Market Overview:

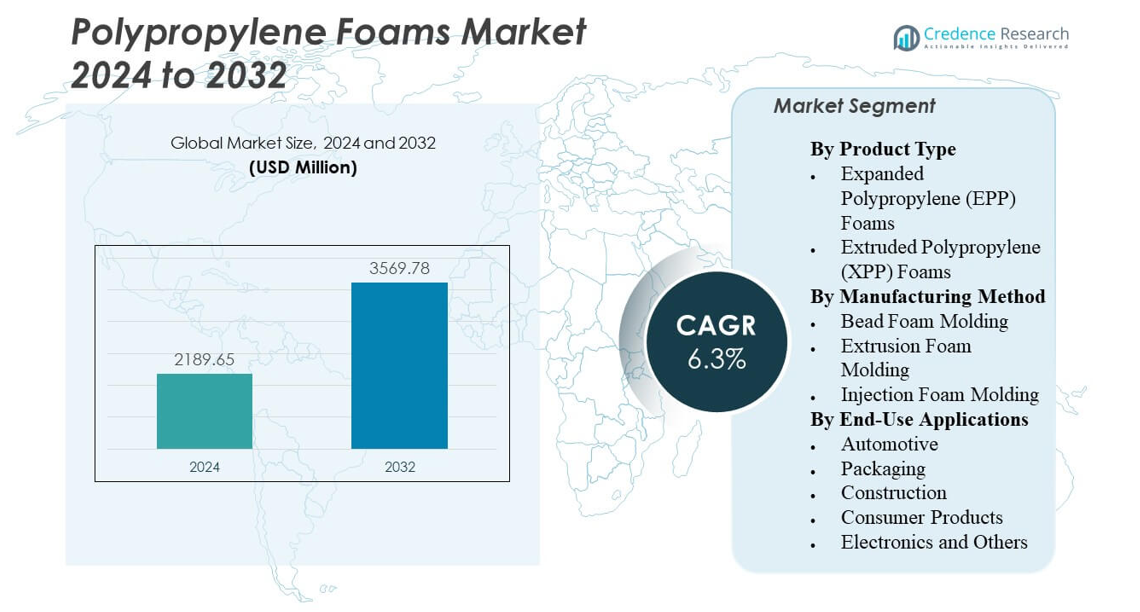

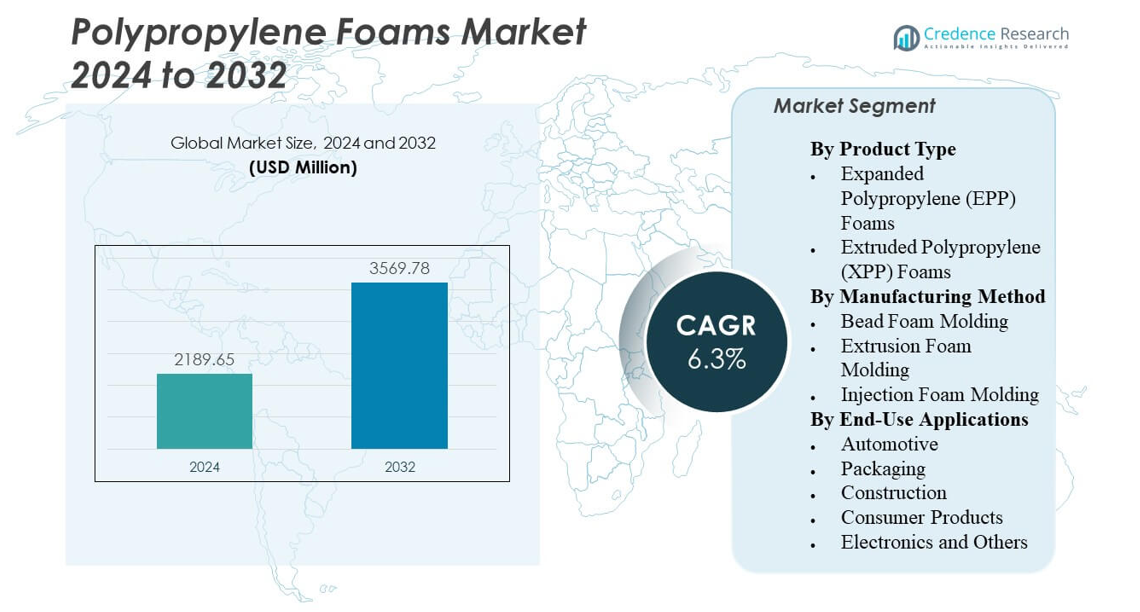

The Polypropylene Foams Market is projected to grow from USD 2189.65 million in 2024 to an estimated USD 3569.78 million by 2032, with a compound annual growth rate (2. CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene Foam Market Size 2024 |

USD 2189.65 million |

| Polypropylene Foam Market, CAGR |

6.3% |

| Polypropylene Foam Market Size 2032 |

USD 3569.78 million |

Rising automotive production and construction investments fuel polypropylene foam use in structural and insulation components. Automakers prefer the material for its lightweight structure, helping reduce emissions and improve energy efficiency. Packaging industries adopt it for shock resistance, cost-effectiveness, and recyclability. The foam’s strong chemical and thermal stability supports applications in electronics and consumer goods. Ongoing R&D in foam molding technologies improves density control and durability. It continues to replace traditional plastics, meeting performance and sustainability expectations in industrial applications.

Asia-Pacific leads global demand driven by strong manufacturing in China, Japan, and India. It benefits from abundant raw materials, low production costs, and expanding automotive and packaging industries. North America and Europe show stable consumption supported by established insulation and vehicle sectors. Latin America emerges as a promising region, supported by rising industrialization and infrastructure projects. Middle East & Africa display gradual growth with expanding logistics and construction networks. Global producers continue investing in localized production facilities to meet growing regional needs.

Market Insights:

- The Polypropylene Foams Market is projected to grow from USD 2189.65 million in 2024 to an estimated USD 3569.78 million by 2032, reflecting a CAGR of 6.3%.

- Rising adoption of lightweight and recyclable materials across automotive, packaging, and construction drives market expansion.

- High raw material cost fluctuations and limited recycling infrastructure restrain consistent profitability for producers.

