Market Overview

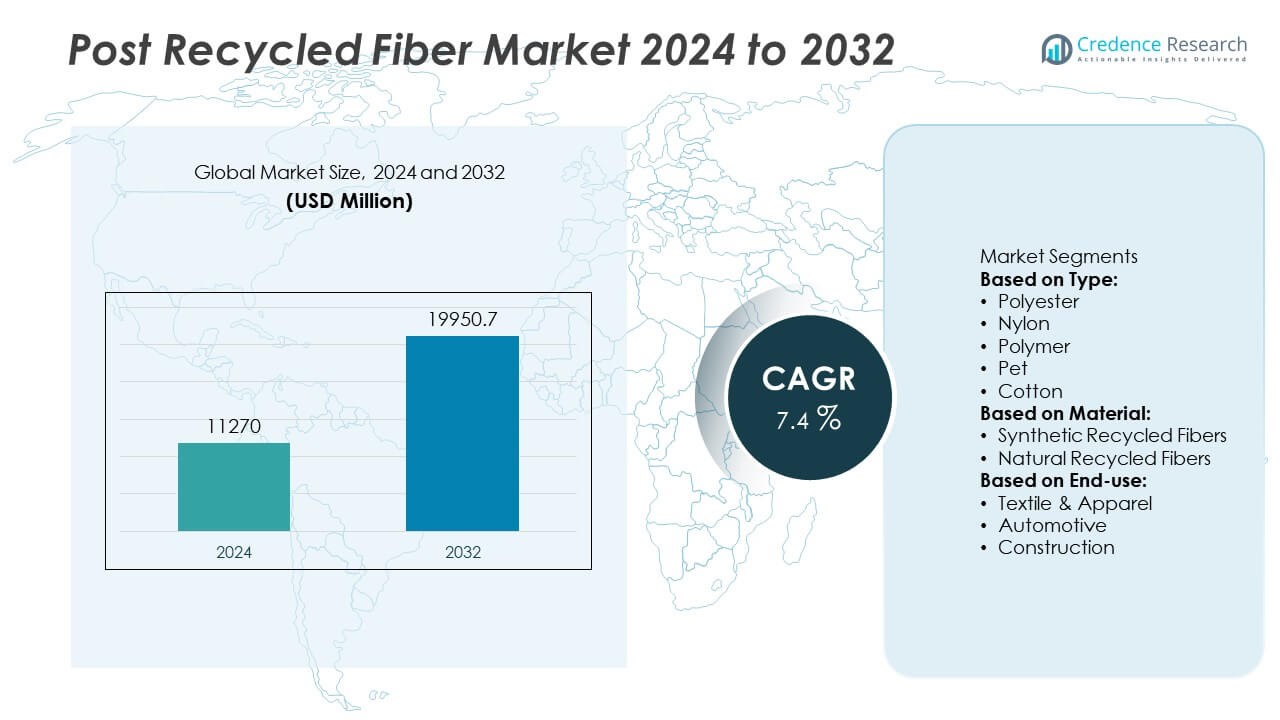

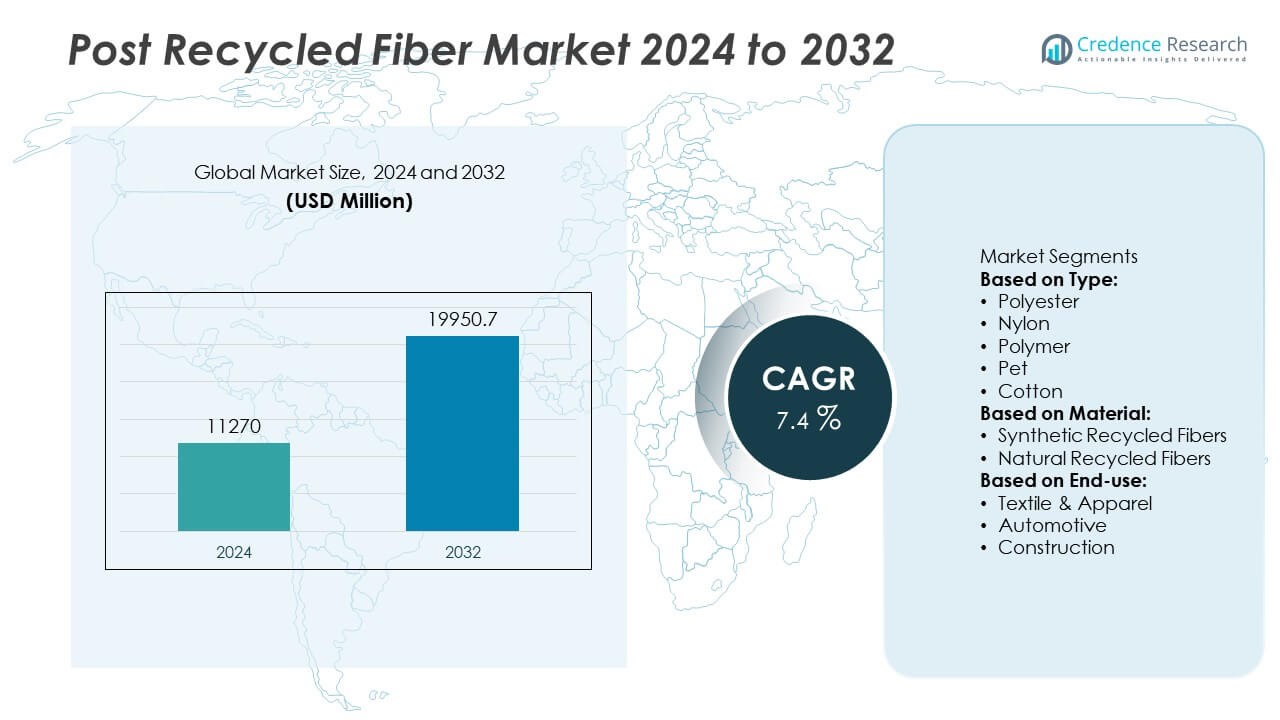

The Post Recycled Fiber market size was valued at USD 11,270 million in 2024 and is projected to reach USD 19,950.7 million by 2032, expanding at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Post Recycled Fiber Market Size 2024 |

USD 11,270 Million |

| Post Recycled Fiber Market, CAGR |

7.4% |

| Post Recycled Fiber Market Size 2032 |

USD 19,950.7 Million |

The Post Recycled Fiber Market grows on the strength of sustainability initiatives, government regulations, and rising demand from packaging and e-commerce industries. It benefits from policies promoting circular economy practices and extended producer responsibility schemes that encourage higher recycled content in consumer goods.

The Post Recycled Fiber Market demonstrates a strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region contributing distinct growth patterns. North America advances through well-established collection systems and high demand from e-commerce packaging, while Europe benefits from strict environmental regulations and advanced waste management networks that ensure consistent fiber recovery. Asia-Pacific shows rapid expansion, driven by industrial growth, urbanization, and rising adoption of domestic recycling systems, particularly in China, India, and Japan. Latin America and the Middle East & Africa reflect gradual development, supported by policy reforms and increasing investment in recycling infrastructure. Key players shaping the competitive landscape include Indorama