Market Overview

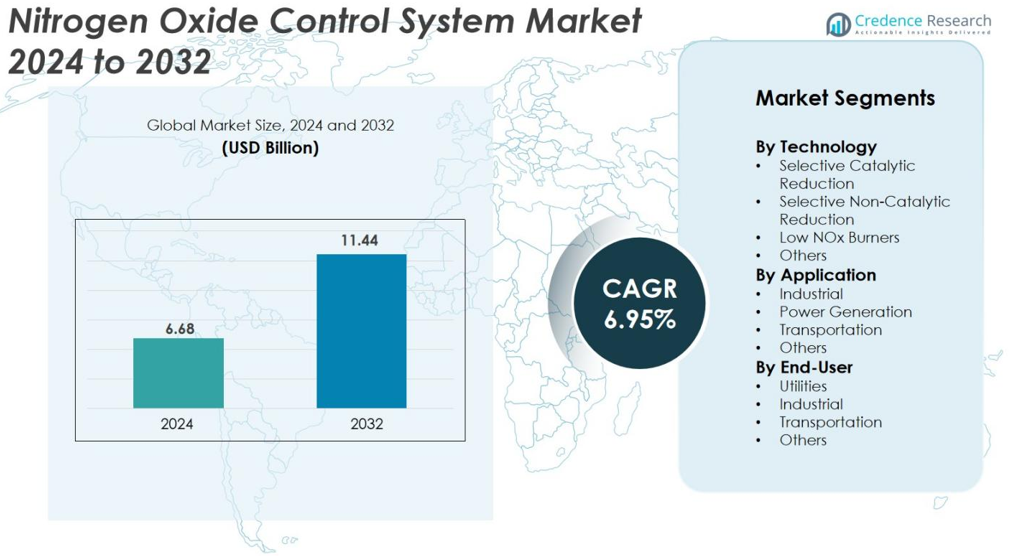

Nitrogen Oxide Control System market size was valued USD 6.68 Billion in 2024 and is anticipated to reach USD 11.44 Billion by 2032, at a CAGR of 6.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nitrogen Oxide Control System market Size 2024 |

USD 6.68 Billion |

| Nitrogen Oxide Control System market, CAGR |

6.95% |

| Nitrogen Oxide Control System market Size 2032 |

USD 11.44 Billion |

The Nitrogen Oxide Control System market includes top players such as ADA-ES, Alstom, BASF SE, CORMETECH Inc., Air Liquide, CECO Environmental, Babcock & Wilcox Enterprises, Ducon Technologies, BHEL, and Amec Foster Wheeler. These companies supply SCR and SNCR systems, catalysts, low-NOx burners, and digital monitoring solutions for power, industrial, and transportation sectors. They compete through advanced catalyst performance, longer service life, and turnkey installation services. Asia-Pacific remains the leading regional market with 34% share in 2024, driven by rapid industrial expansion, strict pollution control regulations, and heavy investment in coal and gas power plants.

Market Insights

- The Nitrogen Oxide Control System market was valued at USD 6.68 Billion in 2024 and is projected to reach USD 11.44 Billion by 2032 at a CAGR of 6.95%.

- Stricter emission regulations in power generation, cement, and chemical industries drive installation of SCR and SNCR units, while utilities hold the largest end-user share.

- Smart monitoring, catalyst recycling, and modular retrofitting systems emerge as key trends as industries seek lower operating costs and improved efficiency.

- Leading companies focus on long-life catalysts, digital control platforms, and turnkey installation to strengthen competitive positions across utilities and industrial facilities.

- Asia-Pacific leads the global market with 34% share, supported by rapid industrialization and heavy power sector investments, while Selective Catalytic Reduction remains the dominant technology segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Technology

Selective Catalytic Reduction (SCR) held the dominant share of 46% in 2024. Industries prefer SCR due to high NOx removal efficiency and compliance with global emission norms. Power plants and heavy industries deploy SCR to meet tightening regulations in Europe, North America, and Asia-Pacific. Selective Non-Catalytic Reduction and Low NOx Burners gained traction for retrofitting older plants and reducing installation costs. Growing investment in cleaner combustion and catalyst innovation supports demand. Other technologies serve small-scale facilities with limited emission control budgets.

- For instance, Mitsubishi Power’s SCR systems achieve up to 95% NOx removal efficiency with minimal ammonia slip, making them a preferred choice in power plants worldwide.

By Application

Power generation accounted for the largest share at 41% in 2024. Coal-fired and gas-based power plants use SCR and SNCR systems to limit NOx output and maintain regulatory compliance. Industrial facilities, including cement, chemicals, and metal processing, also expand adoption to reduce fines and carbon footprints. Transportation applications rise as governments push automotive emission standards and diesel particulate rules. Growing electricity demand and plant modernization projects continue to drive installations in the power sector.

