Market Overview:

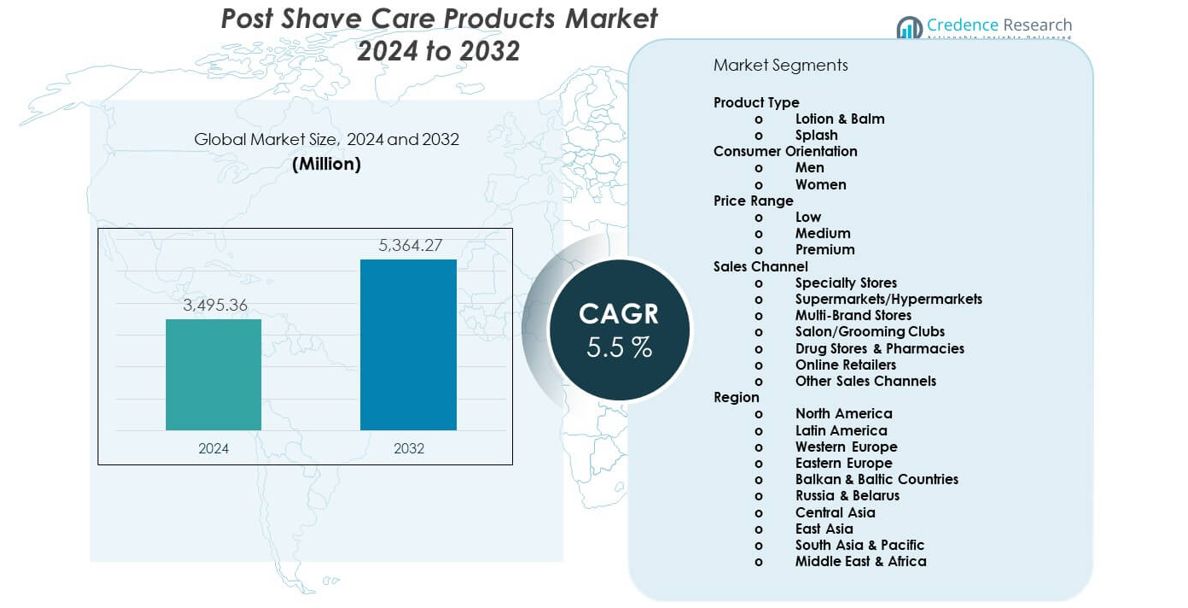

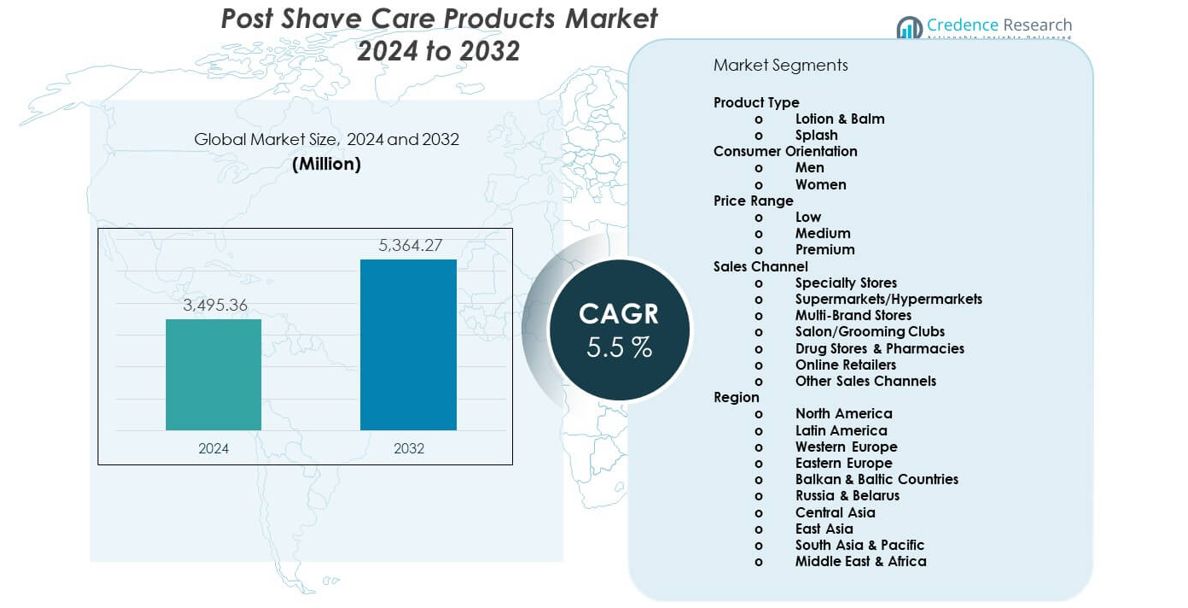

The Post Shave Care Products Market was valued at USD 3,495.36 million in 2024. The market is projected to reach USD 5,364.27 million by 2032. It is expected to grow at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Post Shave Care Products Market Size 2024 |