Ventures Public Company Limited, Reliance Industries Limited, and Lenzing AG, alongside innovators such as UNIFI, Inc. and Infinited Fiber Company, who focus on advanced recycling technologies and sustainable fiber solutions to strengthen their global market position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Post Recycled Fiber Market was valued at USD 11,270 million in 2024 and is expected to reach USD 19,950.7 million by 2032, registering a CAGR of 7.4% during the forecast period.

- Growing emphasis on sustainability and circular economy practices drives market expansion, with governments and corporations promoting recycling initiatives to reduce dependence on virgin materials.

- Rising demand from packaging and e-commerce sectors strengthens adoption, as recycled fibers provide durable and cost-effective raw materials for corrugated boxes, cartons, and protective packaging solutions.

- Technological advancements such as AI-driven sorting systems, advanced de-inking processes, and high-efficiency pulping improve fiber quality and production efficiency, enabling recycled fiber to compete with virgin pulp.

- Competitive dynamics feature global players such as Indorama Ventures, Reliance Industries, Lenzing AG, and UNIFI, Inc., who enhance their positions through investments in recycling infrastructure, strategic partnerships, and sustainable innovation.

- Market restraints include supply inconsistencies, contamination in collected fiber streams, high processing costs, and regulatory compliance pressures that challenge smaller recyclers and limit expansion.