- Asia-Pacific leads global demand, supported by large-scale automotive production and expanding packaging networks.

- Europe and North America maintain steady growth with strong sustainability mandates, while Latin America and the Middle East show emerging potential through industrialization and urban development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Lightweight and Energy-Efficient Materials Across Industries

The Polypropylene Foams Market grows steadily due to the rising need for lightweight and energy-efficient materials. Automotive manufacturers replace heavier plastics with PP foams to improve fuel efficiency and meet emission targets. It supports thermal insulation in buildings, helping reduce energy use. Packaging firms favor the foam for its durability and recyclability. Construction projects benefit from noise and heat insulation properties. The medical industry also adopts PP foam for sterile packaging solutions. Rising environmental awareness drives material shifts toward sustainable polymers. Manufacturers expand foam use to balance performance and circular economy goals.

- For example, ExxonMobil Chemical developed patented high-melt-strength polypropylene formulations with melt tension values ranging from 20 to 80 centinewtons at 190 °C. These materials enhance foam stiffness and thermal resistance, making them suitable for advanced extrusion and sheet foam applications.

Expanding Use in Automotive Interiors and Structural Applications

Automotive interiors increasingly rely on polypropylene foam due to its impact resistance and low density. It helps reduce vehicle weight without compromising safety. Automakers apply it in dashboards, door panels, and seating components. Noise vibration reduction properties enhance passenger comfort and cabin acoustics. Electric vehicle growth boosts foam demand for insulation and lightweight design. OEMs adopt recyclable foams to meet sustainability targets. The foam’s compatibility with molding processes ensures production efficiency. Its broad adaptability strengthens long-term adoption in mobility solutions worldwide.