USD 3,495.36 million |

| Post Shave Care Products Market, CAGR |

5.5% |

| Post Shave Care Products Market Size 2032 |

USD 5,364.27 million |

Demand rises due to higher focus on personal grooming and skin health. Consumers seek products that reduce irritation, redness, and dryness after shaving. Growth in disposable income supports spending on premium balms and lotions. Natural and alcohol-free formulations gain preference due to skin sensitivity concerns. E-commerce expansion improves product access and brand visibility. Urban lifestyles and professional work culture reinforce regular grooming habits. Brand innovation in fragrance and skin-soothing ingredients sustains repeat purchases.

North America and Europe lead the market due to strong grooming culture and brand penetration. The United States, Germany, and the UK show high product usage frequency. Asia Pacific emerges as the fastest-growing region, led by India, China, and South Korea. Rising urbanization and youth population support demand growth. Latin America shows steady adoption driven by Brazil and Mexico. Middle East markets gain traction through premium men’s grooming trends.

Market Insights:

- The market stood at USD 3,495.36 million in 2024 and reaches USD 5,364.27 million by 2032, at 5.5% CAGR.

- North America leads with 35%, Europe follows with 30%, and Asia Pacific holds 25%, driven by grooming culture and brand reach.

- Asia Pacific is the fastest-growing region with 25% share, supported by urbanization and young consumers.

- Lotion and balm dominate product type with a 62.5% share due to comfort and skin repair benefits.

- Men account for 70% share, while the medium price range holds 50% due to balanced value perception.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Focus On Skin Comfort And Post-Shave Protection Needs

Consumers show stronger focus on skin comfort after shaving. Irritation, redness, and dryness remain common concerns. The Post Shave Care Products Market benefits from this daily skincare need. Men prefer products that calm skin and restore moisture. Sensitive skin awareness supports balm and lotion usage. Dermatologist-backed claims build product trust. Grooming routines now include post-shave care as a standard step. Brand messaging stresses protection and recovery benefits.

- For instance, Beiersdorf’s NIVEA Men Sensitive Post Shave Balm is clinically tested to instantly calm and soothe skin irritation and provides intensive, long-lasting hydration. Men prefer products that calm skin and restore moisture.

Premium Grooming Adoption Supported By Lifestyle And Income Shifts

Urban lifestyles encourage polished personal appearance standards. Professionals treat grooming as part of self-image. The Post Shave Care Products Market gains traction from premium product demand. Consumers pay more for advanced formulations and refined scents. Gift purchases also support higher-value product sales. Travel-size packs increase trial among new users. Retail promotions strengthen brand switching behavior. Personal care spending remains resilient across income groups.

- For instance, L’Oréal Men Expert Hydra Energetic range reports hydration efficacy lasting up to 24 hours through vitamin C and glycerin-based formulations. Consumers pay more for advanced formulations and refined scents.

Expansion Of Male Grooming Awareness Across Younger Demographics

Younger consumers adopt grooming habits early. Social media normalizes skincare-focused routines for men. The Post Shave Care Products Market aligns with this behavioral shift. Brands target Gen Z and millennials through digital campaigns. Educational content explains skin recovery benefits after shaving. Product packaging reflects modern and minimalist preferences. Celebrity endorsements strengthen product appeal. Early adoption supports long-term customer retention.

Retail And Digital Availability Improving Product Reach And Trial Rates

Wider retail access improves product visibility. Pharmacies and supermarkets allocate more shelf space. The Post Shave Care Products Market benefits from online platform expansion. E-commerce supports easy comparison and subscription purchases. Influencer reviews influence buyer decisions. Direct-to-consumer channels improve brand margins. Faster delivery improves repeat purchase cycles. Omnichannel strategies support consistent brand presence.

Market Trends:

Growing Preference For Clean Label And Skin-Friendly Formulations

Consumers prefer clean and transparent ingredient lists. Alcohol-free and paraben-free products gain attention. The Post Shave Care Products Market reflects this formulation shift. Brands highlight soothing agents like aloe and chamomile. Dermatology-tested labels support credibility. Natural scents replace strong synthetic fragrances. Packaging highlights ingredient clarity. Clean beauty standards shape product development strategies.

- For instance, Unilever’s Dove Men+Care Post Shave Balm features alcohol-free formulations and is dermatologist-tested for sensitive skin. The product is formulated to soothe skin discomfort and reduce redness using hydrating agents like Vitamin B5.