- Regional analysis highlights North America’s established recycling systems, Europe’s regulatory-driven leadership, Asia-Pacific’s rapid growth fueled by industrialization and e-commerce, and emerging opportunities in Latin America and the Middle East & Africa supported by policy reforms and infrastructure development.

Market Drivers

Rising Global Emphasis on Circular Economy and Sustainability Practices

The Post Recycled Fiber Market benefits from the strong momentum of global sustainability initiatives. Governments and corporations integrate circular economy principles to reduce dependence on virgin materials. It supports waste diversion from landfills by transforming used paper and packaging into new products. Regulatory frameworks in the European Union, United States, and Asia-Pacific strengthen recycling targets and mandate higher recycled content in packaging. Brands face pressure from environmentally conscious consumers to adopt responsible material sourcing. This collective push positions recycled fiber as a central component in sustainable industrial supply chains.

- For instance, Lenzing AG recycled over 120,000 tons of textile waste into new fibers in 2023 under its REFIBRA™ technology platform, directly integrating recycled materials into large-scale textile production.

Expanding Demand from Packaging and E-Commerce Sectors

E-commerce growth generates an unprecedented need for corrugated boxes, cartons, and protective packaging. The Post Recycled Fiber Market gains direct momentum from this structural shift in consumer purchasing. It provides an effective raw material solution that balances durability and cost efficiency. Large-scale retailers and logistics firms adopt recycled fiber to comply with packaging sustainability commitments. The food and beverage industry contributes further demand through recycled paperboard applications. Continuous rise in shipment volumes across global markets reinforces the long-term importance of recycled fiber adoption.

- For instance, International Paper reported processing and reusing over 6.1 million tons of recovered fiber in 2023, with a significant portion directed toward corrugated packaging for e-commerce supply chains.

Regulatory Policies Encouraging Recycling and Waste Reduction Targets

Governments implement ambitious recycling and waste reduction mandates that stimulate fiber recovery. The Post Recycled Fiber Market benefits from policies that incentivize higher recycled content across packaging and printing sectors. It gains support from extended producer responsibility schemes requiring manufacturers to fund collection and recycling infrastructure. Subsidies and tax benefits enhance investment in modern recycling facilities. Import restrictions on waste paper in China and Southeast Asia also drive regional self-reliance in recycled fiber production. Such measures elevate the strategic role of post-consumer fibers in global supply networks.

Technological Advancements Enhancing Quality and Production Efficiency

Recycling technologies improve fiber quality, enabling it to compete with virgin pulp in performance. The Post Recycled Fiber Market integrates advanced pulping, de-inking, and sorting systems that deliver higher yield rates. It ensures better brightness, strength, and consistency in paper products. Leading manufacturers invest in AI-driven sorting equipment and closed-loop water systems to reduce operational costs. Upgraded mills expand processing capacity to handle rising collection volumes efficiently. These technological gains strengthen confidence among end-users to rely on recycled fibers for high-quality applications.

Market Trends

Increasing Integration of Recycled Fiber in Premium Packaging Solutions

The Post Recycled Fiber Market reflects a growing shift toward premium sustainable packaging. Global brands adopt recycled fiber not only for corrugated boxes but also for high-quality folding cartons and specialty papers. It supports brand positioning by aligning with eco-conscious consumer preferences. Packaging suppliers invest in design innovation to make recycled fiber visually appealing and durable. The luxury goods sector gradually incorporates recycled fiber in rigid boxes to showcase environmental responsibility. This trend underscores a balance between performance requirements and sustainability goals.

- For instance, Mondi Group produced more than 1.5 million tons of containerboard and corrugated solutions in 2023, with a substantial share incorporating recycled fiber for high-end packaging used by luxury and FMCG brands.

Rising Investments in Recycling Infrastructure and Collection Systems

Governments and private companies channel significant funds into upgrading recycling networks. The Post Recycled Fiber Market benefits from advanced collection models that improve waste segregation and reduce contamination. It ensures higher fiber recovery rates, enhancing the overall quality of the supply chain. Urban municipalities expand curbside collection systems to capture larger fiber volumes. Recycling firms adopt automation and AI to increase sorting efficiency. These developments strengthen the availability of consistent feedstock for recycled fiber production.

- For instance, Indorama Ventures expanded its recycling capacity in 2023 by installing new PET recycling facilities across Brazil, Poland, and the Philippines, adding more than 390,000 tons of annual processing capacity for post-consumer waste.