Rising Popularity in Consumer Goods and Protective Packaging Applications

The packaging sector drives polypropylene foam demand due to its cushioning and lightweight properties. E-commerce expansion pushes protective packaging innovations using PP foams. Consumer electronics and appliances benefit from strong shock absorption and clean appearance. The material’s flexibility helps tailor shapes for specific products. Recyclability aligns with growing regulatory support for circular packaging. It enables brand owners to cut carbon footprints while maintaining safety. Food packaging also gains traction due to its moisture resistance. Stable performance across temperatures supports adoption in sensitive product logistics.

- For example, JSP Corporation manufactures expanded polypropylene (EPP) foam materials used globally in protective packaging for electronics and appliances. These foams provide strong cushioning, shock absorption, and recyclability benefits. The company markets durable EPP solutions across packaging and automotive sectors to meet safety and sustainability requirements.

Supportive Government Regulations and Industry Sustainability Initiatives

Government policies promoting recyclable materials boost confidence in polypropylene foam solutions. It supports compliance with extended producer responsibility frameworks. Regulations on lightweight materials encourage foam use in transportation and construction. Companies develop closed-loop recycling processes to reclaim PP foam waste. Sustainability certifications enhance market reputation and buyer trust. Investment in bio-based PP foam variants strengthens innovation pipelines. Partnerships between converters and recyclers improve resource efficiency. Public awareness of green materials amplifies the shift toward eco-friendly foams.

Market Trends

Advancement in Foam Processing Technologies Enhancing Product Performance

The Polypropylene Foams Market sees rapid innovation in manufacturing technologies. Continuous extrusion and bead foaming systems enhance product uniformity and density control. Process optimization enables foams with better compression and heat resistance. Automation ensures consistent batch quality for high-volume production. Microcellular foams gain demand for superior insulation and shock absorption. It supports producers in tailoring products for electronics and automotive uses. Manufacturers adopt energy-efficient processes to reduce operational emissions. These innovations set new benchmarks in material performance and reliability.

- For instance, BASF’s Neopolen® P 9255 expanded polypropylene (EPP) foam features molded densities typically between 60 and 90 kg/m³ and provides strong energy absorption with good heat insulation properties. Its lightweight and impact-resistant nature makes it suitable for automotive and protective packaging applications.

Emergence of Bio-Based and Recycled Polypropylene Foam Variants

Sustainability drives innovation in bio-based polypropylene foams derived from renewable feedstocks. Producers integrate recycled polymers without compromising strength and durability. It helps industries meet environmental goals and reduce plastic waste. Material engineers improve recyclate purity for better foam consistency. The trend aligns with consumer preference for low-carbon products. New certification programs validate eco-friendly materials in commercial supply chains. Companies introduce mass-balance solutions to trace renewable input shares. Circular design practices become a key competitive differentiator in foam manufacturing.

Integration of Polypropylene Foams in Electric Vehicles and Battery Systems

Electric vehicle platforms adopt PP foams for insulation and lightweight structural support. It aids in thermal management of battery systems and safety enclosures. Automakers explore high-heat variants to handle powertrain conditions. The foam’s resistance to chemicals and impact ensures durability under stress. Engineers favor it for modular design flexibility in vehicle interiors. Acoustic dampening properties improve cabin quietness in EVs. Expanding EV production capacities globally increase foam demand. Sustainable mobility goals further strengthen long-term integration in next-gen vehicles.

Growing Applications in Construction and Industrial Insulation Projects

Construction growth accelerates demand for PP foams in insulation and soundproofing. Builders favor its stability, low water absorption, and ease of installation. It supports energy-efficient buildings meeting modern thermal codes. Foams find use in HVAC ducts, roofing, and underlay systems. It also replaces polystyrene in several insulation products due to recyclability benefits. Infrastructure modernization in Asia and the Middle East widens market exposure. Demand for eco-certified materials reinforces product acceptance. Continuous R&D expands foam grades fit for extreme weather applications.

- For instance, polypropylene foams demonstrate water absorption below 5% by volume and thermal conductivity around 0.26 W/m·K. Their thermal resistance can reach up to 3.8 R at 70 °F, making them effective for HVAC ducting, roofing, and insulation applications.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

The Polypropylene Foams Market faces persistent raw material price instability. Global polypropylene resin costs fluctuate due to crude oil market variations. Producers struggle with uneven polymer supply during geopolitical disruptions. It impacts production schedules and final product pricing. Logistics issues and trade restrictions increase procurement costs. Smaller converters face challenges maintaining profitability. Inconsistent resin quality affects foam processing efficiency. Companies must strengthen supplier networks to sustain operational continuity.