Rising Demand For Multi-Functional Grooming Products

Consumers favor products with multiple benefits. Single products now soothe, hydrate, and protect skin. The Post Shave Care Products Market follows this convenience trend. Time-saving routines attract working professionals. Hybrid balm-gel formats gain shelf presence. SPF inclusion adds daily skin protection value. Travel-friendly designs support portability. Simplified routines improve daily usage consistency.

- For instance, Procter & Gamble’s Gillette SkinGuard razor features a unique SkinGuard bar and lubrication strips that minimize friction during shaving, and has been clinically proven to reduce the incidence of razor bumps (pseudofolliculitis barbae) by over 60%. The complementary SkinGuard shave gel and aftershave gel contain ingredients like menthol and eucalyptus leaf oil to provide a cooling sensation and soothe the skin.

Brand Differentiation Through Fragrance And Sensory Experience

Scent plays a major role in purchase decisions. Consumers seek subtle and premium fragrances. The Post Shave Care Products Market leverages sensory branding. Texture and absorption speed influence product satisfaction. Cooling effects improve user perception. Luxury-inspired notes elevate brand positioning. Limited editions create short-term demand spikes. Sensory focus strengthens emotional brand attachment.

Customization And Skin-Type Specific Product Positioning

Brands focus on tailored skincare solutions. Products target oily, dry, or sensitive skin types. The Post Shave Care Products Market supports this personalized approach. Clear labeling helps faster consumer choice. Regimen-based kits improve cross-product sales. Skin diagnostics guide product selection online. Personalization improves consumer trust. Tailored solutions increase brand loyalty levels.

Market Challenges Analysis:

High Brand Competition And Product Differentiation Pressure

The market faces intense brand competition. Global and local players share shelf space. The Post Shave Care Products Market struggles with limited differentiation. Similar formulations reduce switching barriers. Marketing costs rise to maintain visibility. Private labels add pricing pressure. Innovation cycles shorten due to fast imitation. Brand loyalty requires constant engagement efforts.

Price Sensitivity And Limited Awareness In Developing Regions

Consumers remain price conscious in emerging markets. Premium products face adoption barriers. The Post Shave Care Products Market sees uneven regional penetration. Awareness of post-shave benefits stays limited. Traditional shaving practices persist in rural areas. Distribution gaps restrict product availability. Low trial rates slow demand growth. Education-led marketing increases cost burdens.

Market Opportunities:

Untapped Demand Across Emerging Markets And Expanding Male Grooming Culture

Urban growth increases exposure to modern grooming habits. Young consumers adopt structured skincare routines early. The Post Shave Care Products Market can scale through these shifts. Brands can introduce entry-level product lines for first-time users. Affordable pricing supports faster market entry. Localized scents improve regional appeal. Offline retail expansion builds trust in new markets. Education-led campaigns explain skin care benefits clearly.

Product Innovation Through Advanced Formulations And Digital Engagement Models

Innovation creates strong growth potential for brands. Products can target razor burn and skin repair needs. The Post Shave Care Products Market benefits from science-backed formulations. Probiotic and barrier-repair ingredients gain interest. Subscription models support predictable revenue flow. Direct channels improve customer feedback loops. Personalized product recommendations improve conversion rates. Digital storytelling strengthens brand credibility and reach.

Market Segmentation Analysis:

Product Type Analysis

Lotion and balm products dominate daily post-shave routines. These formats provide hydration and skin repair benefits. Splash products serve users who prefer a light and quick finish. Fragrance plays a key role in splash selection. Texture and absorption speed guide product choice. Skin sensitivity influences product switching. The Post Shave Care Products Market reflects strong preference for comfort-focused formats.

Consumer Orientation Analysis

Men account for the majority of post-shave product usage. Daily shaving habits support steady demand. Women use post-shave care after hair removal routines. Female-focused products stress skin calm and moisture. Branding adapts to gender-specific skin needs. Packaging design supports clear positioning. The Post Shave Care Products Market benefits from expanding grooming routines across genders.

- For instance, Estée Lauder’s Clinique post-shave and anti-redness solutions are tested across multiple skin types and report visible redness reduction within 2.5 hours (150 minutes) of application in clinical testing. Female-focused products also stress skin calm and moisture as key benefits, often using similar calming ingredients across product lines for all genders.

Price Range Analysis

Low-priced products target mass consumers and first-time buyers. Medium-priced products balance quality and affordability. Premium products focus on advanced formulations and fragrance depth. Brand reputation supports higher pricing tiers. Gift purchases favor premium ranges. Economic conditions shape price sensitivity. The Post Shave Care Products Market shows strong volume concentration in mid-range pricing.

Sales Channel Analysis

Specialty stores support informed product selection. Supermarkets and hypermarkets drive high-volume sales. Multi-brand stores enable brand comparison. Salons promote professional-grade recommendations. Drug stores build trust through skincare credibility. Online retailers support convenience and subscriptions. The Post Shave Care Products Market gains reach through diversified sales channels.