Growing Role of Innovation in Product Development Across End-Use Industries

End-use industries demand recycled fiber products with improved functional characteristics. The Post Recycled Fiber Market responds with advancements in coatings, strength enhancers, and fiber treatment technologies. It provides solutions that meet the requirements of printing, publishing, and consumer goods packaging. Companies introduce lightweight recycled boards that reduce transportation costs while maintaining durability. Food packaging manufacturers adopt barrier-coated recycled fiber to enhance safety and shelf life. This focus on innovation widens the application scope of recycled fibers.

Expansion of Regional Self-Sufficiency in Fiber Sourcing and Processing

Global trade disruptions and import restrictions drive regions to strengthen local recycling ecosystems. The Post Recycled Fiber Market demonstrates a trend toward self-reliance in fiber sourcing and processing. It reduces dependence on imported waste paper by building domestic collection and production capacity. North America and Europe expand recycling hubs, while Asia-Pacific focuses on new mill installations. Local sourcing lowers logistical risks and supports supply stability for manufacturers. This regionalization of fiber recovery reshapes long-term market dynamics.

Market Challenges Analysis

Quality Inconsistencies and Supply Chain Limitations in Fiber Recovery

The Post Recycled Fiber Market faces challenges linked to variations in collected fiber quality. It often encounters contamination from food residues, plastics, and mixed materials that reduce recovery efficiency. Manufacturers struggle to maintain consistent strength, brightness, and durability across recycled products. Limited access to clean, segregated waste streams further complicates production reliability. Seasonal fluctuations in collection volumes impact availability and disrupt supply planning for paper and packaging industries. These constraints limit the ability of recycled fiber to fully match the performance of virgin pulp in certain applications.

High Processing Costs and Regulatory Compliance Pressures

Recycling fiber requires advanced pulping, de-inking, and treatment technologies that carry significant capital and operational costs. The Post Recycled Fiber Market operates under stringent environmental regulations that mandate strict water usage, emissions control, and waste management standards. It places financial strain on small and mid-sized recyclers that lack economies of scale. Rising energy costs increase overall processing expenses, challenging competitiveness in price-sensitive sectors. Compliance with shifting international trade policies on waste paper imports also creates uncertainty. These structural hurdles restrict profitability and slow down capacity expansion across global markets.

Market Opportunities

Quality Variability and Supply Limitations in Fiber Recovery

The Post Recycled Fiber Market struggles with inconsistencies in collected fiber streams that affect product performance. It often faces contamination from plastics, adhesives, and food residues that reduce recovery efficiency. Mills encounter difficulties in maintaining uniform brightness, strength, and cleanliness, especially for high-grade applications. Limited infrastructure for waste segregation weakens supply reliability across many regions. Seasonal fluctuations in collection volumes disrupt continuity in manufacturing and planning cycles. These challenges restrict the ability of recycled fibers to serve as a consistent substitute for virgin pulp.

Rising Processing Costs and Stringent Regulatory Compliance Burdens

The Post Recycled Fiber Market operates under rising cost pressures linked to complex recycling processes. It requires advanced pulping, de-inking, and cleaning systems that demand high capital expenditure and energy consumption. Smaller recyclers face limited resources to adopt new technologies or achieve economies of scale. Environmental regulations impose strict limits on emissions, water usage, and waste discharge, creating additional compliance costs. International trade restrictions on waste paper imports generate uncertainty in raw material flows. These combined pressures hinder profitability and slow expansion efforts within the industry.

Market Segmentation Analysis:

By Type

The Post Recycled Fiber Market segments into pre-consumer recycled fiber and post-consumer recycled fiber. Pre-consumer fiber originates from industrial scrap and unused materials within the paper production process, offering consistent quality and lower contamination risks. It finds extensive use in applications requiring high performance such as printing papers and specialty packaging. Post-consumer fiber, derived from recovered household and commercial waste, represents the larger share due to its broad availability. It supports sustainable packaging solutions that align with regulatory and corporate commitments. Both types play a complementary role, ensuring the recycling ecosystem maintains supply balance across industries.

- For instance, International Paper recovered and reused over 6.1 million tons of post-consumer fiber in 2023, supporting large-scale production of corrugated packaging and specialty paper solutions across its global operations.