- For instance, Bharat Heavy Electricals Limited in India has recently completed manufacturing India’s first SCR catalysts for thermal power plants, with state power corporations in Maharashtra, Telangana, and West Bengal adopting SCR technology to curb NOx emissions.

By End-User

Utilities dominated the market with 43% share in 2024 due to heavy reliance on stationary emission control systems in power plants and municipal boilers. Industrial users followed, driven by strict environmental mandates in cement, fertilizers, and petrochemicals. The transportation segment sees increased adoption of catalytic converters and engine-based solutions. Rising air quality concerns and sustainability targets encourage utilities to upgrade systems with advanced catalysts, low-ammonia slip technology, and automated controls, boosting long-term market growth.

Key Growth Drivers

Stricter Global Emission Regulations

Governments enforce tighter rules to lower air pollution from power plants, factories, and engines. These laws force companies to install NOx control systems to keep operations legal. Power plants use SCR and SNCR units to meet daily emission targets. Cement and metal plants use low-NOx burners to reduce pollution from combustion. Nations in Asia and Europe raise penalty fees for non-compliance, which drives faster adoption. Rising public concern over health risks from nitrogen dioxide supports regulatory pressure. Cleaner technology also helps firms improve public image and remain competitive in global markets.

- For instance, in India, NTPC Limited has implemented low-NOx burners and other combustion modifications across multiple power plants, covering over 20 GW of capacity, to significantly lower NOx emissions from coal-fired units.

Rising Power Generation and Industrial Output

Growing energy demand drives expansion of coal, gas, and biomass power plants. These plants produce large NOx volumes, so operators install control systems to reduce output. Industrial sectors such as chemicals, fertilizers, and steel generate high-temperature emissions that require reliable NOx reduction. Many older facilities replace outdated burners with modern low-NOx units. New capacity additions in India and China support market growth. Investments in refinery upgrades and waste-to-energy plants further increase system demand. Efficiency gains and cost savings from modern equipment attract utilities and manufacturers.

- For instance, Doosan Heavy Industries developed low-NOx burners tailored for high-ash coal-fired power plants in India, enabling effective retrofit and new-build applications to reduce NOx output substantially.

Shift Toward Cleaner Transportation Systems

Transport fleets release high nitrogen oxide levels from diesel engines. Governments enforce strict norms on trucks, buses, and marine vessels. Catalytic converters and exhaust treatment systems help meet emission targets. Rail and shipping operators also adopt catalytic reduction units to lower pollution. Electric and hybrid vehicle adoption reduces long-term NOx output, but current fleets still need control solutions. Ports and city authorities fund retrofitting programs to cut emissions in urban zones. These developments create stable demand across road, marine, and rail applications.

Key Trends & Opportunities

Adoption of Smart and Continuous Monitoring Systems

Industries now deploy sensors and automated controls to track NOx emissions in real time. Digital tools provide alerts, improve burner performance, and reduce ammonia slip. Data analytics help operators schedule maintenance and extend catalyst life. Cloud-linked platforms support remote monitoring in power plants and refineries. This shift lowers operating costs and ensures easy compliance with emission rules. Vendors offering integrated hardware and software gain a strong market edge. The trend creates new service opportunities for monitoring, data analysis, and performance upgrades.

- For instance, a major European energy supplier uses SICK gas analyzers combined with web-based condition monitoring to achieve 97% emission measurement availability, enabling timely maintenance and reducing downtime in waste incineration plants.

Growth of Low-Cost and Modular Solutions

Small and medium plants look for affordable options that work without major downtime. Modular SCR and SNCR units allow quick installation and easier scaling. Compact systems also help older facilities meet emission rules without full plant changes. Manufacturing advances reduce catalyst costs and improve durability. Portable solutions support temporary industrial sites and construction fleets. Demand grows in developing regions where budgets are tight but regulations are rising. This trend opens a large opportunity for cost-efficient designs and retrofitting packages.

- For instance, Lechler USA’s SNCR systems are designed for easy installation and retrofit on boilers, allowing facilities to reduce NOx emissions cost-effectively without major equipment changes.

Key Challenges

High Installation and Operating Costs

Advanced SCR units require catalysts, sensors, and ammonia handling systems, driving up both capital and maintenance costs. These components significantly raise expenses, particularly for older facilities, making adoption challenging for small industries with tight budgets. Long-term costs include catalyst replacements and reagent supply, while specialized staff are needed to operate and maintain the systems. In developing regions, financial barriers and strict emission regulations hinder adoption, slowing market growth despite environmental pressures.

Technical Complexity and Compliance Issues

SCR systems face difficulties with high temperatures, variable fuel quality, and load changes, which can lead to inefficiencies. Poor system tuning results in ammonia slip, reduced efficiency, or excessive fuel consumption, complicating compliance with daily emission limits. Older boilers and engines struggle to meet new standards, and plants without trained staff risk downtime and failed tests. Upgrading outdated structures for modern equipment adds engineering challenges, delaying both installation and expected emission savings.