Limited Recycling Infrastructure and Performance Barriers for Bio-Based Foams

Despite sustainability goals, recycling infrastructure for PP foams remains inadequate in many regions. It complicates waste collection and reprocessing efficiency. Bio-based foams face performance limitations in high-stress industrial use. Manufacturers must balance cost, durability, and environmental benefits. It slows adoption in heavy-duty automotive and construction applications. Limited public awareness also affects post-consumer recovery rates. Technical challenges in foam separation hinder circularity. Industry collaboration is required to scale recycling and material innovation efforts.

Market Opportunities

Rising Adoption in Advanced Packaging and Cold-Chain Logistics

The Polypropylene Foams Market gains new prospects from advanced logistics systems. E-commerce and cold-chain industries seek lightweight, temperature-resistant packaging. PP foam enables secure transit for perishable and sensitive goods. Its moisture control and thermal insulation support pharmaceutical and food sectors. Growing demand for reusable packaging further benefits foam producers. It encourages development of multilayer designs combining rigidity and flexibility. Technological upgrades in molding improve precision for custom packaging. Expanding delivery networks across Asia-Pacific and Europe create sustainable growth pathways.

Emerging Applications in Renewable Energy and Industrial Equipment Insulation

Renewable energy systems use PP foam in turbine housings and battery enclosures. It provides vibration damping and weather protection in wind and solar units. Industrial facilities apply it for equipment sound barriers and thermal wraps. The foam’s resilience under chemical exposure widens its use in refineries and cleanrooms. It supports low-maintenance solutions for long-term asset protection. Manufacturers explore cross-linked PP foam variants with higher temperature tolerance. These features strengthen adoption in future industrial design. Expanding renewable and infrastructure investment supports strong opportunity pipelines globally.

Market Segmentation Analysis:

By Product Type

The Polypropylene Foams Market features two main types: Expanded Polypropylene (EPP) and Extruded Polypropylene (XPP) foams. EPP foams dominate due to strong energy absorption, thermal insulation, and recyclability, supporting automotive and protective packaging applications. It benefits from high demand in impact-resistant components and lightweight structures. XPP foams gain faster growth through uniform density and smooth surface finishes used in food packaging and construction insulation. Continuous innovation in extrusion processes enhances product consistency and durability. Both segments benefit from sustainability trends promoting recyclable materials. Product performance diversity strengthens adoption across industrial sectors.

- For instance, BASF’s Neopolen® P 9235+ expanded polypropylene (EPP) grade provides enhanced surface quality and improved color depth, verified through CIE 1931 color system evaluations. Its durability and visual appeal make it well-suited for automotive trunk liners, bumper cores, and interior components.

By Manufacturing Method

Bead foam molding leads due to its efficiency in producing complex shapes with low material waste. It supports large-volume production for automotive and protective packaging. Extrusion foam molding provides steady output for insulation sheets and profiles. Injection foam molding grows across electronics and appliance components due to design flexibility. It offers superior dimensional stability for lightweight parts. Advancements in process automation improve yield and product precision. Energy-efficient molding systems help manufacturers reduce operating costs. Each method contributes to greater customization and structural innovation in foam manufacturing.

By End-Use Applications

Automotive applications hold the largest share due to lightweighting goals and thermal insulation needs. Packaging follows with high use in cushioning fragile goods and reusable logistics. Construction applications expand through demand for sound and heat insulation. Consumer products include furniture, toys, and appliance interiors using soft yet durable foams. Electronics benefit from anti-static, shock-resistant materials for device safety. It also finds smaller demand in healthcare and industrial equipment. The diversity of end-uses ensures stable long-term consumption. Expanding manufacturing capacity sustains market accessibility across major regions.

- For instance, Hanwha Group’s expanded polypropylene (EPP) foams provide strong impact resistance and buoyancy, making them ideal for automotive battery trays and protective dunnage. These foams maintain shape and strength after multiple impacts, ensuring durability in demanding transport and assembly conditions.