By Material

Segmentation by material highlights old corrugated containers (OCC), mixed paper, and newspapers as the leading categories. The Post Recycled Fiber Market relies heavily on OCC due to the dominance of corrugated packaging in global trade and e-commerce. It provides strength and durability for new packaging products, making it the most in-demand material stream. Mixed paper contributes significantly by supplying fibers for tissue products, paperboard, and lower-grade packaging. Newspapers, though declining in supply, continue to support recycled newsprint and niche applications. It demonstrates how material diversity secures feedstock flexibility for recycling mills.

- For instance, Smurfit Kappa reported recycling more than 7.5 million tons of recovered fiber in 2023, with OCC forming the largest portion, which directly supplied its containerboard and corrugated product divisions across Europe and the Americas.

By End-Use

End-use applications span packaging, printing and writing, and tissue production. The Post Recycled Fiber Market sees the packaging segment dominate, driven by e-commerce growth and sustainability mandates across consumer goods. It ensures a steady supply of corrugated boxes, folding cartons, and protective paper solutions. Printing and writing paper applications, while declining in some markets, still demand high-quality recycled fiber in educational and office supplies. Tissue manufacturing uses mixed paper and recovered fibers to produce household and hygiene products, reflecting rising consumer demand for eco-friendly daily essentials. It underlines the adaptability of recycled fibers across both industrial and consumer-focused applications.

Segments:

Based on Type:

- Polyester

- Nylon

- Polymer

- Pet

- Cotton

Based on Material:

- Synthetic Recycled Fibers

- Natural Recycled Fibers

Based on End-use:

- Textile & Apparel

- Automotive

- Construction

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 32% of the Post Recycled Fiber Market, supported by strong recycling infrastructure and established collection systems. The United States drives the region with its large-scale demand for corrugated packaging from e-commerce and retail distribution. It benefits from advanced sorting technologies that ensure higher-quality fiber recovery, making recycled fiber a reliable substitute for virgin pulp. Canada complements this growth with government-backed policies that promote circular economy initiatives and recycling mandates for packaging industries. The presence of major paper mills and integrated packaging companies strengthens regional capacity and secures steady demand. Continuous investments in material recovery facilities and expansion of curbside collection programs reinforce North America’s leadership position in recycled fiber adoption.

Europe

Europe accounts for 28% of the Post Recycled Fiber Market, shaped by strict environmental regulations and ambitious recycling targets. Countries such as Germany, France, and the United Kingdom emphasize high collection rates, often exceeding global standards. It benefits from the European Union’s directive mandating recycled content in packaging materials, which encourages innovation and consistency in fiber quality. The printing and publishing sector, though declining, continues to rely on recycled newsprint and specialty grades across the region. Strong demand for packaging solutions in food, beverage, and consumer goods accelerates fiber utilization. The region’s well-developed waste management systems ensure a steady supply of recovered paper, making Europe a global model for efficient recycling practices.

Asia-Pacific

Asia-Pacific represents 26% of the Post Recycled Fiber Market, driven by rapid industrialization, urbanization, and strong packaging demand. China, India, and Japan play pivotal roles, supported by growing e-commerce platforms and manufacturing activities that require high volumes of corrugated boxes. It demonstrates rising self-reliance after restrictions on waste paper imports prompted heavy investment in domestic collection and processing facilities. Japan maintains advanced recycling rates through organized household segregation, while India expands infrastructure to meet the rising needs of consumer goods packaging. The region also witnesses new mill installations aimed at processing both pre-consumer and post-consumer fiber at scale. Increasing awareness of sustainability among governments and industries ensures long-term growth potential for recycled fiber adoption.

Latin America

Latin America contributes 8% of the Post Recycled Fiber Market, supported by expanding paperboard and tissue production. Brazil and Mexico dominate regional demand with strong consumer goods and food packaging industries. It faces challenges linked to uneven collection infrastructure, which creates quality and supply inconsistencies. However, investment in urban recycling initiatives and partnerships between governments and private firms improve fiber recovery rates. Regional mills integrate recycled fiber to reduce costs while aligning with global sustainability standards. Steady growth in retail, logistics, and e-commerce further elevates demand for corrugated packaging, positioning Latin America as a developing but important contributor to the global recycled fiber landscape.

