and flexible packaging. China, India, and Southeast Asia have expanding production facilities and lower labour costs, attracting global and local PET film producers. Environmental regulations are less strict compared to Western countries, allowing faster production volume growth. However, dependency on imported raw materials and evolving waste-management systems pose risks. Strong government support, rising disposable income, and the growth of e-commerce and consumer packaged goods continue to drive regional demand in both industrial and consumer applications.

Latin America

Latin America represents about 6% of the PET film market. Growth is supported by urbanisation, increasing disposable incomes, and higher consumption of packaged food and beverages. Local companies are expanding production capacity to meet rising demand in Brazil, Mexico, and other countries. The market also benefits from growth in flexible packaging and industrial films. Challenges include limited infrastructure, currency fluctuations, and reliance on imported raw materials. While the market grows slower than Asia Pacific, it offers opportunities for regional converters and manufacturers that can provide tailored PET film solutions and invest in local production, logistics, and distribution networks.

Middle East & Africa

The Middle East & Africa region accounts for about 4% of the global PET film market. Demand grows due to packaging, food service, construction, and industrial applications, especially in Gulf Cooperation Council countries. Companies focus on high-margin, niche products, as mass-market production is limited. Challenges include weaker recycling systems, high import costs for raw materials, and smaller end-use diversification compared with other regions. Growth potential exists if companies invest in local production facilities, improve logistics, and expand into industrial and commercial applications. Steady investments in infrastructure and consumer packaged goods are expected to gradually increase PET film demand in the region.

Market Segmentations:

By Grade:

By Application:

- Polyethylene Terephthalate (PET)

- Polytrimethylene Terephthalate (PTT)

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Polyethylene Terephthalate Film market include TORAY INDUSTRIES, INC., Nuroll SpA., Qingdao Kingchuan Packaging, Polyplex, GLS Group, Bleher Folientechnik GmbH, Shenzhen KHJ Technology Co., Ltd, COVINIL S.A., Jiangsu Yuxing Film Technology Company, and Mitsubishi Chemical Group. The Polyethylene Terephthalate Film market is highly competitive, driven by innovation, capacity expansion, and strategic partnerships. Companies focus on developing high-performance films for electronics, industrial, and packaging applications, leveraging advanced coating technologies and research capabilities. Regional production facilities are expanding to meet growing demand in food, beverage, and flexible packaging sectors, while cost-efficient manufacturing practices enhance competitiveness in emerging markets. Innovation in specialty films, sustainable PET solutions, and multi-layer structures is a key differentiator, enabling firms to address diverse end-use requirements. The market also experiences consolidation as firms seek scale advantages and improved supply chain efficiency. Overall, competition is shaped by technological differentiation, focus on environmental compliance, and responsiveness to evolving customer needs, which collectively define long-term growth opportunities across global and regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TORAY INDUSTRIES, INC.

- Nuroll SpA.

- Qingdao Kingchuan Packaging

- Polyplex

- GLS Group

- Bleher Folientechnik GmbH

- Shenzhen KHJ Technology Co., Ltd

- COVINIL S.A.

- Jiangsu Yuxing Film Technology Company

- Mitsubishi Chemical Group

Recent Developments

- In November 2024, Polyplex announced the near completion of its expansion of a PET production facility in Decatur, Alabama, with startup expected in the first quarter of 2025. The project includes a new BOPET film line and debottlenecking of the PET resin plant, which is expected to boost the company’s capacity and competitiveness in the US market.

- In February 2024, Eastman Chemical Company entered into a long-term agreement with Nord Pal Plast SA, a part of Dentis Group—a leading Italian multinational specializing in PET packaging waste recovery and mechanical recycling. Under this partnership, Dentis will provide 30,000 metric tonnes per year of rejected PET post-consumer waste to Eastman.

- In January 2024, TekniPlex Healthcare and Alpek Polyester developed the first pharmaceutical-grade PET blister film using 30% post-consumer recycled (PCR) content. This innovation increases sustainability in pharmaceutical packaging by reducing the need for virgin plastics, and the film meets stringent quality standards for product protection and safety.’

- In February 2023, RePEaT Co., Ltd., a Japan-based firm, signed an agreement with Zhejiang Jianxin Jiaren New Materials Co., Ltd. to license its chemical recycling technology for polyester products. This technology is based on dimethyl terephthalate (DMT) and involves the chemical decomposition, conversion, and repolymerization of polyester (PET) products

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PET films will grow steadily due to rising packaging and industrial applications.

- Sustainable and recycled PET solutions will gain more adoption globally.

- Flexible packaging will continue to drive market expansion across food and beverage sectors.

- Advanced coating technologies will improve barrier properties and enhance product performance.

- Growth in electronics and automotive sectors will increase the need for specialty films.

- Emerging economies in Asia Pacific and Latin America will show faster market growth.

- Companies will focus on capacity expansion and regional production facilities to meet demand.

- Innovation in multi-layer and high-performance films will differentiate market players.

- Stringent environmental regulations will push the development of eco-friendly PET films.

- Strategic collaborations and partnerships will strengthen supply chains and market reach.