Segmentation:

By Product Type

- Expanded Polypropylene (EPP) Foams

- Extruded Polypropylene (XPP) Foams

By Manufacturing Method

- Bead Foam Molding

- Extrusion Foam Molding

- Injection Foam Molding

By End-Use Applications

- Automotive

- Packaging

- Construction

- Consumer Products

- Electronics and Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads Market with Strong Share

Asia-Pacific accounts for approximately 46 % share of the Polypropylene Foams Market in 2024. Rapid expansion in automotive production, electronics manufacturing, and construction in China, India, Japan and South Korea drives foam demand in this region. It sees high consumption in lightweight vehicle interiors and protective packaging. Growing urbanisation and infrastructure investments in Southeast Asia further boost insulation and packaging use. Manufacturers benefit from lower production costs and regional raw-material availability. Steady economic growth supports long-term demand stability. Region’s dominance stems from broad end-use adoption and high manufacturing capacity.

North America and Europe Hold Stable Shares with Mature Demand

North America and Europe jointly hold a significant portion of global demand. These regions rely on polypropylene foam for automotive lightweighting and sustainable packaging. Strong regulations on energy efficiency and vehicle emissions promote foam use in insulation and automobile interiors. Demand from consumer goods, electronics, and construction adds to market stability. Established supply chains and advanced manufacturing infrastructure support consistent output. Growth in replacement demand and aftermarket applications sustains market value. Regional buyers value recyclability and performance reliability.

Emerging Growth in Latin America, Middle East & Africa and Other Regions

Latin America and Middle East & Africa register growing interest in polypropylene foam applications. Infrastructure development and rising construction activity in these regions support insulation and building material demand. The packaging sector expands with increasing e-commerce and logistics adoption. Demand in automotive and consumer goods slowly rises as manufacturing and consumption increase. Limited domestic production results in higher imports, creating opportunities for suppliers. Foam manufacturers may target these regions with cost-effective products. Regional economic development and urbanisation underpin potential uptake.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Recticel

- JSP Corporation

- Kaneka Corporation

- BASF SE

- Sealed Air Corporation

- The Armacell Group

- Berry Global Group

- LyondellBasell Industries

Competitive Analysis:

The Polypropylene Foams Market features several established players competing across product quality, geographic footprint and application focus. Some producers specialise in high-density EPP foam for automotive bumpers and protective packaging, while others offer XPP variants for construction insulation and packaging applications. Regional manufacturers in Asia-Pacific leverage lower production costs and proximity to raw-material sources. Producers in North America and Europe emphasise sustainability and recyclable foam solutions to match regulatory and consumer preferences. Competition intensifies on manufacturing efficiency, material innovation and supply-chain reliability. Firms that maintain consistent resin quality and flexible production processes gain advantage. Market leaders focus on expanding regional distribution networks and diversifying end-use segments to improve resilience.

Recent Developments:

- In October 2025, LyondellBasell Industries launched Pro-Fax EP648R, a new polypropylene impact copolymer designed for high-performance injection-molded products meeting rising performance demands.

- In March 2025, LyondellBasell introduced Pro-Fax EP649U, a polypropylene grade optimized for rigid packaging with high flow properties, fast crystallization, and food-contact compliance globally.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Manufacturing Method and End-Use Applications. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight materials will rise across mobility, packaging, and building applications.

- Sustainability goals will drive higher adoption of recyclable and bio-based polypropylene foams.

- Electric vehicle production will expand foam use in interiors and thermal management systems.

- Construction insulation demand will increase with stricter energy-efficiency regulations worldwide.

- Technological advances in foam molding will improve product precision and reduce waste.

- Partnerships between resin suppliers and converters will enhance closed-loop recycling capacity.

- Market players will invest in automation and digital quality monitoring to improve yield.

- Asia-Pacific will retain leadership while Latin America and the Middle East gain momentum.

- Foam producers will diversify into specialized sectors such as cold-chain and medical packaging.

- Global competition will favor firms offering sustainable materials and high customization flexibility.