Middle East & Africa

The Middle East & Africa holds 6% of the Post Recycled Fiber Market, reflecting emerging adoption and gradual development of recycling systems. The Gulf countries invest in modern waste management facilities to reduce landfill dependency and strengthen sustainable resource use. South Africa contributes to regional growth through established paper mills that integrate recycled fiber in packaging and tissue products. It faces constraints such as limited infrastructure and low awareness levels, but policy reforms support greater investment in recycling capacity. Increasing demand for packaged consumer goods, coupled with government sustainability initiatives, drives regional growth. While still a smaller contributor in global terms, the Middle East & Africa demonstrates strong potential as recycling ecosystems mature and expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- UNIFI, Inc.

- Infinited Fiber Company

- Patagonia

- Aquafil S.p.A.

- Hyosung TNC

- Indorama Ventures Public Company Limited

- Recover Textile Systems

- Reliance Industries Limited

- Lenzing AG

- Recover Textile Systems

Competitive Analysis

The competitive landscape of the Post Recycled Fiber Market is defined by global leaders such as Indorama Ventures Public Company Limited, Reliance Industries Limited, Lenzing AG, UNIFI, Inc., Infinited Fiber Company, Patagonia, Aquafil S.p.A., Hyosung TNC, and Recover Textile Systems, who strengthen their positions through innovation and strategic expansion. Indorama Ventures invests in large-scale recycling infrastructure to secure consistent feedstock supply, while Reliance Industries integrates recycled fiber into its extensive polyester operations to serve diverse end-use industries. Lenzing AG emphasizes sustainable fiber innovation with advanced technologies that improve product quality and align with environmental commitments. UNIFI, Inc. leverages its REPREVE brand to capture strong demand from apparel and packaging markets, while Infinited Fiber Company focuses on breakthrough textile-to-textile recycling technologies to expand application scope. Patagonia drives brand influence by embedding recycled fibers into outdoor apparel, reinforcing consumer trust in sustainable practices. Aquafil S.p.A. and Hyosung TNC focus on performance-driven recycled fibers for textiles and industrial uses, enhancing product differentiation. Recover Textile Systems builds on circular textile recovery, providing scalable solutions to global brands. Together, these players shape a competitive environment marked by technological innovation, sustainability leadership, and growing partnerships across industries.

Recent Developments

- In May 2025, Infinited Fiber Company, co-founder and CEO Petri Alava stepped down, with COO Sahil Kaushik assuming the role of acting CEO as the company transitions to its next strategic phase of industrial scaling

- In April 2025, UNIFI, Inc launched REPREVE with CiCLO® technology, a biodegradable recycled polyester and nylon that naturally breaks down in soil or seawater while maintaining performance and dyeability.

- In January 2025, Lenzing AG, it expanded its LENZING™ Lyocell Fill portfolio, offering fibers with at least 50% lower carbon emissions and water consumption compared to standard lyocell.

Market Concentration & Characteristics

The Post Recycled Fiber Market reflects a moderately concentrated structure with the presence of global leaders and specialized regional players that influence competitive dynamics. It is characterized by strong integration across collection, processing, and end-use applications, where large firms secure supply through investments in advanced recycling infrastructure while smaller players operate in niche segments. It shows high reliance on technological innovation, with companies adopting AI-driven sorting systems, chemical recycling methods, and fiber treatment processes to enhance quality and consistency. It demonstrates growing alignment with sustainability mandates, making recycled fiber a preferred choice in packaging, textiles, and paper industries. Strategic partnerships between manufacturers, retailers, and governments strengthen supply security and ensure compliance with environmental regulations. It remains exposed to challenges of fiber quality variability, high processing costs, and regulatory complexities, yet its adaptability across multiple industries reinforces its role as a critical enabler of circular economy practices.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Post Recycled Fiber Market will expand with rising adoption of circular economy practices across industries.

- Demand for sustainable packaging will continue to drive large-scale fiber utilization.

- Advances in recycling technologies will improve fiber quality and strengthen competitiveness with virgin pulp.

- Governments will tighten regulations on waste management, boosting recycled fiber consumption.

- Textile and apparel sectors will integrate more recycled fiber into mainstream product lines.

- Regional self-sufficiency in fiber sourcing will increase due to shifting trade policies and import restrictions.

- Investments in infrastructure and automation will enhance collection efficiency and supply consistency.

- Strategic collaborations between brands and recyclers will accelerate innovation in applications.

- Consumer preference for eco-friendly products will support long-term growth across multiple end uses.

- Global players will consolidate market presence through expansion, partnerships, and technology-driven initiatives.