Regional Analysis

North America

North America held 31% share in 2024, supported by strict EPA emission standards and strong investments in air quality control across power and industrial sectors. Coal and gas power plants install SCR and SNCR systems to meet federal rules, while refineries and cement plants upgrade burners to lower NOx output. The United States drives most revenue due to modernization of aging energy infrastructure and continuous compliance monitoring. Growing adoption of catalytic converters in heavy-duty trucks and marine fleets also boosts demand. Technology upgrades, catalyst replacement services, and digital monitoring platforms support steady long-term market growth.

Europe

Europe accounted for 27% share in 2024, driven by clean air directives and strict enforcement across industrial and transportation sectors. Germany, Italy, and the United Kingdom promote SCR-based solutions for power generation and large manufacturing facilities. The EU’s push for low-emission zones increases adoption in marine and heavy-vehicle fleets. Waste-to-energy plants and district heating units also deploy NOx reduction technologies to meet national emission ceilings. Catalyst recycling programs and support for ammonia-free systems provide new commercial opportunities. Sustainability goals and carbon-neutral policies will continue to stimulate market investments.

Asia-Pacific

Asia-Pacific led global demand with 34% share in 2024. Rapid industrialization, rising power generation, and strict pollution control laws in China, India, Japan, and South Korea support large-scale installations. Coal and gas power plants form the largest end-user base, while cement, iron, steel, and petrochemical industries also increase retrofitting. Governments impose emission caps in urban and industrial zones, pushing mass deployment of SCR and low-NOx burners. Domestic manufacturing and lower equipment costs boost adoption among small and medium plants. Fast economic expansion makes Asia-Pacific the fastest-growing regional market.

Latin America

Latin America held 4% share in 2024, led by Brazil, Mexico, and Chile. The region invests in emission control for cement, fertilizer, and refinery operations as environmental policies tighten. Power utilities adopt selective catalytic and non-catalytic systems to reduce pollution near cities. Diesel vehicle emission limits drive demand for after-treatment technologies in transportation fleets. Budget sensitivity slows adoption in smaller industries, but government incentives and modernization of old plants support gradual growth. Expanding mining and metal processing sectors provide future opportunities for NOx control solutions.

Middle East & Africa

Middle East & Africa represented 3% share in 2024. Refineries, petrochemical facilities, and gas-fired power plants lead adoption due to emission mandates and rising urban air pollution. GCC countries invest in advanced SCR and burner systems to meet sustainability targets. South Africa drives industrial deployment in mining and metallurgy. High installation cost and limited local manufacturing slow large-scale adoption, but international partnerships and environmental reforms support steady progress. Growth in new power projects and clean-fuel initiatives will improve long-term demand for NOx control technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Technology

- Selective Catalytic Reduction

- Selective Non-Catalytic Reduction

- Low NOx Burners

- Others

By Application

- Industrial

- Power Generation

- Transportation

- Others

By End-User

- Utilities

- Industrial

- Transportation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Nitrogen Oxide Control System market features global technology providers, industrial solution companies, and catalyst manufacturers. Leading players such as Alstom, CECO Environmental, BASF SE, BHEL (Bharat Heavy Electricals Limited), and Ducon Technologies Inc. focus on selective catalytic reduction, low-NOx burner innovation, and digital monitoring platforms to help industries meet strict emission limits. These companies expand through partnerships with utilities, refineries, and power plant operators to supply turnkey systems and long-term maintenance services. Catalyst development, including longer life cycles and low-ammonia slip formulations, is a major competitive area. Vendors also invest in modular and cost-efficient systems that support retrofitting in older plants. Mergers, acquisitions, and geographic expansion remain key strategies to strengthen customer reach. Firms that combine hardware, software, and after-sales support hold an advantage in a market driven by compliance and operational reliability.

Key Player Analysis

Recent Developments

- In May 2025, Johnson Matthey agreed to sell its Catalyst Technologies business to Honeywell for GBP 1.8 billion, channeling proceeds toward its Clean Air division and shareholder returns.

- In February 2025, ANDRITZ acquired LDX Solutions, securing wet electrostatic precipitator and regenerative thermal oxidizer know-how complementary to SCR systems.

- In January 2025, Primoris Services began constructing the world’s largest SCR on Unit 4 at Grand River Energy Center in Oklahoma.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities will continue installing SCR units to comply with strict emission norms.

- Industrial plants will adopt low-NOx burners to reduce combustion pollution.

- Digital monitoring will improve system efficiency and lower maintenance costs.

- Catalyst life will increase due to material improvements and better coating processes.

- Marine and heavy-duty vehicle fleets will expand exhaust treatment adoption.

- Developing nations will invest more in retrofitting aging power plants.

- Portable and modular systems will support small and medium industries.

- Ammonia-free and low-slip technologies will gain stronger demand.

- Service contracts and catalyst replacement will form a major revenue stream.

- Asia-Pacific will remain the fastest-growing region due to rising industrial output.