Segmentation:

Product Type

Consumer Orientation

Price Range

Sales Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Multi-Brand Stores

- Salon/Grooming Clubs

- Drug Stores & Pharmacies

- Online Retailers

- Other Sales Channels

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Analysis

North America holds nearly 35% market share in the global landscape. The region benefits from strong grooming awareness and premium product adoption. Consumers prefer dermatologist-tested and skin-friendly formulations. The United States leads regional demand due to high per-capita grooming spend. Retail penetration remains strong across drug stores and online platforms. Brand loyalty supports repeat purchases across age groups. The Post Shave Care Products Market in this region shows stable demand from daily grooming routines.

Europe Regional Analysis

Europe accounts for around 30% market share globally. Western Europe leads due to established grooming culture and heritage brands. Countries such as Germany, France, and the UK drive product innovation. Natural and alcohol-free formulations gain higher acceptance. Specialty stores and pharmacies support informed buying decisions. Male grooming traditions sustain consistent usage patterns. The Post Shave Care Products Market benefits from premium positioning across European markets.

Asia Pacific And Other Regions Analysis

Asia Pacific represents nearly 25% market share and shows strong growth momentum. Urbanization supports wider grooming product adoption. India, China, and South Korea lead regional demand. Younger consumers adopt structured skincare routines early. Online retail channels expand product access across cities. Latin America and Middle East & Africa together hold about 10% share. The Post Shave Care Products Market gains traction through rising disposable income and brand localization strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Post Shave Care Products Market shows strong competition among global consumer goods leaders. Large players focus on brand strength, wide distribution, and product consistency. It favors companies with deep retail penetration and marketing scale. Innovation centers on skin-soothing formulas and premium fragrances. Portfolio breadth helps brands cover multiple price tiers. Regional players compete through localized products and pricing. Private labels increase pressure in mass segments. Strategic branding and channel reach define competitive advantage.

Recent Developments:

- In October 2025, L’Oréal announced a major strategic partnership with Kering, establishing a long-term collaboration in luxury beauty and wellness valued at €4 billion. Through this binding agreement, L’Oréal acquired the House of Creed, one of the world’s leading luxury fragrance houses celebrated for its artisanal craftsmanship and rare natural ingredients, which includes both men’s and women’s fragrance collections. Additionally, L’Oréal secured 50-year exclusive licenses for creating, developing, and distributing fragrance and beauty products for iconic Kering brands including Gucci, Bottega Veneta, and Balenciaga. This expansion positions L’Oréal to strengthen its presence in the luxury men’s fragrance market, which encompasses premium aftershave and post-shave fragrance solutions. The transaction is expected to close in the first half of 2026.

- In June 2025, Unilever announced a significant acquisition in the men’s grooming sector. The company signed an agreement to acquire Dr. Squatch, a prominent men’s personal care brand known for natural grooming products, from growth equity firm Summit Partners. This strategic move valued Dr. Squatch at approximately $1.5 billion and demonstrates Unilever’s commitment to expanding its premium men’s grooming portfolio. Dr. Squatch has built considerable brand equity through viral social media marketing and partnerships with influencers and celebrities, including Sydney Sweeney. The acquisition enables Unilever to strengthen its digital presence and reach new consumer audiences, particularly Gen Z men seeking natural and sustainable grooming solutions.

- In March 2025, Procter & Gamble’s Gillette Venus launched significant product enhancements as part of its continued commitment to women’s shaving care. The brand unveiled the MoistureGlide Razor, specifically designed for individuals with dry skin, featuring two moisture bars composed of over 50% skin conditioners and argan oil to protect against post-shaving dryness. This launch was strategized as an official partnership with the Women’s Tennis Association (WTA), featuring endorsements from professional athletes Taylor Townsend, Alycia Parks, and Peyton Stearns. The refreshed product collection includes limited edition tennis-themed razors and improved packaging, complemented by a television campaign and activation events throughout the WTA season. Venus also introduced a quiz tool to help women identify the most appropriate razor for their specific skin type and developed a new shower holder to maintain razor cleanliness between uses.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Consumer Orientation, Price Range, and Sales Channel segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Post Shave Care Products Market benefits from more structured daily grooming routines.

- Skin-soothing and repair-focused formulations gain wider consumer acceptance.

- Natural and clean-label products attract health-conscious and sensitive-skin users.

- Premium fragrances strengthen brand identity and repeat purchase behavior.

- Multi-functional products simplify grooming routines and improve convenience.

- E-commerce channels expand product discovery and customer reach.

- Personalized skincare solutions enhance brand engagement and loyalty.

- Emerging markets show rising awareness of post-shave skin care needs.

- Dermatology-backed claims build stronger consumer confidence.

- Omnichannel retail strategies improve overall market accessibility.